Académique Documents

Professionnel Documents

Culture Documents

Quarterly Dividend and Earnings Announcements and Stockholders PDF

Transféré par

DianTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Quarterly Dividend and Earnings Announcements and Stockholders PDF

Transféré par

DianDroits d'auteur :

Formats disponibles

American Finance Association

Quarterly Dividend and Earnings Announcements and Stockholders' Returns: An Empirical

Analysis

Author(s): Joseph Aharony and Itzhak Swary

Source: The Journal of Finance, Vol. 35, No. 1 (Mar., 1980), pp. 1-12

Published by: Blackwell Publishing for the American Finance Association

Stable URL: http://www.jstor.org/stable/2327176

Accessed: 28/02/2010 23:35

Your use of the JSTOR archive indicates your acceptance of JSTOR's Terms and Conditions of Use, available at

http://www.jstor.org/page/info/about/policies/terms.jsp. JSTOR's Terms and Conditions of Use provides, in part, that unless

you have obtained prior permission, you may not download an entire issue of a journal or multiple copies of articles, and you

may use content in the JSTOR archive only for your personal, non-commercial use.

Please contact the publisher regarding any further use of this work. Publisher contact information may be obtained at

http://www.jstor.org/action/showPublisher?publisherCode=black.

Each copy of any part of a JSTOR transmission must contain the same copyright notice that appears on the screen or printed

page of such transmission.

JSTOR is a not-for-profit service that helps scholars, researchers, and students discover, use, and build upon a wide range of

content in a trusted digital archive. We use information technology and tools to increase productivity and facilitate new forms

of scholarship. For more information about JSTOR, please contact support@jstor.org.

Blackwell Publishing and American Finance Association are collaborating with JSTOR to digitize, preserve

and extend access to The Journal of Finance.

http://www.jstor.org

THE JOURNAL OF FINANCE * VOL. XXXV, NO. 1 * MARCH 1980

The

VOL. XXXV

3ourna1

of

FINANCE

MARCH1980

No. 1

Quarterly Dividend and Earnings Announcements

and Stockholders' Returns: An Empirical Analysis

JOSEPHAHARONYand ITZHAKSWARY*

I. Introduction

ASSUMING THAT MANAGERS POSSESS inside informationabout their firms' future

prospects, they may use various signaling devices to convey this informationto

the public. Two of the most important signaling devices available are earnings

and dividend figures. The "informationcontent of dividends"hypothesis asserts

that managers use cash dividend announcements to signal changes in their

expectations about future prospects of the firm.' Since dividend decisions are

almost solely at management'sdiscretion,2announcementsof dividend changes

should provide less ambiguousinformationsignals than earningsnumbers.Furthermore,given the discrete nature of dividend adjustments,signals transmitted

by these changes may even provide informationbeyond that conveyed by the

correspondingearningsnumbers.If dividends,then, do convey useful information,

in an efficient capital market this will be reflected in stock price changes

immediately following a public announcement. It is, therefore, an empirical

question whether dividendinformationcontent is useful to capital marketparticipants.

A major difficulty in assessing dividend information content lies in the fact

that dividendand earningsannouncementsoften are closely synchronized.Thus,

one has first to adequately identify informationreflected in both earnings and

dividends and then consider the remainder of the information conveyed by

dividend announcements.

* Lecturer,GraduateSchool of Business Administration,Tel Aviv University,Israel,and Visiting

AssistantProfessor,North CarolinaState Universityat Raleigh,andthe JerusalemSchool of Business

Administration,The HebrewUniversity,and the Bank of Israel,Jerusalem,Israel,respectively.The

authors thank ProfessorYoram Peles of the Jerusalem School of Business Administrationand an

anonymousreferee for helpful comments.Any remainingerrorsare, of course, ours. We also thank

Dr. Dan Palmon of New York University for providingsome data and Ms. HarrietMcLaughlinof

North CarolinaState Universityfor very extensive progranmming

computations.

' Millerand Modigliani[9] have shownthat in the presenceof perfectcapitalmarkets,the dividend

policy of the firm per se, is irrelevantto its valuation.

2 Managersprobablywould be reluctantto use this

discretionarysignalingdevice falsely, because

when the underlyingresults are revealed,the usefulnessof this device for future signalingcould be

dramaticallyreduced.For an analysisof managers'incentivesto signal information,see Ross [12].

1

The Journal of Finance

The information content of dividends hypothesis has been tested in several

recent empirical studies, and the evidence presented seems inconclusive.Watts

[14, 15, 16], using annual data, argued that the informationcontent of dividends

can only be trivial. Pettit [10, 11] and Laub [7], using quarterlydata, suggested

that dividend announcementsconvey informationbeyond that already reflected

in contemporaneousearnings numbers. The main dispute between the studies

centers on the issue of adequate identification and control of the information

conveyed by earnings.Charest [2] examinedinvestment performanceand capital

marketefficiencywith respect to tradingbased on quarterlydividendinformation.

His findings indicated significant abnormal returns in months following the

announcement of selected dividend changes. He made no attempt, however, to

isolate the effect of dividend information from that of information already

reflected in contemporaneousearningsnumbers.

The main purpose of this study is to ascertain whether quarterly dividend

changes provideinformationbeyond that alreadyprovidedby quarterlyearnings

numbers. The study uses a methodology different from any used in previous

studies, and provides evidence on the usefulness of both quarterlydividend and

earningsannouncementsas signals of changes in future prospects of the firm.

II. The Data

A sample of 149 industrialfirms3was selected from those listed on the New York

Stock Exchange. Each firm met the followingcriteria:

1. Quarterlyearningsper share and quarterlycash dividendsper share, including extra dividends, were available on the quarterly industrial compustat

tapes of the Investor ManagementSciences for the period I/1963-IV/1976.

