Académique Documents

Professionnel Documents

Culture Documents

European Tourism 2016 - Trends & Prospects (q3 2016)

Transféré par

TatianaCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

European Tourism 2016 - Trends & Prospects (q3 2016)

Transféré par

TatianaDroits d'auteur :

Formats disponibles

European Tourism in 2016: Trends & Prospects (Q3/2016)

SEUROPEAN

TOURISM 2016

TRENDS & PROSPECTS

APRIL 2016

European Tourism in 2016: Trends & Prospects (Q3/2016)

EUROPEAN TOURISM IN 2016:

TRENDS & PROSPECTS

Quarterly Report (Q3/2016)

A quarterly insights report produced for the Market Intelligence Group

of the European Travel Commission (ETC)

by Tourism Economics (an Oxford Economics Company)

Brussels, November 2016

ETC Market Intelligence Report

European Tourism in 2016: Trends & Prospects (Q3/2016)

Copyright 2016 European Travel Commission

European Tourism in 2016: Trends & Prospects (Q3/2016)

All rights reserved. The contents of this report may be quoted, provided the source is given accurately

and clearly. Distribution or reproduction in full is permitted for own or internal use only. While we

encourage distribution via publicly accessible websites, this should be done via a link to ETC's

corporate website, www.etc-corporate.org, referring visitors to the Research/Trends Watch section.

The designations employed and the presentation of material in this publication do not imply the

expression of any opinions whatsoever on the part of the Executive Unit of the European Travel

Commission.

Data sources: This report includes data from the TourMIS database (http://www.tourmis.info), STR

Global, IATA, AEA and UNWTO.

Economic analysis and forecasts are provided by Tourism Economics and are for interpretation by

users according to their needs.

Published and printed by the European Travel Commission

Rue du March aux Herbes, 61, 1000 Brussels, Belgium

Website: www.etc-corporate.org

Email: info@visiteurope.com

ISSN No: 2034-9297

This report was compiled and edited by:

Tourism Economics (an Oxford Economics Company)

on behalf of the ETC Market Intelligence Group

Cover: Europe, Transylvania, Romania, 13th century Castle Bran, associated with Vlad II the Impaler,

AKA Dracula. Queen Marie of Romanias later residence.

Image ID: 445665049

Copyright: Emily Marie Wilson

European Tourism in 2016: Trends & Prospects (Q3/2016)

TABLE OF CONTENTS

Foreword ............................................................................................................. 4

1. Tourism Performance Summary 2016 ............................................................ 7

2. Global Tourism Forecast Summary .............................................................. 10

3. Recent Industry Performance ....................................................................... 11

3.1 Air Transport .......................................................................................... 11

3.2 Accommodation ..................................................................................... 15

4. Special Feature ............................................................................................. 17

5. Key Source Market Performance .................................................................. 21

5.1 Key Intra-European Markets .................................................................. 21

5.2 Non-European Markets .......................................................................... 25

6. Origin Market Share Analysis........................................................................ 28

6.1 United States.......................................................................................... 29

6.2 Canada ................................................................................................... 30

6.3 Mexico .................................................................................................... 31

6.4 Argentina ................................................................................................ 32

6.5 Brazil ...................................................................................................... 33

6.6 India ....................................................................................................... 34

6.7 China ...................................................................................................... 35

6.8 Japan ..................................................................................................... 36

6.9 Australia ................................................................................................. 37

6.10 United Arab Emirates ........................................................................... 38

6.11 Russia .................................................................................................. 39

7. Economic Outlook ......................................................................................... 40

7.1 Overview ................................................................................................ 40

7.2 Eurozone ................................................................................................ 43

7.3 United Kingdom...................................................................................... 44

7.4 United States.......................................................................................... 45

7.5 Japan ..................................................................................................... 46

7.6 Emerging Markets .................................................................................. 47

8. Appendix 1 .................................................................................................... 51

9. Appendix 2 .................................................................................................... 53

European Tourism in 2016: Trends & Prospects (Q3/2016)

FOREWORD

STRONG GROWTH OVER THE SUMMER PERIOD

The earlier strong performance in Europe continued into the third quarter of

2016. Despite challenges including safety and security, most destinations

across the region shared in the good summer growth in visitor numbers.

According to UNWTO, Europe experienced a 3% increase in international

tourist arrivals compared to the first six months of 2015 1.

International tourist arrivals by destination

2016 year-to-date, % year

Source: ETC, TourMIS

One in three reporting destinations enjoyed double-digit growth in arrivals.

Icelands staggering growth (+34%) is partly due to its key position as a hub for

trans-Atlantic travel while Slovakia and Cyprus (both +19%) benefited from

deferred Russian travel typically bound for Turkey. Southern/Mediterranean

destinations, Portugal (+12%), Serbia, Slovenia and Spain (all +10%) also saw

a robust increase. Fast growth was also recorded by Bulgaria (+13%),

Lithuania and Romania (both +10%), all three considered as key destinations

for bargain hunters.

Turkey (-32%) continues to endure the aftermath of its diplomatic tensions,

threat of terrorism, and weakened relations with its largest source market,

Russia, after a decade of sustained tourism growth. Belgiums tourism

performance is still at a low ebb (-13%), affected by the slowdown in arrivals

from both short and long-haul markets following the attacks in March 2016.

European air passenger traffic (measured by Revenue Passenger Kilometres

(RPK)) remains robust up 3.5% based on 2016 year-to-date data. Growth is

fuelled by strong demand from the Americas, mainly from the US helped by a

stronger US dollar against key European currencies and good economic

UWNTO World Tourism Barometer Vol. 14 September 2016

European Tourism in 2016: Trends & Prospects (Q3/2016)

conditions. Low oil prices continue to result in lower air fares, and both factors

play a role in sustaining air travel demand.

GROWTH MOMENTUM DRIVEN BY KEY LONG-HAUL MARKETS

Since the UK voted to leave the European Union on June 23rd, there has been

considerable uncertainty about the long run impact of Brexit. Although a

weaker sterling against the euro has made travel abroad more expensive for

Britons, they continue to travel internationally with two in three reporting

destinations posting double-digit growth from the UK. Large

Southern/Mediterranean destinations such as Portugal (+14%) and Spain

(+13%) saw substantial growth from British visitors based on data to August.

However, many of these travellers would have planned their trip before the

decision to leave the EU and it is still too early to untangle the likely impact of

this decision on outbound travel from the UK.

Tourist flows from Russia continue to recover following a long period of

weakness. Top destinations rebounding from previous years poor performance

are Cyprus, Iceland and Slovakia up 45%, 22% and 21% respectively. Russias

travel ban to Turkey was cancelled at the end of June this year, however a

slowing economy and a devalued rouble continue to weigh on outbound travel

from this market. While year-to-date data points to a 4.5% decline in travel from

Russia, in the longer run an estimated 8% increase is forecasted over the next

four-year period.

Inbound travel from Russia by destination

Russian share of total arrivals, 2015

Source: ETC, TourMIS

A number of European destinations saw encouraging visitor arrivals form the

US. Travellers from this market continue to take advantage of a stronger

currency and competitive air fares. Despite security concerns and travel alerts

issued by the US Government, the flow of US holidaymakers to Europe

continues to grow. Compared to the same period last year it is estimated that

US arrivals to Europe has increased by 7% so far in 2016. Despite its economic

European Tourism in 2016: Trends & Prospects (Q3/2016)

slowdown, the Chinese market is showing signs of growth as many

destinations reported double-digit growth in arrivals during the first six months

of the year. Chinese arrivals to Europe has been growing at a moderate pace

(+13% a year on average 2005-2015) and growth is so far estimated at 6%.

Prospects remain positive, helped by the rapid growth of Chinas middle class.

Nevertheless, there are fears in terms of safety and security concerns

dissuading Chinese travel to Europe.

