Académique Documents

Professionnel Documents

Culture Documents

Debt Market in India

Transféré par

Basavaraju K RCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Debt Market in India

Transféré par

Basavaraju K RDroits d'auteur :

Formats disponibles

Debt market in india

Introduction

Debt market deals with those securities which yield fixed income group . The debt

market is any market situation where trading debt instruments take place . Examples of

debt instruments include mortgages, promissory notes, bonds, and Certificates of

Deposit A debt market establishes a structured environment where these types of debt

can be traded with ease between interested parties.

It issues fixed income financial instruments of various types and facilitates

trading thereafter .

Reduction in the borrowing cost of the Gov. and enable mobilization of

resources at a reasonable cost .

Provide greater funding avenues to public sector and private sectors projects

and reduce the pressure on institutional financing .

Enhanced mobilization of resources by unlocking illiquid retail investment like

gold .

Assist in the development of a reliable yield curve .

The debt market often goes by other names, based on the types of debt

instruments that are traded .

In the event that the market deals mainly with the trading of corporate bond

issues, the debt market may be known as a bond market .

If mortgages and notes are the main focus of the trading, the debt market may

be known as a credit market .

When fixed rates are connected with the debt instruments, the market may be

known as a fixed income market .

Features of Debt Market

1. It is competitive in nature , as number of participants is large

2. Strong and safe market , as gov. securities are traded

3. Substantially low transaction cost relative to equity & money market

4. Volume of transaction is huge , relative to equity market

5. Heterogeneous in nature , as a result of different types of participants

Participants Involved

Prominently Government , Primary dealers , Mutual Fund Firms , Provident Fund

Houses , Foreign Institutional Investors , Commercial Banks , Insurance Companies and

charitable Institutions are the participants of debt market

www.BankExamsToday.Com

Page 1

Debt market in india

Regulatory Bodies

As debt market trade both government and corporate debt instruments , we have

following two regulators

1. RBI : It regulates and also facilitates the government bonds and other securities

on behalf of governments

2. SEBI : It regulates corporate bonds , both PSU (Public sector undertaking) and

private sector .

Link with money market

1. For a strong debt market the prerequisite is a strong money market

2. If debt is long term requirement , then money market serves as short term

requirement

3. For liquidity purpose also money market is needed along with debt market

1. Primary market

Primary market is that market where the debt instruments are issued for the first

time . which can be issued as follows A. Public prospectus : invites public to buy

B. Private placement : Invites few selected individuals , as the cost of public

issuing is quite a large

C. Rights issue : to the already exciting members , but they can refer to their

beneficiaries in case of unwillingness to buy

However , the issuer has to inform the exchanges in case of issuing debts . to

notify the investors , about associated risk changes

2. Secondary market

Secondary market is where the debt instruments can be traded . it can take place

by the following two ways based on the characteristics of the investors and the

structure of the market are :

A. Wholesale debt market segment of NSE & Over the counter of BSE :

Where the investors are mostly Banks , Financial Institutions , RBI , Primary

dealers , Insurance companies , Provident Funds , MFs , Corporates and FIIs .

B. Retail debt Market : involves participation by individual investors , small

trusts and other legal entities in addition to the wholesale investors classes .

www.BankExamsToday.Com

Page 2

Debt market in india

Types of debt Instruments

1. Government Securities

It is the Reserve Bank of India that issues Government Securities or GSecs on behalf of the Government of India.

These securities have a maturity period of 1 to 30 years. G-Secs offer

fixed interest rate, where interests are payable semi-annually.

For shorter term, there are Treasury Bills or T-Bills, which are issued by

the RBI for 91 days, 182 days and 364 days

2. Corporate Bonds

These bonds come from PSUs and private corporations and are offered

for an extensive range of tenures up to 15 years.

Comparing to Government Securities , corporate bonds carry higher

risks, which depend upon the corporation, the industry where the

corporation is currently operating, the current market conditions, and the

rating of the corporation

3. Certificate of Deposit

Certificate of Deposits (CDs), which usually offer higher returns than

Bank term deposits, are issued in Demat form

Banks can offer CDs which have maturity between 7 days and 1 year.

CDs from financial institutions have maturity between 1 and 3 years

4. Commercial Papers There are short term securities with maturity of 7 to 365 days.

Structured Debt

Structured debt is some type of debt instrument that the lender has

created and adapted to fit the needs and circumstances of the borrower .

A debt package of this type usually includes one or more incentives that

encourage the debtor to do business with the lender, rather than seeking

to develop a working relationship with other lenders.

www.BankExamsToday.Com

Page 3

Debt market in india

While the overall structure of the debt is adapted to the needs of the

borrower, the terms also benefit the lender in the long term.