2. Daily rates of return were available on the tapes constructedby the Center

for Research in Security Prices (CRSP) at the University of Chicagofor the

period 1/1/63-12/31/76.

3. Declaration dates of quarterly dividend payments were available in the

annual cumulative issles of Moody's Dividend Record (published by

Moody's Investors Service, Inc., New York). It is assumed'that these dates

are available through public media such as the Wall Street Journal on the

next business day after announcement.

4. Announcement dates of quarterlyearnings per share were available in the

different annual issues of the Wall Street Journal Index.4

In addition, the daily closing Standard and Poor's Industrial Common Stock

Price Index was obtained from the annual issues of Standard and Poor's Trade

and Securities Statistics-Security Price Index Record, for the period 1/1/6312/31/76.

3This sample consists of the largestset that could be obtainedgiven our selection criteria.

4For the purpose of the current study, the data are constructedso that each quartercontains

reportedquarterlyearningsand dividends.(The originalcompustattapes containin any givenquarter

the earningsearnedand the dividendsreportedin that quarter.)All per-sharedata were adjustedfor

stock splits and stock dividends.

Dividend and Earnings Announcements

m. Methodology and Estimation Procedures

A. Dividend Expectation Model

To examine empiricallythe adjustment of common stock prices to quarterly

dividendannouncements,a measureof unexpectedchange in dividendsfirst must

be derived.The expectationmodel used in this study is a naive model.5It forecasts

no change in dividends from one quarterto another;6that is:

lj,q = Djq-1,

where:Dj,q= expected dividendper share for the j-th firm in the q-th quarterand

Dj,q= actual dividend per share announcedby the j-th firm in the q-th quarter.

Accordingly, a dividend announcement is considered favorable7if Dj,q> 1)j,q,

neutral if Dj,q= 1)j,qand unfavorable8if Dj,q<1)j,q

Justificationfor the naive expectationmodel is derivedfrom the reluctance-tochange dividendsassertation,which states that managersdo not change dividend

payments unless they have reasons to expect a significant change in the future

prospects of the firm. Hence, an increase in dividends should signal a favorable

change in managers'expectations,whereasa decreasein dividendsshould indicate

a pessimistic view of the firm's future prospects. The empiricalobservationthat

most firms follow a policy of dividend stabilizationis consistent with the reluctance-to-changedividendsassertion.In our sample,for example,about 87 percent

of all cases falls in the category of no change in quarterlydividendpayments (see

Table I). Furthermore, Laub [6] has shown that the adjustment process of

quarterlydividends is more likely to be discrete.

B. The Timing of QuarterlyDividend and Earnings Announcements

The major issue to consider is whether quarterly dividend announcements

provide informationbeyond that already provided by quarterly earnings numbers.9A major difficulty lies in the fact that quarterly earnings and dividend

figures often are released to the public at approximatelythe same time. In these

5An alternativedividendexpectationmodel was also used in this study. This is a modifiedversion

of the Lintner[8] model proposedby Fama and Babiak [3] and adjustedhere for quarterlydata:

Dj,q - Dj,q-1 = bljDj,q-1+ b2jEj,q + b3jEj,q-4 +

6j,q,

where:

Ej,q= earningsper share reportedby the j-th firm in the q-th quarter,and

Sj,q= a disturbanceterm assumedto satisfy the usual requirementsof the OLS regressionmodel.

It representsthe unexpectedchangein quarterlydividends.

This model providedresults (not reported)similarto those presentedbelow.

6 No seasonality is observedin the data with respect to changes in dividendsfrom one quarterto

another.Furthermore,Laub[6, p. 558] providesevidencethat ". . . there seems to be some additional

informationin the quarterlydividendsand earningsnot presentin the annualdividendsand earnings."

7 The cases examinedincludedividendincreasesdue to the distributionof extra cash dividendonly

if the extra dividenddiffersfromthat distributedin the same quarterof the previousyear.

8 Only decreases in regular dividends are considered.

numberson commonstock prices

'The effect of publishedquarterlyand annualearnings-per-share

has been demonstratedby Ball and Brown [1], Joy, Litzenbergerand McEnally[5], and others.

The Journal of Finance

cases, any observableadjustmentof stock prices may be the result of a confounding of the informationconveyed by earningsand dividends.

In order to isolate possible dividend effects from those of earnings,this study

examines only those quarterlydividend and earnings announcementsconveyed

to the public on differentdates within any given quarter.In this way, a distinction

is made between earnings announcementsthat precede or follow and those that

accompanydividend announcementswithin any given quarter.The sample data

frequency is presented in Table I.

The sample data are grouped accordingto the direction of dividend changes

from one quarter to another,10and by the number of trading days between

earnings and dividend announcement dates in any given quarter. The sample

includes 2612dividendannouncementsthat follow (Panel A) and 787that precede

(Panel B) quarterly earnings announcements by at least eleven trading days.

Among these are 384 increases, 47 decreases, and 2968 cases of no change in

dividends.

C. Measurement of Abnormal Performance

Assumingthat security returnsare distributedmultivariatenormal,the following market model is used:'1

Rjt = aj + fjRmt + ijt,

(2)

where:

Rj = the geometricmean'2 of the daily rates of return of securityj, over a five

consecutive trading-dayperiod, t,

=

the geometric mean of the daily rates of return of Standard and Poor's

1imt

Industrial - tock Price Index, over a five consecutive trading-dayperiod,

t,

f1j = covariance (4jt, Rmt)/variance(1Rmt),

= E(Ajt) - 8jE(Rmtt),and

disturbanceterm of securityj at period t, and E(,jt) = 0.

Using an OLS regression,equation (2) is run for each stock over the entire period

studied.'3Retum observations are excluded for fifteen days before and fifteen

days after each quarterlydividend and eamings announcementbecause if these

announcements affect stock prices, the residual terms ,jt wil not have a zero

expected value in the period surroundingeach announcementdate.

