Académique Documents

Professionnel Documents

Culture Documents

14th Finance Commission - Final PDF

Transféré par

vishnuTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

14th Finance Commission - Final PDF

Transféré par

vishnuDroits d'auteur :

Formats disponibles

VISIONIAS

www.visionias.in

14th Finance Commission

Table of Content

1. A Brief Introduction of Finance Commission .......................................................................................................... 2

2. Fourteenth Finance Commission ............................................................................................................................ 2

3. Major recommendations of FFC ............................................................................................................................. 2

3.1. Sharing of Union Taxes .................................................................................................................................... 2

3.2. Local Governments .......................................................................................................................................... 2

4. Comparison with 13th Finance Commission .......................................................................................................... 3

5. Criticism .................................................................................................................................................................. 3

Copyright by Vision IAS

All rights are reserved. No part of this document may be reproduced, stored in a retrieval system or

transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise,

without prior permission of Vision IAS

1

www.visionias.in

Vision IAS

1. A Brief Introduction of Finance Commission

Article 280 of the Constitution of India provides for a finance commission as a quasi-judicial body. It is

constituted by the President of India every fifth year. It consists of a chairman and four other members to be

appointed by the president.

It makes recommendations about the following to the President of India:

The distribution of the net proceeds of taxes between the centre and the states and the allocation between

the states of the respective shares of such proceeds

The principles that should govern the grants in aid to the states by the centre

The measures needed to augment the consolidated fund of states to supplement the resources of the local

governments in the states on the basis of the recommendations made by the State Finance Commissions.

Any other method referred to it by the President in the interests of the sound finance.

The recommendations made by finance commission are only advisory in nature and hence, are not binding on

the government.

2. Fourteenth Finance Commission

The 14th Finance Commission (FFC) was appointed under the Chairmanship of Dr. Y. V. Reddy.

Its Terms of References are as Follows:

Primary objectives as mentioned above

Principles which would govern the quantum and distribution of grants-in-aid(non-planned grants to states

The measures to augment state government finances to supplement the finances of local government

To review the state of finances, deficit and debt conditions at different levels of government

3. Major recommendations of FFC

3.1. Sharing of Union Taxes

Increasing the share of tax devolution to 42 per cent of the divisible pool would serve the twin objectives of

increasing the flow of unconditional transfers to the States and yet leave appropriate fiscal space for the

Union to carry out specific purpose transfers to the States.

No minimum guaranteed devolution to the States.

As service tax is not levied in the State of Jammu & Kashmir, proceeds cannot be assigned to this State.

3.2. Local Governments

Local bodies should be required to spend the grants only on the basic services within the functions assigned

to them under relevant legislations.

Distribution of grants to the States using 2011 population data with weight of 90 per cent and area with

weight of 10 per cent. The grant to each state will be divided into two, a grant to duly constituted Gram

panchayats and a grant to duly constituted Municipalities, on the basis of urban and rural population of that

state using the data of census 2011.

The grants to be divided in two parts - a basic grant and a performance grant for duly constituted gram

panchayats and municipalities. In the case of gram panchayats, 90 per cent of the grant will be the basic

grant and 10 per cent will be the performance grant. In the case of municipalities, the division between basic

and performance grant will be on an 80:20 basis.

The grants should go only to those gram panchayats, which are directly responsible for the delivery of basic

services, without any share for other levels using the formula given by the recent SFC. Similarly, the basic

grant for urban local bodies will be divided into tier-wise shares and distributed across each tier, namely the

www.visionias.in

Vision IAS

Municipal corporations, Municipalities (the tier II urban local bodies) and the Nagar panchayats (the tier III

local bodies) using the formula given by the respective SFCs.

In case the SFC formula is not available, then the share of each gram panchayat as specified above should be

distributed across the entities using 2011 population with a weight of 90 per cent and area with a weight of

10 percent. In the case of urban local bodies, the share of each of the three tiers will be determined on the

basis of population of 2011 with a weight of 90 per cent and area with a weight of 10 per cent and then

distributed among the entities in each tier in proportion to the population of 2011 and area in the ratio of

90:10.

Performance grants are being provided to address the following issues: (i) making available reliable data on

local bodies' receipt and expenditure through audited accounts; and (ii) improvement in own revenues.

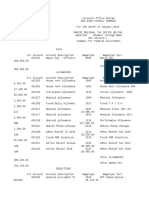

4. Comparison with 13th Finance Commission

Enhanced the share of the states in

the central divisible pool from 32%

(by 13th FC) to 42% which is the

biggest ever increase in vertical tax

devolution.

It

has

not

made

any

recommendation

concerning

sector-specific grants unlike the

13th FC.

5. Criticism

Social sector allotment is reduced.

Backward Regions Grant Fund (BRGF) is wound up. Bihar which got 30% weightage for funding through this

criterion will be badly affected. Bihar being among least developed states it is a matter of concern to the

economy. It is likely to affect the Gross Domestic State Product (GDSP) of Bihar adversely.

