Académique Documents

Professionnel Documents

Culture Documents

Chapter 24 (9) Differential Analysis and Product Pricing Study Guide Solutions Fill-in-the-Blank Equations

Transféré par

Luisa Dahiana Castillo NúñezTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Chapter 24 (9) Differential Analysis and Product Pricing Study Guide Solutions Fill-in-the-Blank Equations

Transféré par

Luisa Dahiana Castillo NúñezDroits d'auteur :

Formats disponibles

Chapter 24 (9)

Differential Analysis and Product Pricing

Study Guide Solutions

Fill-in-the-Blank Equations

1. Differential revenue

2. Differential costs

3. Differential income (Loss)

4. Markup per unit

5. Estimated units produced and sold

6. Total selling and administrative expenses

7. Desired rate of return

8. Target cost

9. Production bottleneck hours per unit

Exercises

1. Charleston Affair currently has a piece of equipment that is no longer needed. The

current book value of the piece of the equipment is $12,000. The company has the

option to lease the equipment for the next three years for $5,500 each year, or sell the

equipment for $16,000. If leased, the equipment would have no residual value at the

end of the lease. The company expects that maintenance and other expenses during the

lease would total $2,000. If sold, Charleston Affair would pay a 5% commission. Prepare

a differential analysis to determine if the company should sell (Alternative 1) or lease

(Alternative 2) the equipment.

Revenues

Costs

Income (loss)

Differential Analysis

Sell (Alt. 1) or Lease (Alt. 2)

Differential Effect

Sell (Alt. 1) Lease (Alt. 2) on Income (Alt. 2)

$16,000

$16,500

$ 500

(800)

(2,000)

(1,200)

$15,200

$14,500

$ (700)

Charleston Affair should sell the asset.

1

2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to publicly accessible website, in whole or in part.

Chapter 24 (9)

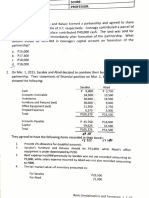

2. Wake Coffee Co. has a piece of equipment no longer needed for production. The

company purchased the equipment for $75,000 and has accumulated depreciation of

$10,000 related to the equipment. Wake Coffee Co. has determined it can either lease

the equipment for the next ten years, for yearly revenues of $9,000, or sell the

equipment for $70,000. If leased, the company expects to incur repairs and other

expenses of $22,000 over the life of the lease. The equipment would also have a $3,500

salvage value. If sold, the broker requires a 4% broker commission. Prepare a differential

analysis to determine if the company should sell (Alternative 1) or lease (Alternative 2)

the equipment.

Revenues

Costs

Income (loss)

Differential Analysis

Sell (Alt. 1) or Lease (Alt. 2)

Differential Effect on

Sell (Alt. 1) Lease (Alt. 2)

Income (Alt. 2)

$70,000

$ 93,500

$ 23,500

(2,800)

(22,000)

(19,200)

$67,200

$ 71,500

$ 4,300

Revenues if leased = $90,000 + $3,500

Wake Coffee Co. should lease the asset.

3. Blair Designs is considering two alternatives for an outdated piece of machinery: leasing

the machinery for five years, which would produce revenue of $8,000 year or selling the

machinery for $38,000. The asset has a current book value of $25,000. If leased, the

company expects to incur $7,000 of expenses for maintenance and taxes, and the

equipment will have a $4,000 salvage value. If sold, the broker charges a 5% commission

fee. Prepare a differential analysis to determine if the company should sell (Alternative

1) or lease (Alternative 2) the machinery.

Revenues

Costs

Income (loss)

Differential Analysis

Sell (Alt. 1) or Lease (Alt. 2)

Differential Effect on

Sell (Alt. 1) Lease (Alt. 2)

Income (Alt. 2)

$38,000

$44,000

$ 6,000

(1,900)

(7,000)

(5,100)

$36,100

$37,000

$ 900

Blair Designs should lease the asset.

2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to publicly accessible website, in whole or in part.

Differential Analysis and Product Pricing 3

Strategy: When determining whether to sell or lease an asset, first determine the

revenues in each situation. If sold, the revenue is the selling price, and if leased, the

revenue is the lease revenue and the salvage value, if any. Next determine the costs,

which usually include a sales commission when selling and cost of upkeep when leasing.

Determine the differential effect on income. If positive, the company should proceed

with Alternative 2.

4. Product B at Charleston Affair generates sales of $59,000 for 10,000 units. Each unit has

variable costs of $4.50 apiece and total fixed costs of $18,000. Prepare a differential

analysis to determine if Product B should be continued (Alternative 1) or discontinued

(Alternative 2) if the fixed costs are unaffected by the decision.

Differential Analysis

Continue (Alt. 1) or Discontinue (Alt. 2) Product B

Differential Effect

Continue (Alt. 1) Discontinue (Alt. 2) on Income (Alt. 2)

$ 59,000

$

0

$(59,000)

Revenues

Costs:

Variable

Fixed

Total costs

Income (loss)

$(45,000)

(18,000)

$(63,000)

$ (4,000)

$

0

(18,000)

$(18,000)

$(18,000)

$ 45,000

0

$ 45,000

$(14,000)

Product B should be continued because the income generated from the product will

cover some of fixed costs.