In order to derive a dividend effect that is not confounded with an earnings

aj

t=

0 All three categories exclude cases that involve stock splits or stock dividends (largerthan 10

percent) in either the currentor previousquarterin question.

See Fama [4, pp. 63-132] for a discussionof this model.

12As pointed out by Scholes and Williams[13], many securitieslisted on organizedexchangesare

tradedonly infrequently,and this introducesinto the marketmodel a potentiallyseriouseconometric

problemof errorsin variables.This nonsynchronoustradingproblemappearsparticularlysevere with

daily prices.To overcomesuch a potentialproblemwe estimatethe marketmodelusingthe geometric

means of the daily rates of returnover five consecutivetrading-dayperiods.The coefficientsobtained

(&,,/,) are then used to estimate daily residuals.(Notice that Scholes and Williams[13] suggest a

differentestimationprocedureto attack this problem.)

13Joy, et al. [5, Appendix]estimate the slope coefficientof equation (2) in altemative ways and

concludethat empiricalresults obtainedusing these estimates are similar.

Dividend and Earnings Announcements

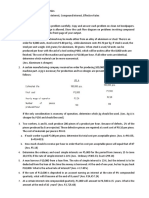

Table I

The Sample Frequency of Quarterly Dividend Announcements Relative to

Quarterly Earnings Announcements

A. Earnings Announcements precede Dividend Announcements

Number of Trading Days Between Announcement Dates

of Quarterly Dividends and Earnings

Category

Increase in Dividendsa

No Change in Dividends

Decrease in Dividends

0-10

11-20

21-40

41-60

61+

11-61+

(Total)

379

2726

68

132

974

13

136

988

10

33

274

1

9

42

0

310

2278

24"

1

2

0

74

690

23c

B. Earnings Announcements follow Dividend Announcements

78

Increase in Dividends

45

27

644

No Change in Dividends

464

211

8

14

8

Decrease in Dividends

' Comparing

quarter-to-quarter change in dividend per-share.

b From 15 different companies.

'From 12 different companies.

1

13

1

effect, the dividend expectation model is applied only to stock/quarters where

cash dividends are announced at least eleven trading days preceding or following

the earnings announcement in the same quarter. The market model is then used

to determine whether stockholders realized abnormal returns in the days surrounding these quarterly dividend and earnings announcements. Abnormal returns, E'i, for frm j on day i are estimated as the difference between the actual

return on day i and the return predicted from the market model

Eji=

1Rji -oi -

j R,,,,d,

(3)

where i denotes the i-th day relative to a given announcement date for firm j.

Then, for any day i within the interval of ten days before to ten days after an

announcement date, the average residual (AR) across sample members is

ARi

z>N

V,q _1'1Ejqi

Qq-1 Nq

(4

where Nq is the number of firms in a calendar quarter q, and Q is the number of

quarters for a given group. (The various groups considered will be discussed in

Section IV.)

The variables eji and AR, are used to measure the information content of

quarterly dividend and earnings announcements and the efficiency with which

this information is incorporated into stock prices. The null hypothesis is that &,i

are drawn from a distribution with zero mean; that is, that the announcements of

quarterly dividends and earnings have no systematic effect on corresponding

stock prices. To test the hypothesis that the average residual at day i is statistically different from zero, the following t-statistic is used:

t(ARO)=.

=

ARiStQ, .t(Q - 1),

S(eqi)

(5)

The Journal of Finance

where:'4

eqi=

Ejqi,

and S(eqi)= AI(Q_

) XQ(eqi-ARX)2.

Cumulative effects of the abnormal retums (CAR) behavior in the days

surroundingthe dividendand earningsannouncementdates (event time zero) are

obtained by summing ARi over event time (K =-10,

CARK= S2K

. . . , 0, . . ., + 10):

ARi.

(6)

IV. Empirical Results and Analysis

A. Information Content of Dividend Changes

Using the dividend expectation model, the sample data are divided into three

subsets: (a) no change in dividends, (b) increases in dividends and (c) decreases

in dividends.Each of these subsets is furtherdivided into two groups:(1) cases in

which earnings announcementsprecede dividend announcements,and (2) cases

in which earnings announcements follow dividend announcements (by at least

eleven trading days). The daily average (AR) and the cumulative daily average

(CAR) abnormalreturnsrealizedby stockholdersin the twenty days surrounding

the dividend announcementdates (hereafterAD) are presented in Panels A, B,

and C of Table II, for each of these groups. The t-statistics presented indicate

whether the AR are significantlydifferentfrom zero. Finally, the CAR plotted in

Figure 1 provide an overview of the results.

Results in Panel A of Table II indicate that stockholdersof companiesthat did

not change their dividends,earned,on average,only normalreturns (as predicted

from the market model) over the twenty days surroundingthe announcement

dates. The CAR during this period are of small magnitudes and the AR do not

differ significantly from zero. These results are similar whether earnings announcements precede or follow dividend announcements.

Results in Panel B indicate that stockholders of companies that announced

dividendincreasesrealized,on average,positive abnormalreturnsover the twenty

days surroundingannouncement dates. Most of the statistically significant abnormal returns occurred during days AD-1 and AD.'5 Moreover, they are of

similar magnitude for both groups whether earnings announcementsprecede or

follow dividend announcements (.72 and 1.03percent, respectively, for these two

days combined).

Finally, stockholders of companies that reduced their dividends sustained, on

average, negative abnormal returns during the twenty days surrounding an4 Since residualsof differentsecurities in any calendartime may be cross-sectionallycorrelated

due to industryand other factors,i,,' are averagedin each calendarquarterq to obtain eq,.The t test

assumes that the eq,are identicallyindependentdistributedacross time (quarters).Watts [17] used

the same t-statistic and examined this assumption. Watts (pp. 142-143) indicated that ". . the

distributionof abnormalreturns is relatively stationary and that the t tests reported ... are wellspecified."A similarexaminationof the present study's abnormalreturnsreached the same conclu-

sions.

