Académique Documents

Professionnel Documents

Culture Documents

MSJG Income Tax Chapter 3 Notes

Transféré par

Mar Sean Jan GabiosaDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

MSJG Income Tax Chapter 3 Notes

Transféré par

Mar Sean Jan GabiosaDroits d'auteur :

Formats disponibles

Page 1 of 3

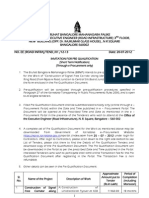

MSJG TAX 1 Chap 3

Mar Sean Jan Gabiosa

Chapter Notes

Income Taxation 7th edition Valencia and Roxas

Chapter 3 Concept of Income

Rule-of-thumb test for determining income for tax purposes is the increase in the

net worth.

Increase in value of property is not income.

Net worth method is used for taxpayers which has no accounting records.

Total assets Total liabilities = Net worth (net taxable income)

Example:

Net worth ending

Net worth beginning

Add: Personal Withdrawals

Nondeductible items

Less: Additional Investments

Nontaxable items

Personal Exemptions*

xx

(xx)

xx

xx

xx

xx

xx

*Basic personal exemption of individual taxpayer is 50,000. Additional of

25,000 per dependent children, maximum of four.

Income is a return on capital (return on investment) not return of capital. [Emphasis

on on not of]

Nontaxable income includes:

Winning from sweepstakes

13th month pay

Other benefits not exceeding 82,000 (R.A. 10653 beginning taxable year

2015)

Taxable income is net income. Net income means gross income less statutory

deductions.

Characteristics of Taxable income

a) gain or profit

b) realized or received

c) by law or treaty, the gain is not excluded from taxation

Income may also be earned partly within and partly without (outside) the

Philippines.

No of days labor in the Phil

Income within =

Total No of days

Total Compensation

Classification of Income

Compensation Income

Profession or Business Income

Passive Income

Page 2 of 3

MSJG TAX 1 Chap 3

Capital Gain

ITR is a formal statement of the taxpayers taxable income and deductions,

reported in the BIR prescribed form, to be filed and paid using the normal or regular

tax rates.

Normal Tax VS Final Tax

Normal tax is the tax imposed on regular earnings; regular/customary/ordinary tax.

Final tax is the term used for tax which have been subjected to tax payment and

may no longer be reported in taxable income.

Normal tax Report in the year-end ITR

Compensation income

Business/Professional Income

Other passive income and capital gains not subject to final tax

Final tax For disclosure only, no need to be taxed again

Interest, dividend and royalty

Sales of real property, and stocks classified as capital asset

Income may be received in the form of cash, property, and service.

When approved by the BIR commissioner, a change in accounting period will

require a separate tax return made from the close of the former accounting year to

the close of the new accounting year.

Cash method income is reported in the year of collection whether earned and/or

unearned.

Accrual method - when earned and incurred

Installment method the reportable income derived on this sale is the proportion of

collection actually received during the year to the gross profit and contract price.

Gross profit

Reportable income = Installment received

Contract Price

Selling Price

Add: Cash received

Fair market value of property

Installment obligations

Mortgage assume by the buyer

Contract Price

Add: Selling price

Excess of Mortgage over cost

Less Mortgage assume by the buyer

Initial payments

Add: Downpayment

Installment received

Excess of mortgage over cost

Annual Installment Payments

Add: Selling price

Less: Initial payments

Page 3 of 3

MSJG TAX 1 Chap 3

Mortgage assume by the buyer

Then, Divide by years of payment

Capital gain tax is 6% of the selling price.

Installment Sale of Personal Property

If the initial payment exceeds 25% of the selling price of the property, the

reportable income in the year of sale would be the whole gross profit. However the

rule does not apply to dealers who regularly sell on installment basis.

Installment Sale of Real Property

If the initial payments do NOT exceed 25%, capital gains tax of 6% is imposed

on selling price or zonal value whichever is higher.

#For short, mortgage assumed by the buyer is not included in the contract price

because he did not want to pay for it. But because it is assumed by him(buyer) he

shoulders it.

Income from Construction Contract

Completed contract method/ Cost-recovery method

Percentage of completion

Farming business all individual, partnerships, or corporations that manage and

cultivate farms for gain or profit are designated farmer.

