Académique Documents

Professionnel Documents

Culture Documents

Of Opportunity: Revenue Window

Transféré par

Mert Barbaros0 évaluation0% ont trouvé ce document utile (0 vote)

69 vues4 pagesThe document discusses how airlines are increasingly generating ancillary revenue through selling additional products and services on their websites beyond just airline tickets. It notes that Ryanair has been particularly successful at this, generating over €360 million or 16.2% of its total revenue from ancillary sales in 2007. The document recommends that all airlines look to implement technologies and prioritize their websites to allow them to better sell ancillary products directly to customers to supplement declining ticket revenues and help manage rising fuel costs. Capturing customers directly on their own websites is seen as key to maximizing ancillary revenue opportunities.

Description originale:

Ancillary Revenues

Titre original

ContentServer.asp

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentThe document discusses how airlines are increasingly generating ancillary revenue through selling additional products and services on their websites beyond just airline tickets. It notes that Ryanair has been particularly successful at this, generating over €360 million or 16.2% of its total revenue from ancillary sales in 2007. The document recommends that all airlines look to implement technologies and prioritize their websites to allow them to better sell ancillary products directly to customers to supplement declining ticket revenues and help manage rising fuel costs. Capturing customers directly on their own websites is seen as key to maximizing ancillary revenue opportunities.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

69 vues4 pagesOf Opportunity: Revenue Window

Transféré par

Mert BarbarosThe document discusses how airlines are increasingly generating ancillary revenue through selling additional products and services on their websites beyond just airline tickets. It notes that Ryanair has been particularly successful at this, generating over €360 million or 16.2% of its total revenue from ancillary sales in 2007. The document recommends that all airlines look to implement technologies and prioritize their websites to allow them to better sell ancillary products directly to customers to supplement declining ticket revenues and help manage rising fuel costs. Capturing customers directly on their own websites is seen as key to maximizing ancillary revenue opportunities.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 4

E-COMMERCE

Revenue Window

of Opportunity

Airlines that arent

selling ancillary products

on their websites are

missing a big payout

By Brian Straus

ay a visit to Ryanair.com and it immediately

will be apparent that it is no ordinary airline website. The large,

flashing reminder that millions of seats are available for just

10with no hidden chargesinvokes the mood of a used car

dealership or a county fair. The bouncing cartoon bunnies on the right draw

attention to the Irish LCCs Easter deals.

atw | APRIL 2008 37

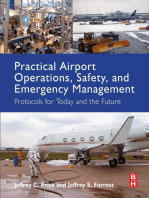

FACT FILE

Airlines Reporting Ancillary

Revenue Results

Most recent full-year period

Airline

Ancillary

Revenue

(Euros,

000)

% of

Total

63,407

4.2

7.35

Aer Lingus

Air Arabia

Euros

Per

Pass.

4,531

3.2

2.57

AirAsia

22,713

6.8

1.62

Air Berlin

58,100

3.7

3.46

Air Deccan

32,745

9.0

4.82

Alaska

134,662

5.8

5.61

Alitalia

49,357

1.0

2.04

Allegiant

21,675

12.8

9.95

Austrian

54,100

2.2

4.99

easyJet

189,477

8.8

5.74

Emirates

23,864

0.6

1.65

Frontier

25,603

3.2

2.55

Korean

55,380

1.0

2.51

LTU

38,000

4.2

7.17

Norwegian 1

12,166

4.1

3.59

362,104

16.2

8.52

3,026

0.1

0.12

SkyEurope

10,827

6.8

4.23

Spanair

47,277

4.0

5.69

Ryanair

SAS

SpiceJet

2,036

1.6

0.78

416,117

3.6

6.00

Vueling 2

33,512

14.2

9.55

WestJet

54,573

4.2

4.89

United

1. Half year. 2. Vueling reported ancillary revenue of

68,612,000. IdeaWorks reduced this by 10 per

passenger which represents an unavoidable booking fee

charged to all passenger segments. Source: IdeaWorks

Sure, you can check an itinerary or

book a fare. For a customer looking

simply to go from Point A to Point B

on the cheap, Ryanair.com is sufficient

and user friendly. But why stop there

when you can avail yourself of so many

more bargains? Supplement your vacation

with a hotel or hostel booking, automobile rental or ski pass. While youre at it,

buy concert or football tickets, arrange for

car insurance, save on your energy bill or

indulge in a bit of online gambling.