1 Day AD is the dividendannouncementdate when the informationis assumedto becomepublicly

availablethroughthe media. Day AD-1 is the declarationdate and in many cases the announcement

is revealedby the wire serviceson that day.

C.

B.

I.

II.

A.

I.

II.

I. No

11.

t

t

t

t

2278 t

AR

AR

AR

AR

AR

AR

Dividend

CAR

CAR

CAR

CAR

Dividend

CAR

CAR

Days

Change

tValue

(%)

Value

Value

(%)

Value

Value

(%)

Value

(%)

(%)

(%)

(%

(%

(%

cases;

*Significant

(%)

Earnings

(%)

Earnings

Earnings

(%)

Earnings

Earnings

Eamnings

in

**Significant

*Significant

at at h

at

Increase

Decrease follow

Relative

5 2.50.5690

follow

follow

precedeto

precede

precede

Dividend

cases;

AD

percent

percent

percent

Dividend

Dividend'

Dividend"

d

Dividend'

Dividend'

Dividend'

level

310

level

level

- - cases;

.20.46

d

.20

(one-tailed

(one-tailed

74 - (one-tailed

test).

.31

.26

test).

test). cases; 11

.40.90.40

.05.27.05 .151.37

.05.80.05

-1.22

.04

.55

.151.18

.15-.13

.351.74

.40 .02-1.24

.12

.171.72

.03

.04-.04

.00

- -

.08

.251.12

-04.0400

- - -

-8

.31.94.06

04 .1400

-7

.62

.47-1.78

-1.53

.2208

cases.

.72

.95-1.39

.551.29

.20

.23.86.24

1.00

1.76

.45

- .97.22

03

- -

.83.21.12

84 .71

-04-79-.451.25

.38

-2.23

-2.36

-

24 -1.01

-1.39

-70

- cases;

.9844

-1.45

'23 - -

-1.57

.18

- - -

- -

.16.87

.14

- .14.21

02-

.09-1.71

23

- - -

.29.29.02

1.03

.00 .04

-

.13.4304

.30.16.01

-1.42

07

71 -.5213-13.061.94

.19

- - - -

.31.12.01

1.09

-.07-.02

.05

- -.04.2502

63 .3608

.08.9214

.13

.441.74

67

-2.57

-2.68

.66.14.03

.14

.061.13

.06

.38-1.01

- -

.37

.67 .433.23*

1.33

3.00*

.33.73.05

-.04.8003

.36

1.69

2.29*

*

.782.35*

.35

*

.28.58.05

.01.92.03

-4.27

.67.35

.17

.36.06 .951.44

1.75

.31.52.03

.051.42

.06

.59 -4.02

.30.25

-3.85

1.00

.46

.95.00.00

1.82

.07

-

.32.14.01

.121.77

.07

- -

1.18

.35

.33.07 -3.67

-3.78

-2.23

1.41

41

-

.421.67

.10

.01.7711

.47.78.05

.02.16.01

- -

-1.08

-1.46

-5.39 -1.13 -4.62

1.97**

.95

-4.44

1.79

-1.17

14

1.27

1.03

.72

.08

- .94.6209

.12.03

-3.75

- .6424

-3.99

-4.15

-1.20

.43

.27

1.33

.06

-

.88.6606

.50.40.03

.071.18

.05

- -

.07.02

-3.70

.76.29 -4.13

-1.89

1.07

26

- -

.51.22.01

.04.7503

- -

.27.13

.24.10 -4.00

-3.60

- -

.2804

1.03

.97.77

.09

- .90.44

-1.25 -4.33

.80.33

-1.92

-4.85

.29.22

-4.46

.74.39 -4.55

-6

-5

Measures

for

-4

Days

-3

- -

.2701

.03

- - -

.80.13 .81.8309

1.16

- -

.54.59.03

00 .81.03

.81.0200

.48.71.06

.63.09

1.25

-1

AD

07-

Table

II

Surrounding

+2

+3

Announcement

+4

Dates

+5

+6

+7

+8

.01.34.01

Dividend

+1

.51.05.00

-2

-3.72

.14.05

- -

Performance

-.01.73.03

- -

-1.69 -3.16 -2.30

-4.26

-1.70

-1.88***

-9

- -

.92.64.47

1.13

-1.90

.46

.86.13.06

-10

+9

The Journal of Finance

Daily

CAR(%)

Cumulative

a.

Dividend

0.15-

Average

Abnormal Returns:

Cases Where Earnings

Precede Dividend Announcements

Decrease

CAR(%)

b.

Dividend

Announcemelnts

Increase

1.04A

-0. 37.

0.91-

-0.90

0.78.

-1.4:

0.65-

-1.96

0.52l

-2.49

0.39-

-3.02

0.26l

-3.55,

0. 13X

-4.00

0.

-4.61

'

-10 -8

-3

AD 2

-01

710

Days Relative

to the Announcement

of DIVIDENDS

-10-8

Date

-3 AD 2

7 10

Days Relative

to the Announcement

of DIVIDENDS

Date

Figure 1. Daily cumulativeAverageAbnormalRetums: Caseswhere EarningsAnnouncements

precede DividendAnnouncements

nouncement dates. Again, most of the statistically significant abnormalreturns

occurredduring days AD-1 and AD, and they are of similar magnitudefor both

groups whether earnings announcementsprecede or follow dividend announcements (-3.76 and -2.82 percent,respectively,in Panel C of Table II). Notice that

abnormalreturns for the decreased dividend groups are of much greater magnitude (in absolute terms) than those of the correspondingincreased dividend

groups.

