Académique Documents

Professionnel Documents

Culture Documents

11

Transféré par

Nahidul Islam IUCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

11

Transféré par

Nahidul Islam IUDroits d'auteur :

Formats disponibles

General Banking and Factors Influencing Propensity to Savings

Chapter: 07

Summary of Findings, Recommendation and Conclusion

Chapter overview

Page no.

7.1. Introduction

81

7.2. Summary of findings

81

7.2.1. Factors increasing the level of banks savings

81

7.2.2. Factors impeding the level of banks savings

81

7.2.3. Suggestions for improving saving mobilization

81

7.3. Recommendation

82-83

7.3.1. General banking activities of basic bank limited

82

7.3.2. Factors influencing propensity to savings:

83

7.4. Conclusion

84

7.5. Bibliography & references

85

7.6. Appendix

86-88

Chapter Summary of Findings, Recommendation and Conclusion

7.1. INTRODUCTION

The purpose of this study was to investigate the factors influencing mobilization of savings in

banks. Using questionnaires and interview schedules, the researcher collected data from banker

and customers. Data was then presented and analyzed accordingly. This chapter provides the

summary of findings, recommendations and conclusions.

7.2. SUMMARY OF FINDINGS

This section presents the findings of the study sub-divided into three parts: Factors increasing the

level of banks savings, Factors impeding the level of banks savings and suggestions for

improving saving mobilization.

7.2.1. Factors increasing the level of banks savings:

On factors that affect savings positively, the respondents indicate that safety of funds, online

banking facilities, secured transaction process, favorable attitude of bank personnel, competitive

interest and service charges and Quick/Prompt service are the most serious factors in that order.

7.2.2. Factors impeding the level of banks savings:

Both customers and bank staff agree on the following as factors affecting deposit mobilization:

Political Instability, High level of taxation, Low level of income, Limited diversity of deposit

products, High inflation rate. These factors are both internal and external to the bank. This calls

for the bank to address the concerns raised by both the bank employees and customers. Strategies

to deal with these concerns need to be put in place in order to mitigate the impediments and raise

deposit levels.

7.2.3. Suggestions for improving saving mobilization:

To encourage savings the respondents recommend adjusting interest rates paid for deposits,

encouraging advanced technologies, developing innovative products which meet the diverse

needs of the society, rewarding savers by offering a wide range of facilities and educating all

staff on the products available and on proper customer care practices.

General Banking and Factors Influencing Propensity to Savings

7.3. RECOMMENDATION

This section presents the recommendation for general banking activities of BASIC Bank Limited

and factors influencing propensity to savings. The first part of this section represents the

recommendation for improving the general banking activities of BASIC Bank Limited.

7.3.1. General banking activities of basic bank limited:

Once an outstanding BASIC Bank Ltd is now facing a huge amount of loss. The Bank that used

to be a standard itself is now in a fragile situation. Although not every branch of this Bank is not

at fault, for some branches, overall performance is not meeting up the standards nowadays. There

can be so many reasons behind this bad performance. However, the following steps may be taken

to recover this situation

The bank should introduce some new products as there are a few to attract new clients. Even

though it is a state owned bank, it operates like a private bank. Hence, to compete in this

modern era of banking where private banks are leading, its a duty of BASIC Bank to enhance

its products and services. New products should be included in its portfolio.

For marketing these products, BASIC Bank should find out a proper way so that the general

people get to know about it. In this case, they may go for door to door operations. In this way

new clients will be interested to take deposit scheme in the bank.

Introducing and marketing new products will not attract customers if the bank does not give

guarantee of proper and well-organized services. For this the bank needs to make sure that

whenever withdrawing money it has enough cash reserve.

Using technology is always of great help whenever there is a need for providing faster services.

BASIC Bank should use more computerized and internet based.

Research and development activities should be taken into consideration.

Loan portfolio should be designed in such a way that there is chance of defaulting. For this,

they can rely on different renowned credit rating companies so that the loss of bad debt can be

removed to some extent.

Effective strategies must be undertaken against defaulters.

Office should be fully decorated to attract clients to take its services.

The bank should unconditionally continue to follow its own rules and procedures.

Chapter Summary of Findings, Recommendation and Conclusion

The bank can introduce reward system for good borrowers as well as punishment for bad

borrowers.

Management must try to think how to increase the profit or shareholders value. They must try

to work freely without any influence.

7.3.2. Factors influencing propensity to savings:

Arising from the findings of the study, the following recommendations are made:

An exhaustive analysis of the real needs of customers and effective segmentation of

customers on the basis of their particular needs should be adopted. Extensive

diversification of the range of products and services offered with a view to effectively meet

the needs of the population.

Banks should design savings products that are accessible, flexible, profitable, liquid, and

attractive.

