Académique Documents

Professionnel Documents

Culture Documents

RM 1

Transféré par

venkynaiduTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

RM 1

Transféré par

venkynaiduDroits d'auteur :

Formats disponibles

A STUDY REPORT ON MUTUAL

FUND IN INDIA

INTRODUCTION

The Indian financial system based on four basic components like Financial

Market, Financial Institutions, Financial Service, Financial Instruments. All are

play important role for smooth activities for the transfer of the funds and

allocation of the funds. The main aim of the Indian financial system is that

providing the efficiently services to the capital market. The Indian capital

market has been increasing tremendously during the second generation

reforms. The first generation reforms started in 1991 the concept of LPG.

(Liberalization,

privatization, Globalization). Then after 1997 second

generation reforms was started, still the its going on, its include reforms of

industrial investment, reforms of fiscal policy, reforms of ex- imp policy,

reforms of public sector, reforms of financial sector, reforms of foreign

investment through the institutional investors, reforms banking sectors. The

economic development model adopted by India in the post independence era

has been characterized by mixed economy with the public sector playing a

dominating role and the activities in private industrial sector control

measures emaciated form time to time. The last two decades have been a

phenomenal expansion in the geographical coverage and the financial

spread of our financial system. The spared of the banking system has been a

major factor in promoting financial intermediation in the economy and in the

growth of financial savings with progressive liberalization of economic

policies, there has been a rapid growth of capital market, money market and

financial services industry including merchant banking, leasing and venture

capital, leasing, hire purchasing. Consistent with the growth of financial

sector and second generation reforms its need to fruition of the financial

sector. It's also need to providing the efficient service to the investor mostly

if the investors are supply small amount, in that point of view the mutual

fund play vital for better service to the small investors. The main vision for

the analysis for this study is to scrutinize the performance of five star rated

1

A STUDY REPORT ON MUTUAL

FUND IN INDIA

mutual

funds,

given

the

weight

of

risk,

return,

and

assets

under

management, net assets value, book value and price earnings ratio.

Concept of Mutual Fund:

Mutual fund is the pool of the money, based on the trust who invests the

savings of a number of investors who shares a common financial goal, like

the capital appreciation and dividend earning. The money thus collect is then

invested in capital market instruments such as shares, debenture, and

foreign market. Investors invest money and get the units as per the unit

value which we called as NAV (net assets value). Mutual fund is the most

suitable investment for the common man as it offers an opportunity to invest

in diversified portfolio management, good research team, professionally

managed Indian stock as well as the foreign market, the main aim of the

fund manager is to taking the scrip that have under value and future will

rising, then fund manager sell out the stock. Fund manager concentration on

risk return trade off, where minimize the risk and maximize the return

through diversification of the portfolio. The most common features of the

mutual fund unit are low cost.

Growth of Mutual Fund Industry:

The history of mutual funds dates support to 19th century when it was

introduced in Europe, in particular, Great Britain. Robert Fleming set up in

1868 the first investment trust called Foreign and colonial investment trust

which promised to manage the finances of the moneyed classes of Scotland

2

A STUDY REPORT ON MUTUAL

FUND IN INDIA

by scattering the investment over a number of different stocks. This

investment trust and other investment trusts which were afterward set up in

Britain and the U.S., resembled today close ended mutual funds. The first

mutual fund in the U.S., Massachusetts investors trust, was set up in March

1924. This was the open ended mutual fund. The stock market crash in

1929, the Great Depression, and the outbreak of the Second World War

slackened the pace of growth of the mutual fund industry. Innovations in

products and services increased the popularity of mutual funds in the 1950s

and 1960s. The first international stock mutual fund was introduced in the US

in 1940. In 1976, the first tax exempt municipal bond funds emerged and in

1979, the first money market mutual funds were created. The latest

additions are the international bond fund in 1986 arm funds in 1990. This

industry witnessed substantial growth in the eighties and nineties when

there was a significant increase in the number of mutual funds, schemes,

assets ,and shareholders. In the US the mutual fund industry registered s ten

fold growth the eighties. Since 1996, mutual fund assets have exceeds

bank deposits. The mutual fund industry and the banking industry virtually

rival each other in size.

organisation of a mutual fund:

There are many entities involved and the diagram below illustrates the

organizational set up of a mutual fund. Mutual funds have a unique structure

not shared with other entities such as companies of firms. It is important for

employees & agents to be aware of the special nature of this structure,

because it determines the rights & responsibilities of the funds constituents

viz., sponsors, trustees, custodians, transfer agents & of course, the fund &

the Asset Management Company(AMC) the legal structure also drives the

inter-relationships between these constituents. The structure of the mutual

3

A STUDY REPORT ON MUTUAL

FUND IN INDIA

fund India is governed by the SEBI (Mutual Funds) regulations, 1996. These

regulations make it mandatory for mutual funds to have a structure of

sponsor, trustee, AMC, custodian. The sponsor is the promoter of the mutual

fund,& appoints the trustees. The trustees are responsible to the investors in

the mutual fund, & appoint the AMC for managing the investment portfolio.

The AMC is the business face of the mutual fund, as it manages all affairs of

the mutual fund. The mutual fund & the AMC have to be registered with SEBI.

Custodian, who is also registered with SEBI, holds the securities of various

schemes of the fund in its custody.

Sponsor:- The sponsor is the promoter of the mutual fund. The

sponsor establishes the Mutual fund & registers the same with SEBI. He

appoints the trustees, Custodians & the AMC with prior approval of

SEBI, & in accordance with SEBI regulations. He must have at least five

year track record of business interest in the financial markets. Sponsor

must have been profit making in at least three of the above five years.

He must contribute at least 40% of the capital of the AMC.

Trustees:- The Mutual Fund may be managed by a Board of trustees a

of individuals, or a trust company a corporate body. Most of the funds

in India are managed by board of trustees. While the board of trustees

is governed by the provisions of the Indian trust act, where the trustee

is the corporate body, it would also be required to comply with the

provisions of the companies act, 1956. the board of trustee company,

as an independent body, act as protector of the unit-holders interest.

The trustees dont directly manage the portfolio of securities. For this

specialist function, they appoint an AMC. They ensure that the fund is

managed by AMC as per the defined objectives & in accordance with

the trust deed & SEBI regulations. The trust is created through a

document called the trust deed i.e., executed by the fund sponsor in

favor of the trustees. The trust deed is required to be stamped as

registered under the provision of the Indian registration act &

4

A STUDY REPORT ON MUTUAL

FUND IN INDIA

registered with SEBI. The trustees begin the primary guardians of the

unit-holders funds & assets, a trustee has to be a person of high repute

& integrity.

Asset Management Company (AMC):- The role of an Asset

management companies is to act as the investment manager of the

trust. They are the ones who manage money of investors. An AMC

takes decisions, compensates investors through dividends, maintains

proper accounting & information for pricing of units, calculates the

NAV, & provides information on listed schemes. It also exercises due

diligence on investments & submits quarterly reports to the trustees.

AMCs have been set up in various countries internationally as an

answer to the global problem of bad loans. Bad loans are essentially of

two types: bad loans generated out of the usual banking operations or

bad lending, and bad loans which emanate out of a systematic banking

crisis. It is in the latter case that banking regulators or governments try

to bail out the banking system of a systematic accumulation of bad

loans which acts as a drag on their liquidity, balance sheets and

generally the health of banking. So, the idea of AMCs or ARCs is not to

bail out banks, but to bail out the banking system itself.

