Académique Documents

Professionnel Documents

Culture Documents

A Study On Self-Assessment Tax System Awareness in Malaysia

Transféré par

aimanTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

A Study On Self-Assessment Tax System Awareness in Malaysia

Transféré par

aimanDroits d'auteur :

Formats disponibles

Australian Journal of Basic and Applied Sciences, 5(7): 881-888, 2011

ISSN 1991-8178

A Study on Self-Assessment Tax System Awareness in Malaysia

Choong Kwai Fatt and Edward Wong Sek Khin

Faculty of Business and Accountancy, University of Malaya, Kuala Lumpur, Malaysia

Abstract: This study seeks to explore and identify the key dimensions that determine the service

quality of the Inland Revenue Board, Malaysia (IRBM) under the new Self-Assessment tax system.

The scope of this study is based on the perceptions of individual taxpayers (comprising government

employees, private sector employees and self-employed businessmen) and tax agents. First, this study

aims to investigate if Malaysian petty traders understand the mechanism of self-assessment tax system,

and secondly, to solicit the problem faced by Malaysian petty traders in tax compliance and tax audit

in the era of Self-Assessment tax system (SAS). The empirical study was undertaken by conducting

a questionnaire survey based on convenient sampling of 310 respondents, that is, 193 male petty

traders and 117 female petty traders from 12 states in Malaysia. Findings from this study reviewed

that the Self-Assessment tax system places an onerous responsibly on petty traders to comprehend the

new system and to comply with the tax administration aspects as to the computations, payment of

taxes, and record keepings. It is suggested that the IRBM to impose penalty discretionary, to take into

account of the educational background, financial position, the amount of tax understated, the frequency

of tax defaults of the petty traders. This study provides an important insight that the Malaysian tax

policy makers and the IRBM ought to seriously consider a simpler and pragmatic tax assessment

system, tailor make for petty traders to achieve tax administrative compliance efficiency , particularly

on the taxpayers awareness and the services needs have some implications for tax planners and policy

makers.

Key words: Self-assessment system, Tax auditors, Tax evasion

INTRODUCTION

On 1 January 2005, in order to promote voluntary tax compliance, the Inland Revenue Board Malaysia

(the IRBM) has implemented the self-assessment tax system (the SAS) on individual taxpayers. Under the SAS,

individual who has income accruing in or derived from Malaysia are required to disclose taxable income

honestly, compute tax payable correctly, file tax return form and pay tax on a timely manner. The key feature

of SAS is that tax return form is deemed the notice of assessment (i.e., the Form J). In a nutshell, under SAS,

the onus to assess the tax liability is on the taxpayers. As a result, taxpayers must have sufficient tax

knowledge in order to assess their tax liability correctly and to file tax return forms on time. For salaried

individuals, they must submit their income tax return forms and pay the balance of tax liability by 30 April

every year. For those who have business income, the submission and payment deadlines are by 30 June.

If individual taxpayers fail to submit tax return, the IRBM will derive their own assessment based on

estimate and issue notice of assessment. Non submission of tax return form and late payment of taxes will

attract monetary penalty; and for repeated offences, imprisonment will be imposed by the Court. Under section

112 (1) of Income Tax Act 1967 (the Act), the penalty on failure to furnish tax return by the stipulated

deadline is a fine ranging from RM200 to RM2,000 or imprisonment not exceeding 6 months or both fine and

imprisonment. Individual taxpayers who fail to make income tax payments for a year of assessment within 30

days from the date of issue of the notice of assessment or deemed assessment are charged a 10% increase on

the tax or outstanding tax balance. If the tax or tax balance is still unpaid after 60 days from the date the 10%

increase is imposed, a further 5% increase will be charged on the tax outstanding, as stipulated in section

103(3) and (4) of the Act.

In view to further intensify voluntary tax compliance, the IRBM instituted tax audit and investigation

system. In January 2007, the tax audit framework and tax investigation framework were published to serve as

a guide to taxpayers, tax agents and IRBM tax auditors. The probability of individual taxpayer being selected

Corresponding Author: Choong Kwai Fatt, Faculty of Business and Accountancy, University of Malaya, Kuala Lumpur,

Malaysia

881

Aust. J. Basic & Appl. Sci., 5(7): 881-888, 2011

to tax audit is once in every five years. Any irregularities from the audit findings will be classified either

incorrect return under section 113 or willful evasion under section 114. Penalties ranging from 100% to 300%

and/or imprisonment up to 3 years will be imposed on tax defaulters.

It was reported that since the implementation of SAS, the Malaysian tax defaulters has increased by almost

10 times within two years time, from 25,160 in 2003 to 239,666 in 2005 (Krishnamoorthy, 2006a). The

offences included failure to submit returns, declaring false returns and not providing sufficient information etc.