The main goal of structured debt is to create a debt situation that

provides the debtor with as many benefits as possible, while also

keeping the overall debt load as low as possible

At the same time, the lender receives an equitable return for the

structured debt arrangement

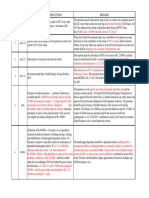

Simply understand the types of Debt Instruments by using chart

Types

Government Securities

Public sectors bonds

Private sector bonds

www.BankExamsToday.Com

Issuers

Central Government :

State Government :

Government agencies ,

statutory bodies , public

sector undertakings

Corporates :

1.

2.

3.

4.

5.

Instruments

Zero Coupon bonds

Coupon bearing bonds

Treasury bills

Floating rate bonds

STRIPs

1. Coupon bearing bond

1. Debentures

2. Government

guaranteed

bonds

3. Commercial papers

4. PSU bonds

1. Debentures

2. Commercial papers

3. Fixed floating rate

4. Zero coupon bonds

5. Inter-corporate deposits

Bank :

1. Certificate of debentures

2. Debentures

3. Bonds

Financial Institutions :

1. Certificate of deposits

2. Bonds

Page 4

Debt market in india

www.BankExamsToday.Com

Page 5

Vous aimerez peut-être aussi

- Laws Regulating Mergers and Acquisition in IndiaDocument19 pagesLaws Regulating Mergers and Acquisition in IndiakumarchamPas encore d'évaluation

- ITMO Multiple Choice QuestionsDocument30 pagesITMO Multiple Choice QuestionsDebraj Das100% (1)

- Borrower-In-Custody Program GuidelinesDocument16 pagesBorrower-In-Custody Program GuidelinesMichael FociaPas encore d'évaluation

- Alternative InvestmentsDocument62 pagesAlternative Investmentsdimplle parmaniPas encore d'évaluation

- Ceili Sample Questions Set 2Document26 pagesCeili Sample Questions Set 2jsdawson67% (3)

- Merrill LynchDocument95 pagesMerrill LynchPrajval SomaniPas encore d'évaluation

- Depository Final ProjectDocument44 pagesDepository Final ProjectShweta Sawant100% (1)

- Income From Other SourcesDocument9 pagesIncome From Other Sourcesrajsab20061093Pas encore d'évaluation

- Mutual Funds NotesDocument6 pagesMutual Funds Notes✬ SHANZA MALIK ✬100% (2)

- Analysis of Indian Debt MarketDocument45 pagesAnalysis of Indian Debt Marketmichelle_susan_dsa100% (1)

- Indirect Tax and GSTDocument124 pagesIndirect Tax and GSTPrasanna KumarPas encore d'évaluation

- Types of SharesDocument9 pagesTypes of SharesArnav bharadiaPas encore d'évaluation

- Operating System MCQ BankDocument21 pagesOperating System MCQ BankSandesh Ks86% (7)

- Chapter 31 Reporting To ManagementDocument6 pagesChapter 31 Reporting To ManagementaamritaaPas encore d'évaluation

- Impact of Repo Rate Hike on Bank LendingDocument54 pagesImpact of Repo Rate Hike on Bank LendingJITENDRA VISHWAKARMAPas encore d'évaluation

- NBL Credit Management Internship ReportDocument65 pagesNBL Credit Management Internship ReportShamsuddin Ahmed43% (7)

- M&A in Retail amid COVIDDocument5 pagesM&A in Retail amid COVIDanon_200519719Pas encore d'évaluation

- Mergers and Acquisition and Treatments To IPR Project (8th Semester)Document15 pagesMergers and Acquisition and Treatments To IPR Project (8th Semester)raj vardhan agarwalPas encore d'évaluation

- Competition Act 2002Document72 pagesCompetition Act 2002Vishwas KumarPas encore d'évaluation

- Registration and Supervision of NBFCsDocument23 pagesRegistration and Supervision of NBFCsAnjnaKandariPas encore d'évaluation

- Tax Structure in IndiaDocument37 pagesTax Structure in IndiaShiva Kumar BandaruPas encore d'évaluation

- Project Report - Merger, Amalgamation, TakeoverDocument18 pagesProject Report - Merger, Amalgamation, TakeoverRohan kedia0% (1)

- Competition Law ProjectDocument11 pagesCompetition Law Projectprithvi yadavPas encore d'évaluation

- Abhuday Investment and Securities Law ProjectDocument14 pagesAbhuday Investment and Securities Law ProjectRahul TiwariPas encore d'évaluation