Pruning of Planning Commission to be NITI Ayog has led to loss of plan grants to states which are performing

well. Karnataka stands to lose plan grants. Rashtriya Krishi Vikas Yojna which contributed significantly to

agricultural productivity and transformation is removed through the process which will affect the sector. To

compensate for all this some extra funding will have to be mobilized by the GOI which caused it. States can

ask for higher untied grants for the reason.

With GOI revenue as a percentage of GDP is shrinking by 1% which makes devolution of funds to states

questionable. How the GOI estimates and plans to face its increasing expenditure in the situation is to be

seen. IT export income has declined to 6 year low this year due to inward bound policies of the west and

USA.

With back ward region grants discontinuation, absence of plan funds to states, reduction of social sector

funding and decline in central kitty will all lead to larger estimable inequities in the devolution of funds to

states in addition to other diversities. So there could be surging fiscal inequalities among the states. How

cooperative federalism can be ushered in given the situation is not clear.

May be 42% unconditional grants are expected to do the job. But this devolution will give a free hand to

states to operate the finances. Inequities with freedom to states are what could be expected.

Good amount of devolution is ordered to local bodies and more clarity of flow is also directed. But there is

no sanction against default in devolution of funds to local bodies. So as always, flow of funds to local bodies

is not ensured. There is no preventive measure against dependence on states either. A special body for

monitoring cooperative federalism is advised which may or may not happen.

In brief there is sacrifice of equity principle in the process of extending a flat unconditional grant of 42%.This

may cause federal chaos instead of cooperative federalism unless additional and strong institutional

arrangement is made to guard the objectives of the present governance.

www.visionias.in

Vision IAS

Vous aimerez peut-être aussi

- q1 AtanuDocument2 pagesq1 AtanuvishnuPas encore d'évaluation

- Essay 1Document1 pageEssay 1vishnuPas encore d'évaluation

- Chapter 1Document8 pagesChapter 1vishnuPas encore d'évaluation

- Registrations VikasDocument3 pagesRegistrations VikasvishnuPas encore d'évaluation

- SiteDocument13 pagesSitevishnuPas encore d'évaluation

- Essay 1Document1 pageEssay 1vishnuPas encore d'évaluation

- SrilankaDocument1 pageSrilankavishnuPas encore d'évaluation

- ReportDocument2 pagesReportvishnuPas encore d'évaluation

- IsraelDocument1 pageIsraelvishnuPas encore d'évaluation

- ReportDocument2 pagesReportvishnuPas encore d'évaluation

- My PartDocument3 pagesMy PartvishnuPas encore d'évaluation

- CMA v2Document9 pagesCMA v2vishnuPas encore d'évaluation

- IT-ITeS Prep DocumentDocument2 pagesIT-ITeS Prep DocumentvishnuPas encore d'évaluation

- ABInBev Brand Tree - IndiaDocument1 pageABInBev Brand Tree - IndiavishnuPas encore d'évaluation

- P & S Assignment 1 - Vishnu Prasad V - FPM-13-10Document6 pagesP & S Assignment 1 - Vishnu Prasad V - FPM-13-10vishnuPas encore d'évaluation

- Finalising RAGDocument177 pagesFinalising RAGvishnuPas encore d'évaluation

- 014Document7 pages014vishnuPas encore d'évaluation

- Description & Learning ObjectivesDocument7 pagesDescription & Learning ObjectivesvishnuPas encore d'évaluation

- Can't Answer With ClarityDocument2 pagesCan't Answer With ClarityvishnuPas encore d'évaluation

- Concept - Document - Technology and Analytics ContinuumDocument10 pagesConcept - Document - Technology and Analytics ContinuumvishnuPas encore d'évaluation

- 2nd July Daily News UMDocument19 pages2nd July Daily News UMvishnuPas encore d'évaluation

- MGM Sjmsom Iitb RtiDocument17 pagesMGM Sjmsom Iitb RtivishnuPas encore d'évaluation

- Nse Live Stock Prices in Excel Ver 4 Portfolio Mangement Through Excel1Document4 pagesNse Live Stock Prices in Excel Ver 4 Portfolio Mangement Through Excel1vishnuPas encore d'évaluation

- Indivuial RAG SortedDocument52 pagesIndivuial RAG SortedvishnuPas encore d'évaluation

- 2019 2 18Document36 pages2019 2 18vishnuPas encore d'évaluation

- Consumer Business: Team-WinsomeDocument1 pageConsumer Business: Team-WinsomevishnuPas encore d'évaluation

- Upsc ExcelDocument284 pagesUpsc ExcelvishnuPas encore d'évaluation

- Introduction To Banker's QuotientDocument10 pagesIntroduction To Banker's QuotientvishnuPas encore d'évaluation

