Académique Documents

Professionnel Documents

Culture Documents

Ratio

Transféré par

Tanmay DattTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Ratio

Transféré par

Tanmay DattDroits d'auteur :

Formats disponibles

Smitesh Bhosale, smiteshbhosale123@gmail.

com 9833781237

1

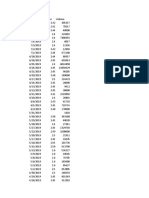

Ratio

Current Ratio

Formula

Current Assets

Current Liabilities

Numerator

Inventories/Stocks

(+)Debtors/B/R

(+)Cash& Bank

(+)Receivables/

Accruals

(+)Short Term loans

(+)Mktable

Investment/ Short

Term Securities

Quick

Ratio/Liquid

Ratio/Acid Test

Ratio

Absolute Cash

Ratio

Quick Assets

Quick Liabilities

Current Assets

(-)Inventories

(-)Prepaid Expenses

(Cash Marketable

Securities) /

Current Liabilities

Cash in Hand

(+)Balance at

Bank(Dr)

(+)Mktable

Investment/ Short

Term Securities

Denominator

Sundry Creditors

(+)O/S Exp.

(+)Short term loans

&advances

(+)Bank OD/

Cash Credit

(+)Provi. for Tax

(+)Proposed

Dividend

(+)Unclaimed

Dividend

Current Liabilities

(-)Bank OD

(-)Cash Credit

Significance/Indicator

Ability to repay short term

commitments promptly.(i.e.,

short term solvency).ideal

ratio is 2:1

High Ratio indicates

existence of idle Current

assets

Ability to meet immediate

liabilities. Ideal ratio is 1.33:1

Sundry Creditors

Availability of cash to meet

(+)O/S Exp.

short term commitments

(+)short term loans

.There is no Ideal Ratio as

&advances

such. However,a ratio>1 may

(+)Bank OD/Cash

indicate that the firm has

Credit

liquid resources, which are

(+)Provi.for Tax

low in profitability.

(+)Proposed

Dividend

(+)Unclaimed

Dividend

4 Basic Defence

Quick Assets

Current Assets

(Annual Cash

Ability to meet regular Cash

Interval

Cash Expense Per

(-)Inventories

Expenses/365)

expenses.

Measure(in

Day

(-)Prepaid Expenses Cash

days)

Expenses=Total

Exp-Depre &write

-offs

Notes: The first 3 ratios are expressed in times eg.1.33 times,2.85 timesor as ratio i.e. 1.33:1The last ratio is

expressed in Days

Smitesh Bhosale, smiteshbhosale123@gmail.com 9833781237

NOTE:For the capital structureratios,the following terms are used with respective meanings assigned(a) Debt=Long Term Borrowed Funds=Debenture+Long Term Loans from Financial institutions

(b) Equity =Owners Funds=Equity Capital+Preference capital+Reserves & surplus Less:Accumulated Losses.

(c) Equity shareholders Funds=Equity Less Preference Share capital

= Equity share Capital +Reserves & surplus less:Accumulated Losses

(d) Total Debt=Debt+Equity=(a)+(b) above.This is called Liability Route

Computation

= Fixed Assets +Net WC.This is called AssetRoute Computation

Ratio

Debt to

Total Funds

Ratio

Equity to

Total Funds

Ratio

Formula

Debt

Total Funds

Numerator

See (a) above

Denominator

See (d) above

Significance/Indicator

Indicator of use of external

funds,Ideal Ratio is 67%

Equity

Total Funds

See (b) above

See (d) above

Debt-Equity

Ratio

Debt

Equity

See (a) above

See (b) above

Capital

Gearing

ratio

Fixed Charge Bearing

Capital

Equity Shareholders

Fund

Preference Share

capital + Debt as per

(a) above

See (c) above

Proprietary

ratio

Proprietary Funds

Total Asset

See (b) above

Net Fixed

Assets+Total Current

Assets(only Tangible

assets will be

included)

Indicates Long Term

Solvency;mode of

Financing,extent of own

funds used in operations;

Ideal Ratio is 33%

Indicates the relationship

between Debt&Equity. Ideal

Ratio is 2:1

Shows proportion of fixed

charge(Dividend or interest)

bearing capital to Equity

Funds;the extent of

advantage or leverage

enjoyed by equity

shareholders.

