Académique Documents

Professionnel Documents

Culture Documents

BPI

Transféré par

Eve Bonaobra BongonCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

BPI

Transféré par

Eve Bonaobra BongonDroits d'auteur :

Formats disponibles

10/31/2016

G.R. No. 174912

TodayisMonday,October31,2016

RepublicofthePhilippines

SUPREMECOURT

Manila

THIRDDIVISION

G.R.No.174912July24,2013

BPIEMPLOYEESUNIONDAVAOCITYFUBU(BPIEUDAVAOCITYFUBU),Petitioner,

vs.

BANK OF THE PHILIPPINE ISLANDS (BPI), and BPI OFFICERS CLARO M. REYES, CECIL CONANAN and

GEMMAVELEZ,Respondents.

DECISION

MENDOZA,J.:

BeforetheCourtisapetitionforreviewoncertiorariunderRule45ofthe1997RulesofCivilProcedure,assailing

theApril5,2006Decision1andAugust17,2006Resolution2oftheCourtofAppeals(CA)inCAG.R.SPNo.74595

affirmingtheDecember21,20013andAugust23,20024ResolutionsoftheNationalLaborRelationsCommission

(NLRC) in declaring as valid and legal the action of respondent Bank of the Philippine IslandsDavao City (BPI

Davao)incontractingoutcertainfunctionstoBPIOperationsManagementCorporation(BOMC).

TheFactualAntecedents

BOMC, which was created pursuant to Central Bank5CircularNo. 1388,Series of 1993(CBPCircular No. 1388,

1993),andprimarilyengagedinprovidingand/orhandlingsupportservicesforbanksandotherfinancialinstitutions,

isasubsidiaryoftheBankofPhilippineIslands(BPI)operatingandfunctioningasanentirelyseparateanddistinct

entity.

A service agreement between BPI and BOMC was initially implemented in BPIs Metro Manila branches. In this

agreement, BOMC undertook to provide services such as check clearing, delivery of bank statements, fund

transfers, card production, operations accounting and control, and cash servicing, conformably with BSP Circular

No.1388.NotasingleBPIemployeewasdisplacedandthoseperformingthefunctions,whichweretransferredto

BOMC,weregivenotherassignments.

The Manila chapter of BPI Employees Union (BPIEUMetro ManilaFUBU) then filed a complaint for unfair labor

practice(ULP).TheLaborArbiter(LA)decidedthecaseinfavoroftheunion.Thedecisionwas,however,reversed

on appeal by the NLRC. BPIEUMetro ManilaFUBU filed a petition for certiorari before the CA which denied it,

holdingthatBPItransferredtheemployeesintheaffecteddepartmentsinthepursuitofitslegitimatebusiness.The

employeeswereneitherdemotednorweretheirsalaries,benefitsandotherprivilegesdiminished.6

OnJanuary1,1996,theserviceagreementwaslikewiseimplementedinDavaoCity.Later,amergerbetweenBPI

andFarEastBankandTrustCompany(FEBTC)tookeffectonApril10,2000withBPIasthesurvivingcorporation.

Thereafter,BPIscashieringfunctionandFEBTCscashiering,distributionandbookkeepingfunctionswerehandled

byBOMC.Consequently,twelve(12)formerFEBTCemployeesweretransferredtoBOMCtocompletethelatters

servicecomplement.

BPIDavaosrankandfilecollectivebargainingagent,BPIEmployeesUnionDavaoCityFUBU(Union),objectedto

thetransferofthefunctionsandthetwelve(12)personneltoBOMCcontendingthatthefunctionsrightfullybelonged

totheBPIemployeesandthattheUnionwasdeprivedofmembershipofformerFEBTCpersonnelwho,byvirtueof

the merger, would have formed part of the bargaining unit represented by the Union pursuant to its union shop

provisionintheCBA.7

TheUnionthenfiledaformalprotestonJune14,2000addressedtoBPIVicePresidentsClaroM.ReyesandCecil

Conanan reiterating its objection. It requested the BPI management to submit the BOMC issue to the grievance

procedureundertheCBA,butBPIdidnotconsideritas"grievable."Instead,BPIproposedaLaborManagement

Conference(LMC)betweentheparties.8

http://www.lawphil.net/judjuris/juri2013/jul2013/gr_174912_2013.html

1/9

10/31/2016

G.R. No. 174912

DuringtheLMC,BPIinvokedmanagementprerogativestatingthatthecreationoftheBOMCwastopreservemore

jobsandtodesignateitasanagencytoplaceemployeeswheretheyweremostneeded.Ontheotherhand,the

Union charged that BOMC undermined the existence of the union since it reduced or divided the bargaining unit.

WhileBOMCemployeesperformBPIfunctions,theywerebeyondthebargainingunitscoverage.Incontractingout

FEBTC functions to BOMC, BPI effectively deprived the union of the membership of employees handling said

functionsaswellascurtailedtherightofthoseemployeestojointheunion.