- Introduction To Banker's QuotientDocument13 pagesIntroduction To Banker's QuotientvishnuPas encore d'évaluation

- Safety Stock LevelDocument8 pagesSafety Stock LevelvishnuPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Court Rules on Tax Liability of Paper ManufacturerDocument30 pagesCourt Rules on Tax Liability of Paper Manufacturersteth16Pas encore d'évaluation

- Police Power, Eminent Domain, and Taxation Discussed in Senior Citizen Discount CaseDocument2 pagesPolice Power, Eminent Domain, and Taxation Discussed in Senior Citizen Discount CaseFayda CariagaPas encore d'évaluation

- Tax Invoice and Tax Credit NoteDocument24 pagesTax Invoice and Tax Credit NoteMichu ParadPas encore d'évaluation

- Income Tax and Value Added TaxDocument388 pagesIncome Tax and Value Added Taxgerald kayPas encore d'évaluation

- Register of Cash in Bank and Other Related Financial TransactionsDocument1 pageRegister of Cash in Bank and Other Related Financial TransactionsCabudol Angel BaldivisoPas encore d'évaluation

- Compliance Manual F.Y. 2020 21 A.Y.2021 22 PDFDocument52 pagesCompliance Manual F.Y. 2020 21 A.Y.2021 22 PDFTHERMAL TECH ENGINEERINGPas encore d'évaluation

- 704 (B) Allocations KPMGDocument72 pages704 (B) Allocations KPMGturbinetimePas encore d'évaluation

- Basic Features of Value Added Tax (VAT) For ItesDocument24 pagesBasic Features of Value Added Tax (VAT) For ItesDebashishDolonPas encore d'évaluation

- Tax Return Engagement LetterDocument2 pagesTax Return Engagement LetterAshru AshrafPas encore d'évaluation

- C.M. Hoskins & Co., Inc. vs. Commissioner of Internal RevenueDocument1 pageC.M. Hoskins & Co., Inc. vs. Commissioner of Internal RevenueAlljun SerenadoPas encore d'évaluation

- Alfresco Construction Services 153/1A, Diamond Harbour Road, Behala Pathak para KOLKATA - 700034Document7 pagesAlfresco Construction Services 153/1A, Diamond Harbour Road, Behala Pathak para KOLKATA - 700034Ashis MingalaPas encore d'évaluation

- BIR Requirements for Starting and Closing a BusinessDocument4 pagesBIR Requirements for Starting and Closing a BusinessMa Therese MontessoriPas encore d'évaluation

- Rajasekar.S CRBB001542 Oct-2021 1636641735351Document1 pageRajasekar.S CRBB001542 Oct-2021 1636641735351Raja SekarPas encore d'évaluation

- CTC - Salary CalculatorDocument4 pagesCTC - Salary Calculatorboopathi.nPas encore d'évaluation

- Vat Proclamation No 285 2002Document50 pagesVat Proclamation No 285 2002mhhdPas encore d'évaluation

- Excel RepublicDocument4 pagesExcel RepublicAlfia safraocPas encore d'évaluation

- FAQ For PIC and Cash GrantDocument4 pagesFAQ For PIC and Cash GrantSathis KumarPas encore d'évaluation

- JMAX0000025230 GST InvoiceDocument1 pageJMAX0000025230 GST InvoiceBzl VargPas encore d'évaluation

- MadrigalDocument468 pagesMadrigalGenelle Mae MadrigalPas encore d'évaluation

- VAT Manual 1Document16 pagesVAT Manual 1Pradeep JagirdarPas encore d'évaluation

- Release NotesDocument13 pagesRelease NotesJbPas encore d'évaluation

- Annual Income Tax Return: - TAN Lance Adrian GUT IerrezDocument4 pagesAnnual Income Tax Return: - TAN Lance Adrian GUT IerrezReina EvangelistaPas encore d'évaluation

- CIR v. Bank of CommerceDocument6 pagesCIR v. Bank of Commerceamareia yapPas encore d'évaluation

- S 0232 01Document50 pagesS 0232 01Shahaan ZulfiqarPas encore d'évaluation

- Big Basket Invoice 30-5Document1 pageBig Basket Invoice 30-5rajendra singhPas encore d'évaluation

- Diferenc Between Tax and FeeDocument1 pageDiferenc Between Tax and FeeAyub ChowdhuryPas encore d'évaluation

- Stonebridge Aquaforest Quote 19056Document2 pagesStonebridge Aquaforest Quote 19056coPas encore d'évaluation

- Form 15G WordDocument2 pagesForm 15G WordAsif NadeemPas encore d'évaluation

- Board Resolution and Secretary CertificateDocument1 pageBoard Resolution and Secretary CertificateKielRinonPas encore d'évaluation

- Invoice No.1197Document2 pagesInvoice No.1197LL Lawwise Consultech India Pvt LtdPas encore d'évaluation