Académique Documents

Professionnel Documents

Culture Documents

Strategic Finance Concepts Explained - Capital Structure, Risk & Return, Capital Budgeting

Transféré par

Bilal KarimTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Strategic Finance Concepts Explained - Capital Structure, Risk & Return, Capital Budgeting

Transféré par

Bilal KarimDroits d'auteur :

Formats disponibles

Strategic Finance

Assignment # 1

Name:

Hafiz Muhammad Hafeez

CMS:

19452

Financial Statement Analysis

Financial statement analysis is the process of reviewing

company's financial statements to make better economic decisions.

and

analyzing

Capital Structure

This is how company manages the finances regarding the operations of the company. The

sources can be equity and debt.

Risk & Return

High risk is associated with higher returns. This is tradeoff between minimum possible risk

and highest possible return.

Capital Budgeting

This is the decision that the firms long term investment in shape of new plant and machinery

and R&D are worth funding through the firms capital structure.

Securities & portfolio Management

This is the art and science of making decisions about investment mix and policy, matching

investments to objectives, asset allocation for individuals and institutions, and balancing risk against

performance.

Dividends

Part of profit given to shareholders of the company.

Financial Evaluation

This is the evaluation of different options of available with the company for finances.

Time value of Money

This is the concept that the value of money today is more and will decrease with time.

Asset Management

This is the process of developing, maintaining, operating and disposing off assets cost effectively.

Working Capital

The capital of business used in day to day operations.

Cost of capital

This is the opportunity cost of capital. i.e. the rate of return that could have been earned by putting

the same money in a different investment.

Importance of companys financial statement and financial reports.

A companys financial statements provide various financial information that investors and

creditors use to evaluate a companys financial performance. Financial statements are also

important to a companys managers because by publishing financial statements,

management can communicate with interested outside parties about its accomplishment

running the company. Different financial statements focus on different areas of financial

performances.

Financial conditions shown in the balance sheet are snapshots of a companys assets,

liabilities and equity at the end of a financial reporting period; they dont reveal what

happened during the period from operations that may have caused changes to financial

conditions. Therefore, operating results during the period also concerns investors. The

financial statement of income statement reports operating results such as sales, expenses

and profits or losses. Using the income statement, investors can both evaluate a companys

past income performance and assess the uncertainty of future cash flows.

Questions regarding the topic

What is the impact of time value of money on capital structure?

How company decide the amount of dividend to be given?

How we calculate the uncertainty in future cash flows?

How does having more or less retained earning effect the shareholders and investors?

Vous aimerez peut-être aussi

- Financial Management: Ariel Dizon Pineda, CPADocument88 pagesFinancial Management: Ariel Dizon Pineda, CPARenz Fernandez100% (7)

- Arundel Partners Sequel Rights ValuationDocument7 pagesArundel Partners Sequel Rights ValuationEmma Keane100% (1)

- Annual Report of Rothschild Bank AG - 2008-2009Document64 pagesAnnual Report of Rothschild Bank AG - 2008-2009Mossad NewsPas encore d'évaluation

- Entoto polytechnic savings plan moduleDocument13 pagesEntoto polytechnic savings plan moduleembiale ayaluPas encore d'évaluation

- Cash Flow StatementDocument103 pagesCash Flow StatementMBA BoysPas encore d'évaluation

- Financial Planning - Definition, Objectives and ImportanceDocument4 pagesFinancial Planning - Definition, Objectives and ImportanceRohit BajpaiPas encore d'évaluation

- Unit 1 Introduction To Financial ManagementDocument12 pagesUnit 1 Introduction To Financial ManagementPRIYA KUMARIPas encore d'évaluation

- Introduction To Finance and AccountingDocument38 pagesIntroduction To Finance and AccountingDr.Ashok Kumar PanigrahiPas encore d'évaluation

- Role of A Financial ManagerDocument4 pagesRole of A Financial Managerkavitachordiya86Pas encore d'évaluation

- Financial ManagementDocument14 pagesFinancial ManagementMru SurvePas encore d'évaluation

