Académique Documents

Professionnel Documents

Culture Documents

FinMan Cases PDF

Transféré par

queene0 évaluation0% ont trouvé ce document utile (0 vote)

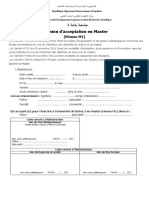

4 vues10 pagesTitre original

FinMan Cases.pdf

Copyright

© © All Rights Reserved

Formats disponibles

PDF ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

4 vues10 pagesFinMan Cases PDF

Transféré par

queeneDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 10

‘k. Five banks offer nominal rates of 6% on deposits; but A pays interest annually,

B pays semiannually, C pays quarterly D pays monthly, and E pays daily.

(1). What effective annual rate does each bank pay? If you deposit $5,000 in

teach bank today, how much will you have atthe end of | year? 2 years?

(@) fall ofthe banks are insured by the government (ihe FDIC) and thus are

equally risky, will they be equally ableto attract funds? Ifnot (and the TVM

is the only consideration), what nominal rate will cause all ofthe banks to

provide the same effective annual rate as Bank A?

‘Suppose you don't have the $5,000 but need itat the end of 1 year. You plan

tomakea series of doposits—annually for A, semiannually for B quarterly

for C, monthly for D, and daily for ¥—with payments beginning today.

‘How lange must the payments be o each bank?

@)_Even ifthe five banks provided the same effective annual rate, would a

tational investor be indifferent between the banks? Explain,

«Suppose you borrow $15,000. The loan’s annual interest rate is 8%, and it re-

quires four equal end-of-year payments, Set up an amortization schedule that

shows the annual payments, interest payments, principal repayments, and be-

ginning and ending loan balances,

ee

| Wa company’s sles are growing arate of 20% annually how Jong will take sles to double?”

What's the difference between an -annwity and an annuity due? What ity is showen here?

i aed

: ° 1

° 3100

(©) Whats the future value of «3s $100 oinary arnt if he annual inorest at 10%?

(2) Whatis ts present value? :

(@) What would the farue and present values be fit was an annuity dus?

A5-year $100 ordinary annuity has an annual interest rate of 10%,

() Whatis its present vaine? eee

(@) What would the present value be if twas 10-year annuity?

{@) Whatwould the present value be ifewasa 25-year amaity?

(&) What would the presen value be ithis was aperpetity?

‘Azo-yenroldstaent wanls to save 8 day forex ttsrent Ever) day she PASS Poe

Aaa eet of each year she invests the accumulated saving (1.095) In = brokerage

fcount with an expected annual return of 12%,

{hf shekaepesaving in thismannes how much wil sheave aecurulated > 955 6?

(©) Ika dt-yearld nestor bogan saving ip His manner Pew much would he TENE ot

age ss?

(9) Mow nuach would the s0-yearoldinesioe have tosawe ach year i accurisie De sae

lantount at 65 a5 the 20-yeai-old investor? :

‘What isthe present value ofthe following uneven cash

810%

‘ow stream? The annual interes ate

is 3 4 Years

100 $200 $300 $50

emaller if ye compound an initial ameunt more often

holding the stated (nominal) tate constant)? Why?

(0) the periodic rate, and (c) the effective

(i) te ar yale tiger ot

than sally (eg, semana,

(2) Deine the sta rote oF oma le

nal te EAR OF)

Gy aie te EAR coespending tos norte of Th compounded seniel?

Wa ed quaneiyicompounded daly?

ae pee vue of $00 ater 8 yirs nde 10% sna compounding?

‘poeny compound?

hail Be EAR coil tenons (gute) att

rip aah end of Yur fre ling on fw atu tt

iat ey Ge Youn ene Bae eat ho oh we 29

aly? ink Yo compound be cah fos nv)

o

bodinary annuity or use

° 2 4 6 Periods

° $100 $100 $100

(@) Whatis the PV? Z

(3) What would be wrong with your answer oFartsi0) and) you wed he nom

ro ee red BAK of the periodic ro yquy/2 = 10%)? = SM, to Solve the prob-

10

ems?