Those options have little if anything to

do with commercial air travel, yet they are

just a mouse click away for the 16 million

people who visit Ryanair.com each month,

many of whom wind up buying more

than just an airline ticket. In some cases,

it would be like leaving the bakery with a

loaf of bread and a set of tires.

38 atw | APRIL 2008

Asked what Ryanair wouldnt sell,

Head of Ancillary Revenue Santina

Doherty answers, Anything illegal.

Doherty tells ATW, We recently

launched our car insurance product in

Ireland and to be honest, I was fairly

skeptical about it just because it was really

quite removed from the travel experience. The company, FBD Insurance,

wanted to launch a no-frills offering

and was willing to pay for access to a

sympathetic market. Enter Ryanair.com

and its massive price-sensitive audience,

and in the first six days FBD generated

16,500 insurance quotes. Thus Ryanair

was in a position to make more money

without purchasing a single extra gallon

of fuel or hiring a single new pilot. In

its first fiscal semester ended Sept. 30,

2007, the LCC generated 252 million

in ancillary revenue, a 54% increase over

the year-ago result. In FY07 it reported

362.1 million, which accounted for

16.2% of its total turnover.

Not everyone should do what

theyre doing, says Jay Sorensen, president of a Wisconsin consultancy that

recently released a guide to the global

ancillary revenue scene. His company,

IdeaWorks, estimates that airlines are

generating 1.7 billion in ancillary revenue and that the figure represents just

the tip of the cumulonimbus. Its a brave

new world for carriers, that, according

to Sorensen and several other industry

experts, will find that rising fuel costs

and falling yields will be more manageable hurdles if they are flexible enough to

rethink the way they package and market

their product and savvy enough to implement the right technology.

Certainly there is a continuum on

which no-frills airlines like Ryanair and

traditional full-service carriers must find

their places, but for the most part it seems

clear that the nearly ubiquitous presence

of the Internet and a maturing traveling

public have forged a market in which customers are accustomed to paying more for

extras that formerly were integrated into

the travel experience.

Younger Internet-savvy customers,

who are unfamiliar with a bygone era of

air travel luxuries, happily embrace low

fares and the ability to create customized travel through a-la-carte pricing,

IdeaWorks says, while the Raymond

James investment bank claims, There is

a greater willingness on the part of consumers to pay up for an ancillary offering

than to absorb a base fare increase, which

is particularly relevant in light of the

industrys current fuel challenge.

Ahead of the Curve Once carriers

implement the technology required

to charge for trip-related perks like

checked baggage, onboard catering or

extra legroom, they can put just about

anything else up for sale. Companies

like Amadeus have produced platforms

enabling airlines to restructure and

unbundle their fares or market and take

commissions on products from thirdparty vendors. All drive revenue, allowing carriers to keep fares competitive.

Some, like Ryanair, forward-thinking

legacy Air Canada and US leisure carrier Allegiant Air, are ahead of the curve.

While it is conceded that traditional

network airlines may find it more difficult to abandon the full-service model,

there is no excuse for standing pat considering the current environment. There

are airlines all over the world who habitually ignore economic imperatives. Its

against logic, but it exists, says Sorensen,

who worked for Midwest Airlines before

starting IdeaWorks. And the transition

will be eased by two factors: Suppliers

are responding to the demand for new,

nimble technology and passengers are

beginning to understand the realities of

21st century air travel.

Last summer, IdeaWorks surveyed

airline executives around the globe and

found that the number of assets still

provided free to passengers is significant.

Free online booking was offered by 95%

of respondents, the first piece of checked

baggage was gratis with 92% and assigned

seating was free on 87%. It all represents

unrealized revenue. Sorensen tells a story

of a United Airlines flight he took from

Chicago OHare to Honolulu before

which the gate agent reminded passengers

that they might want to purchase food in

the terminal prior to boarding. Heres an

airline thats trying to practice ancillary

revenue activities and theyre failing in

spite of themselves because theres something wrong with their system thats not

ensuring that theres adequate food available on the flight.