- Supply Chain AssignmentDocument8 pagesSupply Chain AssignmentBilal KarimPas encore d'évaluation

- Financial Management AssignmentDocument12 pagesFinancial Management AssignmentSoumya BanerjeePas encore d'évaluation

- Financial Management Lecture 101BDocument5 pagesFinancial Management Lecture 101BDenied Stell100% (1)

- Case Study II: Sleeping Beauty Bonds: Name Imitation Affiliated Instructor Course DateDocument6 pagesCase Study II: Sleeping Beauty Bonds: Name Imitation Affiliated Instructor Course DateCollins GathimbaPas encore d'évaluation

- Financial Management - Meaning, Objectives and FunctionsDocument31 pagesFinancial Management - Meaning, Objectives and Functionsjeof basalof100% (1)

- A COMPARATIVE STUDY ON FINANCIAL PERFORMANCE OF SELECT AUTOMOBILE INDUSTRIES IN INDIA" (Four Wheelers)Document100 pagesA COMPARATIVE STUDY ON FINANCIAL PERFORMANCE OF SELECT AUTOMOBILE INDUSTRIES IN INDIA" (Four Wheelers)Prashanth PB82% (17)

- PRACTICAL ACCOUNTING 1 - ReviewDocument21 pagesPRACTICAL ACCOUNTING 1 - ReviewMaria BeatricePas encore d'évaluation

- Business Finance ABM StrandDocument107 pagesBusiness Finance ABM StrandMiss Anonymous23Pas encore d'évaluation

- FM Module 1Document9 pagesFM Module 1ZekiPas encore d'évaluation

- Financial Management: Financial Management Entails Planning For The Future of A Person orDocument5 pagesFinancial Management: Financial Management Entails Planning For The Future of A Person orPriya PalPas encore d'évaluation

- Stretegic FIn Assigmment # 1Document3 pagesStretegic FIn Assigmment # 1Bilal KarimPas encore d'évaluation

- Corporate finance defined and analyzedDocument9 pagesCorporate finance defined and analyzedPrakash KumarPas encore d'évaluation

- Sample Compre Questions Financial ManagementDocument6 pagesSample Compre Questions Financial ManagementMark KevinPas encore d'évaluation

- Assignment:-1: Core PapersDocument32 pagesAssignment:-1: Core PapersAnamikaPas encore d'évaluation

- The Role of Financial Management and Evaluation of Sources of FinanceDocument8 pagesThe Role of Financial Management and Evaluation of Sources of FinancePritam Kumar NayakPas encore d'évaluation

- Financial Management AssignmentDocument11 pagesFinancial Management AssignmentHassan RandhawaPas encore d'évaluation

- Financial ManagementDocument26 pagesFinancial ManagementHILLARY SHINGIRAI MAPIRAPas encore d'évaluation

- Particulars Number CertificateDocument63 pagesParticulars Number CertificatekeerthiPas encore d'évaluation

- Assessing a Venture's Financial StrengthDocument53 pagesAssessing a Venture's Financial StrengthHtet Pyae ZawPas encore d'évaluation

- FINANCIAL MANAGEMENT Study PaperDocument102 pagesFINANCIAL MANAGEMENT Study PaperPriyank TripathyPas encore d'évaluation

- INTRO FINANCIAL MANAGEMENTDocument7 pagesINTRO FINANCIAL MANAGEMENTDoreen AwuorPas encore d'évaluation

- ACCN09B Strategic Cost Management 1: For Use As Instructional Materials OnlyDocument3 pagesACCN09B Strategic Cost Management 1: For Use As Instructional Materials OnlyAdrienne Nicole MercadoPas encore d'évaluation

- Financial ManagementDocument8 pagesFinancial ManagementAfifaPas encore d'évaluation

- FINANCIAL MANAGEMENT OBJECTIVES AND SCOPEDocument3 pagesFINANCIAL MANAGEMENT OBJECTIVES AND SCOPEZeyPas encore d'évaluation

- Articile Write UpDocument7 pagesArticile Write UpKeehara ParkPas encore d'évaluation