‘ne (1), Construct an amortization schedule fo

* installments.

(@) What isthe annual interest expens

‘the lender during Year 2

151,000, 10% annual interest Joan with three ental

1 for the borrower and the annual interest income for

391

integrated Case

Yoshikawa Components Company

1224

BASICS OF CAPITALBUDGETING You recently went to work for Yoshikawa Components Company-a supplier of

aro epaie parts used inthe aftermarket with products from Nissan, Honda, Suara and other automakers, Your

Fe cite financial officer (CFO), has just handed you the estimated cash flows'fr two proposed projets

Project Linvolves adding a new ifem tothe fens ignition system line it would take some time fo bud up the

ravket for this produc, so the cash inflows would increase over ime. Projec’S involves an add-on #0 an existing

Than ad ie cach Bows would decrease over time. Both projects have 3-year lives because Yoshikawa is planning,

fo introduce entirely new modelsafter 3 years.

“Here ar the projects’ net cash flows (in thousands of dollars)

Project —$100 S10 $60 $80

Projects ~5100 570 350 $20

Depreciation, salvege values, net working capital requirements, and tax eflecs are al nchuded in these cash

Bows.

"The CYO also made subjective risk assensrients of each project, and he conchuded that both projects have risk

“characteristics that ane similar to the fem’s average project -Yoshikawa's WACC is 10%. You must determine

{whether one or both of the projects should be accepted.

TMinut ic capital budgeting? Are there any similarities between a fins capital budgeting decisions and an

‘individual's investment decisions?

‘be. Whats the difference between independent and mutually extlusive projects? Between projects with normal

‘and nonnormal cash flows?

GG) Define the tem net presen ealue (NPV). What is each project's NPV?

{@). Whatis therationale behind the NPV method? According to NPV, whieh project() should be accepted if

they are independent? mutually exclusive?

(2) Would the NPVs changeifthe WACC changed? Explain.

4. (1). Dene the term internal rte of rus ARR). What i each projec’ TR?

(2) How isthe IRR on a project related tothe YTM on a bond?

{@)_ What is the lopic behind the IRR method? According fo IRR, which project(s) should be accepted if hey

areindependent? mutually exclusive?

(@) Would the projects’ IRRs change ithe WACC changed?

e. (@) Draw NPV profiles for Projects Land 8. At what discount rate do the profiles cms?

(2). Look at your NPY pile graph without referring othe actual NPVs and IRRs, Which projets) should

te accepted ff they are independent? mutually exclusive? Explain, Are your answers comtst at any

WACC less than 23.63?

Je (2). Whatis the underlying cause of ranking conflicts between NPV and IRR?

@)_ Whats the einvestment rate assumption, and how does affect the NPY versus IRR confit?

(©). Which method is best” Why?

fe!) Define the term modfed IR (MIRA) Find the MIR for Projects Land

() What are the MIRR's advantages and disadvantages vis®-vis the NPV?

th. (1). Whatis the payback period? Find the paybacks for Projects Land.

{@)_ Whatisthe rationale forthe payback method? According tothe payback eteron, which project) should

Te Nepted if the fiem’s maniuon soceptable payback is 2 years, if Projects Land § are indepencienf

Projects [and Saxe mutually exclusive?

‘uth tternational School and Colleges

392

(3) What is the difference between the regular and discounted payback methods?

(4) What ae the two min did vantages of discounted payback? Is the paybeck method of any real useful

ness in capital budgeting decisions? Explain,

‘sa separate project Project the frm Is considering sponsoring a pavilion atthe upcoming World’ Fait

‘The pavilion would cost $500,000, and itis expected to result $5 milion of incremental eash inflows during

its | year of operation. However itrould then take anther year, and $5 milion of costs, © demolish the ste

and renien st fois original condition, Thus, Project Ps expected net cashflows look ike this (in millions of

olla)

°

ee

soa $50 =$50

‘The projects estimated tobe of average risk, s0 its WACC is 10%.

