Académique Documents

Professionnel Documents

Culture Documents

CusdecFinalSAD Taiheiyo

Transféré par

Yre de los ReyesTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

CusdecFinalSAD Taiheiyo

Transféré par

Yre de los ReyesDroits d'auteur :

Formats disponibles

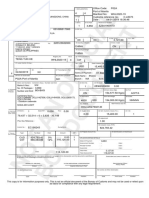

BOC SINGLE ADMINISTRATIVE DOCUMENT

2 Exporter /Supplier Address

BROOKLYN ENTERPRISE PTE LTD

50 COLLYER QUAY #06-04 OUE BAYFRONT SINGAPORE

3 Page

5 Items

6 Tot Pack

1

C

U

S

T

O

M

S

8 Importer/Consignee, Address

000272097000

Tin:

18 Vessel/Aircraft

Registry No.

TB HENRY/BG CHRISTY

15 C.E. Code

17

INDONESIA

20 Terms Of Delivery

CFR

Total Customs Value

USD

XX

S06

32 Item No.

Marks & Nos :

IN BULK

No. Of Packages : 1

Number and Kind : VO-BULK,SOLID,LARGE

01-Basic

Bank Ref No. :

PARTICLES(NODULES)

ID

4000

Rate

27011290000

37 Procedure

- - - Other

Tariff Spec

0.00

35 Item Gross Wgt.

36 Pref

8,012,662.00

Kg(s)

Item Net Weight

39 Quota

000

AFTA

8,012,662.00

Kg(s)

40b Previous

Doc No.

40a AWB/BL

INDONESIAN STEAM COAL

010533457-0002172

33 HS Code

34 C.O. Code

Containers No(s) :

Bank Code :

Bank Name : PCHC

Branch :

NA

Marks and Numbers - Containers No(s) - Number and Kind

24 Thru Bank

47.069

998

660,964.49

Terms of Payment :

P07-Port of Cebu

23 Exch Rate

28 Financial and Banking Data

27 Transhipment Port

30 Location Of Goods

17

ID

16 Country of Origin

29 Port Of Destination

13 T. Rel.

1,241.29

INDONESIA

22 F. Cur.

26

12 Tot. F/I/O

XX

15 Country of Export

TB HENRY/BG CHRISTY

31 Packages

and Desc.

Of Goods

11

XX

21 Local Carrier (If Any) :

85ZA1500282

10

19 Ct

PTG0010-15

7 Reference Number

9 CRF No.

TAIHEIYO CEMENT PHILIPPINES INC.

6F INSULAR LIFE BLDG.GORORDO AVENUE

CEBU

CEBU 6000

6000

PHILIPPINES

14 Broker/Attorney-In-Fact, Address

Tin:

948121346000

JERVY M. LABORES

VILLA FATIMA, MAGUIKAY

MANDAUE6014

PHILIPPINES

25

Office Code:

P07

Port of Cebu

Manifest No: PTG0010-15

Customs reference no.: C-33026

Date :

12/03/2015 08:45:03

1 DECLARATION

NNNNN

312BMSSEX112015

44 Add Infos

Doc / Produ.

Certif. & Aut.

OTHInEV :

INSinFRT :

Fine :

0.000

41 Suppl. Units

0.00

42 Item Customs Value (F.C.)

1.00

0 + 58,426 + 0 + 272,431 - 881,393

43 V.M.

660,964.49

45 Adjustment

1.00

Prev Doc Reference :

46 Dutiable Value (PHP)

Invoice No. :

47 Calculation of Taxes

Type

CUD

EXC

VAT

Dump Bond :

006/MA/INV/EX/XI/

2015

Tax Base

31,169,363.8

6

Rate

Amount

0.00

80,126.00

3,893,830.

00

0%

12%

32,368,463.8

9

Total

3,973,956.00

31,169,363.86

MP

1

1

1

48 Prepaid Account No.

49 Identification of Warehouse

47b ACCOUNTING DETAILS

.............................................................................................................................

:

Mode Of Payment

CASH

Assessment Number

Date : 12/04/2015

: L-50346

Receipt Number

Date :

: Guarantee

Date :

:

.............................................................................................................................

Total Fees

1,265.00

Total Assessment

3,975,221.00

50 We hereby certify that the information contained in all pages of this Declaration and the documents submitted are

to the best of out knowledge and belief true and correct.

JERVY M. LABORES

Broker

Administering Officer /

Notary Public

TAIHEIYO CEMENT PHILIPPINES INC.