The key can be as simple as priorities. Airlines should consider themselves as an e-commerce company,

says Raphael Bejar, whose Paris-based

firm, Airsavings, has grown from a

group purchasing and consulting concern catering to small and mid-size

carriers into one that now provides an

Internet platform, AirlinePlus, that

can be installed in a matter of weeks

and acts as the basis for an airlines

ancillary activities. SkyEurope Airlines,

Aer Arann and Atlas Blue are among

Airsavings clients.

Carriers can use AirlinePlus to pitch

one-time lounge access, SMS itinerary

notification, gaming, catering and other

ancillary items in addition to what Bejar

calls the big three that the general

public has come to expect from popular

online booking agentshotel rooms,

car rental and trip insurance. The technology already is adaptable to Navitaire,

Lufthansa Systems and SITA and can

boost sales by pitching more appropriate

solutionsa five-star hotel for weekday

business travelers or a three-star option for

weekenders, for example. But an airline

must be able to make those basic trip addons available. Without these, it is nearly

impossible to capture a customer with the

more esoteric ancillaries, he argues.

Key to the Kingdom Capturing that

customer is the key to the ancillary

kingdom. Airlines, especially legacy carriers and those based in the US, slightly

miscalculated the effect that the Internet

revolution would have on revenue

streams. Enamored of the unprecedented reach and penetration of online travel

agencies like Orbitz and Expedia, they

worked to make as much of their content as possible available to those sites.

Much of the traveling public became

accustomed to buying their tickets from

those third-party merchants. Certainly an

Irish motorist looking for an insurance

deal will not find one on priceline.com.

Ancillary revenue opportunities are in

part driven by the extent to which carriers directly control the customer booking

process, which is best managed on an airlines own website, Raymond James says

in its January Growth Airline Outlook,

adding that many third-party reservation

systems simply cannot support the more

advanced options and permutations that

airlines now can offer.

The power of the online travel

agencies has startled the airlines. They

are realizing slowly that we can do

this too, Sorensen says. Ryanair and

Allegiant accumulate ancillary revenue

because their customers buy from

them. The former sells 98% of its tickets through its own website while 87%

of Allegiants customers buy at allegiantair.com, helping it realize $21.53

40 atw | APRIL 2008

in ancillary revenue per passenger in

2007, higher than Ryanair and a 33.6%

year-over-year increase. Its Trip Flex

product, which allows for reservation

changes for $7.50-$10 per segment, has

been especially successful. In this new

ancillary age, it is incumbent on airlines

to make their websites the first destination for any potential traveler.

This is especially true in the US, where

legacy carriers traditionally have relied

on selling miles and/or loyalty program

points to anchor their nonticket revenues

while remaining wary of offending passengers by nickel-and-diming them.

This fear of offending customers is

misplaced . . . and has left margin on

the table for carriers slow to the punch,

Raymond James says. Bejar says an

e-commerce revolution, not consolidation, is the key to fixing the industrys

American ills. They should completely

change their vision, he argues. If you do

not have the Internet tools, you will not

have the right business model.

The network carrier that arguably

has adopted this outlook more enthusiastically than any other is Air Canada,

which received ATWs Market Leadership

Award in 2007 in recognition of its

branded fare program. What Air Canada

has done is frankly amazing, Sorensen

says. Its so advanced that the GDSs

arent there yet.

Working with AC on cementing its

website as a destination is Amadeus,

whose e-Commerce Airline Suite is used

by more than 75 airlines to power in

excess of 250 websites in approximately

80 markets. Half of the worlds top 50

airlines have selected Amadeus to provide

their e-commerce solutions, with 80%

of those outsourcing their user interface

as well as their booking and shopping

engines to the technology giant.

According to Amadeus Global DirectorAirline Direct Channel Philippe Der

Arslanian, AC has developed a set of products that allow us to upsell and still promote

and entice end users to buy more. It even

offers customers the option to reduce their

fare by opting out of certain elements,

which he says is quite unheard of but will

contribute to customer loyalty. IdeaWorks

says that ACs unit revenue has risen 22%

since it launched its branded fares in 2003

and 48% of customers buy up at some

point during the process.