According to the then chief executive officer of the IRBM, Tan Sri Zainol Abidin Abdul Rashid, around onethird of Malaysians eligible to pay tax did not do so, in 2005, and 1.3 million potential taxpayers did not file

their tax returns (Krishnamoorthy, 2006b). Related to this, it was estimated that the Malaysian government has

lost approximately RM307.7 million due to tax non-compliance.

In an effort to collect tax arrears, the IRBM has imposed a ban on tax defaulters from leaving the country

and prosecuting them. The ban from leaving the country is made under section 104 of the Act. In 2005, the

number of individuals banned from leaving the country totaled 10,933, with outstanding tax payments of

RM281.27 million (The IRBM, 2005). In 2007, the number of individuals banned from leaving the country

increased to 39,867, involving RM1.4 billion in outstanding taxes (Nan Yang Siang Pau, 2007).

Scholars such as Veerinderjeet and Renuka (2002) and Chow (2004) opined that the implementation of

SAS in Malaysia poses enormous challenges on individual taxpayers. Fundamentally, the success of the SAS

relies heavily on the full cooperation of taxpayers. To be tax compliant, taxpayers need to be tax literate. At

minimum, individual taxpayers need to possess some basic knowledge of personal taxation, with respect to the

taxability of income, deductibility of expenses, entitlements, reliefs, rebates and exemptions. For those who

operate a business, they must have some basic understanding of taxability of income from business and nonbusiness source and the deductibility of expenditure. However, in the Malaysian education system, only

accounting and some business management students are exposed to taxation at tertiary levels. Many young

Malaysians (the future taxpayers) are not formally exposed to taxation in schools. What make it worst is the

Malaysian tax laws are inherently voluminous and complex; and the constant changes make it difficult even

for tax officers, tax academics, tax practitioners to keep abreast of the latest development, let alone the

ordinary people such as the petty traders.

At the time of study, there is no official statistics of number of petty traders in Malaysia; a conservative

estimate is about 200,000. Although petty traders contribution to tax revenue is relatively small, nonetheless,

they may be the victim of SAS and will be subject to tax audit and investigation due to the inherent nature

of their businesses. Notably, Malaysian petty traders have the following peculiar characteristic: (a) the business

transactions are normally in cash basis. The business receipts are in cash terms and the payment for supplies

is also in cash; (b) the business annual turnover is generally less than RM300,000; hence it is not economical

to employ a full time accounting staff to keep records or to seek professional help on tax matters; (c) on

average, the education level of petty traders is low or most of them are illiterate; (d) Petty traders business

fluctuates daily, to a greater extent, the business depends largely on the national economics and weather. In

particular, for those have a petty traders stalls operate at the road sides, on a sunny day, they generally operate

their business for about 12 hours a day, however, on a rainy day; they will not be able to run their business

at all; (e) the IRBM will select them for tax field audit, as it is reasonable to suspect petty traders to under

report taxable income or not reporting of income as the business transaction is in cash basis; and (f) it is

observed that professional accounting/tax firms are reluctant to do the tax reporting for petty traders because

firstly, by nature, the accounting records of petty traders are incomplete, secondly, tax practitioners are doubtful

of the accuracy of the information provided, consequentially, might expose tax firm to higher tax risk, and last

but not least, the tax agent fees that tax firms could charge petty traders for tax filing service is very

minimum, ranging from RM500 to RM1,200.

Under the SAS, petty traders have the following six obligations, namely (1) to keeping sufficient records

related to business income, expenses and cost of doing business, so that the profit or loss from the petty

traders business can be correctly ascertained. Under SAS, the business records must be kept for 7 years for

tax audit purposes; (2) the business transactions must be recorded within 60 days of the business operations

took place; (3) to pay the estimated income tax payable in six bi-monthly installments to the IRBM starting

the month of March. The estimates income tax payable will be computed by the IRB based on the preceding

year income tax payable; (4) to prepare the business profit or loss account for year ended 31 December and

to compute the income tax payable correctly; (5) to submit the income tax return form (i.e., Form B) of the

relevant year of assessment by 30 June in the following year; and (6) pay the balance of tax or outstanding

tax for the current year of assessment by 30 June of the following year.

882

Aust. J. Basic & Appl. Sci., 5(7): 881-888, 2011

It is reasonable to assume that the majorities of the petty traders in Malaysia are having annual turnover

of less than RM300, 000, and operate as sole proprietor or partnership. Hence, there are entitled to the several

tax benefits, for example, (a) business expenses can be deducted against the gross income; (b) capital

allowance can be claimed on motor vehicle, phone, furniture, equipment and others plant and machinery used

in business; (c) personal reliefs; and (d) tax at scale rate of 0% to 28%.

