Académique Documents

Professionnel Documents

Culture Documents

Q 10

Transféré par

Jatin PathakCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Q 10

Transféré par

Jatin PathakDroits d'auteur :

Formats disponibles

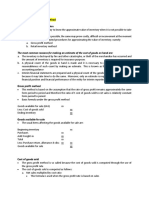

Fine Chemicals plc

Fine Chemicals plc has recently received an invitation to produce a new chemical for

supply to a textile manufacturer. The invitation is to produce 15,000 kg each year for the

next three years at a price of 42 a kg.

The following information has been collected which will help the directors to reach a

decision on whether to accept the invitation or not:

New plant costing 200,000 will need to be bought and paid for at the start of

production. This will have a residual value of 10,000 at the end of the third year. If the

plant is acquired, the business will follow its normal practice of depreciating it on a

straight-line basis in the annual financial accounts.

Ten new workers will be taken on for the duration of production. Recruitment costs,

payable at the start of the production period will total 20,000. The workers will be paid

compensation for being made redundant at the rate of 3,000 per worker, payable at the

end of the production period. During the production period the workers will be paid

200,000 in total each year.

Production of the new chemical will be charged with a share of the businesss

overheads totalling 55,000 in each of the three years. It is estimated that the production

of the new chemical will give rise to an increase of 18,000 in overheads.

Production will require the use of an ingredient, known as X15G, at the rate of 6,000 kg

each year. The business already has inventories of 4,000 kg. This was originally bought

for 15 per kg. This was bought for a previous contract that had to be abandoned. If the

inventories of X15G are not used in production of the new chemical there is no other

use for it and it will be disposed of immediately. It will cost 2 per kg to dispose of the

X15G. The cost of new X15G is 20 per kg.

Production will also require the use of 9,000 kg each year of another ingredient, known

as Y23D. The business already has 9,000 kg in inventories, which cost 25 per kg.

Recently the buying price has dropped to 20 per kg. The business could sell its

inventories of Y23D for 15 per kg. Y23D is used in large quantities on a number of the

businesss current products.

Assessing the investment in the plant is to be undertaken on the basis of a finance cost

of 12% each year.

The above data were discovered by a consultant who is to be paid a total of 2,000 for

the work.

Treat cash flows relating to revenue, overheads, inventories purchases and labour as

occurring at the end of the relevant year.

Required:

Produce calculations which show, on the basis of net present value, whether the new

chemical should be produced or not and state your conclusion.

Vous aimerez peut-être aussi

- Guide To Lincoln Head CentsDocument16 pagesGuide To Lincoln Head Centsulfheidner9103100% (7)

- Sets & Relations-Jee (Main+advanced)Document23 pagesSets & Relations-Jee (Main+advanced)Resonance Dlpd86% (103)

- CorpFinance Cheat Sheet v2.2Document2 pagesCorpFinance Cheat Sheet v2.2subtle69100% (4)

- Chapter 06Document34 pagesChapter 06MaxPas encore d'évaluation

- Management Accounting Exam 15052013Document8 pagesManagement Accounting Exam 15052013Mai Hạnh DeclanPas encore d'évaluation

- Essential ESL Flashcard ActivitiesDocument6 pagesEssential ESL Flashcard ActivitiesBeu Vm100% (1)

- Toc PDFDocument2 pagesToc PDFJatin Pathak100% (1)

- Marketing MixDocument84 pagesMarketing MixVijay GaneshPas encore d'évaluation

- Microeconomics: Recommended Text Box Course AssessmentDocument34 pagesMicroeconomics: Recommended Text Box Course AssessmentsalmanPas encore d'évaluation

- Investment Opportunity in Edible Oil Manufacturing UnitDocument70 pagesInvestment Opportunity in Edible Oil Manufacturing UnitMohamed Shuaib100% (1)

- Budgeting QuestionsDocument8 pagesBudgeting QuestionsumarPas encore d'évaluation

- Business Plan Foe Beauty ParlourDocument14 pagesBusiness Plan Foe Beauty ParlourŠúDéb Dáš100% (2)

- Yaniza, Regine Mae L. - ULO 3A Let's Check: Situation 01Document7 pagesYaniza, Regine Mae L. - ULO 3A Let's Check: Situation 01Regine Mae Lustica Yaniza100% (1)