Financial institutions should implement internal monitoring and risk management policies

in order to guarantee the security of savings deposits.

Continuous training and or in-service courses should be mounted for bank staff to equip

them with product knowledge and customer care services.

The study also recommends the development and extensive use of technology

infrastructure to support the diverse savings services and products.

Commercial banks should develop an effective communication policy based on

dissemination of the best practices and instruments for the promotion of savings designed

to educate customers in the responsible management of their savings.

The banks should also increase interest rates on customer deposits payable to customers to

encourage longer and bigger savings, reduce bank charges and make service provision

increasingly customer friendly.

General Banking and Factors Influencing Propensity to Savings

7.4. CONCLUSION

BASIC Bank limited although a state-owned bank, operates like a private bank. The name

itself contains a meaning that is to develop the small industries in Bangladesh. Though it

is not confined only in the improvement of industrial sector, it has also scattered its activities

in green banking and different CSR activities. This is very sorry to say that despite all its

activities the bank has to find itself in a very bad situation recently. However if precautionary

steps are taken the bank can regain its previous form. Working in General Banking

Department helped me to learn a lot and made my internship program complete. I have

learnt how a bank operates, how clients are handled, how calmly a situation is controlled and

many more.

To conclude, I would like to say that BASIC Bank will surely come out of its recent

status only if they try to be more careful in disbursing its loans. To bring back its strong

existence the management must think of revolutionary initiatives so that this inconvenience

will never be there to bother in future.

The second part of the study represents the analysis of factors influencing propensity to

savings. A strategy for the mobilization of universal savings plays a key role in the distribution

of wealth and in the social and geographic integration. The act of savings is a necessity for every

individual, whatever the level of wealth of a country and of its population. At the microeconomic level, savings are fundamental to the ability of individuals to meet basic needs such as

housing and education, as well as to cope with unforeseen events and accidents and to ensure an

income in old age.

This study has established that the factors increasing the level of banks savings are

safety of funds, online banking facilities, secured transaction process, favorable attitude of bank

personnel, competitive interest and service charges and Quick/Prompt service. On the other

hand, factors impeding the level of banks savings are Political Instability, High level of taxation,

Low level of income, Limited diversity of deposit products, High inflation rate. However, by

following the given recommendations, the level of banks savings can be increased.

Chapter Summary of Findings, Recommendation and Conclusion

7.5. BIBLIOGRAPHY & REFERENCES

1. http://www.investopedia.com/

2. http://www.bangladesh-bank.org/

3. http://www.basicbanklimited.com/

4. http://www.bdbl.com.bd/

5. http://www.myaccountingcourse.com/

6. Annual Report of BASIC Bank Limited, 2015

7. https://www.scribd.com

8. Protap Kumar Ghosha, Sutap Kumar Ghoshb and Lubna Mahjabin Khan (2015), Current

Trend of Bank Selection Criteria of Retail Customers in Bangladesh: An Investigation,

Global Business & Finance Review, Volume. 20.

9. Mohammad Ali Tareq, Savings Mobilization Behavior of NCBS In Bangladesh, Australian

Journal of Business and Economic Studies Volume 1 No. 2 September 2015

10. Athukorala P. (1998), Interest Rates, Savings and Investment: Evidence from India, Oxford

Development Studies, June.

11. Giovannini A (1983). The Interest Rate Elasticity of Savings in Developing Countries,

World Development, July.

12. Gupta K. L (1987), Aggregate Savings, Financial Intermediation and interest Rates,

Review of Economics and Statistics, May.

13. Warman F. and Thirlwall A. P (1994), Interest Rates, Savings, Investment and Growth in

Mexico 1960-90: tests of the Financial Liberalization Hypothesis, The Journal of

Development Studies, and July.

14. Thirlwall A. P (1974 a) Inflation, Savings and Growth in Developing Economies (London:

Macmillan).

15. Bayoumi, T. (1993b). Financial Saving and household Saving, Economic Journal, Vol.

103, November, 1432-1443.

16. Bosworth, B. (1993). Savings and investment in an Open Economy, Washington D C:

Brooking Institution.

17. Dayal-Gulati, A. and C. Thiman (1997). Saving in South East Asia and Latin America

Compared: Searching for Policy Lessons, Working Paper WP/97/110.

General Banking and Factors Influencing Propensity to Savings

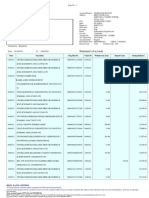

7.6. APPENDIX

Factors affecting propensity to savings

(Only for Internship Report purpose)

Name of the respondent :

Gender

Male

Age

Below 25

Profession

Service

Educational Background:

Monthly income (TK,000) :

Female

25 to 35

Business

SSC and below

Below 20

HSC

20 to 35

35 to 45

Banker

Above 45 years

Student

Others

Bachelor

Masters and above

35 to 50

above 50

A. Please rate () your opinion about the following statement regarding internal and

external factors increasing the levels of bank savings.