2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to publicly accessible website, in whole or in part.

Chapter 24 (9)

5. Wake Coffee Co. incurs a loss from operations for the Standard Coffee line. Sales

revenues for the line total $72,000, while incurring variable costs of goods sold of

$19,500, variable selling expenses of $17,400, and fixed costs of $49,000. Prepare a

differential analysis to determine if the Standard Coffee line should be continued

(Alternative 1) or discontinued (Alternative 2). Assume the company will incur the fixed

costs regardless of the decision.

Differential Analysis

Continue (Alt. 1) or Discontinue (Alt. 2) Standard Coffee

Differential Effect

Continue (Alt. 1) Discontinue (Alt. 2) on Income (Alt. 2)

Revenues

$ 72,000

$

0

$(72,000)

Costs:

Variable

$(36,900)

$

0

$ 36,900

Fixed

(49,000)

(49,000)

0

Total costs

$(85,900)

$(49,000)

$ 36,900

Income (loss)

$(13,900)

$(49,000)

$(35,100)

The Standard Coffee Line should be continued.

6. Product BW of Blair Designs generates sales revenue of $40,000. The product incurs

variable costs of goods sold of $22,000, fixed selling costs of $22,000, and fixed factory

overhead of $21,000. Use a differential analysis to determine if Product BW should be

continued (Alternative 1) or discontinued (Alternative 2). Assume that the company will

incur the fixed factory overhead regardless of the decision.

Revenues

Costs:

Variable

Fixed

Total costs

Income (loss)

Differential Analysis

Continue (Alt. 1) or Discontinue (Alt. 2) Product BW

Differential Effect on

Continue (Alt. 1) Discontinue (Alt. 2)

Income (Alt. 2)

$ 40,000

$

0

$(40,000)

$(22,000)

(43,000)

$(65,000)

$(25,000)

$

0

(21,000)

$(21,000)

$(21,000)

$ 22,000

22,000

$ 44,000

$ 4,000

Product BW should be discontinued.

2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to publicly accessible website, in whole or in part.

Differential Analysis and Product Pricing 5

Strategy: If the company continues the product line, the revenues and costs will be equal

to the amounts expected. However, if the company discontinues the product line, no

revenue will be earned and no variable costs will be incurred. However, the fixed costs

may remain since the company will incur the costs regardless of the number of products

finished. Determine the differential effect on income. If positive, the company should

decide Alternative 2.

7. Charleston Affair currently makes the King Component, incurring variable costs of $18

per unit and fixed costs of $4 per unit. The company has the option to purchase the

component for $20 per unit. Prepare a differential analysis to determine if the company

should make (Alternative 1) or buy (Alternative 2) the King Component. Assume that the

fixed costs will be incurred in each situation.

Differential Analysis

Make (Alt. 1) or Buy (Alt. 2) King Component

Differential Effect

Make (Alt. 1) Buy (Alt. 2) on Income (Alt. 2)

Unit costs:

Purchase price

Variable costs

Fixed costs

Income (loss)

0

(18)

(4)

$(22)

$(20)

0

(4)

$(24)

$(20)

18

0

$ (2)

Charleston Affair should make the King Component.

2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to publicly accessible website, in whole or in part.

Chapter 24 (9)

8. The Wake Coffee Co. currently produces the Sealable Coffee Bag and incurs the

following costs per unit: direct materials, $2; direct labor, $3; variable factory overhead,

$2.50; and fixed factory overhead, $3.50. The company also has the option to purchase

the product for $9.50 per unit. The seller charges a $1.25 freight fee per unit. Prepare a

differential analysis to determine if Wake Coffee Co. should make (Alternative 1) or buy

(Alternative 2) the product, assuming that the fixed costs will be incurred regardless of

the decision.

Differential Analysis

Make (Alt. 1) or Buy (Alt. 2) Sealable Coffee Bag

Differential Effect

Make (Alt. 1) Buy (Alt. 2) on Income (Alt. 2)

Unit costs:

Purchase price

$

0

$ (5.75)

$(5.75)

Freight fee

0

(1.25)

(1.25)

Variable costs

(7.50)

0

7.50

Fixed costs

(3.50)

(3.50)

0

Income (loss)

$(11.00)

$(10.50)

$ 0.50

Wake Coffee Co. should buy the Sealable Coffee Bag.

9. Blair Designs currently produces a Subcomponent, incurring variable direct costs of

$4.25 per unit, variable factory overhead of $2.25 per unit, and fixed factory overhead

of $5.00 per unit. The company could also buy the Subcomponent for $7.50 from an

outside provider, which would also charge a freight fee of $2.00 per unit. Prepare a

differential analysis to determine if Blair Designs should make (Alternative 1) or buy

(Alternative 2) the Subcomponent, assuming that fixed factory overhead will be incurred

if the product is made or sold.

