Académique Documents

Professionnel Documents

Culture Documents

Low Price-To-Book-Value Stocks: Finding The Winners Among

Transféré par

Nikunj PatelTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Low Price-To-Book-Value Stocks: Finding The Winners Among

Transféré par

Nikunj PatelDroits d'auteur :

Formats disponibles

STOCK SCREENING

FINDING THE WINNERS AMONG

LOW PRICE-TO-BOOK-VALUE STOCKS

By John Bajkowski

Simple value screens

that look only for low

prices relative to some

measure of value tend

to produce lists that

include a few hidden

winners among many

losers. One promising

new study, however,

develops a nine-point

scoring system that

seeks to identify lowvalued stocks that also

have solid and

improving financials.

Numerous research studies point to the long-term success of using value

strategies to select stocks. Value strategies build stock portfolios by seeking

out stocks with low prices relative to variables such as earnings, book value,

cash flow, or dividends. However, most academic research relies on constructing large portfolios that beat the market on averagewith a few big winners,

but also containing many losing stocks.

Recently Joseph Piotroski, an accounting professor at the University of

Chicago Graduate School of Business, undertook a study of low price-tobook-value stocks to see if its possible to establish some basic financial

criteria to help separate the winners from the losers.

LOW PRICE-TO-BOOK-VALUE RATIO

Piotroskis work starts with low-price-to-book-value stocks. Price relative to

book value was a favorite measure of Benjamin Graham and his disciples who

sought companies with a share price below their book value per share. While

the market does a good job of valuing securities in the long run, in the short

run it can overreact to information and push prices away from their true

value. Measures such as the price-to-book-value ratio help identify which

stocks may be truly undervalued and neglected.

The price-to-book-value ratio is determined by dividing market price per

share by book value per share. Book value is generally determined by subtracting total liabilities from total assets and then dividing by the number of

shares outstanding. It represents the value of the owners equity based upon

historical accounting decisions. If accounting truly captured the current values

of the firm, then one would expect the current stock price to sell near its

accounting book value. Over the history of a firm, many events occur which

can distort the book value figure. For example, inflation may leave the

replacement cost of capital goods within the firm far above their stated book

value, or the purchase of a firm may lead to the establishment of goodwill,

which is an intangible asset, boosting the level of book value. Different

accounting policies among industries may also come into play when screening

for low price-to-book stocks.

AAIIs Stock Investor Pro was used to perform this screen suggested by

Piotroski. Stock Investor Pro covers a universe of 9,371 NYSE, Amex,

Nasdaq National Market, Nasdaq Small Cap, and over-the-counter stocks.

Piotroski first limited his universe to the bottom 20% of stocks according to

their price-to-book-value ratio. Our first consideration is that only 8,127

stocks have current price-to-book-value ratios in Stock Investor. A company

must have a positive book value to have a meaningful price-to-book-value

ratio. A 20% cut-off translates into approximately 1,600 stocks with a

maximum price-to-book-value ratio of 0.72.

Piotroski found that most stocks trading with an extremely low price-tobook-value ratio were either neglected or financially troubled firms. Small,

thinly traded stocks are rarely followed by analysts. The flow of information

is limited for these stocks and can lead to mispriced stocks. Analysts typically

John Bajkowski is AAIIs financial analysis vice president and editor of Computerized

Investing.

AAII Journal/August 2001

13

STOCK SCREENING

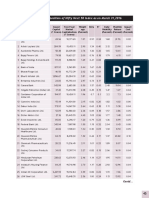

TABLE 1. PIOTROSKIS VALUE SCREEN

Company (Exchange: Ticker)

PrimeSource (M: PSRC)

Rocky Shoes & Boots (M: RCKY)

Franklin Electronic Pbls. (A: FEP)

Acorn Holding (M: AVCC)

U.S. Vision (M: USVI)

Greif Brothers (M: GBCOA)

Millbrook Press (M: MILB)

Delta Apparel (A: DLA)