These findings of capital marketreaction to dividend announcementsstrongly

support the informationcontent of the dividendhypothesis, namely that changes

in quarterly cash dividends do provide information about changes in management's assessment of future prospects of the firm. Furthermore,analyzing only

the cases where dividendsand earningsare announcedat differentpoints in time

and obtaining similar results for either group whether earnings announcements

precede or follow dividend announcements,lends support to the hypothesis that

quarterly dividend announcements contain useful information beyond that already provided by quarterlyearningsnumbers.

The results also support the semi-strong form of the efficient capital market

hypothesis that on average, the stock market adjusts in an efficient manner to

new dividend information.Almost all of the price adjustment occurred within

days AD-1 and AD.

B. Information Content of Earnings: Stocks Classified According to Dividend

and Earnings Changes

To investigate further the hypothesis that quarterlydividend announcements

provide useful information beyond that provided by correspondingquarterly

Dividend and Earnings Announcements

earningsnumbers,we examine stock performancein the days surroundingearnings announcement dates (hereafter AE) in quarters where both dividend and

earnings changes provide favorable signals. For this purpose, a naive earnings

expectation model is applied to the cases included in each dividend increase

group.'6This model forecastsno change in earningsannouncedin a given quarter

from those announcedin the same quarterof the previous year. Accordingly,an

increase in earningsover those of the correspondingquarterfor the previousyear

is considereda favorablesignal and a decreasein earnings,an unfavorablesignal."7

Of the 310 dividend increase cases where earnings precede dividend announcements, 89 percent (i.e., 276 cases) were also in the earnings increase category.

Similarly, of the 74 dividend increase cases where earnings follow dividend

announcements, 86 percent (i.e., 64 cases) were also in the earnings increase

category.Results are presentedin Table III and Figure2 and are discussedbelow.

Results in Table III indicate that stockholders of companies that announced

both earnings and dividend increases in the same quarter realized, on average,

significantpositive abnormalreturns at the earningsannouncementdates (or at

AE-1) whether these earnings announcements preceded or followed the corresponding dividend increase announcements.These results, combined with evidence presented in Table II, provide further support of the hypothesis that

announcements of quarterly dividend changes provide informationbeyond that

already provided by correspondingquarterlyearningsnumbers.When dividend

increases are announced before or after earnings increases, stockholdersrealize

abnormalreturns in the days surroundingboth dividendand earningsannouncement dates.'8This indicates that the significantabnormalreturnsrealizedat the

time of the announcements of dividend changes do not reflect a diffusion or a

leakage of the informationconveyed by earningsnumbersbut rather, additional

informationgeneratedby the dividendannouncements.Thus, these findingshave

important implications for the effectiveness of using quarterly dividend and

earningsnumbersas devices for signalingmanagementexpectations,namely that

changes in quarterly dividends provide a signaling device that is at least as

effective as quarterlyearningsnumbers.

V. SUMMARY

This study attempts to resolve the empirical issue as to whether quarterly

dividend announcements convey useful information beyond that provided by

quarterly earnings numbers. The methodology used examines only those quarterly dividendand earningsannouncementsmade publicon differentdates within

any given quarter. This distinguishes earnings announcementsthat precede or

follow from those that accompany dividend announcements. Findings about

6 Whenthe naive earningsexpectationmodelwas appliedto the cases includedin the two dividend

decrease groups,of the twenty-four(twenty-three)dividenddecrease cases where earningsprecede

(follow) dividend announcements,thirteen (six) cases were also in the earningsdecrease category.

Due to the small number of observationsin these categories,analysis was restricted to favorable

signals only.

17 See Joy, et al. [5] for a justificationof this model.

18 Stock performancefor the 276 and 64 cases analyzedin this section was also examinedfor the

days surroundingthe dividendannouncementdates. Results were similarto those presentedin Panel

B of Table II.

**

II.

I.

t

276CAR AR CAR AR

Value

Value

(%) Days

(%)

Earnings

(%)

Earnings

(%)

cases;

Significant

Significant

b

follow

at at 64

Relative

precede

I 0.5

to

caes.

percent

percent

AE

Dividendh

Dividend'

level

level

.11.57.11

-

.00.02.00

-10

(one-tailed

(one-tailed

.19

.08-1.11

test).

test).

.07.56.07

-.21-.61-.13 .12.33.05

-9

-8

.09.82.12

.14

.02-1.20

-7

Performance

- - .09.02.00

.17

.151.82

-6

Cases

- - .12.19.03

.24

.391.41

-5

-4

Measures

where

for

.05.40.07

-.25

.14-1.27

.14.79.19

.23.88.09

-3

.25.85.11

.52

.751.71

-2

Table

Earnings

.872.62*

.62

.33

1.08

1.59

-1

andSurrounding

1.46

1.16

.29

.58

1.66

3.14*

AE

1.33

1.52

.36

.41.06

1.72

+1

1.55

1.78

.26

.25

1.64

1.97

+2

both

Days

III

Earnings

Dividends

Increase

- +3

1.84

.46.06

1.92

.28.05

1.96

.79.12

.32

2.24

1.72

+4

2.09

.87.13

2.33

.38.09

+5

.45.10

2.19

.35.05

2.28

2.22

.19.03

.85.10

2.18

Announcement

Dates:

- +6

- -

- -

+7

Dividend and Earnings Announcements

Daily

CAR(%)

a.

Cumulative

Average

Precede

Earnings

Abnormal

Returns:

Dividends

Increase

Dividend

CAR(%)

2.33

2.22'

2.08

1.95

1.82

1.68

1.56

1.41

1.30

1.14

1.03

0.86-

0.77

0.59'

0.51

0.32

0.25

0.06

Cases

b.

