Académique Documents

Professionnel Documents

Culture Documents

Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)

Transféré par

Shyam SunderTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)

Transféré par

Shyam SunderDroits d'auteur :

Formats disponibles

KARUTURI

GLOBAL P R E S E N C E . GLOBAL S U C C E S S

To

The Manager Listing Compliance

BSE Limited

P.J Towers, Dalal Street

Mumbai-40000 1

7

To

The Manager,

Listing Department

National Stock Exchange of India Limited

Exchange Plaza, Bandra Kurla Complex,

Bandra East, Mumbai-40005 1

7

Dear Sir/Madam,

Subject: Outcome of Board of Directors Meeting

This is to inform you that the Board of Directors of the

Company a t its meeting held on November 24", 2016, as interalia approved the following transaction:

1.Approval of Un-Audited financial results of the company

for the quarter ended 30" September 2016.

2.Allotment of shares to Rhea Holdings Private Limited

3. Allotment of shares to preferential Warrants holders.

The meeting concluded a t 6.45 PM

For Karuturi Global Limited

&~ a h i v e e Jain

r

Company Secretary

Karuturi Global Limited

Reg. Office : # 304, Embassy Centre, 11, Crescent Road, Bengaluru - 560 001, India. CIN : LO1122KA1994PLC016834

,

. .

T-I

. n 4 nn r n n n nnnn rn~

nn

n n n r n-rnn .

. r

. .

.

:

I

-8

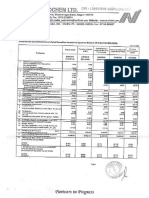

KARUTURI GLOBAL LIMITED

Regd Office: 204, Embassy Centre, Crescent Road, Bangalore 560001

CIN: LOllZZKA1994PLC016834, Email: Info@karuturi.com, webrite: www.karuturi.com,Tel: 080-23085300

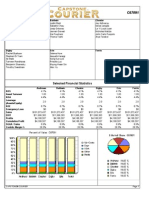

UNAUDITED FINANCIAL RESULTS FOR THE QUARTER ENDED 30.09.2016

(All figures Rupees in Lakhs

CONSOLIDATED

STANDALONE

,.

Particulars

lo

3 months ended

30.09.2016

30.06.2016

31.03.2016

30.09.2016

30.09.2015

3 manthr ended

30.09.2016

30.06.2016

6 months ended

12 months

ended

31.03.2016

30.09.2016

30.09.2015

30.09.2015

Net Revenuellncome from Operations

Total Income f r o m Operations (net)

264 33

253 56

368.39

517.89

598.74

1,429.02

6,000.44

4,831 13

6.079.14

10,831.57

12,752.15

33,149.77

(atb)

264.33

253.56

368.39

517.89

598.74

1,429.02

6,000.44

4,831.13

6,079.14

10,831.57

12,752.15

33,149.77

I Expenses

3)

l ~ o sof

t Materials Consumed

1

I

I

I) purchase of Stock-in Trade

I(increase)/~ecreasein Inventory of

I ~ i n i s h e dGoods, Work-in-Progressand

:) Istock-ln Trade

5 95

226.07

6 21

220.06

1

19.87

I

Total Expenses (2a t o 2f)

Proflt/(loss) from operations before

other income, finance cost, exceptional

items & t a x (1-2)

Other Income

Profit/(loss) before finance cost,

5 lexceptiona~Items & t a x ( 3 4 )

6 l ~ i n a n c eCosts

IProfit/(loss) before exceptional Items &

7 tax (5-6)

Exceptional items/Prior period items

Profit/(loss) before tax (7-8)

1

1

I

I

18.50

492.52

6 27

3.61

18.31

19.49

38.21

46 30

40.78

1

I

I

1,182.11

92.52

33.26

53.85

34.03

16.62

19.03

50 64

74.57

145.16

321.71

271.43

379.55

593.14

683.46

1.730.51

531.34

1,47365

I

8.30

14 691

47.35

4,175.48

452.85

7,340.96

1,538.21

6,710.05

26,936.84

1,342.44

2,984.23

6,212.93

950.83

931.42

914.65

1,179.59

1

1,683.94 1

(535.77)

(243.08)

2.27

(243.34)

93.27

(187.63)

1

1

140.61

1,797.96

I

(536.46)

1

1

3,852.88

(1,657.35)

1

1

(2,673.28)

1

1,499.00 1

(0.22)

5.91

2.53

9.83

(1.472.25)

3.19

(538.99)

(1,667.18)

(1,201.03)

(2,096.22)

87.56

1,052.82

(1,147.18)

(3,149.04)

1,513.87

(13.35)

(94.361

(13.35)

1

1,220.98 1

1,324.54

366.69

1,456.38

4,316.32

1,430.10

74.34

3,058.57

2,466.81

3,18294

1

(1,726.56)