Racing Champions (M: RACN)

Return C a s h Income

LT

Priceon

Asset Market

From A f t e r Debt to Current Gross

toRatio Margin Turnover C a p

A s s e t s Opers Taxes A s s e t s

Book

Y1

Y1

Y1

Y1

Y1

Y1

Q1

Y1

(X)

(%)

($ Mil) ($ Mil)

(%)

(X)

(%)

(X)

($ Mil) Description

0.40

2.7

17.3

5.1

29

2.5

16.2

2.9

25.1 Publishing prods

0.42

0.1

9.1

0.1

31

8.4

23.3

1.2

20.5 Footwear

0.43

3.9

10.1

2.7

14

2.7

36.5

1.4

20.3 Handheld elec references

0.52

6.6

0.8

0.5

0

4.7

33.8

0.9

3.5 Holding co, silicon wafers

0.54

5.9

9.5

4.8

24

2.6

69.8

1.8

27.3 Optical prods & servs

0.55

3.0

117.2

62.4

25

3.3

25.7

1.0

678.8 Indus shipping matls

0.64

4.9

3.5

1.1

20

1.6

44.9

1.0

8.8 Kids non-fiction books

0.68

5.9

16.5

4.7

12

3.0

17.8

1.4

41.4 Sportswear

0.72

2.3

38.6

5.9

37

1.9

45.9

0.9

76.4 Die cast collectibles

Source: AAIIs Stock Investor Pro/Market Guide Inc. Statistics are based on data as of 6/29/2001.

ignore these stocks and tend to focus

on stocks with general interest.

Financially distressed firms may

be beaten down below their intrinsic

value as investors await strong signs

that a company has fixed its problems and the worst is behind it. Poor

prior performance often leads to

overly pessimistic expectations of

future performance. This pessimism

translates into above-market performance as companies outperform

market expectations in subsequent

quarters.

Piotroski found either situation can

create buying opportunities, after

checking on financial strength,

especially when studying smaller-cap

stocks.

FINANCIAL CONDITION

Piotroski developed a nine-point

scale that helps to identify stocks

with solid and improving financials.

Profitability, financial leverage,

liquidity, and operating efficiency

are examined using popular ratios

and basic financial elements that are

easy to find and apply. For this

article, a passing stock is required to

have a perfect score of nine.

PROFITABILITY

Piotroski awarded up to four

points for profitabilityone for

14

AAII Journal/August 2001

positive return on assets, one for

positive cash flow from operations,

one for an improvement in return on

assets over the last year, and one if

cash flow from operations exceeds

net income. These are simple tests

that are easy to measure. Because

the requirements are minimal, there

is no need to worry about industry,

market, or time-specific comparisons.

Piotroski defined return on assets

as net income before extraordinary

items for the fiscal year preceding

the analysis, divided by total assets

at the beginning of the fiscal year.

Return on assets examines the return

generated by the assets of the firm.

A high return implies the assets are

productive and well-managed.

Piotroski did not look for high

levels, only a positive figure. While

the screen may not seem to be very

restrictive, he found that over 40%

of the low price-to-book-value

stocks had experienced a loss in the

prior two fiscal years. Positive

income is a significant event for

these firms.

About 4,000 stocks in Stock

Investor had positive return on

assets over their last fiscal year.

Adding the screen for positive return

on assets to the low price-to-book

universe dropped the number of

passing companies from 1,667 down

to 621.

Exchange Key: N = New York

A = American

M = Nasdaq

Piotroski awarded one point if a

firm had positive operating cash

flow. Operating cash flow is reported on the statement of cash

flows and is designed to measure a

companys ability to generate cash

from day-to-day operations as it

provides goods and services to its

customers. It considers factors such

as cash from the collection of

accounts receivable, the cash incurred to produce any goods or

services, payments made to suppliers, labor costs, taxes, and interest

payments. A positive cash flow from

operations implies that a firm was

able to generate enough cash from

continuing operations without the

need for additional funds.