Date :

Importer/Attorney-In-Fact

52 Control at Office Destination

51 AUTHORIZATION

Date

Subscribed and sworn to before me

Print name

Position

Date

Print name

Position

53 INTERNAL REVENUE (TAX PER BOX #46 & 47

BANK CHARGES

31,169,363.86

0.00

CUSTOMS DUTY

0.00

TAXABLE VALUE PHP

44,011.70

BROKERAGE FEE

WHARFAGE

272,431.00

OTHERS

ARRASTRE CHARGES

881,393.00

TOTAL LANDED COST PHP

265.00

DOCUMENTARY STAMP

1,000.00

32,368,464.56

3,893,830.00

TOTAL VAT PHP

DESCRIPTION IN TARIFF TERMS SHOULD BE

54 SECTION

55 NO. OF PACKAGES EXAMINED

ITEM

DESCRIPTION IN TARIFF TERMS SHOULD BE

NO

EXAMINATION RETURN

QTY

56 DATE RECEIVED

UNIT

UNIT VALUE

57 DATE RELEASED

TARIFF HEADING

1

PLEASE REFER TO RIDER/S FOR FINDINGS ON ITHER ITEMS

REVISED CHARGES

59 CHARGES

60 DECLARATION

61 FINDINGS

LIQUIDATION

62 DIFFERENCES

65 LIQUIDATION AMOUNT

PHP

DUTY

BIR Taxes

66 SHORT/EXCESS

PHP

VAT

Excise Tax/Ad

67 REMARKS

Others

Surcharges

TOTAL

63 ACTION DIRECTED /

RECOMMENDED

64

Date

68

Date

69

Date

CONTINUATION FROM BOX # 31

CUD

EXC

VAT

Date

FREE DISPOSAL

0.00

80,126.00

3,893,830.00

Total Item Taxes

IPF

D&F

3,973,956.00

1,000.00

265.00

Total Global Taxes

1,265.00

3,975,221.00

RATE

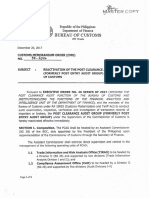

Republic of the Philippines

Department of Finance

BUREAU OF CUSTOMS

Terms Of Payment

Code

Account

010533457-0002172

Bank Reference Number :

Selectivity Color :

Section

GREEN

11

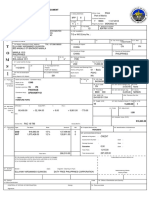

Republic of the Philippines

Department of Finance

BUREAU OF CUSTOMS

ASSESSMENT NOTICE

Customs Office

P07

Port of Cebu

Identification of the Declaration

Model

Ref

Year

Registration

Number

Date

Year

Number

2015

C-33026

2015

L-50346

Declarant Reference No :

12/03/15

Assessment

Day/Mth

Nbr of

Items

04/Decembe

r

85ZA1500282

Declarant : 948121346000

JERVY M. LABORES

VILLA FATIMA, MAGUIKAY

MANDAUE6014

PHILIPPINES

Importer :

TAIHEIYO CEMENT PHILIPPINES INC.

6F INSULAR LIFE BLDG.GORORDO AVENUE

CEBU

CEBU 6000

6000

PHILIPPINES

000272097000

Mode of Payment :

CASH

Account Number

Receipt number

Statement number and date

CUD

EXC

VAT

0.00

80,126.00

3,893,830.00

Total Item Taxes

IPF

D&F

3,973,956.00

1,000.00

265.00

Total Global Taxes

1,265.00

Total assessed amount for the declaration

Amount currently to be paid

3,975,221.00

TRANSACTION RECEIPT

TRANSACTION RECEIPT NO.

CLIENT

TIN

85ZA1500282

TAIHEIYO CEMENT PHILIPPINES INC.

6F INSULAR LIFE BLDG.GORORDO AVENUE

CEBU

CEBU 6000

6000

PHILIPPINES

000272097000

TRANSACTION DETAILS

ENTRY DATE

12/03/2015 00.00.00

ENTRY NO.

C-33026

HOUSE NO.

312BMSSEX112015

MANIFEST NO.

PTG0010-15

REFERENCE NO.

85ZA1500282

AMOUNT

45.00

TOTAL AMOUNT DUE

FORTY FIVE PESOS ONLY

Certified correct :

CARGO DATA EXCHANGE CENTER, INC.