INDUSTRY-WIDE COLLABORATION TOWARDS A SUSTAINABLE

PROMOTION OF EUROPE

Entering the final part of the year, European tourism continues to grow strongly

showing great resilience to economic woes, geopolitical tensions and threats of

terrorism. ETCs Outlook for the coming year remains positive with growth in

arrivals forecasted to be 3% among ETC members. To foster Europes

competitiveness and achieve a better promotion of the region as a tourism

destination, European authorities should capitalise on attracting investment

from public and private stakeholders in order to increase flows of tourist to

Europe, especially from third markets said Eduardo Santander, Executive

Director of the European Travel Commission.

Jennifer Iduh (ETC Executive Unit)

With the contribution of the ETC Market Intelligence Group

European Tourism in 2016: Trends & Prospects (Q3/2016)

1. TOURISM PERFORMANCE

SUMMARY 2016

The overwhelming majority of European destinations report continued growth in

tourism demand through the summer months. 33 destinations have now

submitted 2016 year-to-date data in some capacity, with most reporting data for

the peak months of July and August. 28 of these destinations have recorded

either positive arrivals or overnights growth so far in 2016. In most cases it is

both. By contrast Turkey, Belgium, Switzerland, Monaco, and Greece have all

reported a fall in either arrivals, overnights, or both so far in 2016.

The number of

European destinations

reporting growth in 2016 to

date

33 destinations have

reported on tourism

performance in 2016

Iceland remains the top growth destination in Europe, based on data to

September, keeping it on an impressive growth trajectory which it has

maintained since 2012. This growth is supported by a wide array of both short

and long haul markets and this has perhaps been key to Icelands longevity as

the top performing Europe destination market since its exposure to risks and

economic shocks is well-spread. Ongoing growth in air capacity on transatlantic

routes using Iceland as a hub continues to benefit the destination and suggests

that arrivals growth is not yet ready to abate, although there are some

suggestions that accommodation capacity constraints may start to bite.

Foreign visits and overnights to select destinations

Arrivals

2016 year-to-date*, % change year ago

35

Nights

25

15

5

-5

-15

-25

Iceland

Slovakia

Cyprus

Bulgaria

Portugal

Ireland Rep

Norway

Serbia

Spain

Romania

Slovenia

Lithuania

Poland

Croatia

Malta

Czech Rep

Estonia

Latvia

Montenegro

Netherlands

Austria

Sweden

Denmark

Hungary

Finland

UK

Germany

Luxembourg

Greece

Monaco

Switzerland

Belgium

Turkey

28

Many of the very high growth rates observed in some destinations earlier in the

year have now moderated, which is typical as data now include the more

important and less volatile summer months. This will likely continue over the

remainder of 2016, including further peak season months. Nonetheless, some

impressive growth rates remain.

-35

Source: TourMIS

*date varies (Jan-Sep) by destination

Slovakias strong start to the year helped it retain position as Europes second

fastest growth market in the year-to-date. Growth has moderated from earlier in

the year when arrivals and overnights growth both exceeded 20%. Based on

data to August arrivals growth was 19.1% and overnights growth was 17.5%

and this should secure its status as a top performing destination in 2016. This

European Tourism in 2016: Trends & Prospects (Q3/2016)

growth is a continuation of the rebound in 2015 following on from a poor 2014

growth performance, and some slowdown is still likely later in 2016.

Cyprus enjoyed both strong arrivals and overnights growth of 18.8% and 8.6%

respectively based on data to September. This may involve some gain in

market share at the expense of Turkey given the threat of terrorism and its

tumultuous political landscape of late. Russia was a notable contributor to this

growth with arrivals up 44.5% and overnights 28.2% higher, more than

offsetting the falls in 2015.

The Czech Republic, Serbia, Bulgaria, and Romania all appear to be faring

well, each making strong gains in both arrivals and overnights. As relatively

lower cost markets growth this perhaps reflects some continued bargainhunting in the market. With the exception of Bulgaria, these markets have all

enjoyed double digit growth from the UK, and while post-Brexit data is limited at

this stage, growth from the UK to these markets may accelerate as British

holiday makers look to stretch a relatively weak pound.

Travel from the UK to other

European destinations may

fall following the Brexit vote,

primarily due to weaker

sterling.

UK should benefit as a

destination from the currency

movement

Following the UKs vote to leave the EU, the outlook for outbound travel

demand has been downgraded. This is in line with weaker near-term growth

prospects amid significant uncertainty as well as a fall in the value of the

pound. But weaker sterling means the UK is now a more price-attractive

destination and inbound travel should continue to thrive. This will mostly be

supported by leisure travel growth, while domestic UK travel should also benefit

due to these pricing effects.

Arrivals growth has been strong in Ireland, with growth reported as 12.3%

based on data to August. However, it shoulders a particularly large exposure to

Brexit fallout since the UK is its biggest European source market, albeit with

limited impact in 2016 to date. Since a holiday within the Eurozone became

approximately 10% more expensive when paid for in sterling following the

outcome of the referendum, Ireland will have lost some its appeal from a UK

standpoint. Additionally, a weaker pound will inevitably encourage some

displacement in travel from other source markets away from Ireland and

towards the UK.

The relative strength of the Swiss franc continues weighed on Switzerlands

performance in 2016 to date. Both arrivals and nights to Switzerland have fallen

by 2.1% and 2.5% respectively based on data to August. This marks an

acceleration in the rate of decline compared to arrivals growth to April and

compounds similar falls endured in 2015.

31.8%

Drop in tourist arrivals in

Turkey in the first eight

months of 2016.

Arrivals in Turkey fell 1.6% in

2015 as a whole and a larger

drop is likely this year.

Turkey reported lower arrivals from all monitored source markets based on

data to data to August as it continues to suffer from a combination of political

unrest, weakened relations with the large source market of Russia, and the

threat of terrorism.

Attacks in Turkeys came after threats by the same group which claimed

responsibility for attacks carried out in tourist resorts in Tunisia and Egypt and

in excess of 100 people have been killed as a result of these attacks in 2016

alone. This will only continue to discourage some tourists from visiting Turkey

and travel to Turkey for 2016 as a whole is looking likely to fall further following

a more modest drop in 2015. Russias temporary ban on travel to Turkey

following the shooting down of a Russian bomber will have had a large impact

European Tourism in 2016: Trends & Prospects (Q3/2016)

given that Russia typically accounts for over 10% of arrivals to Turkey. Russian

arrivals accounted for around 75% of the fall in European travel to Turkey in

2015, with larger falls seen so far this year. But with the ban now lifted and the

restoration of relations between the two underway, this negative trend may be

reverse in 2017. However, international travel to Turkey in 2016 as a whole is

likely to be lower than in 2015 before recovery fully begins next year.

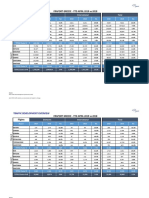

Tourism Performance, 2016 Year-to-Date

International Arrivals

Country

International Nights

% ytd

to m onth

% ytd

to m onth

Austria

5.1

Jan-Sep

4.9

Jan-Sep

Belgium

-13.9

Jan-Aug

-12.3

Jan-Aug

Bulgaria

13.2

Jan-Aug

Croatia

7.3

Jan-Aug

8.8

Jan-Aug

Cyprus

18.8

Jan-Sep

8.6

Jan-Jul

Czech Rep

6.5

Jan-Jun

4.1

Jan-Jun

4.9

Jan-Aug

Estonia

6.5

Jan-Aug

6.4

Jan-Aug

Finland

3.8

Jan-Aug

1.7

Jan-Aug

Germany

1.3

Jan-Aug

1.3

Jan-Aug

Greece

-1.6

Jan-Jun

Hungary

4.6

Jan-Aug

4.0

Jan-Aug

Iceland

33.9

Jan-Sep

Ireland Rep

12.0

Jan-Sep

Latvia

4.1

Jan-Jun

5.7

Jan-Jun

Lithuania

9.5

Jan-Jun

1.0

Jan-Aug

5.7

Jan-Aug

Denmark

Luxembourg

Malta

8.3

Jan-Aug

Montenegro

5.6

Jan-Aug

Netherlands

5.5

Jan-Jul

Monaco

Norw ay

-1.9

Jan-Sep

-2.6

Jan-Aug

5.6

Jan-Jul

11.7

Jan-Sep

Poland

6.8

Jan-Aug

9.2

Jan-Aug

Portugal

12.3

Jan-Aug

10.9

Jan-Aug

Romania

9.9

Jan-Aug

Serbia

11.1

Jan-Sep

11.7

Jan-Sep

Slovakia

19.1

Jan-Aug

17.5

Jan-Aug

Slovenia

9.7

Jan-Aug

8.3

Jan-Aug

Spain

10.1

Jan-Aug

10.1

Jan-Aug

5.1

Jan-Sep

-2.6

Jan-Aug

Sw eden

Sw itzerland

-2.1

Jan-Aug

Turkey

-31.8

Jan-Aug

3.0

Jan-Aug

UK

Source: TourMIS, http://w w w .tourmis.info; available data as of 7.11.16

Measures used for nights and arrivals vary by country

See TourMIS for further data including absolute values

European Tourism in 2016: Trends & Prospects (Q3/2016)