Approximately 5,300 stocks had

positive cash from operations for the

their most recent fiscal year. Adding

this criterion, the screen reduced the

number of passing companies from

621 to 433.

The next variable Piotroski

considered sought improving profitability. Piotroski awarded one point

if the current years return on assets

was greater than the prior years

return on assets. While Table 1 does

not list the prior year return on

assets, all of the passing companies

exhibited significant improvement.

Sixty percent of the stocks went

from negative to positive return on

assets.

STOCK SCREENING

In the complete Stock Investor

universe, 4,111 stocks showed an

improvement in return on assets. But

adding the variable to the overall

screen reduced the number of

passing stocks from 433 to 222.

The final profitability variable

examines the relationship between

the earnings and cash flow. A point

is awarded if cash from operations

exceeded net income before extraordinary items. The measure tries to

avoid those firms making accounting

adjustments to boost earnings in the

short run, that may in turn weaken

long-term profitability. Piotroski

feels that this element may be

especially important for value firms,

which may have a strong incentive

to manage earnings to avoid triggering problems such as violations to

debt covenants.

In Stock Investor Pro, income after

taxes represents income before

extraordinary items. Therefore, the

screen looked for firms with cash

from operations greater than income

after taxes for the most recent fiscal

year. By itself, this variable was not

very restrictive. Nearly 7,000 of the

stocks within the complete universe

passed the filter. Adding the criterion to the overall screen reduced the

number of passing companies from

222 to 169.

CAPITAL STRUCTURE

Piotroski awarded up to three

points for capital structure and the

firms ability to meet future debt

obligationsone if the ratio of debt

to total assets declined in the past

year, one if the current ratio improved over the past year, and one if

the company did not issue any

additional common stock.

Piotroski defined debt to total

assets as: total long-term debt, plus

the current portion of long-term

debt, divided by average total assets.

The higher the figure, the greater the

financial risk. Judicious use of debt

allows a company to expand operations and leverage the investment of

shareholdersprovided that the firm

can earn a higher return than the

cost of debt. Normally, the more

stable the cash flow of a firm, the

greater financial risk a company can

assume. However, a company must

meet the rules (covenants) along

with the interest payments of its

debtor risk bankruptcy and

complete loss of control of the firm.

By raising additional external

capital, a financially distressed firm

is signaling that it is unable to

generate sufficient internal cash

flow. An increase in long-term debt

will place additional constraints on

the financial flexibility of a firm and

Definitions

Price-to-Book: Market price per share divided by book value per

share. A measure of stock valuation relative to net assets. A high

ratio might imply an overvalued situation; a low ratio might

indicate an overlooked stock.

Return on Assets Y1: Net income divided by total assets for the

most recent fiscal year. Provides a measure of managements

efficient use of assets.

Cash From Operations Y1 ($ Mil): The cash flows from

operations for the most recent fiscal year. This is taken directly

from the companys statement of cash flows.

Income After Taxes Y1 ($ Mil): Income after taxes for most

recent fiscal year.

LT Debt to Assets Y1: Long-term debt divided by total assets.

(Long-term debt is defined as liabilities due in a year or moreand

the portion of long-term debt classified as current.)

will likely come at great cost.

A custom field was used to calculate the debt-to-equity ratio within

Stock Investor and the screen looked

for a fiscal year improvement. About

3,800 stocks showed a fiscal year

decrease in debt to total assets when

examining the complete 9,371 stock

universe. The criterion further

reduced the number of passing

companies from 169 to 100.

To judge liquidity, a company

earns one point if its current ratio at

the end of its most recent fiscal year

increased compared to the prior

fiscal year. Liquidity ratios examine

how easily the firm could meet its

short-term obligations, while financial risk ratios examine a companys

ability to meet all liability obligations and the impact of these

liabilities on the balance sheet

structure.