- House On Elm Tracy With MapDocument5 pagesHouse On Elm Tracy With MapIzhkarPas encore d'évaluation

- Engineering EcoDocument26 pagesEngineering EcoEric John Enriquez100% (2)

- Excerpt PDFDocument10 pagesExcerpt PDFJatin PathakPas encore d'évaluation

- Tutorial 7 QuestionsDocument3 pagesTutorial 7 QuestionsSunay PPas encore d'évaluation

- May Exam 2021 Asb4007Document10 pagesMay Exam 2021 Asb4007Submission PortalPas encore d'évaluation

- Rel Costing RevDocument5 pagesRel Costing RevJenicareen Eulalio67% (3)

- Q1 Group Homework 1 - Q6 Chapter 2 Relevant CostingDocument6 pagesQ1 Group Homework 1 - Q6 Chapter 2 Relevant CostingH43K TIMPas encore d'évaluation

- May Exam 2021 Asb4007 ResitDocument10 pagesMay Exam 2021 Asb4007 ResitSubmission PortalPas encore d'évaluation

- Question Bank KTQT 2Document90 pagesQuestion Bank KTQT 2Minh NguyenPas encore d'évaluation

- Practice Set 2Document6 pagesPractice Set 2Marielle CastañedaPas encore d'évaluation

- Summative Exam MS2Document8 pagesSummative Exam MS2NinaPas encore d'évaluation

- Workshop Lecture 9 QsDocument4 pagesWorkshop Lecture 9 QsabhirejanilPas encore d'évaluation

- Maximising Profits and Setting Optimal Price for Abel LtdDocument4 pagesMaximising Profits and Setting Optimal Price for Abel Ltdnicksilvester1991Pas encore d'évaluation

- Test P1 Chapter 10Document10 pagesTest P1 Chapter 10Prince PersiaPas encore d'évaluation

- Management Accounting Level 3: LCCI International QualificationsDocument14 pagesManagement Accounting Level 3: LCCI International QualificationsHein Linn Kyaw50% (2)

- Managing finances efficientlyDocument6 pagesManaging finances efficientlyNaeem IlyasPas encore d'évaluation

- F9 Progress Test 29.08Document3 pagesF9 Progress Test 29.08saeed_r2000422Pas encore d'évaluation

- R11 Q2 (Target)Document2 pagesR11 Q2 (Target)Vivian XuPas encore d'évaluation

- Engineering Eco PDF FreeDocument26 pagesEngineering Eco PDF FreeMJ ArboledaPas encore d'évaluation

- MN20501 Lecture 6 RC In-Class ExerciseDocument3 pagesMN20501 Lecture 6 RC In-Class Exercisesamvrab1919Pas encore d'évaluation

- Marginal and Absorption CostingDocument10 pagesMarginal and Absorption CostingSandip GhoshPas encore d'évaluation

- ABC Quick QuestionsDocument2 pagesABC Quick QuestionsSaeed RahamanPas encore d'évaluation

- ACC223 SecondDocument3 pagesACC223 SecondKezzi Ervin UngayPas encore d'évaluation

- Lecture 6 QuestionsDocument1 pageLecture 6 QuestionsSuzana RubayetPas encore d'évaluation

- 123123Document3 pages123123xjammerPas encore d'évaluation

- ExerciseDocument16 pagesExerciseTrinh NguyenPas encore d'évaluation

- Standard CostingDocument4 pagesStandard CostingHisham MohammedPas encore d'évaluation

- LPG ReportDocument3 pagesLPG Reportเดเดเดเ เดเดเดเPas encore d'évaluation

- ACF214 Principles of Finance: Workshop Solutions 2017-2018Document11 pagesACF214 Principles of Finance: Workshop Solutions 2017-2018Syed Ahmer Hasnain JafferiPas encore d'évaluation

- MN20501 Workshop 4 Relevant CostsDocument2 pagesMN20501 Workshop 4 Relevant Costssamvrab1919Pas encore d'évaluation

- Linear Programming Problems: TruckCar Production, Innis Investments, Family Nutrition, Company ProductionDocument2 pagesLinear Programming Problems: TruckCar Production, Innis Investments, Family Nutrition, Company ProductionKhaled MiliPas encore d'évaluation