- 1 Chapter 5 Internal Reconstruction PDFDocument22 pages1 Chapter 5 Internal Reconstruction PDFAbhiramPas encore d'évaluation

- Dissertation On Debt Securities Market in IndiaDocument103 pagesDissertation On Debt Securities Market in Indiaumesh kumar sahu0% (2)

- Brief Study On History and Development of Insurance in IndiaDocument46 pagesBrief Study On History and Development of Insurance in IndiaSpeedie recordsPas encore d'évaluation

- Role of institutional investors in improving Indian corporate governanceDocument47 pagesRole of institutional investors in improving Indian corporate governanceSaritaMeenaPas encore d'évaluation

- Kotak SecuritiesDocument99 pagesKotak Securitiesfun_magPas encore d'évaluation

- Merger and Amalgamation of Banks in IndiaDocument17 pagesMerger and Amalgamation of Banks in IndiaravianandcnluPas encore d'évaluation

- Anti-Dumping Duties: An Assignment OnDocument24 pagesAnti-Dumping Duties: An Assignment OnAshish pariharPas encore d'évaluation

- Companies ActDocument45 pagesCompanies ActJanavi KalekarPas encore d'évaluation

- (C) NBFC - NotesDocument30 pages(C) NBFC - NotesBarkhaPas encore d'évaluation

- Forms of Amalgamation AccountingDocument35 pagesForms of Amalgamation AccountingKaran VyasPas encore d'évaluation

- Innovative Financial ServicesDocument9 pagesInnovative Financial ServicesShubham GuptaPas encore d'évaluation

- Corporate Disclosure and Investor ProtectionDocument19 pagesCorporate Disclosure and Investor ProtectionPaavni Sharma50% (2)

- Roles and Function of RbiDocument15 pagesRoles and Function of RbiCharu LataPas encore d'évaluation

- Capital Market Vs Money Market: Key DifferencesDocument23 pagesCapital Market Vs Money Market: Key Differencessaurabh kumarPas encore d'évaluation

- Corporate & Project FinanceDocument11 pagesCorporate & Project FinanceAshish SinghPas encore d'évaluation

- Corporate Social Responsibility in IndiaDocument24 pagesCorporate Social Responsibility in IndiaHarman PreetPas encore d'évaluation

- CURRENT PRICING OF IPOs: Is It Investor-Friendly?Document53 pagesCURRENT PRICING OF IPOs: Is It Investor-Friendly?Sayam RoyPas encore d'évaluation

- Indian Depository ReceiptsDocument16 pagesIndian Depository Receipts777priyanka100% (1)

- DepositoryDocument29 pagesDepositoryChirag VaghelaPas encore d'évaluation

- Case Study On Insider TradingDocument2 pagesCase Study On Insider TradingAyushi Singh100% (2)

- Types of SharesDocument3 pagesTypes of SharespatsjitPas encore d'évaluation

- The Sick Unit & Case Study NICCO BATTERIESDocument18 pagesThe Sick Unit & Case Study NICCO BATTERIESabhinav75% (4)

- CCI - Car Parts CaseDocument13 pagesCCI - Car Parts Caseirajiv100% (1)

- Winding Up of A CompanyDocument16 pagesWinding Up of A CompanysanamahewishPas encore d'évaluation

- Introduction - SEBI Takeover CodeDocument7 pagesIntroduction - SEBI Takeover CodeSHUBHANGI DIXITPas encore d'évaluation

- Procedures of Mergers and Acquisition in IndiaDocument10 pagesProcedures of Mergers and Acquisition in IndiaVignesh KymalPas encore d'évaluation

- Independent DirectorDocument54 pagesIndependent DirectorAbhishek RaiPas encore d'évaluation

- Indian Capital MarketDocument35 pagesIndian Capital MarketVivek Rai100% (1)

- Public Issue Management: Roles of Merchant BankersDocument5 pagesPublic Issue Management: Roles of Merchant Bankersvijay_fca4718Pas encore d'évaluation

- Group3 Working Capital Management at Tata SteelDocument19 pagesGroup3 Working Capital Management at Tata SteelKamlesh TripathiPas encore d'évaluation

- Comparison of Tax Structure of India and ChinaDocument20 pagesComparison of Tax Structure of India and ChinaManali RanaPas encore d'évaluation

- Project On Money MarketDocument40 pagesProject On Money Marketrahul dhuriPas encore d'évaluation

- Business Law - Competition LawDocument16 pagesBusiness Law - Competition LawJaspreet ChandiPas encore d'évaluation

- Legal & Regulatory Framework of M&ADocument7 pagesLegal & Regulatory Framework of M&AabdullahshamimPas encore d'évaluation

