Académique Documents

Professionnel Documents

Culture Documents

Bond - A Long-Term Debt Instrument Treasury Bonds - Bonds Issued by The Federal

Transféré par

Carlos Vincent Oliveros0 évaluation0% ont trouvé ce document utile (0 vote)

35 vues1 pageFIN MAN BONDS

Titre original

Bonds Reviewer

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentFIN MAN BONDS

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

35 vues1 pageBond - A Long-Term Debt Instrument Treasury Bonds - Bonds Issued by The Federal

Transféré par

Carlos Vincent OliverosFIN MAN BONDS

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

IDENTIFICATION

Bond a long-term debt instrument

Treasury Bonds Bonds issued by the federal

government, sometimes referred to as government

bonds

Corporate Bonds Bonds issued by corporation

Municipal Bonds Bonds issued by state and

local governments

Foreign Bonds Bonds issued by foreign

governments or by foreign corporations

Par Value The face value of a bond

Coupon Payment The specified number of dollars

of interest paid each year

Coupon Interest Rate The stated annual interest

rate on a bond

Fixed-Rate Bond A bond whose interest rate is

fixed for its entire life

Floating-Rate Bond A bond whose interest rate

fluctuates with shifts in the general level of interest

rates

Zero Coupon Bond A bond that pays no annual

interest but is sold at a discount below par, thus

compensating investors in the form of capital

appreciation

Convertible Bond A bond that is exchangeable at

the option of the holder for the issuing firms

common stock

Warrant a long-term option to buy a stated

number of shares of common stock at a specified

price

Putable Bond A bond with a provision that allows

its investors to sell it back to the company prior to

maturity at a prearranged price

Index (Purchasing Power) Bond A bond that has

interest payments based on an inflation index so as

to protect the holder from inflation

Discount Bond A bond that sells below its par

value; occurs whenever the going rate of interest is

above the coupon rate

Premium Bond A bond that sells above its par

value; occurs whenever the going rate of the

interest is below the coupon rate

Yield to Maturity (YTM) The rate of return earned

on a bond if it is held to maturity

Yield to Call (YTC) The rate of return earned on a

bond when it is called before its maturity date

Price (Interest Rate) Risk The risk of a decline in

a bonds price due to an increase in interest rates

Original Issue Discount (OID) Bond - Any bond

originally offered at a price below its par value

Reinvestment Risk the risk that a decline in

interest rates will lead to a decline in income from a

bond portfolio

Maturity Date A specified date in which the par

value of a bond must be repaid

Investment Horizon The period of time an

investor plans to hold a particular investment

Original Maturity The number of years to maturity

at the same time a bond issued

Duration The weighted average of the time it

takes to receive each of the following bonds cash

flows

Call Provision A provision in a bond contract that

gives the issuer the right to redeem the bonds

under specified terms prior to the normal maturity

date

Sinking Fund Provision A provision in a bond

contract that requires the issuer to retire a portion

of the bond issue each year

Types of Corporate Bonds

Mortgage Bonds A bond backed by fixed assets.

First Mortgage bonds are senior in priority to claims

of second mortgage bonds

Vous aimerez peut-être aussi

- Specific Performance and Equitable Remedies ExplainedDocument67 pagesSpecific Performance and Equitable Remedies ExplainedLyana SulaimanPas encore d'évaluation

- Taxation of Debt Instruments: Key ConsiderationsDocument15 pagesTaxation of Debt Instruments: Key ConsiderationsPunyak SatishPas encore d'évaluation

- Litigation Finance MechanicsDocument3 pagesLitigation Finance MechanicsToby SmallPas encore d'évaluation

- Mutual FundDocument43 pagesMutual Fundsssagar92100% (1)

- 9 Debt SecuritiesDocument32 pages9 Debt SecuritiesSami BitarPas encore d'évaluation

- Bill of exchange, promissory note and cheque regulationsDocument10 pagesBill of exchange, promissory note and cheque regulationsThéotime HabinezaPas encore d'évaluation

- Debt InstrumentsDocument8 pagesDebt InstrumentsparulshinyPas encore d'évaluation

- DF Law of ContractDocument13 pagesDF Law of ContractDarragh FivesPas encore d'évaluation

- Poli - Art 3 Sec 1 Due ProcessDocument119 pagesPoli - Art 3 Sec 1 Due ProcessmimimilkteaPas encore d'évaluation

