Académique Documents

Professionnel Documents

Culture Documents

RA 8800 SAFEGUARD ACT PROTECTS PHILIPPINE INDUSTRY

Transféré par

IELTSTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

RA 8800 SAFEGUARD ACT PROTECTS PHILIPPINE INDUSTRY

Transféré par

IELTSDroits d'auteur :

Formats disponibles

RA 8800: THE SAFEGUARD MEASURE ACT

Chapter 1 : GENERAL PROVISIONS

known as the Safeguard Measures Act

goal of the State: to promote the

competitiveness of domestic industries and

procedures

State has the duty to provide safeguard

measures to protect domestic industries

and procedures from increased imports

scope: applies to products being imported

into the country irrespective of source

Definition of terms

agricultural product refers to a specific

commodity under Chapters 1 to 24 of the

Harmonized System (HS) of Commodity

Classification

Commission Tariff Commission

consumers natural persons or organized

consumer groups who are purchasers,

lessees,

recipients,

or

prospective

purchasers, lessees, recipients of consumer

products, services or credit

critical circumstances circumstances

where there is prima facie evidence that

increased imports, whether absolute or

relative to domestic production, are a

substantial cause of serious injury or threat

thereof to the domestic industry and that

delay in taking action under this Act would

cause damage to the industry that would be

difficult to repair

directly

competitive

products

domestically-produced

substitutable

products

domestic industry domestic producers, as

a whole, of like or directly competitive

products manufactured or produced in the

Philippines or those whose collective output

of like or directly competitive products

constitutes a major proportion of the total

domestic production of those products

RA 8800: THE SAFEGUARD MEASURES ACT

interested parties include domestic

producers, consumers, importers and

exporters of the products under

consideration

like product domestic product which is

identical; can either be alike in all respects

to

the

imported

product

under

consideration or another domestic product

which has characteristics closely resembling

those of the imported products under

consideration

market access opportunity the percentage

of the total annual volume of imports of an

agricultural product to the corresponding

total volume of domestic consumption of

the said product in the country in the three

(3) immediately preceding years for which

data are available

minimum access volume (MAV) amount

of imports of an agricultural product

allowed to be imported into the country at

a customs duty lower than the out-quota

customs duty

positive adjustment to import competition

the ability of the domestic industry to

compete successfully with imports after the

termination of any safeguard measure, or

to the orderly transfer of resources to other

productive pursuits; and to the orderly

transition of dislocated workers in the

industry to other productive pursuits;

price difference amount obtained after

subtracting the c.i.f. import price from the

trigger price

product articles, commodities or goods

Secretary either the Secretary of the

Department of Trade and Industry in the

case of non-agricultural products or the

Secretary of the Department of Agriculture

in the case of agricultural products

serious injury a significant impairment in

the position of a domestic industry after

evaluation by competent authorities of all

relevant factors of an objective and

quantifiable nature having a bearing on the

situation of the industry concerned, in

particular, the rate and amount of the

increase in imports of the product

concerned in absolute and relative terms,

the share of the domestic market taken by

increased imports, changes in levels of

sales, production, productivity, capacity

utilization, profit and losses, and

employment

substantial cause a cause which is

important but not less than any other cause

threat of serious injury serious injury that

is imminent

trigger price price benchmark for applying

the special safeguard measure

trigger volume volume benchmark for

applying the special safeguard measure

In reaching a positive determination that

the increase importation of the product

under consideration is causing serious

injury or threat thereof to a domestic

industry, all relevant factors having a

bearing on the situation of the domestic

industry shall be evaluated.

D. Filing of Verified Petition

1. Any person (natural or juridical),

belonging to or representing a

domestic industry and seriously injured

or threatened by the increased imports

of the product under consideration,

may file with the Secretary a verified

petition.

Petition shall include documentary

evidence establishing the following:

An increase in imports of like or

directly competitive products;

The existence of serious injury or

threat thereof to the domestic

industry; and

The causal link between the

increased imports of the product

under consideration and the

serious injury or threat thereof.

Chapter 2 : GENERAL SAFEGUARD MEASURES

A. When imposed

The Commission shall make a final

determination that a product is being

imported into the country in increased

quantities, which shall be the basis of

the Secretary in applying a general

safeguard measure.

B.

C.

In the case of non-agricultural

products, the Secretary shall first

establish that the application of such

safeguard measures will be in the

public interest.

Imposing Authority

The Secretary of the Department of

Agriculture has the authority to apply a

general safeguard measure in the case of

agricultural products. While in the case of

non-agricultural products, authority is

vested upon the Secretary of the

Department of Trade and Industry.

Determination of Serious Injury or Threat

thereof

RA 8800: THE SAFEGUARD MEASURES ACT

2.

The Secretary shall review the petition

and decide whether to initiate a

preliminary safeguard investigation

within 5 days from receipt of the

petition.

3.

In the absence of such a petition, the

Secretary may, motu proprio, initiate a

preliminary safeguard investigation if

there exist increased imports of the

product under consideration which are

a substantial cause of, or are

threatening to substantially cause,

serious injury to the domestic industry.

The Secretary may also initiate action

upon the request of the President; or a

resolution of the House or Senate

Committee on Agriculture, or House or

Senate Committee on Trade and

Commerce.