Power Shift They are creating a unique

selling proposition for their own website,

Sorensen says. I believe that is going to

be a trend were going to see more of in

the future, shifting the power away from

the big travel agency sites back to the

main airline sites. Der Arslanian claims

carriers can enhance their sites indispensability through concentrating on

post-sales servicing such as rebooking,

loyalty program or voucher redemption

and any additional opportunities that

only the supplier youve used has the

capacity to do.

Delta Air Lines is another legacy

carrier making an effort and is the

most advanced among the US majors,

Sorensen claims. It has integrated

hotel, car rental and lounge access into

the booking process while taking an

approach entirely consistent with the

airlines reputation for professional

and businesslike product branding

and customer service, according to

IdeaWorks. No bouncing bunnies here,

but if DL is able to sell add-ons to 5%

of those buying tickets on its website,

that will equal more than 1.3 million

customers per year.

Doherty will not apologize for what she

calls her shop window, especially now

that there is more to it than meets the eye.

Ryanair upgraded its Navitaire platform

in February and can offer more ancillary

options throughout the booking process

rather than just at the front or back end.

She affords space on the home page to those

partners who can guarantee the attractive

minimums and says the LCC is looking to

add kiosks with ancillary functionality and

handheld computers to track and expedite

buy-on-board sales of everything from foreign currency vouchers to liquor.

US low-cost counterpart JetBlue

Airways went to a cashless cabin last

November and has recorded robust results:

Project Manager Sam Kline says onboard

revenue doubled in the first week and rose

more than 100% through January.

Although integration of mobile phones

into the reservations, booking and boarding process has been slower to come online

(although it has picked up steam in Japan),

Web-based applications are advancing and

soon will be limited only by an airlines

imagination. Its a very creative environment, Doherty concludes. I can take a

risk on a product and if it doesnt work

it doesnt matter. We can come back. Its

important to keep up a high degree of

activity and keep exploring every avenue.

Its a fantastic advantage when were going

into unfavorable economic times.

Vous aimerez peut-être aussi

- ContentServer - Asp 5Document4 pagesContentServer - Asp 5Mert BarbarosPas encore d'évaluation

- Keeping Airport Costs Down in A Post Pandemic World by Working With AirlinesDocument9 pagesKeeping Airport Costs Down in A Post Pandemic World by Working With AirlinesbirunthamrPas encore d'évaluation

- Biplop Sir AssginmentDocument4 pagesBiplop Sir AssginmentShakil Ahmad 40BPas encore d'évaluation

- 2017 - MAN 301 - Ex 2 - Internal Analysis - Case Study RyanairDocument2 pages2017 - MAN 301 - Ex 2 - Internal Analysis - Case Study RyanairmyenPas encore d'évaluation

- The DeccanDocument11 pagesThe DeccanDev R. DiwakarPas encore d'évaluation

- Airlines: About First ResearchDocument16 pagesAirlines: About First ResearchIza YulizaPas encore d'évaluation

- MBA - C8 Marketing ManagementDocument7 pagesMBA - C8 Marketing ManagementKristen NallanPas encore d'évaluation

- Service Marketing RyanairDocument11 pagesService Marketing Ryanairyesim korkmazPas encore d'évaluation

- Technology Trends That The Airlines and Airports Are Being Focused On AreDocument11 pagesTechnology Trends That The Airlines and Airports Are Being Focused On AreLokesh PalaparthiPas encore d'évaluation

- Business Analysis of RyanairDocument26 pagesBusiness Analysis of RyanairNick StathisPas encore d'évaluation

- ParkSpace CanadaDocument3 pagesParkSpace CanadaChauntry ParkspacePas encore d'évaluation

- Final PPT - Airline 4aprilDocument15 pagesFinal PPT - Airline 4aprilSadanand RamugadePas encore d'évaluation

- AE 413 Research Paper 2 - Dela CruzDocument7 pagesAE 413 Research Paper 2 - Dela CruzDELA CRUZ, Anztronn P.Pas encore d'évaluation

- Case Group 6Document7 pagesCase Group 6Israt ShoshiPas encore d'évaluation

- A La Carte Shopping Is GoodDocument15 pagesA La Carte Shopping Is GoodMaarten HoutzagerPas encore d'évaluation

- Ryanair StrengthsDocument4 pagesRyanair StrengthsEduardo VazquezPas encore d'évaluation