2. GLOBAL TOURISM FORECAST

SUMMARY

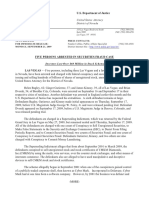

Tourism Economics global travel forecasts are shown on an inbound and outbound basis in the

following table. These are the results of the Tourism Decision Metrics (TDM) model, which is updated

in detail three times per year. Forecasts are consistent with Oxford Economics macroeconomic

outlook according to estimated relationships between tourism and the wider economy. Full origindestination country detail is available online to subscribers.

TDM Visitor Growth Forecasts, % change year

Inbound*

2014

data/estimate/forecast ***

2015

2016

Outbound**

2017

2018

2014

2015

2016

2017

2018

World

4.1%

4.5%

3.8%

3.8%

4.6%

3.2%

4.7%

4.0%

4.0%

4.8%

Americas

North America

Caribbean

Central & South America

8.5%

9.7%

5.3%

6.8%

6.1%

5.6%

8.1%

6.5%

4.2%

3.6%

3.6%

6.4%

3.8%

3.8%

4.3%

3.7%

4.0%

4.0%

3.7%

4.2%

6.9%

8.3%

9.6%

1.7%

5.1%

4.4%

16.1%

6.8%

3.7%

4.8%

3.8%

-0.7%

4.6%

5.3%

2.8%

2.1%

4.0%

4.2%

3.9%

3.1%

Europe

ETC+4

EU

Non-EU

2.1%

4.4%

4.4%

-6.2%

4.7%

4.9%

5.5%

1.5%

1.9%

1.9%

3.9%

-6.4%

3.0%

2.6%

2.1%

7.1%

4.4%

4.1%

3.8%

6.9%

-0.2%

2.4%

2.0%

-8.9%

3.3%

5.5%

5.4%

-5.8%

1.8%

2.8%

2.8%

-2.8%

2.8%

2.5%

2.6%

3.7%

4.6%

4.4%

4.5%

5.2%

5.2%

2.2%

7.1%

-7.9%

1.9%

6.5%

3.9%

4.7%

5.2%

7.2%

5.1%

-0.5%

0.9%

5.2%

8.4%

3.5%

1.9%

2.7%

4.5%

2.4%

4.4%

3.8%

4.4%

5.0%

3.4%

5.2%

-1.2%

5.9%

-4.8%

6.4%

7.4%

3.3%

7.5%

-3.8%

7.7%

4.3%

1.2%

2.8%

-0.3%

5.8%

-0.6%

3.7%

3.1%

5.0%

4.9%

4.2%

4.7%

4.2%

5.1%

3.7%

Asia & the Pacific

North East

South East

South

Oceania

5.2%

7.3%

2.8%

9.7%

6.1%

5.8%

4.3%

8.1%

3.5%

7.2%

8.8%

8.6%

9.2%

9.2%

9.0%

4.6%

4.2%

5.2%

4.3%

5.3%

4.9%

5.0%

4.8%

5.3%

4.3%

6.7%

8.0%

4.5%

13.8%

3.9%

7.8%

8.9%

6.4%

9.0%

4.0%

8.8%

10.2%

7.2%

5.4%

4.6%

5.4%

5.3%

6.0%

6.7%

4.7%

5.3%

5.4%

5.9%

6.2%

2.6%

Africa

2.1%

-4.7%

-2.6%

5.7%

6.2%

3.9%

1.8%

-0.2%

4.0%

4.1%

Mid East

8.0%

1.9%

3.6%

5.6%

6.1%

8.7%

1.4%

4.2%

7.3%

8.0%

Northern

Western

Southern/Mediterranean

Central/Eastern

- Central & Baltic

* Inbound is based on the sum of the country overnight tourist arrivals and includes intra-regional flows

** Outbound is based on the sum of visits to all destinations

The geographies of Europe are defined as follows:

Northern Europe is Denmark, Finland, Iceland, Ireland, Norway, Sweden, and the UK;

Western Europe is Austria, Belgium, France, Germany, Luxembourg, Netherlands, and Switzerland;

Southern/Mediterranean Europe is Albania, Bosnia-Herzegovina, Croatia, Cyprus, FYR Macedonia, Greece,

Italy, Malta, Montenegro, Portugal, Serbia, Slovenia, Spain, and Turkey;

Central/Eastern Europe is Armenia, Azerbaijan, Bulgaria, Czech Republic, Estonia, Hungary, Kazakhstan,

Kyrgyzstan, Latvia, Lithuania, Poland, Romania, Russian Federation, Slovakia, and Ukraine;

Central & Baltic Europe is Bulgaria, Czech Repub lic, Estonia, Hungary, Latvia, Lithuania, Poland, Romania,

and Slovakia;

ETC+4 is all ETC members plus France, the Netherlands, Sweden, and the United Kingdom

Source: Tourism Economics

10

European Tourism in 2016: Trends & Prospects (Q3/2016)

3. RECENT INDUSTRY PERFORMANCE

INDUSTRY PERFORMANCE STRONG

Passenger growth in 2016 to date has continued in line with the strong expansion

seen in 2015 worldwide.

European passenger growth has been maintained and the deterrent of further terror

attacks in Europe has eased but still weighs on growth from Asia.

A strong dollar helps bring travel growth from the Americas to Europe.

European hotel industry is exercising pricing power but tourists remain price

conscious.

3.1 AIR TRANSPORT

5.8%

The rate of World RPK

growth in 2016 to date

YTD growth based on data

to August

In the year to August, World Revenue Passenger Kilometre (RPK) growth was

5.8%, slightly slower than earlier 2016 year-to-date growth but still comfortably

above the average annual growth rate over the past 10 years (5.2%). Growth

has been helped by low oil prices continuing to feed into reduced air fares.

RPK growth was strongest in the Middle East based on 2016 year-to-date data,

with many of its hubs benefitting as gateways between Asia, Europe, and the

Americas. Growth has exceeded that for 2015 as a whole and is despite some

weaker regional traffic related to the oil industry. However, capacity growth has

continued to outstrip that of demand and passenger load factors (PLF) have

declined in the year to August on some transcontinental routes via the Middle

East and some routes to and from the Middle East itself. As these hubs

continue to jostle for market share, by adding new routes, PLF may suffer

further.

Annual International Air Passenger Growth

2014

% year, RPK

14

2015

2016 ytd

12

10

8

6

4

2

0

Africa

Asia/Pacific

Europe

Latin

America

Mid. East N. America

World

Source: IATA

11

European Tourism in 2016: Trends & Prospects (Q3/2016)

Air passenger demand to and from Asia/Pacific has grown by 8.6% so far in

2016 based on data to August. The reported rate of RPK growth marks 2016 as

the fastest growth year of the past decade, excluding the post-recession

rebound in 2010 of 9%. Fears of slowing economic growth in China have eased

in recent months, with indicators from the services side of the economy

indicating that it is still expanding strongly. Household wealth and spending

continues to rise and is supporting international travel demand.