E.

Preliminary Determination

1. Not later than 30 days from receipt of

the petition or a motu proprio initiation

of

the

preliminary

safeguard

investigation, the Secretary shall, on

the basis of the evidence and

submissions, make a preliminary

determination that increased imports

of the product under consideration are

a substantial cause of, or threaten to

substantially cause, serious injury to

the domestic industry.

2.

3.

The Secretary shall notify the

interested parties and require them to

submit their answers within 5 working

days from receipt of such notice. The

notice shall be deemed received 5

working days from the date of

transmittal to the interested parties.

When the interested parties failed to

respond within the prescribed period

or the investigation is significantly

impeded, decision will be based on the

facts derived from the evidence at

hand.

Upon

a

positive

preliminary

determination, the Secretary shall,

without delay, transmit its records to

the Commission for immediate formal

investigation.

In critical circumstances where

a delay would cause damage

difficult to repair, and

pursuant to a positive

preliminary determination, the

Secretary shall immediately

issue, through the Secretary of

Finance, a written instruction

to the Commissioner of

RA 8800: THE SAFEGUARD MEASURES ACT

Customs

authorizing

the

imposition of a provisional

general safeguard measure.

F.

Formal Investigation

1. The Commission shall publish the

notice of the commencement of the

investigation, and public hearings,

within 5 working days from receipt of

the request from the Secretary.

Evidence regarding the importation of

subject product shall be submitted to

the Commission within 15 days after

the initiation of the investigation by the

Commission.

2.

Public hearings shall afford

interested

parties

and

consumers an opportunity to

be present, or to present

evidence, to respond to the

presentation of other parties

and consumers and otherwise

be heard.

The Commission shall complete its

investigation and submit its report to

the Secretary within 120 calendar days

from receipt of the referral by the

Secretary.

When the Secretary certifies

that the report is urgent, the

Commission shall complete

the investigation and submit

such report to the Secretary

within 60 days.

The Commission shall make

available for inspection by

interested parties, copies of all

evidence submitted on or

before the relevant due date.

Provided, however, that any

confidential information or

any information provided on a

confidential basis, shall, upon

cause being shown, not be

disclosed without permission

of the party submitting it.

1.

2.

3.

3.

During

the

investigation,

the

Commission shall issue appropriate

notice to representatives of the

concerned domestic industry or other

parties, to submit an adjustment plan

to import competition, within 45 days

upon receipt of such notice. Except,

when the Secretary certifies urgency,

such adjustment plan must be

submitted within 30 days.

If the Commission makes an

affirmative determination of

injury or threat thereof,

individual

commitments

regarding actions to take to

facilitate positive adjustment

to import competition shall

be

submitted

to

the

Commission by any of the

following:

1. Firm in the domestic

industry,

2. Certified or recognized

union or group of

workers in the domestic

industry,

3. Local community,

4. Trade

association

representing

the

domestic industry, or

5. Other person or group of

persons.

G. Adoption of Definitive Measures

Upon its positive determination, the

Commission shall recommend to the

Secretary an appropriate definitive

measure, in the form of:

RA 8800: THE SAFEGUARD MEASURES ACT

4.

5.

Other actions including the

initiation

of

international

negotiations,

may

also

be

recommended by the Commission.

In the event of a negative

determination, or if the cash bond is in

excess of the definitive safeguard duty

assessed,

the

Secretary

shall

immediately issue, through the

Secretary of Finance, a written

instruction to the Commission of

Customs, authorizing the return of the

cash bond or the remainder thereof,

within 10 days from the date a final

determination has been made.

An increase in, or imposition of,

any duty on the imported product;

A decrease in or the imposition of

a tariff-rate quota (MAV) on the

product;

A modification or imposition of any

quantitative restriction on the

importation of the product into the

Philippines;

One

or

more

appropriate

adjustment measures, including

the provision of trade adjustment

assistance;

Any combination of actions

described in subparagraphs (1) to

(4).

The Secretary shall not accept

another petition from the same

industry, with respect to the same

imports of the product under

consideration within 1 year after

the date of rendering such a

decision.

The general safeguard measure shall

be limited to the extent of redressing

or preventing the injury and to

facilitate adjustment by the domestic

industry from the adverse effects

directly attributed to the increased

imports.

Provided,

that

when

quantitative import restrictions are

used, such measures shall not reduce

the quantity of imports below the

average imports for the three (3)

preceding representative years, unless

clear justification is given that a

different level is necessary to prevent

or remedy a serious injury.

A general safeguard measure shall not

be applied to a product originating

from a developing country if its share

of total imports of the product is less

than three percent (3%). Provided,

that developing countries with less

than three percent (3%) share

collectively account for not more than

nine percent (9%) of the total

imports.

The decision imposing a general

safeguard measure, the duration of

which is more than one (1) year, shall

be reviewed at regular intervals for

purposes of liberalizing or reducing its

intensity. The same shall be

terminated where the benefiting

industry

fails

to

show

any

improvement, as may be determined

by the Secretary.

The Secretary shall issue a written

instruction to the heads of the

concerned government agencies to

implement the appropriate general

safeguard measure as determined by

the Secretary within 15 days from

receipt of the report.