The current ratio compares the

level of the most liquid assets

(current assets) against that of the

shortest maturity liabilities (current

liabilities). It is computed by dividing current assets by current liabilities. A high current ratio indicates

high level of liquidity and less risk of

financial trouble. Too high a ratio

may point to unnecessary investment

in current assets, or failure to collect

receivables, or a bloated inventory

all of which negatively affect earn-

of Terms

Current Ratio Y1: Current assets, including cash, accounts

receivable and inventory, divided by current liabilities, including all

short-term debt for the latest fiscal year. A rough measure of

financial risk: the smaller current assets relative to current

liabilities, the greater the risk of credit failure.

Gross Margin Y1: Gross margin (net sales less cost of goods

sold) for the latest fiscal year.

Asset Turnover (Y1): Total asset turnover for the latest fiscal

year. Computed by dividing total sales by the total assets for the

same period. Measures the amount of sales volume the company is

generating on its investment in assets.

Market Cap Q1 ($Mil): Number of common stock shares

outstanding times share price for the most recent quarter. Provides

a measure of firm size.

AAII Journal/August 2001

15

STOCK SCREENING

ings. Too low a ratio implies

illiquidity and the potential for being

unable to meet current liabilities and

random shocks that may temporarily

reduce the inflow of cash.

Piotroski assumed that an improvement in the current ratio is a

good signal regarding a companys

ability to service its current debt

obligations. He also indicated in a

footnote that the decline in the

current ratio was only significant if

the current ratio is near one. All of

the passing stocks have the current

ratios well above this cutoff; 3,037

stocks showed an increase in the

current ratio. Adding this criterion

to the screen reduced the number of

passing companies from 100 to 52.

The final capital structure element

awards one point if the firm did not

issue common stock over the last

year. Similar in concept to an

increase in long-term debt, financially distressed companies that raise

external capital could be indicating

that they are unable to generate

sufficient internal cash flow to meet

their obligations. Additionally,

issuing stock while its stock price is

depressed (low price-to-book)

highlights the weak financial condition of the company.

Adding this criterion to the screen

reduced the number of passing

companies from 52 to 30. Independently, 3,000 stocks maintained or

reduced the number of outstanding

shares during their last fiscal year.

OPERATING EFFICIENCY

The remaining two elements

examine changes in the efficiency of

operations. Companies gain one

point for showing an increase in

their gross margin and another point

if their asset turnover has increased

over the last fiscal year. The ratios

reflect two key elements impacting

return on assets.

Long-term investors buy shares of

a company with the expectation that

the company will produce a growing

future stream of cash. Profits point

to the companys long-term growth

and staying power. Gross profit

margin reflects the firms basic

pricing decisions and its material

costs. It is computed by dividing

gross income (sales less cost of goods

sold) by sales for the same time

period. The greater and the more

stable the margin over time, the

greater the companys expected

profitability. Trends should be

closely followed because they

generally signal changes in market

competition.

Piotroski zeroed in on improving

gross profit margin because of

immediate signals of an improvement in production costs, inventory

costs, or increase in the selling price

of the companys product or service.

In our universe, 3,332 stocks showed

an improvement in year-over-year

gross profit margins. The gross

margin criterion reduced the number

of passing companies from 30 to 19.

The final element in Piotroskis

financial scoring system adds a point

if asset turnover for the latest fiscal

year is greater than the prior years

turnover.

Asset turnover (total sales divided

by beginning period total assets)

measures how well the companys

assets have generated sales. Industries differ dramatically in asset

turnover, so comparison to firms in

similar industries is crucial. Too high

a ratio relative to other firms may

indicate insufficient assets for future

growth and sales generation, while

too low an asset turnover figure

points to redundant or low productivity assets.

An increase in the asset turnover

signifies greater productivity from

To track the performance of the this value screen

based on Piotroskis work, go to the Stock Screens

area under Tools on the left-hand side.