Where

11

Both

Earnings

Follow

Earnings

and

Dividend

0

-0.02

-0 .21

-106

Days

Relative

Date

-3

AE 2

7 10

to the Announcement

of EARNINGS

-10-4

Days

Relative

Date

-3

AE 2

710

to the Announcement

of EARNINGS

Figure 2. Daily cumulativeAverageAbnonnal Returns:Cases where both Earningsand Dividends Increase

capital market reaction to the dividendannouncementsstudied strongly support

the hypothesis that changes in quarterlycash dividendsprovide useful information beyond that provided by correspondingquarterly earnings numbers. In

addition, the results also support the semi-strong form of the efficient capital

markethypothesis;that is, on the average,the stock marketadjustsin an efficient

manner to new quarterlydividend information.

References

1. R. Ball, and P. Brown. "An EmpiricalEvaluationof AccountingIncome Numbers.' Journal of

AccountingResearch, 6 (Autumn1968).

2. G. Charest."DividendInformation,Stock Returnsand MarketEfficiencyII."Journal of Financial Economics,6 (June/September1978).

3. E. Fama, and H. Babiak. "DividendPolicy: An EmpiricalAnalysis."Journal of the American

Statistical Association, 63 (December1968).

4. E. Fama.Foundation of Finance (New York,Basic Books: 1976).

5. M. 0. Joy, R. H. Litzenberger,and R. W. McEnally. "The Adjustment of Stock Prices to

Announcementsof UnanticipatedChanges in QuarterlyEarnings."Journal of Accounting

Research, 15 (Autumn1977).

6. M. P. Laub."SomeAspects of the AggregationProblemin the DividendEarningsRelationship."

Journal of the American Statistical Association, 68 (September1972).

7. M. P. Laub. "On the InformationalContent of Dividends,"Journal of Business, 49 (January

1976).

12

The Journal of Finance

8. J. Lintner. "Distributionof Incomes of CorporationsAmong Dividends,Retained Earningsand

Taxes."American EconomicReview,46 (May 1956).

9. M. H. Miller,and F. Modigliani."DividendPolicy, Growth,and the Valuationof Shares."Journal

of Business, 34 (October1961).

10. R. Pettit. "DividendAnnouncements,Security Performance,and Capital Market Efficiency."

Journal of Finance, 27 (December1972).

11. R. Pettit. "The Impactof Dividendand EarningsAnnouncements:A Reconciliation."Journal of

Business, 49 (January1976).

12. S. A. Ross. "The Determinationof FinancialStructure:The Incentive-SignalingApproach."The

Bell Journal of Economics,8 (Spring1977).

13. M. Scholes, and J. Williams."EstimatingBetas fromNonsynchronousData."Journal of Financial Economics,5 (December1977).

14. R. Watts. "The InformationContentof Dividends."Journal of Business, 46 (April1973).

15. R. Watts. "Commentson the Impact of Dividend and EarningsAnnouncements:A Reconciliation."Journal of Business, 46 (January1976).

16. R. Watts. "Commentson the InformationalContent of Dividends."Journal of Business, 49

(January1976).

17. R. Watts. "Systematic'Abnormal'Returns After QuarterlyEarningsAnnouncements."Journal

of Financial Economics,6 (June/September1978).

Vous aimerez peut-être aussi

- Why Moats Matter: The Morningstar Approach to Stock InvestingD'EverandWhy Moats Matter: The Morningstar Approach to Stock InvestingÉvaluation : 4 sur 5 étoiles4/5 (3)

- Asquith Mullins (1986) Signalling With Dividends, Stock Repurchases Equity IssuesDocument19 pagesAsquith Mullins (1986) Signalling With Dividends, Stock Repurchases Equity IssuesAbdullahPas encore d'évaluation

- Asquith and Mullins 1983Document21 pagesAsquith and Mullins 1983Angelie AngelPas encore d'évaluation

- 00.divsto1028 - PublishedDocument10 pages00.divsto1028 - Publishede learningPas encore d'évaluation

- Ball MuchNewInformation 2008Document43 pagesBall MuchNewInformation 2008amangoel875Pas encore d'évaluation

- A Note On Cash Flow VariablesDocument11 pagesA Note On Cash Flow VariablesAnonymous O69Uk7Pas encore d'évaluation

- Solution Manual For Ethical Obligations and Decision Making in Accounting Text and Cases 4th EditionDocument30 pagesSolution Manual For Ethical Obligations and Decision Making in Accounting Text and Cases 4th Editiongabrielthuym96j100% (18)

- Blackwell Publishing American Finance AssociationDocument16 pagesBlackwell Publishing American Finance AssociationJulyanto Candra Dwi CahyonoPas encore d'évaluation

- 1.3pead - Analyst and Time Series - Jar 2006Document30 pages1.3pead - Analyst and Time Series - Jar 2006Eva WinartoPas encore d'évaluation

- Cohen and Frazzini, 2008Document36 pagesCohen and Frazzini, 2008yangPas encore d'évaluation

- Stock SplitDocument36 pagesStock SplitSivakarthik SubramanianPas encore d'évaluation

- PiotroskiDocument42 pagesPiotroskinwiggersPas encore d'évaluation

- Accounting Research Center, Booth School of Business, University of ChicagoDocument27 pagesAccounting Research Center, Booth School of Business, University of ChicagoLexie RevilPas encore d'évaluation

- Beyond The Quartiles - White Paper - FINALDocument8 pagesBeyond The Quartiles - White Paper - FINALTDGoddardPas encore d'évaluation

- This Content Downloaded From 178.244.206.198 On Thu, 25 Mar 2021 12:03:28 UTCDocument41 pagesThis Content Downloaded From 178.244.206.198 On Thu, 25 Mar 2021 12:03:28 UTCElif AcarPas encore d'évaluation

- FIN 620 ProjectDocument12 pagesFIN 620 ProjectatodawitPas encore d'évaluation

- A Study To Analyse Effect of Corporate Actions On Stock Market Returns of Selected Indian IT CompaniesDocument22 pagesA Study To Analyse Effect of Corporate Actions On Stock Market Returns of Selected Indian IT CompaniesAnkit SarkarPas encore d'évaluation