- Study notes on transfer pricing methodsDocument2 pagesStudy notes on transfer pricing methodskcp123Pas encore d'évaluation

- BU5026 Assignment 2010Document6 pagesBU5026 Assignment 2010Saurabh Pote0% (1)

- Chapter 04Document8 pagesChapter 04Md. Saidul Islam0% (1)

- Non-Routine DecisionsDocument5 pagesNon-Routine DecisionsVincent Lazaro0% (1)

- Calculating Average Rate of Return (ARR) : Method and Worked ExampleDocument4 pagesCalculating Average Rate of Return (ARR) : Method and Worked ExamplehjycjycjycPas encore d'évaluation

- Ga - EnergyDocument20 pagesGa - EnergyPranks9827653878Pas encore d'évaluation

- Cost Exercises - Corrections To BookDocument3 pagesCost Exercises - Corrections To Bookchamie143Pas encore d'évaluation

- Management Accounting II Problem Solving QuizDocument2 pagesManagement Accounting II Problem Solving QuizOlivia Chanco ManriquePas encore d'évaluation

- Management Accounting II Quiz SolutionsDocument2 pagesManagement Accounting II Quiz SolutionsOlivia Chanco ManriquePas encore d'évaluation

- University of London Preliminary Exam 2017Document11 pagesUniversity of London Preliminary Exam 2017Pei TingPas encore d'évaluation

- Depreciation MCQsDocument5 pagesDepreciation MCQsAsaduzzaman LimonPas encore d'évaluation

- Else VierDocument22 pagesElse VierNakambull Hilma100% (1)

- Financial Management Assignment (to be submitted just after winter breakDocument6 pagesFinancial Management Assignment (to be submitted just after winter breakaman27842Pas encore d'évaluation

- Assignment - Capital BudgetingDocument2 pagesAssignment - Capital BudgetingMuhammad Ali SamarPas encore d'évaluation

- Capital Budgeting Problems SolvedDocument4 pagesCapital Budgeting Problems SolvedLiana Monica Lopez0% (1)

- Assignment 4 - Variances - 50140Document9 pagesAssignment 4 - Variances - 50140Hafsa HayatPas encore d'évaluation

- Engineering Contract Payback and Capitalization CalculationsDocument2 pagesEngineering Contract Payback and Capitalization Calculationsnajib casanPas encore d'évaluation

- Budgeting QuestionsDocument4 pagesBudgeting QuestionsDavilla CuptaPas encore d'évaluation

- TOPIC Practice Questions: Question: MayDocument13 pagesTOPIC Practice Questions: Question: MayPines MacapagalPas encore d'évaluation

- 1 2 2006 Dec QDocument12 pages1 2 2006 Dec QGeorges NdumbePas encore d'évaluation

- Cost Volume Profit Analysis For Paper 10Document6 pagesCost Volume Profit Analysis For Paper 10Zaira Anees100% (1)

- Sizing and Costing ReportDocument5 pagesSizing and Costing ReportAnonymous I9ctbEPas encore d'évaluation

- Management Accounting 2Document3 pagesManagement Accounting 2ROB101512Pas encore d'évaluation

- PETROLEUM ENGINEERING ECONOMICS ASSIGNMENTDocument2 pagesPETROLEUM ENGINEERING ECONOMICS ASSIGNMENTWilfred ThomasPas encore d'évaluation

- Assignment On DepreciationDocument4 pagesAssignment On DepreciationNouman MujahidPas encore d'évaluation

- Impact Assessment AAK: Taxes and the Local Manufacture of PesticidesD'EverandImpact Assessment AAK: Taxes and the Local Manufacture of PesticidesPas encore d'évaluation

- Impact assessment AAK: The impact of Tax on the Local Manufacture of PesticidesD'EverandImpact assessment AAK: The impact of Tax on the Local Manufacture of PesticidesPas encore d'évaluation

- D Re Ig Q2 ZDSTM 8 BZJ Oa 6 RDocument25 pagesD Re Ig Q2 ZDSTM 8 BZJ Oa 6 RJatin PathakPas encore d'évaluation

- Road Not TakenDocument5 pagesRoad Not TakenJatin PathakPas encore d'évaluation

- Electricity GuideDocument62 pagesElectricity GuideJatin PathakPas encore d'évaluation