Thereafter,theUniondemandedthatthematterbesubmittedtothegrievancemachineryastheresorttotheLMC

was unsuccessful. As BPI allegedly ignored the demand, the Union filed a notice of strike before the National

ConciliationandMediationBoard(NCMB)onthefollowinggrounds:

a) Contracting out services/functions performed by union members that interfered with, restrained and/or

coercedtheemployeesintheexerciseoftheirrighttoselforganization

b)Violationofdutytobargainand

c)Unionbusting.9

BPIthenfiledapetitionforassumptionofjurisdiction/certificationwiththeSecretaryoftheDepartmentofLaborand

Employment (DOLE), who subsequently issued an order certifying the labor dispute to the NLRC for compulsory

arbitration. The DOLE Secretary directed the parties to cease and desist from committing any act that might

exacerbatethesituation.

On October 27, 2000, a hearing was conducted. Thereafter, the parties were required to submit their respective

position papers. On November 29, 2000, the Union filed its Urgent Omnibus Motion to Cease and Desist with a

prayer that BPIDavao and/or Mr. Claro M. Reyes and Mr. Cecil Conanan be held in contempt for the following

allegedactsofBPI:

1. The Bank created a Task Force Committee on November 20, 2000 composed of six (6) former FEBTC

employeestohandletheCashiering,Distributing,Clearing,TelleringandAccountingfunctionsoftheformer

FEBTC branches but the "task force" conducts its business at the office of the BOMC using the latters

equipmentandfacilities.

2. On November 27, 2000, the bank integrated the clearing operations of the BPI and the FEBTC. The

clearingfunctionofBPI,thensolelyhandledbytheBPIProcessingCenterpriortothelabordispute,isnow

encroached upon by the BOMC because with the merger, differences between BPI and FEBTC operations

werediminishedordeleted.Whatthebankdidwassimplytogetthetotalofallclearingtransactionsunder

BPI but the BOMC employees process the clearing of checks at the Clearing House as to checks coming

fromformerFEBTCbranches.Priortothelabordispute,therunupanddistributionofthechecksofBPIwere

returned to the BPI processing center, now all checks whether of BPI or of FEBTC were brought to the

BOMC. Since the clearing operations were previously done by the BPI processing center with BPI

employees,saidfunctionshouldbeperformedbyBPIemployeesandnotbyBOMC.10

On December 21, 2001, the NLRC came out with a resolution upholding the validity of the service agreement

between BPI and BOMC and dismissing the charge of ULP. It ruled that the engagement by BPI of BOMC to

undertakesomeofitsactivitieswasclearlyavalidexerciseofitsmanagementprerogative.11Itfurtherstatedthat

the spinning off by BPI to BOMC of certain services and functions did not interfere with, restrain or coerce

employeesintheexerciseoftheirrighttoselforganization.12TheUniondidnotpresentevenaniotaofevidence

showingthatBPIhadterminatedemployees,whowereitsmembers.Infact,BPIexertedutmostdiligence,careand

efforttoseetoitthatnounionmemberwasterminated.13TheNLRCalsostressedthatDepartmentOrder(D.O.)

No.10seriesof1997,stronglyrelieduponbytheUnion,didnotapplyinthiscaseasBSPCircularNo.1388,series

of1993,wastheapplicablerule.

After the denial of its motion for reconsideration, the Union elevated its grievance to the CA via a petition for

certiorariunderRule65.TheCA,however,affirmedtheNLRCsDecember21,2001Resolutionwithmodification

that the enumeration of functions listed under BSP Circular No. 1388 in the said resolution be deleted. The CA

notedattheoutsetthatthepetitionmustbedismissedasitmerelytouchedonfactualmatterswhichwerebeyond

theambitoftheremedyavailedof.14 Be that as it may, the CA found that the factual findings of the NLRC were

supportedbysubstantialevidenceand,thus,entitledtogreatrespectandfinality.TotheCA,theNLRCdidnotact

withgraveabuseofdiscretionastomeritthereversaloftheresolution.15

Furthermore,theCAratiocinatedthat,consideringtheramificationsofthecorporatemerger,itwaswellwithinBPIs

prerogatives"todeterminewhatadditionaltasksshouldbeperformed,whoshouldbestperformitandwhatshould

bedonetomeettheexigenciesofbusiness."16ItpointedoutthattheUniondidnot,bythemerefactofthemerger,

http://www.lawphil.net/judjuris/juri2013/jul2013/gr_174912_2013.html

2/9

10/31/2016

G.R. No. 174912

becomethebargainingagentofthemergedemployees17astheUnionsrighttorepresentsaidemployeesdidnot

ariseuntilitwaschosenbythem.18

AstotheapplicabilityofD.O.No.10,theCAagreedwiththeNLRCthatthesaidorderdidnotapplyasBPI,beinga

commercialbank,itstransactionsweresubjecttotherulesandregulationsoftheBSP.

Notsatisfied,theUnionfiledamotionforreconsiderationwhichwas,however,deniedbytheCA.