Read about other value screens that utilize the pricebook-value ratio, such as Benjamin Graham and Stock

16

AAII Journal/August 2001

the asset base and possibly greater

sales levels. In our database, 3,345

stocks showed in improvement in

asset turnover. The asset turnover

improvement criterion reduced the

number of passing companies from

19 to 12.

To help ensure minimum liquidity

and financial reporting standards,

over-the-counter stocks and ADRs

were excluded. The nine firms that

remained are listed in Table 1.

The list represents a diverse set of

primarily small-cap stocks. Franklin

Electronics produces handheld

electronic reference products such as

dictionaries, language translators,

biblical references, and even medical

reference materials. Sales have

declined in recent years as people

have shifted from dedicated

handheld electronic databases to

general purpose Palm and Pocket PC

PDAs (personal digital assistants). Its

low price-to-book-value ratio of

0.43 reflects the markets uncertainty

of Franklin Electronics big bet on

the future of E-books with its latest

general purpose E-book reader and

PDA. For this stock to do well, its

bet must pay off.

The screen in this article required a

perfect score of nine. Requiring a

score of eight, would have lead to 42

passing stocks. Overall, Piotroski

found that the higher the financial

score, the higher the average portfolio return.

Piotroskis work consists of

creating low-price-to-book portfolios

and further segmenting them in

varying portfolios of financial

strength. Overall, the higher the

financial score the greater the

average portfolio return. Results of

individual stocks will vary dramatically. Even with these additional

financial tests, it is important to

perform a careful analysis of any

passing stocks.

Market Winners.

To brush up on stock analysis terms, go to the

Investing Pathways area on the right-hand side

and click on Financial Statement Analysis.

Vous aimerez peut-être aussi

- CheatSheet (Finance)Document1 pageCheatSheet (Finance)Guan Yu Lim100% (3)

- Dun &bradstreetDocument46 pagesDun &bradstreetNadeem0% (1)

- Creating Value Thru Best-In-class Capital AllocationDocument16 pagesCreating Value Thru Best-In-class Capital Allocationiltdf100% (1)

- Dan Simon 2016 W2 PDFDocument2 pagesDan Simon 2016 W2 PDFAnonymous ndTTXL80MnPas encore d'évaluation

- Summary of Joshua Rosenbaum & Joshua Pearl's Investment BankingD'EverandSummary of Joshua Rosenbaum & Joshua Pearl's Investment BankingPas encore d'évaluation

- Liquidity Ratios: What They Are and How to Calculate ThemDocument4 pagesLiquidity Ratios: What They Are and How to Calculate ThemLanpe100% (1)

- Investment Banking Technical KnowledgeDocument5 pagesInvestment Banking Technical KnowledgeJack JacintoPas encore d'évaluation

- 16 Financial Ratios To Determine A Company's Strength and WeaknessesDocument5 pages16 Financial Ratios To Determine A Company's Strength and WeaknessesOld School Value88% (8)

- Where's The Bar - Introducing Market-Expected Return On InvestmentDocument17 pagesWhere's The Bar - Introducing Market-Expected Return On Investmentpjs15Pas encore d'évaluation

- Financial InfoDocument23 pagesFinancial InfojohnsolarpanelsPas encore d'évaluation

- Dividends and Other Payouts: Chapter NineteenDocument53 pagesDividends and Other Payouts: Chapter NineteenAli AhmadPas encore d'évaluation

- Internal Loss FinancingDocument4 pagesInternal Loss Financingvivek0% (1)

- Return On EquityDocument7 pagesReturn On EquityTumwine Kahweza ProsperPas encore d'évaluation

- Bestbuy Fall2006Document108 pagesBestbuy Fall2006Ali SameiPas encore d'évaluation

- 4th Edition Summary Valuation Measuring and Managing The ValueDocument17 pages4th Edition Summary Valuation Measuring and Managing The Valuekrb2709Pas encore d'évaluation

- Philippine Transfer Taxes and Value Added Tax-2011Document54 pagesPhilippine Transfer Taxes and Value Added Tax-2011Chris Rivero100% (2)