(1) Whatis Project P's NPV? What ists IRR? ils MIRR?_

@)_Dravr Project P's NPV profile, Does Project P have normal or nonnormal cashflows? Should this project

be accepted? Explain.

10° |

Hil Integrated Case

Morton Handley & Company

eat

INTEREST RATE DETERMINATION Masia Juarez is professional tennis player, and your frm manages her

money, She has asked you to give her information about what determines the level of various interest rates.

‘Your boss has prepared some questions for yout to consider

‘4, What are the four most fundamental factor tet affect the eost of money or the general level of interest

ates, in the economy?

bi. What ethereal rskcfime ate of interest (*) andthe nominal

rmessured?

«Define the terms inflation promi (UP), fal isk prem (DRE, Lit promi (LP) ond maturity isk

premio CMRE). Which ofthese premiuins is incided in determining the interest rate on (1) short-lerm

UTS ‘reauny securities, 2) longterm US. Teasuiy secures, (3) shor-term corporate securities and (S)

qongterm corporate securities? Explain how the premiums would vary overtime and among the different

securities sted.

44. Whatis the term structure of interest rates? What isa yield curve?

fe. Suppose most investors expect the inflation rate tobe next year, 6% the following eat, and 8% there

for The rel ssk-free rate 3%. The maturity risk premium is zero for bonds that mature 1 year or less

fn 0.1% for 2-year bonds hen the MRD increases by 04% per year thereafter fr 20 years, aftr which it

instal, Wha i the interest rte on 1-10, and 20-year Treasury bonds? Draw a yield curve with these

data What factors can explain why is constructed yield curve is upwact-loping?

£Atany given time, how would the yield carve facing a AAA rated company compare with the yield carve

for US Treasury secites? At any given time, how would the yield curve facing » BBaec company

compare wth the yield eave for US, Tessury secures? Draw a graph oillustraie your answer

fg. Whatis the pure expectations theory? What does the pure expectations theory imply about the term struc

ture of interest ates?

res rate (7) How are these two rates

1h. Suppose you observe the following term structure for Treasury securities:

Maturity _ Yel

‘year 50%

2 yeas 62

Syears 6a

‘years 65

Sears 65

“Assume that the pure expectations theory of the term structure is correct. (This implies that you ean use

the yield curve provided to “back out” the markets expectations about future interest rtes,) What does

the market expect willbe the interest rate on I-year securities | year from now? What does the market

‘expect will be the interest rate on 3-year securities 2 years from now?

148

a. Derivative transactions are designed to increase risk and are used almost exclu

sively by speculators who are looking to capture high returns,

1. Hedge funds typically have large minimum investments and are marketed to

institutions and individuals with high net worths.

©. Hedge funds have traditionally been highly regulated.

The New York Stock Exchange is an example of a stock exchange that has a

physical location.

“2. Allargerbid-ask spread means that the dealer will realize a lower profit

£. The efficient markets hypothesis assumes that all investors are rational

Hil Integrated Case

‘Smyth Barry & Company

15-13. FINANCIAL MARKETS AND INSTITUTIONS Assume that you recenly graduated with a degree in finance

and have just reported to worl as an investment adviser atthe brokerage frm of Smyth Barry & Co. Your

first assignment is to explain the nature of the US. financial markets to Michelle Varga, a professional

‘tennis player who recently cams tothe United States fram Mexico, Varga is a highly ranked tennis player

‘who expects fo invest substantial amounts of money through Smyth Barry. She is very bright therefore,

she would like to understand in general terms what will happen to her money. Your boss has developed

the following questions that you must use to explain the U.S. financial aystom to Varga

‘What are the three primary ways in which capital is transferred between savers and borrowers? De-

seribe each one.