Differential Analysis

Make (Alt. 1) or Buy (Alt. 2) Subcomponent

Differential Effect

Make (Alt. 1) Buy (Alt. 2) on Income (Alt. 2)

Unit costs:

Purchase price

Freight fee

Variable costs

Fixed costs

Income (loss)

0

0

(6.50)

(5.00)

$(11.50)

$ (7.50)

(2.00)

0

(5.00)

$(14.50)

$(7.50)

(2.00)

6.50

0

$(3.00)

Blair Designs should make the Subcomponent.

2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to publicly accessible website, in whole or in part.

Differential Analysis and Product Pricing 7

Strategy: First, determine the costs associated with making the product, which usually

include the variable and fixed costs. Next, determine the costs associated with buying

the product, which include the costs to acquire the good (purchase price, freight fees,

etc.), and fixed costs since the company will incur the costs regardless of the products

produced. Then, determine the differential effect on income, and if positive, the

company should proceed with Alternative 2.

10. Charleston Affair is considering replacing an outdated piece of machinery. Use the

information below for the old piece of machinery and new machinery to prepare a

differential analysis to determine if Charleston Affair should continue (Alternative 1) or

replace (Alternative 2) the old machine.

Old machine:

Estimated annual variable manufacturing costs

Estimated selling price

Estimated residual value

Estimated remaining useful life

New machine:

Purchase price

Estimated annual variable manufacturing costs

Estimated residual value

Estimated useful life

$18,000

$10,000

$6,500

7 years

$110,000

$5,000

$1,500

7 years

Differential Analysis

Continue with Old Machine (Alt. 1) or Replace Old Machine (Alt. 2)

Differential Effect

Continue (Alt. 1) Replace (Alt. 2) on Income (Alt. 2)

Revenues:

Proceeds from sale of old machine

Residual Value

Costs:

Purchase price

Variable manufacturing costs (7 years)

Total costs

Income (loss)

0

6,500

$

0

(126,000)

$(126,000)

$(119,500)

10,000

1,500

$ 10,000

(5,000)

$(110,000)

(35,000)

$(145,000)

$(133,500)

$(110,000)

91,000

$ (19,000)

$ (14,000)

Charleston Affair should continue with the old machine.

2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to publicly accessible website, in whole or in part.

Chapter 24 (9)

11. Wake Coffee Co. has an outdated piece of machinery that the company is considering

replacing. Use the information below for the two pieces of machinery. Prepare a

differential analysis to determine if the company should continue with the old piece of

machinery (Alternative 1) or replace the piece of machinery (Alternative 2).

Old machine

Estimated annual variable manufacturing costs $15,000

Estimated selling price

$3,200

Estimated remaining useful life

5 years

New machine

Purchase price

$42,000

Estimated annual variable manufacturing costs $6,000

Estimated residual value

0

Estimated useful life

5 years

Differential Analysis

Continue with Old Machine (Alt. 1) or Replace Old Machine (Alt. 2)

Differential Effect on

Continue (Alt. 1) Replace (Alt. 2)

Income (Alt. 2)

Revenues:

Proceeds from sale of old machine

Costs:

Purchase price

Variable manufacturing costs (5 years)

Total costs

Income (loss)

$

0

(75,000)

$(75,000)

$(75,000)

3,200

$ 3,200

$(42,000)

(30,000)

$(72,000)

$(68,800)

$(42,000)

45,000

$ 3,000

$ 6,200

Wake Coffee Co. should replace the old machine.

2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to publicly accessible website, in whole or in part.

Differential Analysis and Product Pricing 9

12. Blair Designs has an old piece of equipment that management is considering replacing.

Use the information below for the piece of equipment and its replacement to prepare a

differential analysis to determine if the company should continue with the old piece of

equipment (Alternative 1) or replace the piece of equipment (Alternative 2).

Old equipment

Estimated annual variable manufacturing costs $11,500

Estimated selling price

$3,200

Estimated remaining useful life

10 years

New equipment

Purchase price

$50,000

Estimated annual variable manufacturing costs

$5,000

Estimated residual value

$5,000

Estimated useful life

10 years

Differential Analysis

Continue with Old Equipment (Alt. 1) or Replace Old Equipment(Alt. 2)

Differential Effect

Continue (Alt. 1) Replace (Alt. 2) on Income (Alt. 2)

Revenues:

Proceeds from sale of old equipment

Residual value

Costs:

Purchase price

Variable manufacturing costs (10 years)

Total costs

Income (loss)

0

0

$

0

(115,000)

$(115,000)

$(115,000)

3,200

5,000

$ (50,000)

(50,000)

$(100,000)

$ (91,800)

3,200

5,000

$(50,000)

65,000

$ 15,000

$ 23,200

Blair Designs should replace the old piece of equipment.

Strategy: First, determine the revenues for each alternative. If continued to use the piece

of equipment, any residual value would be considered revenue. If replaced, the proceeds

from the sale and any residual value of the new equipment would be considered

revenue. Next, determine the costs, which include the variable manufacturing costs for

both situations, or the costs to produce goods with the equipment. The cost to purchase

the new equipment would be considered a cost if replaced. Then, determine the

differential effect on income. If positive, the company should proceed with Alternative 2.

