Académique Documents

Professionnel Documents

Culture Documents

RMC No 63-2012

Transféré par

veraCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

RMC No 63-2012

Transféré par

veraDroits d'auteur :

Formats disponibles

REPUBLIC OF THE PHILIPPINES

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

Quezon City

October 29, 2012

REVENUE MEMORANDUM CIRCULAR NO. 63-2012

SUBJECT

Clarifying The Issues Affecting Invoicing And Recording Of

Income Payments For Media Advertising Placements

TO

All Internal Revenue Officials, Employees and Others

Concerned

This Circular is being issued to standardize the procedure for invoicing and

recording income payments and gross receipts for media advertising placements as

well as to clarify the tax treatment of the income payments for media advertising

placements.

Background

Advertising agencies, media suppliers and advertisers comprise the tripartite

institutional structure of the advertising industry. Depending on their industry

practice, advertising agencies have different procedures in billing their

clients/advertisers.

Clients/advertisers make income payments for media

advertisement contracts directly to the advertising agency or directly to the media

supplier for the total cost of the media advertisement, inclusive of creative and media

services, advertising commission or service fees and value-added tax (VAT). Issues

thus arise from the invoicing of income payments and recording of gross receipts such

that the reporting thereof does not accurately reflect the income recipients and which

may affect the computation of taxes due on the transaction.

This Circular shall govern the invoicing and recording by advertising agencies

of their income payments received for media advertising placements.

DISCUSSION

I.

Contracting for media advertisements

In contracts for media advertisements, the media supplier shall bill the client

for the total cost of production and media placement. The client/advertiser shall pay

the media supplier directly for the amount billed by it.

A. On the income payment by client/advertiser to the media supplier

1) The media supplier shall bill the client/advertiser for the total amount

of media placement. Upon payment, Client/advertiser shall withhold

two percent (2%) on the entire invoice amount of the media supplier.

(Sec. 2.57.2[E][4][p] and [E][4][q], RR 2-98, as amended)

Client/advertisers shall likewise issue Certificate of Creditable Income

Tax Withheld at Source (BIR Form 2307) in the name of the media

supplier.

B. On the gross receipts of the media supplier:

1) Upon receipt of income payment from the advertiser, the media

supplier shall issue VAT invoice/official receipt to client/advertiser

(Section 113, NIRC of 1997, as amended) and shall report the entire

amount as business income for income tax purposes.

II.

Commission/Service Fee of Advertising Agency relative to the media

advertisement and placement contracted

A. On the payment of commission/service fee by the media supplier to the

advertising agency.

1) The advertising agency shall bill the media supplier for its

commissions/service fee. Upon payment by the media supplier to the

advertising agency, it shall withhold two percent (2%) from the

commission/service fee of the advertising agency (Sec.

2.57.2[E][4][h], RR 2-98, as amended); it shall likewise issue

Certificate of Creditable Income Tax Withheld at Source (BIR Form

2307) in the name of the advertising agency.

B. On the receipt of commission/service fee by the advertising agency

1) The advertising agency shall issue its VAT invoice/official receipt to

the media supplier for the amount of commission/service fee received.

The amount of VAT shall be reported based on the commission/service

fee of the advertising agency.

III.

Illustration of Pertinent Accounting Entries in the Books of Accounts of

the Advertising Agency; Advertiser; and Media Entity

The following provides illustrative accounting entries in the books of accounts

of the advertiser, media entity, and the advertising agency.

Assume that an advertiser shall pay PhP100,000.00 to the media supplier,

inclusive of 12% VAT; assume that the media supplier is a TV and radio block

timer selling TV and radio commercial spot and payments to it are subject to

the 2% creditable withholding tax; assume that the advertising agency

commission is 15% of the advertising contract price (Php100,000), inclusive

of VAT.

Page 2 of 2

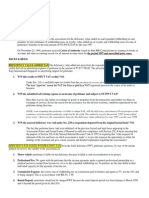

A) Accounting entries in the Books of Account of the Advertiser

I. Receipt of Billing from Media Supplier

Advertising Expense (P100,000/1.12)

Deferred Input VAT

Accounts Payable-Media Entity

Debit

89,285.71

10,714.29

Credit

100,000.00

II. Payment to Media Supplier

Accounts Payable- Media Entity

Creditable IT Withheld*

Cash

Input VAT**

Deferred Input VAT

Debit

100,000.00

Credit

1,785.71

98,214.29

10,714.29

10,714.29

* For CWT, tax base should be on the

income payment from payor-purchaser

of service exclusive of VAT.