A STUDY REPORT ON MUTUAL

FUND IN INDIA

Types of AMCs in Indian Context:

The following are the various types of AMCs we have in India.

AMCs

AMCs

AMCs

AMCs

AMCs

owned

owned

owned

owned

owned

by

by

by

by

by

banks.

financial institutions.

Indian private sector companies.

foreign institutional investors.

Indian & foreign sponsors.

Custodian:- Often an independent organization, it takes custody all

securities & other assets of mutual fund. Its responsibilities include

receipt & delivery of securities collecting income-distributing dividends,

safekeeping of the unit & segregating assets & settlements between

schemes. Mutual fund is managed either trust company board of

trustees. Board of trustees & trust are governed by provisions of Indian

trust act. If trustee is a company, it is also subject Indian Company Act.

Trustees appoint AMC in consultation with the sponsors & according to

SEBI regulation. All mutual fund schemes floated by AMC have to be

approved by trustees. Trustees review & ensure that net worth of the

company is according to stipulated norms, every quarter. Though the

trust is the mutual fund, the AMC is its operational face. The AMC is the

first functionary to be appointed, & is involved in appointment of all

other functionaries. The AMC structures the mutual fund products,

markets them & mobilizes fund, manages the funds & services to the

investors. A draft offer document is to be prepared at the time of

launching the fund. Typically, it pre-specifies investment objectives of

the fund, the risk associated, the cost involved in the process & the

broad rules to enter & to exit from the fund & other areas of operation.

In India as in most countries, these sponsors need approval from a

regulator, SEBI in our case. SEBI looks at track records of the sponsor &

6

A STUDY REPORT ON MUTUAL

FUND IN INDIA

its financial strength granting approval to the fund for commencing

operations. A sponsor then hires an asset management company to

invest the funds according to the investment objective. It also hires

another entity to be the custodian of the assets of the fund & perhaps

the third one to handle registry work for the unit holder of the fund.

Registrars & Transfer Agent (R & T Agent):- The Registrars &

Transfer Agents(R & T Agents) are responsible for the investor servicing

function, as they maintain the records of investors in mutual funds.

They process investor applications; record details provide by the

investors on application forms; send out to investors details regarding

their investment in the mutual fund; send out periodical information on

the performance of the mutual fund; process dividend payout to

investor; incorporate changes in information as communicated by

investors; & keep the investor record up-to-date, by recording new

investors & removing investors who have withdrawn their funds.

tax planning and mutual fund :

Investors in India have option for the tax-saving mutual fund schemes for the

simple reason that it helps them to save money. The tax-saving mutual funds

or the equity-linked savings schemes (ELSS) receive certain tax exemptions

under Section 88 of the Income Tax Act. That is one of the reasons why the

investors in India add the tax-saving mutual fund schemes to their portfolio.

The tax-saving mutual fund schemes are one of the important types of

mutual funds in India that investors can option for. There are several

companies in India that offer tax saving mutual fund schemes in the country.

While planning our investments we spend a considerable amount of time

evaluating various options and determining which suits us the best. But

when it comes to planning out investments from a tax saving perspective,

more often than not, we simply go the traditional way and do the exact same

7

A STUDY REPORT ON MUTUAL

FUND IN INDIA

thing that we did in the earlier years. Well, in case you were not aware the

guidelines governing such investments are a lot different this year and

lethargy on your part to rework your investment plan could cost you dear.

tax saving scheme:

Equity Linked Saving Schemes (ELSS): Equity Linked Saving Scheme (ELSS) is

also a type of mutual fund and falls under the Equity Mutual Fund category.

As the name indicates, ELSS mutual fund invests major portion of its corpus

into equity and equity related instruments. But there are some distinct

features which makes ELSS plans different from other equity mutual funds.

Investments made in ELSS plans are eligible for deduction from the taxable

income under Section 80C of the Income Tax Act. There is no limit for

investments in ELSS plans, but investments of up to Rs 1,00,000 qualify for

income tax benefits. Investments made in normal mutual funds (other than

ELSS plans) do not qualify for income tax deduction.

Features of an ELSS Plan :

ELSS is an equity linked tax saving investment instrument.

Money collected under ELSS plan is mainly invested in equity and

equity related instruments.

This financial product is more suited to those investors who are willing

to take high risk and looking for high returns.

There is no upper limit on investments that can be made in ELSS.

However investments upto INR 1,00,000 made in ELSS in a financial

year qualify for deduction from taxable income under Section 80C of

the Income Tax Act.

ELSS comes with a 3 year lock in period.

Long term capital gains earned on investments from ELSS are tax free.

Also dividends earned from ELSS plan are tax free in the hands of the

investor

A STUDY REPORT ON MUTUAL

FUND IN INDIA

SWOT ANALYSIS:

SWOT Analysis presents the information about external and internal

environment of mutual fund in structured from where by key external

opportunity and threats can be compared systematically with internal

capabilities and weakness. The basic objectives of SWOT analysis is provide

a framework to reflect on the industry capabilities to avail opportunities or to

overcome threats presented by environment.

STRENGHT:

WEAKNESS:

Full benefit of diversification

Lesser return compared to equity

Tax benefit

Poor technology and service level

Transperancy and flexibility

Lack of prop marketing

Expert investment management

OPPORTUNITY:

THREATS:

Government policies and tax

Arrival of more private and foreign

concession

players

Setting up a specific fund

Introduction of more debt

Technology development

investment in market.

BANKS V/S MUTUAL FUND:

A STUDY REPORT ON MUTUAL

FUND IN INDIA

CHARACTERISTICS

Returns

Network

Administrative exp.

Liquidity

Risk

Quality of assets

Interest calculation

BANKS

Low

High penetration

High

At a cost

Low

Not transperance

Minimum balance

MUTUAL FUND

Better

Low but improving

Low

Better

Moderate

Transparent

Everyday

between 10th and 30th of

Investment option

every month

Less

More

DEFINITION OF MUTUAL FUNDS

Mutual

funds

are

open-ended investment companies

that

pool

investors' money into a fund operated by a portfolio manager. This manager

then turns around and invests this large pool of shareholder money in a

portfolio of various assets, or combinations of assets.

How it works/Example:

Mutual funds may include investments in stocks, bonds, options, futures,

currencies, treasuries and money market securities. Depending on the stated

objective of the fund, each will vary in regard to content and risk.

Funds issue and redeem shares on demand at the fund's NAV, or net asset

value. Mutual fund management fees typically range between 0.5% and 2%

of assets per year, but 12b-1 fees, exchange fees and other administrative

charges also apply.

10

A STUDY REPORT ON MUTUAL

FUND IN INDIA

Additionally, a given mutual fund will issue different classes of its shares to

investors. The most common variations of share classes for load mutual

funds are front-load A shares, back-end load B shares, and level-load C

shares.

Class A Shares A mutual fund's A Shares charge a front-end load at the

time of purchase. This is a sales fee that is charged as a percentage of

the

total investment and

is

used

to

compensate

the

financial

representative who sells the fund. The amount of the front-end load is

subtracted from the original investment. For example: If an investor

places $10,000 in a mutual fund with a front-end load of 2%, then the

total sales charge would be $200. The remaining $9,800 will go toward

the purchase of shares in the fund. A shares may also impose an assetbased sales charge. Investors do not pay these charges directly.

