Académique Documents

Professionnel Documents

Culture Documents

Valuation of Sampa video Inc

Transféré par

MorsalDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Lire ce document dans d'autres langues

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Valuation of Sampa video Inc

Transféré par

MorsalDroits d'auteur :

Formats disponibles

Sampa video Inc.

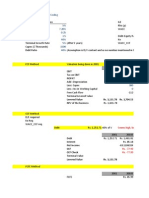

First we looked at the projected free cash flows. We established the cash

flows by using the EBIAT+depreciation-CapX-investment in NWC. The

investment in NWC is throughout the years 0 so we could also leave them

out of the equation. When using this formula the cash flows of Sampa

videao inc. are for the investment year and the following years 2002-2006

respectively -1500, -112, 6, 151, 314, 395 (thousand of dollars). The total

value is $4813 thousand(exhibit 4).

After computing the cash flows we need the discount rate. Because Sampa

video inc. is entirely equity financed we can calculate the discount rate by

looking at the asset beta. This is 1.5 (exhibit 3). To compute the

appropriate discount rate we used the formula: Risk free rate+Market

risk*asset Beta (Rf+Mr*a). The appropriate discount rate that follows is

15.8%(exhibit 4).

Finally we can use the discount factor to compute the Net present value of

Sampa video inc if it was completely equity based which is $1228,48

thousand (exhibit 4)

The adjusted present value is the net present value plus the present value

of the tax shield. From exhibit 3 we can see that the tax rate is 40%. When

the firm raises $750 thousand of debt to fund the project the Present value

of the tax shield will be $750*0,4=300 thousand. When we ad the

calculation of the NPV in exhibit 4 we get a total adjusted present value of

300+1228.5=$1528,5 thousand.

If we assume that the firm maintains a 25% Debt-to-market value ratio,

our new return on equity (Re) will be 18.05. (calculation shown below)

D

Formula for return on equity: =Ra+ ( RaRd)

E

In this case: =15.8+0.333(15.86.8 ) =18.80 %

We calculate the WACC with the next formula:

E RdD

Rwacc=

+(

( 1t )) Rwacc=18.80 0.75+(6.80.25(10.4 ))

E+ D

E+ D

Rwacc=15.12 %

After inserting this information in Excel, we got a NPV of $1469.97(in

thousands)

6. The APV method is a very transparent method, because it makes a clear

distinction between the assets and financing decisions (e.g. investments)

of a firm. The APV method is also a method that calculates the Present

Value of tax shields by discounting them with a debt rate. So, the APV

method is more appropriate to use in cases when a firm has a permanent

debt, so the firm can add the discounted tax shields to the value of the

firm. The APV method is also a useful method when the firm has a

constant changing debt-to-equity ratio because the capital structure of a

firm is irrelevant for this method.

On the other hand, a firm can easily implement the WACC method when

there is constant value of the D/E ratio because the WACC method

calculates the levered value of the firm by discounting the free cash flows

from operations with the weighted average cost of capital. The CCF

method calculates the value of the firm, by discounting the capital cash

flows (FCF+ interest tax shield) with the return on assets. This means that

it is appropriate to use the CCF or WACC method, when the debt is a fixed

part of the firms value. At last, if all the assumptions of the model are

equal, the choice of a model should be indifferent because the value of a

firm would practically be the same.

Vous aimerez peut-être aussi

- Radio One AnswerDocument3 pagesRadio One AnswerAditya Consul50% (6)

- MIdland FInalDocument7 pagesMIdland FInalFarida100% (8)

- ASK Wealth Advisors Corporate PresentationDocument22 pagesASK Wealth Advisors Corporate PresentationAnonymous bdUhUNm7J100% (1)

- Sampa Video, Inc. Free Cash Flow Forecast and WACC CalculationsDocument3 pagesSampa Video, Inc. Free Cash Flow Forecast and WACC CalculationsKaustav BhattacharjeePas encore d'évaluation

- Marriott SolutionDocument3 pagesMarriott Solutiondlealsmes100% (1)