2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to publicly accessible website, in whole or in part.

10

Chapter 24 (9)

13. Charleston Affair produces Product K for $8 per pound, which can be sold for $15 per

pound or processed into Product M, which sells for $30 per pound. Each pound requires

an additional $12 to process into Product M. Prepare a differential analysis to determine

if the company should sell Product K (Alternative 1) or process further into Product M

(Alternative 2).

Differential Analysis

Sell Product K (Alt. 1) or Process into Product M (Alt. 2)

Differential Effect

Sell (Alt. 1) Process Further (Alt. 2) on Income (Alt. 2)

Revenues, per unit

$15

$ 30

$ 15

Costs, per unit

(8)

(20)

(12)

Income (loss), per unit

$ 7

$ 10

$ 3

Charleston Affair should process further into Product M.

14. Wake Coffee Co. processes Standard Coffee in batches of 5,000 pounds, which sell for

$8 per pound and cost $10,000 to produce. The company can process the Standard

Coffee into Deluxe Coffee for additional costs of $6,000 per 5,000 pound batch. Each

batch of Deluxe Coffee produces 3,000 pounds, which sell for $15 per pound. Prepare a

differential analysis to determine if Wake Coffee Co. should sell Standard Coffee

(Alternative 1) or process further into Deluxe Coffee (Alternative 2).

Differential Analysis

Sell Standard Coffee (Alt. 1) or Process into Deluxe Coffee (Alt. 2)

Differential Effect

Sell (Alt. 1) Process Further (Alt. 2) on Income (Alt. 2)

Revenues

$ 40,000

$ 45,000

$ 5,000

Costs

(10,000)

(16,000)

(6,000)

Income (loss) $ 30,000

$ 29,000

$(1,000)

Wake Coffee Co. should sell Standard Coffee.

2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to publicly accessible website, in whole or in part.

Differential Analysis and Product Pricing 11

15. Blair Designs produces 4,000 yards of Solid Fabric per batch, which sells for $5 per yard.

Each batch of Solid Fabric produced incurs $12,000 of costs. The company can incur an

additional $3,000 in costs to process the batch of Simple Fabric into 2,400 yards of

Patterned Fabric, which sells for $12 per yard. Prepare a differential analysis to

determine if the company should sell Solid Fabric (Alternative 1) or process further into

Patterned Fabric (Alternative 2).

Differential Analysis

Sell Solid Fabric (Alt. 1) or Process into Patterned Fabric (Alt. 2)

Differential Effect on

Sell (Alt. 1) Process Further (Alt. 2)

Income (Alt. 2)

Revenues

$ 20,000

$ 28,800

$ 8,800

Costs

(12,000)

(15,000)

(3,000)

Income (loss)

$ 8,000

$ 13,800

$ 5,800

Blair Designs should process further into Patterned Fabric.

Strategy: The revenue in each situation would be the revenues produced by the goods.

The costs are equal to the total costs incurred to produce the product. If processed

further, the costs should include the costs to produce the original product and the costs

to process further into the more finished good. Next, determine the differential effect on

income. If positive, the company should proceed with Alternative 2.

16. Charleston Affair received a special purchase order for 5,000 units at a purchase price of

$10 per unit, which are normally sold at $12 each. Each unit requires $6 of variable

manufacturing costs. Each purchase order incurs processing costs of $2,000. Prepare a

differential analysis to determine if the company should reject (Alternative 1) or accept

(Alternative 2) the order, assuming there is sufficient capacity.

Differential Analysis

Reject (Alt. 1) or Accept (Alt. 2) Order

Revenues

Costs:

Variable manufacturing costs

Processing costs

Income (loss)

Differential Effect

Reject (Alt. 1) Accept (Alt. 2) on Income (Alt. 2)

$0

$ 50,000

$ 50,000

$0

0

$0

$(30,000)

(2,000)

$ 18,000

$(30,000)

(2,000)

$ 18,000

Charleston Affair should accept the special order.

2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to publicly accessible website, in whole or in part.

12

Chapter 24 (9)

17. Wake Coffee Co. normally sells finished goods for $8.50 per unit. The company received

a special order to sell 4,000 units for $4.50 each. The variable manufacturing costs per

unit is $3, and the company will incur an additional $2.50 per unit to rush the order.

Prepare a differential analysis to determine if the company should reject (Alternative 1)

or accept (Alternative 2) the order, assuming there is sufficient capacity to produce the

goods.

Differential Analysis

Reject (Alt. 1) or Accept (Alt. 2) Order

Revenues, per unit

Costs, per unit:

Variable manufacturing costs

Rush order costs

Income (loss)

Differential Effect

Reject (Alt. 1) Accept (Alt. 2) on Income (Alt. 2)

$0

$ 4.50

$ 4.50

$0

0

$0

$(3.00)

(2.50)

$(1.00)

$(3.00)

(2.50)

$(1.00)

Wake Coffee Co. should reject the special order.