1wphi1

Hence,thepresentpetitionwiththefollowing

ASSIGNMENTOFERRORS:

A. THE PETITION BEFORE THE COURT OF APPEALS INVOLVED QUESTIONS OF LAW AND ITS

DECISIONDIDNOTADDRESSTHEISSUEOFWHETHERBPISACTOFOUTSOURCINGFUNCTIONS

FORMERLYPERFORMEDBYUNIONMEMBERSVIOLATESTHECBA.

B. THE HONORABLE COURT OF APPEALS ERRED IN HOLDING THAT DOLE DEPARTMENT ORDER

NO.10DOESNOTAPPLYINTHISCASE.

TheUnionisofthepositionthattheoutsourcingofjobsincludedintheexistingbargainingunittoBOMCisabreach

of the unionshop agreement in the CBA. In transferring the former employees of FEBTC to BOMC instead of

absorbingtheminBPIasthesurvivingcorporationinthemerger,thenumberofpositionscoveredbythebargaining

unit was decreased, resulting in the reduction of the Unions membership. For the Union, BPIs act of arbitrarily

outsourcingfunctionsformerlyperformedbytheUnionmembersand,infact,transferringanumberofitsmembers

beyondtheambitoftheUnion,isaviolationoftheCBAandinterferedwiththeemployeesrighttoselforganization.

TheUnioninsiststhattheCBAcoverstheagreementwithrespect,notonlytowagesandhoursofwork,buttoall

othertermsandconditionsofwork.Theunionshopclause,beingpartoftheseconditions,statesthattheregular

employees belonging to the bargaining unit, including those absorbed by way of the corporate merger, were

required to join the bargaining union "as a condition for employment." Simply put, the transfer of former FEBTC

employeestoBOMCremovedthemfromthecoverageofunionizedestablishment.WhiletheUnionadmittedthat

BPIhastheprerogativetodeterminewhatshouldbedonetomeettheexigenciesofbusinessinaccordancewith

the case of Sime Darby Pilipinas, Inc. v. NLRC,19 it insisted that the exercise of management prerogative is not

absolute, thus, requiring good faith and adherence to the law and the CBA. Citing the case of Shell Oil Workers

Unionv.ShellCompanyofthePhilippines,Ltd.,20theUnionclaimsthatitisunfairlaborpracticeforanemployerto

outsourcethepositionsintheexistingbargainingunit.

PositionofBPIDavao

For its part, BPI defended the validity of its service agreement with BOMC on three (3) grounds: 1] that it was

pursuant to the prevailing law at that time, CBP Circular No. 1388 2] that the creation of BOMC was within

managementprerogativesintendedtostreamlinetheoperationsandprovidefocusforBPIscoreactivitiesand3]

thattheUnionrecognized,initsCBA,theexclusiverightandprerogativeofBPItoconductthemanagementand

operationofitsbusiness.21

BPIarguesthatthecaseofShellOilWorkersUnionv.ShellCompanyofthePhilippines,Ltd.,22citedbytheUnion,

isnotonallfourswiththepresentcase.Insaidcase,thecompanydissolveditssecurityguardsectionandreplaced

it with an outside agency, claiming that such act was a valid exercise of management prerogative. The Court,

however,ruledagainstthesaidoutsourcingbecausetherewasanexpressassuranceintheCBAthatthesecurity

guardsectionwouldcontinuetoexist.Havingfailedtoreserveitsrighttoeffectadissolution,thecompanysactof

outsourcingandtransferringsecurityguardswasinvalidatedbytheCourt,rulingthattheunfairlaborpracticestrike

calledbytheUniondidhavetheimpressionofvalidity.Incontrast,thereisnoprovisionintheCBAbetweenBPIand

the Union expressly stipulating the continued existence of any position within the bargaining unit. For BPI, the

absenceofthispeculiarfactisenoughreasontopreventtheapplicationofShelltothiscase.

BPIlikewiseinvokessettledjurisprudence,23wheretheCourtupheldtheactsofmanagementtocontractoutcertain

functions held by employees, and even notably those held by union members. In these cases, the decision to

outsource certain functions was a justifiable business judgment which deserved no judicial interference. The only

requisiteofthisactisgoodfaithonthepartoftheemployerandtheabsenceofmaliciousandarbitraryactioninthe

outsourcingoffunctionstoBOMC.

On the issue of the alleged curtailment of the right of the employees to selforganization, BPI refutes the Unions

allegationthatULPwascommittedwhenthenumberofpositionsinthebargainingwasreduced.Itcitesascorrect

the CA ruling that the representation of the Unions prospective members is contingent on the choice of the

employee,thatis,whetherornottojointheUnion.Hence,itwasprematurefortheUniontoclaimthattherightsof

itsprospectivememberstoselforganizewererestrainedbythetransferoftheformerFEBTCemployeestoBOMC.