Instead, they are taken from the fund's assets. The fund then uses

these fees to market and distribute its shares. The 12b-1 fee, which

can equal a maximum of 0.25% per year, is an example of an assetbased sales charge.

Class B Shares: B Shares charge back-end loads. When an investor

purchases the B shares of a mutual fund, the sales charge is deferred

until the fund is sold. This deferred load usually decreases each year. B

shares typically charge a higher asset-based sales charge than Class A

Shares. For example: The B shares of a mutual fund may carry a 5%

load if shares are sold within the first year. This back-end load of 5%,

however, could be reduced by 1 % every year, until it is eliminated in

the 5th year. Some B shares automatically convert to A shares after a

specified period of time, which reduces the 12b-1 fees.

Class C Shares: Class C shares typically do not impose a front-end load,

but will often charge a nominal fee if the shares are sold within one

11

A STUDY REPORT ON MUTUAL

FUND IN INDIA

year. Class C shares often impose a high asset-based sales charge, but

will not convert to A shares when the load reverts to zero.

DIFFERENT TYPES AND KINDS OF MUTUAL FUNDS

Mutual fund industry of India is continuously evolving. Along the way, several

industry bodies are also investing towards investor education. Yet, according

to a report by Boston Analytics, less than 10% of our households consider

mutual funds as an investment avenue. It is still considered as a high-risk

option. In fact, a basic inquiry about the types of mutual funds reveals that

these are perhaps one of the most flexible, comprehensive and hassle free

modes of investments that can accommodate various types of investor

needs.Various types of mutual funds categories are designed to allow

12

A STUDY REPORT ON MUTUAL

FUND IN INDIA

investors to choose a scheme based on the risk they are willing to take, the

investable amount, their goals, the investment term, etc.Let us have a look

at some important mutual fund schemes under the following three

categories based on maturity period of investment:

I. OPEN-ENDED - This scheme allows investors to buy or sell units at any

point in time. This does not have a fixed maturity date.

1. Debt/ Income - In a debt/income scheme, a major part of the investable

fund are channelized towards debentures, government securities, and other

debt instruments. Although capital appreciation is low (compared to the

equity mutual funds), this is a relatively low risk-low return investment

avenue which is ideal for investors seeing a steady income.

2. Money Market/ Liquid - This is ideal for investors looking to utilize their

surplus funds in short term instruments while awaiting better options. These

schemes invest in short-term debt instruments and seek to provide

reasonable returns for the investors.

3. Equity/ Growth - Equities are a popular mutual fund category amongst

retail investors. Although it could be a high-risk investment in the short term,

investors can expect capital appreciation in the long run. If you are at your

prime earning stage and looking for long-term benefits, growth schemes

could be an ideal investment.

13

A STUDY REPORT ON MUTUAL

FUND IN INDIA

3.i. Index Scheme - Index schemes is a widely popular concept in the west.

These follow a passive investment strategy where your investments replicate

the movements of benchmark indices like Nifty, Sensex, etc.

3.ii. Sectoral Scheme - Sectoral funds are invested in a specific sector like

infrastructure, IT, pharmaceuticals, etc. or segments of the capital market

like large caps, mid caps, etc. This scheme provides a relatively high riskhigh return opportunity within the equity space.

3.iii. Tax Saving - As the name suggests, this scheme offers tax benefits to its

investors. The funds are invested in equities thereby offering long-term

growth opportunities. Tax saving mutual funds (called Equity Linked Savings

Schemes) has a 3-year lock-in period.

4. Balanced - This scheme allows investors to enjoy growth and income at

regular intervals. Funds are invested in both equities and fixed income

securities; the proportion is pre-determined and disclosed in the scheme

related offer document. These are ideal for the cautiously aggressive

investors.

II. CLOSED-ENDED - In India, this type of scheme has a stipulated maturity

period and investors can invest only during the initial launch period known as

the NFO (New Fund Offer) period.

14

A STUDY REPORT ON MUTUAL

FUND IN INDIA

1. Capital Protection - The primary objective of this scheme is to safeguard

the principal amount while trying to deliver reasonable returns. These invest

in high-quality fixed income securities with marginal exposure to equities and

mature along with the maturity period of the scheme.

2. Fixed Maturity Plans (FMPs) - FMPs, as the name suggests, are mutual fund

schemes with a defined maturity period. These schemes normally comprise

of debt instruments which mature in line with the maturity of the scheme,

thereby earning through the interest component (also called coupons) of the

securities in the portfolio. FMPs are normally passively managed, i.e. there is

no active trading of debt instruments in the portfolio. The expenses which

are charged to the scheme, are hence, generally lower than actively

managed schemes.

III. INTERVAL - Operating as a combination of open and closed ended

schemes, it allows investors to trade units at pre-defined intervals.

15

A STUDY REPORT ON MUTUAL

FUND IN INDIA

INTRODUCTION TO COMPANIES

1] HDFC ASSET MANAGEMENT COMPANY LIMITED.

HDFC Asset Management Company Ltd (AMC) was incorporated under the

Companies Act, 1956, on December 10, 1999, and was approved to act as an

Asset Management Company for the HDFC Mutual Fund by SEBI vide its

letter dated July 3, 2000. HDFC Mutual Fund is one of the largest mutual

funds and well-established fund house in the country with consistent fund

performance across categories since its incorporation on December 10,

1999. While our past experience does make us a veteran, but when it comes

to investments, we have never believed that the experience is enough.

Investment Philosophy. The single most important factor that drives HDFC

Mutual Fund is its belief to give the investor the chance to profitably invest in

the financial market, without constantly worrying about the market swings.

To realize this belief, HDFC Mutual Fund has set up the infrastructure required

to conduct all the fundamental research and back it up with effective

analysis. Our strong emphasis on managing and controlling portfolio risk

avoids chasing the latest "fads" and trends. In terms of the Investment

Management Agreement, the Trustee has appointed the HDFC Asset

16

A STUDY REPORT ON MUTUAL

FUND IN INDIA

Management Company Limited to manage the Mutual Fund. The paid up

capital of the AMC is Rs. 25.169 core. Zurich Insurance Company (ZIC), the

Sponsor of Zurich India Mutual Fund, following a review of its overall

strategy, had decided to divest its Asset Management business in India. The

AMC had entered into an agreement with ZIC to acquire the said business,

subject to necessary regulatory approvals. On obtaining the regulatory

approvals, the following Schemes of Zurich India Mutual Fund have migrated

to HDFC Mutual Fund on June 19, 2003. Zurich Insurance Company (ZIC), the

Sponsor of Zurich India Mutual Fund, following a review of its overall

strategy, had decided to divest its Asset Management business in India. The

AMC had entered into an agreement with ZIC to acquire the said business,

subject to necessary regulatory approvals.

*HDFC Sovereign Gilt Fund has been wound up in March 2006

The AMC is also providing portfolio management / advisory services and

such activities are not in conflict with the activities of the Mutual Fund. The

AMC has renewed its registration from SEBI vide Registration No. - PM /

INP000000506 dated February 12, 2013 to act as a Portfolio Manager under

the

SEBI

(Portfolio

Managers)

Regulations,

1993.

The

Certificate

Registration is valid from January 1, 2013 to December 31, 2015.