H. Contents of the Report by the Commission

The Commission shall submit to the

Secretary the following:

1. the investigation report;

RA 8800: THE SAFEGUARD MEASURES ACT

2.

3.

4.

the proposed recommendations;

a copy of the submitted adjustment

plan; and

the commitments made by the

domestic industry to facilitate positive

adjustment to import competition.

The report shall also include a

description of the short and long-term

effects of the affirmative or negative

recommendation on the petitioner, or

other interested parties.

The Commission, after submitting the

report to the Secretary, shall make it

available to the public except

confidential information and publish a

summary in two (2) newspapers of

general circulation.

I. Limitations on Actions

Not exceeding 4 years - any action taken

under the general safeguard provisions,

including the period (if any) in which

provisional safeguard relief was in

effect.

Not exceeding an aggregate of 10 years the effective period of any safeguard

measure, including any extensions of

such measure.

Any duty imposed pursuant to the

safeguard measure may be specific

and/or ad valorem, in the amount

necessary to prevent/redress/remedy

the injury to the domestic industry.

A quantitative restriction measure shall

not reduce the quantity of imports

below the level of a recent period (i.e.,

the average of imports in the last 3

representative years of which statistics

are available), unless there is clear

justification for different levels in order

to prevent/remedy serious injury.

Any action described in G (Adoption of

Definitive Measures), subparagraphs

(1), (2), and (3) that is effective for more

than 1 year shall be phased down at

regular intervals within the period of

effectivity.

The Secretary shall not accept any

further petition for the same article

within 2 years after the expiration of the

action, provided that a safeguard

measure with a duration of up to 180

days may be applied again to the same

product if:

a.) at least 1 year has elapsed since the

date of introduction of the safeguard

measure

b.) such measure has not been applied

on the same product more than twice in

the 5-year period immediately preceding

the introduction of the measure.

J. Monitoring

The Commission shall monitor

developments in the domestic industry,

for as long as any definitive measure is

in effect. It shall then submit to the

Secretary a report on the results of the

monitoring if the initial application of a

definitive measure exceeds 3 years, or if

an extension of such action exceeds 3

years. This report shall be submitted not

later than the midpoint of the initial

period, and of each such extension,

during which the action is in effect.

A hearing shall be conducted by the

Commission in the preparation of each

monitoring report, where interested

parties will be given reasonable

opportunity to be present, to present

evidence, and to be heard.

RA 8800: THE SAFEGUARD MEASURES ACT

K. Notice of GSM (General Safeguard Measure)

The Secretary shall notify the CSWTO

(Committee on Safeguards of the World

Trade Organization):

a.) when initiating an action relating to serious

injury or threat thereof and the reasons for it

b.) when adopting a provisional GSM following a

positive preliminary determination

c.) when applying/extending a definitive GSM

following a positive final determination.

L. Reduction/Modification/Termination of Action

A GSM action may be

reduced/modified/terminated (r/m/t) by

the Secretary only after

a.) he determines (based on the monitoring

report) that

- the domestic industry has not

undertaken adequate efforts to

make a positive adjustment to

import competition, or

- the GSM action is not that

effective anymore because of

changed economic circumstances

b.) majority of the domestic industrys

representative submits to him a petition

requesting such r/m/t because of positive

adjustments the domestic industry made to

import competition. This petition must be

submitted at least 1 year before expiration

of the period of effectivity.

If r/m/t of action is being requested for

an action that has been in effect for 3

years or less, the industry first submits

its request to the Secretary. The

Secretary shall then refer the request to

the Commission. The Commission shall

conduct an investigation following the

producers, to be completed within 60

days from receipt of the request. Then,

the Commission shall submit a report to

the Secretary. The Secretary shall then

take action considering the conditions,

not later than 30 days after receipt of

the report.

(petitioning industry Secretary Commission

Secretary r/m/t of action)

M. Extension and Re-application of GSM

The petitioner may request an extension

of the GSM (by appealing to the

Secretary) if (1) the action continues to

be necessary to prevent/remedy the

serious injury, and (2) there is evidence

that domestic industry is making positive

adjustment to import competition. The

request should be made at least 90 days

before the expiration of the GSM. This

request shall then be immediately

referred by the Secretary to the

Commission. After formal investigation,

the Commission shall submit a report to

the Secretary not later than 60 days

from its receipt of the request. The

Secretary shall issue an order granting or

denying the petition within 7 days from

receipt of the report. The order shall be

more liberal than the initial application.

Chapter 3: SPECIAL SAFEGUARD MEASURE FOR

AGRICULTURAL PRODUCTS

A.

When imposed

An additional special safeguard duty may be

imposed on an agricultural product upon

positive final determination of the following:

1.

the product being imported is the

same as the product being produced by the

applicant domestic industry; and,

2.1. cumulative import volume in a given year

exceeds its trigger volume subject to the

conditions under Section 23; or,

2.2. actual CIF import price falls below its trigger

price subject to the conditions under Section 24.

B.

Imposing authority

The Secretary of Agriculture has the authority to

impose the special safeguard measure.

C.

(petitioning industry

SecretaryCommissionSecretarygrant/deni

al of extension/re-application)

N. Evaluation

After termination of any action, the

Commission shall evaluate the

effectiveness of the actions taken by the

domestic industry by holding a public

hearing on such matter, at which all

interested parties have the opportunity

to present evidence/testimony.

