Académique Documents

Professionnel Documents

Culture Documents

RMO NO. 14-2016 - Digest PDF

Transféré par

Jesús Lapuz0 évaluation0% ont trouvé ce document utile (0 vote)

39 vues1 pageTitre original

RMO NO. 14-2016_digest copy.pdf

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

39 vues1 pageRMO NO. 14-2016 - Digest PDF

Transféré par

Jesús LapuzDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

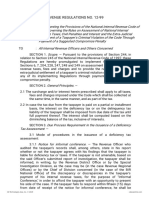

REVENUE MEMORANDUM ORDER NO.

14-2016 issued on April 18, 2016 revises the

guidelines for the execution of waivers from the defense of prescription pursuant to Section 222

of the National Internal Revenue Code (NIRC) of 1997, as amended.

The waiver may be, but not necessarily, in the form prescribed by Revenue Memorandum

Order No. 20-90 or Revenue Delegation Authority Order No. 05-01. The taxpayer's failure to

follow the aforesaid forms does not invalidate the executed waiver for as long as the following are

complied with:

a) The Waiver of the Statute of Limitations under Section 222 (b) and (d) shall be

executed before the expiration of the period to assess or to collect taxes. The date of

execution shall be specifically indicated in the waiver.

b) The waiver shall be signed by the taxpayer himself or his duly authorized

representative. ln the case of a corporation, the waiver must be signed by any of its

responsible officials;

c) The expiry date of the period agreed upon to assess/collect the tax after the regular

three-year period of prescription should be indicated.

Except for waiver of collection of taxes which shall indicate the particular taxes assessed,

the waiver need not specify the particular taxes to be assessed nor the amount thereof, and it may

simply state "all internal revenue taxes" considering that during the assessment stage, the

Commissioner of Internal Revenue (CIR) or her duly authorized representative is still in the

process of examining and determining the tax liability of the taxpayer.

The taxpayer is charged with the burden of ensuring that the waivers of statute of limitation

are validly executed by its authorized representative. The authority of the taxpayer's representative

who participated in the conduct of audit or investigation shall not be thereafter contested to

invalidate the waiver. The waiver may be notarized. However, it is sufficient that the waiver is in

writing as specifically provided by the NIRC, as amended. The waiver shall take legal effect and

be binding on the taxpayer upon its execution thereof.

lt shall be the duty of the taxpayer to submit its duly executed waiver to the CIR or officials

previously designated in existing issuances or the concerned revenue district officer or group

supervisor as designated in the Letter of Authority/Memorandum of Assignment who shall then

indicate acceptance by signing the same. Such waiver shall be executed and duly accepted prior

to the expiration of the period to assess or to collect. The taxpayer shall have the duty to retain a

copy of the accepted waiver.

The two (2) material dates that need to be present on the waiver are the date of execution

of the waiver by the taxpayer or its authorized representative; and the expiry date of the period the

taxpayer waives the statute of limitations. Before the expiration of the period set on the previously

executed waiver, the period earlier set may be extended by subsequent written waiver made in

accordance with this Order.

Vous aimerez peut-être aussi

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeD'Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeÉvaluation : 1 sur 5 étoiles1/5 (1)

- Taxpayer's RemediesDocument5 pagesTaxpayer's RemediesCel TanPas encore d'évaluation

- Bir Waiver of Defense of PrescriptionDocument3 pagesBir Waiver of Defense of PrescriptionCha Ancheta CabigasPas encore d'évaluation

- Tax 2 Finals (Remedies To Cta)Document27 pagesTax 2 Finals (Remedies To Cta)heureux690Pas encore d'évaluation

- Bar Review Companion: Taxation: Anvil Law Books Series, #4D'EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Pas encore d'évaluation

- (Evidence) (Torralba v. People) (Bernardo)Document5 pages(Evidence) (Torralba v. People) (Bernardo)thethebigblackbookPas encore d'évaluation

- A. Assessment B. Collection: Remedies of The GovernmentDocument10 pagesA. Assessment B. Collection: Remedies of The GovernmentGianna CantoriaPas encore d'évaluation