103.56

366.47

(2,093.03)

(389.69)

1,846 07

(17.90)

1,865.48

(541.68)

0.26

(295.65)

2,269.59

9,767.92

(1,340.52)

1,733.13

110.43

11.221.26

(109.20)

1,264.31

4,736.70

1,288.79

3,880.30

(84.72)

115 49

I

1

145.27 1

18.37

2,283.81

225.34

940.52

8,265.64

1,607.93

(75.25)

404.75

44.54

1

3.61

6,270.09

1,113.23

1,808.38

1,15508

(11.15)

868.09

1,201.51

4,827.91

1.291.05

415.90

1,111 18

1,457 80

3.204.16

4,832.26

(17.87)

6 33

653 27

885 96

865.04

1

1

I

(57.38)

1,158.41

2,251 29

656 78

922 42

(409.10)

668.05

68 14

42.39

926.47

1

I

I

23.78

15.78

(293.37)

1

1

7,643.03

5,546.52

591.76

2,096.51

1.99

2.97

5.91

(12,858.77

101.57

(1,729.53)

585.86

14,955.28

(94 36)

(6.60)

108.17

111.94

(2.45)

(1,635.17)

14,843.33

588.31

(388.92)

(55.71)

(528.33)

(444.63)

(1,653.83)

(1,288.60)

( 0 221

3.63

0.26

3.41

1.06

3.18

1.14

3.63

7.48

4 77

51.15

55.87

(389.14)

(52.08)

(528.07)

(441.22)

(1,652.77)

(1,285.42)

(3,147.90)

1,517.50

115.65

(1,630.40)

639.46

14,899.20

10,197.27

10,197.27

10,197.27

10,197.27

10,197.27

10.197.27

10.197.27

10,197.27

10,197.27

10,197.27

12 Other Comprehensive Income

13 Total Comprehensive Income (11+12)

12.16

446.13

14.89

10 Tax Expense

Net Profitl(Loss) for the period after tax

11 (9-10)

1

I

1

27 50

I) Other Expenses

311.81

18.34

I

Deprec~ationand Amortisation Expenses

7.17

1

I

1

8.30

i ) IEmpoyee Benefits Expense

30.09.2015

12 monthr

ended

income from Operations

3)

?)

6 months ended

Paid-upequity sharecapital (Facevalue

14 of the Shareshall be indicated)

Reserve excluding Revaluation Reserves

as per balancesheet of previous

15 accounting year

I Earnings Per Share (before extraordinary items) ( o f 'Rs 11-each) (not

16 annuaiised):

10.197.2;

1.86.623.4C

95,359.87

(a) Basic

(b) Diluted

ii Earnings Per Share (after extral o r d i n a i i t e m s l (of 'Rs 11-each1 (not

17 annualised):

10.197.27

(0.038)

(0.005)

(0.052)

(0.043)

(0.1621

(0.126)

(0.3091

0 149

0.011

10.160)

0.063

1.461

(0 026)

(0.003)

(0.035)

(0.029)

(0.110)

(0.085)

(0.209)

0.101

0.008

(0.1081

0.042

0.98t

(a) Basic

( 0 038)

(0.005)

(0.052)

(0.043)

(0.162)

(0.126)

(0.309)

0.149

0.011

(0.160)

0.063

1.461

(b) Diluted

(0.026)

(0 003)

(0.035)

(0.029)

(0.1101

(0.085)

(0.2091

0.101

0.008

(0.108)

0.042

0.98E

Notes :

1. The above results as reviewed by the Audit Commttee were approved by the Board of Directors at their Meeting held on 24th Nov. 2016

2. The Company has adopted Indian Accounting Standards (ind AS) from 1st Apr, 2016 and accordingly these financial results have been

prepared in accordance with the recognition and measurement principles laid down In the Ind AS 34 Interim Financial Reporting.

3. Statutory Auditors of the Company have conducted limited review on the financial results for the quarter ended 30.09.2016

4. As the Company deals primarily with flor~cultureand allied products, segment wise figures are not published.

5. Figures for the previous periods have been regrouped, whenever necessary, to correspond with the figures of the current period.

6. interest cost on Borrowings debited to relevant subsidiary based on end use of funds.

7. Reconciliation between Standalone financial results, as previously reported in accordance with the Accounting Standard framework

referred to as Previous IGAAP and Ind AS for the quarter presented are as under:

3 M ended

Particulars

1

1

Net profit for the period under IGAAP

D ffe-ence c n acc3.i:

iz.r I

)an

c f re$en.e recag- t on l e : 3f .e ate= costs

:is an e ~ o.cc

c >cnert .a-

. e r o p s e = 1C.-e. ::T=-.:-;

30.09.2015

378

C:3

nr:-e

Others

(532.24)l

6 M ended

Stmdalone

30.09.2015

0.26

( 3 22

317

1.06

Deferred Tax

3 M ended

6 M ended

1

1

31.03.2016

30.09.2015

(1,292.68)l

376

0.21

114.83

(C 64

C 44

1

I

30.09.2015

(528.07)

(1,652.77)

2C:

3 52

0.82

3.75

115.65

639.46

3.18

due to non availability of accounts for the period ended 30th Sep, 2016.