***HELLO THERE! REMEDY OF PARTY ADVERSELY

AFFECTED BY THE SAFEGUARD MEASURES AT THE

END KAY FLOWCHART SIYA. ***

RA 8800: THE SAFEGUARD MEASURES ACT

Imposed amount

based on the Volume Test

The special safeguard duty shall be

appropriately set to a level not exceeding

one-third of the applicable out-quota

customs duty on the agricultural product

under consideration in the year when it is

imposed.

based on the Price Test

The special safeguard duty shall be

computed as follows:

i.

0, if the price difference is at most

10% of the trigger price; or

ii.

30% of the amount by which the

price difference exceeds 10% of

the trigger price, if 10% <

difference < 40%; or

iii.

50% of the amount by which the

price difference exceeds 40% of

the trigger price, plus amount

imposed under (ii), if 40% <

difference < 60%; or

iv.

70% of the amount by which the

price difference exceeds 60% of

the trigger price, plus amounts

v.

D.

1.

2.

3.

4.

E.

imposed under (ii) and (iii), if 60%

< difference < 75%; or

90% of the amount by which the

price difference exceeds 75% of

the trigger price, plus amounts

imposed under (ii), (iii) and (iv), if

difference exceeds 75%.

Procedure

Any person, whether natural or juridical,

may request the Secretary of Agriculture to

verify if a particular product can be imposed

a special safeguard duty. The Secretary shall

come up with a finding within five working

days from the receipt of a request. Or, the

Secretary may, motu proprio, initiate the

imposition of a special safeguard measure

following the satisfaction of the conditions

for imposing the measure.

Upon positive final determination, the

Secretary shall issue a department order

requesting the Commissioner of Customs,

through the Secretary of Finance, to impose

an additional special safeguard duty on an

agricultural product, consistent with

Philippine international treaty obligations.

The Secretary shall make the administration

of the safeguard measure transparent by

giving notice in writing to the WTO

Committee on Agriculture within ten (10)

days from the implementation of such

measure.

The special safeguard measures for

agricultural products shall lapse with the

duration of the reform process in

agriculture as determined in the WTO.

Thereafter, recourse to safeguard measures

shall be subject to the provisions on general

safeguard measures.

Limitations/Considerations

The special safeguard duty shall not apply

to the volumes of the imported agricultural

product under consideration that are

brought into the country under the

minimum access volume mechanism.

RA 8800: THE SAFEGUARD MEASURES ACT

The special characteristics of perishable and

seasonal agricultural imports shall be taken

into account in determining the applicable

special safeguard measure.

Chapter 4: SPECIAL PROVISIONS

Judicial Review. - Any interested party who is

adversely affected by the ruling of the Secretary in

connection with the imposition of a safeguard

measure may file with the Court of Tax Appeals, a

petition for review of such ruling within thirty (30)

days from receipt thereof: Provided, however, That

the filing of such petition for review shall not in any

way stop, suspend or otherwise toll the imposition

or collection of the appropriate tariff duties or the

adoption of other appropriate safeguard measures,

as the case may be.

The petition for review shall comply with the same

requirements and shall follow the same rules of

procedure and shall be subject to the same

disposition as in appeals in connection with adverse

rulings on tax matters to the Court of Appeals.

Penalty Clause. - Any government official or

employee who shall fail to initiate, investigate, and

implement the necessary actions as provided in this

Act and the rules and regulations to be issued

pursuant hereto, shall be guilty of gross neglect of

duty and shall suffer the penalty of dismissal from

public service and absolute disqualification from

holding public office.

Prohibition of Concurrent Recourse to Safeguard

Measures. - There shall be no recourse to the use of

the general safeguard measure under Chapter II of

this Act concurrently with the special safeguard

measure as provided for under Chapter III of this Act

and vice-versa.

Issuance of Implementing Rules and Regulations. Within sixty (60) days after the effectivity of this Act,

the Department of Agriculture and the Department

of Trade and Industry in consultation with the

Department of Finance, the Bureau of Customs, the

National Economic and Development Authority, and

the Tariff Commission, after consultations with

domestic industries and with the approval of the

Congressional Oversight Committee which is hereby

created under this Act, shall promulgate the

necessary rules and regulations to implement this

Act.

Oversight. - There shall be a Congressional Oversight

Committee composed of the Chairmen of the

Committee on Trade and Industry, the Committee

on Ways and Means, and the Committee on

Agriculture of both the Senate and the House of

Representatives to oversee the implementation of

this Act.

Administrative System Support. - Upon the effectivity

of this Act, any sum as may be necessary for the

Department of Agriculture, the Department of Trade

and Industry, and the Tariff Commission to

undertake their functions efficiently and effectively

shall be included in the General Appropriations Act.

The aforementioned government agencies are

hereby authorized to collect such fees, charges, and

safeguard duties that are deemed necessary.

Fifty percent (50%) of the revenue collected from

such fees, charges, and safeguard duties shall be set

aside in a Remedies Fund which shall be earmarked

for the use of these agencies in the implementation

of remedies, including the safeguard measures.