http://www.lawphil.net/judjuris/juri2013/jul2013/gr_174912_2013.html

3/9

10/31/2016

G.R. No. 174912

TheCourtsRuling

Inessence,theprimordialissueinthiscaseiswhetherornottheactofBPItooutsourcethecashiering,distribution

andbookkeepingfunctionstoBOMCisinconformitywiththelawandtheexistingCBA.Particularlyindisputeisthe

validityofthetransferoftwelve(12)formerFEBTCemployeestoBOMC,insteadofbeingabsorbedinBPIafterthe

corporatemerger.TheUnionclaimsthataunionshopagreementisstipulatedintheexistingCBA.Itisunfairlabor

practiceforemployertooutsourcethepositionsintheexistingbargainingunit,citingthecaseofShellOil

WorkersUnionv.ShellCompanyofthePhilippines,Ltd.24

The Unions reliance on the Shell Case is misplaced. The rule now is covered by Article 261 of the Labor Code,

whichtookeffectonNovember1,1974.25Article261provides:

ART.261.JurisdictionofVoluntaryArbitratorsorpanelofVoluntaryArbitrators.xxxAccordingly,violationsofa

Collective Bargaining Agreement, except those which are gross in character, shall no longer be treated as unfair

laborpracticeandshallberesolvedasgrievancesundertheCollectiveBargainingAgreement.Forpurposesofthis

article,grossviolationsofCollectiveBargainingAgreementshallmeanflagrantand/ormaliciousrefusaltocomply

withtheeconomicprovisionsofsuchagreement.[Emphasessupplied]

Clearly,onlygrossviolationsoftheeconomicprovisionsoftheCBAaretreatedasULP.Otherwise,theyaremere

grievances.

Inthepresentcase,theallegedviolationoftheunionshopagreementintheCBA,evenassumingitwasmalicious

andflagrant,isnotaviolationofaneconomicprovisionintheagreement.TheprovisionsrelieduponbytheUnion

werethosearticlesreferringtotherecognitionoftheunionasthesoleandexclusivebargainingrepresentativeofall

rankandfile employees, as well as the articles on union security, specifically, the maintenance of membership in

good standing as a condition for continued employment and the union shop clause.26 It failed to take into

consideration its recognition of the banks exclusive rights and prerogatives, likewise provided in the CBA, which

includedthehiringofemployees,promotion,transfers,anddismissalsforjustcauseandthemaintenanceoforder,

disciplineandefficiencyinitsoperations.27

TheUnion,however,insiststhatjobsbeingoutsourcedtoBOMCwereincludedintheexistingbargainingunit,thus,

resultinginareductionofanumberofpositionsinsuchunit.Thereductioninterferedwiththeemployeesrightto

selforganizationbecausethepowerofaunionprimarilydependsonitsstrengthinnumber.28

Itisincomprehensiblehowthe"reductionofpositionsinthecollectivebargainingunit"interfereswiththeemployees

right to selforganization because the employees themselves were neither transferred nor dismissed from the

service.AstheNLRCclearlystated:

In the case at hand, the union has not presented even an iota of evidence that petitioner bank has started to

terminate certain employees, members of the union. In fact, what appears is that the Bank has exerted utmost

diligence,careandefforttoseetoitthatnounionmemberhasbeenterminated.Intheprocessoftheconsolidation

or merger of the two banks which resulted in increased diversification of functions, some of these nonbanking

functionsweremerelytransferredtotheBOMCwithoutaffectingtheunionmembership.29

BPI stresses that not a single employee or union member was or would be dislocated or terminated from their

employment as a result of the Service Agreement.30 Neither had it resulted in any diminution of salaries and

benefitsnorledtoanyreductionofunionmembership.31

Asfarasthetwelve(12)formerFEBTCemployeesareconcerned,theUnionfailedtosubstantiallyprovethattheir

transfer,madetocompleteBOMCsservicecomplement,wasmotivatedbyillwill,antiunionismorbadfaithsoas

toaffectorinterferewiththeemployeesrighttoselforganization.

Itistobeemphasizedthatcontractingoutofservicesisnotillegalperse. Itisanexerciseofbusinessjudgmentor

managementprerogative.Absentproofthatthemanagementactedinamaliciousorarbitrarymanner,theCourtwill

not interfere with the exercise of judgment by an employer.32 In this case, bad faith cannot be attributed to BPI

becauseitsactionswereauthorizedbyCBPCircularNo.1388,Seriesof199333issuedbytheMonetaryBoardof

the then Central Bank of the Philippines (now Bangko Sentral ng Pilipinas). The circular covered amendments in

BookIoftheManualofRegulationsforBanksandOtherFinancialIntermediaries,particularlyonthematterofbank

service contracts. A finding of ULP necessarily requires the alleging party to prove it with substantial evidence.

Unfortunately,theUnionfailedtodischargethisburden.

1wphi1

MuchhasbeensaidabouttheapplicabilityofD.O.No.10.BoththeNLRCandtheCAagreedwithBPIthatthesaid

orderdoesnotapply.WithBPI,asacommercialbank,itstransactionsaresubjecttotherulesandregulationsofthe

governingagencywhichistheBangkoSentralngPilipinas.34TheUnioninsiststhatD.O.No.10shouldprevail.

http://www.lawphil.net/judjuris/juri2013/jul2013/gr_174912_2013.html

4/9

10/31/2016

G.R. No. 174912

TheCourtisoftheview,however,thatthereisnoconflictbetweenD.O.No.10andCBPCircularNo.1388.Infact,

theycomplementeachother.