- Made By: Akshay VirkarDocument19 pagesMade By: Akshay Virkarakshay virkarPas encore d'évaluation

- RBI Role as India's Central BankDocument6 pagesRBI Role as India's Central Bankabhiarora07Pas encore d'évaluation

- Insurance Regulatory and Development ActDocument13 pagesInsurance Regulatory and Development ActSai VasudevanPas encore d'évaluation

- SEBI Takeover Code - UpdatedDocument24 pagesSEBI Takeover Code - UpdatedSagarPas encore d'évaluation

- Fund Based ActivitiesDocument35 pagesFund Based Activitiesyaminipawar509100% (3)

- Balance of PaymentDocument4 pagesBalance of PaymentAMALA APas encore d'évaluation

- Going for Broke: Insolvency Tools to Support Cross-Border Asset Recovery in Corruption CasesD'EverandGoing for Broke: Insolvency Tools to Support Cross-Border Asset Recovery in Corruption CasesPas encore d'évaluation

- DraftDocument54 pagesDraftkajalPas encore d'évaluation

- History and Overview of Debt MarketDocument6 pagesHistory and Overview of Debt MarketPRATIK SHETTYPas encore d'évaluation

- Debt Market: Unit 5 Bms MarketingDocument25 pagesDebt Market: Unit 5 Bms MarketingSuccess ForumPas encore d'évaluation

- Debt MarketsDocument46 pagesDebt MarketsDiv KabraPas encore d'évaluation

- Cpo 2017 Asked Words (WWW - Qmaths.in)Document11 pagesCpo 2017 Asked Words (WWW - Qmaths.in)Rakesh Kumar SaranPas encore d'évaluation

- Social Issues in IndiaDocument18 pagesSocial Issues in IndiaBasavaraju K RPas encore d'évaluation

- E-Commerce Syllabus and FrameworkDocument91 pagesE-Commerce Syllabus and Frameworkpavanjammula100% (5)

- Deficit FinancingDocument2 pagesDeficit FinancingBasavaraju K RPas encore d'évaluation

- MS Access MCQ BankDocument24 pagesMS Access MCQ BankBasavaraju K RPas encore d'évaluation

- Consumer Proctection Act 1986Document20 pagesConsumer Proctection Act 1986Basavaraju K RPas encore d'évaluation

- Basic Computer Knowledge-GK Toady PDFDocument36 pagesBasic Computer Knowledge-GK Toady PDFBasavaraju K RPas encore d'évaluation

- The Agency ProblemDocument2 pagesThe Agency ProblemBasavaraju K RPas encore d'évaluation

- Notes Fileextentions PDFDocument3 pagesNotes Fileextentions PDFSelvaraj VillyPas encore d'évaluation

- Business EnvironmentDocument18 pagesBusiness EnvironmentBasavaraju K RPas encore d'évaluation

- Environment Protection Act of 1986Document18 pagesEnvironment Protection Act of 1986Basavaraju K RPas encore d'évaluation

- Regional ImbalanceDocument20 pagesRegional Imbalancesujeet_kumar_nandan7984100% (8)

- Epa 1986Document2 pagesEpa 1986Basavaraju K RPas encore d'évaluation

- Responsible For Regional Imbalances in IndiaDocument4 pagesResponsible For Regional Imbalances in IndiaBasavaraju K RPas encore d'évaluation

- IPRL&PDocument265 pagesIPRL&PRomit Raja SrivastavaPas encore d'évaluation

- Https WWW - Tin-Nsdl - Com Download Pan Form49ADocument9 pagesHttps WWW - Tin-Nsdl - Com Download Pan Form49Ashivangkumar83Pas encore d'évaluation

- Ema Ge Berk CF 2GE SG 23Document12 pagesEma Ge Berk CF 2GE SG 23Sascha SaschaPas encore d'évaluation

- Value Engineering & Its BenefitsDocument2 pagesValue Engineering & Its BenefitsBasavaraju K RPas encore d'évaluation

- TRAI RegulationsDocument2 pagesTRAI RegulationsBasavaraju K RPas encore d'évaluation

- Sarfaesi Act 2002Document3 pagesSarfaesi Act 2002Basavaraju K RPas encore d'évaluation

- Nature of Deduction in Income TaxDocument4 pagesNature of Deduction in Income TaxBasavaraju K RPas encore d'évaluation

- 8th BRICS Summit 2016 - at A GlanceDocument3 pages8th BRICS Summit 2016 - at A GlanceBasavaraju K RPas encore d'évaluation

- RailBudgetSpeech 2016-17 HighlightsDocument8 pagesRailBudgetSpeech 2016-17 HighlightsFirstpostPas encore d'évaluation