- Financial Ratio Analysis Guide for Measuring Organizational PerformanceDocument6 pagesFinancial Ratio Analysis Guide for Measuring Organizational PerformanceWensen ChuPas encore d'évaluation

- BBBY Case ExerciseDocument7 pagesBBBY Case ExerciseSue McGinnisPas encore d'évaluation

- DIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)D'EverandDIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)Pas encore d'évaluation

- Annual Report 2014Document110 pagesAnnual Report 2014Kevin Brown0% (1)

- Fund PerformanceDocument13 pagesFund PerformanceHilal MilmoPas encore d'évaluation

- Diagnostic Test 1ST Sem S.Y. 2019 2020fabm 2Document16 pagesDiagnostic Test 1ST Sem S.Y. 2019 2020fabm 2FRANCESPas encore d'évaluation

- The Right Role For Multiples in ValuationDocument5 pagesThe Right Role For Multiples in Valuationedusho26100% (1)

- Internal Control of Fixed Assets: A Controller and Auditor's GuideD'EverandInternal Control of Fixed Assets: A Controller and Auditor's GuideÉvaluation : 4 sur 5 étoiles4/5 (1)

- Summary of Piotroski FscoreDocument3 pagesSummary of Piotroski FscoreFredPas encore d'évaluation

- Finding The Winners Among Low Price To Book Value Stocks PDFDocument4 pagesFinding The Winners Among Low Price To Book Value Stocks PDFrubencito1Pas encore d'évaluation

- Financial Ratio Analysis Reveals Lam Research's Strong PerformanceDocument34 pagesFinancial Ratio Analysis Reveals Lam Research's Strong PerformanceEyad AbdullahPas encore d'évaluation

- Finance: Analysis of Financial Statements RatiosDocument18 pagesFinance: Analysis of Financial Statements RatiosJohn Verlie EMpsPas encore d'évaluation

- 1determine A FirmDocument50 pages1determine A FirmCHATURIKA priyadarshaniPas encore d'évaluation

- How To Evaluate A StockDocument2 pagesHow To Evaluate A StockdarshanabmsPas encore d'évaluation

- S&P LISTED Private EquityDocument2 pagesS&P LISTED Private EquityRoberto PerezPas encore d'évaluation

- Assessing Fund Performance:: Using Benchmarks in Venture CapitalDocument13 pagesAssessing Fund Performance:: Using Benchmarks in Venture CapitalNamek Zu'biPas encore d'évaluation

- Financial Ratio Analysis ExplainationDocument5 pagesFinancial Ratio Analysis ExplainationSyaiful RokhmanPas encore d'évaluation

- Intangibles and Earnings: Counterpoint Global InsightsDocument14 pagesIntangibles and Earnings: Counterpoint Global InsightsTimothyNgPas encore d'évaluation

- Theory On RationsDocument9 pagesTheory On RationsPriyanshu GuptaPas encore d'évaluation

- Trillion Dollar Mistake 10152013Document8 pagesTrillion Dollar Mistake 10152013Tom JacobsPas encore d'évaluation

- V20 - 11 Financial Institutions Fair Value SurveyDocument20 pagesV20 - 11 Financial Institutions Fair Value SurveyKevin SmithPas encore d'évaluation

- Accounting ReviewDocument63 pagesAccounting ReviewLee ChiaPas encore d'évaluation

- Reinvestment PaperDocument15 pagesReinvestment PapermecontactyelPas encore d'évaluation

- FinanceDocument3 pagesFinanceVũ Hải YếnPas encore d'évaluation

- What Is Return On AssetsDocument5 pagesWhat Is Return On AssetsIndah ChaerunnisaPas encore d'évaluation

- Write Up m201802 SinghalDocument14 pagesWrite Up m201802 Singhalshalini singhalPas encore d'évaluation

- New Constructs ArticlesDocument8 pagesNew Constructs ArticleskongbengPas encore d'évaluation