- W 04 H 01Document2 pagesW 04 H 01Jatin PathakPas encore d'évaluation

- F0 XG 4 Z XGC H8 QN SDTy XW8Document49 pagesF0 XG 4 Z XGC H8 QN SDTy XW8Jatin PathakPas encore d'évaluation

- Chemical Reactions and Equations: Assignments in Science Class X (Term I)Document26 pagesChemical Reactions and Equations: Assignments in Science Class X (Term I)Jatin PathakPas encore d'évaluation

- MSN OQUJp ALl IIlt 3 ZFXMDocument29 pagesMSN OQUJp ALl IIlt 3 ZFXMJatin PathakPas encore d'évaluation

- 10th 12 PDFDocument17 pages10th 12 PDFNitesh JainPas encore d'évaluation

- Magnetic Effects of Electriccurrent: Solution: SolutionDocument33 pagesMagnetic Effects of Electriccurrent: Solution: SolutionJatin PathakPas encore d'évaluation

- Nature of Business EconomicsDocument10 pagesNature of Business EconomicsShuchi GoelPas encore d'évaluation

- 2922 Topper 21 101 2 4 62 568 Refraction Through Glass Up201508061120 1438840220 6121Document2 pages2922 Topper 21 101 2 4 62 568 Refraction Through Glass Up201508061120 1438840220 6121Jatin PathakPas encore d'évaluation

- Light Reflection and Refraction Up201506181308 1434613126 7982Document10 pagesLight Reflection and Refraction Up201506181308 1434613126 7982Sameer KumarPas encore d'évaluation

- 2917 Topper 21 101 2 4 62 571 Lens Formulae Up201508061120 1438840220 4747Document2 pages2917 Topper 21 101 2 4 62 571 Lens Formulae Up201508061120 1438840220 4747Jatin PathakPas encore d'évaluation

- 2923 Topper 21 101 2 4 62 569 Refraction Through Spherical Lens Up201508061120 1438840220 6485Document6 pages2923 Topper 21 101 2 4 62 569 Refraction Through Spherical Lens Up201508061120 1438840220 6485Jatin PathakPas encore d'évaluation

- Worksheets Grade 9Document6 pagesWorksheets Grade 9Jatin PathakPas encore d'évaluation

- NCRT PageDocument1 pageNCRT PagedjangoroflPas encore d'évaluation

- 78 Topper 21 101 2 4 64 The Human Eye and The Colourful World Up201506181308 1434613126 7982 PDFDocument6 pages78 Topper 21 101 2 4 64 The Human Eye and The Colourful World Up201506181308 1434613126 7982 PDFJatin PathakPas encore d'évaluation

- 2919 Topper 21 101 2 4 62 565 Reflection by Spherical Mirrors Up201508061120 1438840220 5291Document5 pages2919 Topper 21 101 2 4 62 565 Reflection by Spherical Mirrors Up201508061120 1438840220 5291Jatin PathakPas encore d'évaluation

- Trig TricksDocument4 pagesTrig TricksDevendra YadavPas encore d'évaluation

- 2922 Topper 21 101 2 4 62 568 Refraction Through Glass Up201508061120 1438840220 6121Document2 pages2922 Topper 21 101 2 4 62 568 Refraction Through Glass Up201508061120 1438840220 6121Jatin PathakPas encore d'évaluation

- 2922 Topper 21 101 2 4 62 568 Refraction Through Glass Up201508061120 1438840220 6121Document2 pages2922 Topper 21 101 2 4 62 568 Refraction Through Glass Up201508061120 1438840220 6121Jatin PathakPas encore d'évaluation

- 2918 Topper 21 101 2 4 62 566 Mirror Formulae Up201508061120 1438840220 5014Document3 pages2918 Topper 21 101 2 4 62 566 Mirror Formulae Up201508061120 1438840220 5014Jatin PathakPas encore d'évaluation

- 78 Topper 21 101 2 4 64 The Human Eye and The Colourful World Up201506181308 1434613126 7982 PDFDocument6 pages78 Topper 21 101 2 4 64 The Human Eye and The Colourful World Up201506181308 1434613126 7982 PDFJatin PathakPas encore d'évaluation