1b. What isa market? Differentiate between the following types of markets: physical asset markets versus

financial asset markets, spot markets versus futures markels, money markets versus capital markets,

‘primary markets verss secondary markets, and public markets versus private markets,

¢ Why are financial markets essential for a healthy economy and economic growth?

‘d._ What are derivatives? Hovr ean derivatives be used to reduce risk? Can derivatives be used to increase

risk? plain

‘e.Briefly describe each ofthe following financial institutions: commercial banks, investment banks, mu=

bial fund, hedge funds, and private equity companies.

{. What are the two leading stock mackets? Describe the two basic types of tock markets,

If Apple Computer decided to issue addltional common stock and Varga purchased 100 shares of this

stock from Smyth Barry, the underwrite, would this transaction be a primary or a secondary market

‘ransaction? Would it makea difference if Varga purchased previously outstanding Apple stock in the

dealer market? Explain,

1h. What is an intial public offering (PO)?

‘What doesit mean fora market to beeificent? Explain why somestock prices may be more efficient thant

others.

j, After your consultation with Michelle, she asks to discuss these two scenarios with you:

(1) While in the walting room of your ofice, she overheard an analyst on a fitancial TV network say

that a particular medical research company just received FDA approval for one of its products.

(On the basis of this “hot” information, Michelle wants to buy many shares of that company’s

stock, Assuming the stock market is highly efficient, what advice woald you give her?

(@). Shehas read a number of newspaper articles about a huge IPO being carried out by a leading.

‘technology company, She wants to get as many shares in the IPO as possible and would even be

‘willing to buy the sharos in the open market iewmediately after the issue, What advice do you

hhaveforher?

921

‘Western Money Management Inc, -

4. Ifthe yield to maturity for each bond remains at 9% what will be the price of

tach bond 1 year from now? What is the expected capital gains yield for each

bond? What is the expected total return for each bond?

Mr. Clarkis considering another bond, Bond D. Ithas an 8% semiannual coupon

‘and a $1,000 face value (ie, it pays a $40 coupon every 6 months). Bond D is

‘scheduled to mature in 9 years and has a price of $1,150. Its also callable in 5

years ata call price of $1,040.

(1) Whatis the bond’s nominal yield to maturity?

(@) What is the bond's nominal yield to call?

@)_ IMs. Clark were to purchase this bond, would he be more likely to receive

the yield to maturity of yield to call? Explain your answer.

£ Explain briefly the difference between interest rate (or price) risk and reinvest-

‘ment rte risk Which ofthe following bonds has the most intrest rate risk?

‘© AS.year bond with a9% annual coupon

+ AS.yearbond with a zero coupon

+ A.10-year bond with a 9% armual coupon.

+ A.10-yea bond with a zero coupon

5. Only do this part if you are using a spreadsheet. Calculate the price of each

‘bond (A, B,and ©) at the end of each year until maturity, assuming interest rates

remain constant. Create a graph showing the time path of each bond's value

similar to Figure 9-2

(2) Whatis the expected interest yield for each bond in each year?

(2). Whatis the expected capital gains yield foreach bond in each year?

(@)_ Whatis the total return foreach bond in exch year?

BOND VALUATION Robert Black and Carol Alvarez are vice presidents of Wester Money Management and

‘codirecors ofthe company’s pension fund management division, A major new client, the California League

‘of Cites, has requested that Wester present an investment seminar to the mayors ofthe represented cites.

Back a Alvarez ho ill make he presentation ave asked yout help them by answering the following

questions. ogous:

a. What area bond's key features?

b. Wat rel proviso and ekg find proviso? Do te provlons mak onde mae oa

sky?

‘How isthe value of any asst whose value is based on expected future each lows determined?

4. How is abond’s value determined? What is the value ofa 10-year, $1,009 par value bond with a 10% an-

‘ual coupon if ts required retum is 109?

© (1). What's the value ofa 13% coupon bond that i otherwise identical to the bond described in Part d?

‘Would we now have a discount ora premium bond?

(©) Whalis the value ofa 7% coupon bond with these characteristics? Would we now havea discount or

premiumbond?