9. Reconciliation of reserver as below:

- ..- - .-.-

Reserves as per erstwhile IGAAP

Deferred Tax Impact

1

1

I

1

1

(3.9311

0.37

95,359.87

Others

Reserves as per IND A5

95,358.51

0.21

Employee benefits ARurial gan/jiorsJon long term defned beneftr plan

IDepreciation & Amortisation

31.03.2016

4.71

1

1

31.03.2016

1,86,617.85

(0.92)

0.33

(1.91)

14,904.83

3 92

3 83

(5.63)

0.12

(1,285.42)

8. Karuturi Limited has received the order of the court for winding up on 30th March 2016 and account of Karuturi Ltd., has not been included

1 2 M ended

31.03.2016

632.77

0.11

Total Comprehensive income under ind A5

Consolidated

(1,653.7811

1

I

l 2 M ended

For Karuturi Global Limited

8.11

1.86.623.46

Place : Bangalore

Anithaa Karuturi

Date : 24Hi12016

Director

14,899.20

KARUTllRl GLOBAL LIMITED

Regd Office: 204, Embassy Centre, Crescent Road, Bangalore 560001

Particulars

Statement of Assets and Liabilities

Standalone

Sep-16

Mar-16

EQUITY AND LIABILITIES

Shareholders' Funds

Share Capital

Reserves and Surplus

Minority Interest

Non-Current Liabilities

Long-term borrowings

Deferred Tax T ,iabilities (Net)

Other Long Term Liabilities

Long 'l'crm Provisions

Current Liabilities

Short-'lb.iii Rorrowi rigs

Tradc Payables

Other Current Liabilities

Short tern1 Provisions

Consolidated

Mar-16

Sep-16

10,197.27

95,757.75

10,197.27

95,359.87

10,197.27

2,05,126.43

10,197.27

1,86,623.46

2.59

26,311.31

25,732.34

8.39

8.39

55,065.06

114.42

2,174.36

76.17

38,899.62

116.96

2,222.59

81.89

8,118.17

751.96

16,948.16

182.21

7,804.79

1,047.15

17,548.18

174.40

10,476.19

3 3,543.3 8

25,302.77

184.78

30,869.55

14,086.08

1,58,275.22

1,57,872.38

3,22,260.63

3,19,313.55

786.97

0.31

824.17

63,595.77

777.38

62,694.33

63,611.10

683.02

62,150.72

10,218.95

15,092.00

2,38,367.30

2,296.85

35,537.74

62.90

815.70

1,659.93

336.53

2,38,278.28

769.52

40,364.61

79.43

721.35

1,660.20

462.65

YY.4b

2,616.78

149.99

17,264.52

70.77

lUL./b

2,687.50

51.35

12,601.17

68.27

3,6.28.U4

3,805.41

22,853.99

2,808.95

13,355.53

537.17

14,442.44

2,696.74

15,071.27

961.65

1,58,275.23

1,57,872.39

3,22,260.63

3,19,313.56

36,010.58

202.97

ASSETS

Non Current Assets

Fixed Assets

- 'l'angible Assets

- Intangible Assets

- Capital Work in Progress

Non Current Investments

Deferred Tax Assets (Net)

Long Term Loans and Adva~iccs

Other Non Current Assets

Current Assets

Il~ventor~es

Trade Receivables

Cash and Cash Equivalents

Short Tcrni Loan ancl Acl~~i~iccs

Other Current Assets

0.32

Vous aimerez peut-être aussi

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosD'EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- TTR RRL: LimitedDocument5 pagesTTR RRL: LimitedShyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Auditors Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Auditors Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For June 30, 2016 (Result)Document3 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Document8 pagesAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Announces Q2 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended September 30, 2016 (Result)Document7 pagesAnnounces Q2 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document8 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Document8 pagesFinancial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document7 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For September 30, 2016 (Result)Document4 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2015 (Result)Document8 pagesStandalone Financial Results, Limited Review Report For September 30, 2015 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document8 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document12 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document7 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document8 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document6 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document7 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Pdfnews PDFDocument5 pagesPdfnews PDFMurthy KarumuriPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document7 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Consolidated Financial StatementsDocument78 pagesConsolidated Financial StatementsAbid HussainPas encore d'évaluation