18. Blair Designs sells its finished goods in batches of 2,000 units for $4 per unit. The

company has received a special order for three batches for a total selling price of

$10,000. Each unit incurs variable manufacturing costs of $1.50 per unit and each batch

incurs variable costs of $200. Prepare a differential analysis to determine whether Blair

Designs should reject (Alternative 1) or accept (Alternative 2) the order, assuming there

is sufficient capacity to produce the goods.

Differential Analysis

Reject (Alt. 1) or Accept (Alt. 2) Order

Revenues

Costs:

Variable manufacturing costs

Per batch variable costs

Income (loss)

Differential Effect

Reject (Alt. 1) Accept (Alt. 2) on Income (Alt. 2)

$0

$10,000

$10,000

$0

0

$0

$(9,000)

(600)

$ 400

$(9,000)

(600)

$ 400

Blair Designs should accept the special order.

Strategy: If the company rejects the special order, no revenues will be earned and no

variable costs incurred. However, if the company accepts the special order, the revenue

and costs should be considered. If the differential effect on income is positive, the

company should proceed with Alternative 2.

2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to publicly accessible website, in whole or in part.

Differential Analysis and Product Pricing 13

19. Charleston Affair uses the product cost concept to price its goods. The company plans to

release a new product in the upcoming month. Use the information shown below to

determine:

a. Product cost per unit

$3.50 = $49,000/14,000

b. Desired profit

$12,000 = $120,000 10%

c. Markup percentage

90% = ($12,000 + $32,100)/$49,000

d. Markup per unit

$3.15 = 90% $3.50

e. Normal selling price per unit

$6.65 = $3.50 + $3.15

Total product cost

$49,000

Total selling and administrative expenses

$32,100

Total assets

$120,000

Estimated units produced and sold

14,000

Desired rate of return on assets

10%

2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to publicly accessible website, in whole or in part.

14

Chapter 24 (9)

20. Wake Coffee Co. uses the product cost concept to price its goods. With the information

shown, calculate each of the following for a new good:

a. Product cost per unit

$4.00 = $24,800/6,200

b. Desired profit

$11,400 = $95,000 12%

c. Markup percentage (round to the nearest percentage)

87% = ($10,200 + $11,400)/$24,800

d. Markup per unit

$3.48 = 87% $4.00

e. Normal selling price per unit

$7.48 = $3.48 + $4.00

Total product cost

$24,800

Total selling and administrative expenses $10,200

Total assets

$95,000

Estimated units produced and sold

6,200

Desired rate of return on assets

12%

21. Blair Designs plans the release of a new product in the upcoming year. Use the product

cost concept and the information below to determine the following:

a. Product cost per unit

$1.28= $32,000/25,000

b. Desired profit

$21,000 = $140,000 15%

c. Markup percentage (round to the nearest percentage)

91%= ($21,000 + $8,000)/$32,000

d. Markup per unit (round to the nearest cent)

$1.16 = 91% $1.28

e. Normal selling price per unit

$2.44 = $1.28 + $1.16

Total product cost

$32,000

Total selling and administrative expenses

$8,000

Total assets

$140,000

Estimated units produced and sold

25,000

Desired rate of return on assets

15%

2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to publicly accessible website, in whole or in part.

Differential Analysis and Product Pricing 15

Strategy: After estimating the costs, determine the product cost per unit, which is equal

to the total product costs divided by the estimated number of units produced and sold.

Next, determine the markup percentage, which is the sum of the desired profit and

selling and administrative expenses divided by the total product cost, similar to the

break-even calculation with a target profit. The desired profit is the amount of income

the company expects to earn on its assets, calculated by multiplying the total assets by

the desired rate of return. The markup per unit is calculated by multiplying the markup

percentage by the product cost per unit. Add the markup and product costs per unit to

determine the normal selling price per unit.

22. Charleston Affair currently sells 1,000 units of Product Z for $64.50 and expects the price

to rise by 12% in the upcoming year. The balance sheet shows total assets of $200,000,

and management has set a required rate of return of 15% on the assets. Use the target

costing method to determine the total target cost the company should achieve.

Selling price= $72.24 = $64.50 1.12

Desired profit = $30,000 = $200,000 15%

Target cost = $42,240 = ($72.24 1,000 units) $30,000

23. Wake Coffee Co. expects for the price of Standard Coffee to be $12 per pound in 2016

and sell 2,000 pounds. The company owns $52,000 in assets, with a required rate of

return on the assets of 12%. Determine the total target cost the company should

achieve using the target costing method.

Desired profit = $6,240 = $52,000 12%

Target cost = $17,760 = ($12 2,000 units) $6,240

24. Blair Designs has a desired profit of $40 per unit of Product T in the upcoming year.

Product T currently sells for $72 a unit, but the price is expected to increase 20% in the

upcoming year. Use target costing to determine the target cost per unit the company

should achieve.

Selling price = $86.40 = $72 1.20

Target cost = $46.40 = $86.40 $40

Strategy: The target costing method determines the maximum costs the company

should incur if the product sells at a specified selling price and the company would like to

earn a desired profit. The target cost is equal to the estimated selling price less the

desired profit.