- Introduction and Fundamental Tools of FinanceDocument11 pagesIntroduction and Fundamental Tools of FinanceCaptain Rs -pubg mobilePas encore d'évaluation

- Financial Performance of Kerala Gramin Bank Special Reference To Southern AreaDocument81 pagesFinancial Performance of Kerala Gramin Bank Special Reference To Southern AreaPriyanka Ramath100% (1)

- A Project On Capital StructureDocument62 pagesA Project On Capital StructurejagadeeshPas encore d'évaluation

- Course Title: Strategic Finance: Submitted By: Qasim Farooq 1252108Document3 pagesCourse Title: Strategic Finance: Submitted By: Qasim Farooq 1252108Kasem Farook ChaudhryPas encore d'évaluation

- Chapter - I 1.1 Introduction To The StudyDocument91 pagesChapter - I 1.1 Introduction To The StudyNaresh KumarPas encore d'évaluation

- Introduction To Corporate Finance: MeaningDocument6 pagesIntroduction To Corporate Finance: Meaningkunal makyPas encore d'évaluation

- Financial Management Overview and Key ConceptsDocument13 pagesFinancial Management Overview and Key ConceptssoleilPas encore d'évaluation

- Finance Function ObjectivesDocument7 pagesFinance Function ObjectivesanbuPas encore d'évaluation

- Understanding Financial Management FunctionsDocument29 pagesUnderstanding Financial Management Functionsa NaniPas encore d'évaluation

- Financial Management.... PGDocument17 pagesFinancial Management.... PGManali PatilPas encore d'évaluation

- Principle of Finance Chapter - I: DR S.M.Tariq ZafarDocument25 pagesPrinciple of Finance Chapter - I: DR S.M.Tariq ZafarSúprítí RóyPas encore d'évaluation

- Week 1Document12 pagesWeek 1Anne Maerick Jersey OteroPas encore d'évaluation

- Sandesh Sir: Anuj NairDocument55 pagesSandesh Sir: Anuj NairAnuj NairPas encore d'évaluation

- Polytechnic University of The Philippines Office of The Pup Graduate School Dean G/F M.H. Delpilar Campus Sta. Mesa, ManilaDocument11 pagesPolytechnic University of The Philippines Office of The Pup Graduate School Dean G/F M.H. Delpilar Campus Sta. Mesa, ManilaJennybabe SantosPas encore d'évaluation

- Efficient Market Hypothesis AssingmentDocument5 pagesEfficient Market Hypothesis AssingmentJohn P ReddenPas encore d'évaluation

- FM 1Document7 pagesFM 1Rohini rs nairPas encore d'évaluation

- FM - NotesDocument40 pagesFM - NotesdeepeshmahajanPas encore d'évaluation

- Punjab National Bank Ratio AnalysisDocument62 pagesPunjab National Bank Ratio AnalysiskodalipragathiPas encore d'évaluation

- Cash Flow Final PrintDocument61 pagesCash Flow Final PrintGeddada DineshPas encore d'évaluation

- Cases in Finance Assignment FinalDocument22 pagesCases in Finance Assignment FinalIbrahimPas encore d'évaluation

- According To Phillipatus, "Financial Management Is Concerned With The Managerial Decisions ThatDocument26 pagesAccording To Phillipatus, "Financial Management Is Concerned With The Managerial Decisions Thataneesh arvindhanPas encore d'évaluation

- Assignment 1 FINDocument5 pagesAssignment 1 FINMohammad SajidPas encore d'évaluation

- Financial Management 2Document7 pagesFinancial Management 2Rashmi RanjanaPas encore d'évaluation

- FM 006Document6 pagesFM 006Eswara kumar JPas encore d'évaluation

- Financial StatementsDocument4 pagesFinancial StatementsConrad DuncanPas encore d'évaluation

- Funtional Areas of FinanceDocument3 pagesFuntional Areas of FinanceAyushi TiwariPas encore d'évaluation

- Reading Article1Document6 pagesReading Article1KOHILAVANI A/P BALAN PREREG STUDENTPas encore d'évaluation