- 11-13-07 The Duty To RepresentDocument5 pages11-13-07 The Duty To RepresentHouston Criminal Lawyer John T. Floyd100% (1)

- Ar Questions in Negotiable InstrumentDocument9 pagesAr Questions in Negotiable InstrumentAtty AnnaPas encore d'évaluation

- CONTRACTS OUTLINE - JamesDocument65 pagesCONTRACTS OUTLINE - JamesRebekahPas encore d'évaluation

- Types of CDOsDocument9 pagesTypes of CDOsKeval ShahPas encore d'évaluation

- Fire InsuranceDocument18 pagesFire InsuranceMayurRawoolPas encore d'évaluation

- Tetley - Mixed Jurisdictions - Common Law Vs Civil LawDocument28 pagesTetley - Mixed Jurisdictions - Common Law Vs Civil LawEvgenije OnjeginPas encore d'évaluation

- Elements of ContractDocument6 pagesElements of ContractJerome ArañezPas encore d'évaluation

- Lombard Risk - Regulation in HONG KONGDocument3 pagesLombard Risk - Regulation in HONG KONGLombard RiskPas encore d'évaluation

- Rights of Persons Arrested, Detained or Under CIDocument74 pagesRights of Persons Arrested, Detained or Under CILex Tamen CoercitorPas encore d'évaluation

- Study Unit 20Document13 pagesStudy Unit 20Hazem El SayedPas encore d'évaluation

- FormalismDocument4 pagesFormalismCarlos Vincent Oliveros100% (1)

- Principles of Criminal LiabilityDocument2 pagesPrinciples of Criminal Liabilityninnik0% (1)

- Contract Law OutlineDocument33 pagesContract Law Outlinenwoz100% (1)

- Asset-Backed Commercial PaperDocument4 pagesAsset-Backed Commercial PaperdescataPas encore d'évaluation

- Indian Debt Markets Evolution and InstrumentsDocument33 pagesIndian Debt Markets Evolution and InstrumentsNainisha SawantPas encore d'évaluation

- ContractsDocument29 pagesContractsattyeram9199Pas encore d'évaluation

- OID Demystified (Somewhat)Document6 pagesOID Demystified (Somewhat)Reznick Group NMTC PracticePas encore d'évaluation

- Court denies wife's habeas corpus petition to compel husband's cohabitationDocument30 pagesCourt denies wife's habeas corpus petition to compel husband's cohabitationMikhailFAbzPas encore d'évaluation

- Cases On ArraignmentDocument69 pagesCases On ArraignmentMarlon BaltarPas encore d'évaluation

- Chap 3 Fixed Income SecuritiesDocument45 pagesChap 3 Fixed Income SecuritiesHABTAMU TULU0% (1)

- Convertible BondDocument52 pagesConvertible BondAtif SaeedPas encore d'évaluation

- Commercial Bank OperationsDocument20 pagesCommercial Bank OperationsPradnyesh GanuPas encore d'évaluation

- Documents - MX Oblicon Reviewer 2010Document159 pagesDocuments - MX Oblicon Reviewer 2010Carlos Vincent OliverosPas encore d'évaluation

- Extenguishment of Obligation Group4Document112 pagesExtenguishment of Obligation Group4Lheia Micah De CastroPas encore d'évaluation

- Social and CultureDocument6 pagesSocial and CultureMaridel SulbianoPas encore d'évaluation

- Price FixingDocument1 pagePrice FixingMerryshyra MisagalPas encore d'évaluation

- Are Human Rights Merely PoliticsDocument4 pagesAre Human Rights Merely PoliticsThetis Skondra100% (1)

- Stock Market Training - Debt MarketDocument12 pagesStock Market Training - Debt MarketShakti ShuklaPas encore d'évaluation

- Module 8 - InclusionsDocument4 pagesModule 8 - InclusionsLysss EpssssPas encore d'évaluation

- Study On The Replacement of Construction & Demolition Waste Materials As Fine Aggregates in The Production of Low Strength ConcreteDocument8 pagesStudy On The Replacement of Construction & Demolition Waste Materials As Fine Aggregates in The Production of Low Strength ConcreteIJRASETPublications100% (1)

- Article 1156Document2 pagesArticle 1156Archie ViernesPas encore d'évaluation

- List of Cases For Rights of The AccusedDocument32 pagesList of Cases For Rights of The AccusedLala PastellePas encore d'évaluation