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderPas encore d'évaluation

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderPas encore d'évaluation

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderPas encore d'évaluation

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderPas encore d'évaluation

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderPas encore d'évaluation

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderPas encore d'évaluation

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderPas encore d'évaluation

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderPas encore d'évaluation

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderPas encore d'évaluation

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderPas encore d'évaluation

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderPas encore d'évaluation

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- The Trend Intensity Indicator: by Richard LieDocument2 pagesThe Trend Intensity Indicator: by Richard Liepderby1Pas encore d'évaluation

- Financial Derivatives Questions On Forward ContractDocument3 pagesFinancial Derivatives Questions On Forward ContractNikita ShekhawatPas encore d'évaluation

- Parcor TheoriesDocument2 pagesParcor TheoriesKristine Claire PangandoyonPas encore d'évaluation

- CMSA Approval of Swala Oil and Gas (Tanzania) Plc's ProspectusDocument1 pageCMSA Approval of Swala Oil and Gas (Tanzania) Plc's ProspectusMuhidin Issa MichuziPas encore d'évaluation

- The Boeing Company Financial Analysis - 3Document33 pagesThe Boeing Company Financial Analysis - 3Marina LubkinaPas encore d'évaluation

- Original ProjectDocument61 pagesOriginal Projectlawrence amoasiPas encore d'évaluation

- Financial MarketDocument50 pagesFinancial MarketJocel VictoriaPas encore d'évaluation

- Richard Dennis Sonterra Capital Vs Cba Nab Anz Macquarie Gov - Uscourts.nysd.461685.1.0-1Document87 pagesRichard Dennis Sonterra Capital Vs Cba Nab Anz Macquarie Gov - Uscourts.nysd.461685.1.0-1Maverick MinitriesPas encore d'évaluation

- Enercapita Energy Overview - Feb 2016v4 PDFDocument20 pagesEnercapita Energy Overview - Feb 2016v4 PDFgahtanPas encore d'évaluation

- CFA Financial Statement Analysis Flashcards - Chegg - Com1Document16 pagesCFA Financial Statement Analysis Flashcards - Chegg - Com1anissa claritaPas encore d'évaluation

- Merrill Lynch Financial Analyst BookletDocument2 pagesMerrill Lynch Financial Analyst Bookletbilly93Pas encore d'évaluation

- Alternative Sources of FinanceDocument8 pagesAlternative Sources of FinancediahPas encore d'évaluation

- Week 2 - Measures of Risks and ReturnsDocument37 pagesWeek 2 - Measures of Risks and ReturnsAbdullah ZakariyyaPas encore d'évaluation

- Comfort ShoesDocument32 pagesComfort ShoesGrace Priscilla SiahaanPas encore d'évaluation

- Capstone Round 0 ReportDocument16 pagesCapstone Round 0 Reportcricket1223100% (1)

- Singapore Financial SystemDocument21 pagesSingapore Financial SystemSaikat SahaPas encore d'évaluation

- IMFI 2019 02 PuspitaningtyasDocument13 pagesIMFI 2019 02 PuspitaningtyasYulianto ImantakaPas encore d'évaluation

- BS DanielDocument6 pagesBS Danielsandy30694Pas encore d'évaluation

- Study On Call Money & Commercial Paper MarketDocument28 pagesStudy On Call Money & Commercial Paper MarketVarun Puri100% (2)

- Qatar Airways FS 31 March 2019 (En)Document62 pagesQatar Airways FS 31 March 2019 (En)HusSam Ud DinPas encore d'évaluation

- I. Banking-Merchant BankingDocument25 pagesI. Banking-Merchant BankingHanika JulkaPas encore d'évaluation

- Capital Budgeting Decisions ApplicationDocument3 pagesCapital Budgeting Decisions ApplicationSanjana AkkireddyPas encore d'évaluation

- Fundamental Ethical and Professional Principles (A) : Acca Strategic Business Reporting (SBR)Document109 pagesFundamental Ethical and Professional Principles (A) : Acca Strategic Business Reporting (SBR)Pratham BarotPas encore d'évaluation

- Gold ETFDocument11 pagesGold ETFPravin ChoughulePas encore d'évaluation

- Project Appraisal-1 PDFDocument23 pagesProject Appraisal-1 PDFFareha RiazPas encore d'évaluation

- PNB Ubi Obc MergerDocument5 pagesPNB Ubi Obc MergerShivansh BhattPas encore d'évaluation

- Assignment Help Guide SheetDocument11 pagesAssignment Help Guide SheetShakil KhanPas encore d'évaluation

- AXIS BANK + EnaamDocument8 pagesAXIS BANK + Enaammaharshi_mehta2089Pas encore d'évaluation

- Chapter 6 Exercises (Bonds & Interest)Document2 pagesChapter 6 Exercises (Bonds & Interest)Shaheera SuhaimiPas encore d'évaluation

- Far AnswersDocument2 pagesFar AnswersMikhail Ayman MasturaPas encore d'évaluation