** See Sec. 4.110-2(c), RR 16-2005, as

amended.

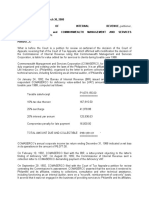

B) Accounting entries in the Books of Account of the Media Supplier

I. Billing to Client-Advertiser for the

Media placement

Accounts Receivable-Advertiser

Income/Fees-Media Placement

Deferred VAT Payable

Debit

100,000.00

Credit

89,285.71

10,714.29

II. Receipt of Income Payment from

Advertiser

Cash

Creditable IT Withheld

Accounts Receivable-Advertiser

98,214.29

1,785.71

Deferred VAT Payable

Output VAT

10,714.29

100,000.00

10,714.29

Page 3 of 3

III. Receipt of Billing from Ad Agency for

Commission (inclusive of VAT)

Commissions-advertising (P15,000/1.12)

Deferred Input VAT

Accounts Payable-Ad Agency

13,392.86

1,607.14

15,000.00

IV. Payment for Commission to Ad Agency

Accounts Payable-Ad Agency

Creditable IT Withheld

Cash

Input VAT

Deferred Input VAT

15,000.00

267.86

14,732.14

1,607.14

1,607.14

C) Accounting entries in the Books of Account of the Advertising Agency

I. Billing to Media Supplier

Accounts Receivable-Media

Commission Income/Fees

Deferred VAT Payable

Debit

15,000.00

Credit

13,392.86

1,607.14

II. Receipt of Income Payment from

Advertising Agency

Cash

Creditable IT Withheld

Accounts Receivable-Advertiser

Deferred VAT Payable

Output VAT

14,732.14

267.86

15,000.00

1,607.14

1,607.14

All concerned are hereby enjoined to be guided accordingly and to give this

Circular as wide publicity as possible.

(Original Signed)

KIM S. JACINTO-HENARES

Commissioner of Internal Revenue

K-1

Page 4 of 4

Vous aimerez peut-être aussi

- Tax Volume5Series33Document4 pagesTax Volume5Series33Reynalyn BanggowoyPas encore d'évaluation

- RMC 72-04Document9 pagesRMC 72-04ai0412Pas encore d'évaluation

- RMC 72-2004 Issues On Withholding RatesDocument9 pagesRMC 72-2004 Issues On Withholding RatesEva HubadPas encore d'évaluation

- CREBA v. Executive SecretaryDocument35 pagesCREBA v. Executive Secretarydes_4562Pas encore d'évaluation

- SEMINAR ON NGAsDocument63 pagesSEMINAR ON NGAsHelen Joy Grijaldo JuelePas encore d'évaluation

- RMC 72-2004 PDFDocument9 pagesRMC 72-2004 PDFBobby LockPas encore d'évaluation

- RR 12-01Document6 pagesRR 12-01matinikkiPas encore d'évaluation

- Determine the income tax payable for 2020 and 2021 and theexcess MCIT carry-overDocument46 pagesDetermine the income tax payable for 2020 and 2021 and theexcess MCIT carry-overmicaella pasionPas encore d'évaluation

- Value Added Taxes Part 2Document15 pagesValue Added Taxes Part 2Deo CoronaPas encore d'évaluation

- Modvat and CenvatDocument3 pagesModvat and CenvatpravinsankalpPas encore d'évaluation

- Income tax credit for April 15 deadlineDocument2 pagesIncome tax credit for April 15 deadlinebrainPas encore d'évaluation

- Cenvat Credit PDFDocument38 pagesCenvat Credit PDFsaumitra_mPas encore d'évaluation

- General Principles CasesDocument294 pagesGeneral Principles CasesAnne OcampoPas encore d'évaluation

- Week 7: Taxation of Individuals (Non Residents and Aliens) and General Professional PartnershipsDocument6 pagesWeek 7: Taxation of Individuals (Non Residents and Aliens) and General Professional PartnershipsEddie Mar JagunapPas encore d'évaluation

- Characteristic of Vat-Business TaxationDocument8 pagesCharacteristic of Vat-Business TaxationAthena LouisePas encore d'évaluation