In view of the success of SAS depends largely on taxpayer acceptance to the new changes and to highlight

the possible shortcoming of the SAS and tax audit system, hawkers are selected as the primary focus of this

study. It is reasonable to assume that hawkers are at higher risk of being selected for tax audit and

investigation as the nature of transactions are in cash terms which are more prone to under reporting of

income, couple to the facts that they do not usually keep a complete set of accounts. In addition, having long

operating hours, they would not have much time and efforts to deal with book keeping and tax matters. Hence,

petty traders may be the prime target for tax audit. At the time of study, to the best of our knowledge, there

is no published study related to petty traders and their experience in tax compliance and tax audit in the era

of SAS. The lack of empirical evidence shaped the motivation of study. Hence, this study has emerged to fill

up a knowledge gap.

The Research Objectives:

This study aims:1. to investigate if Malaysian petty traders understand the mechanism of self-assessment tax system;

2. to solicit the problem faced by Malaysian petty traders in tax compliance and tax audit in the era of SAS.

Methodology:

A questionnaire was designed to collect data. The questionnaire gathers background information of the

petty traders and solicits their tax compliance experience and feedback in respect of tax audit and tax related

matters. The data collection was carried out nationwide over a period of three months from July to September

2007. A total of 311 usable questionnaires were collected.

RESULTS AND DISCUSSION

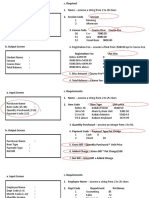

Table 1 presents the respondents profiles. The findings showed that the respondents represented a wide

geographical coverage of Malaysia. The proportions of responses from each state somewhat reflect the reality

in Malaysia that Selangor Darul Ehsan, Penang and Wilayah Persekutuan notably have a bigger number of

hawkers than Terengganu and Sarawak. About 62.4% of the respondents were males and 37.6% were females.

The majority of the petty traders surveyed were Chinese (55.9%), and the remainders were Malays (37.3%),

Indian (5.5%) and other races (1.3%). In respect of education, 5.5% of the respondents indicated that they had

never been to school, 37% had primary education, 47.3% had secondary education, 7.7% had a certificate or

diploma, whilst, 1.6% had a bachelor degree and 1% had other qualifications.

About 14.8% of the respondents have been in the business for less than 1 year, 39.2% (between 1-5 years)

and 46% (more than 5 years). In respect of the location of business, 26.4% run the business at food court,

31.5% at shop lot or coffee shop, 33.1% operated their business at the roadsides and 9% at other premises.

The findings somewhat reflect the real life phenomenon in Malaysia that a substantial majority of petty traders

run their business at the roadsides. As for the types of business, the survey found 15.4% of the respondents

sell food such as chicken rice and mixed rice, 15.8% sell noodles, 27% sell other types of food such as satay,

nasi lemak, roti canai, and other Malaysian delicacies. The remainders sell both food and beverages (25%),

beverages only (11.3%) and fruits (4.8%). About 26.4% earned average daily sales of less than RM100, 32.5%

earned between RM101-200, 18.6% (between RM201-350), 11.6 % (between RM351-500), just 10.9% earned

more than RM500 daily.

Tax Compliance in the Era of SAS: Petty Traders, Perspectives:

Several questions were designed to canvas the petty traders feedback in tax compliance and tax audit in

the era of SAS. At the outset, we asked if they were aware of the implementation of SAS in Malaysia on

individual taxpayers with effect from YA 2004. Figure 1 reports that half of the hawkers surveyed indicated

that they were aware of SAS, whilst another half indicated that they were not aware of the new regime. When

asked if they have filed income tax returns before, the results as presented in Figure 2 shows that more than

51% provided an affirmative answer and 49% indicated a no. To further probe the issue, we asked the

883

Aust. J. Basic & Appl. Sci., 5(7): 881-888, 2011

Table 1: The Respondents Profiles.

Particulars

Frequency

State

Selangor Darul Ehsan

79

Pulau Pinang

50

Wilayah Persekutuan

46

Johor

28

Perak

24

Pahang

24

Negeri Sembilan

19

Kedah

15

Malacca

13

Kelantan

7

Terengganu

1.0

Sarawak

3

Gender

Male

194

Female

117

Race

Chinese

174

Malay

116

Indian

17

Others

4

Education level

Never been to school

17

Primary school

115

Secondary school

147

Certificate/diploma

24

Tertiary

5

Others

3

Length in the business

Less than 1 year

46

1-5 years

122

More than 5 years

143

Types of business

Rice (chicken rice, mixed rice)

48

Noodles

49

Other food (satay, roti canai, Malaysian delicacies etc)

27.0

Food and beverages

80

Beverages only

35

Fruits only

15

Location of business

Food court/hawker centre

82

Shop lot/coffee shop

98

Roadside stalls

103

Others

28

Average daily sales

Less than RM100

82

Between RM101-200

101

Between RM201-350

58

Between 351-500

36

More than RM500

34

Total

311

Percentage (%)

25.4

16.1

14.8

9.0

7.7

7.7

6.1

4.8

4.2

2.3

3

1.0

62.4

37.6

55.9

37.3

5.5

1.3

5.5

37.0

47.3

7.7

1.6

1.0

14.8

39.2

48.0

15.4

15.8

8

25.7

11.3

4.8

26.4

31.5

33.1

9.0

26.4

32.5

18.6

11.5

10.9

100%

respondents if they have paid income tax for YA 2004, Figure 3 reports that merely one third indicated yes,

whilst two third indicated no. Next, when asked if they have ever faced any problem for not filing income

tax form, 15% of the respondents indicated that they had experienced some problems for not filing income tax

form, and the majority (85%) indicated never (see Figure 4).