AWARDS & RECOGNITION :

ICRA Mutual Fund Awards 2012

Bloomberg UTV Financial Leadership Awards, 2012

Outlook Money Awards 2011

CNBC-TV18-CRISIL Mutual Fund Awards 2012

HDFC TAXSAVER (ELSS)

17

of

A STUDY REPORT ON MUTUAL

FUND IN INDIA

The nature of the scheme is open ended equity linked savings (ELSS) scheme

with a lock-in period of 3 years. It will be comes in market at March 31, 1996.

The minimum application amount is for new & existing investors Rs.500 and

in multiples of Rs. 500 thereafter.

2] SBI FUNDS MANAGEMENT LIMITED (SBIFM).:

SBI Funds Management Ltd. is the investment manager of SBI Mutual Fund.

SBI Mutual Fund has been constituted as a trust, sponsored by State Bank

India. Today the Fund has an investor base of over 2.8 million spread over 23

schemes. With a large network of collecting branches and investor service

centers, SBI Mutual Fund constantly endeavors to get closer to its growing

family of investors. SBI Mutual Fund (SBI MF) is one of the largest mutual

funds in the country with an investor base of over 4.6 million. With over 20

years of rich experience in fund management, SBI MF brings forward its

expertise in consistently delivering value to its investors. Proven Skills in

18

A STUDY REPORT ON MUTUAL

FUND IN INDIA

wealth generation: SBI Mutual Fund is India's largest bank sponsored mutual

fund and has an enviable track record in judicious investments and

consistent wealth creation. The fund traces its lineage to SBI - India's largest

banking enterprise. The institution has grown immensely since its inception

and today it is India's largest bank, patronized by over 80% of the top

corporate houses of the country. SBI Mutual Fund is a joint venture between

the State Bank of India and Society General Asset Management, one of the

world's leading fund management companies that manages over US$ 500

Billion worldwide.

Exploiting expertise, compounding growth:

In twenty years of operation, the fund has launched 38 schemes and

successfully redeemed fifteen of them. In the process it has rewarded it's

investors handsomely with consistently high returns A total of over 5.4

million investors have reposed their faith in the wealth generation expertise

of the Mutual Fund. Schemes of the Mutual fund have consisently out

performed

benchmark

indices

and

have

emerged

as

the

preferred

investment for millions of investors and HNIs. Today, the fund manages over

Rs. 51,461 cores of assets and has a diverse profile of investors actively

parking their investments across 36 active schemes. The fund serves this

vast family of investors by reaching out to them through network of over 130

points of acceptance, 28 investor service centers, 46 investor service desks

and 56 district organizers. SBI Mutual is the first bank-sponsored fund to

launch an offshore fund Resurgent India Opportunities Fund. Growth

through innovation and stable investment policies is the SBI MF credo.

Currently the SBI Mutual Fund offers 177 schemes in with different

investment objective and needs, as follows. Sbi mutual fund schemes offers:

NO . OF SCHEMES INCLUDING

177

OPTIONS

Equity schemes

36

19

A STUDY REPORT ON MUTUAL

FUND IN INDIA

Debt schemes

Short term debt schemes

Equity and debt

Money market

Gilt fund

115

11

3

0

12

SBI Mutual fund is Indias largest bank sponsored mutual fund and has an

enviable track record in judicious investments and consistent wealth

creation. The fund traces its lineage to SBI Indias largest banking enterprise.

The institution has grown immensely since its inception and today it is Indias

largest bank patronized by over 80% of the top corporate houses of the

country. Started in July 198 7, the fund has launched 67 schemes and

successfully redeemed 15 schemes. In the process, it has rewarded its

investors handsomely with consistently high returns. A total of over 3.5

million investors have reposed their faith in the wealth generation expertise

of the mutualfund. Schemes of the mutual fund have consistently

outperformed benchmarks indices and have emerged as the preferred

investment

for

the

millions

of

investors.

Today

the

fund

manages

Rs.29492.9685 core as on Mar 31, 2012 of assets and has diversified profile

of investors actively parking their investments across 37 active schemes.

SBI MAGNUM TAX GAIN (ELSS) :The nature of the scheme is open ended

equity linked savings (ELSS) scheme with a lock-in period of 3 years. It will be

comes in market at 1996.

3] RELIANCE MUTUAL FUND. :

20

A STUDY REPORT ON MUTUAL

FUND IN INDIA

Reliance Mutual Fund ('RMF') is one of India leading Mutual Funds, with

Average Assets under Management (AUM) of Rs. 90,636 Cores and an

investor count of over 58.42 and 64.53 Lakh folios. Reliance Mutual Fund, a

part of the Reliance Group, is one of the fastest growing mutual funds in

India. RMF offers investors a well-rounded portfolio of products to meet

varying investor requirements and has presence in 179 cities across the

country. Reliance Mutual Fund constantly endeavors to launch innovative

products and customer service initiatives to increase value to investors.

Reliance Capital Asset Management Limited (RCAM) is the asset manager

of Reliance Mutual Fund. RCAM is a subsidiary of Reliance Capital Limited

(RCL). Presently, RCL holds 65.23% of its total issued and paid-up equity

share capital and the balance of its issued and paid up equity share capital is

held by other shareholders which includes Nippon Life Insurance Company

(NLI), holding 26% of RCAMs total issued and paid up equity share capital.

NLI acquired the said 26% share holding in RCAM on August 17, 2012.

Reliance Capital Ltd. is one of Indias leading and fastest growing private

sector financial services companies, and ranks among the top 3 private

sector financial services and banking companies, in terms of net worth.

Reliance Capital Ltd. has interests in asset management, life and general

insurance, private equity and proprietary investments, stock broking and

other financial services. Reliance Mutual Fund (RMF) was initially set up as a

Trust in accordance with the provisions ofthe Indian Trust Act, 1882 by

Reliance Capital Limited acting as a Settler /Sponsor, vide a Trust Deed dated

21

A STUDY REPORT ON MUTUAL

FUND IN INDIA

April 25, 1995 (the Original Trust Deed).The Original Trust Deed was duly

registered under the Indian Registration Act, 1908. The Original Trust Deed

was subsequently amended from time to time. In order to consolidate all

amendments to the Original Trust Deed in one document, an Amended and

Restated Trust Deed was executed on March 15, 2011 (the Amended and

Restated Trust Deed). The Amended and Restated Trust Deed was

subsequently registered under the Indian Registration Act, 1908 and the

Amended and Restated Trust Deedwas duly filed with SEBI. Reliance Capital

Trustee Co. Limited entered into an Investment Management Agreement

dated May 12, 1995 with Reliance Capital Asset Management Ltd. (RCAM) to

function as the Investment Manager for all the Schemes of RMF.

Reliance Mutual Fund, a part of the Reliance Anil Dhirubhai Ambani Group is

the No. 1 Mutual Fund in India. Reliance Mutual Fund offers investors a well

rounded portfolio of products to meet varying investor requirements.

Reliance Mutual Fund has a presence in over 100 cities across the country,

an investor base of over 3.9 million and manages assets over Rs. 67,598

Cores as on August 31, 2007. Reliance Mutual Fund constantly endeavors to

launch innovative products and customer service initiatives to increase value

to investors. Reliance Mutual Fund schemes are managed by Reliance Capital

Asset Management Ltd. a wholly owned subsidiary of Reliance Capital Ltd.

Reliance Capital Ltd. is one of Indias leading and fastest growing private

sector financial services companies, and ranks among the top 3 private

sector financial services and banking companies, in terms of net worth.