- CH 3 Discussion and Practice QuestionsDocument11 pagesCH 3 Discussion and Practice Questionsshimoni.mistry.180670107043Pas encore d'évaluation

- Financial Ratio AnalysisDocument5 pagesFinancial Ratio AnalysisDraeselle Desoy-GallegoPas encore d'évaluation

- An Introduction To Fundamental Analysis: Jason O Bryan 19 September 2006Document23 pagesAn Introduction To Fundamental Analysis: Jason O Bryan 19 September 2006Saumil ShahPas encore d'évaluation

- Ratio Analysis: Ratio Analysis Is The Process of Establishing and Interpreting Various RatiosDocument26 pagesRatio Analysis: Ratio Analysis Is The Process of Establishing and Interpreting Various RatiosTarpan Mannan100% (2)

- The Impact of Working Capital Management On The Profitability of The Listed Companies in The London Stock ExchangeDocument13 pagesThe Impact of Working Capital Management On The Profitability of The Listed Companies in The London Stock ExchangeTamer A. El Hariry100% (1)

- Short-term Solvency and Liquidity Ratios GuideDocument18 pagesShort-term Solvency and Liquidity Ratios GuideSachini Dinushika KankanamgePas encore d'évaluation

- Gaap Opportunity CostDocument3 pagesGaap Opportunity CostSai HarshaPas encore d'évaluation

- Paper CostcoDocument4 pagesPaper CostcoDhe SagalaPas encore d'évaluation

- Lecture 1. Ratio Analysis Financial AppraisalDocument11 pagesLecture 1. Ratio Analysis Financial AppraisaltiiworksPas encore d'évaluation

- Financial Statement AnalysisDocument30 pagesFinancial Statement AnalysisHYUN JUNG KIMPas encore d'évaluation

- Financial Statement Analysis A Look at The Balance Sheet PDFDocument4 pagesFinancial Statement Analysis A Look at The Balance Sheet PDFnixonjl03Pas encore d'évaluation

- Investment Analysis and Portfolio ManageDocument14 pagesInvestment Analysis and Portfolio ManageSannithi YamsawatPas encore d'évaluation

- Valuation Seminar ExerciseDocument4 pagesValuation Seminar ExerciseMihai MirceaPas encore d'évaluation

- CAHPTER 3. Analisis Keuangan (Analysis of Financial Statements) MankeuDocument12 pagesCAHPTER 3. Analisis Keuangan (Analysis of Financial Statements) MankeuKezia NatashaPas encore d'évaluation

- AEC 6 - Financial ManagementDocument6 pagesAEC 6 - Financial ManagementRhea May BalutePas encore d'évaluation

- Section A: Fm202 Final Examination Semester 2 2016 Marking GuideDocument12 pagesSection A: Fm202 Final Examination Semester 2 2016 Marking Guidemerita homasiPas encore d'évaluation

- Case Study - Stella JonesDocument7 pagesCase Study - Stella JonesLai Kok WeiPas encore d'évaluation

- Oneliners P3Document4 pagesOneliners P3Nirvana BoyPas encore d'évaluation

- Module 1 Homework AssignmentDocument3 pagesModule 1 Homework Assignmentlgarman01Pas encore d'évaluation

- Looking Beyond Free Cash FlowDocument18 pagesLooking Beyond Free Cash FlowGurjeevAnandPas encore d'évaluation

- Understanding Financial StatementsDocument5 pagesUnderstanding Financial Statementsa25255tPas encore d'évaluation

- Opt-Sciences Corp (Pink:Opst)Document9 pagesOpt-Sciences Corp (Pink:Opst)narang.gp5704Pas encore d'évaluation

- Financial Ratios For Chico ElectronicsDocument8 pagesFinancial Ratios For Chico ElectronicsThiago Dias DefendiPas encore d'évaluation

- StatusDocument5 pagesStatusNikunj PatelPas encore d'évaluation

- FNFDocument3 pagesFNFNikunj PatelPas encore d'évaluation

- Investor Behavior Towards Investment OptionsDocument2 pagesInvestor Behavior Towards Investment OptionsNikunj PatelPas encore d'évaluation

