Académique Documents

Professionnel Documents

Culture Documents

A Project On Tax Audit: Guidance Note On Tax Audit Under Section 44AB of The Income-Tax Act, 1961

Transféré par

Nooral AlfaDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

A Project On Tax Audit: Guidance Note On Tax Audit Under Section 44AB of The Income-Tax Act, 1961

Transféré par

Nooral AlfaDroits d'auteur :

Formats disponibles

A PROJECT ON TAX AUDIT

CHAPTER 1

INTRODUCTION

Guidance Note on Tax Audit Under Section 44AB of the Income-tax Act, 1961

Changes approved subsequent to the publication of the Supplementary Guidance Note.

1. Form No.3CD was extensively amended by Notification No.208/2006 dated 10th August,

2006. The Supplementary Guidance Note on Tax Audit under section 44AB of the

Income-tax Act, 1961 was published in 2006 as a part of the Guidance Note on Audit of

Fringe Benefits under the Income-tax Act, 1961.

2. Subsequent to the publishing of the Supplementary Guidance Note, the Finance Act, 2007

has made amendments in section 40A(3). New Rule 6DD was inserted in the Income-tax

Rules by Notification No.208/2007 dated 27.6.2007 w.e.f. A.Y. 2008-09.

3. It was also necessary to give guidance in respect of valuation of purchases, sales and

inventory under section 145A of the Income-tax Act in the context of Value Added Tax

introduced by the State Government.

4. The Finance Act, 2007 has also amended the provisions relating to the fringe benefit tax.

5. Consequent changes have been made in the Guidance Note on Tax Audit under section

44AB of the Income-tax Act, 1961 which have been approved by the Council.

6. The following changes be read in the Guidance Note on Tax Audit [2005 Edition], the

Guidance Note on Audit of Fringe Benefit under the Income tax Act and the

Supplementary Guidance Note on Tax Audit [2006 Edition]

1. Clause No.12(a) and (b) Para No.23 of the Guidance Note (2005 Edition)

23(a) Method of valuation of closing stock employed in the previous year. 23(b) Details of

deviation, if any, from the method of valuation prescribed under section 145A and the effect

thereof on the profit or loss

This clause requires the details regarding method of valuation of closing stock employed in the

previous year and the details of deviation, if any, from the method of valuation prescribed under

section 145A and the effect thereof on the profit or loss.

There is no change from paragraphs from 23.1 to 23.17. After that, the following paragraphs are

being added.

VIVEK COLLEGE OF COMMERCEPage 1

A PROJECT ON TAX AUDIT

23.18 The input State-Level Value Added Tax (VAT) paid on purchases cannot be included in the

cost of purchases. Where the tax paid on inputs is available for set-off against the tax payable on

sales or is refundable, it is in the nature of taxes recoverable from taxing authorities. The

Accounting Standard (AS) 2 Valuation of Inventories issued by the ICAI deals with cost of

inventories and cost of purchases. As per para 6 and 7 of the said AS-2, the cost of purchases

cannot include duties and the taxes which are subsequently recoverable from the taxing

authorities. Hence the input tax which is refundable, should not be included in the cost of

purchases.

23.19 The Input State-Level VAT, to the extent it is refundable, will not form part of the cost of

the inventory. The inventory of inputs is to be valued at net of the input tax which is refundable.

If the inputs are obtained from the dealers who are exempt from the VAT, the actual cost of

purchase should be considered as a part of cost of inventory.

23.20 A dealer may purchase certain common inputs which are to be used for making taxable

sales as well as for making exempt sales. In such a case, the dealer, on the date of purchase,

should estimate inputs expected to be used for making taxable sales and for making exempts

sales. The dealer should recognize VAT credit only in respect of those inputs which are expected

to be used for making taxable sales and no VAT credit should be recognized in respect of inputs

expected to be used for making exempt sales. Subsequently, in case the actual use is different

from the estimated use, the dealer should pass an appropriate adjustment entry for the same.

Similarly, in the case of stock transfer/consignment sale of goods out of the State where VAT

credit is available only to the extent of a certain portion of input tax paid, the dealer should make

an estimate of the expected stocks transfers/ consignment sales and account for accordingly.

23.21 VAT is collected from the customers on behalf of the VAT authorities and, therefore, its

collection from the customers is not an economic benefit for the enterprise. It does not result in

any increase in the equity of the enterprise. Accordingly it should not be recognized as an income

of the enterprise. Similarly, the payment of VAT should not be treated as an expense in the

financial statements of the enterprise. Therefore it should be credited to an appropriate account,

say. VAT Payable Account. In case the VAT has not been charged separately but has made a

VIVEK COLLEGE OF COMMERCEPage 2

A PROJECT ON TAX AUDIT

composite charge, it should segregate the portion of sales which is attributable to tax and should

credit the same to VAT Payable Account at periodic intervals.

The amount of VAT payable adjusted against the VAT Credit Receivable (Capital Goods)

Account and amounts paid in cash will be debited to this account. The credit balance in VAT

Payable Account at the year-end should be shown on the Liabilities side of the balance sheet

under the head Current Liabilities. It is important to note that where the assessee is enjoying tax

holiday under the relevant state law as a result of which the liability to pay is deferred for a

period of more than one year then it should be reflected as a long term liability.

23.22 Section 145A of the Income Tax Act provides that the valuation of purchase and sales of

goods and inventory for the purpose of computation of income from business or profession shall

be made on the basis of method of accounting regularly employed by the assessee but this shall

be subject to certain adjustments. Therefore, it is not necessary to change the method of valuation

of purchase, sale and inventory regularly employed in the books of account. The adjustment

provided for in this section should be made while computing the income for the purpose of

preparing the return of income.

non-compliance of section 145A of the Income Tax Act.

23.23 The adjustments envisaged by section 145A will not have any impact on the

trading account of the assessee. In other words both under exclusive

method of accounting and inclusive method of accounting, the gross profit in

the trading account will remain the same. The same is illustrated for a

trading concern and a manufacturing concern as follows:

Trading Concern

Three items purchased @ Rs.3.00 lakhs per item. VAT on purchase @ 10%. There is

no opening stock.

Two items sold @ Rs.4.50 lakhs per item. VAT on sales @ 10%

The Trading Account on EXCLUSIVE METHOD

Meanings of International Trade:Internal trade refers to the exchange of goods and services between the buyers and sellers

within the political boundaries of the same country. It may be carried on either as a wholesale

trade or a retail trade.

External trade or international trade is the trade between different countries i.e. it extends

beyond the political boundaries of the countries. In other words, it is the trade between two

countries. Hence, it is also known as foreign trade.

VIVEK COLLEGE OF COMMERCEPage 3

A PROJECT ON TAX AUDIT

Trading with nations beyond the seas is however not new to Indians. Evidences about our interna

tional trade are found in the ancient literatures of our country. But the volume of such trade was

insignificant and continued to remain so tight through the middle ages and up to the advent of the

British rule in India. It is only after the British rule that Indias foreign trade took a definite

shape.

International trade on large scale has become a phenomenon of the 20 th century especially after

the IInd World War. There is practically no country today, which is functioning as a closed system.

Even socialist countries like Russia and China are now taking concrete steps to capture foreign

markets

for the products

produced in their country. International trade, thus, has

become as essential ingredient of the normal economic life of any country.

Similarities and Differences between Internal and International Trade:The general procedure and operations are similar to both internal trade and international trade.

The following are the similarities between the two: 1. Satisfaction of Consumer:

In domestic trade and in international trade, success depends upon effectively satisfying the basic

requirements of the consumers.

2. Goodwill Creation:

It is necessary to build goodwill both in the domestic market as well as in the international

market. If a firm is able to develop goodwill of the consumers, its task will be much simpler than

the one, which is not able to build up its own reputation. In both

the cases, the seller should take all positive measures to gain the confidence of the consumers in

his product.

3. Market Research:

The marketing program should be formulated after a careful market research. Failure to assess

the target market shall ultimately bring failure in the task of marketing.

4. Product Planning and Development:

Research and development with a view to product improvement is necessary in both internal and

international trade. The marketer should keep a constant watch over the changes occurring in the

consumers tastes and the preferences and develop or modify his product to suit the needs of his

customers.

However, there are certain special features, which differentiate internal trade from international

trade. The difference is as follows:1. Demand and Supply:

Demand and supply can`t work out their full effects where foreign trade is concerned. Where as

such factors can work out their full efforts in the case of internal trade.

2. Physical Obstacle to Commerce:

VIVEK COLLEGE OF COMMERCEPage 4

A PROJECT ON TAX AUDIT

Where

international

trade

is

carried

on,

a

far

greater

degree

of inequality between conditions of production in different countries is necessary to

stimulate

trade when the countries are widely separated than when they are adjoining.