Petty Traders Tax Filling Experience:

Of those who had filed tax return before. To further probe the tax compliance issue, we solicited their tax

filling experience. Figure 5 reports that merely 15% of the respondents felt that personal tax return form (i.e.,

Form B) is simple to fill up, and the majority of respondents (85%) indicated otherwise. When asked if they

faced any problem in filing out Form B, Figure 6 reports that more than one third (36%) indicated they did,

whilst 24% indicated a no, and 40% did not response to this question. Of those who had indicated facing

problem in filling From B, we asked the respondents what were the underlying problems. Table 2 reports that

14.5% of the petty traders surveyed indicated they dont understand Bahasa Malaysia as Form B is written in

the national language, 23.8% indicated that they didnt know how to fill up Form B, meanwhile, about 14.5%

indicated that Form B asked too much information, and some proportion of the respondents indicated that Form

B was too technical (20.6%) and too complicated (7.7%) for ordinary people, like petty traders.

884

Aust. J. Basic & Appl. Sci., 5(7): 881-888, 2011

Fig. 1: Aware of the implementation of SAS in YA2004.

Fig. 2: File income Tax Return Before.

Fig 3: Pay income Tax for YA 2004.

Fig. 4: Faced problem for not filling income tax return.

Table 2: What are the problems faced when filling up Form B?

Type of problem faced

Frequency (%)*

1

Do not understand Bahasa Malaysia

14.5

2

Do not know how to fill up the Form B

23.8

3

Asking for too many information

14.5

4

Too technical

20.6

5

Too complicated

7.7

6

Others

1.1

* Noted that the total frequency distribution did not add up to 100%, as the respondents were allowed to indicate more than one problem

faced related to filing up Form B, whilst some did not response to this question.

Seeking the IRBMs staff for Assistance in Filing Tax Return Form:

In turn, we asked if the respondents had ever sought the IRBM staff in helping them to fill up Form B.

Figure 7 reports that about 39% indicated that they had. Of those who had sought the IRBMs staff for help,

we further probe if they found the IRBMs service satisfactory on a ten-point scale anchored on 1 (extremely

not satisfactory) to 10 (very satisfactory). The results show a mean score of 6.27 on a ten-point scale

(significant at p<0.001), thus indicates overall, for those who had sought the IRBMs assistance in filling up

tax form, the majority were quite satisfied with the quality of tax service provided. When asked if they were

willing to attend the IRBMs briefing, just one third (33%) indicated that they were willing, whilst two third

(67%) indicated otherwise (see Figure 8).

About Tax agents Service and Fees:

Figure 9 shows that about 58.8% of the respondents were willing to pay tax agent to fill out tax return

form for them, however, 41.2% were not willing. In respect of the amount of tax agent fees that they were

willing to pay, more than 80% were willing to pay less than RM300, about 9.3% were willing to pay between

RM301 to 500, and less than 1% were willing to pay more than RM1,000 (see Table 3).

Familiarity with Tax Exemptions and Record Keeping Requirement:

To be tax compliant and to avoid paying unnecessary tax, it is of paramount important for the petty traders

to be aware of tax exemptions available for small businesses such as petty traders. As expected, Figure 10

reports that only 21.1% of the respondents indicated they were family with tax exemptions available to them.

885

Aust. J. Basic & Appl. Sci., 5(7): 881-888, 2011

Table 3: How much are you willing to pay to have your tax return completed by experience tax agent per

year?

Frequency

Percentage (%)

Less than RM300

250

80.4

Between RM301-500

29

9.3

Between RM501-1,000

9

2.9

More than RM1,000

2

0.6

No response

21

6.8

Total

311

100%

Fig. 5: Thought frorm B is simple to fill up.

Fig. 6: Faced problem in filling up the form B.

Fig. 7: Sought the IRBM`s staff Assistance in filling up tax return form.

Fig. 8: Willing to attend breifing by the IRBM.

Fig. 9: Willing to pay tax agent.

Fig. 10: Familiar with tax exemptions.