- Wiley Financial Management Association InternationalDocument11 pagesWiley Financial Management Association InternationalKavitha ReddyPas encore d'évaluation

- An 20 Economic 20 Analysis 20 of 20 Interest 20 Rate 20 Swaps 20 by 20 Bicksler 20 and 20 ChenDocument13 pagesAn 20 Economic 20 Analysis 20 of 20 Interest 20 Rate 20 Swaps 20 by 20 Bicksler 20 and 20 ChenGabriela M AnișoaraPas encore d'évaluation

- Crowding and Factor ReturnDocument51 pagesCrowding and Factor ReturnShri Krishna BhatiPas encore d'évaluation

- Accounting Research Center, Booth School of Business, University of ChicagoDocument42 pagesAccounting Research Center, Booth School of Business, University of ChicagoNic KnightPas encore d'évaluation

- Dividend PolicyDocument8 pagesDividend PolicyHarsh SethiaPas encore d'évaluation

- Dividend Month Premium in The Korean Stock MarketDocument34 pagesDividend Month Premium in The Korean Stock Market찰리 가라사대Pas encore d'évaluation

- Chapter 2Document3 pagesChapter 2Aqsa ChaudhryPas encore d'évaluation

- Accounting Research Center, Booth School of Business, University of ChicagoDocument32 pagesAccounting Research Center, Booth School of Business, University of ChicagoCarmen TaverasPas encore d'évaluation

- Critical Accounting Policy Disclosures: C B. L M J. SDocument38 pagesCritical Accounting Policy Disclosures: C B. L M J. SmaddenwythPas encore d'évaluation

- Wiley, Accounting Research Center, Booth School of Business, University of Chicago Journal of Accounting ResearchDocument12 pagesWiley, Accounting Research Center, Booth School of Business, University of Chicago Journal of Accounting ResearchSafira DhyantiPas encore d'évaluation

- Is There Crowd Wisdom in Accounting? Evidence From Forecasts in Equity-Based CrowdfundingDocument27 pagesIs There Crowd Wisdom in Accounting? Evidence From Forecasts in Equity-Based CrowdfundingDINDA TUSTIKAPas encore d'évaluation

- Brinson Et Al. (1986) - Determinants of Portfolio PerformanceDocument7 pagesBrinson Et Al. (1986) - Determinants of Portfolio Performanceadf237Pas encore d'évaluation

- A Study On Performance Analysis of Equities Write To Banking SectorDocument65 pagesA Study On Performance Analysis of Equities Write To Banking SectorRajesh BathulaPas encore d'évaluation

- Estimating Private Equity Returns From Limited Partner Cash FlowsDocument33 pagesEstimating Private Equity Returns From Limited Partner Cash FlowsCamil ChaoulPas encore d'évaluation

- Cash Flow andDocument92 pagesCash Flow andBen XingPas encore d'évaluation

- Lev&Thiagaraian 1993JARDocument27 pagesLev&Thiagaraian 1993JARBeeHoofPas encore d'évaluation

- Next 4Document10 pagesNext 4Nurhasanah Asyari100% (1)

- A Study On The Impact of Dividend Announcement On Stock PriceDocument9 pagesA Study On The Impact of Dividend Announcement On Stock PriceVidya Hegde KavitasphurtiPas encore d'évaluation

- Factors and Factor Exposures: InsightsDocument6 pagesFactors and Factor Exposures: InsightsYashas IndalkarPas encore d'évaluation

- Accounting Research Center, Booth School of Business, University of ChicagoDocument34 pagesAccounting Research Center, Booth School of Business, University of ChicagorainPas encore d'évaluation

- Term Report Fat MW Ss YeDocument27 pagesTerm Report Fat MW Ss YeYasmin El-AlawaPas encore d'évaluation

- QM222 Final Project Justin PadillaDocument12 pagesQM222 Final Project Justin PadillaMr BrownstonePas encore d'évaluation

- Predictive Power of Weekly Fund Flows: Equity StrategyDocument32 pagesPredictive Power of Weekly Fund Flows: Equity StrategyCoolidgeLowPas encore d'évaluation

- Financial Analysis On Mutual Fund Schemes With Special Reference To SBI Mutual Fund CoimbatoreDocument6 pagesFinancial Analysis On Mutual Fund Schemes With Special Reference To SBI Mutual Fund CoimbatoreCheruv SoniyaPas encore d'évaluation

- Manneh NaserDocument11 pagesManneh NaseramandaPas encore d'évaluation

- Cost of DebtDocument17 pagesCost of DebtAmit Kumar KunduPas encore d'évaluation

- Impact of Dividend On Stock Price and Valuation of FirmDocument12 pagesImpact of Dividend On Stock Price and Valuation of FirmShalini VermaPas encore d'évaluation

- Cesari 2015Document17 pagesCesari 2015Nicoara AdrianPas encore d'évaluation

- SSRN Id3111607Document46 pagesSSRN Id3111607Bálint GrPas encore d'évaluation

- 1 s2.0 S0165410116300763 MainDocument24 pages1 s2.0 S0165410116300763 MainAmal AouadiPas encore d'évaluation

- Financial AnalysisDocument67 pagesFinancial Analysisdushya4100% (1)

- Final ThreeDocument26 pagesFinal ThreeGolam Samdanee TaneemPas encore d'évaluation

- Mutual Fund ReportDocument24 pagesMutual Fund ReportRohit RajPas encore d'évaluation

- Catering Theory by Baker & WurglerDocument42 pagesCatering Theory by Baker & Wurglerarchaudhry130Pas encore d'évaluation

- Effect of Dividend On Stock Price in Emerging Stock Market: A Study On The Listed Private Commercial Banks in DSEDocument13 pagesEffect of Dividend On Stock Price in Emerging Stock Market: A Study On The Listed Private Commercial Banks in DSEFariha TasnimPas encore d'évaluation