They derive income from

a) Farm products raised;

b) Trading of farm products purchased; and

c) Other farm income

In accrual basis for computing gross income derived from faming, ending inventory

is part of gross income while beginning inventory is deducted from gross income

(reverse way of adding beginning inventory and deducting ending inventory in

computing gross sales)

Crop basis is employed when crops shall be harvested more than one year from

time of planting.

Income from crop realized

xx

Less: Entire cost of producing

xx

Income

xx

Vous aimerez peut-être aussi

- Philippine Income Taxation - IncomeDocument48 pagesPhilippine Income Taxation - IncomeJenny Malabrigo, MBAPas encore d'évaluation

- Income Tax (1) - FinalDocument50 pagesIncome Tax (1) - FinalMay Encarnina P. Gaoiran100% (5)

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeD'Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeÉvaluation : 1 sur 5 étoiles1/5 (1)

- Wealth Management PPT FinalDocument42 pagesWealth Management PPT FinalCyvita VeigasPas encore d'évaluation

- AFAR - Income Recognition: Installment Sales, Franchise, Long-Term ConstructionDocument9 pagesAFAR - Income Recognition: Installment Sales, Franchise, Long-Term ConstructionJohn Mahatma Agripa93% (15)

- Income Taxation Reviewer: Mariano Marcos State University-College of Law 2011Document59 pagesIncome Taxation Reviewer: Mariano Marcos State University-College of Law 2011Kristelle Quibuyen100% (1)

- Chapter 9 Regular Income Tax - Inclusion From Gross IncomeDocument5 pagesChapter 9 Regular Income Tax - Inclusion From Gross IncomeJason MablesPas encore d'évaluation

- Individuals Income TaxDocument25 pagesIndividuals Income TaxNestor III Dela CruzPas encore d'évaluation

- Bac03-Chapter 5Document25 pagesBac03-Chapter 5Rea Mariz JordanPas encore d'évaluation

- Chapter 9 SummaryDocument4 pagesChapter 9 SummaryFubuki JigokuPas encore d'évaluation

- Author Ayan Ahmed Blog Capital Gain in FranceDocument5 pagesAuthor Ayan Ahmed Blog Capital Gain in FranceAYAN AHMEDPas encore d'évaluation

- Fin623 GDBDocument14 pagesFin623 GDBparishyazizPas encore d'évaluation

- ALZONA - OE Financing DecisionsDocument3 pagesALZONA - OE Financing DecisionsJames Ryan AlzonaPas encore d'évaluation

- Allowable Deductions NotesDocument5 pagesAllowable Deductions NotesPaula Mae DacanayPas encore d'évaluation

- CHAPTER 4 - IncomeTaxDocument7 pagesCHAPTER 4 - IncomeTaxVicente, Liza Mae C.Pas encore d'évaluation

- Module 04 Income Tax Compliance RevisedDocument25 pagesModule 04 Income Tax Compliance RevisedSly BluePas encore d'évaluation

- Lecture 1 - Introduction To Income TaxDocument27 pagesLecture 1 - Introduction To Income TaxMimi kupiPas encore d'évaluation

- Final MF0003 2nd AssigDocument6 pagesFinal MF0003 2nd Assignigistwold5192Pas encore d'évaluation

- CHAPTER 5 Corporate Income Taxation Regular Corporations ModuleDocument10 pagesCHAPTER 5 Corporate Income Taxation Regular Corporations ModuleShane Mark CabiasaPas encore d'évaluation

- Module 04 - Income Tax ComplianceDocument21 pagesModule 04 - Income Tax ComplianceMark Emil BaritPas encore d'évaluation

- Accounting Method: Special Considerations in Reporting of Gross IncomeDocument2 pagesAccounting Method: Special Considerations in Reporting of Gross Incomemigueltanfelix149Pas encore d'évaluation

- Real Estate Taxation - Transfer of PropertyDocument9 pagesReal Estate Taxation - Transfer of PropertyJuan FrivaldoPas encore d'évaluation

- Taxation PDFDocument55 pagesTaxation PDFHumphrey OdchiguePas encore d'évaluation

- Module 6 CGT - 1Document3 pagesModule 6 CGT - 1Marklein DumangengPas encore d'évaluation

- Dealings in Property: Lesson 12Document18 pagesDealings in Property: Lesson 12lcPas encore d'évaluation