2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to publicly accessible website, in whole or in part.

16

Chapter 24 (9)

25. All products at Charleston Affair must pass through a sealing treatment. When operating

at full capacity, the treatment is considered a production bottleneck. Use the

information below to determine the most profitable product when using bottleneck

resources.

Product X Product Y Product Z

Unit selling price

$ 9

$ 12

$ 18

Unit variable cost

2

6

10

Unit contribution margin

$ 7

$ 6

$ 8

Sealing treatment hours per unit

0.50

0.75

0.80

Unit contribution margin per production bottleneck hour

$ 14

$ 8

$ 10

Product X is the most profitable product when using bottleneck resources.

26. All finished goods at Wake Coffee Co. must pass through a sanitizing wash, which is a

production bottleneck when operating at full capacity. Use the information below to

determine the most profitable product when using bottleneck resources.

Unit selling price

Unit variable cost

Unit contribution margin

Sanitizing wash hour per unit

Unit contribution margin per production bottleneck hour

Standard Deluxe French Roast

$ 100

$ 150

$ 200

40

80

120

$ 60

$ 70

$ 80

1.20

1.25

1.60

$ 50

$ 56

$ 50

The Deluxe would be the most profitable product when using bottleneck resources.

27. When operating at full capacity at Blair Designs, the stitching process is considered to be

a production bottleneck. Use the information below to determine which product is most

profitable when using bottleneck resources. Round answers to the nearest cent.

Solid Patterned Print

Unit selling price

$ 150

$ 210 $ 240

Unit variable cost

80

95

100

Unit contribution margin

$ 70

$ 115 $ 140

Stitching process hours per unit

1.00

1.70

1.80

Unit contribution margin per production bottleneck hour $70.00

$67.65 $77.78

The Print product would be the most profitable when using bottleneck resources.

Strategy: If a bottleneck exists, the company must determine which product will be most

profitable for the amount of time it must spend in the production bottleneck. The unit

contribution margin per production bottleneck hour is calculated by dividing the unit

contribution margin by the time each unit spends in the production bottleneck.

2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to publicly accessible website, in whole or in part.

Vous aimerez peut-être aussi

- WRD Finman 13e - SG - CH 24Document8 pagesWRD Finman 13e - SG - CH 24Luisa Dahiana Castillo NúñezPas encore d'évaluation

- Managerial Accounting Ch.20Document9 pagesManagerial Accounting Ch.20hyewon6parkPas encore d'évaluation

- Chapter 7. KeyDocument8 pagesChapter 7. KeyHuy Hoàng PhanPas encore d'évaluation

- Incremental Analysis for Business DecisionsDocument12 pagesIncremental Analysis for Business Decisionsenter_sas100% (1)

- Decision Making: Key Topics To KnowDocument16 pagesDecision Making: Key Topics To KnowEmelita ManlangitPas encore d'évaluation

- Decisions Involving Alternative ChoicesDocument42 pagesDecisions Involving Alternative Choicesvaibhavmakkar54Pas encore d'évaluation

- CH 07 DOitDocument4 pagesCH 07 DOitHanna DizonPas encore d'évaluation

- TIP Relevant Costing Ex TipDocument10 pagesTIP Relevant Costing Ex TipmaurPas encore d'évaluation

- BBC Session: Incremental AnalysisDocument31 pagesBBC Session: Incremental AnalysisGenevieve BachelorPas encore d'évaluation

- CH 7 Incremental AnalysisDocument42 pagesCH 7 Incremental AnalysisrusfazairaafPas encore d'évaluation

- Class Note - Chpt12 Decision MakingDocument19 pagesClass Note - Chpt12 Decision MakingNicole LinPas encore d'évaluation

- Lecture 3-Linear ProgrammingDocument40 pagesLecture 3-Linear ProgrammingadmiremukurePas encore d'évaluation

- Exercises Easy Average Difficult 1Document9 pagesExercises Easy Average Difficult 1Denzel Pambago Cruz100% (1)

- Session 08: Tactical Decision MakingDocument18 pagesSession 08: Tactical Decision MakingFrancisco Pedro SantosPas encore d'évaluation

- PROBLEM in RELEVANT COSTING 2 OCT 11 2019Document3 pagesPROBLEM in RELEVANT COSTING 2 OCT 11 2019Ellyza SerranoPas encore d'évaluation

- Decision MakingDocument33 pagesDecision Makingali100% (1)

- Relevant Decision FactorPart3Document3 pagesRelevant Decision FactorPart3naddiePas encore d'évaluation

- Incremental AnalysisDocument82 pagesIncremental AnalysisMicha Silvestre100% (1)

- Problem SolvingDocument2 pagesProblem SolvingGileah ZuasolaPas encore d'évaluation

- Relevant Costing TestbankDocument9 pagesRelevant Costing TestbankPrecious Vercaza Del RosarioPas encore d'évaluation

- Week1 Exercises KarinaPadillaDocument7 pagesWeek1 Exercises KarinaPadillakarina padillaPas encore d'évaluation