- Tax XXXXDocument60 pagesTax XXXXGerald Bowe ResuelloPas encore d'évaluation

- TaxationDocument55 pagesTaxationorlandoPas encore d'évaluation

- Sony v. CIRDocument2 pagesSony v. CIRMaya Julieta Catacutan-EstabilloPas encore d'évaluation

- Value Added TaxDocument11 pagesValue Added TaxPreethi RajasekaranPas encore d'évaluation

- Bir RMC No. 97-2021: Philippine Tax Perspective On Social Media InfluencersDocument6 pagesBir RMC No. 97-2021: Philippine Tax Perspective On Social Media InfluencersIvan AnaboPas encore d'évaluation

- Today Is Friday, September 26, 2014Document13 pagesToday Is Friday, September 26, 2014annabanana07Pas encore d'évaluation

- Indonesian Tax Treatment For Foreign Drilling Companies FDCDocument4 pagesIndonesian Tax Treatment For Foreign Drilling Companies FDCJoko ArifiantoPas encore d'évaluation

- Accrual Accounting and Income Determination: Revsine/Collins/Johnson/Mittelstaedt: Chapter 2Document40 pagesAccrual Accounting and Income Determination: Revsine/Collins/Johnson/Mittelstaedt: Chapter 2Tan Siew LiPas encore d'évaluation

- Full Text Due Process ClauseDocument79 pagesFull Text Due Process ClauseAnonymous 2UPF2xPas encore d'évaluation

- TaxationDocument5 pagesTaxationWindylyn LalasPas encore d'évaluation

- Service Provided by Custom House AgentDocument3 pagesService Provided by Custom House AgentRaj Kishore SahooPas encore d'évaluation

- CREBA Inc. vs. Romulo, G.R. No. 160756, March 9, 2010Document22 pagesCREBA Inc. vs. Romulo, G.R. No. 160756, March 9, 2010KidMonkey2299Pas encore d'évaluation

- Social Media InfluencerDocument15 pagesSocial Media InfluencerKate Hazzle JandaPas encore d'évaluation

- Chapter 9 - Service TaxDocument5 pagesChapter 9 - Service TaxNURKHAIRUNNISAPas encore d'évaluation

- Service Tax Audit: A Guide for ProfessionalsDocument13 pagesService Tax Audit: A Guide for ProfessionalsrohitPas encore d'évaluation

- Office of The Commissioner of Service Tax, Delhi-I 17-B, IAEA House, Indraprastha Estate, New Delhi - 110 002Document11 pagesOffice of The Commissioner of Service Tax, Delhi-I 17-B, IAEA House, Indraprastha Estate, New Delhi - 110 002pmPas encore d'évaluation

- VAT Compliance RequirementsDocument4 pagesVAT Compliance RequirementsRyan AllanicPas encore d'évaluation

- MCIT Explained: Minimum Corporate Income Tax in the PhilippinesDocument76 pagesMCIT Explained: Minimum Corporate Income Tax in the PhilippinesFC Estoesta100% (1)

- RMC 130-2016Document2 pagesRMC 130-2016Earl John PajaroPas encore d'évaluation

- Taxation Report Vina MarieDocument12 pagesTaxation Report Vina MarieAnonymous gmDxRbnwOPas encore d'évaluation

- CREBA V RomuloDocument58 pagesCREBA V RomuloBuladasPukikiPas encore d'évaluation

- RR 9 98 PDFDocument7 pagesRR 9 98 PDFJoey Villas MaputiPas encore d'évaluation

- Panasonic vs. CIRDocument6 pagesPanasonic vs. CIRLeBron DurantPas encore d'évaluation

- Tax Digest VatDocument7 pagesTax Digest Vatma.catherine merillenoPas encore d'évaluation

- RMC No 16-2013Document3 pagesRMC No 16-2013Eric DykimchingPas encore d'évaluation

- B Chamber of Real Estate Vs RomuloDocument23 pagesB Chamber of Real Estate Vs RomuloAr Yan SebPas encore d'évaluation

- Amendments to the Tax Code under TRAIN LawDocument23 pagesAmendments to the Tax Code under TRAIN LawCha GalangPas encore d'évaluation

- CREBA vs. Romulo, GR No. 160756 Dated March 9, 2010Document28 pagesCREBA vs. Romulo, GR No. 160756 Dated March 9, 2010Abbey Agno PerezPas encore d'évaluation

- Introduction To Business Taxes: MARCH 13, 2021Document16 pagesIntroduction To Business Taxes: MARCH 13, 2021Floyd delMundoPas encore d'évaluation