3. Artificial Barriers to Trade:

The natural difficulties may be increased by artificial barriers to trade, either through prohibitive

laws as in war time of through customs duties or protective tariffs.

4. Obstacles of Mobility of Capital:

Men who refuse to leave their own land may invest capital abroad. A foreign loan must offer

a much higher rate of interest than a home loan. Not only is there a real risk of loss of interest

and even capital, but an investor feels a sense of insecurity when money is invested abroad.

5. Differences in Economic Environment from country to country:

Different countries may have different facilities for carrying out productive activities.

Difference

in

system

of national and local taxation, regulations for health, factory organization, education and

insurance, policy regarding the transport and public utilities, laws relating to industrial

combinations and trade, etc., do exist between countries. These differences bring about a

difference in the cost of production.

6. The geographical and climatic conditions:

They may give rise to territorial division of labour and localization of industries.

Some countries may have natural resources is abundance such as iron ore, coal, etc., whereas in

some other countries climatic conditions give advantages to them.

7. Long-distance:

International trade is generally of long-distance. This may affect the transport costs and the cost

of different factors of production.

8. Preference:

Preference for home and the prejudice against foreigners remain as one of the major factors that

would explain as to why the rates of earning of the different of equal efficiency would not be

equalized between different countries.

VIVEK COLLEGE OF COMMERCEPage 5

A PROJECT ON TAX AUDIT

CHAPTER 2

Benefits of International Trade

The various gains of international trade are as follows:

1. International Specialization:

International trade enables to specialize in the production of those goods in which each country

has special advantages. Some countries are rich in minerals and in hydroelectric power. Some are

blessed with extensive land but have very little population. In the absence of trade, every country

will be forced to produce all types of goods, even those for which they do not have facilities for

production. International trade, on the other hand, will enable each country to specialize in the

commodities in which it has absolute or comparative advantages. Thus, international trade brings

about specialization and also all other advantages associated with such specialization.

2. Increased Production and Higher Standard of Living:

It is well known that specialization leads to the following:

Best utilization of resources.

Concentration on the production of goods in which they have advantages.

Saving of time and energy in production and perfecting the skills in production.

Inventing and using new techniques of production. All these indicate one basis advantage viz.,

increased production. Increased production will also mean higher standard of living for

people in both the countries.

3. Availability of Scarce Materials:

VIVEK COLLEGE OF COMMERCEPage 6

A PROJECT ON TAX AUDIT

International trade is the only method by which a country can supplement its storage of resources

or certain essential materials. There is no country in the world which has all the resources it

requires.

At

the

same

time,

there

are

some countries which have been blessed by nature with some rare materials. International trade

ensures equal access to raw materials for all countries.

4. Equalization of Prices between Countries:

An important gain of international trade or the effect of it is the tendency of internationally

traded goods to have the same price everywhere. Through international trade, supply is increased

in the importing country and thereby the prices are reduced.

CHAPTER 3

EXPORTS

VIVEK COLLEGE OF COMMERCEPage 7

A PROJECT ON TAX AUDIT

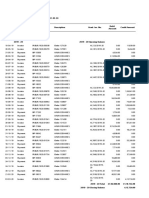

Department of Commerce

System on Foreign Trade Performance Analysis (FTPA)

Export of Principal Commodities Groups

Dated: 4/12/2009

Values in Rs. Crores

Sr.No. Commodity

Apr-Mar 2004

A)

PLANTATION

2,723.26

B)

AGRI & ALLIED PRDTS

24,844.48

C)

MARINE PRODUCTS

6,105.63

D)

ORES & MINERALS

10,884.62

E)

LEATHER & MNFRS

9,939.43

F)

GEMS & JEWELLERY

48,586.07

G)

SPORTS GOODS

455.48

H)

CHEMICALS & RELATED

45,768.06

PRODUCTS

I)

ENGINEERING GOODS

48,324.44

J)

ELECTRONIC GOODS

8,293.86

K)

PROJECT GOODS

386.58

L)

TEXTILES

56,082.22

M)

HANDICRAFTS

2,296.13

N)

CARPETS

2,691.23

O)

COTTON RAW INCL WASTE 942.37

P)

Q)

PETROLEUM PRODUCTS

UNCLASSIFIED EXPORTS

TOTAL

16,397.44

8,645.46

293,366.75

VIVEK COLLEGE OF COMMERCEPage 8

Apr-Mar 2005

2,909.38

65769.48

7, 0 64.11

35874.05

16351.11

1 27424.33

660.12

109592.65

%Growth

6.83

164.72

15.69

229.58

64.50

162.26

44.92

139.45

%Share

0.78

7.82

0.84

4.27

1.94

15.16

0.07

13.04

69118.23

8,493.43

337.03

58,044.73

1,695.79

2,859.58

422.58

43.03

2.41

-12.82

3.50

-26.15

6.26

-55.16

18.41

2.26

0.09

15.46

0.45

0.76

0.11

31,404.15

10,167.77

375,339.50

91.52

17.61

27.94

8.37

2.71

100.00

A PROJECT ON TAX AUDIT

Data Source: DGCIS, Kolkata

Department of Commerce

System on Foreign Trade Performance Analysis (FTPA)

Top 10 Countries of Export

Dated: 7/12/2009

Values in Rs. Crores

Rank

Country

Apr-Mar 2004 Apr-Mar

2005

1

USA

52,798.54

61,851.55

2

U ARAB EMTS 23,552.85

33,015.13

3

CHINA P RP

13,579.06

25,232.97

4

SINGAPORE

9,763.93

17,975.35

5

HONG KONG

14,988.52

16,587.91

6

UK

13,892.31

16,539.71

7

GERMANY

11,692.62

12,698.75

8

BELGIUM

8,297.56

11,276.48

9

ITALY

7,946.88

10,271.29

10

JAPAN

7,854.45

9,561.02

Total

293,366.75

375,339.50

Data Source: DGCIS, Kolkata

Department of Commerce

System on Foreign Trade Performance Analysis (FTPA)

Export of Principal Commodities Groups

Dated: 4/12/2009

VIVEK COLLEGE OF COMMERCEPage 9

DOC-NIC

%Growth

17.15

40.17

85.82

84.10

10.67

19.06

8.60

35.90

29.25

21.73

27.94

%Share

16.482

8.803

6.724

4.795

4.426

4.417

3.388

3.009

2.74

2.55

100.00

DOC-NIC

A PROJECT ON TAX AUDIT

Values in Rs. Crores

Sr.No.

Commodity

A)

PLANTATION

B)

AGRI & ALLIED PRDTS

C)

MARINE PRODUCTS

D)

ORES & MINERALS

E)

LEATHER & MNFRS

F)

GEMS & JEWELLERY

G)

SPORTS GOODS

H)

CHEMICALS & RELATED

PRODUCTS

I)

ENGINEERING GOODS

J)

ELECTRONIC GOODS

K)

PROJECT GOODS

L)

TEXTILES

M)

HANDICRAFTS

N)

O)

P)

Q)

CARPETS

COTTON RAW INCL WASTE

PETROLEUM PRODUCTS

UNCLASSIFIED EXPORTS

Total

Data Source: DGCIS, Kolkata

Apr-Mar 2005

2,909.38

28,276.93

6,469.22

22,818.77

10,880.57

61,833.71

459.60

59,148.06

Apr-Mar 2006

3,319.41

31,960.37

7,035.91

27,288.34

11,943.45

61,833.71

595.87

69,148.93

%Growth

14.09

13.03

8.76

19.59

9.77

11.19

29.65

16.91

%Share

0.73

7.00

1.54

5.98

2.62

15.06

0.13

15.15

69,118.23

8,493.43

337.03

58,044.73

1,695.79

69,118.23

10,039.90

337.03

68,823.32

2,045.34

23.65

18.21

94.29

18.57

20.61

18.72

2.20

0.14

15.08

0.45

2,859.58

422.58

31,404.15

10,167.77

375,339.50

3,774.55

2,904.35

51,532.80

11,135.77

456,417.88

32.00

0.83

587.29

0.64

64.10

11.29

9.52

2.44

21.60

100.00

DOC-NIC

Department of Commerce

System on Foreign Trade Performance Analysis (FTPA)

Top 10 Countries of Export

Dated: 7/12/2009

Values in Rs. Crores

Rank Country

Apr-Mar 2005

Apr-Mar 2006

%Growth

%Share

1

2

24.21

15.22

16.832

8.333

USA

U ARAB EMT

S

61,851.55

33,015.13

76,828.09

38,038.85

VIVEK COLLEGE OF COMMERCEPage 10

A PROJECT ON TAX AUDIT

3

4

5

6

7

8

9

10

CHINA P RP

25,232.97

SINGAPORE

17,975.35

UK

16,539.71

HONG KONG

16,587.91

GERMANY

12,698.75

BELGIUM

11,276.48

ITALY

10,271.29

JAPAN

9,561.02

Total

375,339.50

Data Source: DGCIS, Kolkata

29,924.91

24,019.65

22,399.21

19,796.10

15,877.02

12,711.96

11,152.67

10,985.39

456,417.88

Department of Commerce

System on Foreign Trade Performance Analysis (FTPA)

Export of Principal Commodities Groups

Dated: 4/12/2009

Values in Rs. Crores

Sr. Commodity

Apr-Mar 2006

No.