- Rmo 20-90Document2 pagesRmo 20-90cmv mendoza100% (3)

- Collection and Recovery of TaxDocument6 pagesCollection and Recovery of Taxs4sahith100% (1)

- CIR vs. Systems Technology InstituteDocument2 pagesCIR vs. Systems Technology InstituteMaria100% (3)

- Tax 01-Lesson 02 - Tax RemediesDocument42 pagesTax 01-Lesson 02 - Tax RemediesShannise Dayne Chua0% (1)

- 2017 Syllabus Transportation Law OutlineDocument12 pages2017 Syllabus Transportation Law OutlineJesús Lapuz100% (1)

- 2017 Syllabus Transportation Law OutlineDocument12 pages2017 Syllabus Transportation Law OutlineJesús Lapuz100% (1)

- RR 12-99Document16 pagesRR 12-99doraemoanPas encore d'évaluation

- Remedies of The TaxpayerDocument4 pagesRemedies of The TaxpayerAngelyn Sanjorjo50% (2)

- Tax Remedies Chapter 2 ReportDocument69 pagesTax Remedies Chapter 2 ReportVinz G. VizPas encore d'évaluation

- Notes and Digest Art. VIIIDocument57 pagesNotes and Digest Art. VIIIJesús LapuzPas encore d'évaluation

- Notes and Digest Art. VIIIDocument57 pagesNotes and Digest Art. VIIIJesús LapuzPas encore d'évaluation

- Assessment and Audit Under GSTDocument19 pagesAssessment and Audit Under GSTSONICK THUKKANIPas encore d'évaluation

- Pilipinas Shell Petroleum Corporation vs. Commissioner of Internal Revenue, 541 SCRA 316, December 21, 2007Document6 pagesPilipinas Shell Petroleum Corporation vs. Commissioner of Internal Revenue, 541 SCRA 316, December 21, 2007idolbondocPas encore d'évaluation

- CHAPTER 3 Dissolution and Winding UpDocument47 pagesCHAPTER 3 Dissolution and Winding UpJesús Lapuz50% (2)

- Partnership and Agency Digests For Atty. CochingyanDocument28 pagesPartnership and Agency Digests For Atty. CochingyanEman Santos100% (3)

- Tax RemediesDocument10 pagesTax RemediesBryan CatungalPas encore d'évaluation

- RR 12-99 Full TextDocument5 pagesRR 12-99 Full TextErmawoo100% (2)

- Tax RemediesDocument8 pagesTax RemediesJade BelenPas encore d'évaluation

- 1040 Exam Prep Module XI: Circular 230 and AMTD'Everand1040 Exam Prep Module XI: Circular 230 and AMTÉvaluation : 1 sur 5 étoiles1/5 (1)

- Tax Doctrines in Dimaampao CasesDocument3 pagesTax Doctrines in Dimaampao CasesDiane UyPas encore d'évaluation

- NOTES and Cases Digest - Art. VIDocument82 pagesNOTES and Cases Digest - Art. VIJesús LapuzPas encore d'évaluation

- Tax Remedies Lecture1aDocument7 pagesTax Remedies Lecture1acmv mendozaPas encore d'évaluation

- RR No. 18-2013 (Digest)Document3 pagesRR No. 18-2013 (Digest)Alisa FitzpatrickPas encore d'évaluation

- 1 Syllabus - NIRC Remedies (1st Sem 18-19)Document13 pages1 Syllabus - NIRC Remedies (1st Sem 18-19)Zyki Zamora Lacdao100% (3)

- Module 6 Tax Remedies ReviewerDocument11 pagesModule 6 Tax Remedies ReviewerburgerpattygirlPas encore d'évaluation

- Bir Waiver of Defense of PrescriptionDocument3 pagesBir Waiver of Defense of PrescriptionCha Ancheta Cabigas0% (1)

- Waiver of Statute of LimitationDocument2 pagesWaiver of Statute of LimitationJerome Delos ReyesPas encore d'évaluation

