Académique Documents

Professionnel Documents

Culture Documents

Black Hat Essay - Two Businessmen and An Adult Film Star

Transféré par

liechtymarkTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Black Hat Essay - Two Businessmen and An Adult Film Star

Transféré par

liechtymarkDroits d'auteur :

Formats disponibles

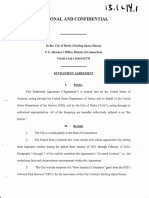

Black Hat Essay: Two Businessmen and an Adult Film Star

Mark J. Liechty

The focus of this essay is James J. McDermott (McDermott). McDermott was the CEO

of the investment bank Keefe, Bruyette & Woods. While CEO, McDermott acquired material

inside information involving the acquisitions and mergers of various companies. Central Fidelity

Banks, Inc., Advanta Corporation, Barnett Banks, Inc., First Commerce Corp., California State

Bank, and First Commercial Corp. were the acquiring businesses whose securities were

purchased and sold. An extramarital affair was occurring between McDermott and adult film

actress Kathryn B. Gannon (Gannon)(A.K.A. Marylin Star). McDermott, through his position

at the investment bank, would get material inside information about upcoming mergers and pass

this information to Gannon via the telephone. Indeed, it was phone records and the timing of

calls that constituted the evidence on which McDermott was convicted. Gannon would act on

this information by purchasing securities. Sadly for McDermott, Gannon was also involved in a

romantic relationship with New Jersey businessman Anthony P. Pomponio (Pomponio).

Gannon was passing the information, given to her by McDermott, to Pomponio, and Pomponio

was trading on the information. Eventually, the SEC was onto them and the filing of charges

ensued.1

The federal securities regulation McDermott was convicted of violating was 10b of the

Securities Exchange Act of 1934 codified as 15 U.S.C. 78j(b), which, in substantive part,

provides:

It shall be unlawful for any person, directly or indirectly, by the use of any means or

instrumentality of interstate commerce or of the mails, or of any facility of any national

securities exchange . . .

(b) To use or employ, in connection with the purchase or sale of any security registered

on a national securities exchange or any security not so registered, or any securities-based

swap agreement1 any manipulative or deceptive device or contrivance in contravention

of such rules and regulations as the Commission may prescribe as necessary or

appropriate in the public interest or for the protection of investors. . .

, and codified as 17 C.F.R. 240.10b5 (Rule 10b-5) which provides:

It shall be unlawful for any person, directly or indirectly, by the use of any means or

instrumentality of interstate commerce, or of the mails or of any facility of any national

securities exchange,

(a) To employ any device, scheme, or artifice to defraud, . . .

McDermott was convicted of violating these provisions when it was proven to a jury that he gave

material, non-public information to Gannon for a personal benefit in breach of his fiduciary

duty.2

1

2

Brief for the United States of America, United States v. McDermott, 245 F.3d 133 (2d Cir. 2001) (No. 00-1572)

United States v. McDermott, 245 F.3d 133 (2d Cir. 2001)

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Hernandez V DBPDocument2 pagesHernandez V DBPChino SisonPas encore d'évaluation

- AC Revised Executive Committee Charter PDFDocument4 pagesAC Revised Executive Committee Charter PDFNicole Andrea EdradaPas encore d'évaluation

- UK Visas & Immigration: Partially Completed ApplicationDocument11 pagesUK Visas & Immigration: Partially Completed ApplicationNorma RiepenhausenPas encore d'évaluation

- Book 6. Vocab by TopicDocument278 pagesBook 6. Vocab by TopicNguyenThiPhuongThuyPas encore d'évaluation

- Mem of Appeal Sec of Labor-2Document12 pagesMem of Appeal Sec of Labor-2Torni JoPas encore d'évaluation

- Comparative Models in PolicingDocument17 pagesComparative Models in PolicingSpyderNinjaPas encore d'évaluation

- Amended Forest Hills School Board ComplaintDocument56 pagesAmended Forest Hills School Board ComplaintCincinnatiEnquirer100% (1)

- People Vs Sandiganbayan CrimproDocument1 pagePeople Vs Sandiganbayan CrimproCarl MontemayorPas encore d'évaluation

- De Leon-v-Duterte-DigestDocument2 pagesDe Leon-v-Duterte-DigestAlexandria FernandezPas encore d'évaluation

- Cap-398 The Public Leadership Code of Ethics Act - Laws of TanzaniaDocument28 pagesCap-398 The Public Leadership Code of Ethics Act - Laws of TanzaniaFredy MarikiPas encore d'évaluation

- SSRN Id1815442Document48 pagesSSRN Id1815442gustavocesarPas encore d'évaluation

- Non Judicial Stamp Paper: Rs.10 Rs.10Document3 pagesNon Judicial Stamp Paper: Rs.10 Rs.10MunaPas encore d'évaluation

- Mathuradas Vassanji v. Raimal Hirji, 1935 SCC OnLine Bom 81Document10 pagesMathuradas Vassanji v. Raimal Hirji, 1935 SCC OnLine Bom 81arunimaPas encore d'évaluation

- Case PR (Talak) - Mahad Ahmed MohamedDocument30 pagesCase PR (Talak) - Mahad Ahmed MohamedKamarulAzimMuhaimiPas encore d'évaluation

- 12Document3 pages12rojith rojithPas encore d'évaluation

- Banking Regulation Act, 1949: Zafrin MemonDocument26 pagesBanking Regulation Act, 1949: Zafrin Memonzafrinmemon100% (1)

- Sterling Agreement in DerbyDocument10 pagesSterling Agreement in DerbyThe Valley IndyPas encore d'évaluation

- The 1943 Constitution of The PhilippinesDocument17 pagesThe 1943 Constitution of The PhilippinesNaethan ReyesPas encore d'évaluation

- Practicality - Negative SpeechDocument1 pagePracticality - Negative SpeechClarissed100% (3)

- Caedo V Yu Khe ThaiDocument2 pagesCaedo V Yu Khe ThaiABPas encore d'évaluation

- Related Documents To Verify Before Buying A New PropertyDocument3 pagesRelated Documents To Verify Before Buying A New PropertyLegalpropertiesPas encore d'évaluation

- Salinas V CaDocument4 pagesSalinas V CaPeperoniiPas encore d'évaluation

- Cmo 22 2007editedDocument2 pagesCmo 22 2007editedKylene Nichole EvaPas encore d'évaluation

- Aninao Vs Asturias Chemicals (Mineral Land Not Covered by OLT and CARP)Document2 pagesAninao Vs Asturias Chemicals (Mineral Land Not Covered by OLT and CARP)Keogh YrinPas encore d'évaluation

- G1P 2019 List MweDocument42 pagesG1P 2019 List MwekddeviPas encore d'évaluation

- AssignmentDocument3 pagesAssignmentJevi RuiizPas encore d'évaluation

- Otremba V State of NevadaDocument24 pagesOtremba V State of NevadaKSNV News3LVPas encore d'évaluation

- Notice of InfringementDocument2 pagesNotice of InfringementratiexpressPas encore d'évaluation

- Republic Vs Zurbaran Realty and Development Corp. (Bersamin) FactsDocument5 pagesRepublic Vs Zurbaran Realty and Development Corp. (Bersamin) FactsKatrina Vianca DecapiaPas encore d'évaluation

- Law AssignmentDocument13 pagesLaw AssignmentZherePas encore d'évaluation