- Intro To Finance Unit 1Document6 pagesIntro To Finance Unit 1ManishJaiswalPas encore d'évaluation

- Khuzdar Kuchlak Section 4Document1 pageKhuzdar Kuchlak Section 4Bilal KarimPas encore d'évaluation

- Civil AdvDocument1 pageCivil AdvBilal KarimPas encore d'évaluation

- 28-Mauve Area, G-9/1, Islamabad. Phone: 051-9260190, Fax: 051-9261116 WebsitesDocument1 page28-Mauve Area, G-9/1, Islamabad. Phone: 051-9260190, Fax: 051-9261116 WebsitesBilal KarimPas encore d'évaluation

- CPEC EducationDocument3 pagesCPEC EducationBilal KarimPas encore d'évaluation

- Entrepreneurship Research in EmergenceDocument25 pagesEntrepreneurship Research in EmergenceBilal KarimPas encore d'évaluation

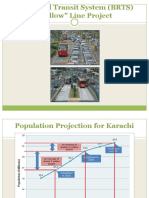

- BRT PresentationDocument14 pagesBRT PresentationBilal KarimPas encore d'évaluation

- Online Shoping Decision MakingDocument21 pagesOnline Shoping Decision MakingBilal KarimPas encore d'évaluation

- CPEC Projects As Per MapDocument4 pagesCPEC Projects As Per MapBilal KarimPas encore d'évaluation

- Stretegic FIn Assigmment # 1Document3 pagesStretegic FIn Assigmment # 1Bilal KarimPas encore d'évaluation

- Online Shoping Decision MakingDocument21 pagesOnline Shoping Decision MakingBilal KarimPas encore d'évaluation

- Economic Corridoor InformationDocument4 pagesEconomic Corridoor InformationBilal KarimPas encore d'évaluation

- Taxation IssuesDocument3 pagesTaxation IssuesBilal KarimPas encore d'évaluation

- How Capital Markets Channel Funds and Drive Economic GrowthDocument5 pagesHow Capital Markets Channel Funds and Drive Economic GrowthBilal KarimPas encore d'évaluation

- Questions OriginalDocument3 pagesQuestions OriginalBilal KarimPas encore d'évaluation

- Economic Corridor A Birds Eye ViewDocument7 pagesEconomic Corridor A Birds Eye ViewBilal KarimPas encore d'évaluation

- Early HarvestDocument1 pageEarly HarvestBilal KarimPas encore d'évaluation

- Newsletter July 20151Document12 pagesNewsletter July 20151Bilal KarimPas encore d'évaluation

- What Are The Factors Which Force Users To Share Their Information On Social Network Site Like Facebook?Document11 pagesWhat Are The Factors Which Force Users To Share Their Information On Social Network Site Like Facebook?Bilal KarimPas encore d'évaluation

- Economic Corridor A Birds Eye ViewDocument7 pagesEconomic Corridor A Birds Eye ViewBilal KarimPas encore d'évaluation

- CPEC Projects As Per MapDocument4 pagesCPEC Projects As Per MapBilal KarimPas encore d'évaluation

- Society Registraion ActDocument6 pagesSociety Registraion ActBilal KarimPas encore d'évaluation

- Course Outline EntrepreneurshipDocument4 pagesCourse Outline EntrepreneurshipBilal KarimPas encore d'évaluation

- Mohd Zahid Laton, FPP Uitm PahangDocument19 pagesMohd Zahid Laton, FPP Uitm PahangBilal KarimPas encore d'évaluation

- Course Outline EntrepreneurshipDocument4 pagesCourse Outline EntrepreneurshipBilal KarimPas encore d'évaluation

- Economic Corridor A Birds Eye ViewDocument7 pagesEconomic Corridor A Birds Eye ViewBilal KarimPas encore d'évaluation

- Words of WisedomDocument3 pagesWords of WisedomBilal KarimPas encore d'évaluation

- QUESTION PAPER-S4 - Set 2Document3 pagesQUESTION PAPER-S4 - Set 2Titus ClementPas encore d'évaluation