- Obligations and ContractDocument10 pagesObligations and ContractMikee SamsonPas encore d'évaluation

- Torts Outline: Negligence EssentialsDocument29 pagesTorts Outline: Negligence EssentialsjoanPas encore d'évaluation

- Public International Law Exam Guide Public International Law Exam GuideDocument30 pagesPublic International Law Exam Guide Public International Law Exam GuidehayfaPas encore d'évaluation

- Principals and Agents: Like The Master and Servant in Torts. Deals With Issues of Control and LiabilityDocument17 pagesPrincipals and Agents: Like The Master and Servant in Torts. Deals With Issues of Control and LiabilityAlex HafezPas encore d'évaluation

- International LawDocument13 pagesInternational LawRitesh KumaiPas encore d'évaluation

- EcoCash Merchant Application FormDocument4 pagesEcoCash Merchant Application FormTatenda Charariza100% (1)

- LIFE INSURANCE PRINCIPLESDocument9 pagesLIFE INSURANCE PRINCIPLESMadz MadrastoPas encore d'évaluation

- Contract Essay Draft 1Document2 pagesContract Essay Draft 1Matthew Miller100% (1)

- Public vs Private Finance StudyDocument10 pagesPublic vs Private Finance StudyRich Ann Redondo VillanuevaPas encore d'évaluation

- Declaration of Martial Law & The Fall of The DictatorshipDocument19 pagesDeclaration of Martial Law & The Fall of The Dictatorshiprick100% (1)

- UNIT 1 - The Legal Environment Chapter 3 - Dispute ResolutionDocument3 pagesUNIT 1 - The Legal Environment Chapter 3 - Dispute ResolutioncdompeyrePas encore d'évaluation

- Oklahoma High School Mock Trial Program: Glossary of Legal TermsDocument7 pagesOklahoma High School Mock Trial Program: Glossary of Legal Termsblargh117100% (1)

- Chapter 3 Financial InstrumentsDocument64 pagesChapter 3 Financial InstrumentsCyryll PayumoPas encore d'évaluation

- Unit-5 (Global Logisitcs) L&SCMDocument20 pagesUnit-5 (Global Logisitcs) L&SCMAalok GhoshPas encore d'évaluation

- Directors and Officers LiabilityDocument3 pagesDirectors and Officers LiabilityNaga Mani MeruguPas encore d'évaluation

- Administrative Law Is That Branch of Law That Governs The Scope and Activities of Government AgenciesDocument3 pagesAdministrative Law Is That Branch of Law That Governs The Scope and Activities of Government AgenciesMiyanda Hakauba HayombwePas encore d'évaluation

- Bankruptcy Outline - Pottow 2011Document125 pagesBankruptcy Outline - Pottow 2011LastDinosaur1100% (2)

- Securities Regulation Code January 31,2018Document62 pagesSecurities Regulation Code January 31,2018cha chaPas encore d'évaluation

- Financial Markets ExplainedDocument14 pagesFinancial Markets ExplainedDavid DavidPas encore d'évaluation

- Recognition of States: Declaratory Theory-It Views That Recognition Is Merely "Declaratory" of TheDocument3 pagesRecognition of States: Declaratory Theory-It Views That Recognition Is Merely "Declaratory" of TheNievesAlarconPas encore d'évaluation

- Lecture 2 The Insurance MechanismDocument36 pagesLecture 2 The Insurance MechanismRammohanreddy RajidiPas encore d'évaluation

- Outline Public Intl LawDocument15 pagesOutline Public Intl LawUE LawPas encore d'évaluation

- Chapter 1 - Notes - Fixed Income AnalysisDocument3 pagesChapter 1 - Notes - Fixed Income AnalysisKaran PPas encore d'évaluation

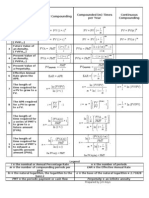

- Time value analysis tools and bond characteristicsDocument3 pagesTime value analysis tools and bond characteristicsJerleen FelismeniaPas encore d'évaluation

- Book 1Document3 pagesBook 1Carlos Vincent OliverosPas encore d'évaluation

- Total Proposed BudgetDocument1 pageTotal Proposed BudgetCarlos Vincent OliverosPas encore d'évaluation