- WK 9-10 Case Study EasyjetDocument4 pagesWK 9-10 Case Study EasyjetSarfaraj OviPas encore d'évaluation

- Press Release 70 Ancillary Revenue Top 10Document7 pagesPress Release 70 Ancillary Revenue Top 10Loren SteffyPas encore d'évaluation

- WestJet Charles ProjectDocument27 pagesWestJet Charles Projectinderdhindsa100% (2)

- Alligiant Airlines AssignmentDocument13 pagesAlligiant Airlines AssignmentImran MalickPas encore d'évaluation

- RyanAir CaseDocument10 pagesRyanAir Casedian ratnasari100% (13)

- Ryanair: European Pioneer of Budget Airline TravelDocument3 pagesRyanair: European Pioneer of Budget Airline TravelPrabal Pratim DasPas encore d'évaluation

- Group Assignment Opm554 ArticleDocument13 pagesGroup Assignment Opm554 ArticleAfiq Najmi RosmanPas encore d'évaluation

- Masters in Business Administration: Cohort: MBEA/09A/PT Year 1 MBA/09A/PT Year 1Document8 pagesMasters in Business Administration: Cohort: MBEA/09A/PT Year 1 MBA/09A/PT Year 1Chamil Suranga SilvaPas encore d'évaluation

- Air TranDocument4 pagesAir TranAmna ZaraPas encore d'évaluation

- SynopsisDocument3 pagesSynopsisto_meet_1085Pas encore d'évaluation

- OneTwoTrip - Flying Smarter - Russia Beyond The HeadlinesDocument3 pagesOneTwoTrip - Flying Smarter - Russia Beyond The HeadlinesKatrinaFetzerPas encore d'évaluation

- Sample Case Study - LOW - COST - STRATEGYDocument11 pagesSample Case Study - LOW - COST - STRATEGYbernie011Pas encore d'évaluation

- BAM Airport Thesis 2020.08 FINALDocument17 pagesBAM Airport Thesis 2020.08 FINALYog MehtaPas encore d'évaluation

- Air Canada's Strenght and WeaknessDocument2 pagesAir Canada's Strenght and Weaknessseymourjermaine31Pas encore d'évaluation

- An Analysis of Traveler NeedDocument11 pagesAn Analysis of Traveler NeedHassan FouadPas encore d'évaluation

- Emirates Paper-Libre PDFDocument9 pagesEmirates Paper-Libre PDFnuwanchanaka9Pas encore d'évaluation

- E Commerce - AirAsiaDocument25 pagesE Commerce - AirAsiakhormm100% (3)

- Easyjet SummaryDocument21 pagesEasyjet SummaryAyesha Kusuma WardhaniPas encore d'évaluation

- News 20: Do Hong Ngoc Diep - Bien Hoa Gifted High-School 1Document1 pageNews 20: Do Hong Ngoc Diep - Bien Hoa Gifted High-School 1Beedle The BardPas encore d'évaluation

- Emirates Airlines StrategyDocument9 pagesEmirates Airlines StrategyAloha Pn100% (1)

- 7 Ps of Ryan Air and Qns For EvaluationDocument6 pages7 Ps of Ryan Air and Qns For EvaluationPrashant VyasPas encore d'évaluation

- EasyJet CaseDocument10 pagesEasyJet CaseJico Bumagat100% (1)

- PMktg-Pg. 290-360-nDocument80 pagesPMktg-Pg. 290-360-nNam anh LêPas encore d'évaluation

- Ryanair Marketing MixDocument3 pagesRyanair Marketing MixAditya D ModakPas encore d'évaluation

- BCD Travel Global Distribution White Paper July 2007Document13 pagesBCD Travel Global Distribution White Paper July 2007Jayant GogtePas encore d'évaluation

- Case EasyJetDocument7 pagesCase EasyJetmaria2908Pas encore d'évaluation

- Air DeccanDocument3 pagesAir DeccanShreya EaswaranPas encore d'évaluation

- Case Study 4: Ryanair and The Revolution in Low-Cost Air TravelDocument3 pagesCase Study 4: Ryanair and The Revolution in Low-Cost Air TravelsuongxuongnuiPas encore d'évaluation