Shows extent of

OwnersFunds,i.e.,Shareholde

rs funds utilized in financing

the assets of the business.

Fixed Asset

Fixed Asset

Net Fixed

See (d) above

Shows proportion of fixed

Smitesh Bhosale, smiteshbhosale123@gmail.com 9833781237

to Long

Term fund

ratio

Long term Funds

Assets,i.e.,Gross

Block (-)Depreciation

Assets(Long Term

Assets)financed by long-term

funds.Indicating the financing

approach followed by the

firm.ie.Conservative,Matching

or aggressive; Ideal Ratio is

less than one.

``

Ratio

Debt

service

Coverag

e Ratio

Formula

Interest

Coverag

e Ratio

EBIT

Interest

EBIT

Interest on Debt

EAT

EAT

Dividend on

Preferen

ce

Earnings for Debt

Services

(interest+instalment)

Numerator

N/P after Taxation

(+)Interest on Debt Funds

(+)Non-Cash Operating

Expenses

(e.g.:Depreciation &

amortizations)

(+)Non-Cash Operating

Adjustments

(e.g.: Loss on sale of Fixed

Assets)

Denominator

Interest on Debt

(+)Instalment of

Debt?

Loan(i.e.,Principal

amount repaid)

Significance/Indicator

Indicates extent of current

earnings available for

meeting commitments of

interest and

instalment;Ideal ratio must

between 2 to 3 times

Indicates ability to meet

interest obligations of the

current year.Should

generally be greater than

1.

Indicates ability to pay

Dividend on Preference

Smitesh Bhosale, smiteshbhosale123@gmail.com 9833781237

Dividend

Coverag

e Ratio

Preference Dividend

Preference Capital

Capital

Ratio

Raw

Material

Turnover

Ratio

Formula

Cost of Material

consumed

Average stock of RM

Numerator

Opening stock of

RM

(+)Purchase

(-)Closing stock

of RM

Denominator

(opening stock+closing stock)

2

Significance/Indicator

Indicates how fast

/regularly RM are used

in Production

WIP

Turnover

Ratio

Factory Cost

Average stock of WIP

(Opening WIP+closing WIP)

2

Indicates the WIP

Movement /production

cycle

Finished

Goods

/Stock

Turnover

Ratio

Cost of goods sold

Average stock

(opening stock+closing stock)

2

Indicates how fast

inventory is used

/sold.High T/O ratio

indicates fast moving

material while low ratio

may mean dead or

excessive stock

Debtors

Turnover

Ratio

Credit Sales

Average Accounts

Receivable

Material

consumed

(+)Wages

(+)Production OH

For Manufactures

Opening stock

of FG

(+)(+)Purchase

(-)Closing stock

of FG

For Traders

(+)Purchase

(-)Closing stock

of FG

Credit Sales net

of returns

Creditors

Turnover

Ratio

Credit Purchases

Average Accounts

Payable

Working

Capital

Turnover

Turnover

Net Working Capital

Credit Purchases

net of returns ,if

any

Sales net of

returns

Or

(Max stock+Min.Stock)

2

AccountsReceivable=Debtors+B

/R

Average Accounts

Receivable=(op.bal + Cl.Bal)/2

Account Payable=Creditors+B/P

Average Accounts

Payable=(op.bal+Clg.Bal)/2

Current assets

Less:Current Liabilities

Indicates the speed of

collection of Credit

sales/debtors

Indicates

speed/velocity of

payment to creditors

Ability to generate

sales per rupee of

Working Capital

Smitesh Bhosale, smiteshbhosale123@gmail.com 9833781237

Ratio

Fixed

Turnover

Assets

Net Fixed assets

Sales net of

Turnover

returns

Ratio

8 Capital

Turnover

Turnover

Capital Employed

Sales net of

Ratio

returns

Note:1 Assets Route:Fixed assets+Net Working Capital

7

Ability to generate

sales per rupee of

Fixed assets

Net Fixed assets

Capital Employed can be

computed using (a)Assets Route

or(b)Liability Route(note 1)

Ability to generate

sales per rupee of Long

Term Investment

Liability Route: Equity share capital+Pref.share capital+Reserves & surplus+Long term Debt Less:Accumulated

losses LessNon Trade investment

Note:2.T/O ratios can also be expressed in terms of days as 365 / T/O ratio.