Vous aimerez peut-être aussi

- Cusdec Final SADDocument5 pagesCusdec Final SADSamantha Swift0% (1)

- CusdecFinalSAD 3CNA1600007 PDFDocument6 pagesCusdecFinalSAD 3CNA1600007 PDFMhean Samson BermejoPas encore d'évaluation

- CusdecFinalSAD 5Z3A1900073 PDFDocument5 pagesCusdecFinalSAD 5Z3A1900073 PDFKiko KokiPas encore d'évaluation

- KELMNN00106EA001Document3 pagesKELMNN00106EA001joyce magpayoPas encore d'évaluation

- INSTRUCTION: Select The Correct Answer For Each of The Following Questions. Mark Only One Answer For Each Item by 1X40 40 Points Multiple ChoiceDocument5 pagesINSTRUCTION: Select The Correct Answer For Each of The Following Questions. Mark Only One Answer For Each Item by 1X40 40 Points Multiple ChoiceCherry GalosmoPas encore d'évaluation

- Estimated Duties and Taxes PDFDocument1 pageEstimated Duties and Taxes PDFDianne Bernadeth Cos-agonPas encore d'évaluation

- Certificate of Origin: Group IVDocument16 pagesCertificate of Origin: Group IVTravis OpizPas encore d'évaluation

- BOC CMO 32-2017 Reactivation of The Post Clearance Audit Group of The Bureau of CustomsDocument3 pagesBOC CMO 32-2017 Reactivation of The Post Clearance Audit Group of The Bureau of CustomsPortCalls100% (2)

- Customs Broker Licensure Examination PDFDocument2 pagesCustoms Broker Licensure Examination PDFAileen Bobadilla0% (2)

- Entry Lodgement and Cargo Clearance ProcessDocument36 pagesEntry Lodgement and Cargo Clearance ProcessNina Bianca Espino100% (1)

- SYLLABIDocument5 pagesSYLLABINasudi AspricPas encore d'évaluation

- BOC CMO 17 2016 Guidelines Procedures On The Implementation of The Electronic Certificate of Origin System ECOSDocument6 pagesBOC CMO 17 2016 Guidelines Procedures On The Implementation of The Electronic Certificate of Origin System ECOSPortCalls100% (1)

- DHL 1Document1 pageDHL 1Pilacan KarylPas encore d'évaluation

- Cao 4-2004Document21 pagesCao 4-2004Philip Harold Tolentino100% (4)

- C U S T O M S: Boc Single Administrative DocumentDocument2 pagesC U S T O M S: Boc Single Administrative DocumentNaj MusorPas encore d'évaluation

- CDP LONG QUIZ - With AnswersDocument28 pagesCDP LONG QUIZ - With AnswersElaine Antonette RositaPas encore d'évaluation

- Presidential Decree NO.930Document9 pagesPresidential Decree NO.930Lj CadePas encore d'évaluation

- Bill of LadingDocument2 pagesBill of Ladingsnhd_swprPas encore d'évaluation

- Computation of Excise TaxDocument4 pagesComputation of Excise TaxMax IIIPas encore d'évaluation

- Final SadDocument3 pagesFinal SadJennylyn GalloPas encore d'évaluation

- NP2Document3 pagesNP2Jeffrey L. Medina50% (4)

- TCC Cases Digests 2014-2015Document16 pagesTCC Cases Digests 2014-2015praning125Pas encore d'évaluation

- Incoterms 2010 Made Simple (Summary)Document3 pagesIncoterms 2010 Made Simple (Summary)ArcherA.Sagang100% (11)

- Incoterms ExplainedDocument2 pagesIncoterms Explainedpram006Pas encore d'évaluation

- DUA-SAD Text enDocument120 pagesDUA-SAD Text enGloria MorenoPas encore d'évaluation

- Certificate of Origin-Form DDocument2 pagesCertificate of Origin-Form DAdelia Paramitha75% (4)

- C U S T O M S: Boc Single Administrative DocumentDocument2 pagesC U S T O M S: Boc Single Administrative DocumentRATED KMJS100% (2)

- Schedule of Import Export Arrastre and Wharfage ChargesDocument1 pageSchedule of Import Export Arrastre and Wharfage Chargessieuihm67% (3)

- Import Clearance and FormalitiesDocument32 pagesImport Clearance and FormalitiesJhecyl Ann BasagrePas encore d'évaluation

- BOC Tax ComputationDocument2 pagesBOC Tax ComputationRom100% (1)

- Primer AHTNDocument5 pagesPrimer AHTNlito77100% (1)

- CDP Long QuizDocument26 pagesCDP Long QuizElaine Antonette RositaPas encore d'évaluation

- Form D SampleDocument2 pagesForm D SamplePattiya KhanrinPas encore d'évaluation

- Administrative LawsDocument20 pagesAdministrative LawsTravis OpizPas encore d'évaluation

- Assignment - ETHICS AND STANDARDS OF THE CUSTOMS BROKERAGEDocument6 pagesAssignment - ETHICS AND STANDARDS OF THE CUSTOMS BROKERAGEcris addunPas encore d'évaluation