- Amakusa Dibs Trading SDN BHD: No. 18-1, Jalan Meru Bestari A10, Medan Meru Bestari, 30020 Ipoh, Perak, Malaysia.Document1 pageAmakusa Dibs Trading SDN BHD: No. 18-1, Jalan Meru Bestari A10, Medan Meru Bestari, 30020 Ipoh, Perak, Malaysia.Raditsyahz Jupian'sPas encore d'évaluation

- Financial Times UK. September 06, 2022Document24 pagesFinancial Times UK. September 06, 2022Mãi Mãi LàbaoxaPas encore d'évaluation

- BrokersDocument4 pagesBrokersAkansha AgarwalPas encore d'évaluation

- Schedule BDocument2 pagesSchedule Bapi-3507963220% (1)

- 10 Budget Word Problems To Practice in ClassDocument2 pages10 Budget Word Problems To Practice in ClasshellkatPas encore d'évaluation

- Gerrymdayanan : Prk3Crossingsalimbalan Baungon 8707bukidnonDocument6 pagesGerrymdayanan : Prk3Crossingsalimbalan Baungon 8707bukidnonGerry DayananPas encore d'évaluation

- CTS ROLES AND TOPICS ON PERCENTAGES, PROFIT AND LOSS, SIMPLE INTEREST, COMPOUND INTERESTDocument12 pagesCTS ROLES AND TOPICS ON PERCENTAGES, PROFIT AND LOSS, SIMPLE INTEREST, COMPOUND INTERESTArunPas encore d'évaluation

- 601-The Incredible Shrinking Factor Return PDFDocument11 pages601-The Incredible Shrinking Factor Return PDFJoshua BayPas encore d'évaluation

- Thesis Demo 1THE ROLE OF RATIO ANALYSIS IN FINANCIALDocument8 pagesThesis Demo 1THE ROLE OF RATIO ANALYSIS IN FINANCIALNigar SultanaPas encore d'évaluation

- NCFM Commodity Derivatives Mock TestDocument12 pagesNCFM Commodity Derivatives Mock TestsimplypaisaPas encore d'évaluation

- Accounts Nitin SirDocument11 pagesAccounts Nitin Sirpuneet.sharma1493Pas encore d'évaluation

- HDFC Bank provides nationwide banking services with 2000+ branchesDocument16 pagesHDFC Bank provides nationwide banking services with 2000+ branchesVenkateshwar Dasari NethaPas encore d'évaluation

- Chapter1 5importance JRJDocument45 pagesChapter1 5importance JRJJames R JunioPas encore d'évaluation

- Chapter 3Document24 pagesChapter 3kietlet0Pas encore d'évaluation

- BT Australian Shares Index W: Growth of $10,000Document3 pagesBT Australian Shares Index W: Growth of $10,000Ty ForsythPas encore d'évaluation

- Introduction to Business & EconomicsDocument128 pagesIntroduction to Business & EconomicsVamsi KrishnaPas encore d'évaluation

- Checklist For Applications For Registration Under BOOK 1 of E.O. 226Document3 pagesChecklist For Applications For Registration Under BOOK 1 of E.O. 226Grace RenonPas encore d'évaluation

- Bioscan Group 2 11062023Document4 pagesBioscan Group 2 11062023Aditi KathinPas encore d'évaluation

- PDF Maths Project DDDocument10 pagesPDF Maths Project DDMartin RozariyoPas encore d'évaluation

- Cell Phone Shop FinalDocument26 pagesCell Phone Shop Finalapi-249675528Pas encore d'évaluation

- Lecture Notes Chapters 1-4Document28 pagesLecture Notes Chapters 1-4BlueFireOblivionPas encore d'évaluation

- Delta 9 Deck ApprovedDocument23 pagesDelta 9 Deck ApprovedAnonymous xhcUYpAlPas encore d'évaluation

- Fintech Comparison Tool - Dentons Publisher - GlobalDocument84 pagesFintech Comparison Tool - Dentons Publisher - GlobalOlegPas encore d'évaluation

- Advanced ExcelDocument6 pagesAdvanced ExcelKeith Parker100% (4)