E.g.:No.of days Average stock is held =365/stock turnover ratio

Ratio

1 Return on

Investment(RO

I)

Or

Return On

Capital

Employed(ROC

E)

2 Return On

Equity(ROE)

Or

Return on Net

Worth(RONW)

3 Return On

Assets(ROA)

4 Earnings Per

Formula

Total Earnings

Capital Employed

Numerator

Earnings After Tax

(+)Int.on Debt

Funds

(+)Non-operating

adjts(e.g.:other

income/Loss on sale

of Fixed assets etc.)

Net Fixed Assets

(+)Net WC

(-)External

Liabilities(Long Term)

Significance/Indicator

Overall profitability of the business on th

funds employed.

If ROCE>Interest Rate ,use of debt funds

justified

Equity Earnings

Shareholders Funds

Earnings

Taxation

N/P after Taxes

Average Total Assets

Earnings After

Taxation

Average Total Assets or

Tangible Assets or FA ,

ie,1/2 of Op.bal & Cl.Bal

Indicates Net Income per rupee of avera

Fixed Assets.

Residual earnings

No.of Equity Shares

Return or Income per Share,whether or n

(EAT-Pref.Dividend)

After

Denominator

Capital Employed can

be computed by using

(a) Assets Route

or(b)Liability Route(note

1 under Turnover Ratio)

Indicates profitability of Equity Funds/O

Funds invested in the business

Smitesh Bhosale, smiteshbhosale123@gmail.com 9833781237

Share(EPS)

Number of Equity

Shares

5 Dividend Per

Share(DPS)

Total Equity Dividend

Number of Equity

Shares

Market Price per

share

Earnings Per Share

6 Price Earnings

Ratio(PE ratio)

7 Dividend

yield(%)

8 Book Value per

Share

9 Market Value

to book Value

Dividend

Avg or Cl. Market

Price

Net Worth

Number of Equity

Shares

Market Price per

share

Book value per Share

i.e.,

EAT

(-)Preference

Dividend

Profits Distributed to

Equity Shareholders.

Average Mkt Price

(closing Mkt price)

as per Stock

Exchange

quotations.

Dividend

As calculated in

(2)above

Average or closing

Mkt price as per

Stock Exchange

quotations.

outstanding=Equity

Capital

Face value per

share

distributed as dividends.

As per (4)above

Amount of Profits distributed per share.

EPS as calculated

(4)above

in

Average or closing Mkt

price as per Stock

Exchange quotations.

Indicates the relationship between Mark

Price and EPS, and the shareholders

perception of the company.

True return on invest.based on Mkt Value

Shares

As per (4)above

Basis of Valuation of Shares based on bo

values.

Ratio as calculated in

(8)above

Higher ratio indicates better position for

Shareholders in terms of Return &capita

gains.

Vous aimerez peut-être aussi

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Tax Module 2 Unit 2Document10 pagesTax Module 2 Unit 2Beatriz LorezcoPas encore d'évaluation

- Chapter 1 - Concept Questions and Exercises StudentDocument19 pagesChapter 1 - Concept Questions and Exercises StudentHương NguyễnPas encore d'évaluation

- Individual Paper Income Tax Return 2016Document39 pagesIndividual Paper Income Tax Return 2016aarizahmadPas encore d'évaluation

- UNACEMDocument246 pagesUNACEMAlexandra Guzman BurgaPas encore d'évaluation

- Accounting Made Easy by Rajesh Agrawal, R SrinivasanDocument192 pagesAccounting Made Easy by Rajesh Agrawal, R Srinivasangaurav newatiaPas encore d'évaluation