79% of the respondents admitted that they were not familiar about tax exemptions. In addition, under the era

of self-assessment, taxpayers are required to keep tax records and the supporting business document for 7 years

for tax audit purposes. The survey found about 28.6% knew that they need to keep business records for 7

years, whilst the remainder 71.4% did not know about this record keeping requirement (Figure 11). To probe

the issue further, the survey found about 33.1% indicated that they kept business record for 7 years, 66.9%

indicated that they did not do so (Figure 12). Nearly 65% of the hawkers surveyed expressed that it is difficult

for them to keep all business record for 7 years (Figure 13).

Petty Traders Response towards Tax Audit:

In the era of SAS, taxpayers will be audited once in every five years. Surprisingly, merely 36% of

hawkers surveyed were aware of tax audit and just 43% of them were ready for tax audit (see Figure 14 and

15 respectively). When asked if they were worried of the IRBM staff to conduct a tax audit on them for YA

2004. Figure 16 reports that about one third indicated they were worried, whilst 66% indicated otherwise.

886

Aust. J. Basic & Appl. Sci., 5(7): 881-888, 2011

Fig. 11: Aware of the requirement to keep record for 7 years.

Fig. 12: Kept business record for 7 years.

Fig. 13: Difficult to keep record for 7 years.

Fig. 14: Aware of tax Audit.

Fig. 15: Ready for tax audit.

Fig. 16: Worry if the IRBM conduct tax audit for YA 2004.

To probe the issue on tax audit further, we asked why they were worried about tax audit, some of the

replies were (i) do not have any supporting document, scared will be penalized, (ii) because never paid

income tax, worry because ignorance of certain tax rules, (iii) worry that could be errors or mistakes

occurred in the income tax which he declared before, (iv) I thought only big business need to pay tax,

hawker no need to pay, (v) I dont have enough information about this tax thing.

When probe further on why they were not worried about tax audit, some of the responses were as follows,

(i) The tax agent will manage the document, (ii) the income is very small, wont be subject tot tax, (iii)

because I declared the accurate income tax to the IRB, (iv) business small, no need to worry. Did not earn

much money, (v) income is low, so not taxable, (vi) because I kept all the records and asked tax agent

to fill up the form

Implications of Findings:

The survey found in general, the hawkers surveyed did not have a good knowledge about the mechanism

of SAS, and they were apprehensive of tax audit. The plausible explanation was due to lack of formal tax

education in primary, secondary and tertiary levels in Malaysia. The findings somewhat indicate that in the

era of SAS, it is imperative for all individuals (taxpayers and future taxpayers) to be formally exposed to tax

education, so as to enable them to understand the mechanism of SAS and to equip them with some basic tax

knowledge. It is worth noting here that knowing the importance of tax education; the Japanese government has

introduced tax education even at kindergarten level because students are the future taxpayers (Sarker, 2003).

The Government may consider to simplifying the system of tax computation for petty traders. It is

suggested to impose taxation of 7% on the gross receipts of the petty traders having turnover of less than

RM300,000 annually to be their deemed statutory income. These will relief them from keeping detailed record

887

Aust. J. Basic & Appl. Sci., 5(7): 881-888, 2011

of income and expenses for 7 years and complex computation of taxable income. Currently, these petty traders

just do not have the time let alone the cash resources to voluntarily comply with SAS. Hence, a simplified

tax will attract more voluntary compliance from petty traders.

Tax agent firms who assist the petty traders to file their tax should be given incentive to subsidize the

cost of doing a national duty. They should not be penalized for any irregularity found if hawkers accounting

records are incomplete. It is suggested that a 50% on the fees received should be given to tax exemption, as

provided in export incentives.

Limitations of the Study:

This study has several limitations. Firstly, it is an exploratory study. Secondly, the data was collected

based on convenience sampling. Thirdly, self-reported data was used for data analysis; hence, they could be

over-reported. Last but not least, this study only sampled those petty traders that involved in selling processed

food, and excluded those petty traders that traded in unprocessed goods, durables and service. Bearing in mind

of the above limitations, care must be exercised in interpreting the results and to generalize the findings to the

populations.

Conclusion:

The SAS places an onerous responsibly on hawkers to comprehend the new system and to comply with

the tax administration aspects as to the computations, payment of taxes, and record keepings. It is suggested

that the IRBM to impose penalty discretionary, to take into account of the educational background, financial

position, the amount of tax understated, the frequency of tax defaults of the petty traders. This study provides

an important insight that the Malaysian tax policy makers and the IRBM ought to seriously consider a simpler

and pragmatic tax assessment system, tailor make for petty traders to achieve tax administrative compliance

efficiency.

REFERENCES

Chow, C.Y., 2004. Gearing Up for the Self Assessment Tax Regime for Individuals, Tax National,

2nd Quarter, pp: 20-23

Krishnamoorthy, M., 2006a. Defaulters rise by 10 times, The Star, 14 August, 2006. Available at

http://www.thestar.com.my, assessed on 5 April 2009.

Krishnamoorthy, M., 2006b. 1.3 million did not pay tax, The Star, 26 August, 2006. Available at

http://www.thestar.com.my, assessed on 5 April 2009.