- Philippine Journalists, Inc. vs. CIRDocument3 pagesPhilippine Journalists, Inc. vs. CIRCourtney TirolPas encore d'évaluation

- RR 2-98 Section 2.57 (B) - CWTDocument3 pagesRR 2-98 Section 2.57 (B) - CWTZenaida LatorrePas encore d'évaluation

- Revenue Memorandum Order No. 014-16: April 4, 2016 April 4, 2016Document2 pagesRevenue Memorandum Order No. 014-16: April 4, 2016 April 4, 2016Milane Anne CunananPas encore d'évaluation

- ALO WAIVER-finalDocument14 pagesALO WAIVER-finalJasper Alon100% (1)

- RR 5-2000 & 14-2011 ISSUANCE OF TCCs 2020 iBOOK VersionDocument5 pagesRR 5-2000 & 14-2011 ISSUANCE OF TCCs 2020 iBOOK VersionQuinciano MorilloPas encore d'évaluation

- Tax Remedies: Arellano University School of LawDocument5 pagesTax Remedies: Arellano University School of LawviviviolettePas encore d'évaluation

- RM 20-90Document1 pageRM 20-90CaliPas encore d'évaluation

- 6.summary of Significant CTA Cases (August 2009)Document18 pages6.summary of Significant CTA Cases (August 2009)Castanos LyndonPas encore d'évaluation

- Tax RemediesDocument6 pagesTax RemediesJollibee Bida BidaPas encore d'évaluation

- Assessment & AuditDocument18 pagesAssessment & AuditNishant GulianiPas encore d'évaluation

- Assessment & AuditDocument24 pagesAssessment & Audit9punitagrawalPas encore d'évaluation

- Labor LawDocument29 pagesLabor LawmissyaliPas encore d'évaluation

- 2Document2 pages2maePas encore d'évaluation

- Assessment and Audit: After Reading This Chapter, You Shall Be Equipped ToDocument19 pagesAssessment and Audit: After Reading This Chapter, You Shall Be Equipped ToAnkitaPas encore d'évaluation

- Required Before The BIR May Audit The Records of The Taxpayer? Letter of Authority (LOA)Document6 pagesRequired Before The BIR May Audit The Records of The Taxpayer? Letter of Authority (LOA)Jade CoritanaPas encore d'évaluation

- Revenue Regulations No. 12-99: September 6, 1999Document16 pagesRevenue Regulations No. 12-99: September 6, 1999I.G. Mingo MulaPas encore d'évaluation

- Unit 2 - Collection and Recovery of TaxDocument9 pagesUnit 2 - Collection and Recovery of TaxRakhi Dhamija100% (1)

- Provision Related To Advance Payment of TaxDocument8 pagesProvision Related To Advance Payment of TaxBISHWAJIT DEBNATHPas encore d'évaluation

- Notes in Taxation IIDocument6 pagesNotes in Taxation IIJoe BuenoPas encore d'évaluation

- LifeBlood - Assessment Process Tax 2Document17 pagesLifeBlood - Assessment Process Tax 2Monjid AbpiPas encore d'évaluation

- Section 2.57.4 of RR No. 2-98Document2 pagesSection 2.57.4 of RR No. 2-98fatmaaleahPas encore d'évaluation

- Taxation NotesDocument40 pagesTaxation NotesFelixberto Jr. BaisPas encore d'évaluation

- Rev. Regs. 12-99Document21 pagesRev. Regs. 12-99Phoebe SpaurekPas encore d'évaluation

- Bir RR 12-99Document21 pagesBir RR 12-99Isaac Joshua AganonPas encore d'évaluation

- RMC 47-2019Document2 pagesRMC 47-2019RichardPas encore d'évaluation

- Guidelines and Instructions For BIR Form No. 0619-F (Monthly Remittance Form of Final Income Taxes WithheldDocument1 pageGuidelines and Instructions For BIR Form No. 0619-F (Monthly Remittance Form of Final Income Taxes WithheldMark Joseph BajaPas encore d'évaluation

- Last Minute Notes in Tax RemediesDocument10 pagesLast Minute Notes in Tax RemediesJake MendozaPas encore d'évaluation