- Nifty 50 PDFDocument2 pagesNifty 50 PDFNikunj PatelPas encore d'évaluation

- Pyrolysis of Waste Tyres for Future FuelsDocument1 pagePyrolysis of Waste Tyres for Future FuelsNikunj PatelPas encore d'évaluation

- Pyrolysis of Waste Tyres for Future FuelsDocument1 pagePyrolysis of Waste Tyres for Future FuelsNikunj PatelPas encore d'évaluation

- PDFDocument18 pagesPDFNikunj PatelPas encore d'évaluation

- Nifty 50Document2 pagesNifty 50Nikunj PatelPas encore d'évaluation

- Abra College V Aquino DigestDocument1 pageAbra College V Aquino DigestNicolePas encore d'évaluation

- 06 Challenger Series SolutionsDocument60 pages06 Challenger Series Solutionssujalpratapsingh71Pas encore d'évaluation

- VDA DE RACHO Vs ILAGANDocument1 pageVDA DE RACHO Vs ILAGANJanex TolineroPas encore d'évaluation

- Case Digest TaxationDocument9 pagesCase Digest TaxationJC RamosPas encore d'évaluation

- Chapter 18 Consolidated FS - Part 2Document13 pagesChapter 18 Consolidated FS - Part 2Erwin Labayog MedinaPas encore d'évaluation

- NLG - Annual Report 2016Document48 pagesNLG - Annual Report 2016Kiva DangPas encore d'évaluation

- Horizontal and Vertical Ratio AnalysisDocument21 pagesHorizontal and Vertical Ratio AnalysismrnttdpnchngPas encore d'évaluation

- DocxDocument10 pagesDocxAiziel OrensePas encore d'évaluation

- Working Capital Project Report 2Document48 pagesWorking Capital Project Report 2Evelyn KeanePas encore d'évaluation

- Chapter 1: Financial Management and Financial ObjectivesDocument15 pagesChapter 1: Financial Management and Financial ObjectivesAmir ArifPas encore d'évaluation

- 1 Villanueva vs. City of IloiloDocument26 pages1 Villanueva vs. City of IloiloAustine CamposPas encore d'évaluation

- RBI Master Circular On RestructuringDocument120 pagesRBI Master Circular On RestructuringHarish PuriPas encore d'évaluation

- March 2010 Part 3 InsightDocument85 pagesMarch 2010 Part 3 InsightLegogie Moses AnoghenaPas encore d'évaluation

- Answer Key POD Cup Jr. Final RoundDocument6 pagesAnswer Key POD Cup Jr. Final RoundRitsPas encore d'évaluation

- Building and Other Construction Workers (Regulation of Employment and Conditions of Service) Act, 1996Document7 pagesBuilding and Other Construction Workers (Regulation of Employment and Conditions of Service) Act, 1996Latest Laws TeamPas encore d'évaluation

- Budgeting and Programming Master PlanDocument14 pagesBudgeting and Programming Master PlanJim YauPas encore d'évaluation

- IAS 20 Summary NotesDocument5 pagesIAS 20 Summary NotesShiza ArifPas encore d'évaluation

- Cost Analysis FundamentalDocument15 pagesCost Analysis FundamentalLakshman Rao100% (1)

- Chapter 17Document10 pagesChapter 17Neriza maningasPas encore d'évaluation

- Quice Foods Industries Ltd profit and loss analysisDocument4 pagesQuice Foods Industries Ltd profit and loss analysisOsama RiazPas encore d'évaluation

- SA4 Pension&Other Employee BenefitsDocument6 pagesSA4 Pension&Other Employee BenefitsVignesh SrinivasanPas encore d'évaluation

- International Financial Management 1219993582593066 8Document41 pagesInternational Financial Management 1219993582593066 8sachinPas encore d'évaluation