Ministry of Finance, 2006. Federal Governments Revenue Estimate 2007. Available at

http://www.treasury.gov.my. Assessed on 2 March 2009.

Nan Yang Siang Pau, 2007. Preventing 40,000 taxpayer leaving Malaysia, 26 March 2007.

Sarker, T.K., 2003. Improving Tax Compliance in Developing Countries via Self Assessment SystemsWhat Could Bangladesh Learn From Japan? Asia-Pacific Tax Bulletin, 9(6): 3-34.

The IRBM, 2005. Annual Report 2005, Inland Revenue Board of Malaysia.

Veerinderjeet, S. and B. Renuka, 2002. The Malaysian Self- Assessment System of Taxation Issues and

Challenges, Akauntan Nasional, January/February, pp: 10-15.

888

Vous aimerez peut-être aussi

- A Comparative Analysis on Tax Administration in Asia and the PacificD'EverandA Comparative Analysis on Tax Administration in Asia and the PacificPas encore d'évaluation

- PTX - AssignmentDocument15 pagesPTX - AssignmentNUR ALEEYA MAISARAH BINTI MOHD NASIR (AS)Pas encore d'évaluation

- Self Assessment System in MalaysiaDocument9 pagesSelf Assessment System in MalaysiaYeoh Shin Yee100% (2)

- LOC Taxed Under ITADocument3 pagesLOC Taxed Under ITARizhatul AizatPas encore d'évaluation

- Taxation Suggested Solution: LessDocument9 pagesTaxation Suggested Solution: LesskannadhassPas encore d'évaluation

- Malaysian TaxationDocument19 pagesMalaysian Taxationsyahirah7767% (3)

- Malaysian TaxationDocument1 pageMalaysian TaxationHONGCHIPWAIPas encore d'évaluation

- The Development in Shariah Auditing in MalaysiaDocument20 pagesThe Development in Shariah Auditing in MalaysiaAshween Raj яMc100% (1)

- Basic Distinction in The Tax Treatment of A Resident or Non-Resident Individual Is As FollowsDocument10 pagesBasic Distinction in The Tax Treatment of A Resident or Non-Resident Individual Is As FollowsGwen93Pas encore d'évaluation

- Bbap2103 - Management Accounting 2016Document16 pagesBbap2103 - Management Accounting 2016yooheechulPas encore d'évaluation

- Conventional AccountingDocument2 pagesConventional AccountingChoi Minri0% (1)

- Accounting EquationDocument36 pagesAccounting EquationZainon Idris100% (1)

- Chapter 2 Corporate TaxDocument50 pagesChapter 2 Corporate TaxNgPas encore d'évaluation

- Appeal Tax Procedure (Malaysia)Document2 pagesAppeal Tax Procedure (Malaysia)Zati TyPas encore d'évaluation

- Assignment Question BAC2634 2110Document11 pagesAssignment Question BAC2634 2110Syamala 29Pas encore d'évaluation

- Group Assignment Far 1Document3 pagesGroup Assignment Far 1Farah Farhain100% (1)

- Malaysian Tax ResidenceDocument7 pagesMalaysian Tax ResidenceramanaraoPas encore d'évaluation

- Deloitte Tax Challenge 2012Document4 pagesDeloitte Tax Challenge 2012伟龙Pas encore d'évaluation

- GST in MalaysiaDocument15 pagesGST in MalaysiaIzzuddin YussofPas encore d'évaluation

- Taxation Chapter 1 RMH1Document11 pagesTaxation Chapter 1 RMH1Fahim Ashab ChowdhuryPas encore d'évaluation

- Basis of Malaysian Income TaxDocument19 pagesBasis of Malaysian Income TaxMalabaris Malaya Umar SiddiqPas encore d'évaluation

- Tega Payment SystemDocument8 pagesTega Payment Systemzarfarie aron67% (3)

- Law Report Ques 41Document15 pagesLaw Report Ques 41Syahirah AliPas encore d'évaluation

- BKAS3083 Topic1Document27 pagesBKAS3083 Topic1WEIWEICHONG93Pas encore d'évaluation

- Audit Assignment Case 3Document11 pagesAudit Assignment Case 3Yee HooiPas encore d'évaluation

- Group 7 - 3eb03 - The Human Resources Management and Payroll CycleDocument28 pagesGroup 7 - 3eb03 - The Human Resources Management and Payroll CycleAndini dwi juliantiPas encore d'évaluation

- GST AwarenessDocument12 pagesGST AwarenessAfifah Abd HalimPas encore d'évaluation

- Chapter 2 - Conceptual Framework and Standard Setting Process (Part 2)Document13 pagesChapter 2 - Conceptual Framework and Standard Setting Process (Part 2)Nurul Artikah SariPas encore d'évaluation