- C U S T O M S: Boc Single Administrative DocumentDocument2 pagesC U S T O M S: Boc Single Administrative DocumentGwen CondezPas encore d'évaluation

- Proposed Bureau of Customs Order On Security To Guarantee Payment of Duties and TaxesDocument14 pagesProposed Bureau of Customs Order On Security To Guarantee Payment of Duties and TaxesPortCalls100% (1)

- VALUATION METHOD 1 Part 1Document5 pagesVALUATION METHOD 1 Part 1Lloyd AniñonPas encore d'évaluation

- Customs 6 NotesDocument15 pagesCustoms 6 Notesarrah_100% (1)

- Challenges That Customs Brokers/Processors Encounter in Processing Import Entry in Manila International Container PortDocument9 pagesChallenges That Customs Brokers/Processors Encounter in Processing Import Entry in Manila International Container PortTravis OpizPas encore d'évaluation

- Goods Subject For Consumption Under Formal Entry ProcessDocument13 pagesGoods Subject For Consumption Under Formal Entry ProcessElaine Antonette RositaPas encore d'évaluation

- Ahtn and AseanDocument4 pagesAhtn and Aseanalfredo ruelPas encore d'évaluation

- TCCP v. CMTADocument40 pagesTCCP v. CMTAIvan LuzuriagaPas encore d'évaluation

- DOF RO Manual PDFDocument97 pagesDOF RO Manual PDFMaesea BaldonPas encore d'évaluation

- Remigio Vs SandiganbayanDocument5 pagesRemigio Vs SandiganbayanArahbells67% (3)

- TAR2Document4 pagesTAR2Angelica RosePas encore d'évaluation

- Request For Release Under Tentative AssessmentDocument1 pageRequest For Release Under Tentative AssessmentRusiel PanchoPas encore d'évaluation

- Full Text Customs Broker Board ExamDocument2 pagesFull Text Customs Broker Board ExamTheSummitExpress50% (4)

- Custom DutiesDocument5 pagesCustom DutiesJoey WassigPas encore d'évaluation

- Procedure - Section711 - Rev2 - 28july 2020Document3 pagesProcedure - Section711 - Rev2 - 28july 2020AcePas encore d'évaluation

- Q and A in Tariff and Customs Law (Final 7.11.14)Document44 pagesQ and A in Tariff and Customs Law (Final 7.11.14)Castelo Banlaygas100% (2)

- CMO 28 2003 SGL Accreditation Clearance ProceduresDocument16 pagesCMO 28 2003 SGL Accreditation Clearance ProceduresJamaica Marjadas100% (1)

- Post Clearance Audit QuizDocument10 pagesPost Clearance Audit QuizJeammuel ConopioPas encore d'évaluation

- Meaning of Customs Duties and TariffDocument4 pagesMeaning of Customs Duties and TariffLei Chumacera100% (1)

- AWB 250-11855093jkjDocument1 pageAWB 250-11855093jkjAmmar AhmedPas encore d'évaluation

- Draft Bureau of Customs Rules: Civil Remedies in Collecting Duties and Taxes From An ImporterDocument16 pagesDraft Bureau of Customs Rules: Civil Remedies in Collecting Duties and Taxes From An ImporterPortCallsPas encore d'évaluation

- Arrastre Tariff Rate New June 5 2018Document1 pageArrastre Tariff Rate New June 5 2018Declarant 88SunfreightPas encore d'évaluation

- Ethics SaDocument10 pagesEthics SaJes MinPas encore d'évaluation

- Hafale ClearnaceDocument3 pagesHafale Clearnacemumtaz_khanPas encore d'évaluation

- Draft LC TextDocument3 pagesDraft LC TextJundi100% (1)

- Up Tax Reviewer 2014 PDFDocument257 pagesUp Tax Reviewer 2014 PDFJoseph Rinoza PlazoPas encore d'évaluation

- Ucpb v. RamosDocument1 pageUcpb v. RamosYre de los ReyesPas encore d'évaluation

- Police PowerDocument27 pagesPolice PowerYre de los ReyesPas encore d'évaluation

- BPI Vs IACDocument1 pageBPI Vs IACYre de los ReyesPas encore d'évaluation

- Police PowerDocument27 pagesPolice PowerYre de los ReyesPas encore d'évaluation

- Police PowerDocument27 pagesPolice PowerYre de los ReyesPas encore d'évaluation

- Kevin Colcomb, Matthew Rymell and Alun Lewis: Very Heavy Fuel Oils: Risk Analysis of Their Transport in Uk WatersDocument12 pagesKevin Colcomb, Matthew Rymell and Alun Lewis: Very Heavy Fuel Oils: Risk Analysis of Their Transport in Uk WatersSidney Pereira JuniorPas encore d'évaluation