- Should Barbour Drop Product T-2Document33 pagesShould Barbour Drop Product T-2Vias TikaPas encore d'évaluation

- Amercian FuelDocument8 pagesAmercian FuelAsh KaiPas encore d'évaluation

- Section 9Document10 pagesSection 9nourhan rezkPas encore d'évaluation

- Relevant Costing: ExampleDocument7 pagesRelevant Costing: Examplebakhtawar soniaPas encore d'évaluation

- Course TitleDocument5 pagesCourse TitleSolomon G ShPas encore d'évaluation

- Accounting for Managers: Calculating Break-Even PointsDocument123 pagesAccounting for Managers: Calculating Break-Even PointsAmanuel GirmaPas encore d'évaluation

- Solution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 12Document34 pagesSolution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 12jasperkennedy078% (27)

- Relevant Costing Problems FA05Document3 pagesRelevant Costing Problems FA05Cy HicartePas encore d'évaluation

- Incremental Costing ProblemDocument8 pagesIncremental Costing ProblemJessica Faith Ignacio EstacioPas encore d'évaluation

- Incremental Analysis (2nd Week)Document16 pagesIncremental Analysis (2nd Week)Jebeth RiveraPas encore d'évaluation

- Chapter 7 Examples 2Document2 pagesChapter 7 Examples 2AMNAPas encore d'évaluation

- BDC Preboard Feb 2011 - MasDocument10 pagesBDC Preboard Feb 2011 - Mas1hewlett100% (1)

- Individual Assignment For Acct For MGMTDocument4 pagesIndividual Assignment For Acct For MGMTSujib Barman88% (8)

- Chapter13 Transfer PricingDocument5 pagesChapter13 Transfer PricingDayan DudosPas encore d'évaluation

- Ca CH4Document12 pagesCa CH4Charlotte ChanPas encore d'évaluation

- Differential Cost AnalysisDocument7 pagesDifferential Cost AnalysisSalman AzeemPas encore d'évaluation

- Should XYZ Company Make or Buy WidgetsDocument8 pagesShould XYZ Company Make or Buy WidgetsPui YanPas encore d'évaluation

- Prelim-Mas 2-TestDocument18 pagesPrelim-Mas 2-TestDan Andrei BongoPas encore d'évaluation

- CH 26 Exercises ProblemsDocument5 pagesCH 26 Exercises ProblemsAhmed El KhateebPas encore d'évaluation

- Decision Making 36 Practice Questions & SolutionsDocument33 pagesDecision Making 36 Practice Questions & SolutionsAbdullah Naeem57% (7)

- Quiz in Rel. CostDocument3 pagesQuiz in Rel. CostTrine De LeonPas encore d'évaluation

- Incremental Analysis ProblemsDocument10 pagesIncremental Analysis ProblemsLiyana Chua0% (1)

- Incremental AnalysisDocument40 pagesIncremental Analysismehnaz kPas encore d'évaluation

- اسئلة ادارية 5+6+7+8+9+1Document17 pagesاسئلة ادارية 5+6+7+8+9+1Maysaa AlhusbanPas encore d'évaluation

- Final Exam - Practice FinalDocument12 pagesFinal Exam - Practice FinalShi FrankPas encore d'évaluation

- Introductory Chemistry A Foundation 7th Edition Test Bank Steven S ZumdahlDocument36 pagesIntroductory Chemistry A Foundation 7th Edition Test Bank Steven S Zumdahldiesnongolgothatsczx100% (39)

- Study ProbesDocument64 pagesStudy ProbesEvan Jordan100% (1)

- Full Download Introductory Chemistry A Foundation 7th Edition Test Bank Steven S Zumdahl PDF Full ChapterDocument23 pagesFull Download Introductory Chemistry A Foundation 7th Edition Test Bank Steven S Zumdahl PDF Full Chaptervergencyooelite.vafrzk100% (17)

- Achievement Test 4: Chapters 7-8 Managerial AccountingDocument7 pagesAchievement Test 4: Chapters 7-8 Managerial AccountingLey EsguerraPas encore d'évaluation

- Relevant Cost Part 1 of 2Document25 pagesRelevant Cost Part 1 of 2simsonPas encore d'évaluation

- Docx 1Document10 pagesDocx 1Anna Marie AlferezPas encore d'évaluation

- Cost & Managerial Accounting II EssentialsD'EverandCost & Managerial Accounting II EssentialsÉvaluation : 4 sur 5 étoiles4/5 (1)

- A to Z Cost Accounting Dictionary: A Practical Approach - Theory to CalculationD'EverandA to Z Cost Accounting Dictionary: A Practical Approach - Theory to CalculationPas encore d'évaluation

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsD'EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsPas encore d'évaluation

- Actuarial Finance: Derivatives, Quantitative Models and Risk ManagementD'EverandActuarial Finance: Derivatives, Quantitative Models and Risk ManagementPas encore d'évaluation

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageD'EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageÉvaluation : 5 sur 5 étoiles5/5 (1)