A)

PLANTATION

3,319.41

B)

AGRI & ALLIED PRDTS

31,960.37

C)

MARINE PRODUCTS

7,035.91

D)

ORES & MINERALS

27,288.34

E)

LEATHER & MNFRS

11,943.45

F)

GEMS & JEWELLERY

68,752.59

G)

SPORTS GOODS

595.87

H)

CHEMICALS & RELATED

69,148.93

PRODUCT

I)

ENGINEERING GOODS

85,462.14

J)

ELECTRONIC GOODS

10,039.90

K)

PROJECT GOODS

654.81

VIVEK COLLEGE OF COMMERCEPage 11

18.59

33.63

35.43

19.34

25.03

12.73

8.58

14.90

21.60

DOC-NIC

6.564

5.265

4.916

4.347

3.488

2.799

2.4410

2.41

100.00

Apr-Mar 2007 %Growth %Share

3,938.51

39,344.68

8,001.04

31,685.96

13,650.38

72,295.17

573.54

83,357.37

18.65

23.10

13.72

16.12

14.29

5.15

-3.75

20.55

0.69

6.88

1.40

16.12

2.39

12.64

0.10

14.58

119,874.96

13,292.73

622.43

40.27

32.40

-4.94

20.97

2.32

0.11

A PROJECT ON TAX AUDIT

L)

M)

N)

O)

P)

Q)

TEXTILES

HANDICRAFTS

CARPETS

COTTON RAW INCL WASTE

PETROLEUM PRODUCTS

UNCLASSIFIED EXPORTS

Total

68,823.32

2,045.34

3,774.55

2,904.35

51,532.80

11,135.77

456,417.88

74,391.06

1,981.91

4,199.09

6,107.81

84,520.15

13,942.50

571,779.25

8.09

-3.10

11.25

110.30

64.01

25.20

25.28

13.01

0.35

0.73

110.30

14.78

2.44

100.00

Trends in exports

Sr.No.

Commodity

A)

B)

C)

D)

E)

PLANTATION

AGRI & ALLIED PRDTS

MARINE PRODUCTS

ORES & MINERALS

LEATHER & MNFRS

F)

G)

H)

GEMS & JEWELLERY

SPORTS GOODS

CHEMICALS & RELATED

PRODUCTS

ENGINEERING GOODS

ELECTRONIC GOODS

PROJECT GOODS

TEXTILES

HANDICRAFTS

CARPETS

COTTON RAW INCL WASTE

PETROLEUM PRODUCTS

UNCLASSIFIED EXPORTS

Total

I)

J)

K)

L)

M)

N)

O)

P)

Q)

Apr-Mar 200

4

2,723.26

24,844.48

6,105.63

10,884.62

9,939.43

Apr-Mar 200

9(P)

4,943.39

65,769.38

7,064.11

35,874.05

16,351.11

% Growth

% Share

81.52

164.72

15.69

229.58

64.50

0.58

7.82

15.69

4.27

1.94

48,586.07

455.48

45,768.06

127,424.33

660.12

109,592.65

162.26

44.92

139.45

15.16

0.07

13.04

48,324.44

8,293.86

386.58

56,082.22

2,296.13

2,691.23

942.37

16,397.44

8,645.46

293,366.75

183,975.64

32,781.90

626.05

88,498.38

1,375.48

3,564.09

2,865.85

123,397.98

35,213.45

839,977.94

280.70

295.25

61.94

57.80

-40.09

32.43

204.11

652.54

307.30

186.32

21.90

3.90

0.07

10.53

0.16

0.42

0.34

14.6

4.19

100

VIVEK COLLEGE OF COMMERCEPage 12

A PROJECT ON TAX AUDIT

Trends in export

We will consider only the top 5 commodity groups as it constitute 75.23% of total exports.

1. ENGINEERING GOODS:- Export of items under this group comprising

Manufactures of Metals,

Machinery and Instruments,

Primary and Semi-finished Iron & Steel and

Transport Equipment

This sector saw a growth rate of 13.04% over past 6 years which is nominal seeing to the growth

of Indian economy.

2. GEMS & JEWELLERY:- This part saw a nominal growth of 15.16%.

3. PETROLEUM PRODUCTS: - This section consists of re-export of processed goods of crude

petroleum. These sections constitute a good portion of Indian exports to great surprise. It

increased by 14.6%

4. CHEMICALS & RELATED PRODUCTS: - Three out of the four sub-groups under this head

viz. Basic Chemicals, Pharmaceuticals & Cosmetics, Plastics & Linoleum, Rubber, and Glass.

This section saw a nominal growth of 13.04%

5. TEXTILES: This section mainly comprises of: wool

silk

jute, etc.

This section saw a growth of 10.53%.

6. HANDICRAFT: - Another interesting section to discuss here is the handicraft section which saw a

decline which is opposite to all other sections. This section includes Metal Art ware, Textiles

(hand printed), Wood wares and Zari goods. It saw a decline of 40.09% this may be due to the

reason that it highly depends upon the taste and preference which may change with time and

region so that might be the possible reason for such an abrupt behavior.

VIVEK COLLEGE OF COMMERCEPage 13

A PROJECT ON TAX AUDIT

CHAPTER 4

IMPORTS

VIVEK COLLEGE OF COMMERCEPage 14

A PROJECT ON TAX AUDIT

Department of Commerce

System on Foreign Trade Performance Analysis (FTPA)

Import of Principal Commodities Groups

Dated: 4/12/2009

Values in Rs. Crores (P) Provisional

Commodity

Apr-Mar

Apr-Mar

2008

2009(P)

A)

BULK IMPORTS

451,341.89

620,105.80

B)

PEARLS, PRECIOUS & SEMI 32,094.27

66,410.18

-PRECIOUS STONES

C)

MACHINERY

181,376.64

183,033.69

D)

PROJECT GOODS

5,207.90

14,383.74

E)

OTHERS

342,291.00

456,654.36

Total

1,012,311.75 1,340,587.75

Data Source: DGCIS, Kolkata

Department of Commerce

System on Foreign Trade Performance Analysis (FTPA)

Top 10 Countries of Import

Dated: 7/12/2009

Values in Rs. Crores (P) Provisional

Rank Country

Apr-Mar 2008 Apr-Mar 2009(P)

1

CHINA P RP

109,116.11

144,114.78

VIVEK COLLEGE OF COMMERCEPage 15

%Growt

h

37.39

106.92

%Share

0.91

176.19

33.41

32.43

13.65

1.07

34.06

100.00

46.26

4.95

%Growth %Share

32.07

10.752

A PROJECT ON TAX AUDIT

2

3

4

5

6

7

8

9

10

U ARAB EMTS

SAUDI ARAB

USA

IRAN

GERMANY

SWITZERLAND

KUWAIT

NIGERIA

KOREA RP

Total

Data Source: DGCIS, Kolkata

54,233.20

78,110.31

84,625.13

43,945.93

39,736.04

39,570.82

30,959.93

30,662.91

24,307.91

1,012,311.75

94,768.04

89,654.59

83,537.24

55,806.96

53,785.86

52,649.41

43,199.45

39,995.41

39,514.39

1,340,587.75

74.74

14.78

-1.29

26.99

35.36

33.05

39.53

30.44

62.56

32.43

7.073

6.694

6.235

4.166

4.017

3.938

3.229

2.9810

2.95

100.00

DOC-NIC

Trends in import

IMPORTS

Sr.No. Commodity

A)

BULK IMPORTS

B)

PEARLS, PRECIOUS &

SEMIPRECIOUSSTONES

C)

MACHINERY

D)

E)

PROJECT GOODS

OTHERS

Total

Apr-Mar 2004 Apr-Mar 2009(P)

134,451.00

620,105.80

32,757.32

66,410.18

%Growth %Share

361.21

46.25

102.73

4.95

42,752.62

183,033.69

328.12

13.65

1,819.62

147,327.10

359,107.66

14,383.74

456,654.36

1,340,587.75

690.48

209.95

273.31

1.07

34.06

100

VIVEK COLLEGE OF COMMERCEPage 16

A PROJECT ON TAX AUDIT

Trends in import

The Indian import saw a increment of 273.31% over a period of 6 years (including projections

for year 2009) this an massive increment as the oil & petroleum products saw a massive growth

on account of increasing energy demand of the country also fertilizer, suar and other bulk goods

saw a healthy growth in their consumption back home. This is a matter of concern as the deficit

in foreign trade is increasing year after year. The major group of the commodities saw the

following trend:Bulk imports:Import of items under bulk category as a whole comprising inter-alia Fertilizers, Cereals, Sugar,

Edible Oil, Iron and Steel and Petroleum Crude and Products, Paper and newsprint saw a

phenomenal growth of more than 361%. while oil and related products features growth

over years as a matter of increased awareness and high fuel prices and to some extent better

public transport facilities like metros and other projects and rules it saw only growth of mere 4%

during April-Dec 2008-2009 this shows that expenses on other expenses are increasing and it can

be well understood by the fact that the economic development is picking up over years and as

such requirements of other commodities increased in this section.