In Latin America year-to-date RPK growth has slowed to its lowest rate since

2009. Recessions in Venezuela and Argentina, coupled with the particular deep

recession in Brazil offset demand growth elsewhere in the Latin America region

and total regional growth will remain sluggish in 2016. Both business and

leisure-related travel are suffering and RPK growth is unlikely to surpass that of

2015 at any point this year. In the case of Brazil, the summers Olympic Games

in Rio de Janeiro may have provided temporary respite, while recoveries in

Venezuela and Argentina are currently a distant prospect.

Monthly International Air Passenger Growth

May-16

% year, RPK

14

Jun-16

Jul-16

12

Aug-16

10

8

6

4

2

0

Africa

Asia/Pacific

Europe

Latin

America

Mid. East N. America

World

Source: IATA

In Europe, year-to-date RPK growth is also at its slowest since 2009 but growth

is still robust and has grown in all months of 2016 so far. Fear of further terrorist

attacks such as those seen Paris and Brussels are a likely cause of this as

some European destinations are perhaps being substituted for destinations

elsewhere.

12

European Tourism in 2016: Trends & Prospects (Q3/2016)

International Air Passenger Traffic Growth

Total

% year, RPK

20

3mth mav

15

10

5

0

-5

-10

aot-06

janv.-07

juin-07

nov.-07

avr.-08

sept.-08

fvr.-09

juil.-09

dc.-09

mai-10

oct.-10

mars-11

aot-11

janv.-12

juin-12

nov.-12

avr.-13

sept.-13

fvr.-14

juil.-14

dc.-14

mai-15

oct.-15

mars-16

aot-16

-15

Source: IATA

Data from the Association of European Airlines (AEA) confirmed that strong

growth in European airline capacity continued throughout the first quarter of

2016. Growth has averaged 4.5% so far in 2016 compared to 4.2% for the

same period in 2015. This remains in line with the trend in recent years and

continued capacity expansion at this rate is supportive of further demand

growth.

European Airlines Capacity

2014

ASK, 4 week moving average, % change year ago

14

2015

2016

12

10

8

6

4

2

0

-2

Q1

Q2

Q3

Q4

Source: AEA

Airline load factors have eased a little in recent months but remain high despite

this capacity growth. Oil prices have risen recently, but remain historically low

and continue to feed into lower air fares, in line with the usual lag period due to

price hedging, providing a further boost to demand. Average load factor for the

year-to-date is only marginally lower than for the same period in previous years

(78% compared to 80.9% in 2015 and 80.5% in 2014).

13

European Tourism in 2016: Trends & Prospects (Q3/2016)

European Airlines Passenger Load Factor

2014

Weekly load factor, %

90

2015

88

2016

86

84

82

80

78

76

74

72

70

Q1

Q2

Q3

Q4

Source: AEA

87%

Peak of European airline

passenger load factor in

2016 to date

Based on data to Q3

In 2016 total European airline passenger growth has significantly outpaced

demand on European-Asian routes. This may be related to fears regarding

recent terrorist attacks, as well as some slowdown in emerging markets. This is

particularly true in the case of travel to France where nearly 40% fewer

Japanese and 23% fewer Chinese arrivals are reported in year-to-date data to

October (not available through TourMIS). Passenger demand growth for Asian

routes has diverged from total European passenger demand to an

unprecedented extent in 2016: the average percentage point (pp) difference

has widened further to 3.4pp (compared to 2.8pp as of Q2 2016). This follows a

period in 2014 and 2015 when travel between Europe and Asia increased at a

faster rate than total European airline passenger growth.

European Airline Passenger Traffic: Asia

RPK, 4 week moving average, % change year ago

20

Asia

Total

15

10

5

0

-5

-10

Source: AEA

Air passenger flows between Europe and the Americas continued to grow at a

faster rate than total scheduled travel to and from Europe in 2016. The two

flows have also diverged to an unprecedented degree. The average difference

between them was 5.3pp for 2016 to date. This is a substantial premium

compared to the average difference in 2015 of 1.7pp. The greatest percentage

point difference observed in 2016 was 9.7. United States outbound travel to

Europe has been particularly strong due to the relative strength of the dollar

14

European Tourism in 2016: Trends & Prospects (Q3/2016)

9.7pp

The gap between EuropeAmericas and total European

airline passenger growth in

2016

This is the biggest observed

pp difference in 2016

against key European currencies as well as favourable economic conditions in

the United States. Even with some slightly softer US demand implied by this

data in recent months it will remain an important long-haul growth market in

2016, especially with some weakening demand from Asia.

European Airline Passenger Traffic: Americas

RPK, 4 week moving average, % change year ago

Americas

Total

20

15

10

5

0

-5

Source: AEA

3.2 ACCOMMODATION

Global accommodation sector performance remained mixed in the first nine

months of 2016. The worst performing region was the Middle East & Africa; all

three measures of Occupancy, ADR and revenue per available room (RevPAR)

showed a downturn compared to the first nine months of 2015. Meanwhile all

other regions boasted at least one positive performance measure although in

Europes case this was just occupancy.

Global Hotel Performance

Occ

Jan-Sep year to date, % change year ago

4

ADR ()

RevPAR ()

2

0

-2

-4

-6

-8

-10

Asia/Pacific

Americas

Europe

Middle East/Africa

Source: STR Global

In Asia/Pacific occupancy was up 1.8% compared to the first nine months of

2015. However, this growth was likely aided by lower average daily rates (ADR)

in the region which fell 3.2% in euro terms over the same period. As a result,

15

European Tourism in 2016: Trends & Prospects (Q3/2016)

RevPAR also fell the only global region for which this was the case. This

modest demand and price cutting is consistent with some weakening

economies and softer travel demand from Asian markets.

In the Americas, room rates continued to rise in US dollar terms (2.3%) but this

continued to be entirely buoyed by North American performance; ADR in other

regions of the Americas fell over the same period. North American hotel

occupancy was unchanged from 2015 levels, allowing hotels to continue to

exercise pricing power and raise rates, indicating a degree of optimism

regarding future growth. However, across the rest of the Americas occupancy

rates were down with large falls in the Caribbean and South America. South

Americas accommodation sector in particular continued to feel the pinch of

recessions.

0.2%

The rate of occupancy

growth in Europe in 2016

Based on 2016 year-to-date

data to September

In Europe as a whole, accommodation sector performance was exceptionally

lacklustre with occupancy growing by just 0.2% alongside a 2.3% reduction in

ADR over the same period. This led to RevPAR contraction of 2.1%. However,

the regional growth trend includes ADR priced in euros while in local currency

terms a majority of destinations were able to raise room rates. Notably, the UK

and Russia have been able to raise rates in local currency terms in Russias

case by 12% in rouble terms but, because of weaker currencies in 2016 to

date, ADR is lower than a year ago in euro terms. Recent depreciation of

sterling will exacerbate this trend for the UK.

16

European Tourism in 2016: Trends & Prospects (Q3/2016)

4. SPECIAL FEATURE

THE IMPACTS OF BREXIT ON EUROPEAN TOURISM

1.4%

UK GDP growth in 2017 as

recession should be avoided

Slower growth is due to

weaker investment with

heightened uncertainty

The UK voted to leave the EU in the referendum held on 23rd June with

significant and far-reaching implications for a wide range of business activities,

including tourism. A previous special feature (in the Q1/2016 report) considered

the potential impacts of a UK vote to leave on economic growth. This feature

updates that prior analysis and describes potential impacts on tourism across

Europe.

Since the so-called Brexit vote, the economic outlook for the UK has

deteriorated, although recession still appears unlikely. Following some initial

gloomy data releases and surveys, the UK economy has enjoyed some good

news with continued growth reported in output and spending. But this growth is

slower than the trend earlier in the year and Oxford Economics current

baseline expectation of 1.4% GDP growth in 2017 is consistent with prior

scenarios of Brexit.

Business investment is set to drop over the next year and will be the largest

drag on the economy in coming years. Large businesses are unwilling to spend

due to the uncertainty surrounding the UKs future relationship with the EU.