- The Entrepreneur’S Dictionary of Business and Financial TermsD'EverandThe Entrepreneur’S Dictionary of Business and Financial TermsPas encore d'évaluation

- HR QueriesDocument6 pagesHR Queriesfrancy_rajPas encore d'évaluation

- Motor Accident Claim PetitionDocument4 pagesMotor Accident Claim PetitionAbhijit TripathiPas encore d'évaluation

- Company Law Question BankDocument83 pagesCompany Law Question Bankshakthi jayanth100% (1)

- Executive Summary, Environment Analysis, and Business DescriptionDocument20 pagesExecutive Summary, Environment Analysis, and Business DescriptionRouen91% (11)

- How Many Mutual Funds Constitute A Diversified Mutual Fund PortfolioDocument10 pagesHow Many Mutual Funds Constitute A Diversified Mutual Fund PortfolioKris SzczerbinskiPas encore d'évaluation

- Essential overview of corporate finance fundamentalsDocument3 pagesEssential overview of corporate finance fundamentalsmiguelmendezh940% (1)

- MCQ PartnershipDocument24 pagesMCQ Partnershiplou-924Pas encore d'évaluation

- Case DigestDocument5 pagesCase DigestAlexylle Garsula de ConcepcionPas encore d'évaluation

- Perbadanan Pengurusan Sentosa Court Pejabat Pengurusan Sentosa Court Ac-3 No.4 JLN TMN Sri Sentosa, JLN Klang Lama 58000 Kuala LumpurDocument16 pagesPerbadanan Pengurusan Sentosa Court Pejabat Pengurusan Sentosa Court Ac-3 No.4 JLN TMN Sri Sentosa, JLN Klang Lama 58000 Kuala LumpurkswongPas encore d'évaluation

- A Presentation On Executive Training: Ajeet Kumar 8NBNG010 Icfai, Nagpur MBA (2008-2010) Company Guide:-MR. CHIRAG JOSHIDocument20 pagesA Presentation On Executive Training: Ajeet Kumar 8NBNG010 Icfai, Nagpur MBA (2008-2010) Company Guide:-MR. CHIRAG JOSHIJayesh GarachhPas encore d'évaluation

- Real Estate Broker License RequirementsDocument42 pagesReal Estate Broker License RequirementsYamada KunPas encore d'évaluation

- Three Circle Family ModelDocument5 pagesThree Circle Family ModelAnoosha MazharPas encore d'évaluation

- Business of Investment BankingDocument35 pagesBusiness of Investment BankingHarsh SudPas encore d'évaluation

- FCFF Valuation Model: Before You Start What The Model Inputs Master Inputs Page Earnings NormalizerDocument64 pagesFCFF Valuation Model: Before You Start What The Model Inputs Master Inputs Page Earnings NormalizerUmangPas encore d'évaluation

- ACCA F9 LSBF Studynotes June2012Document185 pagesACCA F9 LSBF Studynotes June2012Mohammad Kamruzzaman100% (2)

- 10000027105Document1 614 pages10000027105Chapter 11 DocketsPas encore d'évaluation

- Viceroy 2Document18 pagesViceroy 2OinkPas encore d'évaluation

- one+din+L6315-DSP55+MB+VER 1.4+20201224Document10 pagesone+din+L6315-DSP55+MB+VER 1.4+20201224Eliecer RdguezPas encore d'évaluation

- Numberical Test (Đã S A CH A)Document95 pagesNumberical Test (Đã S A CH A)beaml0% (1)

- Tarun Das CV For Public Financial Management ReformsDocument13 pagesTarun Das CV For Public Financial Management ReformsProfessor Tarun DasPas encore d'évaluation

- PPR 218 Key Steps To Retirement Income PlanningDocument9 pagesPPR 218 Key Steps To Retirement Income PlanningMaria CeciliaPas encore d'évaluation

- Teaching Money Creation and Monetary PolicyDocument21 pagesTeaching Money Creation and Monetary PolicyJuan Diego González Bustillo100% (1)

- Contracts Cheat SheetDocument2 pagesContracts Cheat SheetTim Morris50% (2)

- Order in The Matter of Hum Projects LTDDocument14 pagesOrder in The Matter of Hum Projects LTDShyam SunderPas encore d'évaluation

- Preo PosterDocument9 pagesPreo PosterJames Tyrone MedinaPas encore d'évaluation

- POST OFFICE ACCOUNT OPENINGDocument2 pagesPOST OFFICE ACCOUNT OPENINGRajdeep BanerjeePas encore d'évaluation

- CIR v. Central Luzon Drug CorporationDocument3 pagesCIR v. Central Luzon Drug CorporationPatricia BautistaPas encore d'évaluation

- Toolkit Cover LetterDocument14 pagesToolkit Cover LetterLiam ReadPas encore d'évaluation

- Financial Management Decision for Twilight Acres FarmDocument5 pagesFinancial Management Decision for Twilight Acres FarmVatsal DesaiPas encore d'évaluation

- Comprehensive Income & NcahsDocument6 pagesComprehensive Income & NcahsNuarin JJ67% (3)