Pearls, Precious & Semi-precious stones:This section grows at a constant pace each year without much fluctuation as India is becoming a

hub to finish the semi-finished jewelry products and then re-export it to other countries. This

section features a growth of 102.73%.

Machinery:Some of the major heads under this section are imports for

1. Transmission apparatus for radio-telephony, radio-broadcasting

2. Aircraft (for example, helicopters, airplanes); spacecraft

3. Automatic data processing machines, etc.

This section witnessed a growth of 328.18% and this very much understood by the increased

expenditure on defense and advancement in the field of aerospace.

Project goods:Project Imports are the imports of machinery, instruments, and apparatus etc., required for initial

sating up of a unit or for substantial expansion of an existing unit. This section saw an increment

of triumphing increase of 690.48% this phenomenal increase can be well understood by the good

GDP growth figures shown in years previous to 2008.9.

Others:This head includes various other remaining commodities like1.Gold & Silver 2.Artificial Resins

& Plastic Materials3.Professional Instruments etc. except electrical4.Coal, Coke &

Briquettes, etc.5.Medicinal & Pharmaceutical Products6.Chemical Materials & Products7.Non-

VIVEK COLLEGE OF COMMERCEPage 17

A PROJECT ON TAX AUDIT

Metallic Mineral Manufactures, etc. This section witnessed a growth of 209.95% which is well

justified by the growth of different horizons of the Indian market.

Leading Exporters and Importers

in Merchandise Trade in 2010

(in US $ billion)

Rank

Exporter Value

Share(%

s

)

1

China

1578

10.4

2

US

1278

8.4

3

Germany 1269

8.3

4

Japan

770

5.1

20

India

216

1.4

Source: World Trade Report 2011, WTO

Rank

1

2

3

4

13

Importer

s

China

US

Germany

Japan

India

Value

Shares(%)

1968

1395

1067

693

323

12.8

9.1

6.9

4.5

2.1

The leading merchandise exporters in 2010 were China (US $ 1.58 trilllion,or 10.4per cent of

world exports),the United States (US $ 1.28 trillion,8.4per cent of world),Germany ( US $ 1.27

trillion,8.3per cent of world),Japan (US $ 770 billion,5per cent of world ).Indias exports were

US $ 216 billion and ranks 20 th. The United States overtook Germany to become the secondlargest exporter,one year after Germany ceded the top position to China.

CHAPTER 5

FOREIGN TRADE IN INDIA

PREAMBLE

CONTEXT

For India to become a major player in world trade, an all encompassing, and comprehensive

view needs to be taken for the overall development of the countrys foreign trade. While increase

in exports is of vital importance, we have also to facilitate those imports which are required to

stimulate our economy. Coherence and consistency among trade and other economic policies is

important for maximizing the contribution of such policies to development. Thus, while

incorporating the existing practice of enunciating an annual EXIM Policy, it is necessary to go

much beyond and take an integrated approach to the developmental requirements of Indias

foreign trade. This is the context of the new Foreign Trade Policy.

VIVEK COLLEGE OF COMMERCEPage 18

A PROJECT ON TAX AUDIT

OBJECTIVES

Trade is not an end in itself, but a means to economic growth and national development.

The primary purpose is not the mere earning of foreign exchange, but the stimulation of

greater economic activity. The Foreign Trade is built around two major objectives. These are:

1. To doubles our percentage share of global merchandise trade within the next five years; and

2. To acts as an effective instrument of economic growth by giving a thrust to employment

generation.

STRATEGY

These objectives are proposed to be achieved by adopting, among others, the following

strategies:

1. Unshackling of controls and creating an atmosphere of trust and transparency to unleash the

innate entrepreneurship of our businessmen, industrialists and traders.

2. Simplifying procedures and bringing down transaction costs.

3. Neutralizing incidence of all levies and duties on inputs used in export products, based on the

fundamental principle that duties and levies should not be exported.

4. Facilitating development of India as a global hub for manufacturing, trading and services.

5. Identifying and nurturing special focus areas which would generate additional employment

opportunities, particularly in semi-urban and rural areas, and developing a series of Initiatives

for each of these.

6. Facilitating technological and infrastructural up gradation of all the sectors of the Indian

economy, especially through import of capital goods and equipment, thereby increasing value

addition and productivity, while attaining internationally accepted standards of quality.

7. Avoiding inverted duty structures and ensuring that our domestic sectors are not disadvantaged in

the Free Trade Agreements/Regional Trade Agreements/Preferential Trade Agreements that we

enter into in order to enhance our exports.

8. Upgrading our infrastructural network, both physical and virtual, related to the entire Foreign

Trade chain, to international standards.

9. Revitalizing the Board of Trade by redefining its role, giving it due recognition and inducting

experts on Trade Policy.

VIVEK COLLEGE OF COMMERCEPage 19

A PROJECT ON TAX AUDIT

10. Activating our Embassies as key players in our export strategy and linking our Commercial

Wings abroad through an electronic platform for real time trade intelligence and enquiry

dissemination.

PARTNERSHIP:

The new Policy envisages merchant exporters and manufacturer exporters, business and industry

as partners of Government in the achievement of its stated objectives and goals. The dynamics

of a liberalized trading system sometimes results in injury caused to domestic industry on

account of dumping. When this happens, effective measures to redress such injury will be taken.

ROADMAP:

This Policy is essentially a roadmap for the development of Indias foreign trade. It contains

the basic principles and points the direction in which we propose to go. By virtue of its very

dynamics, a trade policy cannot be fully comprehensive in all its details. It would naturally

require modification from time to time. We propose to do this through continuous

updating, based on the inevitable changing dynamics of international trade. It is in partnership

with business and industry that we propose to erect milestones on this roadmap

CHAPTER 6

HIGHLIGHTS OF INDIAS TRADE POLICY

I.

II.

Special Economic Zones (SEZs)

Offshore Banking Units (OBUs) shall be permitted in SEZs. Detailed guidelines are being

worked out by RBI. This should help some of our cities emerge as financial nerve centers

of Asia.

Units in SEZ would be permitted to undertake hedging of commodity price risks, provided such

transactions are undertaken by the units on stand-alone basis. This will impart security to the

returns of the unit.

It has also been decided to permit External Commercial Borrowings (ECBs) for tenure of less

than three years in SEZs. The detailed guidelines will be worked out by RBI. These will provide

opportunities for accessing working capital loan for these units at internationally competitive

rates.

Employment oriented

Agriculture

VIVEK COLLEGE OF COMMERCEPage 20

A PROJECT ON TAX AUDIT

Export restrictions like registration and packaging requirement are being removed today on

Butter, Wheat and Wheat products, Coarse Grains, Groundnut Oil and Cashew to Russia

.Quantitative and packaging restrictions on wheat and its products, Butter, Pulses, grain and

flour of Barley, Maize, Bajra, Ragi and Jowar have already been removed on 5 th March,

2002.Restrictions on export of all cultivated (other than wild) varieties of seed, except Jute and

Onion, removed.

To promote export of agro and agro based products, 20 Agro export zones have been notified. In

order to promote diversification of agriculture, transport subsidy shall be available for export of

fruits, vegetables, floriculture, poultry and dairy products. The details shall be worked out in

three months.

3% special DEPB rate for primary & processed foods exported in retail packaging of 1 kg

or less.

Cottage Sector and Handicrafts

(i)

An amount of Rs. 5 crore under Market Access Initiative (MAI) has been earmarked

for promoting cottage sector exports coming under the KVIC.

(ii)

The unit in the handicrafts sector can also access funds from MAI scheme for development of

website for virtual exhibition of their product.