- Midland Energy Resources WACC20052006Average$11.4B/$18.3B = $13.2B/$21.4B = $14.6B/$24.2B =62.3%61.7%60.3%61.5Document13 pagesMidland Energy Resources WACC20052006Average$11.4B/$18.3B = $13.2B/$21.4B = $14.6B/$24.2B =62.3%61.7%60.3%61.5killer dramaPas encore d'évaluation

- Assignment - Sampa VideoDocument5 pagesAssignment - Sampa Videobhatiasanjay11Pas encore d'évaluation

- Midland WACCDocument2 pagesMidland WACCDeniz Minican100% (3)

- Week 3 QuizDocument8 pagesWeek 3 QuizPetraPas encore d'évaluation

- Midland Case CalculationsDocument24 pagesMidland Case CalculationsSharry_xxx60% (5)

- Sampa Video Financial Projections and AssumptionsDocument10 pagesSampa Video Financial Projections and AssumptionskanabaramitPas encore d'évaluation

- Airthread DCF Vs ApvDocument6 pagesAirthread DCF Vs Apvapi-239586293Pas encore d'évaluation

- Sampa Video Group 5Document6 pagesSampa Video Group 5Ankit MittalPas encore d'évaluation

- Sampa Video IncDocument4 pagesSampa Video IncarnabpramanikPas encore d'évaluation

- Corporate Valuation: Group - 2Document6 pagesCorporate Valuation: Group - 2RiturajPaulPas encore d'évaluation

- Midland Energy Group A5Document3 pagesMidland Energy Group A5Deepesh Moolchandani0% (1)

- Midland Energy Case StudyDocument5 pagesMidland Energy Case StudyLokesh GopalakrishnanPas encore d'évaluation

- Analysis of AirThread Connection Acquisition Cash Flows and ProjectionsDocument66 pagesAnalysis of AirThread Connection Acquisition Cash Flows and Projectionsbachandas75% (4)

- Ameritrade's Cost of Capital AnalysisDocument7 pagesAmeritrade's Cost of Capital AnalysisTom Ziv100% (2)

- Sampa Video Inc.Document8 pagesSampa Video Inc.alina8763Pas encore d'évaluation

- SampaSoln EXCELDocument4 pagesSampaSoln EXCELRasika Pawar-HaldankarPas encore d'évaluation

- 2017-11-16 Independent Expert Report EDocument35 pages2017-11-16 Independent Expert Report EAli Gokhan KocanPas encore d'évaluation

- Sampa VideoDocument18 pagesSampa Videomilan979Pas encore d'évaluation

- DCF and Trading Multiple Valuation of Acquisition OpportunitiesDocument4 pagesDCF and Trading Multiple Valuation of Acquisition Opportunitiesfranky1000Pas encore d'évaluation

- Mercury AthleticDocument13 pagesMercury Athleticarnabpramanik100% (1)

- Sampa Video: Project ValuationDocument18 pagesSampa Video: Project Valuationkrissh_87Pas encore d'évaluation

- Air Thread ReportDocument13 pagesAir Thread ReportDHRUV SONAGARA100% (2)

- Mercury Athletic Footwear Case SolutionDocument3 pagesMercury Athletic Footwear Case SolutionDI WU100% (2)

- Group4 SectionA SampavideoDocument5 pagesGroup4 SectionA Sampavideokarthikmaddula007_66Pas encore d'évaluation

- Sampa Video Inc.: Case 3 Corporate Finance December 3, 2015Document5 pagesSampa Video Inc.: Case 3 Corporate Finance December 3, 2015Morsal SarwarzadehPas encore d'évaluation

- Sampa Video Solution Harvard Case SolutionDocument11 pagesSampa Video Solution Harvard Case Solutionhernandezc_josePas encore d'évaluation

- Blockchain to Transform Financial ServicesDocument4 pagesBlockchain to Transform Financial ServicesUJJWALPas encore d'évaluation

- Requsition Letter For Due Diligence AssignmentDocument6 pagesRequsition Letter For Due Diligence AssignmentMohammad Monowar Noor ManikPas encore d'évaluation