- Tax 304 - Vat Compliance RequirementsDocument5 pagesTax 304 - Vat Compliance RequirementsiBEAYPas encore d'évaluation

- The Perspective of Vat Concessions Regime in Tanzania PDFDocument32 pagesThe Perspective of Vat Concessions Regime in Tanzania PDFHandley Mafwenga SimbaPas encore d'évaluation

- RR 9-98Document5 pagesRR 9-98matinikkiPas encore d'évaluation

- Withholding Tax: Period of Payment of TaxDocument4 pagesWithholding Tax: Period of Payment of TaxlegendPas encore d'évaluation

- PWC Newsletter - Value Added Tax Regulations, 2015 - Updated VersionDocument5 pagesPWC Newsletter - Value Added Tax Regulations, 2015 - Updated VersionAnonymous FnM14a0Pas encore d'évaluation

- Taxation Facts Ruling IssueDocument10 pagesTaxation Facts Ruling IssueWindylyn LalasPas encore d'évaluation

- Tax-Free Exchanges That Are Not Subject To Income Tax, Capital Gains Tax, Documentary Stamp Tax And/or Value-Added Tax, As The Case May BeDocument7 pagesTax-Free Exchanges That Are Not Subject To Income Tax, Capital Gains Tax, Documentary Stamp Tax And/or Value-Added Tax, As The Case May BeJouhara ObeñitaPas encore d'évaluation

- CBDT Circular 5 of 2016 - 29.02.2016 - No TDS Ad Agency PaymentsDocument1 pageCBDT Circular 5 of 2016 - 29.02.2016 - No TDS Ad Agency PaymentsSubramanyam SettyPas encore d'évaluation

- Overview of Key Amendments to the Philippine Tax Code under the TRAIN LawDocument28 pagesOverview of Key Amendments to the Philippine Tax Code under the TRAIN LawScarlette CooperaPas encore d'évaluation

- Real Estate Tax ChallengeDocument24 pagesReal Estate Tax ChallengeChristine Rose Bonilla LikiganPas encore d'évaluation

- Withholding Taxes: Carlo P. Divedor 19 October 2017Document20 pagesWithholding Taxes: Carlo P. Divedor 19 October 2017Melanie Grace Ulgasan LuceroPas encore d'évaluation

- SET 23 24 Detail Guide EDocument20 pagesSET 23 24 Detail Guide ENishan MahanamaPas encore d'évaluation

- ANDALAS UNIVERSITY MID TERM EXAMDocument6 pagesANDALAS UNIVERSITY MID TERM EXAMMuhammad AlfarrabiePas encore d'évaluation

- Tax CasesDocument67 pagesTax CasesRichardEnriquezPas encore d'évaluation

- Indian Service TaxDocument13 pagesIndian Service Taxanon_993677Pas encore d'évaluation

- Ice of Tbe 3iar QC:onfil:Jant: L/epublic of TBC Jbilippitteti Upreme Ourt FflattilaDocument5 pagesIce of Tbe 3iar QC:onfil:Jant: L/epublic of TBC Jbilippitteti Upreme Ourt FflattilaveraPas encore d'évaluation

- Ra 9262 Anti-Violence Against Women ActDocument14 pagesRa 9262 Anti-Violence Against Women Actapi-250425393Pas encore d'évaluation

- COA Circular 2019 001 Re Control Mechanism To Enforce The Submission of Barangay Financial TransactionsDocument14 pagesCOA Circular 2019 001 Re Control Mechanism To Enforce The Submission of Barangay Financial TransactionsveraPas encore d'évaluation

- COA Circular 2019 001 Re Control Mechanism To Enforce The Submission of Barangay Financial TransactionsDocument14 pagesCOA Circular 2019 001 Re Control Mechanism To Enforce The Submission of Barangay Financial TransactionsveraPas encore d'évaluation

- Senate Bill No. 308 - Taxpayer's Bill of RightsDocument11 pagesSenate Bill No. 308 - Taxpayer's Bill of RightsveraPas encore d'évaluation

- PRC CPA Accreditation Form (39Document3 pagesPRC CPA Accreditation Form (39veraPas encore d'évaluation

- Squash StickDocument56 pagesSquash StickDanah Jane GarciaPas encore d'évaluation