(iii)

Under the Export Promotion Capital Goods (EPCG) scheme, these units will not be required to

maintain average level of exports, while calculating the Export Obligation.

(iv)

These units shall be entitled to the benefit of Export House status on achieving lower average

export performance of Rs.5crore as against Rs. 15crore for others; and

(v)

The units in handicraft sector shall be entitled to duty free imports of an enlarged list of items as

embellishments up to 3% of FOB value of their exports.

Small Scale Industry With a view to encouraging further development of centers of economic

and export excellence such as Tirupur for hosiery, woolen blanket in Panipat, woolen knitwear in

Ludhiana, following benefits shall be available to small scale sector:

i.

Common service providers in these areas shall be entitled for facility of EPCG scheme.

ii.

The recognized associations of units in these areas will be able to access the funds under the

Market Access Initiative scheme for creating focused technological services and marketing

abroad.

iii.

Such areas will receive priority for assistance for identified critical infrastructure gaps from the

scheme on Central Assistance to States.

iv.

Entitlement for Export House status at Rs. 5 crore instead of Rs. 15 crore for others.

VIVEK COLLEGE OF COMMERCEPage 21

A PROJECT ON TAX AUDIT

Leather

Duty free imports of trimmings and embellishments up to 3% of the FOB value hitherto confined

to leather garments extended to all leather products.

Textiles

i.

Sample fabrics permitted duty free within the 3% limit for trimmings and embellishments.

ii.

10% variation in GSM be allowed for fabrics under Advance Licence.

iii.

Additional items such as zip fasteners, inlay cards, eyelets, rivets, eyes, toggles, velcrotape, cord

and cord stopper included in input output norms.

iv.

Duty Entitlement Passbook (DEPB) rates for all kinds of blended fabrics permitted.

Such blended fabrics to have the lowest rate as applicable to different constituent fabrics.

Gem & Jewellery

i.

Customs duty on import of rough diamonds is being reduced to 0%. Import of rough diamonds is

already freely allowed. Licensing regime for rough diamond is being abolished. This should help

the country emerge as a major international centre for diamonds.

ii.

.Value addition norms for export of plain jewellery reduced from 10% to 7%. Export of all

mechanised unstudded jewellery allowed at a value addition of 3 % only. Having already

achieved leadership position in diamonds, now efforts will be made for achieving quantum jump

on jewellery exports as well.

iii.

Personal carriage of jewellery allowed through Hyderabad and Jaipur airport as well.

(III) Technology oriented

(a) Electronic hardware

The Electronic Hardware Technology Park (EHTP) scheme is being modified to enable the

sector to face the zero duty regimes under ITA (Information Technology Agreement)-1. The units

shall be entitled to following facility:

Net Foreign Exchange as a Percentage of Exports (NFEP) positive in 5 years.

No other export obligation for units in EHTP.

VIVEK COLLEGE OF COMMERCEPage 22

A PROJECT ON TAX AUDIT

Supplies of ITA I items having zero duty in the domestic market to be eligible for counting of

export obligation.

o Chemicals and Pharmaceuticals

All pesticides formulations to have 65% of DEPB rate of such pesticides.Free export of

samples without any limit.

o Reimbursement of 50% of registration fees for registration of drugs.

o

Projects

Free import of equipment and other goods used abroad for more than one year.

CHAPTER 7

SPECIAL SCHEMES IN TRADE POLICY

Export clusters

a) Upgradation of infrastructure in existing clusters/industrial locations under the Department of

Industrial Policy & Promotion (DIPP) scheme to increase overall competitiveness of the export

clusters.

b) Supplemental efforts to be made under the ASIDE scheme and similar schemes of

other Ministries to bridge technology and productivity gaps in identified clusters.

c) 10 such clusters with high growth potential to be reinvigorated based on a participatory

approach.

Rehabilitation of sick units

VIVEK COLLEGE OF COMMERCEPage 23

A PROJECT ON TAX AUDIT

For revival of sick units, extension of export obligation period to be allowed to such units based

on BIFR rehabilitation schemes. This facility shall also be available to units outside the purview

of BIFR but operating under the State rehabilitation programme.

Removal of Quantitative Restrictions.

a) Import of 69 items covering animal products, vegetables and spices, antibiotics and films

removed from restricted list.

b) Export of 5 items namely paddy except basmati, cotton linters, rare earth, silk cocoons, family

planning devices except condoms removed from restricted list.

Special economic zones scheme

a) Sales from Domestic Tariff Area (DTA) to SEZs to be treated as export. This would now entitle

domestic suppliers to Drawback/ DEPB benefits, CST exemption and Service Tax exemption.

b) Agriculture/Horticulture processing SEZ units will now be allowed to provide inputs and

equipments to contract farmers in DTA to promote production of goods as per the requirement of

importing countries. This is expected to integrate the production and processing and help in

promoting SEZs specializing in agro exports.

c) Foreign bound passengers will now be allowed to take goods from SEZs to promote trade,

tourism and exports.

d) Domestic sales by SEZ units will now be exempt from SAD.

e) Restriction of one year period for remittance of export proceeds removed for SEZ units.

f) Netting of export permitted for SEZ unit provided it is between same exporter and importer over

a period of 12 months.

g) SEZ units permitted to take job work abroad and exports goods from there only.

h) SEZ units can capitalize import payables.

i) Wastage for subcontracting/exchange by gem and jewellery units in transactions between SEZ

and DTA will now be allowed.

j) Export/import of all products through post parcel/courier by SEZ units will now be allowed.

k) The value of capital goods imported by SEZ units will now be amortized uniformly over 10

years.

l) SEZ units will now be allowed to sell all products including gems and jewellery through

exhibitions and duty free shops or shops set up abroad

VIVEK COLLEGE OF COMMERCEPage 24

A PROJECT ON TAX AUDIT

m) Goods required for operation and maintenance of SEZ units will now be allowed duty free.

EOU Scheme

a) Agriculture/Horticulture processing EOUs will now be allowed to provide inputs and equipments

to contract farmers in DTA to promote production of goods as per the requirement of importing

countries. This is expected to integrate the production and processing and help in promoting agro

exports.

b) EOUs are now required to be only net positive foreign exchange earner and there will now be no

export performance requirement.

c) Foreign bound passengers will now be allowed to take goods from EOUs to promote trade,

tourism and exports.

d) The value of capital goods imported by EOUs will now be amortized uniformly over 10years.

e) Period of utilization of raw materials prescribed for EOUs increased from 1 year to 3years.

f) Gems and jewellery EOUs are now being permitted sub-contracting in DTA.

g) Wastage for subcontracting/exchange by gem and jewellery units in transactions between EOUs

and DTA will now be allowed as per norms.

h) Export/import of all products through post parcel/courier by EOUs will now be allowed.

i) EOUs will now be allowed to sell all products including gems and jewellery through exhibitions

and duty free shops or shops set up abroad.

j) Gems and jewellery EOUs will now be entitled to advance domestic sales.

EPCG scheme

a) The scheme shall now allow import of capital goods for pre-production and post- production

facilities also.

b) The Export Obligation under the scheme shall now be linked to the duty saved and shall be 8

times the duty saved.

c) To facilitate upgradation of existing plant and machinery, import of spares shall also be allowed

under the scheme.

d) To promote higher value addition in exports, the existing condition of imposing an additional

Export Obligation of 50% for products in the higher product chain to be done away with.

VIVEK COLLEGE OF COMMERCEPage 25

A PROJECT ON TAX AUDIT

e) Greater flexibility for fulfillment of export obligation under the scheme by allowing export of

any other product manufactured by the exporter. This shall take care of the dynamics of

international market.

f) Capital goods up to 10 years old shall also be allowed under the scheme.

g) To facilitate diversification into the software sector, existing manufacturer exporters will be

allowed to fulfill export obligation arising out of import of capital goods under the scheme for

setting up of software units through export of manufactured goods of the same company.

h) Royalty payments received from abroad and testing charges received in free foreign exchange to

be counted for discharge of export obligation under EPCG scheme.

DEPB Scheme

a) Facility for provisional DEPB rate introduced to encourage diversification and promote export of

new products.

b) DEPB rates rationalized in line with general reduction in Customs duty.

Advance Licence

a) Standard Input Output Norms for 403 new products notified.

b) Anti-dumping and safeguard duty exemption to advance licence for deemed exports for supplies

to EOU/SEZ/EHTP/STP.

DFRC Scheme

a) Duty Free Replenishment Certificate scheme extended to deemed exports to provide a boost to

domestic manufacturer.

b) Value addition under DFRC scheme reduced from 33% to 25%.