Political announcements had removed some of the uncertainty surrounding the

timing of the UKs formal exit from the EU and the future relationship, but the

high court ruling that this is subject to parliamentary approval adds further

confusion. A deadline of the end of March 2017 has been set by the

Government for triggering Article 50 of the Lisbon Treaty which begins the

formal process of leaving the EU and the start of official negotiations. This

would begin a two-year negotiating period and the UK will therefore no longer

be part of the EU by early 2019. But greater parliamentary approval and input

may affect this timing and also the goals of negotiations.

Exchange Rate: Sterling vs Euro

1 =

1.5

New baseline

1.4

Pre-Brexit baseline

1.4

1.3

1.3

1.2

1.2

1.1

1.1

1.0

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

Source: Tourism Economics

Government statements have clarified that a key point for the UK in any future

relationship will be control over immigration. This stance is incompatible with

17

European Tourism in 2016: Trends & Prospects (Q3/2016)

1.15

Expected value of sterling for

2017 on average

15% weaker value than preBrexit vote expectations

the UK remaining within the European Economic Area. The UK governments

current preferred option appears to be to negotiate a free trade agreement with

the EU; involving complex negotiations within a relatively short timeframe. The

alternative would be a reversion to trading under WTO rules. Both options

would likely involve lower trade volumes and long-run GDP lower than under a

pre-Brexit baseline outlook.

There has been a strong reaction in currency markets to the clarifications of the

UKs future status outside of the EU. Sterling fell further against the euro and

the US dollar in October and is likely to remain relatively weak for the duration

of the negotiation period. Oxford Economics forecasts suggest an average rate

1.15 for 2017; only a modest improvement from the current low rates. This

expected rate is 15% weaker than the rate of 1.35 which was anticipated for

2017 prior to the vote.

The value of sterling, and this large swing in value, is an important factor in

understanding the impact on tourism demand. A fall in the value of sterling

typically results in a narrowing of the tourism balance. The UK typically runs a

negative tourism balance as tourism exports (inbound spending) are smaller

than tourism imports (outbound spending) and this is expected to become

smaller in 2017 and 2018 as a result of the falls in sterling. The weaker

currency means that UK is a more affordable destination resulting in an

increase in visits. At the same time, foreign travel has become more expensive

and UK departures are set to fall.

UK tourism balance and exchange rate index

Tourism exports minus imports, bn

-5

Exchange rate index, inverted

70

Tourism balance (lhs)

Exchange rate index (rhs)

-10

80

-15

90

-20

100

-25

2000

110

2002

2004

2006

2008

2010

2012

2014

2016

2018

Source: Tourism Economics

The benefit to UK inbound travel may be partly offset by a possible fall in

business travel related to the lower investment. Weaker business activity in the

UK and less inward investment will act as a drag on related travel demand.

Draft headline UK arrivals data have been published for the year to August and

show some modest improvement in the two months following the referendum

vote (more detailed data, including the split by source market is only available

for months to June fully consistent with that sourced through TourMIS in the

source market performance section).

UK outbound travel has also not been immediately affected in total for 2016 to

date according to both UK departures data and data reported by other

18

European Tourism in 2016: Trends & Prospects (Q3/2016)

European destinations through TourMIS. A majority of European destinations

are reporting slower growth from the UK than earlier in the year, but this is also

part of the wider trend of more moderate growth being evident as less volatile

peak summer months are included in year-to-date calculations.

Larger impacts on UK outbound and inbound travel demand are likely to be

evident in 2017 given the more recent movements in the currency and typical

lags between this and tourism behaviour due to pre-bookings.

UK outbound travel is set to fall by around 2.5% in 2017, taking into account

the slower economic growth and weaker value of sterling. This contrasts with

an expectation of around 3.5% growth prior to the Brexit vote. This 6% point

swing in expected growth will vary considerably by destination.

UK visitor arrivals by top 20 destinations, pp change in growth, 2017

Australia

India

Thailand

China

United States

Cyprus

Canada

Ireland

Egypt

Poland

Czech Republic

Greece

Spain

Italy

UAE

Sweden

Belgium

France

Portugal

-8.1%

-7.9%

-7.8%

-7.8%

-7.7%

-7.3%

-7.0%

-6.5%

-6.5%

-6.2%

-6.1%

-5.9%

-5.5%

-4.9%

-4.8%

-4.8%

-4.8%

-4.6%

-4.6%

-9%

-8%

-7%

-6%

-5%

-4%

Note: Destinations in Europe shaded as light blue.

-3%

-2%

-1%

0%

Source: Tourism Economics

Typical relationships between exchange rates and travel demand show that

long-haul travel demand is more price sensitive than short-haul travel. Hence,

UK travel to longer-haul destinations will see more of an impact. In fact some

UK travellers may switch away from more expensive long-haul trips with a

relative benefit to less expensive alternative destinations within the region.

The overall impact for European impacts is likely to be for slower growth from

the UK and potential declines at least in the short-term. Exposure to the UK

market will determine the extent to which this will affect the market as a whole.

Many short-haul destinations are more heavily reliant on the UK as a source

market, in which case the overall impact on performance will be larger.

However, looking at a city destination level, there are some large long-haul

market with high exposure to the UK market.

All impacts, are of course, uncertain given the ongoing developments in the

political relationships. As well as the economic uncertainty the precise outcome

of the negotiated relationship between UK and the EU will be important in

several areas. For example, UK currently benefits from high air access as all

19

European Tourism in 2016: Trends & Prospects (Q3/2016)

EU carriers can freely operate across borders. Any reduction in air capacity

from a new agreement could directly increase travel costs2.

% share of

international

arrivals

City arrivals from the UK, 2015

000s arrivals

Berlin

Bangkok

Rome

Istanbul

Cracow

Barcelona

Las Vegas, NV

Warsaw

Antalya

Dubai

Orlando, FL

Amsterdam

Paris

New York, NY

Dublin

11%

3%

8%

5%

23%

10%

12%

18%

7%

8%

16%

18%

10%

9%

30%

0

200

400

600

800

1,000

1,200

1,400

Source: Tourism Economics

http://www.oxera.com/Latest-Thinking/Publications/Reports/2016/How-could-Brexit-affect-the-transport-sector.aspx

20

European Tourism in 2016: Trends & Prospects (Q3/2016)

5. KEY SOURCE MARKET

PERFORMANCE

2016 MAINTAINS ITS MOMENTUM

European travel demand continues to grow across the majority of markets.

Intra-European travel remains crucial for future growth while US travel demand

continues to grow helped by a strong dollar.

Economic slowdown and a weaker pound in the UK as a result of the Brexit

referendum is a concern for outbound travel demand but UK inbound will benefit.

Trends discussed in this section in some cases relate to the first nine months of the year although

actual coverage varies by destination. For the majority of countries July or August will be the latest

available data point. Further detailed monthly data for origin and destination, including absolute

values, can be obtained from TourMIS, http://tourmis.info.

5.1 KEY INTRA-EUROPEAN MARKETS

out of 32 destinations

reported growth from

Germany pointing to

continued intra-regional

growth in 2016

German visits and overnights to select destinations

Arrivals

2016 year-to-date*, % change year ago

25

Nights

20

15

Turkey, -27.6% (A)

10

5

0

-5

-10

-15

Iceland

Bulgaria

Norway

Estonia

Portugal

Slovakia

Monaco

Latvia

Czech Rep

Poland

Croatia

Malta

Austria

Cyprus

Lithuania

Spain

Slovenia

Denmark

Netherlands

Ireland Rep

Sweden

Romania

Serbia

Finland

Greece

Montenegro

UK

Luxembourg

Switzerland

Hungary

Belgium

Turkey

26

The vast majority of European destination markets have reported growth from

Germany so far in 2016 compared to the same period of 2015. Iceland boasted

the strongest growth in arrivals from Germany: 22.7% higher based on data to

September compared to the same period in 2015. Bulgaria has also enjoyed

strong growth from Germany (+19.2%). German tourists typically comprise over

10% of all arrivals to Bulgaria, hence growth of this magnitude represents a

substantial number of new arrivals. Travel to Belgium and Turkey has fallen

sharply as travellers are deterred from both destinations in the aftermath of

terror attacks.