Reliance Capital Ltd. has interests in asset management and mutual funds,

life and general insurance, private equity and proprietary investments, stock

broking and other financial services. This group dominates this key are in the

financial sector..This mega business houses show that it has assets under

management of Rs. 90,938 crore (US$ 22.73 billion) andan investor base of

over6.6 million .Reliances mutual fund schemes are managed by Reliance

22

A STUDY REPORT ON MUTUAL

FUND IN INDIA

Capital Asset Management Limited RCAM), a subsidiary of Reliance Capital

Limited, which holds 93.37% of the paid-up capital of RCAM. The company

not ched up a healthy growth of Rs. 16,354 crore (US$ 4.09 billion)in assets

under management in February2008 and helped propel the Total industrywide

AUM

to

Rs.

565,459

crore

(US$

141.36

billion)(Source:

indiainvestments.com). A sharp rise in fixed maturity plans (FMPs) and

collection of Rs. 7000 crore (US$ 1.75 billion) through new fund offers (NFOs)

created this surge. In A Urankings, Reliance continues to be in the number

one spot. The Anil Dhirubhai Ambani Group owns Reliance; they are the

fastest growing investment company in India so far. To meet the erratic

demand of the financial market, Reliance Mutual Fund designed a distinct

portfolio that is sure to please potential investors. Reliance Capital Asset

Management Limited manages RMF.

4] FRANKLIN TEMPLETON MUTUAL FUND.:

FTMF has been constituted as a Trust on January 4, 1996 in accordance with

the provisions of the Indian Trusts Act, 1882 and the Deed of Trust is

registered under the Indian Registration Act, 1908. FTMF has been sponsored

by Templeton International Inc. (liability restricted to the seed corpus of Rs. l

lakh) with Franklin Templeton Trustee Services Pvt. Ltd. (Trustee) as the

Trustee. The Trustee has entered into an Investment Management Agreement

dated January 5, 1996 with Franklin Templeton Asset Management (India)

23

A STUDY REPORT ON MUTUAL

FUND IN INDIA

Pvt. Ltd. (AMC) appointing the AMC as the Investment Manager for all the

schemes of FTMF. FTMF is registered with SEBI on February 19, 1996.

Templeton International Inc. is a part of the Franklin Templeton Group, which

is one of the largest Investment Management Company with US$683.5 bln

(approximately Rs.3,856,478 core) in assets under management as on May

31, 2012 and around 26 million Shareholder Accounts. Franklin Templeton

has offices in over 30 countries including the United States of America,

Bahamas, Canada, Argentina, France, Germany, Italy, Luxembourg, Poland,

Russia, the United Kingdom, Hong Kong, Singapore, Korea, India, China,

Australia and South Africa. Review of activities of Franklin Templeton Mutual

Fund: During the year under review, the Mutual Fund continued to focus on

launching meaningful products with investment objectives that are relevant

to investors. The Mutual Fund launched Templeton India Corporate Bond

Opportunities Fund, an open end debt fund investing in corporate bonds,

mobilizing over Rs.250 core, FT India Feeder - Franklin U.S. Opportunities

Fund, a fund of funds scheme investing in the units of Franklin U. S.

Opportunities Fund, an overseas fund that invests primarily in U. S.

securities, mobilizing over Rs.100 core and Franklin Templeton Fixed Tenure

Fund Series XVI mobilizing over Rs.68 core. As a part of product

rationalization process to make the offerings more meaningful and easy to

understand for investors and to reduce product overlap between similar

schemes, few schemes / plans were merged during the year. The Liquid Plan

of Templeton India Treasury Management Account (TITMA) was merged into

Regular Plan of TITMA effective September 4, 2011. Franklin FMCG Fund and

Franklin Pharma Fund merged into Franklin India Prima Plus effective

September 9, 2011. Franklin India Index Tax Fund (FITF) merged into Franklin

India Index Fund NSE Nifty Plan effective September 9, 2011. Franklin India

Index Tax Fund (FITF) was launched in February 2001 as open end passively

managed ELSS scheme. The scheme invested in companies, whose securities

are part of the S&P CNX Nifty, with the aim to generate returns

24

A STUDY REPORT ON MUTUAL

FUND IN INDIA

commensurate with S&P CNX Nifty. As part of our product rationalization

process and with a view to reduce overlap between similar schemes, it was

decided to merge FITF with the Growth Option under the Nifty Plan of

Franklin India Index Fund. The effective date of the merger was September 9,

2011. As on March 31, 2012, the Mutual Fund served more than 20 lakh

active investors through its 34 branches and 105 offices of our collection

partners across India.

FRANKLINE INDIA TAX SHEILD:

The nature of the scheme is open ended equity linked savings (ELSS) scheme

with a lock-in period of 3 years. It will be comes in market at April 10 1999.

The minimum application amount is for new & existing investors Rs.500 and

in multiples of Rs. 500 thereafter.

MUTUAL FUNDS :

Franklin Templeton has over 200 different open-ended mutual funds and 7

closed-end funds in the fund family. Included in these are 36 state and

federal tax free income funds, an area of investment pioneered by Franklin.

Prominent funds in the fund family include the world's largest equity fund

Templeton Growth Fund, Inc. (opened 1954, $29.5bn assets), the Mutual

Shares fund (opened 1949, $7.9bn assets), and the Mutual Discovery Fund

(opened $1992, 7.6bn assets) and the Templeton Growth (Euro) Fund A (acc)

($6.1bn assets). The Franklin Income Fund (FKINX, assets $33.6bn) is a

mutual fund in

Morningstar's

"conservative

allocation" category

and

"large/value" style box. The fund was created in 1948 and has paid

uninterrupted dividends for 60 years. The Franklin Income Fund is

constructed primarily of dividend-paying stocks and bonds (2%).

OBJECTIVES OF STUDY

25

A STUDY REPORT ON MUTUAL

FUND IN INDIA

The main objective of the study is to make investors aware of performance

and provide

information on the comparison of tax saving funds of selected asset

management companies. The

specific objectives are:

To understand the organisation of mutual fund industry.

To compare the performance of selected tax saving schemes in

comparison with standard

deviation.

To offer suggestions based on the findings arrived from the study.

26

A STUDY REPORT ON MUTUAL

FUND IN INDIA

SCOPE OF STUDY

The study is all about understanding the customers perception to the tax

benefit in mutual fund. The purpose of this study of performance evaluation

of tax saving mutual funds by taking fours elected companies which are

HDFC, Franklin Templeton, SBI and Reliance is to employ the resources in

such a manner as to afford for the investors combine benefits of low risk,

steady returns, high liquidity and capital appreciation through diversification

and expert management.

27

A STUDY REPORT ON MUTUAL

FUND IN INDIA

LIMITATIONS OF STUDY

The study was limited by the time constraint; hence extent to study is

not possible.

The study was limited to 5 companies only.

The policy and application are applicable to the particular assessment

year only.

The analysis and interpretation purely based on the data collected

from various website.

The accuracy of interpretation depends upon the accuracy of these

data.

The return from the mutual fund depends upon the returns of the

securities involved in the portfolio. The return from the market

depends upon the efficiency of the market and other various factor

affecting the fund and economy as a whole. So the researcher doesnt

claim the 100% accuracy of the result conducted from the study.