- Indonesia Stainless Steel MarketDocument4 pagesIndonesia Stainless Steel MarketAgustina EffendyPas encore d'évaluation

- Impact of Food Technology On The Economy of PakistanDocument2 pagesImpact of Food Technology On The Economy of PakistanM Zahid Gondal100% (5)

- THAILANDDocument5 pagesTHAILANDChandresh BhattPas encore d'évaluation

- International Economics - 9 Edition Instructor's ManualDocument86 pagesInternational Economics - 9 Edition Instructor's ManualMarkoPas encore d'évaluation

- Role of EXIM BankDocument2 pagesRole of EXIM Bankultimatekp144100% (1)

- Project FabricsDocument2 pagesProject FabricsAbhishek ChaturvediPas encore d'évaluation

- INDSKPQP02L.01 02 Cost Analysis and Preferential Certificate Application Form - V5Document8 pagesINDSKPQP02L.01 02 Cost Analysis and Preferential Certificate Application Form - V5HoJienHau0% (1)

- Explanatory Notes To The Harmonized System Hts Cycle 2012 2017 by World Customs Organization 287492024xDocument5 pagesExplanatory Notes To The Harmonized System Hts Cycle 2012 2017 by World Customs Organization 287492024xSeno Rifa'i0% (1)

- The Classical Theory of International TradeDocument2 pagesThe Classical Theory of International TradeAline JosuePas encore d'évaluation

- Greece EssayDocument3 pagesGreece Essayapi-386610612Pas encore d'évaluation

- Commercial Correspondence Assignment For Trade of Portable Air ConditionerDocument11 pagesCommercial Correspondence Assignment For Trade of Portable Air ConditionerFaishalAhmadPas encore d'évaluation

- Global Vs RakaDocument53 pagesGlobal Vs Rakakunal hajarePas encore d'évaluation

- Export - Import Documentation ProceduresDocument58 pagesExport - Import Documentation ProceduresJebin James75% (4)

- SCHEME Food Products HCDocument4 pagesSCHEME Food Products HC114912Pas encore d'évaluation

- Feasibility Industrial ShkodraDocument73 pagesFeasibility Industrial ShkodraAgim Derguti100% (1)

- Technological University of The Philippines: Taguig CampusDocument46 pagesTechnological University of The Philippines: Taguig CampusXyramhel AcirolPas encore d'évaluation

- Eac Pvoc - Request For Certificate Form 1.2Document1 pageEac Pvoc - Request For Certificate Form 1.2Alphonse MbaraPas encore d'évaluation

- Trade BarriersDocument16 pagesTrade BarriersErum MohtashimPas encore d'évaluation

- Chapter 3 Environmental AnalysisDocument27 pagesChapter 3 Environmental AnalysisMota Angry Khan100% (1)

- Cartels During The War (January 1, 1919)Document39 pagesCartels During The War (January 1, 1919)Oxony20Pas encore d'évaluation

- Tea - The Past, The Present and The FutureDocument66 pagesTea - The Past, The Present and The FutureSimranjeet SinghPas encore d'évaluation

- CA Final Custom Question Bank PDFDocument128 pagesCA Final Custom Question Bank PDFJitendra ChauhanPas encore d'évaluation

- Ecgc ProjectDocument4 pagesEcgc ProjectrabharaPas encore d'évaluation

- Iii. Trade Policies and Practices by Measure (1) O: Trinidad and Tobago WT/TPR/S/151Document48 pagesIii. Trade Policies and Practices by Measure (1) O: Trinidad and Tobago WT/TPR/S/151hinbox7Pas encore d'évaluation

- LeibyEtAl1997 Oil Imports An Assessment of Costs and Benefits ORNL6851Document120 pagesLeibyEtAl1997 Oil Imports An Assessment of Costs and Benefits ORNL6851ridgepablo0% (1)

- 12 Aluminium and Alumina: ProductionDocument10 pages12 Aluminium and Alumina: Productiontarungupta2001Pas encore d'évaluation

- Asian Regionalism: A Style of Its OwnDocument21 pagesAsian Regionalism: A Style of Its OwnNaitsirhc NaitsirhcPas encore d'évaluation

- Fund Based and Non-Fund Based Operations of The BankDocument30 pagesFund Based and Non-Fund Based Operations of The Bankrahul0105Pas encore d'évaluation

- Trade DefficiateDocument15 pagesTrade DefficiateYogita Ghag GaikwadPas encore d'évaluation