The remaining fifty percent (50%) shall be deposited

under a special account to be created in the National

Treasury and shall be earmarked for competitiveness

enhancement measures for the industries affected

by the increased imports. The disposition thereof

shall be determined through the General

Appropriations Act.

Assistance to Farmers and Fisherfolk. - To safeguard

and enhance the interest of farmers and fisherfolk,

nothing in this Act shall in any manner affect the

provisions of Republic Act No. 8435, otherwise

known as the Agriculture and Fisheries

RA 8800: THE SAFEGUARD MEASURES ACT

Modernization Act.

Conditions for Application of Safeguard Measures. In the application of any safeguard measure under

this Act, the following conditions must be observed:

(1) All actions must be transparent and shall not

allow any anti-competitive, monopolistic or

manipulative business devise; and

(2) Pursuant to the non-impairment clause of the

Constitution, nothing in this Act shall impair the

obligation of existing supply contracts.

Separability Clause. - If any provision of this Act is

held invalid, the other provisions of this Act not

affected shall remain in force and effect.

Repealing Clause. - All laws, decrees, rules and

regulations, executive or administrative orders and

such other presidential issuances as are inconsistent

with any of the provisions of this Act are hereby

repealed, amended or otherwise modified

accordingly.

Effectivity Clause. - This Act shall take effect fifteen

(15) days following its complete publication in two

(2) newspapers of general circulation or in the

Official Gazette, whichever comes earlier.

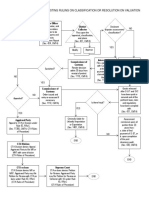

REMEDY OF PARTY ADVERSELY AFFECTED BY THE SAFEGUARD

MEASURES

Any juridical/natural person

representing domestic

industry may petition

Request from President,

House Resolution

Secretary for action on Safeguard measures

(Parties notified to submit answers or else decision is based on

evidence at hand)

Transmit to Commission for Investigation upon determination

that importation is substantial cause or threat

Upon positive determination, the Commission shall

recommend to the Secretary appropriate definitive measures

The Secretary shall issue a written instruction to heads of

government agencies for implementation

Shall not stop, suspend

or toll imposition of

tariff duties and other

safeguard measures

Any interested party adversely affected by imposition of a

safeguard measure may file per petition for review with the

Court of Tax Appeals

(within 30 days from receipt of such ruling)

Shall comply with the same requirements and follow the

same rules of procedure and subject to the same disposition

as in appeals in connection with adverse rulings on tax

matters to the CA

Muto Propio

Vous aimerez peut-être aussi

- RA 8751 Countervailing LawDocument6 pagesRA 8751 Countervailing LawAgnus SiorPas encore d'évaluation

- Safeguard MeasuresDocument11 pagesSafeguard MeasuresMargieAnnPabloPas encore d'évaluation

- Ra 8752 Gr1 OutlineDocument5 pagesRa 8752 Gr1 OutlineIELTSPas encore d'évaluation

- Cao3 2006aDocument27 pagesCao3 2006aMariz Tan ParrillaPas encore d'évaluation

- CMTA Disputing Assessment or ClassificationDocument1 pageCMTA Disputing Assessment or ClassificationWorstWitch TalaPas encore d'évaluation

- Donor's Tax BasicsDocument5 pagesDonor's Tax BasicsEyriel CoPas encore d'évaluation

- Tax Rates - SPSPS ReviewDocument10 pagesTax Rates - SPSPS ReviewKenneth Bryan Tegerero TegioPas encore d'évaluation

- Presidential Decree NO.930Document9 pagesPresidential Decree NO.930Lj CadePas encore d'évaluation

- Estate Tax ReviewerDocument1 pageEstate Tax ReviewerMariah Janey VicentePas encore d'évaluation

- SC Decision Vs CAO 3-2006 (Broker Accreditation by The BOC)Document8 pagesSC Decision Vs CAO 3-2006 (Broker Accreditation by The BOC)PortCalls100% (1)

- Tax Reviewer - Train Law - Rates and ComputationsDocument5 pagesTax Reviewer - Train Law - Rates and ComputationsCelestiaPas encore d'évaluation

- Clearance Procedures for ImportsDocument36 pagesClearance Procedures for ImportsNina Bianca Espino100% (1)

- Excise TaxesDocument5 pagesExcise TaxesJoAnne Yaptinchay Claudio100% (2)

- TAX-501 (Excise Taxes)Document6 pagesTAX-501 (Excise Taxes)Ryan AllanicPas encore d'évaluation

- Samar-I Electric Cooperative, Petitioner, vs. Commissioner of Internal Revenue, Respondent.Document18 pagesSamar-I Electric Cooperative, Petitioner, vs. Commissioner of Internal Revenue, Respondent.Maria Nicole Vaneetee100% (1)

- VAT Guide: Understanding Value-Added Tax PrinciplesDocument32 pagesVAT Guide: Understanding Value-Added Tax Principlessei1davidPas encore d'évaluation

- DONOR's TaxDocument4 pagesDONOR's TaxAnne Elamparo50% (4)

- Chapter 01 Introduction To Internal Revenue TaxesDocument12 pagesChapter 01 Introduction To Internal Revenue TaxesNikki BucatcatPas encore d'évaluation