Consistent with the maxim, interpretare et concordare leges legibus est optimus interpretandi modus, a statute

shouldbeconstruednotonlytobeconsistentwithitselfbutalsotoharmonizewithotherlawsonthesamesubject

matter, as to form a complete, coherent and intelligible system of jurisprudence.35 The seemingly conflicting

provisionsofalaworoftwolawsmustbeharmonizedtorendereacheffective.36Itisonlywhenharmonizationis

impossiblethatresortmustbemadetochoosingwhichlawtoapply.37

In the case at bench, the Union submits that while the Central Bank regulates banking, the Labor Code and its

implementing rules regulate the employment relationship. To this, the Court agrees. The fact that banks are of a

specializedindustrymust,however,betakenintoaccount.Thecompetenceindeterminingwhichbankingfunctions

may or may not be outsourced lies with the BSP. This does not mean that banks can simply outsource banking

functionsallowedbytheBSPthroughitscirculars,withoutgivingregardtotheguidelinessetforthunderD.O.No.

10issuedbytheDOLE.

While D.O. No. 10, Series of 1997, enumerates the permissible contracting or subcontracting activities, it is to be

observedthat,particularlyinSec.6(d)invokedbytheUnion,theprovisionisgeneralincharacter"xxxWorksor

servicesnotdirectlyrelatedornotintegraltothemainbusinessoroperationoftheprincipalxxx."Thisdoesnot

limit or prohibit the appropriate government agency, such as the BSP, to issue rules, regulations or circulars to

further and specifically determine the permissible services to be contracted out. CBP Circular No. 138838

enumerated functions which are ancillary to the business of banks, hence, allowed to be outsourced. Thus,

sanctionedbysaidcircular,BPIoutsourcedthecashiering(i.e.,cashdeliveryanddepositpickup)andaccounting

requirements of its Davao City branches.39 The Union even described the extent of BPIs actual and intended

contractingouttoBOMCasfollows:

"Asaninitiatorymove,thefunctionsoftheCashieringUnitoftheProcessingCenterofBPI,handledbyitsregular

rank and file employees who are members of the Union, xxx [were] transferred to BOMC with the Accounting

Departmentasnextinline.TheDistributing,ClearingandBookkeepingfunctionsoftheProcessingCenterofthe

formerFEBTCwerelikewisecontractedouttoBOMC."40

Thus, the subject functions appear to be not in any way directly related to the core activities of banks. They are

functionsinaprocessingcenterofBPIwhichdoesnothandleormanagedeposittransactions.Clearly,thefunctions

outsourcedarenotinherentbankingfunctions,and,thus,arewellwithinthepermissibleservicesunderthecircular.

The Court agrees with BPI that D.O. No. 10 is but a guide to determine what functions may be contracted out,

subject to the rules and established jurisprudence on legitimate job contracting and prohibited laboronly

contracting.41 Even if the Court considers D.O. No. 10 only, BPI would still be within the bounds of D.O. No. 10

whenitcontractedoutthesubjectfunctions.Thisisbecausethesubjectfunctionswerenotrelatedornotintegralto

themainbusinessoroperationoftheprincipalwhichisthelendingoffundsobtainedintheformofdeposits.42From

the very definition of "banks" as provided under the General Banking Law, it can easily be discerned that banks

perform only two (2) main or basic functions deposit and loan functions. Thus, cashiering, distribution and

bookkeepingarebutancillaryfunctionswhoseoutsourcingissanctionedunderCBPCircularNo.1388aswellas

D.O.No.10.EvenBPIitselfrecognizesthatdepositandloanfunctionscannotbelegallycontractedoutastheyare

directlyrelatedorintegraltothemainbusinessoroperationofbanks.TheCBP'sManualofRegulationshaseven

categoricallystatedandemphasizedontheprohibitionagainstoutsourcinginherentbankingfunctions,whichrefer

to any contract between the bank and a service provider for the latter to supply, or any act whereby the latter

supplies,themanpowertoservicethedeposittransactionsoftheformer.43

Inonecase,theCourtheldthatitismanagementprerogativetofarmoutanyofitsactivities,regardlessofwhether

suchactivityisperipheralorcoreinnature.44Whatisofprimordialimportanceisthattheserviceagreementdoes

notviolatetheemployee'srighttosecurityoftenureandpaymentofbenefitstowhichheisentitledunderthelaw.

Furthermore, the outsourcing must not squarely fall under laboronly contracting where the contractor or sub

contractormerelyrecruits,suppliesorplacesworkerstoperformajob,workorserviceforaprincipalorifanyofthe

followingelementsarepresent:

i) The contractor or subcontractor does not have substantial capital or investment which relates to the job,

work or service to be performed and the employees recruited, supplied or placed by such contractor or

subcontractorareperformingactivitieswhicharedirectlyrelatedtothemainbusinessoftheprincipalor

ii)Thecontractordoesnotexercisetherighttocontrolovertheperformanceoftheworkofthecontractual

employee.45

WHEREFORE,thepetitionisDENIED.

http://www.lawphil.net/judjuris/juri2013/jul2013/gr_174912_2013.html

5/9

10/31/2016

G.R. No. 174912

SOORDERED.