- Classification of Taxes in IndiaDocument2 pagesClassification of Taxes in IndiaBasavaraju K RPas encore d'évaluation

- Group C Non Technical Posts DT 05-10-2016Document49 pagesGroup C Non Technical Posts DT 05-10-2016Basavaraju K R100% (6)

- Value Analysis PDFDocument32 pagesValue Analysis PDFBasavaraju K RPas encore d'évaluation

- Investment Operations Certificate (IOC) Key Features and BenefitsDocument2 pagesInvestment Operations Certificate (IOC) Key Features and BenefitsPrabjyoth NairPas encore d'évaluation

- AIF Benchmarking - FAQsDocument10 pagesAIF Benchmarking - FAQsHarishPas encore d'évaluation

- WM Group C09-C15 (Mutual Funds)Document21 pagesWM Group C09-C15 (Mutual Funds)Prince JoshiPas encore d'évaluation

- Abfm CH 25 Full PDF (No Video) - 19592914 - 2023 - 06 - 05 - 21 - 50Document31 pagesAbfm CH 25 Full PDF (No Video) - 19592914 - 2023 - 06 - 05 - 21 - 50gurugulab8876Pas encore d'évaluation

- Fraud in The Micro-Capital Markets Including Penny Stock FraudDocument559 pagesFraud in The Micro-Capital Markets Including Penny Stock FraudScribd Government DocsPas encore d'évaluation

- Standardised Approach To Valuation of Investment Portfolio of Alternative Investment Funds (AIFs)Document4 pagesStandardised Approach To Valuation of Investment Portfolio of Alternative Investment Funds (AIFs)Ishani MukherjeePas encore d'évaluation

- PPTDocument15 pagesPPTNeha DuaPas encore d'évaluation

- Dodd-Frank Rating Information Disclosure Form: RatingsDocument19 pagesDodd-Frank Rating Information Disclosure Form: RatingsTara SinhaPas encore d'évaluation

- Old Companies Ordinance Cap 32 PDFDocument392 pagesOld Companies Ordinance Cap 32 PDFSinoPas encore d'évaluation

- PT Bank Central Asia TBK: Credit Profile Financial HighlightsDocument1 pagePT Bank Central Asia TBK: Credit Profile Financial HighlightsAz ChePas encore d'évaluation

- Charles P. Jones, Investments: Analysis and Management, Tenth Edition, John Wiley & Sons Prepared by G.D. Koppenhaver, Iowa State UniversityDocument8 pagesCharles P. Jones, Investments: Analysis and Management, Tenth Edition, John Wiley & Sons Prepared by G.D. Koppenhaver, Iowa State UniversityFebria NathaniaPas encore d'évaluation

- Mutual Funds: Kaushik Raja Pondicherry University - MBADocument40 pagesMutual Funds: Kaushik Raja Pondicherry University - MBApalak2407Pas encore d'évaluation

- Unit 10 SECP (Complete)Document21 pagesUnit 10 SECP (Complete)Zaheer Ahmed SwatiPas encore d'évaluation

- SEC Opinion 4-28-1997Document2 pagesSEC Opinion 4-28-1997Nash Ortiz LuisPas encore d'évaluation

- JANA PetSmart LetterDocument5 pagesJANA PetSmart Lettermarketfolly.com100% (1)

- Infographic FIN346 Chapter 2Document2 pagesInfographic FIN346 Chapter 2AmaninaYusriPas encore d'évaluation

- IRDAI (Investments) Master Circular Regulations 2016 6.3 (A) Exhaustive List of Category Codes - Annexure 1Document5 pagesIRDAI (Investments) Master Circular Regulations 2016 6.3 (A) Exhaustive List of Category Codes - Annexure 1Puran Singh LabanaPas encore d'évaluation

- Swift Foods, Inc. Operations and Financial OverviewDocument10 pagesSwift Foods, Inc. Operations and Financial OverviewMydel AvelinoPas encore d'évaluation

- Finman ReviewerDocument6 pagesFinman ReviewerALYANA LINOG100% (1)

- FCW Invest Perf 0716Document3 pagesFCW Invest Perf 0716vlady_2009Pas encore d'évaluation

- SecuritisationDocument74 pagesSecuritisationrohitpatil699Pas encore d'évaluation

- Provides credit ratings and analyzes organizations' credit riskDocument10 pagesProvides credit ratings and analyzes organizations' credit riskSwathi AshokPas encore d'évaluation

- Initial Public Offering (IPO)Document15 pagesInitial Public Offering (IPO)ackyriotsxPas encore d'évaluation