- Income TaxDocument85 pagesIncome TaxvicsPas encore d'évaluation

- Income Tax 1. Definition, Nature, and General Principles A. Criteria in Imposing Philippine Income TaxDocument36 pagesIncome Tax 1. Definition, Nature, and General Principles A. Criteria in Imposing Philippine Income TaxPascua PeejayPas encore d'évaluation

- HQ05 - Capital Gains TaxationDocument10 pagesHQ05 - Capital Gains TaxationClarisaJoy Sy100% (3)

- Gains and Losses From Dealings in PropertiesDocument29 pagesGains and Losses From Dealings in PropertiesCj Garcia100% (1)

- Lesson 4 Business Income and Income From Exercise of ProfessionDocument52 pagesLesson 4 Business Income and Income From Exercise of ProfessionAngelica Faith MorcoPas encore d'évaluation

- Inctax Lecture Notes Froup 2 and 6Document27 pagesInctax Lecture Notes Froup 2 and 6KrizahMarieCaballeroPas encore d'évaluation

- BS Is RatioAnalysisDocument84 pagesBS Is RatioAnalysisSujit ParabPas encore d'évaluation

- Tax Midterm ReviewerDocument18 pagesTax Midterm ReviewerAyessa GayamoPas encore d'évaluation

- 9 - Intro To Business TaxesDocument16 pages9 - Intro To Business TaxesEULALIA QuiniquiniPas encore d'évaluation

- Chapter 3 Concept of IncomeDocument12 pagesChapter 3 Concept of IncomeGlomarie GonayonPas encore d'évaluation

- Income Tax 04 Tax and Accounting SchemesDocument10 pagesIncome Tax 04 Tax and Accounting SchemesJade Ivy GarciaPas encore d'évaluation

- Lecture 3 - Income Taxation (Corporate)Document8 pagesLecture 3 - Income Taxation (Corporate)Lovenia Magpatoc50% (2)

- Installment, Home-Branch, Liquidation, LT Constn ContractsDocument47 pagesInstallment, Home-Branch, Liquidation, LT Constn ContractsArianne Llorente83% (6)

- Bsa2 - TaxDocument40 pagesBsa2 - TaxLyca Nichol IbanPas encore d'évaluation

- Income Taxation SchemesDocument7 pagesIncome Taxation SchemesLeonard CañamoPas encore d'évaluation

- IT Module No. 7: Introduction To Regular Income TaxDocument13 pagesIT Module No. 7: Introduction To Regular Income TaxjakePas encore d'évaluation

- Dealings in PropertieDocument10 pagesDealings in PropertieAdmPas encore d'évaluation

- Income Tax - Individuals FULL PPT.2Document82 pagesIncome Tax - Individuals FULL PPT.2Pauline88% (8)

- NT - Items of Gross Income 0510 - Income TaxDocument7 pagesNT - Items of Gross Income 0510 - Income TaxElizah PorcadoPas encore d'évaluation

- Taxation CH 4Document3 pagesTaxation CH 4Kristel Nuyda LobasPas encore d'évaluation

- Gross Income Deductions - Lecture Handout PDFDocument4 pagesGross Income Deductions - Lecture Handout PDFKarl RendonPas encore d'évaluation

- Tax Tips-Small Business-August 2012Document16 pagesTax Tips-Small Business-August 2012api-115380838Pas encore d'évaluation

- Adjustments For Final AccountsDocument48 pagesAdjustments For Final AccountsArsalan QaziPas encore d'évaluation

- 3 Income Tax ConceptsDocument37 pages3 Income Tax ConceptsRommel Espinocilla Jr.Pas encore d'évaluation

- Income Tax Part ADocument23 pagesIncome Tax Part AVishwas AgarwalPas encore d'évaluation

- Income TaxationDocument38 pagesIncome TaxationElson TalotaloPas encore d'évaluation

- Chapter 13 ADocument22 pagesChapter 13 AAdmPas encore d'évaluation

- Taxation Law DoctrinesDocument5 pagesTaxation Law DoctrinesĽeońard ŮšitaPas encore d'évaluation

- Lesson 2: Income Tax Schemes, Accounting Periods, Methods and ReportingDocument28 pagesLesson 2: Income Tax Schemes, Accounting Periods, Methods and ReportingCJ GranadaPas encore d'évaluation

- Advanced Accounting HintsDocument5 pagesAdvanced Accounting HintsCA Uma KrishnaPas encore d'évaluation