JOSECATRALMENDOZA

AssociateJustice

WECONCUR:

PRESBITEROJ.VELASCO,JR.

AssociateJustice

Chairperson

DIOSDADOM.PERALTA

AssociateJustice

ROBERTOA.ABAD

AssociateJustice

MARVICMARIOVICTORF.LEONEN

AssociateJustice

ATTESTATION

IattestthattheconclusionsintheaboveDecisionhadbeenreachedinconsultationbeforethecasewasassigned

tothewriteroftheopinionoftheCourtsDivision.

PRESBITEROJ.VELASCO,JR.

AssociateJustice

Chairperson,ThirdDivision

CERTIFICATION

PursuanttoSection13,ArticleVIIIoftheConstitutionandtheDivisionChairperson'sAttestation,Icertifythatthe

conclusionsintheaboveDecisionhadbeenreachedinconsultationbeforethecasewasassignedtothewriterof

theopinionoftheCourt'sDivision.

MARIALOURDESP.A.SERENO

ChiefJustice

Footnotes

1 Penned by Associate Justice Rodrigo F. Lim. Jr., with Associate Justices Teresita DyLiacco Flores and

RamonR.Garcia.concurringrollo,pp.84103.

2Id.at105107.

3Id.at5379.

4Id.at8182.

5NowBangkoSentralngPilipinas(BSP).

6Rollo,p.181.

7Id.at8788.

8Id.at88.

9Id.at90.

10Id.at91.

11Id.at93.

12Id.at92.

13Id.at93.

http://www.lawphil.net/judjuris/juri2013/jul2013/gr_174912_2013.html

6/9

10/31/2016

G.R. No. 174912

14Id.at96.

15Id.at97.

16Id.at98.

17Id.at99.

18Id.

19351Phil.1013(1998).

20148APhil.229(1971).

21Section1,ArticleIV.ExclusiveRightsandPrerogativesTheUNIONallallitsmembersherebyrecognize

thatthemanagementandoperationofthebusinessoftheBANKwhichinclude,amongothers,thehiringof

employees,promotion,transfers,anddismissalforjustcauseaswellasthemaintenanceoforder,discipline

andefficiencyinitsoperationarethesoleandexclusiveprerogativeoftheBANK..

22Supranote20.

23 Cecille de Ocampo v. NLRC, G.R. No. 101539, September 4, 1992, 213 SCRA 652 Asian Alcohol

Corporation v. NLRC, 364 Phil. 912 (1999). G.R. No. 131108, March 25, 1999, Manila Electric Company v.

Quisumbing,383Phil.47(2000)

24Supranote20.

25Bustamantev.NLRC,332Phil.833,839(1996).

26Rollo,p.57.

27Id.at125.

28Id.at37.

29Id.at7273.

30Id.at125126.

31Id.

32ManilaElectricCompanyv.SecretaryQuisumbing,383Phil.47,60(2000).

33CBPCIRCULARNO.1388Seriesof1993

The Monetary Board, in its Resolution No. 231 dated March 19, 1993, approved the following

amendments to Book I of the Manual of Regulations for Banks and Other Financial

Intermediaries:

SECTION1.ThefollowingnewsectionisherebyaddedafterSection1176oftheManual:

SECTION1177.BankServiceContract.Abankwithexpandedcommercialbankingauthority

oracommercialbankmayengageabankservicebureauorcorporationtoperformthefollowing

services:

(a)dataprocessingsystemsdevelopmentandmaintenance

(b)depositandwithdrawalrecording

(c)computationandrecordingofinterests,servicecharges,penalties,andotherfees

(d) checkclearing processing, such as the transmission and receipt of checkclearing

items/tapes to and from the Central Bank (CB), collection and delivery of checks not

includedinthePhilippineClearingHouseSystem,aswellastherecordingofthesame

http://www.lawphil.net/judjuris/juri2013/jul2013/gr_174912_2013.html

7/9

10/31/2016

G.R. No. 174912

(e)printinganddeliveryofbankstatementsand

(f)providinggeneralsupportservices,suchaspurchasingofbankforms,equipmentand

supplies messengerial, janitorial and services necessary budget and expense

accounting,andothersimilarservices.

Banksmayenterintocontractscoveringabovementionedservices,providedthat:

1.TheperformancebytheServiceBureauofaforesaidbankservicespertinenttodeposit

operationswillnotinanywayviolatelawsonsecrecyofbankdeposits

2.TherewillbenodiminutionofCentralBank'ssupervisoryandexaminingauthorityover

banks,norinanymannerimpedeCB'sexercisethereof

3. The administrative powers of CB over the bank, its directors and officers shall not be

impairedbysuchtransferofactivities

4. The bank remains responsible for the performance of subject activities in the same

manner and to the same extent as it was before the transfer of said services to the

Bureau

5.TheServiceBureaushallbeownedexclusivelybybanksandshallrenderservicesto

banksand

6.Thebankshallcontinuetocomplywithalllawsandregulations,coveringtheactivities

performedbytheServiceBureauforandinitsbehalfsuchas,butmaynotbelimitedto,

keeping of records and preparation of reports, signing authorities, internal control, and

clearingregulations."