-20

Source: TourMIS

*date varies (Jan-Sep) by destination

21

European Tourism in 2016: Trends & Prospects (Q3/2016)

Montenegro has enjoyed strong arrivals growth of 55.7% from the Netherlands

in 2016 to date as well as strong overnights growth (+34.3%), both based on

data to August. Iceland has also reported robust growth from the Netherlands

based on data to September which showed the number of Dutch arrivals to be

up 24.5% compared to the same period in 2015.

Arrivals from the Netherlands to the UK have grown strongly based on data to

June, and this growth will potentially be bolstered by the weaker pound in the

second half of 2016.

Dutch visits and overnights to select destinations

2016 year-to-date*, % change year ago

25

Arrivals

Nights

Montenegro, 34.3% (N) & 55.7% (A)

15

-5

-15

Montenegro

Iceland

Norway

Estonia

Bulgaria

Lithuania

Slovakia

Portugal

Spain

Malta

UK

Denmark

Finland

Czech Rep

Austria

Slovenia

Greece

Croatia

Romania

Hungary

Serbia

Luxembourg

Poland

Switzerland

Germany

Sweden

Monaco

Cyprus

Belgium

Latvia

Turkey

-25

Source: TourMIS

Some of the caution that existed at the beginning of the year appears to have

dissipated and the majority of destinations are now reporting some growth from

France, returning to more normal trends. Lithuania, Iceland, and Norway in

particular have reported strong growth from France. The UK is one of the few

destinations which reported falling arrivals from France based on data to June,

6% lower than the same period in 2015. As data relevant to the weaker pound

becomes available we would expect to see a return to growth.

French visits and overnights to select destinations

Arrivals

2016 year-to-date*, % change year ago

35

Nights

30

25

Belgium, -14.2% (N) & -15.2% (A)

Greece, -20.6% (A)

Turkey, -33.5% (A)

20

15

10

5

0

-5

-10

Lithuania

Iceland

Norway

Cyprus

Slovakia

Bulgaria

Portugal

Estonia

Denmark

Croatia

Spain

Finland

Slovenia

Ireland Rep

Malta

Poland

Romania

Montenegro

Luxembourg

Germany

Monaco

Netherlands

Latvia

Serbia

Switzerland

Czech Rep

Austria

Hungary

Sweden

UK

Belgium

Greece

Turkey

French travel behaviour has

seemingly normalised

following the disruption

earlier in the year related to

terror attacks.

*date varies (Jan-Sep) by destination

Source: TourMIS

*date varies (Jan-Sep) by destination

22

European Tourism in 2016: Trends & Prospects (Q3/2016)

Iceland was the favoured destination of Italians in arrivals growth terms based

on data to September, closely followed by Denmark and Slovakia based on

data to August. The UK and Estonia also reported strong growth from Italy

based on data to June and August respectively. The UK could see this growth

accelerate in the second half of the year thanks to a weaker pound. However, a

large minority of destinations report some falling demand from Italy in the year

to date, and growth prospects remain subdued.

Italian visits and overnights to select destinations

Arrivals

2016 year-to-date*, % change year ago

30

Nights

25

Belgium, -31.4% (N) & -31.5% (A)

Turkey, -57.7% (A)

20

15

10

5

-5

-10

Iceland

Denmark

Slovakia

UK

Estonia

Luxembourg

Portugal

Ireland Rep

Monaco

Romania

Poland

Finland

Cyprus

Slovenia

Spain

Montenegro

Malta

Latvia

Serbia

Bulgaria

Croatia

Greece

Switzerland

Netherlands

Austria

Hungary

Sweden

Czech Rep

Germany

Lithuania

Belgium

Turkey

Source: TourMIS

Weaker sterling is likely to

weigh on UK outbound in the

short term.

*date varies (Jan-Sep) by destination

Thirteen reporting destinations have enjoyed double-digit arrivals growth from

the UK so far in 2016. Three of these destinations (Latvia, Iceland, and Croatia)

have enjoyed arrivals growth in excess of 20%. The large destinations of Spain,

Portugal, and Ireland each reported handsome double-digit growth in arrivals

and overnights based on data to August. Since arrivals from the UK equate to

around 50% of total arrivals to Ireland, 25% of total arrivals to Spain, and 16%

of total arrivals to Portugal, such growth is a substantial driver of total growth

for all three destinations.

But following the UKs referendum vote to leave the EU the near-term growth

prospects have been downgraded amid significant uncertainty. UK outbound

travel demand expectations have been downgraded due to the weaker growth

outlook for the UK economy, coupled with a fall in the value of the pound.

Notably, the pound has lost in excess of 10% of its value against the euro in

2016. And whilst Britons will continue to travel, some destinations will shoulder

a greater proportion of the Brexit burden than others in the short-term, namely

Ireland, Spain, and Portugal given their high share of British arrivals.

23

European Tourism in 2016: Trends & Prospects (Q3/2016)

UK visits and overnights to select destinations

Arrivals

2016 year-to-date*, % change year ago

35

Nights

25

Turkey, -30.9% (A)

15

-5

-15

-25

Latvia

Iceland

Croatia

Slovakia

Montenegro

Denmark

Spain

Portugal

Ireland Rep

Greece

Slovenia

Sweden

Romania

Cyprus

Poland

Serbia

Netherlands

Czech Rep

Hungary

Norway

Lithuania

Malta

Austria

Estonia

Switzerland

Germany

Luxembourg

Bulgaria

Finland

Monaco

Belgium

Turkey

Source: TourMIS

out of 32 destinations

reported falling arrivals or

overnights from Russia. The

most sizeable falls were

observed in Turkey.

Turkey has endured the largest decline in Russian arrivals so far in 2016, down

87.9% based on data to August, even weaker than the 67.7% decline reported

earlier in the year based on data to April. Relations between the two have been

fragile since the Turkish Air Force shot down a Russian fighter jet on the

Syrian-Turkey border in November 2015. Russia had imposed (but has since

lifted) travel restrictions on Russian tourists visiting Turkey, and, notable efforts

have been made to restore relations between the two countries. Some

improvement in tourism performance may follow in 2017, but Russians will still

share the same safety concerns of other European markets regarding travel to

Turkey and any growth is unlikely to immediately offset these falls.

Cyprus, Iceland, and Slovakia all reported strong arrivals growth from Russia.

In Cyprus, arrivals growth was in double-digit territory (+44.5%) based on data

to September. But this includes some rebound from falls in prior years and

potentially some substitution from travel which would ordinarily have been

bound for Turkey.

Russian visits and overnights to select destinations

Arrivals

2016 year-to-date*, % change year ago

30

Nights

20

Cyprus, 44.5% (A)

Malta, -31.4% (N)

Turkey, -87.9% (A)

10

0

-10

-20

Cyprus

Iceland

Slovakia

Bulgaria

Greece

Spain

Montenegro

Latvia

Croatia

Romania

Serbia

Estonia

Norway

Lithuania

Luxembourg

Poland

Slovenia

Portugal

Monaco

Hungary

UK

Denmark

Switzerland

Czech Rep

Finland

Germany

Netherlands

Austria

Sweden

Belgium

Malta

Turkey

20

*date varies (Jan-Sep) by destination

-30

Source: TourMIS

*date varies (Jan-Sep) by destination

24

European Tourism in 2016: Trends & Prospects (Q3/2016)

5.2 NON-EUROPEAN MARKETS

All but six destinations have reported some growth from the US so far in 2016.

Iceland was the most popular US growth destination, up 63.5% based on data

to September. This growth is aided by Icelands growing importance as a hub

for trans-Atlantic travel. Both Europeans and North Americans have been

increasingly breaking up trans-Atlantic trips with some nights in Iceland. In

addition, continued growth in scheduled seats on flights between Iceland and

the US, and also to European destinations will allow continued growth.