- Activity 3ADocument5 pagesActivity 3AJaried SumbaPas encore d'évaluation

- Chapter 4-Mcit, Iaet, GitDocument22 pagesChapter 4-Mcit, Iaet, GitJayvee FelipePas encore d'évaluation

- Inclusion of Gross IncomeDocument24 pagesInclusion of Gross IncomeAce ReytaPas encore d'évaluation

- MSJG Income Tax Chapter 8 NotesDocument9 pagesMSJG Income Tax Chapter 8 NotesMar Sean Jan GabiosaPas encore d'évaluation

- Chapter 2 - Management CashewDocument9 pagesChapter 2 - Management CashewMar Sean Jan GabiosaPas encore d'évaluation

- Parnership Corpo NotesDocument15 pagesParnership Corpo NotesMJ YaconPas encore d'évaluation

- 2009 A-1 Class Notes PDFDocument3 pages2009 A-1 Class Notes PDFCzarina CasallaPas encore d'évaluation

- MSJG Income Tax Chapter 5 NotesDocument3 pagesMSJG Income Tax Chapter 5 NotesMar Sean Jan GabiosaPas encore d'évaluation

- Chapter 8 Valuation of InventoriesDocument39 pagesChapter 8 Valuation of InventoriesMichelle Joy Nuyad-Pantinople100% (1)

- MSJG Income Tax Chapter 4 NotesDocument4 pagesMSJG Income Tax Chapter 4 NotesMar Sean Jan GabiosaPas encore d'évaluation

- MSJG Income Tax Chapter 7 NotesDocument7 pagesMSJG Income Tax Chapter 7 NotesMar Sean Jan GabiosaPas encore d'évaluation

- MSJG Income Tax Chapter 9 NotesDocument5 pagesMSJG Income Tax Chapter 9 NotesMar Sean Jan GabiosaPas encore d'évaluation

- MSJG Income Tax Chapter 2 NotesDocument5 pagesMSJG Income Tax Chapter 2 NotesMar Sean Jan GabiosaPas encore d'évaluation

- MSJG Income Tax Chapter 6 NotesDocument3 pagesMSJG Income Tax Chapter 6 NotesMar Sean Jan GabiosaPas encore d'évaluation

- Reflection Paper For Hope of The FlowersDocument4 pagesReflection Paper For Hope of The FlowersMar Sean Jan Gabiosa100% (1)

- Pals Doctrinal Syllabus Taxation Law 2015Document235 pagesPals Doctrinal Syllabus Taxation Law 2015Mar Sean Jan GabiosaPas encore d'évaluation

- MSJG Income Tax Chapter 1 NotesDocument5 pagesMSJG Income Tax Chapter 1 NotesMar Sean Jan GabiosaPas encore d'évaluation

- Developments of MusicDocument10 pagesDevelopments of MusicMar Sean Jan GabiosaPas encore d'évaluation

- MSJG Chap 2 SummaryDocument1 pageMSJG Chap 2 SummaryMar Sean Jan GabiosaPas encore d'évaluation

- MSJG Chap 1 10 QuestionsDocument6 pagesMSJG Chap 1 10 QuestionsMar Sean Jan Gabiosa100% (2)

- Personality Temperament TestDocument1 pagePersonality Temperament TestMar Sean Jan Gabiosa100% (1)

- Personality Temperament Test Profile Portrait PDFDocument4 pagesPersonality Temperament Test Profile Portrait PDFMar Sean Jan GabiosaPas encore d'évaluation

- MSJG Chap 1 SummaryDocument3 pagesMSJG Chap 1 SummaryMar Sean Jan GabiosaPas encore d'évaluation

- Rules For IBF BadmintonDocument3 pagesRules For IBF BadmintonMar Sean Jan GabiosaPas encore d'évaluation

- List of Martial ArtsDocument10 pagesList of Martial ArtsMar Sean Jan Gabiosa100% (1)

- MinsupalaDocument3 pagesMinsupalaMar Sean Jan GabiosaPas encore d'évaluation

- FIN516 W6 Homework-4Document4 pagesFIN516 W6 Homework-4Roxanna Gisell RodriguezPas encore d'évaluation

- Assignment III - Descriptive QuestionsDocument2 pagesAssignment III - Descriptive QuestionsAndroid AccountPas encore d'évaluation