Reduction of Transaction Cost

a) High priority being accorded to the EDI implementation programme covering all

major community partners in order to minimize transaction cost, time and discretion. We are now

gearing ourselves to provide on line approvals to exporters where exports have been effected

from 23 EDI ports.

b) Online issuance of Importer-Exporter Code(IEC) number by linking the DGFT EDI network

with the Income Tax PAN data base is under progress.

c) Applications filed electronically (through websitewww.nic.in/eximpol) shall have a 50%lower

processing fee as compared to manual applications.

VIVEK COLLEGE OF COMMERCEPage 26

A PROJECT ON TAX AUDIT

Miscellaneous

a) Actual user condition for import of second hand capital goods upto 10 years olddispensed with.

b) Reduction in penalinterest ratefrom 24% to 15% for all old cases of default under EximPolicy.

c) Restriction on export of warranty spares removed.

d) IEC holder to furnish online return of imports/exports made on yearly basis.

e) Export of free of cost goods for export promotion @ 2% of average annual exports in preceding

three years subject to ceiling of Rs.5 lakh permitted

CHAPTER 8

India's Trade with Different Countries/Alliances

India's total external trade (exports plus imports including re-exports) in the year 1950-51 stood

at Rs. 1214 crore. Since then, this has witnessed continuous increase with occasional down turns.

During 2007-08 the value of Indias external trade reached Rs. 1605022 crore.

India's exports of merchandise goods touched the target of US$159 billion in 2007-08 recording

a growth of around 26% in dollar terms. Indias growth of exports is much higher than that of the

world economy as well as many major economies of the world.

At the same time, imports increased from Rs. 840506 crore in 2006-2007 to Rs. 964850 crore

during 2007-2008 thereby registering a growth of 29% in rupee terms. The trade deficit in 200708 was increased to Rs. (-) 324678 crore as against Rs. (-) 268727 crore during 2006-07.

In dollar terms, Asia & Asean accounted for 51.54 per cent of Indias total exports, followed by

Europe (22.99%) and America (17.04%). Indias imports were highest from Asia & Asean

(62.52%) followed by Europe (19.97%) and America (9.05%), during the same period.

India-Europe Trade

VIVEK COLLEGE OF COMMERCEPage 27

A PROJECT ON TAX AUDIT

Europeans countries account for about 22.5 per cent of India's total trade while India's exports to

Europe during 2006-07 were US$ 28.87 billion. During this year, bilateral trade increased by

26 per cent over 2005-06. While India's export to Europe recorded a growth of 17 per cent,

India's import from Europe grew by 33 per cent. The top five items of India's exports to Europe

are ready-made garments including accessories, gems & jewellery, machinery & instruments,

petroleum (crude & products) and transport equipment. The top five items of India's imports

from Europe are machinery (except electrical & electronics), pearls/precious, semi-previous

stones, electronic goods, transport equipments and iron & steel.

Trade and Investment relations with European Union

The European Union (EU) presently consists of 27 countries. These countries are Austria,

Belgium, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece,

Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, The Netherlands, Poland,

Portugal, Slovak Republic, Slovenia, Spain, Sweden, UK, Bulgaria and Romania.

India and EU enjoy healthy economic relations. These relations have been built on the

foundation of

1. India-EU Corporation Agreement on Partnership and Development which came into effect in

August, 1994

2. India-EU Strategic Partnership which was announced in September, 2005.

India also has bilateral economic Agreements with a number of individual EU countries in the

areas of trade, investments and avoidance of double taxation. India has agreements

for investments and promotions/protections with 22 countries of Europe, including 17 countries

of EU. Similarly, agreements for avoidance of double taxation exist with 26 countries in EU.

India-EU bilateral relations are reviewed at the official level by the India-EC Joint Commission.

This had its last meeting in July 2008. Three Sub-Commissions on Trade, Economic Cooperation

and Development Cooperation and nine Joint Working Groups on agriculture and marine

products, textiles, information technology & communications, consular matters, environment,

steel, food processing industries, pharmaceuticals & bio-technology and technical barriers to

trade (TBT)/sanitary and photo sanitary (SPS) issues are functioning and their reports are

considered by Joint Commission.

India-Africa Trade

There are more than 50 countries in the Sub-Saharan Africa (SSA) regional. In spite of various

constraints such as distance, language barriers, lack of information etc. India's trade with the

region has grown rapidly. The trade between India and SSA region has grown from US$7572.65

million in 2004-05 to US$ 197,053.37 million in 2007-08 registering a growth of 32.34%.

VIVEK COLLEGE OF COMMERCEPage 28

A PROJECT ON TAX AUDIT

India's exports to the region have increased by 30.85% from US$ 4218.23 million in 2004-05 to

US$ 83,535.94 million in 2007-08 and the imports form the region have increased by

42.70%from US$ 3354.42 million in 2004-05 to US$ 111,517.43 million in 2007-08.

India's Trade with Different Countries/AlliancesMajor items of exports:

Cotton yarn, fabrics made ups etc.

drugs, pharmaceuticals and fine chemicals

manufactures of Metals

Machinery and Instruments

Man made Yarn, Fabrics Made ups

Transport equipment

Primary and Semi finished iron and steel

RMG cotton including accessories

Plastic and linoleum products

Inorganic/organic/agro chemicals.

Major Items of imports:

Gold,

Cashew Nuts

Inorganic Chemicals,

Wood & Wood Products,

Metalifers ors & Metal Scrap,

Iron & Steel,

Cotton raw. Comb/uncombed/waste,

VIVEK COLLEGE OF COMMERCEPage 29

A PROJECT ON TAX AUDIT

Coal, coke & Briquettes etc.

Pulp and waste paper,

Non ferrous metals,

Organic chemicals,

Machinery except elect. & electronic,

Fertilizer crude,

Electronic goods,

Pearls precious semiprecious stones.

Focus Africa Programme

In order to enhance the bilateral trade between India and African countries, the "Focus: Africa"

Programme was launched by Minister for Commerce & Industry on 31st March 2002. Initially

focus was on seven African countries viz. Ghana, Nigeria South Africa, Tanzania, Kenya,

Ethiopia and Mauritius. In view of the enthusiasm generated by this programme in its first year,

the Government expanded the programme to cover the entire continent of Africa including

six North African countries during the year 2003-04. The Focus Africa programme is continuing

for the fifth year during 2006-07.

Preferential Trade Agreement (PTA) with SACU

South Africa, Lesotho, Swaziland, Botswana and Namibia have formed the South Africa

Customs Union (SACU) with a common Custom Tariff Policy. A Joint Working Group (JWG)

consisting of Government representatives from both sides was set up to examine the proposal

to prepare a draft.

Frame Work Treaty for the Preferential Trade Agreement (PTA) between India and SACU

countries. In a meeting of JWG held in Namibia on 6th-7th September 2004, the draft

Framework Agreement was finalized. In the sixth session of the India-South Africa Joint

Ministerial Commission Meeting held in New Delhi on 5-6 Dec. 2005, both sides agreed that a

comprehensive Free Trade Agreement within a reasonable time, and in the interim, a limited

scope agreement providing for exchange of tariff concession on select list of products between

India and SACU, would give further impetus to bilateral trade. India and Southern African

Custom Union (SACU) commenced negotiations for Preferential Trade Agreement (PTA) at

Pretoria, South Africa on 5th-6th October, 2007. The 2nd round for PTA with SACU was held at

Walvis Bay, Namibia on 21st-22nd February, 2008.

VIVEK COLLEGE OF COMMERCEPage 30

A PROJECT ON TAX AUDIT

CECPA with Mauritius

During the visit of PM of India to Mauritius from March 30-April 2, 2005 both the countries

agreed for a Comprehensive Economic Cooperation and Partnership Agreement (CECPA) to

boost bilateral trade, investment and general economic cooperation. Seven Rounds of talks on

CECPA have been held so far. The 7th round of talks was recently held in New Delhi on the

7thJuly 2006.

During the visit of the Prime Minister of Mauritius to India in October 2005 the

following bilateral agreements/MoUs were signed between two countries:

1. Mutual Legal Assistance Treaty in Criminal Matters;

2. Agreement on the Transfer of Sentenced Persons;

3. MoU for cooperation in the field of Hydrography;

4. MoU for Harmonization of Standards between concerned agencies;

5. MoU for Cooperation on Consumer Protection and Legal Metrology;

6. MoU between Indian Institute of Public Administration (IIPA) and Government of Mauritius;

7. MoU on Preferential Trade Agreement.

Joint Trade Committee (JTC) meeting with Ethiopia

The Joint Trade Committee (JTC) meeting is an institutional arrangement under the aegis

of Trade Agreement to review the implementation of Trade Agreement and to identify

bottlenecks is promoting trade between the countries. The 4th JTC meeting with Ethiopia was

held on 5thJune 2006 at New Delhi. Shri. Jairam Ramesh, Hon'ble Minister of State for

Commerce,Govt. of India and the H.E. Mr Ahmed Tusa, State Minister of Trade and Industry,

Govt.of Ethiopia co-chaired this JTC meeting.