- Tax CaseDocument6 pagesTax CaseAlvy Faith Pel-eyPas encore d'évaluation

- Refunds Under IT ActDocument6 pagesRefunds Under IT ActRuhul AminPas encore d'évaluation

- Dof Department Order No. 023-01Document2 pagesDof Department Order No. 023-01Ralph Ronald CatipayPas encore d'évaluation

- BIR Revenue Memorandum Order No. 56-2016Document6 pagesBIR Revenue Memorandum Order No. 56-2016PortCalls100% (2)

- Guidelines and Procedures in The Change of Accounting Period JFD 03.17.11Document2 pagesGuidelines and Procedures in The Change of Accounting Period JFD 03.17.11Aemie JordanPas encore d'évaluation

- Sei - ItrDocument36 pagesSei - ItrMiguel CasimPas encore d'évaluation

- Senate Bill Position PaperDocument1 pageSenate Bill Position PaperAw LapuzPas encore d'évaluation

- AOI v.2Document9 pagesAOI v.2Jesús LapuzPas encore d'évaluation

- Election LawsDocument22 pagesElection LawsJesús LapuzPas encore d'évaluation

- Cases Digests Art. III Sec. 4-15Document79 pagesCases Digests Art. III Sec. 4-15Jesús LapuzPas encore d'évaluation

- Treasurers Affidavit v.2Document1 pageTreasurers Affidavit v.2Jesús LapuzPas encore d'évaluation

- Legal Opinion - Club Intramuros Investment CommitteeDocument3 pagesLegal Opinion - Club Intramuros Investment CommitteeJesús LapuzPas encore d'évaluation

- Notes and Cases Digest Art. XIDocument31 pagesNotes and Cases Digest Art. XIJesús LapuzPas encore d'évaluation

- Class Schedule Constitutional Law Review 2017Document2 pagesClass Schedule Constitutional Law Review 2017Jesús LapuzPas encore d'évaluation

- Notes and Cases Digest Art. IXDocument68 pagesNotes and Cases Digest Art. IXJesús LapuzPas encore d'évaluation

- Article III Bill of Rights: Enrile v. SalazarDocument8 pagesArticle III Bill of Rights: Enrile v. SalazarJesús LapuzPas encore d'évaluation

- Class Schedule Constitutional Law Review 2017Document2 pagesClass Schedule Constitutional Law Review 2017Jesús LapuzPas encore d'évaluation

- Consti Death Art Vi 16-28Document38 pagesConsti Death Art Vi 16-28Jesús LapuzPas encore d'évaluation

- Section 16: Avelino Vs Cuenco FactsDocument14 pagesSection 16: Avelino Vs Cuenco FactsJesús LapuzPas encore d'évaluation

- Yup DeliverableDocument7 pagesYup DeliverableJesús LapuzPas encore d'évaluation

- 'Documents - Tips - Evidence Goni V CaDocument4 pages'Documents - Tips - Evidence Goni V CaJesús LapuzPas encore d'évaluation

- 1.abuse of Right To PrivacyCases 1-5Document7 pages1.abuse of Right To PrivacyCases 1-5Jesús LapuzPas encore d'évaluation

- Europe Trip 2017 ItineraryDocument4 pagesEurope Trip 2017 ItineraryJesús LapuzPas encore d'évaluation

- BALANEDocument2 pagesBALANEJesús LapuzPas encore d'évaluation

- Policy PaperDocument3 pagesPolicy PaperJesús LapuzPas encore d'évaluation

- Evidence Digests Vi and ViiDocument20 pagesEvidence Digests Vi and ViiJesús LapuzPas encore d'évaluation

- Take Home Exam (Odds)Document5 pagesTake Home Exam (Odds)Jesús LapuzPas encore d'évaluation

- Clemente Calde vs. The Court of Appeals G.R. No. 93980 June 27, 1994 FactsDocument54 pagesClemente Calde vs. The Court of Appeals G.R. No. 93980 June 27, 1994 FactsJesús LapuzPas encore d'évaluation