- Ecom Paper FormatDocument2 pagesEcom Paper FormatCarlos Vincent OliverosPas encore d'évaluation

- Assignment 1Document1 pageAssignment 1Carlos Vincent OliverosPas encore d'évaluation

- PLC Branding Packaging LabelingDocument42 pagesPLC Branding Packaging LabelingCarlos Vincent OliverosPas encore d'évaluation

- Topic Dane LikertDocument12 pagesTopic Dane LikertMadeline AldianoPas encore d'évaluation

- Oblicon Super Reviewer PDFDocument36 pagesOblicon Super Reviewer PDFCarlos Vincent OliverosPas encore d'évaluation

- Carlos Vincent Oliveros Joshua Mopera Charlotte Millo Shiela Mae Del Rosario Justine Vernadette Lumpas Flaws DiscussionDocument1 pageCarlos Vincent Oliveros Joshua Mopera Charlotte Millo Shiela Mae Del Rosario Justine Vernadette Lumpas Flaws DiscussionCarlos Vincent OliverosPas encore d'évaluation

- TCH WRT LettersDocument4 pagesTCH WRT LettersCarlos Vincent OliverosPas encore d'évaluation

- Bonds CH08Document16 pagesBonds CH08Hendrickson Cruz SaludPas encore d'évaluation

- Chapter 8,9,10 - Reviewer With AnsDocument117 pagesChapter 8,9,10 - Reviewer With AnsCarlos Vincent Oliveros100% (1)

- TQM Group 4Document22 pagesTQM Group 4Carlos Vincent OliverosPas encore d'évaluation

- Chapter 8 EditedDocument23 pagesChapter 8 EditedCarlos Vincent Oliveros100% (1)

- Gap AnalysisDocument3 pagesGap AnalysisCarlos Vincent OliverosPas encore d'évaluation

- 4.2 Financial Statement Basics Exercises1Document24 pages4.2 Financial Statement Basics Exercises1Carlos Vincent OliverosPas encore d'évaluation

- Quality Customer-Supplier RelationshipsDocument29 pagesQuality Customer-Supplier RelationshipsCarlos Vincent OliverosPas encore d'évaluation

- SolutionsDocument8 pagesSolutionsSaul Led OthaimPas encore d'évaluation

- Methods of Forecasting in A Manufacturing CompanyDocument31 pagesMethods of Forecasting in A Manufacturing Companyeuge_prime2001Pas encore d'évaluation

- Financial Statement and Cash Flow Analysis: Answers To Concept Review QuestionsDocument9 pagesFinancial Statement and Cash Flow Analysis: Answers To Concept Review QuestionsCarlos Vincent OliverosPas encore d'évaluation

- TVM Formulas (I, N)Document2 pagesTVM Formulas (I, N)basco23Pas encore d'évaluation

- Target Market StrategyDocument37 pagesTarget Market StrategyCarlos Vincent OliverosPas encore d'évaluation

- 9 Dimensions of QualityDocument12 pages9 Dimensions of QualityCarlos Vincent OliverosPas encore d'évaluation

- Finance AnalysisDocument36 pagesFinance AnalysisSarah GuPas encore d'évaluation

- SolutionsDocument8 pagesSolutionsSaul Led OthaimPas encore d'évaluation

- Chapter 5 Q&ADocument5 pagesChapter 5 Q&ACarlos Vincent OliverosPas encore d'évaluation

- Chapter 2Document25 pagesChapter 2Ronalyn EscamillasPas encore d'évaluation

- Chapter 1 Advanced Acctg. SolmanDocument20 pagesChapter 1 Advanced Acctg. SolmanLaraPas encore d'évaluation

- 2023citizen's Charter (2nd Edition) For Extension OfficesDocument1 203 pages2023citizen's Charter (2nd Edition) For Extension OfficesJason YinPas encore d'évaluation

- Protecting Your Income Even Aer Retirement Is Assured: Aditya Birla Sun Life Insurance Vision Lifeincome PlanDocument6 pagesProtecting Your Income Even Aer Retirement Is Assured: Aditya Birla Sun Life Insurance Vision Lifeincome PlanParmeshwar SinghPas encore d'évaluation

- Chapter - 2&3 - Practice - Problems Hull Ed 10thDocument2 pagesChapter - 2&3 - Practice - Problems Hull Ed 10thAn KouPas encore d'évaluation