VIVEK COLLEGE OF COMMERCEPage 31

A PROJECT ON TAX AUDIT

CHAPTER 9

Free Trade Agreement (FTA)

Free Trade Agreement (FTA)

Free trade agreements (FTAs) are generally made between two countries. Many governments,

throughout the world have either signed FTA, or are negotiating or contemplating new bilateral

free trade and investment agreements.

FTA signed

o INDO-THAILAND(9 October, 2003)

o INDO-SRILANKA(28 December, 1998)

FTA by 2011

o Brunei

o Indonesia

o Malaysia

FTA by 2016

o Philippines

o Cambodia

o Laos

o Myanmar

o Vietnam

VIVEK COLLEGE OF COMMERCEPage 32

A PROJECT ON TAX AUDIT

FTA Ongoing

o China

o Singapore

Note: At the third Asean-India summit, the prime minister, Dr. Manmohan Singh came out with

a bold vision of an Asian economic community which will include ASEAN, China, Japan, Korea

and India

.

Indo-Thailand

India and Thailand signed FTA on October 09, 2003 with four other accords for enhancing

cooperation in agriculture, tourism and science.

Both the countries signed MoU on agricultural cooperation, MoU on tourism cooperation,

agreement on visa exemption for diplomatic and official passport holders and programme

of cooperation in biotechnology.

The agreements were signed in the presence of the then Prime Minister Atal Bihari Vajpayee and

the Thai counterpart Thaksin Shinawatara, in Bangkok. It also contains a provision regarding

emergency measures to protect domestic producers in case of sudden surges in imports.

Agricultural co-operations MoU provides joint activities between the two states, covering

agricultural and forestry research, biotechnology soil and water conservation, water shed

management, land use planning and horticulture.

The agreement will be valid for five years from the date of signing (as mentioned then).The

agreement on tourism through reciprocal establishment of representative offices of the tourism

department of the India as well as Thailand.

The fifth agreement upon biotechnology envisages the establishment of an IndiaThailand biotechnology panel for

o Formulation,

o Approval

o Monitoring

o Review of action plans.

Indo-Sri Lanka

Agreement

Overview of Indo-Lanka Free Trade Agreement Milestones

VIVEK COLLEGE OF COMMERCEPage 33

A PROJECT ON TAX AUDIT

o 28 December 1998 - Signing of the Free Trade Agreement in New Delhi by the

PrimeMinister of India and the President of Sri Lanka.

o 2 February 2000 - Letters of Exchange to finalize the annexure.

o 1 March 2000 - Full implementation of the Free Trade Agreement.

Salient Features

Establishment of a Free Trade Area through complete or phased elimination of tariffs

The FTA does not remove all tariffs on all goods at once.

Negative Lists to protect national interests of both countries.

The Rules of Origin (ROO) criteria to ensure a minimum local content.

Adequate safety clauses to protect domestic and national interests of both countries.

Review and consultation mechanisms to ensure the smooth operation of the Agreement.

India's commitments (for duty concessions)

Granting duty free access for 1351 items by 6 - digit HS Code upon entry into

force of the Agreement (Annexure E).

25% tariff reduction for 528 Textile items

Other than the 429 items in the Negative List of India, 50% reduction of tariffs for

the balance 2799 items, upon entry into force of the Agreement followed by phased out

removal of tariffs up to 100% in 2 stages within 3 years. Tea and Garments come under a

special quota regime.

A 50% fixed tariff concession for imports of Tea from Sri Lanka on a preferential basis

subject to an annual maximum quota of up to 15 million kg .

A 50% fixed tariff concession for imports of Garments from Sri Lanka (remaining in

India's Negative List) subject to a maximum annual quota of 8 million pieces of which a

minimum of 6 million pieces should contain Indian fabrics. No category of Garments

could exceed 1.5 million pieces per annum.

Sri Lanka's commitments (for duty concessions)

VIVEK COLLEGE OF COMMERCEPage 34

A PROJECT ON TAX AUDIT

Granting duty free access for 319 items by 6 - digit HS Code (raw materials and

machinery for industries) upon entry into force of the Agreement

50% reduction of tariffs for 889 items by 6 - digit HS Code (raw materials) upon entry

into force of the Agreement followed by phased out removal of tariffs as follows

o up to 70% at the end of the 1st year

o up to 90% at the end of the 2nd year

o 100% at the end of the 3rd year

For 1180 items in Sri Lanka's Negative there will not be any duty preference.

For the remaining 2724 items by 6-digit HS Code, upon entry into force of theAgreement

, the removal of tariffs will be phased out within 8 years as follows:

o Not less than 35% before the end of the 3rd year

o Not less than 70% before the end of the 6th year

o Not less than 100% before the end of the 8th year

Indo-Singapore

Declaration of Intent on the Singapore - India Comprehensive Economic Cooperation

Agreement (CECA)

1. On 8 April 2002, the Prime Minister of India, Shri Atal Bihari Vajpayee, and Prime Minister of

Singapore, Mr. Goh Chok Tong, met in Singapore and agreed to establish a Joint Study Group to

study the benefits of an India-Singapore Comprehensive Economic Cooperation Agreement

(CECA).

2. The Joint Study Group met seven times, in its report, the Joint Study Group has concluded that

CECA between India and Singapore would provide significant benefits for both countries, in

terms of the potential for increased trade and investment, and through economic cooperation.

3. As important as the direct economic benefits the CECA would bring to the two countries, the

CECA would serve to strengthen ties between India and Singapore, and to form a bridge between

India and the Association of Southeast Asian Nations (ASEAN) region.

4.

Significantly, the CECA could serve as a pathfinder for the India-ASEAN Free Trade

Agreement, and to connect Singapore to one of the world's most dynamic emerging

economies. Negotiations for the India-Singapore CECA should begin as soon as possible and aim

to conclude with the signing of the relevant agreements as early as possible.

ONGOING NEGOTIATIONS

VIVEK COLLEGE OF COMMERCEPage 35

A PROJECT ON TAX AUDIT

ASEAN-India FTA

On July 23rd, during his visit to Thailand for the East Asia Summit, External Affairs

Minister S.M. Krishna made a strong pitch for the signing of the agreement in October, during

the next ASEAN-India Summit, as a key element of a pan-regional strategy.

Later the next day, the Union Cabinet approved the FTA in trade in goods between India and the

Association of South East Asian Nations (ASEAN), despite concerns raised by several Ministers

over the pact In a press release dated July 26th, the Kerala Independent Fish workers Federation

said that the FTA will lead to a huge loss of livelihoods in the fisheries and agriculture

sector especially in Kerala (KSMTF Press Release on ASEAN India FTA).

EU-India FTA

The 7th round of negotiations for a FTA between India and the European Union (EU) took place

in Brussels from July 13th to 15th 2009. High on the agenda was the seizure of

Indian pharmaceutical consignments during transit in EU, based on the EU line of strong

implementation of Intellectual Property Rights regulations.

EFTA-India FTA

India talks FTA with Switzerland DNA | July 15th, 2009Instead of stopping the West and

multinational drug makers in their efforts to block India's low-cost generic drugs exports, the

government is helping their cause by aggressively pursuing FTAs with developed economies,

which could further hamper the world's access to such drugs.

India-South Korea CEPA

India, South Korea to ink trade pact on 7 Aug Live Mint | July 15th, 2009

Minister of commerce and industry Anand Sharma is scheduled to visit Seoul in early August to

sign the agreement which includes trade in goods and services as well as investments. The

Cabinet had approved the signing of a Comprehensive Economic Partnership Agreement(CEPA)

with South Korea on 2 July.

India-New Zealand FTA

Delay to Start Of Talks With IndiaGuide2 | July 9th, 2009The start of free trade talks with India

has been delayed following a change in India's commerce minister since elections in May. New

Zealand Trade Minister Tim Groser expected negotiations would be able to start before the end

of the year. Preliminary talks were to have been held this month.