- BBFA2303 Take Home Exam - Eng & BM - Jan20Document10 pagesBBFA2303 Take Home Exam - Eng & BM - Jan20AnniePas encore d'évaluation

- Lecture 2 - Residence Status (Latest)Document22 pagesLecture 2 - Residence Status (Latest)Anis Idayu AbdullahPas encore d'évaluation

- Read The Following Excerpt From A Complaint Filed by TheDocument1 pageRead The Following Excerpt From A Complaint Filed by TheLet's Talk With Hassan0% (1)

- Responsibilities of TaxpayersDocument10 pagesResponsibilities of Taxpayers'Aisyah Roselan0% (1)

- Question AIS AssignmentDocument4 pagesQuestion AIS Assignmentfaris ikhwanPas encore d'évaluation

- Fin430 - Dec2019Document6 pagesFin430 - Dec2019nurinsabyhahPas encore d'évaluation

- Management Accounting Practices in Many Countries Around The World A Review of The LiteratureDocument5 pagesManagement Accounting Practices in Many Countries Around The World A Review of The LiteratureNurhani Syafina100% (1)

- BBFA2303 Sample Exam QuestionDocument11 pagesBBFA2303 Sample Exam QuestionAnniePas encore d'évaluation

- BKAL1013 Tutorial 1Document5 pagesBKAL1013 Tutorial 1syuhadaPas encore d'évaluation

- Lecture 1 - Introduction of Malaysia TaxationDocument29 pagesLecture 1 - Introduction of Malaysia TaxationkantarubanPas encore d'évaluation

- MIA By-Laws (On Professional Ethics, Conduct and Practice)Document36 pagesMIA By-Laws (On Professional Ethics, Conduct and Practice)Nur IzzahPas encore d'évaluation

- Topic 6 MFRS 108 Changes in Acc Policies, Estimates, ErrorsDocument30 pagesTopic 6 MFRS 108 Changes in Acc Policies, Estimates, Errorsdini sofiaPas encore d'évaluation

- Earnings ManagementDocument16 pagesEarnings ManagementakfajarPas encore d'évaluation

- Ais Activiy Chapter 5 PDFDocument4 pagesAis Activiy Chapter 5 PDFAB CloydPas encore d'évaluation

- PBL Case 2 - Ais 630Document36 pagesPBL Case 2 - Ais 630Normala HamzahPas encore d'évaluation

- Expenses Control The Two Kinds of Expenses To ControlDocument19 pagesExpenses Control The Two Kinds of Expenses To ControlNathanFrancisPas encore d'évaluation

- Indah Water Konsortium SDN BHDDocument2 pagesIndah Water Konsortium SDN BHDMardhiah RamlanPas encore d'évaluation

- Topic 4 - Time Value of MoneyDocument64 pagesTopic 4 - Time Value of MoneyHisyam SeePas encore d'évaluation

- Lecture Tutorial - P, CL and CA (A)Document3 pagesLecture Tutorial - P, CL and CA (A)yym cindyy100% (1)

- AIS Report (Chapter 8)Document24 pagesAIS Report (Chapter 8)Cherlynn MagatPas encore d'évaluation

- Far410 Chapter 2 Conceptual Framework EditedDocument60 pagesFar410 Chapter 2 Conceptual Framework EditedWAN AMIRUL MUHAIMIN WAN ZUKAMALPas encore d'évaluation

- Proposal Tax Payer EducationDocument22 pagesProposal Tax Payer EducationDenis Robert Mfugale100% (1)

- Teori PerakaunanDocument47 pagesTeori PerakaunannabielanicoPas encore d'évaluation

- Group No 10 HRIS AssignmentDocument8 pagesGroup No 10 HRIS AssignmentWinifridaPas encore d'évaluation

- Limitations of Mfrs 136Document3 pagesLimitations of Mfrs 136Ros Shinie BalanPas encore d'évaluation

- Research ProposalDocument44 pagesResearch ProposalMoges GetahunPas encore d'évaluation

- Mfrs116 - Property, Plant and EquipmentDocument21 pagesMfrs116 - Property, Plant and EquipmentTenglum LowPas encore d'évaluation

- Report Palm Haul Sdn. BHDDocument15 pagesReport Palm Haul Sdn. BHDAsan BerlinPas encore d'évaluation

- Statement of Cash FlowsDocument7 pagesStatement of Cash FlowsFarahin SyedPas encore d'évaluation

- Internal Control Cases: Bern Fly Rod CompanyDocument2 pagesInternal Control Cases: Bern Fly Rod CompanyTrixie Jane Bautista LeymaPas encore d'évaluation

- Case Study 26 Finalized 1Document11 pagesCase Study 26 Finalized 1auni fildzah100% (1)

- A Study On Self-Assessment Tax System Awareness in MalaysiaDocument11 pagesA Study On Self-Assessment Tax System Awareness in MalaysiaEfriani SipahutarPas encore d'évaluation