SECTION2.Section1379(a)isherebyamendedbyaddingaparagraphafteritem(10),as

follows:

"(11) Bank service corporations all of the capital of which is owned by one or more banks and

organizedtoperformforandinbehalfofbankstheservicesenumeratedinSection1177."

ThisCircularshalltakeeffectimmediately.

JOSEL.CUISIA,JR.

Governor

34Rollo,pp.100101.

35DreamworkConstruction,Inc.v.Janiola,G.R.No.184861,June30,2009,591SCRA466,474CSCv.

CA,G.R.No.176162,October9,2012,sc.judiciary.gov.ph/jurisprudence/2012/october2012/176162.pdf,(last

visitedJune17,2013).

36 Remo v. The Honorable Secretary of Foregin Affairs, G.R. No. 169202, March 5, 2010, 614 SCRA 281,

290.

37DreamworkConstruction,Inc.v.Janiola,supranote35at475.

38SeeNote33.

39Rollo,p.181182.

40Rollo,p.219.

41Rollo,p.201.

42Sec.3.1.,ChapterI,R.A.No.8191,TheGeneralBankingLawof2000FirstPlantersPawnshop,Inc.v.

CIR,G.R.No.174134,July30,2008,560SCRA606,619Galvezv.CA,G.R.No.187919,April25,2012,

671SCRA223,238.

43X162.1(2008X169.1),ManualofRegulationsforBanks.

44Alviadov.Procter&GamblePhils.Inc.,G.R.No.160506,March9,2010,614SCRA563,577.

http://www.lawphil.net/judjuris/juri2013/jul2013/gr_174912_2013.html

8/9

10/31/2016

G.R. No. 174912

45Id.Art.106,LaborCodeofthePhilippines.

TheLawphilProjectArellanoLawFoundation

http://www.lawphil.net/judjuris/juri2013/jul2013/gr_174912_2013.html

9/9

Vous aimerez peut-être aussi

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Title I General Provisions: (Batas Pambansa Blg. 68)Document21 pagesTitle I General Provisions: (Batas Pambansa Blg. 68)Eve Bonaobra BongonPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Title I General Provisions: (Batas Pambansa Blg. 68)Document21 pagesTitle I General Provisions: (Batas Pambansa Blg. 68)Eve Bonaobra BongonPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Alonso V VillamorDocument5 pagesAlonso V VillamorEve Bonaobra BongonPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Alonso V VillamorDocument5 pagesAlonso V VillamorEve Bonaobra BongonPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- RA 10175 - Cybercrime LawDocument14 pagesRA 10175 - Cybercrime LawXymon BassigPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- UP V PhilabDocument18 pagesUP V PhilabLynne Dela Cruz100% (1)

- UP V PhilabDocument18 pagesUP V PhilabLynne Dela Cruz100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- UP V PhilabDocument18 pagesUP V PhilabLynne Dela Cruz100% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Syllabus Crimininal Procedure (S.y. 2008 - 2009)Document15 pagesSyllabus Crimininal Procedure (S.y. 2008 - 2009)Eve Bonaobra Bongon100% (1)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Practice and Procedure in Family LawDocument102 pagesPractice and Procedure in Family LawAj Guadalupe de MataPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- Court Rules on Validity of Tractor Sale Between Brothers Despite MortgageDocument2 pagesCourt Rules on Validity of Tractor Sale Between Brothers Despite MortgageRowena GallegoPas encore d'évaluation

- 2 Ejectment - Reply - DSG Vs REMDocument6 pages2 Ejectment - Reply - DSG Vs REMmercy rodriguezPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- UGC GrievanceRedressalRegulationsDocument9 pagesUGC GrievanceRedressalRegulationsmurkyPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- ICSI UDIN Guidelines for Certification ServicesDocument4 pagesICSI UDIN Guidelines for Certification ServicesSACHIN REVEKARPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Compliance of Citizenship Requirement For Application of CPF GrantDocument2 pagesCompliance of Citizenship Requirement For Application of CPF GrantSGExecCondosPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Resolution On Standing Committee ChairmanshipDocument3 pagesResolution On Standing Committee ChairmanshipNikki BautistaPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- IRS Allotment Dependency by Philippine Province 2009-2018Document10 pagesIRS Allotment Dependency by Philippine Province 2009-2018Rheii EstandartePas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- Palafox Vs Province of Ilocos NorteDocument3 pagesPalafox Vs Province of Ilocos NorteKrys Martinez0% (1)

- Sem-III Political Science - Minor - PDFDocument2 pagesSem-III Political Science - Minor - PDFNaveen SiharePas encore d'évaluation