- 78 Topper 21 101 2 4 64 The Human Eye and The Colourful World Up201506181308 1434613126 7982 PDFDocument6 pages78 Topper 21 101 2 4 64 The Human Eye and The Colourful World Up201506181308 1434613126 7982 PDFJatin PathakPas encore d'évaluation

- 2917 Topper 21 101 2 4 62 571 Lens Formulae Up201508061120 1438840220 4747Document2 pages2917 Topper 21 101 2 4 62 571 Lens Formulae Up201508061120 1438840220 4747Jatin PathakPas encore d'évaluation

- 2921 Topper 21 101 2 4 62 567 Refraction of Light Up201508061120 1438840220 5851Document3 pages2921 Topper 21 101 2 4 62 567 Refraction of Light Up201508061120 1438840220 5851Jatin PathakPas encore d'évaluation

- Threat of SubstitutesDocument3 pagesThreat of SubstitutesKeshav Raj SharmaPas encore d'évaluation

- Estimate Inventory Value Using Gross Profit MethodDocument2 pagesEstimate Inventory Value Using Gross Profit MethodJoanne Rheena BooPas encore d'évaluation

- Jati English EditedDocument16 pagesJati English Editedapi-301579767Pas encore d'évaluation

- How monetary policy impacts Pakistan's economic growthDocument10 pagesHow monetary policy impacts Pakistan's economic growthSamsam RaufPas encore d'évaluation

- Multiple Choice Questions 1 The Short Run Supply Curve of ADocument2 pagesMultiple Choice Questions 1 The Short Run Supply Curve of Atrilocksp SinghPas encore d'évaluation

- Applied Seminar in EconomicsDocument6 pagesApplied Seminar in EconomicszamirPas encore d'évaluation

- AC2101 SemGrp4 Team6Document34 pagesAC2101 SemGrp4 Team6Kwang Yi JuinPas encore d'évaluation

- FINC2011 Tutorial 4Document7 pagesFINC2011 Tutorial 4suitup100100% (3)

- Unemployment and Inflation: Chapter Summary and Learning ObjectivesDocument27 pagesUnemployment and Inflation: Chapter Summary and Learning Objectivesvivianguo23Pas encore d'évaluation

- Long Exam: 1671, MBC Bldg. Alvarez ST., Sta. Cruz, ManilaDocument2 pagesLong Exam: 1671, MBC Bldg. Alvarez ST., Sta. Cruz, ManilakhatedeleonPas encore d'évaluation

- Toaz - Info Business Studies Notes PRDocument116 pagesToaz - Info Business Studies Notes PRمحمد عبداللہPas encore d'évaluation

- Hotels Sector Analysis Report: SupplyDocument7 pagesHotels Sector Analysis Report: SupplyArun AhirwarPas encore d'évaluation

- Introducing New Market OfferingsDocument26 pagesIntroducing New Market OfferingsarjunPas encore d'évaluation

- Admin Service - Lease Management - Type of Leases and Treatment in UNDP BooksDocument8 pagesAdmin Service - Lease Management - Type of Leases and Treatment in UNDP BooksPrateek JainPas encore d'évaluation

- Training Manual 1A PKDocument41 pagesTraining Manual 1A PKstelu sisPas encore d'évaluation

- Sample For AssignmentDocument16 pagesSample For AssignmentRiya AhujaPas encore d'évaluation

- Study Material Economics 2009Document90 pagesStudy Material Economics 2009Rohit PatelPas encore d'évaluation

- ExerciseDocument3 pagesExerciseK61CA Cao Nguyễn Hạnh ChâuPas encore d'évaluation

- Profit and Loss Questions Easy Part 1 PDFDocument14 pagesProfit and Loss Questions Easy Part 1 PDFajayPas encore d'évaluation

- Cost Accounting & Financial Management Solved Paper Nov 2009, Chartered AccountancyDocument16 pagesCost Accounting & Financial Management Solved Paper Nov 2009, Chartered AccountancyAnkit2020Pas encore d'évaluation

- Midterm Exam 1 Practice - SolutionDocument6 pagesMidterm Exam 1 Practice - SolutionbobtanlaPas encore d'évaluation

- Spon's Civil Engineering and Highway Works Price B... - (PART 2 On Costs and Profit)Document6 pagesSpon's Civil Engineering and Highway Works Price B... - (PART 2 On Costs and Profit)mohamedPas encore d'évaluation