28

A STUDY REPORT ON MUTUAL

FUND IN INDIA

BENEFITS OF INVESTING IN A MUTUAL FUND

As an investor, you would like to get maximum returns on your investments,

but you may not have the time to continuously study the stock market to

keep track of them. You need a lot of time and knowledge to decide what to

buy or when to sell. A lot of people take a chance and speculate, some get

lucky, most don t. This is where mutual funds come in. Mutual funds offer

you the following advantages :

Professional management: Qualified professionals manage your money,

but they are not alone. They have a research team that continuously

analyses the performance and prospects of companies. They also select

suitable investments to achieve the objectives of the scheme. It is a

continuous process that takes time and expertise which will add value to

your investment. Fund managers are in a better position to manage your

investments and get higher returns.

Diversification: The clich, "don't put all your eggs in one basket" really

applies to the concept of intelligent investing. Diversification lowers your risk

29

A STUDY REPORT ON MUTUAL

FUND IN INDIA

of loss by spreading your money across various industries and geographic

regions. It is a rare occasion when all stocks decline at the same time and in

the same proportion. Sector funds spread your investment across only one

industry so they are less diversified and therefore generally more volatile.

More choice: Mutual funds offer a variety of schemes that will suit your

needs over a lifetime. When you enter a new stage in your life, all you need

to do is sit down with your financial advisor who will help you to rearrange

your portfolio to suit your altered lifestyle.

Affordability: As a small investor, you may find that it is not possible to buy

shares of larger corporations. Mutual funds generally buy and sell securities

in large volumes which allow investors to benefit from lower trading costs.

The smallest investor can get started on mutual funds because of the

minimal investment requirements. You can invest with a minimum of Rs.500

in a Systematic Investment Plan on a regular basis.

Tax benefits: Investments held by investors for a period of 12 months or

more qualify for capital gains and will be taxed accordingly. These

investments also get the benefit of indexation.

Liquidity: With open-end funds, you can redeem all or part of your

investment any time you wish and receive the current value of the shares.

Funds are more liquid than most investments in shares, deposits and bonds.

Moreover, the process is standardised, making it quick and efficient so that

you can get your cash in hand as soon as possible.

30

A STUDY REPORT ON MUTUAL

FUND IN INDIA

Rupee-cost averaging: With rupee-cost averaging, you invest a specific

rupee amount at regular intervals regardless of the investment's unit price.

As a result, your money buys more units when the price is low and fewer

units when the price is high, which can mean a lower average cost per unit

over time. Rupee-cost averaging allows you to discipline yourself by

investing every month or quarter rather than making sporadic investments.

Transparency: The performance of a mutual fund is reviewed by various

publications and rating agencies, making it easy for investors to compare

fund to another. As a unitholder, you are provided with regular updates, for

example daily NAVs, as well as information on the fund's holdings and the

fund manager's strategy.

Regulations: All mutual funds are required to register with SEBI (Securities

Exchange Board of India). They are obliged to follow strict regulations

designed to protect investors. All operations are also regularly monitored by

the SEBI.

DISADVANTAGE OF INVESTING IN A MUTUAL FUND

There are certainly some benefits to mutual fund investing, but you should

also be aware of the drawbacks associated with mutual funds.No Insurance:

Mutual funds, although regulated by the government, are not insured against

losses. The Federal Deposit Insurance Corporation (FDIC) only insures against

certain losses at banks, credit unions, and savings and loans, not mutual

funds. That means that despite the risk-reducing diversification benefits

31

A STUDY REPORT ON MUTUAL

FUND IN INDIA

provided by mutual funds, losses can occur, and it is possible (although

extremely unlikely) that you could even lose your entire investment. Dilution:

Although diversification reduces the amount of risk involved in investing in

mutual funds, it can also be a disadvantage due to dilution. For example, if a

single security held by a mutual fund doubles in value, the mutual fund itself

would not double in value because that security is only one small part of the

funds holdings. By holding a large number of different investments, mutual

funds tend to do neither exceptionally well nor exceptionally poorly.Fees and

Expenses: Most mutual funds charge management and operating fees that

pay for the funds management expenses (usually around 1.0% to 1.5% per

year for actively managed funds). In addition, some mutual funds charge

high sales commissions, 12b-1 fees, and redemption fees. And some funds

buy and trade shares so often that the transaction costs add up significantly.

Some of these expenses are charged on an ongoing basis, unlike stock

investments, for which a commission is paid only when you buy and sell .

Poor Performance: Returns on a mutual fund are by no means guaranteed.

In fact, on average, around 75% of all mutual funds fail to beat the major

market indexes, like the S&P 500, and a growing number of critics now

question whether or not professional money managers have better stockpicking capabilities than the average investor.

Loss of Control: The managers of mutual funds make all of the decisions

about which securities to buy and sell and when to do so. This can make it

difficult for you when trying to manage your portfolio. For example, the tax

consequences of a decision by the manager to buy or sell an asset at a

certain time might not be optimal for you. You also should remember that

you are trusting someone else with your money when you invest in a mutual

fund.

32

A STUDY REPORT ON MUTUAL

FUND IN INDIA

Trading Limitations: Although mutual funds are highly liquid in general,

most mutual funds (called open-ended funds) cannot be bought or sold in the

middle of the trading day. You can only buy and sell them at the end of the

day, after theyve calculated the current value of their holdings.

Size: Some mutual funds are too big to find enough good investments. This

is especially true of funds that focus on small companies, given that there

are strict rules about how much of a single company a fund may own. If a

mutual fund has $5 billion to invest and is only able to invest an average of

$50 million in each, then it needs to find at least 100 such companies to

invest in; as a result, the fund might be forced to lower its standards when

selecting companies to invest in.

Inefficiency of Cash Reserves: Mutual funds usually maintain large cash

reserves as protection against a large number of simultaneous withdrawals.

Although this provides investors with liquidity, it means that some of the

funds money is invested in cash instead of assets, which tends to lower the

investors potential return.

Too Many Choices: The advantages and disadvantages listed above apply

to mutual funds in general. However, there are over 10,000 mutual funds in

operation, and these funds vary greatly according to investment objective,

size, strategy, and style. Mutual funds are available for virtually every

investment strategy (e.g. value, growth), every sector (e.g. biotech,

internet), and every country or region of the world. So even the process of

selecting a fund can be tedious.

33

A STUDY REPORT ON MUTUAL

FUND IN INDIA

RESEARCH METHODOLOGY

What is Research:Different investment avenues are available to investors. Mutual funds also

offer good investment opportunities to the investors. Like all investments,

they also carry certain risks. The investors should compare the risks and

expected yields after adjustment of tax on various instruments while taking

investment decisions. The investors may seek advice from experts and

consultants including agents and distributors of mutual funds schemes while

making investment decisions. With an objective to make the investors aware

of performance of mutual funds, an attempt has been made to provide

information on the comparison of tax saving funds of selected Asset

Management Companies such as HDFC, FRANKLIN INDIA, RELIANCE, SBI and

which may help the investors in taking investment decisions. The analysis is

also compared with the calculations based on the Average return and

Standard deviation for the period 2008-12. This paper is carried out to find

out the returns of funds thereby studying the performance of the selected

tax saving schemes in the market. The investor invests the funds based on

the returns, net asset value and also the trend prevailing in the market.

Mutual Fund is a trust that pools the savings of a number of investors who

share a common financial goal. Mutual funds are one of the best investments

34

A STUDY REPORT ON MUTUAL

FUND IN INDIA

ever created because they are very cost efficient and very easy to invest in.