- Notes in Other Percentage TaxDocument2 pagesNotes in Other Percentage TaxNovie Marie Balbin AnitPas encore d'évaluation

- Excise TaxesDocument6 pagesExcise TaxesJohn MPas encore d'évaluation

- ASEAN Harmonized Tariff Nomenclature ExplainedDocument3 pagesASEAN Harmonized Tariff Nomenclature ExplainedJojo Aboyme CorcillesPas encore d'évaluation

- Value-Added Tax (VAT) Is A Tax On Consumption Levied On The Sale, Barter, Exchange or LeaseDocument27 pagesValue-Added Tax (VAT) Is A Tax On Consumption Levied On The Sale, Barter, Exchange or LeaseDon CabasiPas encore d'évaluation

- M3 Excise Tax Students Copy Revised PDFDocument73 pagesM3 Excise Tax Students Copy Revised PDFTokis SabaPas encore d'évaluation

- Acctg201 ProcessCostingLectureNotesDocument24 pagesAcctg201 ProcessCostingLectureNotesSophia Marie Eredia FerolinoPas encore d'évaluation

- CMTA: Customs Modernization and Tariff Act overviewDocument39 pagesCMTA: Customs Modernization and Tariff Act overviewTyronePas encore d'évaluation

- VAT BasicsDocument25 pagesVAT BasicsAjey MendiolaPas encore d'évaluation

- Tax1 Tariff and Customs LawDocument12 pagesTax1 Tariff and Customs LawIvan LuzuriagaPas encore d'évaluation

- 11-T-11 Admin & Judicial ProceduresDocument22 pages11-T-11 Admin & Judicial ProceduresCherrylyn CaliwanPas encore d'évaluation

- VAT Law Essentials in 40 CharactersDocument78 pagesVAT Law Essentials in 40 CharactersgoerginamarquezPas encore d'évaluation

- INPUT TAXES: SOURCES AND CATEGORIESDocument4 pagesINPUT TAXES: SOURCES AND CATEGORIESJaneLayugCabacunganPas encore d'évaluation

- Tariff and Customs Code FundamentalsDocument7 pagesTariff and Customs Code FundamentalsJaylin DizonPas encore d'évaluation

- Rmo 16-2007Document4 pagesRmo 16-2007Jaypee LegaspiPas encore d'évaluation

- Samar-I Electric Cooperative. v. CommissionerDocument12 pagesSamar-I Electric Cooperative. v. CommissionerRheneir Mora100% (1)

- Entry Lodgement and Cargo Clearance Process PDFDocument36 pagesEntry Lodgement and Cargo Clearance Process PDFHiro TanamotoPas encore d'évaluation

- Ra 8181Document5 pagesRa 8181Cons BaraguirPas encore d'évaluation

- Investment Fiscal IncentivesDocument28 pagesInvestment Fiscal Incentivesjeanvaljean999Pas encore d'évaluation

- CDP LONG QUIZ - With AnswersDocument28 pagesCDP LONG QUIZ - With AnswersElaine Antonette RositaPas encore d'évaluation

- Vat On Sale of Goods or PropertiesDocument7 pagesVat On Sale of Goods or Propertiesnohair100% (3)

- RR 12-99 Rules On Assessments PDFDocument19 pagesRR 12-99 Rules On Assessments PDFJeremeh PenarejoPas encore d'évaluation

- VAT Exempt SalesDocument5 pagesVAT Exempt SalesNEstandaPas encore d'évaluation

- Overview CMTADocument12 pagesOverview CMTAAnileto BolechePas encore d'évaluation

- Certificate of Origin: Group IVDocument16 pagesCertificate of Origin: Group IVTravis OpizPas encore d'évaluation

- Local Government Taxation PDFDocument16 pagesLocal Government Taxation PDFSani BautisTaPas encore d'évaluation

- Procedure - Section711 - Rev2 - 28july 2020Document3 pagesProcedure - Section711 - Rev2 - 28july 2020AcePas encore d'évaluation

- Cao-01-2019 Post Clearance Audit and Prior Disclosure ProgramDocument32 pagesCao-01-2019 Post Clearance Audit and Prior Disclosure Programlaila ursabiaPas encore d'évaluation

- Donor's Tax Rates and ExemptionsDocument5 pagesDonor's Tax Rates and ExemptionsKim EspinaPas encore d'évaluation

- Diagnostic in Basic AccountingDocument5 pagesDiagnostic in Basic Accountingjapvivi cece100% (2)

- Import Clearance ProceduresDocument32 pagesImport Clearance ProceduresJhecyl Ann BasagrePas encore d'évaluation

- Lecture Notes (Sec. 801-813)Document3 pagesLecture Notes (Sec. 801-813)Roselle BautroPas encore d'évaluation

- Cpa Review School of The Philippines ManilaDocument1 pageCpa Review School of The Philippines ManilaSophia PerezPas encore d'évaluation

- Valencia & Roxas Income Taxation - IndividualsDocument12 pagesValencia & Roxas Income Taxation - IndividualsJonathan Junio100% (1)

- Meaning of Customs Duties and TariffDocument4 pagesMeaning of Customs Duties and TariffLei Chumacera100% (1)