- Lincoln House Divided SpeechDocument4 pagesLincoln House Divided Speechpeterson_parkerPas encore d'évaluation

- 114789-2001-UCPB General Insurance Co. Inc. v. MasaganaDocument6 pages114789-2001-UCPB General Insurance Co. Inc. v. MasaganaMark Anthony Javellana SicadPas encore d'évaluation

- 06-Coca-Cola Bottlers Phil., Inc. v. City of Manila GR No 156252Document7 pages06-Coca-Cola Bottlers Phil., Inc. v. City of Manila GR No 156252ryanmeinPas encore d'évaluation

- Paula Haugen v. Nassau County Department of Social Services County of Nassau, 171 F.3d 136, 2d Cir. (1999)Document3 pagesPaula Haugen v. Nassau County Department of Social Services County of Nassau, 171 F.3d 136, 2d Cir. (1999)Scribd Government DocsPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- 8 Causes of Delays in Public ProcurementDocument4 pages8 Causes of Delays in Public ProcurementPj TignimanPas encore d'évaluation

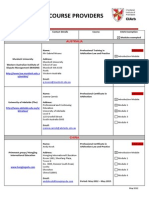

- Recognised Course Providers ListDocument13 pagesRecognised Course Providers ListSo LokPas encore d'évaluation

- Flowchart Institution of Proceedings For The Discipline of Judges and JusticesDocument1 pageFlowchart Institution of Proceedings For The Discipline of Judges and JusticesKristine Delos SantosPas encore d'évaluation

- Conjugal Property Named On The ParamourDocument8 pagesConjugal Property Named On The ParamourMan2x SalomonPas encore d'évaluation

- Microsoft Collaborate Terms of UseDocument6 pagesMicrosoft Collaborate Terms of UseZeeshan OpelPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Legal English Inheritance Law Property Law (Mgr. Kołakowska)Document2 pagesLegal English Inheritance Law Property Law (Mgr. Kołakowska)KonradAdamiakPas encore d'évaluation

- United States Court of Appeals, Eleventh CircuitDocument52 pagesUnited States Court of Appeals, Eleventh CircuitScribd Government DocsPas encore d'évaluation

- Notice of Decertification Petition by Members of SEIU Local 221 in San Diego, California 11-21-12Document5 pagesNotice of Decertification Petition by Members of SEIU Local 221 in San Diego, California 11-21-12Anonymous iC9QziKPas encore d'évaluation

- Written Task 1 - Child Pornography in CartoonsDocument4 pagesWritten Task 1 - Child Pornography in CartoonsMauri CastilloPas encore d'évaluation

- Lgu-Zaragoza OpmaDocument11 pagesLgu-Zaragoza OpmaArrah BautistaPas encore d'évaluation

- Jurisdiction over AFPCES dismissal caseDocument2 pagesJurisdiction over AFPCES dismissal caseKDPas encore d'évaluation

- Raquel Kho V. Republic of The Philippines: G.R. No. 187462, June 1, 2016 Peralta, JDocument2 pagesRaquel Kho V. Republic of The Philippines: G.R. No. 187462, June 1, 2016 Peralta, JHANNAH GRACE TEODOSIOPas encore d'évaluation

- 2GO Travel - Itinerary ReceiptDocument2 pages2GO Travel - Itinerary ReceiptGeoseff Entrata100% (1)

- PCLL Examiner Comments on Business Associations ExamDocument3 pagesPCLL Examiner Comments on Business Associations ExamDenis PoonPas encore d'évaluation

- Answering Brief of Defendants-Appellees: Ronald Pierce et al vs. Chief Justice Tani Cantil-Sakauye Judicial Council Chair and Steven Jahr Judicial Council Administrative Director - Federal Class Action Lawsuit for Alleged Illegal Use of California Vexatious Litigant Law by Family Court Judges in Child Custody Disputes - Ventura County - Tulare County - Sacramento County - San Mateo County - Santa Clara County - Riverside County - San Francisco County - US District Court for the Northern District of California Judge Jeffrey S. White - US Courts for the Ninth Circuit - 9th Circuit Court of Appeal Class Action for Injunctive and Declaratory ReliefDocument171 pagesAnswering Brief of Defendants-Appellees: Ronald Pierce et al vs. Chief Justice Tani Cantil-Sakauye Judicial Council Chair and Steven Jahr Judicial Council Administrative Director - Federal Class Action Lawsuit for Alleged Illegal Use of California Vexatious Litigant Law by Family Court Judges in Child Custody Disputes - Ventura County - Tulare County - Sacramento County - San Mateo County - Santa Clara County - Riverside County - San Francisco County - US District Court for the Northern District of California Judge Jeffrey S. White - US Courts for the Ninth Circuit - 9th Circuit Court of Appeal Class Action for Injunctive and Declaratory ReliefCalifornia Judicial Branch News Service - Investigative Reporting Source Material & Story Ideas100% (1)

- Indian Penal CodeDocument3 pagesIndian Penal CodeSHRUTI SINGHPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)