Investors in India opt for the tax-saving mutual fund schemes for the simple

reason that it helps them to save money. The tax-saving mutual funds or the

equity-linked savings schemes (ELSS) receive certain tax exemptions under

Section 80C of the Income Tax Act. That is one of the reasons why the

investors in India add the tax-saving mutual fund schemes to their portfolio.

The tax-saving mutual fund schemes are one of the important types of

mutual funds in India that investors can opt for. The present study is carried

out to find out the returns of funds thereby studying the performance of the

tax saving funds in the market. The investor invests the funds based on the

returns, net asset value and also the trend prevailing in the market. Since the

market being high volatile there is a need to study the performance and

comparative statement of various tax saving funds performing in the market.

Data collection Methods:The following research methodology has been adopted for assessing the

performance of tax

saving funds of selected Asset Management Companies in the market.

Sources of data:

The present study is purely based on secondary data. Top five ELSS schemes

were as per their AUM . The sample ELSS schemes are HDFC Tax Saver, DSP

BlackRock Tax saver fund, Reliance Tax Saver, SBI Magnum Tax Gain and

Franklin India Tax shield. The data is collected from the fact sheets, reports,

35

A STUDY REPORT ON MUTUAL

FUND IN INDIA

websites, magazines, books and journals etc. are considered. The deviations

are properly analyzed. For each of the scheme, the risk ratios (Average

return and Standard Deviation) were also observed carefully and correlated

with the returns. Accordingly, proper findings were found out and conclusions

were drawn about the best performance scheme among all.

DATA ANALYSIS & INTERPRETATION

CALCULATION OF STANDARD DEVIATION OF SELECTED FUNDS

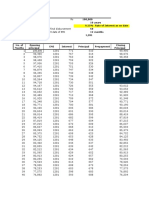

1]. HDFC Tax Saver

Table 1.1 Standard Deviation for HDFC Tax Saver

YEAR

RETURN

AVERAGE

RETURN

36

DY=(Y-Y)

DY2

A STUDY REPORT ON MUTUAL

FUND IN INDIA

2008

2009

2010

2011

2012

Total

-51.55

99.07

26.42

-22.62

26.59

77.91

15.58

15.58

15.58

15.58

15.58

-35.97

83.49

10.84

38.2

11.01

1293.84

6970.58

117.55

1459.24

121.22

9962.43

Standard Deviation (S.D) =

= 49.90

2]. Franklin India Tax Shield

Table 1.2 Standard Deviation for Franklin India Tax Shield

YEAR

RETURN

AVERAGE

DY=(Y-Y)

DY2

2008

2009

2010

2011

-49.22

78.81

23.47

-15.19

RETURN

13.45

13.45

13.45

13.45

-62.67

65.36

10.02

-28.64

3827.53

4271.93

100.40

820.24

37

A STUDY REPORT ON MUTUAL

FUND IN INDIA

2012

Total

29.38

67.25

13.45

15.93

253.76

9373.86

Standard Deviation (S.D) =

= 48.41

3]. SBI Magnum Tax Gain

Table 1.4 Standard Deviation for SBI Magnum Tax Gain

YEAR

RETURN

AVERAGE

DY=(Y-Y)

DY2

2008

2009

2010

2011

-54.86

86.41

12.98

-23.50

RETURN

11.06

11.06

11.06

11.06

-65.92

75.35

1.92

-34.56

4345.45

5677.62

2.69

1194.39

38

A STUDY REPORT ON MUTUAL

FUND IN INDIA

2012

Total

34.29

55.32

11.06

23.23

539.63

11759.78

Standard Deviation (S.D) =

= 54.22

4] Reliance Tax Saving Fund

Table 1.5 Standard Deviation for Reliance Tax Saving Fund

YEAR

RETURN

AVERAGE

DY=(Y-Y)

DY2

2008

2009

2010

2011

-52.35

82.01.

22.49

-24.23

RETURN

14.79

14.79

14.79

14.79

-67.14

67.22

7.7

-39.02

4507.78

4518.53

59.29

1522.56

39

A STUDY REPORT ON MUTUAL

FUND IN INDIA

2012

Total

46.05

73.97

14.79

31.26

977.19

11585.35

Standard Deviation (S.D) =

= 53.82

standard deviation and return of selected tax saving schemes

Table 1.6 Return vs. Risk estimated of selected tax saving schemes

FUND

HDFC

Frankin

SBI

reliance

40

RETURN

STANDARD

15.58

13.45

11.06

14.79

DEVIATION

49.90

48.41

54.22

53.82

A STUDY REPORT ON MUTUAL

FUND IN INDIA

Interpretation: From the table 1.6 shows that average return and standard

deviation details. From the table it can be seen that DSP Blackrock fund

making highest average return of 18.75% during the period. However

its

also facing highest risk of 64.22 of all the four funds. The SBI fund, HDFC

fund, Franklin India funds and Reliance fund are making similar amount

average return but risk is not much higher.

CONCLUSIONS & FINDINGS

CONCLUSION :

Mutual funds are one of the best investments ever created because they are

very cost efficient and very easy to invest in. All the selected schemes have

allocated majority of corpus to large cap stock and some schemes also have

allocation to mid cap. Various external causes affect the fund performance. It

is suggestible for the investors to choose the right scheme according to their

risk apatite tolerance and objective of the scheme. And it is always

41

A STUDY REPORT ON MUTUAL

FUND IN INDIA

suggested to invest in equity schemes for longer tenure. Investors while

investing in the mutual funds is very cautious.

SUMMARY OF FINDINGS:

In order to know the performance of the tax saving schemes in mutual fund

as per the research design from five selected AMC company data was

collected. Further the data was analyzed in previous chapter evaluating by

(Average return and standard deviation determination methods of mutual

fund) to getting some finding.

An Individual can take an advantage of this funds and schemes to save

tax by investing

maximum of Rs 1,00,000.

After analyzing the data, it is understood that the DSP BlackRock Tax

Saver, Reliance

Tax Saving, Franklin India Tax Shield and HDFC Tax saver fund have

performed better

with average return of 18.75, 14.49, 13.45 and 15.58% respectively.

Further, DSP BlackRock Tax Saver has a higher risk (standard deviation)

of 64.22, which

has given the highest return among selected schemes. In the case of return,

the SBI

Magnum Tax Gain has given less return with a high risk (standard deviation)

of 54.22%

42

A STUDY REPORT ON MUTUAL

FUND IN INDIA

SUGGESTIONS & RECOMMENDATIONS

Investors can go ahead in investing in Reliance Tax Saving, Franklin

India Tax Shield and HDFC Tax saver fund for acquiring better returns

as well as tax savings.

SBI AMC has to revise SBI Magnum Tax Gain portfolio to increase fund

returns and provide to the investors a more secure investment option

along with tax saving.

The Franklin India Tax Shield scheme tends to hold portfolio that were

less risky than the market portfolio.

According return against the risk schemes will be ranked accordingly

HDFC fund 1st, Reliance fund is 2 nd ,Frankline fund is 3rd and SBI fund is

4th

AMCs should take more efforts on spreading awareness about taxing

mutual funds as these investment instruments provides a higher return

with tax saving

It should also induce technology that reduces turnaround time for

services like investment, redemptions and transfers and bring them on

par with bank in turnaround time.