Latvia and Portugal also fared well; each reporting respective US arrivals

increases of 41.1% and 20.1% with almost equal overnights to match based on

data to June and August respectively.

Turkey and Belgium have seen notably lower arrivals from the US, each down

in excess of 25%, due to a combination of political unrest and terror threats.

The US government issued a travel alert to US citizens regarding the risk of

potential terrorist attacks throughout Europe in 2016. Perceived high-risk

destinations included France due to Euro 2016, Poland, which hosted World

Youth Day (which attracted around 2 million visitors) and Turkey. This travel

alert expired at the end of August 2016 and is therefore reflected in much of the

reported data.

US visits and overnights to select destinations

Arrivals

2016 year-to-date*, % change year ago

35

Nights

Iceland, 63.5% (A)

Belgium, -25.7% (N) & -25.5% (A)

Turkey, -37.2% (A)

25

15

-5

-15

Iceland

Latvia

Portugal

Norway

Slovakia

Serbia

Malta

Poland

Netherlands

Finland

Montenegro

Slovenia

Spain

Croatia

Denmark

Estonia

Romania

Greece

Switzerland

Germany

Sweden

Lithuania

Hungary

Czech Rep

UK

Austria

Bulgaria

Monaco

Cyprus

Luxembourg

Belgium

Turkey

-25

Source: TourMIS

*date varies (Jan-Sep) by destination

Arrivals growth was reported in just over half of reporting European

destinations, although Japan remains a large source market for many

destinations despite this relative stagnation. Some strengthening of the yen in

2016, and notably following the Brexit vote, has aided affordability for Japanese

travellers, but does not fully offset prior currency depreciation. Japans

economy has been in and out of recession over the past few years and this has

been evident in reported outbound tourism performance. Growth has been

notable in Montenegro, where arrivals from Japan in excess of 50% (albeit from

a relatively low base). Japanese arrivals growth was also strong in Iceland and

Poland where volumes increased in excess of 25% based on data to

September and August respectively. Turkey and Belgium were amongst the

least popular destination markets due to a combination of political unrest and

the threat of terrorism.

25

European Tourism in 2016: Trends & Prospects (Q3/2016)

Japanese visits and overnights to select destinations

Arrivals

2016 year-to-date*, % change year ago

30

Nights

Montenegro, 50.9% (A)

Belgium, -41.5% (N) & -46.2% (A)

Turkey, -56.8% (A)

20

10

-10

-20

Montenegro

Iceland

Poland

Slovakia

Bulgaria

UK

Portugal

Latvia

Norway

Lithuania

Sweden

Estonia

Denmark

Finland

Cyprus

Serbia

Spain

Monaco

Switzerland

Austria

Czech Rep

Hungary

Germany

Slovenia

Croatia

Luxembourg

Netherlands

Romania

Belgium

Turkey

-30

Source: TourMIS

*date varies (Jan-Sep) by destination

China continues to be a source of huge arrivals growth for many European

destinations, albeit from some lower volumes than for more established

markets. Half a dozen countries reported arrivals growth from China in excess

of 30%. The UK reported a 16% fall in the number of Chinese arrivals it

received based on data to June but a weaker pound may help to soften this fall

in the latter half of the year.

Turkey and Belgium were again amongst the least popular Chinese destination

markets due to the perceived threat of terror attacks and security issues which

will likely continue to undermine some Chinese growth to Europe for the

remainder of 2016. This is further evidenced in some reported French year-todate data to October (not available through TourMIS) which reports large falls

in Chinese visitors in 2016 compared to 2015.

Chinese visits and overnights to select destinations

Arrivals

2016 year-to-date*, % change year ago

50

Nights

40

Switzerland, -21.8% (A)

Belgium, -23.8% (N) & -26.9% (A)

Greece, -27.6% (A)

Turkey, -50.8% (A)

30

20

10

-10

-20

Slovakia

Norway

Hungary

Serbia

Latvia

Iceland

Poland

Sweden

Finland

Spain

Slovenia

Bulgaria

Portugal

Czech Rep

Romania

Estonia

Croatia

Lithuania

Austria

Denmark

Germany

Cyprus

Montenegro

Netherlands

UK

Luxembourg

Switzerland

Monaco

Belgium

Greece

Turkey

Source: TourMIS

*date varies (Jan-Sep) by destination

All but six reporting destinations enjoyed arrivals growth from India. Three of

these are familiar in the form of Turkey, Belgium, and the UK. Croatia was the

most popular Indian growth destination with arrivals 78.6% higher and

overnights 68.8% higher in 2016 than 2015 based on data to August. This

growth across the majority of destinations has been aided by a strong

26

European Tourism in 2016: Trends & Prospects (Q3/2016)

economic backdrop in India (led by strong GDP growth, a positive consumer

spending outlook, and a rising number of middle-income households). And,

although current arrivals numbers from India are low in absolute terms, India

will become increasingly more important as a source market for European

destinations in the coming years.

Indian visits and overnights to select destinations

Arrivals

2016 year-to-date*, % change year ago

50

Nights

40

Croatia, 68.8% (N) & 78.6% (A)

Belgium, -21.8% (N) & -31.8% (A)

Turkey, -35.6% (A)

30

20

10

Source: TourMIS

Turkey

Belgium

UK

Monaco

Switzerland

Montenegro

Sweden

Germany

Finland

Czech Rep

Denmark

Hungary

Austria

Bulgaria

Poland

Romania

Slovakia

Netherlands

Latvia

-10

Croatia

*date varies (Jan-Sep) by destination

Many destinations have reported sizeable arrivals and overnights growth from

Canada so far in 2016. Travel to Iceland was strong to September (+62.1%),

aided by its hub status on transatlantic flights. Continued growth in scheduled

seats on flights between Iceland and Canada and onward to European

destinations will facilitate further growth. Strong growth to Finland is skewed by

substantial flows in January when Finland hosted the Ice Hockey World Junior

Championships with reported arrivals growth of 175% and overnights growth of

701% compared to January 2015. This has since abated to more typical rates.

Spain was also the recipient of some very strong arrivals growth from Canada

(45.9% based on data to August), albeit from a very small base. It is possible

that along with Spain is benefitting from some displaced travel which may have

otherwise been bound for France if not for recent terrorist activity.

Canadian visits and overnights to select destinations

Arrivals

2016 year-to-date*, % change year ago

50

Nights

40

Iceland, 62.1% (A)

Belgium, -22.0% (N) & -21.3% (A)

Turkey, -37.6% (A)

30

20

10

-10

-20

Iceland

Finland

Spain

Slovakia

Poland

Croatia

Portugal

Romania

Serbia

Slovenia

Montenegro

Lithuania

Denmark

Sweden

Hungary

Monaco

Netherlands

Czech Rep

Austria

Switzerland

Germany

Greece

Bulgaria

Latvia

Cyprus

Belgium

Turkey

Source: TourMIS

*date varies (Jan-Sep) by destination

27

European Tourism in 2016: Trends & Prospects (Q3/2016)

6. ORIGIN MARKET SHARE ANALYSIS

METHODOLOGY

Based on the Tourism Decision Metrics (TDM) model, the following charts and analysis show

Europes evolving market position in absolute and percentage terms for selected source

markets. 2015 values are, in most cases, year-to-date estimates based on the latest available

data and are not final reported numbers.

Data in these charts and tables relate to reported arrivals in all destinations as a comparable

measure of outbound travel for calculation of market share.

For example, US outbound figures featured in the analysis are larger than reported departures

in national statistics as long haul trips often involve travel to multiple destinations. In 2014 US

data reporting shows 11.9m departures to Europe while the sum of European arrivals from the

US was 23.4m. Thus each US trip to Europe involved a visit to two destinations on average.