(©) What would happen tothe values of the 7%, 10%, and 13% coupon bonds over tine Ifthe requires

‘return remained at 10%? [Hint: With a francial ealculator, enter PMT, I/YR. FV, and N; then change

(overtide) N to see what happens tothe PV as it approaches maturity]

299

(@)_ What isthe yield to maturity on a 10-year, 9%, annual coupon, $1,000 par value bond that ses for $887.02

that sells for $1,134.20? What does the fact that it sells at a discount or at a premium tell you about the

lationship between r, and the coupon rate?

@ _Whatare the total return, the current yield, and the capital gains yleld forthe discount bond? Assume that

itis held to maturity and the company does not defaulton it. (Lint: Refer io Footnote 10 for the definition

‘of the current yield and to Table S-1)

What is interest rate (or price) risk? Which has more interest rate risk, an annual payment J-year bond or

‘10-year bond? Why?

What is reimoestment rte risk? Which has more reinvestment rale risk, L-yeat bond ora 10-year bond?

How does the equation for valuing a bond change if semiannual payments are made? Find the value of a

A0-yeas, semiannual payment, 10% coupon bond if nominal t= 13%

Suppose for $1000 you could buy a 10%, 10-year, annval payment bond ora 10%, 10-year semiannwal payment

bond. They are equally risky. Which would you prefer? If $1,000 ie the proper price for the semiannual bond,

‘what isthe equllbrium price forthe annual paytnent bond?

Suppose a 10-year 10%, semiannual coupon bond with a par value of $1,000 is currently selling for $1,350,

producing a nominal yield to maturity of 8%, However, it can be called after 4 years lor $1050.

(1) What isthe bond's nominal yield to call (PTC)?

@) Ifyou bought this bond, would you be more likely to eam the YTM or the YTC? Why?

‘Does the yield to maturity represent the promised or expected return on the boned? Explain

‘Theso bonds were rated AA- by S&P, Would you aonsider them investment-grade or junk bonds?

What factors determine a company’s bond rating?

1 this frm were to default on the bonds, would the company be immadiately liquidated? Would the bond

holders be assured of receiving all of theis promised payments? Explain.

S

=

=

ke

Sales for 2008 were $455,150,000, and EBITDA was 15% of sales, Further-

‘more, depreciation and amortization were 11% of net fixed assets, interest was

$8,575,000, the corporate tax rate was 40%, and Sinotronies pays 40% ofits net

{income in dividends. Given this information, construct the firm's 2008 income

statement

Construct the statement of stockholders’ equity for the year ending December

31, 2008, and the 2008 statement of cash flows

Calculate the 2007 and 2008 net working capital and 2008 free cash flow:

If Sinotronics increased its dividend payout ratio, what effect would this have

‘on corporate taxes paid? What effect would this have on taxes paid by the com

pany’s shareholders?

Wil Integrated Case

Everelite Technology Co., Ltd., Part I

2-14 FINANCIALSTATEMENTS At the end of 2008, Robert Su--MBA graduate from the Hong Kong University of Science

and Technology—~is asked by his uncle, Frank u, the Chairman of Everclite Technology Co., Lid ts help Kim feview

the company’s financial status, Eereite Technology was established in May 1994, and is one ofthe mast succes

IT solution providers of software and services. Itwon the 2004 MIS Best Choice award duet ite competencies the

provision of workstations and servers high-speed network and related peripheral equipment, computer software,

‘as well as consullation and maintenance services.