43

A STUDY REPORT ON MUTUAL

FUND IN INDIA

REFERENCE

WEBLIOGRAPHY

WWW.GOOGLE.COM

SLIDE SHARE

MANAGEMENT PARADISE

44

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Objectives of StudiesDocument6 pagesObjectives of Studiesvenkynaidu100% (1)

- Chapter No.1 Introduction To International Standards On AuditingDocument34 pagesChapter No.1 Introduction To International Standards On AuditingvenkynaiduPas encore d'évaluation

- Project Report On "Working Capital On QCML Company": Miss. Micheal Augustine Mary Roll No: 18Document60 pagesProject Report On "Working Capital On QCML Company": Miss. Micheal Augustine Mary Roll No: 18venkynaiduPas encore d'évaluation

- F A ProjectDocument46 pagesF A ProjectvenkynaiduPas encore d'évaluation

- Serial No NoDocument27 pagesSerial No NovenkynaiduPas encore d'évaluation

- RM ProjectDocument45 pagesRM Projectvenkynaidu100% (1)

- Introduction To International Standards On AuditingDocument30 pagesIntroduction To International Standards On Auditingvenkynaidu100% (1)

- Project On Finalization of Partnership FirmDocument38 pagesProject On Finalization of Partnership Firmvenkynaidu67% (3)

- Index: Sr. No. Description 1 2 3Document63 pagesIndex: Sr. No. Description 1 2 3venkynaiduPas encore d'évaluation

- 1 Messages Reply To: To: CC:: ResumeDocument1 page1 Messages Reply To: To: CC:: ResumevenkynaiduPas encore d'évaluation

- Financial Statement On Sole Trading Ok ProjectDocument51 pagesFinancial Statement On Sole Trading Ok Projectvenkynaidu57% (14)

- Project Report: Masters of Commerce Degree Semester-3 ACADEMIC YEAR: 2015-16 Submitted byDocument41 pagesProject Report: Masters of Commerce Degree Semester-3 ACADEMIC YEAR: 2015-16 Submitted byvenkynaiduPas encore d'évaluation

- Coperative Society FinalDocument41 pagesCoperative Society Finalvenkynaidu100% (1)

- Sole TradingDocument15 pagesSole TradingvenkynaiduPas encore d'évaluation

- Project Report: Masters of Commerce Degree Semester-2 ACADEMIC YEAR: 2015-16 Submitted byDocument47 pagesProject Report: Masters of Commerce Degree Semester-2 ACADEMIC YEAR: 2015-16 Submitted byvenkynaidu100% (1)

- Marginal Costing PROJECTDocument38 pagesMarginal Costing PROJECTvenkynaidu67% (9)

- Co Operative Housing SocietyDocument29 pagesCo Operative Housing Societyvenkynaidu100% (1)

- Financial Statement On Sole Trading Ok ProjectDocument51 pagesFinancial Statement On Sole Trading Ok Projectvenkynaidu57% (14)

- VenkyDocument1 pageVenkyvenkynaiduPas encore d'évaluation

- Environmental AuditingDocument36 pagesEnvironmental AuditingvenkynaiduPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Entrepreneurial Ecosystem Assessment VNDocument54 pagesEntrepreneurial Ecosystem Assessment VNYongtong OuPas encore d'évaluation

- Where Vision Gets BuiltDocument100 pagesWhere Vision Gets BuiltxaveonePas encore d'évaluation

- Approved List of ValuersDocument7 pagesApproved List of ValuersTim Tom100% (1)

- Comparision Between Pre GST and Post Gst....Document26 pagesComparision Between Pre GST and Post Gst....Yash MalhotraPas encore d'évaluation

- Bbma MHV - Ms.enDocument15 pagesBbma MHV - Ms.enXeno WerkPas encore d'évaluation

- Assignment 1 BAN 100 Edwin CastilloDocument11 pagesAssignment 1 BAN 100 Edwin CastilloEdwin CastilloPas encore d'évaluation

- Turnaround Management: Prof Ashish K MitraDocument27 pagesTurnaround Management: Prof Ashish K MitraAnuj GuptaPas encore d'évaluation

- Nikl Metals WeeklyDocument7 pagesNikl Metals WeeklybodaiPas encore d'évaluation

- Initiative of National Housing PolicyDocument4 pagesInitiative of National Housing PolicyMuhaimin RohizanPas encore d'évaluation

- Basic Accounting For Non-Accountants (A Bookkeeping Course)Document49 pagesBasic Accounting For Non-Accountants (A Bookkeeping Course)Diana mae agoncilloPas encore d'évaluation

- Additional Time Value ProblemsDocument2 pagesAdditional Time Value ProblemsBrian WrightPas encore d'évaluation

- (IBF301) - International Finance SyllabusDocument2 pages(IBF301) - International Finance SyllabusSu NgPas encore d'évaluation

- ENPSForm Amandeep KaurDocument5 pagesENPSForm Amandeep KaurManmohan SinghPas encore d'évaluation

- Auditing Problems IAS 17: LEASES (0ld Standard) Dr. Glen de Leon, CPADocument29 pagesAuditing Problems IAS 17: LEASES (0ld Standard) Dr. Glen de Leon, CPAArcelli Dela CruzPas encore d'évaluation

- Activity No. 2 (Moredo) : Problem 1Document3 pagesActivity No. 2 (Moredo) : Problem 1Eloisa Joy MoredoPas encore d'évaluation

- Financial MArket in BangladeshDocument2 pagesFinancial MArket in BangladeshSaj Jad33% (3)

- Department of Labor: BC10Document1 pageDepartment of Labor: BC10USA_DepartmentOfLaborPas encore d'évaluation

- Loan CalculatorDocument5 pagesLoan CalculatorHema Kumar Hema KumarPas encore d'évaluation

- CFAB - Accounting - QB - Chapter 9Document13 pagesCFAB - Accounting - QB - Chapter 9Nga Đào Thị Hằng100% (1)

- Final Annual NGBIRR FY 2022.23Document208 pagesFinal Annual NGBIRR FY 2022.23Dunson MuhiaPas encore d'évaluation

- The Business Case For Basel IIDocument10 pagesThe Business Case For Basel IIGordonPas encore d'évaluation

- PPP ThailandDocument18 pagesPPP ThailandenfrspitPas encore d'évaluation

- IFA AssignmentDocument5 pagesIFA AssignmentAdnan JawedPas encore d'évaluation

- Fiscal Space Assessment Project 1Document49 pagesFiscal Space Assessment Project 1VincentPas encore d'évaluation

- Modelo - Due DiligenceDocument17 pagesModelo - Due DiligenceAdebayorMazuzePas encore d'évaluation

- Notice of Belief of AbandonmentDocument1 pageNotice of Belief of AbandonmentSeasoned_SolPas encore d'évaluation

- Santander 219-432-Informe Anual ENG ACCE PDFDocument296 pagesSantander 219-432-Informe Anual ENG ACCE PDFvhsodaPas encore d'évaluation

- Currency Derivatives: For Use With International Financial Management, 3e Jeff Madura and RolandDocument37 pagesCurrency Derivatives: For Use With International Financial Management, 3e Jeff Madura and Rolandياسين البيرنسPas encore d'évaluation

- Cyber Receipt PDFDocument1 pageCyber Receipt PDFprince_rahul_159Pas encore d'évaluation

- Demystifying The Ichimoku CloudDocument10 pagesDemystifying The Ichimoku CloudShahzad Dalal100% (1)