VIVEK COLLEGE OF COMMERCEPage 36

A PROJECT ON TAX AUDIT

CHAPTER 10

BIBLIOGRAPHY

www.google.com

.

www.yahoo.com

.

www.economictimes.com

.

www.searchindia.com

Data Source: DGCIS, Kolkata

VIVEK COLLEGE OF COMMERCEPage 37

Vous aimerez peut-être aussi

- Mcom Part 2 Project of Mvat Cen VatDocument53 pagesMcom Part 2 Project of Mvat Cen Vatrani26oct100% (4)

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeD'Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeÉvaluation : 1 sur 5 étoiles1/5 (1)

- Form 704Document704 pagesForm 704Dhananjay KulkarniPas encore d'évaluation

- Your Amazing Itty Bitty® Book of QuickBooks® TerminologyD'EverandYour Amazing Itty Bitty® Book of QuickBooks® TerminologyPas encore d'évaluation

- Statement of Submissin of Audit Report in Form-704Document704 pagesStatement of Submissin of Audit Report in Form-704Suruchi Kejriwal GoyalPas encore d'évaluation

- Form-704 NewDocument251 pagesForm-704 NewHusaina NasikwalaPas encore d'évaluation

- Sales Tax Special Procedure (Withholding) Rules, PDFDocument6 pagesSales Tax Special Procedure (Withholding) Rules, PDFAli MinhasPas encore d'évaluation

- Value Added Tax (Vat) : Difference Between VAT and Sales Tax: VAT Is Levied On Goods andDocument4 pagesValue Added Tax (Vat) : Difference Between VAT and Sales Tax: VAT Is Levied On Goods andMuneeb Ghufran DadawalaPas encore d'évaluation

- Guidance Note On Accounting For State-Level Value Added Tax: F F Y Y I IDocument8 pagesGuidance Note On Accounting For State-Level Value Added Tax: F F Y Y I Idark lord89Pas encore d'évaluation

- Value Added TaxationDocument6 pagesValue Added Taxationapi-3822396Pas encore d'évaluation

- Income Tax AuditDocument21 pagesIncome Tax AuditindraPas encore d'évaluation

- Audit Project TAX AUDITDocument34 pagesAudit Project TAX AUDITkarthika kounder67% (9)

- Value Added Tax in PakistanDocument6 pagesValue Added Tax in PakistanMuhammad AwanPas encore d'évaluation

- Accounting For VAT in Th... Accounting Center, Inc.Document4 pagesAccounting For VAT in Th... Accounting Center, Inc.Martin EspinosaPas encore d'évaluation

- Input Tax Apportionment Guide EN - 31 12 2019Document25 pagesInput Tax Apportionment Guide EN - 31 12 2019Fazlihaq DurraniPas encore d'évaluation

- Taxguru - In-Concept Meaning of Turnover in Tax AuditDocument16 pagesTaxguru - In-Concept Meaning of Turnover in Tax AuditTAX FILLINGPas encore d'évaluation

- AE24 Lesson 5Document9 pagesAE24 Lesson 5Majoy BantocPas encore d'évaluation

- Atlas Mining Vs CirDocument2 pagesAtlas Mining Vs CirmenforeverPas encore d'évaluation

- Eatern Telecom v. CIR DigestDocument4 pagesEatern Telecom v. CIR DigestKristineSherikaChyPas encore d'évaluation

- Usage of VAT Journal in BUSYDocument6 pagesUsage of VAT Journal in BUSYSaileshResumePas encore d'évaluation

- Bustax Chapter 9Document10 pagesBustax Chapter 9Pineda, Paula MariePas encore d'évaluation

- Procedure To Be Followed For Delhi Value Added TaxDocument6 pagesProcedure To Be Followed For Delhi Value Added TaxChirag MalhotraPas encore d'évaluation

- 44627bos34430pmcp15 PDFDocument30 pages44627bos34430pmcp15 PDFVishav JindalPas encore d'évaluation

- Deferred Tax-Accounting Standard-22-Accounting For Taxes On IncomeDocument6 pagesDeferred Tax-Accounting Standard-22-Accounting For Taxes On IncomerlpolyfabsmaheshPas encore d'évaluation

- Value Added Tax AUDITDocument40 pagesValue Added Tax AUDITBhagwat Thakker60% (5)

- C9 Input VATDocument18 pagesC9 Input VATdraga pinasPas encore d'évaluation

- Excise Tax Returns User GuideDocument89 pagesExcise Tax Returns User GuideNoori Zahoor KhanPas encore d'évaluation

- Business and Transfer Taxation Chapter 9 Discussion Questions AnswerDocument3 pagesBusiness and Transfer Taxation Chapter 9 Discussion Questions AnswerKarla Faye LagangPas encore d'évaluation

- VAT Taxpayer Guide (Input Tax)Document54 pagesVAT Taxpayer Guide (Input Tax)NstrPas encore d'évaluation

- Overview of Excise DutyDocument36 pagesOverview of Excise DutysumitPas encore d'évaluation

- TaxtionDocument14 pagesTaxtionAbu Bakar Md Sami 60Pas encore d'évaluation

- Tax Deduction at Source On Purchase of Goods (Section 194 Q)Document7 pagesTax Deduction at Source On Purchase of Goods (Section 194 Q)Pallavi SharmaPas encore d'évaluation

- True False Periodic Dan Perpetual System MerchandiseDocument4 pagesTrue False Periodic Dan Perpetual System MerchandiseBayu Ragil PamungkasPas encore d'évaluation

- ICV Supplier Certification Guidelines OCT 2023Document30 pagesICV Supplier Certification Guidelines OCT 2023Noori Zahoor KhanPas encore d'évaluation

- VAT Accounting and ReturnsDocument34 pagesVAT Accounting and ReturnsVijay BhattiPas encore d'évaluation

- VAT GUIDE 2nd EditionDocument28 pagesVAT GUIDE 2nd EditionLoretta Wise100% (1)

- CIN Accounting Entries Accounting Entry in Procurement: For Domestic Procurement of Raw MaterialDocument20 pagesCIN Accounting Entries Accounting Entry in Procurement: For Domestic Procurement of Raw MaterialPriyabrata RayPas encore d'évaluation

- New Features in Tally - ERP 9 Series A Release 1.0Document15 pagesNew Features in Tally - ERP 9 Series A Release 1.0san_shiralPas encore d'évaluation

- Audit Project TAX AUDITDocument34 pagesAudit Project TAX AUDITkhairejoPas encore d'évaluation

- Commissioner of Internal Revenue V. Lancaster Philippines, Inc. FactsDocument11 pagesCommissioner of Internal Revenue V. Lancaster Philippines, Inc. FactsJun Bill CercadoPas encore d'évaluation

- Allama Iqbal Open University: Assignment # 2Document13 pagesAllama Iqbal Open University: Assignment # 2Irfan AslamPas encore d'évaluation

- Lesson-10 Budgetory ControlDocument11 pagesLesson-10 Budgetory ControlSumit YadavPas encore d'évaluation

- Lecture, Chap. 5Document5 pagesLecture, Chap. 5Moshe FarzanPas encore d'évaluation

- Chapter 2 Inventory RevisedDocument10 pagesChapter 2 Inventory RevisedAmaa AmaaPas encore d'évaluation

- Sales Tax PesentationDocument19 pagesSales Tax PesentationMukund MungalparaPas encore d'évaluation

- Chapter 22Document25 pagesChapter 22Rachel Pepito BaladjayPas encore d'évaluation

- Kingdom of Bahrain: Vat Healthcare GuideDocument23 pagesKingdom of Bahrain: Vat Healthcare GuideKazi MohammedPas encore d'évaluation

- SGV Cup AccountingDocument13 pagesSGV Cup AccountingMCDABCPas encore d'évaluation

- Project On Value Added TaxDocument38 pagesProject On Value Added TaxKavita NadarPas encore d'évaluation

- May 2022Document6 pagesMay 2022Chandu NeredibilliPas encore d'évaluation

- Value Added TaxDocument20 pagesValue Added Taxrpd2509Pas encore d'évaluation

- Digest Contex Corp V CIR GR 151135Document3 pagesDigest Contex Corp V CIR GR 151135Timothy Joel CabreraPas encore d'évaluation

- Draft RR Registration EOPT - For Public ConsultationDocument18 pagesDraft RR Registration EOPT - For Public ConsultationGennelyn OdulioPas encore d'évaluation

- Vat Returns Manual 2021Document25 pagesVat Returns Manual 2021mactechPas encore d'évaluation

- Goa VAT LawDocument23 pagesGoa VAT LawSiddesh ChimulkerPas encore d'évaluation

- Chap-Vat 29Document4 pagesChap-Vat 29Tanya TandonPas encore d'évaluation

- Accounting Technician Level 3 Module 3 Part 1Document29 pagesAccounting Technician Level 3 Module 3 Part 1Rona Amor MundaPas encore d'évaluation

- Value Added TaxDocument56 pagesValue Added TaxmafumhekluivertPas encore d'évaluation

- L10 - Revenue RecognitionDocument8 pagesL10 - Revenue RecognitionAhmed HussainPas encore d'évaluation

- HR PolicyDocument35 pagesHR PolicyNooral AlfaPas encore d'évaluation