- CIR Assessment Prescription DisputeDocument162 pagesCIR Assessment Prescription DisputeJN CE100% (1)

- Nature of Contract of SaleDocument12 pagesNature of Contract of SaleIrene Frances Chia100% (1)

- RA 8800: PHILIPPINE SAFEGUARD MEASURES ACTDocument12 pagesRA 8800: PHILIPPINE SAFEGUARD MEASURES ACTRebecca LongPas encore d'évaluation

- Combine PDFDocument12 pagesCombine PDFRebecca LongPas encore d'évaluation

- C !""##$ C % &C' C (&% C &C C C& C&C (&%) C (+C)Document12 pagesC !""##$ C % &C' C (&% C &C C C& C&C (&%) C (+C)michael ritaPas encore d'évaluation

- Orld Rade Rganization: G/SG/N/1/PHL/2Document51 pagesOrld Rade Rganization: G/SG/N/1/PHL/2Tru ColorsPas encore d'évaluation

- Special DutiesDocument9 pagesSpecial DutiesMARKPas encore d'évaluation

- Kuya GlenDocument10 pagesKuya GlenGlen AltasPas encore d'évaluation

- TR Events MGT Services NC III PDFDocument98 pagesTR Events MGT Services NC III PDFMR. CHRISTIAN DACORONPas encore d'évaluation

- .Cybercrimes An Indian PerspectiveDocument8 pages.Cybercrimes An Indian PerspectiveIELTSPas encore d'évaluation

- Research 1 PDFDocument6 pagesResearch 1 PDFAmol InglePas encore d'évaluation

- Rape Case Exemption for 13-Year-OldDocument1 pageRape Case Exemption for 13-Year-OldEunice0% (2)

- Ramon B. de Los Reyes and Zoilo P. Perlas For Plaintiffs-Appellants. Villamor & Gancayco For Defendants-AppelleesDocument3 pagesRamon B. de Los Reyes and Zoilo P. Perlas For Plaintiffs-Appellants. Villamor & Gancayco For Defendants-AppelleesIELTSPas encore d'évaluation

- Basic Grammar Rules PDFDocument3 pagesBasic Grammar Rules PDFsakiaslamPas encore d'évaluation

- Ryerson International Comparison Ofcyber Crime - March2013 PDFDocument51 pagesRyerson International Comparison Ofcyber Crime - March2013 PDFIELTSPas encore d'évaluation

- Republic of The Philippine1Document5 pagesRepublic of The Philippine1Gada AbdulcaderPas encore d'évaluation

- Cyber CrimeDocument9 pagesCyber CrimeIELTSPas encore d'évaluation

- A Cyberspace Treaty - A UN Convention or Protocol On Cybersecurity and CybercrimeDocument12 pagesA Cyberspace Treaty - A UN Convention or Protocol On Cybersecurity and CybercrimeInterSecuTechPas encore d'évaluation

- Cyber CrimeDocument9 pagesCyber CrimeIELTSPas encore d'évaluation

- Del Castillo Case - Digest Part 1Document7 pagesDel Castillo Case - Digest Part 1IELTSPas encore d'évaluation

- Anti Piracy, Anti Hijacking, Anti Torture, and Comprehensive Law On FirearmsDocument22 pagesAnti Piracy, Anti Hijacking, Anti Torture, and Comprehensive Law On FirearmsIELTSPas encore d'évaluation

- Insurance Cases 1-7Document20 pagesInsurance Cases 1-7IELTSPas encore d'évaluation

- People of The Philippines vs. Adriano Cabrillas, Benny Cabtalan, G.R. No. 175980, February 15, 2012Document1 pagePeople of The Philippines vs. Adriano Cabrillas, Benny Cabtalan, G.R. No. 175980, February 15, 2012IELTSPas encore d'évaluation

- 09-07 Poli CasesDocument5 pages09-07 Poli CasesIELTSPas encore d'évaluation

- Arson Laws and Case Studies in the PhilippinesDocument15 pagesArson Laws and Case Studies in the PhilippinesIELTS100% (1)

- Rizal On LunaDocument4 pagesRizal On LunaIELTSPas encore d'évaluation

- Del Castillo List of Cases 2013 - January - April - July - OctoberDocument2 pagesDel Castillo List of Cases 2013 - January - April - July - OctoberIELTS100% (1)

- Digests For SPLDocument3 pagesDigests For SPLIELTSPas encore d'évaluation

- MARCOS II vs. CIR (Estate Tax) FactsDocument5 pagesMARCOS II vs. CIR (Estate Tax) FactsIELTSPas encore d'évaluation

- Digests For SPLDocument3 pagesDigests For SPLIELTSPas encore d'évaluation

- Philippine Prosecutor's Office Counter-AffidavitDocument5 pagesPhilippine Prosecutor's Office Counter-AffidavitIELTS0% (2)

- Del Castillo List of Cases 2013 - January - April - July - OctoberDocument2 pagesDel Castillo List of Cases 2013 - January - April - July - OctoberIELTS100% (1)

- MARCOS II vs. CIR (Estate Tax) FactsDocument5 pagesMARCOS II vs. CIR (Estate Tax) FactsIELTSPas encore d'évaluation