- Bab 5 Analisis Laporan KeuanganDocument54 pagesBab 5 Analisis Laporan KeuanganBenedict MihoyoPas encore d'évaluation

- FM II Case Study For ValuationsDocument2 pagesFM II Case Study For Valuationssiddhant kohliPas encore d'évaluation

- Financial Analysis of Wipro LTD PDFDocument101 pagesFinancial Analysis of Wipro LTD PDFAnonymous f7wV1lQKRPas encore d'évaluation

- Problem No. 1: Accounting For Partnership Do-It - Yourself: Problem SetsDocument3 pagesProblem No. 1: Accounting For Partnership Do-It - Yourself: Problem Setstide podsPas encore d'évaluation

- Rofo 2018 ArDocument18 pagesRofo 2018 ArNate TobikPas encore d'évaluation

- Accounting Theory: MD. Jahangir AlamDocument37 pagesAccounting Theory: MD. Jahangir AlamShekh Rakin MosharrofPas encore d'évaluation

- Week 2 Lecture Notes (1 Slide)Document71 pagesWeek 2 Lecture Notes (1 Slide)Sarthak GargPas encore d'évaluation

- Chapter 2 Financial Statement Analysis For StudentsDocument49 pagesChapter 2 Financial Statement Analysis For StudentsRossetteDulinPas encore d'évaluation

- CUP VI - Financial Accounting and ReportingDocument17 pagesCUP VI - Financial Accounting and ReportingRonieOlarte0% (1)

- Corporate Banking: 11/04/21 Om All Rights Reserved. 1Document180 pagesCorporate Banking: 11/04/21 Om All Rights Reserved. 1Pravah ShuklaPas encore d'évaluation

- Working Capital Management at Raymond Ltd.Document92 pagesWorking Capital Management at Raymond Ltd.Bhagyesh R Shah67% (6)

- Report On Working Capital Management of Sbi P SharmaDocument58 pagesReport On Working Capital Management of Sbi P SharmaPrakash Sharma67% (9)

- Piecemeal Distribution of Cash: MeaningDocument6 pagesPiecemeal Distribution of Cash: MeaningRonak AgarwalPas encore d'évaluation

- Presentation 3Document14 pagesPresentation 3Muhammad ZohaibPas encore d'évaluation

- Bharat Heavy Electricals Limited (BHEL) : June 2017Document38 pagesBharat Heavy Electricals Limited (BHEL) : June 2017Sumit RoyPas encore d'évaluation

- Solution Manual For Financial Accounting An Introduction To Concepts Methods and Uses 13th Edition by StickneyDocument32 pagesSolution Manual For Financial Accounting An Introduction To Concepts Methods and Uses 13th Edition by Stickneya540142314Pas encore d'évaluation

- NEW CRG Manual (10/2018) by Bangladesh BankDocument27 pagesNEW CRG Manual (10/2018) by Bangladesh Bankআবদুল্লাহ আল সাকিব100% (1)

- PsycapDocument6 pagesPsycapmanali_thakarPas encore d'évaluation

- Lecture 3 Measurement Model of Productivity 27 FebDocument33 pagesLecture 3 Measurement Model of Productivity 27 Febbabanianjali100% (1)

- Historical Cost Definition Principle and How It WorksDocument4 pagesHistorical Cost Definition Principle and How It WorkshieutlbkreportPas encore d'évaluation

- PeopleSoft FSCM 92 Release Notes Through Update Image7Document184 pagesPeopleSoft FSCM 92 Release Notes Through Update Image7ram4friendsPas encore d'évaluation

- Accomplishment Report - 2021 SampleDocument20 pagesAccomplishment Report - 2021 Sampleshamsan dilangalenPas encore d'évaluation

- Impact of Cash Holding On Firm Performance: A Case Study of Non-Financial Listed Firms of KSEDocument12 pagesImpact of Cash Holding On Firm Performance: A Case Study of Non-Financial Listed Firms of KSEYounes HouryPas encore d'évaluation

- Mid Exam AdvanceDocument1 pageMid Exam AdvanceIfaPas encore d'évaluation

- On LeaseDocument12 pagesOn Leasesonam sharmaPas encore d'évaluation