- AirThread G015Document6 pagesAirThread G015sahildharhakim83% (6)

- Lex Service PLCDocument3 pagesLex Service PLCMinu RoyPas encore d'évaluation

- Midland's Cost of Capital Calculations for DivisionsDocument8 pagesMidland's Cost of Capital Calculations for DivisionsDevansh RaiPas encore d'évaluation

- Airthread ValuationDocument19 pagesAirthread Valuation45ss28Pas encore d'évaluation

- Excel Spreadsheet Sampa VideoDocument5 pagesExcel Spreadsheet Sampa VideoFaith AllenPas encore d'évaluation

- Sampa Video Home Delivery ProjectDocument26 pagesSampa Video Home Delivery ProjectFaradilla Karnesia100% (2)

- FIN322 Chapter 18 APV and WACCDocument6 pagesFIN322 Chapter 18 APV and WACCchi_nguyen_100Pas encore d'évaluation

- Sampa Video Inc.: Thousand of Dollars Exhibit 4Document2 pagesSampa Video Inc.: Thousand of Dollars Exhibit 4nimarPas encore d'évaluation

- Sampa Video CaseDocument6 pagesSampa Video CaseRahul BhatnagarPas encore d'évaluation

- Group 3-Case 1Document3 pagesGroup 3-Case 1Yuki Chen100% (1)

- Sampa VideoDocument2 pagesSampa VideoAadith RamanPas encore d'évaluation

- Sampa Case SolutionDocument4 pagesSampa Case SolutionOnal RautPas encore d'évaluation

- Sampa VideoDocument24 pagesSampa VideoDaman Pathak100% (1)

- 25th June - Sampa VideoDocument6 pages25th June - Sampa VideoAmol MahajanPas encore d'évaluation

- Radio OneDocument23 pagesRadio Onepsu0168100% (1)

- The value of an unlevered firmDocument6 pagesThe value of an unlevered firmRahul SinhaPas encore d'évaluation

- DCF valuation of video delivery business expansionDocument24 pagesDCF valuation of video delivery business expansionHenny ZahranyPas encore d'évaluation

- Comprehensive DCF analysis of a projectDocument12 pagesComprehensive DCF analysis of a projectAditya BansalPas encore d'évaluation

- Capital Budgeting and Valuation With Leverage: P.V. ViswanathDocument33 pagesCapital Budgeting and Valuation With Leverage: P.V. ViswanathAnonymous fjgmbzTPas encore d'évaluation

- Advanced ValuationDocument15 pagesAdvanced Valuationgiovanni lazzeriPas encore d'évaluation

- WACC NTDocument40 pagesWACC NTHamid S. ParwaniPas encore d'évaluation

- FM414 LN 6 Master Copy Presentation Solutions - Valuation - 2024 ColorDocument16 pagesFM414 LN 6 Master Copy Presentation Solutions - Valuation - 2024 ColorAntonio AguiarPas encore d'évaluation

- P 4Document56 pagesP 4billyryan1Pas encore d'évaluation

- Financial Analysis - Sony and Apple - PT2Document16 pagesFinancial Analysis - Sony and Apple - PT2chuck martinPas encore d'évaluation

- Dong Tien Ias 36Document8 pagesDong Tien Ias 36Quoc Viet TrinhPas encore d'évaluation

- Marriot Corp. Finance Case StudyDocument5 pagesMarriot Corp. Finance Case StudyJuanPas encore d'évaluation

- The Cost of Capital: Answers To Seleected End-Of-Chapter QuestionsDocument9 pagesThe Cost of Capital: Answers To Seleected End-Of-Chapter QuestionsZeesun12Pas encore d'évaluation

- Calculating Project NPV and Investment ConsiderationsDocument14 pagesCalculating Project NPV and Investment ConsiderationsMaster's FamePas encore d'évaluation

- Typical Cash Flows at The Start: Cost of Machines (200.000, Posses, So On Balance SheetDocument7 pagesTypical Cash Flows at The Start: Cost of Machines (200.000, Posses, So On Balance SheetSylvan EversPas encore d'évaluation