- Poster MakingDocument3 pagesPoster MakingIELTSPas encore d'évaluation

- Commercial Law Review - Corp Cases 1 To 6 CompleteDocument9 pagesCommercial Law Review - Corp Cases 1 To 6 CompleteIELTSPas encore d'évaluation

- Human Based ApproachDocument50 pagesHuman Based Approachmikayz30Pas encore d'évaluation

- Crim CasesDocument16 pagesCrim CasesIELTSPas encore d'évaluation

- 4.harmful Effects of Aircraft ExhaustDocument2 pages4.harmful Effects of Aircraft ExhaustIELTSPas encore d'évaluation

- 402-Judgment Minor Rape CaseDocument12 pages402-Judgment Minor Rape CaseLive LawPas encore d'évaluation

- A.C. No. 5581Document5 pagesA.C. No. 5581Jon SantiagoPas encore d'évaluation

- Module 2 - Citizenship TrainingDocument34 pagesModule 2 - Citizenship TrainingPrincess Ivonne Manigo AtilloPas encore d'évaluation

- OCI Grievance Panel Dismisses ComplaintDocument3 pagesOCI Grievance Panel Dismisses Complaintdiona macasaquitPas encore d'évaluation

- An Advocate Vs Bar Council of India and AnrDocument24 pagesAn Advocate Vs Bar Council of India and AnrSantosh PujariPas encore d'évaluation

- Active Assailant, Loss of Attraction and Threat (ALT) : FAQ'sDocument2 pagesActive Assailant, Loss of Attraction and Threat (ALT) : FAQ'sAnalia RodriguezPas encore d'évaluation

- Internship Details - NGOs and Research Organisations - KanooniyatDocument18 pagesInternship Details - NGOs and Research Organisations - Kanooniyatarooshi SambyalPas encore d'évaluation

- Collaboration AgreementDocument6 pagesCollaboration AgreementspliffdawurkPas encore d'évaluation

- EU Customs CooperationDocument8 pagesEU Customs CooperationBoda MariaPas encore d'évaluation

- 15 - (G.R. No. 162230, August 12, 2014)Document18 pages15 - (G.R. No. 162230, August 12, 2014)Lilian FloresPas encore d'évaluation

- 97.2 Inchausti vs. SolerDocument1 page97.2 Inchausti vs. SolerRosh Lepz100% (1)

- SAME SEX MARRIAGE TABOO IN INDIADocument10 pagesSAME SEX MARRIAGE TABOO IN INDIAanushka kashyap100% (1)

- The Role of A Criminal InvestigatorDocument8 pagesThe Role of A Criminal Investigatorapi-325085974Pas encore d'évaluation

- 107 - G.R. No. 200238Document1 page107 - G.R. No. 200238masterlazarusPas encore d'évaluation

- RPD Daily Incident Report 1/29/24Document4 pagesRPD Daily Incident Report 1/29/24inforumdocsPas encore d'évaluation

- DIGEST NatioDnal Spiritual Assembly v. PascualDocument2 pagesDIGEST NatioDnal Spiritual Assembly v. PascualCarlos PobladorPas encore d'évaluation

- Trademark Law An Economic Perspective PDFDocument2 pagesTrademark Law An Economic Perspective PDFKaye Dominique TonoPas encore d'évaluation

- DPNM Rules As of 10-13-18Document54 pagesDPNM Rules As of 10-13-18Stefan SmithPas encore d'évaluation

- DOJ Circular No. 70Document3 pagesDOJ Circular No. 70Sharmen Dizon Gallenero100% (1)

- Marikay Abuzuaiter E-Mail FilesDocument33 pagesMarikay Abuzuaiter E-Mail FilesYESWeeklyPas encore d'évaluation

- Polotan Vs Ca DigestDocument3 pagesPolotan Vs Ca DigestRengie Galo100% (3)

- Lex Communique Moot Court Competition Researcher TestDocument4 pagesLex Communique Moot Court Competition Researcher TestYashdeep LakraPas encore d'évaluation

- Handout Twelve Angry Men VATE Conference 2010Document19 pagesHandout Twelve Angry Men VATE Conference 2010Zoom Zoom Zoom100% (1)

- SULH - Group Asimen 2Document7 pagesSULH - Group Asimen 2Hamizah MuhammadPas encore d'évaluation

- Clark County Jail Pre-Book Sheet: DefendantDocument5 pagesClark County Jail Pre-Book Sheet: DefendantKGW NewsPas encore d'évaluation

- Ho vs. NarcisoDocument3 pagesHo vs. NarcisoRochelle Ann ReyesPas encore d'évaluation

- Adelfa Properties Inc v. Court of AppealsDocument16 pagesAdelfa Properties Inc v. Court of AppealsGlad RonPas encore d'évaluation

- Protection of Trans Rights (Newsletter)Document3 pagesProtection of Trans Rights (Newsletter)Aishwarya PandeyPas encore d'évaluation

- TN LLB Syllabus Book 3 Yrs-11-15Document5 pagesTN LLB Syllabus Book 3 Yrs-11-15HEMALATHA SPas encore d'évaluation

- Sample Thesis Title For Criminology Students in The PhilippinesDocument5 pagesSample Thesis Title For Criminology Students in The Philippinesh0nuvad1sif2100% (1)