- Jofi 13196Document68 pagesJofi 13196Mohamwd AbobakrPas encore d'évaluation

- A Dea Comparison of Systematic and Lump Sum Investment in Mutual FundsDocument10 pagesA Dea Comparison of Systematic and Lump Sum Investment in Mutual FundspramodppppPas encore d'évaluation

- Interindustry Dividend Policy Determinants in The Context of An Emerging MarketDocument6 pagesInterindustry Dividend Policy Determinants in The Context of An Emerging MarketChaudhary AliPas encore d'évaluation

- Do Tracking Stocks Reduce Informational Asymmetries by Elder Et Al. (JFR 2005)Document18 pagesDo Tracking Stocks Reduce Informational Asymmetries by Elder Et Al. (JFR 2005)Eleanor RigbyPas encore d'évaluation

- Maqasid ShariahDocument30 pagesMaqasid ShariahbadliPas encore d'évaluation

- Hero Moto Corp Financial AnalysisDocument16 pagesHero Moto Corp Financial AnalysisUmeshchandu4a9Pas encore d'évaluation

- Assessing Fund Performance:: Using Benchmarks in Venture CapitalDocument13 pagesAssessing Fund Performance:: Using Benchmarks in Venture CapitalNamek Zu'biPas encore d'évaluation

- Capital Structure, Cost of Debt and Dividend Payout of Firms in New York and Shanghai Stock ExchangesDocument9 pagesCapital Structure, Cost of Debt and Dividend Payout of Firms in New York and Shanghai Stock ExchangesDevikaPas encore d'évaluation

- Banks ControlDocument29 pagesBanks ControlAnirban MukherjeePas encore d'évaluation

- Zakat Declaration Form CZ501Document2 pagesZakat Declaration Form CZ501syed suleman shahPas encore d'évaluation

- Chap 001Document40 pagesChap 001AhmedPas encore d'évaluation

- Cost of Equity Risk Free Rate of Return + Beta × (Market Rate of Return - Risk Free Rate of Return)Document7 pagesCost of Equity Risk Free Rate of Return + Beta × (Market Rate of Return - Risk Free Rate of Return)chatterjee rikPas encore d'évaluation

- Life Cycle Management of Port Structures Recommended Practice For ImplementationDocument58 pagesLife Cycle Management of Port Structures Recommended Practice For Implementationsafehian100% (2)

- ICICI Home Loans Project ReportDocument109 pagesICICI Home Loans Project ReportJohn Paul86% (21)

- How To Manage Wisly Your SalaryDocument1 pageHow To Manage Wisly Your SalaryKhalid BrahimPas encore d'évaluation

- PSC 2011 Amended Annual Report SEC Form 17-A For SECDocument125 pagesPSC 2011 Amended Annual Report SEC Form 17-A For SECSamantha CabugonPas encore d'évaluation

- Fintech Report 2019Document28 pagesFintech Report 2019Nadeem KhanPas encore d'évaluation

- Introduction To Financial ReportingDocument2 pagesIntroduction To Financial ReportingMariel DiazPas encore d'évaluation

- Pure and Conditional Obligation.Document2 pagesPure and Conditional Obligation.Lauren Obrien83% (12)

- Horizontal Balance Sheet: Total Equity&LiabilitiesDocument7 pagesHorizontal Balance Sheet: Total Equity&LiabilitiesM.TalhaPas encore d'évaluation

- How To See CibilDocument2 pagesHow To See CibilSahil PatelPas encore d'évaluation

- Takavi An Advance Made To A Raiyat by His Superior Tenure Holder To Enable Him To Recover The Agricultural Losses Caused by Natural CalamitiesDocument5 pagesTakavi An Advance Made To A Raiyat by His Superior Tenure Holder To Enable Him To Recover The Agricultural Losses Caused by Natural Calamitiesprasadpatil71Pas encore d'évaluation

- JFCDocument2 pagesJFCAlyssa MabalotPas encore d'évaluation

- Digest. Compilation. Tax2Document148 pagesDigest. Compilation. Tax2Ma. Consorcia GoleaPas encore d'évaluation

- S140215681 0 PDFDocument2 pagesS140215681 0 PDFShirley RobertsPas encore d'évaluation

- Self & Wife - Mediclaim PolicyDocument5 pagesSelf & Wife - Mediclaim PolicyShrikant Sahu100% (4)

- ELE UdiDocument17 pagesELE UdiNabadeep BorahPas encore d'évaluation

- Point Figure ChartsDocument11 pagesPoint Figure Chartsja_357Pas encore d'évaluation

- Lewis A Kaplan Financial Disclosure Report For 2010Document14 pagesLewis A Kaplan Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Last Six Months Current AffairsDocument325 pagesLast Six Months Current AffairsjenisysPas encore d'évaluation

- Upload 7Document59 pagesUpload 701fe20bec113Pas encore d'évaluation

- International Financial Management 1Document35 pagesInternational Financial Management 1胡依然Pas encore d'évaluation

- Probset #2 - Engineering EconomicsDocument2 pagesProbset #2 - Engineering EconomicsKshatriya EllaPas encore d'évaluation

- Role of A BMDocument2 pagesRole of A BMraj singhPas encore d'évaluation

- New Microsoft Word DocumentDocument28 pagesNew Microsoft Word Documentjaz143Pas encore d'évaluation

- Moody's - Government of ArgentinaDocument28 pagesMoody's - Government of ArgentinaCronista.com100% (1)

- Can The Developers Move For Specific Performance of The Development Agreement?Document6 pagesCan The Developers Move For Specific Performance of The Development Agreement?Manas Ranjan SamantarayPas encore d'évaluation

- Microsoft For Startups Deck 19Document20 pagesMicrosoft For Startups Deck 19Rajni Kant Sinha100% (1)