- Sl. No. Index NoDocument66 pagesSl. No. Index NokapgopiPas encore d'évaluation

- Implementing Strategies: Marketing, Finance, R&D and CIS Issues ChapterDocument22 pagesImplementing Strategies: Marketing, Finance, R&D and CIS Issues ChaptereternitylouisPas encore d'évaluation

- FINMAR Chapter 1 (Reviewer)Document4 pagesFINMAR Chapter 1 (Reviewer)Lazarae De DiosPas encore d'évaluation

- 3 Types Business Organizations & Company Law MalaysiaDocument15 pages3 Types Business Organizations & Company Law MalaysiaAisyah Jaafar100% (1)

- Project ProphecyDocument54 pagesProject ProphecyAnonymous m6yoprE9z100% (1)

- Baggao Water Supply Project Info MemoDocument6 pagesBaggao Water Supply Project Info MemoAnonymous 6Xoh1YWIDePas encore d'évaluation

- Bec Final 1Document16 pagesBec Final 1yang1987Pas encore d'évaluation

- Dealpro Purpose Code List 190515Document8 pagesDealpro Purpose Code List 190515Sreenivas SungadiPas encore d'évaluation

- Mémoire de Fin D'étudeDocument50 pagesMémoire de Fin D'étudeRachid Mdh0% (1)

- India Cements' Hostile Takeover of Raasi Cements - Case Study on Synergies and Market ConsolidationDocument5 pagesIndia Cements' Hostile Takeover of Raasi Cements - Case Study on Synergies and Market ConsolidationDeepshikha BandebucchePas encore d'évaluation

- RENEW ENGINEERING FIRM REGISTRATIONDocument6 pagesRENEW ENGINEERING FIRM REGISTRATIONAhmad MasoodPas encore d'évaluation

- Bhavishya Nirman Bond and NABARD Rural Bond-List of Brokers in Mumbai (STD Code: 022) Name of Arranger Code No. AddressDocument3 pagesBhavishya Nirman Bond and NABARD Rural Bond-List of Brokers in Mumbai (STD Code: 022) Name of Arranger Code No. AddressCfhunSaatPas encore d'évaluation

- 1 Hour Tunnel Method Forex StrategyDocument7 pages1 Hour Tunnel Method Forex StrategyhiltonengPas encore d'évaluation

- Safe Investment??: (A Case Study On Risk of Diversification)Document26 pagesSafe Investment??: (A Case Study On Risk of Diversification)A Srihari KrishnaPas encore d'évaluation

- Calculating Goodwill Using Capitalization MethodDocument9 pagesCalculating Goodwill Using Capitalization MethodMital ParmarPas encore d'évaluation

- Letter From Shapley 23/07/2012Document2 pagesLetter From Shapley 23/07/2012bwanamamboPas encore d'évaluation

- International Tax AvoidanceDocument27 pagesInternational Tax Avoidanceflordeliz12Pas encore d'évaluation

- Cash Flow of Southwest AirlinesDocument4 pagesCash Flow of Southwest AirlinessumitPas encore d'évaluation

- 489592katina Stefanova Is CIO and CEO of Marto Capital, A Systematic Multi Strategy Asset Manager. That The Genius of International InvestmentsDocument2 pages489592katina Stefanova Is CIO and CEO of Marto Capital, A Systematic Multi Strategy Asset Manager. That The Genius of International Investmentssamanthawrightkgn6Pas encore d'évaluation

- Global CrisisDocument21 pagesGlobal Crisishema sri mediPas encore d'évaluation

- B. MG Buys One Month Futures Where It Agrees To Buy, in One Month's Time The SameDocument7 pagesB. MG Buys One Month Futures Where It Agrees To Buy, in One Month's Time The Samemegha sharmaPas encore d'évaluation

- Preview of Chapter 5: Intermediate Accounting IFRS 2nd Edition Kieso, Weygandt, and WarfieldDocument82 pagesPreview of Chapter 5: Intermediate Accounting IFRS 2nd Edition Kieso, Weygandt, and WarfieldLong TranPas encore d'évaluation

- Ch-4 Stock Markets - OldDocument56 pagesCh-4 Stock Markets - OldYibeltal AssefaPas encore d'évaluation

- Due Diligence Planning, Questions, IssuesDocument224 pagesDue Diligence Planning, Questions, IssueshowierdPas encore d'évaluation