- CKR Ib4 Inppt 05Document49 pagesCKR Ib4 Inppt 05aimanPas encore d'évaluation

- Ch01 IntroDocument16 pagesCh01 IntroaimanPas encore d'évaluation

- ACT 3142 Group 4 Article ReviewDocument2 pagesACT 3142 Group 4 Article ReviewaimanPas encore d'évaluation

- Act 3142 BiDocument3 pagesAct 3142 BiaimanPas encore d'évaluation

- Act 3142 Audit II Lesson Plan - Semester 1 201617Document2 pagesAct 3142 Audit II Lesson Plan - Semester 1 201617aimanPas encore d'évaluation

- T CODES 2Document13 pagesT CODES 2aashima_soodPas encore d'évaluation

- Prelim Exam-Business Tax - Set BDocument3 pagesPrelim Exam-Business Tax - Set BRenalyn Paras0% (1)

- 2 - BootDocument3 pages2 - Bootsubham duttaPas encore d'évaluation

- RPP EspDocument11 pagesRPP EspKrissiana PermataPas encore d'évaluation

- US Internal Revenue Service: f6198 - 1999Document1 pageUS Internal Revenue Service: f6198 - 1999IRSPas encore d'évaluation

- Agreeya Solutions (India) Private Limited: Earnings DeductionsDocument1 pageAgreeya Solutions (India) Private Limited: Earnings DeductionsGirnar studioPas encore d'évaluation

- Mepco Full BillDocument1 pageMepco Full BillIftakhar HussainPas encore d'évaluation

- Unlimited VCC Method PDFDocument9 pagesUnlimited VCC Method PDFAzren Dino100% (3)

- Hotel Confirmation TemplateDocument2 pagesHotel Confirmation TemplateantonytechnoPas encore d'évaluation

- Name: in This Lesson, You Will Learn To:: InstructionsDocument4 pagesName: in This Lesson, You Will Learn To:: InstructionsEthan JohnsonPas encore d'évaluation

- Anand Medical t16Document1 pageAnand Medical t16Kamlesh PrajapatiPas encore d'évaluation

- Power of Commissioner Penalties PDFDocument14 pagesPower of Commissioner Penalties PDFKomal JaiswalPas encore d'évaluation

- Village Electrification PrgramDocument7 pagesVillage Electrification PrgramFranz BautistaPas encore d'évaluation

- SBI Fee & ChargesDocument16 pagesSBI Fee & ChargesAks SomvanshiPas encore d'évaluation

- 4 2020 UP BOC Taxation Law Reviewer PDFDocument263 pages4 2020 UP BOC Taxation Law Reviewer PDFRose Ann Lascuña100% (7)

- April 2023 The Bill ElectricityDocument1 pageApril 2023 The Bill ElectricityAbdul Raheem OfficialPas encore d'évaluation

- Discounts: Types of Discounts Calculation of Discounts Practice Questions Answer BankDocument6 pagesDiscounts: Types of Discounts Calculation of Discounts Practice Questions Answer BankUmar SageerPas encore d'évaluation

- 072) Parle Agro - Civil - Extra Work Qty - 3804Document4 pages072) Parle Agro - Civil - Extra Work Qty - 3804Vikrant KoulPas encore d'évaluation

- Commissioner of Internal Revenue Vs Unioil CorporationDocument26 pagesCommissioner of Internal Revenue Vs Unioil CorporationRudnar Jay Bañares BarbaraPas encore d'évaluation

- Classification of TaxesDocument1 pageClassification of TaxesMiss KimPas encore d'évaluation

- Calianno, JoeDocument2 pagesCalianno, JoeJohn HornePas encore d'évaluation

- Fedai Rules LatestDocument25 pagesFedai Rules LatestVIJAYASEKARANPas encore d'évaluation

- Module 4 .1 - Schedule of Withholding TaxesDocument2 pagesModule 4 .1 - Schedule of Withholding Taxeskrisha milloPas encore d'évaluation

- Hard Activity On JavaDocument5 pagesHard Activity On JavaMilbertPas encore d'évaluation

- Region Bank StatementDocument4 pagesRegion Bank Statementpolaoapp3044Pas encore d'évaluation

- Lic Premium ReceiptDocument1 pageLic Premium ReceiptMallarsu MaheshPas encore d'évaluation

- Tax Invoice DetailsDocument1 pageTax Invoice Detailsramesh chaohanPas encore d'évaluation

- ICTD International Tax Literature Review - V2Document54 pagesICTD International Tax Literature Review - V2Chiara WhitePas encore d'évaluation

- Model Questions For GST End ExamDocument2 pagesModel Questions For GST End ExamAnshu KPas encore d'évaluation

- Degree of Financial Leverage Formula Excel TemplateDocument4 pagesDegree of Financial Leverage Formula Excel TemplateSyed Mursaleen ShahPas encore d'évaluation