Evereit also provides corporate data center elated produc and services, including:

high speed network and telecommunications equipment sich as Intemet traffic management solutions;

information security software and hardware such as frewalls and S50 (single sign on) systems;

storage equipment, workstations, and servers for data computing:

telecommunications application software such as e-mails, blogs, CIMS (computerintegrated mam

solutions), ERP (enterprise resource planning) solutions, as well as data warehouse and mining solutions,

remote backup solutions for data recovery, and

application software management solutions for data management,

‘The information industry refers to those companies engeged in value-added services on information eystems,

and/or software applications. There ar three main business categories: products, projects, and servlees, The new

‘e-business model has boosted the growth ofthe information industry in market size in receot years

Being aleadinge-business solutions provider Everalite'smain businessliesin te projectoand seevicescalegories

‘The demand for information services comes mainly from the finance industry, the manufacturing industry, an the

government. Besides having a lange pool of human resources to provide service to cients, Everebive also trades

‘computer hardware. In 2008, with the economic recession and the restrcturing ofthe finance industry the demand

for IT services from the finance industry was low. The electronics manufacturing industry had also slashed thelt

IT budgets substantially, All these facors contribute the decrease in revenue for the information industry in

2008, In 2009, the market demand is forecasted to incease de to the further growth of wideband services, Sew

evelopment of elearning services, and the increasing popularity of online games, Prandal institutions are aloo

‘expecied fo increase their budgets on system integration in 2009

Robert began by gathering the financial statements and other data given in Tables IC 21 and IC 2-2. Assume

that you are Robert's assistant You must help him answer the following questions for Frank.

3. What i the impact of the 2008 market recession on Everelie's assets, labiliie, and saler?

[verelit’s EBIT became smaller in 2008. By jus using the income statements, can you provide the reasons?

What caused Everelie's total assets to increase in 2008?

‘What financing sources dic Everlite use to support its total assets! expansion?

Everlite’s current assets account for a large part of the firm's total assets. Did Everlite support its current

assets mainly from short-term financing or long-term financing?

vere’ long-ierm debs are much mow than equity Whats the impact of this condition onthe company?

Peer

2007

Aes

cash $ 208323 $ 102024

Accounts receivable 690294 820979

‘ventories 942374 sata

Total current assets Siege = Seaaai7

Gross fixed assets 317,503, 232.179

Less aceurulated deprecation 5405, 34187

Netfixed assets sea | 5 197

‘Total assets 52,1045

Liabilities and Equity

Short-term borrowings 5 286,149

‘Accounts payable aiagtt

Accruals 103,362

Total currentliabities 5 e141

Long-term debt ‘410769 372931

CCormmen stock (100,000 shares) 550,000, 550.000,

Retained esmings an8i6 103,358

‘otal equity Fees — § 653356

‘Total liabilities and equity 52108489

a9 SBA

Re ence cud

ic se ae Ne 2008

Sales 52325967

Cast of goods sold 1.869325

‘Other expenses 287563

“Total operating costs excluding depreciation and amortization $2,138,989

Depreciation and amortization 25,363

sir Fas

Inerest expense 31a

esr 52193

Taxes (40%) . 44a77

Netincome sa3i6

es sos7

Ps $1.00

Book value pershare $662

Stock price $1560

‘Shares oustanding 100,000

Taxrate 40%

2007

$2,220,607

1655827

23870

Hia9697

26341

Fes

13,802

50767

40307,

Sis0,A60

$150

sia

$653

$2180

100,000

40%

Vous aimerez peut-être aussi

- Stage 2022 ADDAXDocument2 pagesStage 2022 ADDAXDenis nchouwatPas encore d'évaluation

- Livret Etudiant 2018-2019 PDFDocument15 pagesLivret Etudiant 2018-2019 PDFMagor Gueye100% (2)

- Demande de Reconnaissance Master-DESS PDFDocument2 pagesDemande de Reconnaissance Master-DESS PDFAbdoul k DialloPas encore d'évaluation

- رتسام Master: Objectifs de la formationDocument1 pageرتسام Master: Objectifs de la formationAbdlilah MaPas encore d'évaluation

- Pré-Inscription en Doctorat Des Candidats Non Salariés Au Titre de L'année Universitaire 2021-2022Document1 pagePré-Inscription en Doctorat Des Candidats Non Salariés Au Titre de L'année Universitaire 2021-2022Soukaina IdlhajaliPas encore d'évaluation