Items

Level of agreement

Strongly

agree

Favorable bank policy

Competitive interest on savings

Competitive interest and service

charges

Safety of funds

High income level

Quick/Prompt service

Secured transaction process

Favorable attitude of bank personnel

ATM facilities

Online banking facilities

Agree

Neutral

Disagree

Strongly

disagree

Chapter Summary of Findings, Recommendation and Conclusion

B. Please rate () your opinion about the following statement regarding internal and

external factors impeding the levels of bank savings.

Items

Level of agreement

Strongly

agree

Agree

Neutral

Low level of income

Large spread between deposit

and lending rate

Lack of bank soundness

High level of taxation

High inflation rate

Political Instability

Limited diversity of deposit

products

Negative staff attitude and

poor responsiveness

High transaction cost

Inadequate marketing tactics

. Thank you

Disagree

Strongly

disagree

General Banking and Factors Influencing Propensity to Savings

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Exercise of LeverageDocument1 pageExercise of LeverageNahidul Islam IUPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Finance Means Money ManagementDocument1 pageFinance Means Money ManagementNahidul Islam IUPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Final Exam - Spring-2020 RevisedDocument1 pageFinal Exam - Spring-2020 RevisedNahidul Islam IUPas encore d'évaluation

- Median 3. Mode 4. Standard Deviation 5. Variance 6. Coefficient of VariationDocument3 pagesMedian 3. Mode 4. Standard Deviation 5. Variance 6. Coefficient of VariationNahidul Islam IUPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- ReturnDocument1 pageReturnNahidul Islam IUPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- C. DFL Or, 1.25 Or, 50% D. DFL Or, 1.25 Or, 8% E. DTL Dol X DFL XDocument1 pageC. DFL Or, 1.25 Or, 50% D. DFL Or, 1.25 Or, 8% E. DTL Dol X DFL XNahidul Islam IUPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Components of Capital StructureDocument3 pagesComponents of Capital StructureNahidul Islam IUPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Determinants of Deposit Mobilization of Private Commercial PDFDocument8 pagesDeterminants of Deposit Mobilization of Private Commercial PDFNahidul Islam IUPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Buy A Land For TK 10Document1 pageBuy A Land For TK 10Nahidul Islam IUPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Effect of Macroeconomic Variables On The Financial Performance of Non-Life Insurance Companies in BangladeshDocument22 pagesThe Effect of Macroeconomic Variables On The Financial Performance of Non-Life Insurance Companies in BangladeshNahidul Islam IUPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Presentation On Capital BudgetingDocument15 pagesPresentation On Capital BudgetingNahidul Islam IUPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Business ResearchDocument35 pagesBusiness ResearchNahidul Islam IUPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Time Value of Money Means TodayDocument3 pagesTime Value of Money Means TodayNahidul Islam IUPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Answer To The Case StudyDocument11 pagesAnswer To The Case StudyNahidul Islam IU100% (3)

- Pages From Online Teaching and CompetenciesDocument2 pagesPages From Online Teaching and CompetenciesNahidul Islam IUPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Fin 514 Fixed Income SecuritiesDocument3 pagesFin 514 Fixed Income SecuritiesNahidul Islam IUPas encore d'évaluation

- MathDocument3 pagesMathNahidul Islam IU100% (4)

- The History of SukukDocument4 pagesThe History of SukukNahidul Islam IUPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Data For GretlDocument1 pageData For GretlNahidul Islam IUPas encore d'évaluation

- Selected Questions For MBA and BBADocument1 pageSelected Questions For MBA and BBANahidul Islam IUPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- AsadDocument3 pagesAsadNahidul Islam IUPas encore d'évaluation

- Front PageDocument1 pageFront PageNahidul Islam IUPas encore d'évaluation

- By N JahanDocument2 pagesBy N JahanNahidul Islam IUPas encore d'évaluation

- Primary Sources of DataDocument2 pagesPrimary Sources of DataNahidul Islam IUPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- SWOT AnalysisDocument15 pagesSWOT AnalysisNahidul Islam IUPas encore d'évaluation

- Enterprise Risk ManagementDocument12 pagesEnterprise Risk ManagementAnoop Chaudhary67% (3)

- Facebook Expose Part 1 of WitnessesDocument5 pagesFacebook Expose Part 1 of WitnessesByronHubbardPas encore d'évaluation