The geographies of Europe are defined as follows:

Northern Europe is Denmark, Finland, Iceland, Ireland, Norway, Sweden, and the UK;

Western Europe is Austria, Belgium, France, Germany, Luxembourg, Netherlands, and

Switzerland;

Southern/Mediterranean Europe is Albania, Bosnia-Herzegovina, Croatia, Cyprus, FYR

Macedonia, Greece, Italy, Malta, Montenegro, Portugal, Serbia, Slovenia, Spain, and Turkey;

Central/Eastern Europe is Armenia, Azerbaijan, Bulgaria, Czech Republic, Estonia, Hungary,

Kazakhstan, Kyrgyzstan, Latvia, Lithuania, Poland, Romania, Russian Federation, Slovakia,

and Ukraine.

28

European Tourism in 2016: Trends & Prospects (Q3/2016)

6.1 UNITED STATES

US Market Share Summary

2016

Growth (2016-21)

Level

Share**

105,002

Annual

average

4.5%

Long haul (000s)

62,358

59.4%

5.3%

Short haul (000s)

42,644

40.6%

3.3%

27,446

26.1%

Northern Europe (000s)

6,648

Western Europe (000s)

Southern Europe (000s)

Central/Eastern Europe (000s)

Total outbound travel (000s)

Travel to Europe (000s)

Growth (2011-16)

Cumulative

growth*

24.6%

Cumulative

growth*

36.1%

29.4%

61.7%

32.4%

61.0%

17.6%

38.3%

41.9%

39.0%

5.5%

30.4%

27.4%

32.9%

26.8%

6.3%

5.8%

32.6%

6.7%

34.8%

6.4%

9,368

8.9%

4.3%

23.2%

8.8%

19.5%

10.2%

7,786

7.4%

5.4%

29.9%

7.7%

44.7%

7.0%

3,645

3.5%

7.9%

46.4%

4.1%

45.7%

3.2%

Share 2021**

Share 2011**

-

*Shows cumulative change over the relevant time period indicated

**Shares are expressed as % of total outbound travel

Source: Tourism Economics

US Long Haul* Outbound Travel

Visits, 000s

80.000

Rest of Long Haul

Central/Eastern Europe

Southern Europe

Western Europe

Northern Europe

70.000

60.000

50.000

40.000

30.000

20.000

10.000

0

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

*Long haul defined as tourist arrivals to destinations outside North America

Source: Tourism Economics

Europe's Share of US Market

% share of long haul* market

20%

18%

16%

14%

12%

10%

8%

6%

4%

2%

0%

2006

2008

2010

Northern Europe

Western Europe

Southern Europe

2012

2014

2016

2018

2020

*Long haul defined as tourist arrivals to destinations outside North America

Source: Tourism Economics

29

European Tourism in 2016: Trends & Prospects (Q3/2016)

6.2 CANADA

Canada Market Share Summary

2016

Grow th (2016-21)

Level

Share**

Annual

average

Cum ulative

grow th*

Share 2021**

Cum ulative

grow th*

Share 2011**

32,609

4.1%

22.2%

-0.8%

Long haul (000s)

12,588

38.6%

3.2%

17.0%

37.0%

16.9%

32.8%

Short haul (000s)

20,021

61.4%

4.6%

25.4%

63.0%

-9.4%

67.2%

Travel to Europe (000s)

4,866

14.9%

2.6%

13.6%

13.9%

17.5%

12.6%

Northern Europe (000s)

1,136

3.5%

5.9%

33.4%

3.8%

12.7%

3.1%

Western Europe (000s)

1,656

5.1%

2.4%

12.8%

4.7%

7.9%

4.7%

Southern Europe (000s)

1,778

5.5%

0.8%

4.0%

4.6%

31.8%

4.1%

296

0.9%

-0.2%

-1.2%

0.7%

17.7%

0.8%

Total outbound travel (000s)

Central/Eastern Europe (000s)

Grow th (2011-16)

*Show s cumulative change over the relevant time period indicated

**Shares are expressed as % of total outbound travel

Source: Tourism Economics

Canada Long Haul* Outbound Travel

Visits, 000s

14.000

Rest of Long Haul

12.000

Southern Europe

Northern Europe

Central/Eastern Europe

Western Europe

10.000

8.000

6.000

4.000

2.000

0

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

*Long haul defined as tourist arrivals to destinations outside North America

Source: Tourism Economics

Europe's Share of Canadian Market

% share of long haul* market

20%

18%

16%

14%

12%

10%

8%

6%

4%

2%

0%

2006

2008

2010

Northern Europe

Western Europe

Southern Europe

Central/Eastern Europe

2012

2014

2016

2018

2020

*Long haul defined as tourist arrivals to destinations outside North America

Source: Tourism Economics

30

European Tourism in 2016: Trends & Prospects (Q3/2016)

6.3 MEXICO

Mexico Market Share Summary

2016

Grow th (2016-21)

Level

Share**

Annual

average

Cum ulative

grow th*

Share 2021**

Cum ulative

grow th*

Share 2011**

21,696

3.4%

18.0%

37.9%

Long haul (000s)

2,776

12.8%

4.1%

22.0%

13.2%

38.9%

12.7%

Short haul (000s)

18,920

87.2%

3.3%

17.4%

86.8%

37.8%

87.3%

Travel to Europe (000s)

1,423

6.6%

3.4%

18.1%

6.6%

20.1%

7.5%

Northern Europe (000s)

105

0.5%

2.5%

13.2%

0.5%

27.8%

0.5%

Western Europe (000s)

601

2.8%

4.8%

26.5%

3.0%

-2.8%

3.9%

Southern Europe (000s)

557

2.6%

2.2%

11.4%

2.4%

43.3%

2.5%

Central/Eastern Europe (000s)

160

0.7%

2.5%

13.0%

0.7%

66.4%

0.6%

Total outbound travel (000s)

Grow th (2011-16)

*Show s cumulative change over the relevant time period indicated

**Shares are expressed as % of total outbound travel

Source: Tourism Economics

Mexico Long Haul* Outbound Travel

Visits, 000s

3.500

3.000

2.500

Rest of Long Haul

Central/Eastern Europe

Southern Europe

Western Europe

Northern Europe

2.000

1.500

1.000

500

0

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

*Long haul defined as tourist arrivals to destinations outside North America

Source: Tourism Economics

Europe's Share of Mexican Market

Northern Europe

Western Europe

Southern Europe

Central/Eastern Europe

% share of long haul* market

35%

30%

25%

20%

15%

10%

5%

0%

2006

2008

2010

2012

2014

2016

2018

2020

*Long haul defined as tourist arrivals to destinations outside North America

Source: Tourism Economics

31

European Tourism in 2016: Trends & Prospects (Q3/2016)

6.4 ARGENTINA

Argentina Market Share Summary

Grow th (2016-21)

2016

Level

Total outbound travel (000s)

Grow th (2011-16)

Share**

Annual

average

Cum ulative

grow th*

Share 2021**

Cum ulative

grow th*

Share 2011**

10,517

3.0%

16.1%

52.5%

Long haul (000s)

2,971

28.3%

5.4%

30.2%

31.7%

54.9%

27.8%

Short haul (000s)

7,545

71.7%

2.0%

10.6%

68.3%

51.6%

72.2%

Travel to Europe (000s)

1,165

11.1%

5.1%

28.3%

12.2%

78.0%

9.5%

Northern Europe (000s)

138

1.3%

9.4%

56.6%

1.8%

80.3%

1.1%

Western Europe (000s)

58

0.5%

6.8%

39.0%

0.7%

54.6%

0.5%

Southern Europe (000s)

841

8.0%

3.1%

16.2%

8.0%

79.5%

6.8%

Central/Eastern Europe (000s)

129

1.2%

11.4%

71.8%

1.8%

77.6%

1.1%

*Show s cumulative change over the relevant time period indicated

**Shares are expressed as % of total outbound travel

Source: Tourism Economics

Argentina Long Haul* Outbound Travel

Visits, 000s

3.500

3.000

2.500

2.000

Rest of Long Haul

Central/Eastern Europe

Southern Europe

Western Europe

Northern Europe

1.500

1.000

500

0

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

*Long haul defined as tourist arrivals to destinations outside South America

Source: Tourism Economics

Europe's Share of Argentinian Market

Northern Europe

Western Europe

Southern Europe