- SAMPLEX A - Obligations and Contracts - Atty. Sta. Maria - Finals 2014Document2 pagesSAMPLEX A - Obligations and Contracts - Atty. Sta. Maria - Finals 2014Don Dela ChicaPas encore d'évaluation

- Kingfisher CaseDocument6 pagesKingfisher CaseAditi SoniPas encore d'évaluation

- BibliographyDocument5 pagesBibliographyNadine SantiagoPas encore d'évaluation

- Deed of Conditional Sale of Motor VehicleDocument1 pageDeed of Conditional Sale of Motor Vehicle4geniecivilPas encore d'évaluation

- Rural Urban MigrationDocument42 pagesRural Urban MigrationSabitha Ansif100% (1)

- Case Study - IDocument3 pagesCase Study - IMamta Singh RajpalPas encore d'évaluation

- A Transaction Cost DOuglas NorthDocument9 pagesA Transaction Cost DOuglas NorthSala AlfredPas encore d'évaluation

- Assignment 1ADocument5 pagesAssignment 1Agreatguy_070% (1)

- DWSD Lifeline Plan - June 2022Document12 pagesDWSD Lifeline Plan - June 2022Malachi BarrettPas encore d'évaluation

- Tesalt India Private LimitedDocument16 pagesTesalt India Private LimitedSaiganesh JayakaranPas encore d'évaluation

- Managing Human Resources, 4th Edition Chapters 1 - 17Document49 pagesManaging Human Resources, 4th Edition Chapters 1 - 17Aamir Akber Ali67% (3)

- Procter & Gamble: Expansion PlanDocument6 pagesProcter & Gamble: Expansion PlanSarthak AgarwalPas encore d'évaluation

- Percentage QuestionsDocument16 pagesPercentage QuestionsdokhlabhaiPas encore d'évaluation

- Auditing Chapter 2 Part IIIDocument3 pagesAuditing Chapter 2 Part IIIRegine A. AnsongPas encore d'évaluation

- Account Statement 12-10-2023T22 26 37Document1 pageAccount Statement 12-10-2023T22 26 37muawiyakhanaPas encore d'évaluation

- Commercial Law New (Updated)Document95 pagesCommercial Law New (Updated)Ahmad Hamed AsekzayPas encore d'évaluation

- Exercise 2 - CVP Analysis Part 1Document5 pagesExercise 2 - CVP Analysis Part 1Vincent PanisalesPas encore d'évaluation

- Accounting Cycle of A Service Business-Step 3-Posting To LedgerDocument40 pagesAccounting Cycle of A Service Business-Step 3-Posting To LedgerdelgadojudithPas encore d'évaluation

- Citi Bank in BangladeshDocument2 pagesCiti Bank in BangladeshSSN073068Pas encore d'évaluation

- Financial Services CICDocument19 pagesFinancial Services CICAashan Paul100% (1)

- UntitledDocument986 pagesUntitledJindalPas encore d'évaluation

- Transportation System in India - English - 1562066518 PDFDocument22 pagesTransportation System in India - English - 1562066518 PDFKapil YadavPas encore d'évaluation

- Triggering Event at UnileverDocument3 pagesTriggering Event at UnileverUzmaCharaniaPas encore d'évaluation

- Impact of Microfinance Services On Rural Women Empowerment: An Empirical StudyDocument8 pagesImpact of Microfinance Services On Rural Women Empowerment: An Empirical Studymohan ksPas encore d'évaluation

- Online Banking and E-Crm Initiatives A Case Study of Icici BankDocument4 pagesOnline Banking and E-Crm Initiatives A Case Study of Icici BankMani KrishPas encore d'évaluation

- Case 2 Social Business Full Speed Ahead or Proceed With Caution 3Document4 pagesCase 2 Social Business Full Speed Ahead or Proceed With Caution 3Ruman MahmoodPas encore d'évaluation

- Mean Vs Median Vs ModeDocument12 pagesMean Vs Median Vs ModekomalmongaPas encore d'évaluation

- C39SN FINANCIAL DERIVATIVES- TUTORIAL-OPTION PAYOFFS AND STRATEGIESDocument11 pagesC39SN FINANCIAL DERIVATIVES- TUTORIAL-OPTION PAYOFFS AND STRATEGIESKhairina IshakPas encore d'évaluation

- Drivers of Supply Chain ManagementDocument10 pagesDrivers of Supply Chain Managementalsamuka31100% (1)