- Saharish Del-Bom 5:6:21Document2 pagesSaharish Del-Bom 5:6:21Sohaib DurraniPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Examiner's Indorsement To Collector For Processing of Alert Order - Al KongDocument5 pagesExaminer's Indorsement To Collector For Processing of Alert Order - Al Kongmitch galaxPas encore d'évaluation

- Eacsb PDFDocument297 pagesEacsb PDFTai ThomasPas encore d'évaluation

- Housing LawsDocument114 pagesHousing LawsAlvin Clari100% (2)

- Employee Grievance Settlement Procedure: A Case Study of Two Corporation SDocument12 pagesEmployee Grievance Settlement Procedure: A Case Study of Two Corporation SSandunika DevasinghePas encore d'évaluation

- Answerkey PDFDocument9 pagesAnswerkey PDFParas MalhotraPas encore d'évaluation

- Ontario G1 TEST PracticeDocument9 pagesOntario G1 TEST Practicen_fawwaazPas encore d'évaluation

- Famous Slogan PDFDocument16 pagesFamous Slogan PDFtarinisethy970Pas encore d'évaluation

- Complaint-Affidavit THE UNDERSIGNED COMPLAINANT Respectfully Alleges: I, MR. NAGOYA, of Legal Age, Filipino, Single, and A Resident of Baguio CityDocument2 pagesComplaint-Affidavit THE UNDERSIGNED COMPLAINANT Respectfully Alleges: I, MR. NAGOYA, of Legal Age, Filipino, Single, and A Resident of Baguio CityNarz SabangPas encore d'évaluation

- Entrep Q4 - Module 5Document10 pagesEntrep Q4 - Module 5Paula DT PelitoPas encore d'évaluation

- Samyu AgreementDocument16 pagesSamyu AgreementMEENA VEERIAHPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- C. Rules of Adminissibility - Documentary Evidence - Best Evidence Rule - Loon Vs Power Master Inc, 712 SCRADocument1 pageC. Rules of Adminissibility - Documentary Evidence - Best Evidence Rule - Loon Vs Power Master Inc, 712 SCRAJocelyn Yemyem Mantilla VelosoPas encore d'évaluation

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument3 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceHiten AhirPas encore d'évaluation

- Sun Server X3-2 (Formerly Sun Fire X4170 M3) : Installation GuideDocument182 pagesSun Server X3-2 (Formerly Sun Fire X4170 M3) : Installation GuideFrancisco Bravo BustamantePas encore d'évaluation

- Child OffendersDocument35 pagesChild OffendersMuhd Nur SadiqinPas encore d'évaluation

- of GoldDocument22 pagesof GoldPooja Soni100% (5)

- Suraya Binti Hussin: Kota Kinabalu - T1 (BKI)Document2 pagesSuraya Binti Hussin: Kota Kinabalu - T1 (BKI)Sulaiman SyarifuddinPas encore d'évaluation

- Art 1455 and 1456 JurisprudenceDocument7 pagesArt 1455 and 1456 JurisprudenceMiguel OsidaPas encore d'évaluation

- AND9201/D The Effect of Pan Material in An Induction Cooker: Application NoteDocument9 pagesAND9201/D The Effect of Pan Material in An Induction Cooker: Application NoteRajesh RoyPas encore d'évaluation

- Presentation: Pradhan Mantri Gram Sadak YojanaDocument25 pagesPresentation: Pradhan Mantri Gram Sadak Yojanaamitmishra50100% (1)

- BDA Advises JAFCO On Sale of Isuzu Glass To Basic Capital ManagementDocument3 pagesBDA Advises JAFCO On Sale of Isuzu Glass To Basic Capital ManagementPR.comPas encore d'évaluation

- The Endgame of Treason - Doyle - ThesisDocument237 pagesThe Endgame of Treason - Doyle - Thesisdumezil3729Pas encore d'évaluation

- Suite in C Major: Jan Antonín LosyDocument10 pagesSuite in C Major: Jan Antonín LosyOzlem100% (1)

- Why I Love This ChurchDocument3 pagesWhy I Love This ChurchJemicah DonaPas encore d'évaluation

- Vikrant SinghDocument3 pagesVikrant SinghUtkarshPas encore d'évaluation

- A Project Report On Labour LawDocument4 pagesA Project Report On Labour LawSaad Mehmood SiddiquiPas encore d'évaluation

- Lesson 25 The Fruits of Manifest Destiny StudentDocument31 pagesLesson 25 The Fruits of Manifest Destiny StudentGabriel BalderramaPas encore d'évaluation

- 11i Implement Daily Business Intelligence: D17008GC30 Edition 3.0 April 2005 D 41605Document14 pages11i Implement Daily Business Intelligence: D17008GC30 Edition 3.0 April 2005 D 41605Bala KulandaiPas encore d'évaluation