- Name: Xolisa Surname: Sikembula 65173104 UNIQUE NUMBER: 803495 Due Date: 28 AugustDocument2 pagesName: Xolisa Surname: Sikembula 65173104 UNIQUE NUMBER: 803495 Due Date: 28 AugustXolisaPas encore d'évaluation

- Bio DataDocument7 pagesBio DataPrakash KcPas encore d'évaluation

- EMIS Company Profile 7108284 PDFDocument1 pageEMIS Company Profile 7108284 PDFMadhusmita pattanayakPas encore d'évaluation

- GCG MC 2017-03, Implementing Rules and Guidelines of EO No 36, S 2017Document13 pagesGCG MC 2017-03, Implementing Rules and Guidelines of EO No 36, S 2017bongricoPas encore d'évaluation

- VRF For Indian VendorDocument18 pagesVRF For Indian VendorKedar ChoksiPas encore d'évaluation

- Needs VS WantsDocument2 pagesNeeds VS WantsMhie RelatorPas encore d'évaluation

- SBL Revision Notes PDFDocument175 pagesSBL Revision Notes PDFAliRazaSattar100% (3)

- Ee Roadinfra Tend 01Document3 pagesEe Roadinfra Tend 01Prasanna VswamyPas encore d'évaluation

- X120 Cslides 19Document19 pagesX120 Cslides 19Jowelyn Cabilleda AriasPas encore d'évaluation

- Bangladesh Income Tax RatesDocument5 pagesBangladesh Income Tax RatesaadonPas encore d'évaluation

- General Provisions Fiscal Year 2022: Official Gazette J 3, 2022Document23 pagesGeneral Provisions Fiscal Year 2022: Official Gazette J 3, 2022Ju DebPas encore d'évaluation

- Tarea 2 Capítulo 2Document14 pagesTarea 2 Capítulo 2Eber VelázquezPas encore d'évaluation

- Increased Decreased: Sample: Cash in Bank Account Was DebitedDocument3 pagesIncreased Decreased: Sample: Cash in Bank Account Was DebitedAtty Cpa100% (2)

- The 6 Killerapps-NotesDocument6 pagesThe 6 Killerapps-NotesKashifOfflinePas encore d'évaluation

- ACC 558 Lecture 5 IPSAS 23 ASSETSDocument89 pagesACC 558 Lecture 5 IPSAS 23 ASSETSEzekiel Korankye OtooPas encore d'évaluation

- Wipro Case StudyDocument10 pagesWipro Case StudyNisha Bhagat0% (1)

- BSTX Reviewer (Midterm)Document7 pagesBSTX Reviewer (Midterm)alaine daphnePas encore d'évaluation

- Overview of Taxation and Nigerian Tax System FinalDocument52 pagesOverview of Taxation and Nigerian Tax System FinalAdeyemi MayowaPas encore d'évaluation

- Torex Gold - Corporate Presentation - January 2023 202Document49 pagesTorex Gold - Corporate Presentation - January 2023 202Gustavo Rosales GutierrezPas encore d'évaluation

- Final MR Notes (2Document155 pagesFinal MR Notes (2namrocksPas encore d'évaluation

- Microeconomics 19th Edition Samuelson Test BankDocument25 pagesMicroeconomics 19th Edition Samuelson Test BankRobertFordicwr100% (55)

- Taxation - Vietnam (TX-VNM) (F6) SASG 2021 SP Amends - FinalDocument20 pagesTaxation - Vietnam (TX-VNM) (F6) SASG 2021 SP Amends - FinalXuân PhạmPas encore d'évaluation

- 54R-07 - AACE InternationalDocument17 pages54R-07 - AACE InternationalFirasAlnaimiPas encore d'évaluation

- TallyDocument69 pagesTallykarnikajain5100% (6)

- Abeel V Bank of America Etal Trillions 4 12Document390 pagesAbeel V Bank of America Etal Trillions 4 12James SempseyPas encore d'évaluation

- Ced IlloDocument26 pagesCed IlloManolache DanPas encore d'évaluation

- Unit 4 Topic 1 EntrepDocument2 pagesUnit 4 Topic 1 EntrepEll VPas encore d'évaluation

- List Peserta FinalDocument8 pagesList Peserta FinalSyifa AryantiPas encore d'évaluation