- Marketing - Essay On EASY JETDocument14 pagesMarketing - Essay On EASY JETTalen MutyavaviriPas encore d'évaluation

- Ryanair ReportDocument8 pagesRyanair ReportJulia MariańskaPas encore d'évaluation

- Basic Economy Is EverywhereDocument4 pagesBasic Economy Is EverywhereNiraj SinghPas encore d'évaluation

- Travel AgentsDocument36 pagesTravel AgentsFaizAhmedPas encore d'évaluation

- Q1) Is The Budget Airline Segment An Attractive Place To Compete? Answer 1) Competitive RivalryDocument6 pagesQ1) Is The Budget Airline Segment An Attractive Place To Compete? Answer 1) Competitive RivalryRuchin Dwivedi0% (1)

- Apex Pricing Case LetDocument4 pagesApex Pricing Case LetnmatfeverPas encore d'évaluation

- E-Commerce in Airline BusinessDocument7 pagesE-Commerce in Airline BusinessRomell GandezaPas encore d'évaluation

- Skift MagazineDocument14 pagesSkift MagazineMAV MacalePas encore d'évaluation

- SCM RyanairDocument12 pagesSCM RyanairjuttmoholPas encore d'évaluation

- Micro Economics Assignment - Airline Industry - SanthoshDocument4 pagesMicro Economics Assignment - Airline Industry - SanthoshSanthosh TholpdayPas encore d'évaluation

- Flying Smart: A Handy Guide for the New Airline TravellerD'EverandFlying Smart: A Handy Guide for the New Airline TravellerPas encore d'évaluation

- The Evolution of Yield Management in the Airline Industry: Origins to the Last FrontierD'EverandThe Evolution of Yield Management in the Airline Industry: Origins to the Last FrontierPas encore d'évaluation

- Cruising to Profits, Volume 1: Transformational Strategies for Sustained Airline ProfitabilityD'EverandCruising to Profits, Volume 1: Transformational Strategies for Sustained Airline ProfitabilityPas encore d'évaluation

- Practical Airport Operations, Safety, and Emergency Management: Protocols for Today and the FutureD'EverandPractical Airport Operations, Safety, and Emergency Management: Protocols for Today and the FutureÉvaluation : 4 sur 5 étoiles4/5 (5)

- Mobile Apps Are Everywhere : Except in The Insurance IndustryDocument6 pagesMobile Apps Are Everywhere : Except in The Insurance IndustryMert BarbarosPas encore d'évaluation

- Journal of Air Transport Management: John F. O 'Connell, David Warnock-SmithDocument10 pagesJournal of Air Transport Management: John F. O 'Connell, David Warnock-SmithMert BarbarosPas encore d'évaluation

- ContentServer - Asp 2Document2 pagesContentServer - Asp 2Mert BarbarosPas encore d'évaluation

- Energy Policy: Johanna L. Mathieu, Mark E.H. Dyson, Duncan S. CallawayDocument12 pagesEnergy Policy: Johanna L. Mathieu, Mark E.H. Dyson, Duncan S. CallawayMert BarbarosPas encore d'évaluation

- European Journal of Operational Research: Fredrik Ødegaard, John G. WilsonDocument14 pagesEuropean Journal of Operational Research: Fredrik Ødegaard, John G. WilsonMert BarbarosPas encore d'évaluation

- Pilot'S Operating Handbook AND Faa Approved Airplane Flight ManualDocument128 pagesPilot'S Operating Handbook AND Faa Approved Airplane Flight ManualHonorio Perez MPas encore d'évaluation

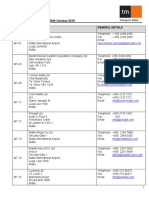

- Alliance Air Routing For 12-05-2021Document1 pageAlliance Air Routing For 12-05-2021S KPas encore d'évaluation

- China RVSMDocument8 pagesChina RVSMtjminionPas encore d'évaluation

- BRFTXT Ga305 11 Mei 2023Document26 pagesBRFTXT Ga305 11 Mei 2023surabaya garudaindonesiaPas encore d'évaluation

- Aircraft - SpecSheetDetails - AT72-1025 - 27jun2021 r1Document11 pagesAircraft - SpecSheetDetails - AT72-1025 - 27jun2021 r1Heder NietoPas encore d'évaluation