- APV Vs WACCDocument8 pagesAPV Vs WACCMario Rtreintaidos100% (2)

- FM9Document3 pagesFM9Shankari JayaPas encore d'évaluation

- VebitdaDocument24 pagesVebitdaAndr EiPas encore d'évaluation

- Portfolio RiskDocument24 pagesPortfolio RiskABC DEFPas encore d'évaluation

- 28 Solved PCC Cost FM Nov09Document16 pages28 Solved PCC Cost FM Nov09Karan Joshi100% (1)

- Final Exam ReviewDocument5 pagesFinal Exam ReviewBlake CrusiusPas encore d'évaluation

- Analysis of HDFC Mutual FundDocument41 pagesAnalysis of HDFC Mutual FundjidnyasabhoirPas encore d'évaluation

- Understanding Percentage Tax in the PhilippinesDocument12 pagesUnderstanding Percentage Tax in the PhilippinesPablo InocencioPas encore d'évaluation

- Fixed Asset and Depreciation Schedule: Instructions: InputsDocument8 pagesFixed Asset and Depreciation Schedule: Instructions: InputsFaruk RhamadanPas encore d'évaluation

- FINANCIAL PERFORMANCE ANALYSIS OF MACHCHAPUCHHRE BANK AND KUMARI BANK BASED ON CAMELDocument95 pagesFINANCIAL PERFORMANCE ANALYSIS OF MACHCHAPUCHHRE BANK AND KUMARI BANK BASED ON CAMELRajPas encore d'évaluation

- High-Frequency Trading - Reaching The LimitsDocument5 pagesHigh-Frequency Trading - Reaching The LimitsBartoszSowulPas encore d'évaluation

- HybridDocument6 pagesHybridFernando SunPas encore d'évaluation

- Document Prezentare IEBA TRUST V15 IUL 2017Document28 pagesDocument Prezentare IEBA TRUST V15 IUL 2017Elena DidilaPas encore d'évaluation

- Semrep 2015 06 30 en 00 2015 09 01 5077884 PDFDocument196 pagesSemrep 2015 06 30 en 00 2015 09 01 5077884 PDFRobert Sunho LeePas encore d'évaluation

- Lecture # 15: Presentation of Financial Instruments DefinitionsDocument4 pagesLecture # 15: Presentation of Financial Instruments Definitionsali hassnainPas encore d'évaluation

- Petsec Energy May-19 Investor PresentationDocument40 pagesPetsec Energy May-19 Investor Presentationnishant bhushanPas encore d'évaluation

- SEC Letter To 9/11 Commission About Foreign Reports of Insider TradingDocument2 pagesSEC Letter To 9/11 Commission About Foreign Reports of Insider Trading9/11 Document ArchivePas encore d'évaluation

- China - Rising Foreign Demand Amid DeleveragingDocument62 pagesChina - Rising Foreign Demand Amid DeleveragingbondbondPas encore d'évaluation

- Sig Ar 0405Document84 pagesSig Ar 0405kapoorvikrantPas encore d'évaluation

- Beta CalculationDocument8 pagesBeta Calculationbrahmi_xyzPas encore d'évaluation

- LTN20101213005Document303 pagesLTN20101213005cageronPas encore d'évaluation

- Reforms in Capital MarketDocument22 pagesReforms in Capital MarketJitendra KalwaniPas encore d'évaluation

- Icex FinalDocument33 pagesIcex FinalAmi Parekh MehtaPas encore d'évaluation

- What Is IFRSDocument5 pagesWhat Is IFRSRR Triani APas encore d'évaluation

- Calculating bond duration and yieldDocument48 pagesCalculating bond duration and yieldOUSSAMA NASRPas encore d'évaluation

- BSP GSSM MatrixDocument13 pagesBSP GSSM MatrixSahr33nPas encore d'évaluation

- Thesis PresentationDocument14 pagesThesis Presentationmissycoleen05100% (1)