- 2020-2021 PlaquetteDocument1 page2020-2021 Plaquettewafa928Pas encore d'évaluation

- Tableau Bourse D'excellence 22-23 FRDocument1 pageTableau Bourse D'excellence 22-23 FRtamba vieux tolnoPas encore d'évaluation

- Modalites Selection Master 2020-2021 V8Document4 pagesModalites Selection Master 2020-2021 V8Hamza ABBASSIPas encore d'évaluation

- Dates Pour Inscription Aux Universités Du Canada Pour Étrangers 2Document1 pageDates Pour Inscription Aux Universités Du Canada Pour Étrangers 2Albert KintePas encore d'évaluation

- Calendrier Pédagogique Année Universitaire 2023-2024 Semestres PairsDocument1 pageCalendrier Pédagogique Année Universitaire 2023-2024 Semestres PairsBOUANANE AbdelkrimPas encore d'évaluation

- Candidature DoctoratDocument1 pageCandidature Doctoratomm berPas encore d'évaluation

- Politique Bourse CEA 2ieDocument8 pagesPolitique Bourse CEA 2ieBenjamin Vivien KetohouPas encore d'évaluation

- Dossier MasterDocument4 pagesDossier MasterLucien PavardPas encore d'évaluation

- Charte Des Theses 22-07-09Document4 pagesCharte Des Theses 22-07-09adilbihPas encore d'évaluation

- L Mi IaeDocument2 pagesL Mi IaeOrionPas encore d'évaluation

- Calendrier Academique - 2021 - 2022 - Universite de Yaounde I 1Document5 pagesCalendrier Academique - 2021 - 2022 - Universite de Yaounde I 1Kiss DanielPas encore d'évaluation

- Equivalences Entre Les Systemes Deducation Tunisien Et QuebecoisDocument1 pageEquivalences Entre Les Systemes Deducation Tunisien Et QuebecoisGhassen ben saidPas encore d'évaluation

- Master Diffusion Culture - WebDocument2 pagesMaster Diffusion Culture - WebViannisoPas encore d'évaluation

- 2020.11.13 Anexa 1 - Formular Mae-MecDocument4 pages2020.11.13 Anexa 1 - Formular Mae-MecÁryan AdrixPas encore d'évaluation

- Fiche Candidature M1Document1 pageFiche Candidature M1Bibliothèque Al-itkanPas encore d'évaluation

- 2020 - International - Nantes Saint-Nazaire - School of ArtDocument9 pages2020 - International - Nantes Saint-Nazaire - School of ArtaoaiPas encore d'évaluation

- استخدام أسلوب التحليل الهرمي لاختيار المواقع المثلى للتموين عبادي محمد وفيصل شيادDocument11 pagesاستخدام أسلوب التحليل الهرمي لاختيار المواقع المثلى للتموين عبادي محمد وفيصل شيادAmeen ThanoonPas encore d'évaluation

- DPFSemestre 5Document1 pageDPFSemestre 5Elhabib ElPas encore d'évaluation

- Avis de Scac FavorableDocument4 pagesAvis de Scac Favorablesofiane mj100% (1)

- ClermontDocument1 pageClermontZagoum CarnotPas encore d'évaluation

- Critères Selection DoctoratDocument2 pagesCritères Selection DoctoratMohamed Aziz Ben RomdhanePas encore d'évaluation

- Depp Rers 2019 - 1162516Document411 pagesDepp Rers 2019 - 1162516Pierre-Eric AllierPas encore d'évaluation

- RG Bordeaux MontaigneDocument2 pagesRG Bordeaux Montaignesofiane mjPas encore d'évaluation

- Formulaire D'evaluation Bourse D'excellence 2018-19-ConvertiDocument5 pagesFormulaire D'evaluation Bourse D'excellence 2018-19-Convertitamba vieux tolnoPas encore d'évaluation

- Anca GreereDocument29 pagesAnca GreereDanielaPas encore d'évaluation