- Robinson R66: General CharacteristicsDocument5 pagesRobinson R66: General CharacteristicsSuresh KumarsskPas encore d'évaluation

- Attachment - 1547469143499100001 - Attach - 1 - 1547469143499100001 - MR Rohit Bakshi X 2 BOM-DEL PDFDocument1 pageAttachment - 1547469143499100001 - Attach - 1 - 1547469143499100001 - MR Rohit Bakshi X 2 BOM-DEL PDFAnkur SharmaPas encore d'évaluation

- List of AOC Holders As at 251019 - MALTADocument5 pagesList of AOC Holders As at 251019 - MALTARICARDO SILVA100% (1)

- In, Out and Around Hamilton: Walsh@Matamata - Be Prepared Airstrips Gadgets in The VFR CockpitDocument28 pagesIn, Out and Around Hamilton: Walsh@Matamata - Be Prepared Airstrips Gadgets in The VFR CockpitdarrenPas encore d'évaluation

- As365-Ec155-Sa365 2021-03-06Document7 pagesAs365-Ec155-Sa365 2021-03-06chiri003Pas encore d'évaluation

- Gulf Air RoutesDocument4 pagesGulf Air RoutesMLR123Pas encore d'évaluation

- Safo 138Document36 pagesSafo 138Panos ThalassisPas encore d'évaluation

- Ad 2005-13-16Document10 pagesAd 2005-13-16Lu SaPas encore d'évaluation

- Eurocontrol KM PDFDocument2 pagesEurocontrol KM PDFKathyPas encore d'évaluation

- 2015 PPL Workbook v2Document28 pages2015 PPL Workbook v2NeethPas encore d'évaluation

- Sport Aviation Jun-1975Document116 pagesSport Aviation Jun-1975laerciofilho100% (1)

- Aircraft Operating Cost ReportDocument20 pagesAircraft Operating Cost ReportFrank Lamparski100% (3)

- Tech - Quiz - Test 747Document5 pagesTech - Quiz - Test 747MEZZAROBBAPas encore d'évaluation

- CPDLC Latency Timer MOLDocument11 pagesCPDLC Latency Timer MOLepjoycePas encore d'évaluation

- 1 New MessageDocument1 page1 New Messagenm9x2w9ts4Pas encore d'évaluation

- Airbus Safety First Magazine 03 PDFDocument20 pagesAirbus Safety First Magazine 03 PDFhjhjhhPas encore d'évaluation

- ISAGO Checklist - Headquarters: GOSM Edition 8 - Effective April, 2019Document25 pagesISAGO Checklist - Headquarters: GOSM Edition 8 - Effective April, 2019Mary Nelly Julio DiazPas encore d'évaluation

- Proiect Initial Training 2011 EUROCONTROLDocument302 pagesProiect Initial Training 2011 EUROCONTROLTraian Brad0% (1)

- 3.3 Unsolved MysteryDocument7 pages3.3 Unsolved MysteryCansın NazPas encore d'évaluation

- Analysis of EasyJet and Indian Low Cost Airlines StrategiesDocument14 pagesAnalysis of EasyJet and Indian Low Cost Airlines StrategiesNitika MishraPas encore d'évaluation

- Ata 100Document109 pagesAta 100KeilaeFrancisco ArcePas encore d'évaluation

- SBKP/VCP Campinas, Brazil: .Rnav - SidDocument1 pageSBKP/VCP Campinas, Brazil: .Rnav - Sidjoiko ukukl8kuPas encore d'évaluation

- Eurocontrol Think Paper 10 Perfect Green FlightDocument12 pagesEurocontrol Think Paper 10 Perfect Green FlightNeo PilPas encore d'évaluation

- (F 16「戰隼」(Fighting.falcon)戰鬥機圖冊) .F16.C D.avionics.checklistDocument7 pages(F 16「戰隼」(Fighting.falcon)戰鬥機圖冊) .F16.C D.avionics.checklistCasper TsayPas encore d'évaluation

- DCS L-39 Flight Manual EN PDFDocument295 pagesDCS L-39 Flight Manual EN PDFChristian De LeónPas encore d'évaluation