Académique Documents

Professionnel Documents

Culture Documents

Certified Management Accountant

Transféré par

Yusuf HusseinDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Certified Management Accountant

Transféré par

Yusuf HusseinDroits d'auteur :

Formats disponibles

Certified Management Accountant(CMA) is a USA based certification, overseen by the IMA (Institute of Management Accountants).

From

the last few years the CMA has been growing and spreading its global presence, and is now well known in China and throughout the Middle

East.

Chartered Institute of Management Accountant(CIMA) certification is handled by the CIMA (Chartered Institute of Management

Accountants). The CIMA is recognized in many countries, especially those in the UK and commonwealth.

Q.:Which course is more beneficial CMA or CIMA?

Answer: CMA certification is a great ascription for management professionals who are looking for enhancing their knowledge and skills in

the financial management fields. The course prepares a professional with skills in the area of financial planning, analysis, control, decision

support, and professional ethics.

In case of CIMA, it gives knowledge and insight into how the different areas of accounting relate to the business world. This accounting

qualification is most relevant to the current trends of the industry, helping candidates to unleash their talent and accelerate their career in the

business field.

So, depending upon your preference of field that you want to work in and build skills around, the benefits differ. Hence it is difficult to

generalize which certification is better as both of them cater to people with different aspirations.

Q.:What is the Requirements/Eligibility Criteria to pass CMA and CIMA Exam?

Answer: The eligibility criteria can be defined on the basis of Education and Experience.

Education:

CMA:A bachelor degree from a recognized university is required to get qualified for the CMA exam, but there is no eligibility for CIMA exam.

CIMA:Everyone can do CIMA course program because CIMA itself offers a more rigorous program.

Experience:

In case of CMA certification no experienced is required. But in case of CIMA Candidates must have 3 years of working experience in related

field.

Q.:Who provides the certifications?

Answer:The CMA certification is provided by Institute of management accountants, America while CIMA is given by Chartered institute of

management accountants, UK.

Q.:What is the registration fee for each of the courses?

Answer:CMAs registration fee for students is $ 476 and professionals are $1030 whereas for CIMA it is GBP 75.

Q.:How many papers do you have to give?

Answer:If you are doing CMA you have to give 2 papers at a single level and if you pursue CIMA you have to give 16 papers at 5 levels.

Q.:When does the exam take place?

Answer:CMA exams can be taken in January February, May-June or September- October. CIMA exams can be scheduled according to

you.

Q.:How long will it take to complete the course?

Answer:CMA takes a minimum of 6 months to a year to complete while CIMA can take up to 3-4 years.

Q.:What jobs can I get after completing the course?

Answer:CMA certification gets you the following jobs:

Financial risk manager

Financial analyst and planner

Capital Venture

Internal Auditor

Cost accountant and Manager

CIMA certification gets you the following jobs:

Finance analyst

Finance manager

Internal auditor

Financial analyst

Financial accountant

Tax specialist

Q.:What would be my average salary?

Answer:A CMAs salary would be $33,500 which would be approx. INR 21,30,000.

A CIMAs salary would be $ 33,000 which would be approx. INR 21,00,000.

Q.:Where should you go to visit the official websites?

Answer:CMA- www.imanet.org/cma-certification/

CIMA- http://www.cimaglobal.com/

COMPARISION

CIMA

CMA

Certification

Chartered institute of management accountants

Institute of management accountants (IMA)

Country

UK and Commonwealth

USA, China, India, Middle-east

Topics covered

Strategic management

Risk management

Financial strategy

Project and Relationship management

Advanced management accounting

Advanced financial reporting

Organisational management

Management accounting

Financial reporting

Taxation

Registration fee

$99 USD

Financial planning

Performance and control

Financial decision making

Performance management

Cost accounting

Risk management

Decision Analysis

Professional Ethics

Planning, budgeting and forecasting

Investment decisions

Student - $476.25 USD

Professional - $1030 USD

Sets of examination

16 papers 5 level exams

2 papers

Exam dates

You can schedule your exams accordingly.

Jan-feb, may-jun, sep-oct

Minimum Time duration

3-4 years.

6 months-1year

Median salary

$ 33,318; INR 2,117,241

$33,573; INR 21,33,076

Future Prospects/ideal for

Finance analyst

Finance manager

Internal auditor

Financial risk manager

Financial planner and analyst

Capital venture

Website

Financial analyst

Financial accountant

Internal auditor

Cost accountant and manager

Tax specialist

http://www.cimaglobal.com/

www.imanet.org/cma-certific

Vous aimerez peut-être aussi

- Professional: $245 Academic: $135 Student: $39 Two-Year Student: $78Document5 pagesProfessional: $245 Academic: $135 Student: $39 Two-Year Student: $78anwarPas encore d'évaluation

- CMA Handbook PDFDocument13 pagesCMA Handbook PDFAsterism LonePas encore d'évaluation

- Cma CourseworkDocument8 pagesCma Courseworkafjwoovfsmmgff100% (2)

- Certified Management Accountant (CMA), US Part 1 - Financial Planning, Performance and Analytics - 2020 Study BookDocument256 pagesCertified Management Accountant (CMA), US Part 1 - Financial Planning, Performance and Analytics - 2020 Study BookKarthiPas encore d'évaluation

- CMA Handbook 2017 PDFDocument30 pagesCMA Handbook 2017 PDFDank ShankPas encore d'évaluation

- PDFDocument3 pagesPDFMustafa Tevfik ÖzkanPas encore d'évaluation

- Of Certified Management Accountant: Ractising The ProfessionDocument8 pagesOf Certified Management Accountant: Ractising The ProfessionTiago PereiraPas encore d'évaluation

- Diploma in Accounting Program BUSI 293 I PDFDocument10 pagesDiploma in Accounting Program BUSI 293 I PDFSheena MachinjiriPas encore d'évaluation

- CMA PresentationDocument34 pagesCMA PresentationBinuNairPas encore d'évaluation

- Letter of Explaination Based On CAIPS ReportDocument2 pagesLetter of Explaination Based On CAIPS Report47ksrPas encore d'évaluation

- MSC Finance and Accounting Programme Handbook 2022-23Document57 pagesMSC Finance and Accounting Programme Handbook 2022-23rodrigoPas encore d'évaluation

- TYB - Practical Questions - Final PDFDocument321 pagesTYB - Practical Questions - Final PDFChandana RajasriPas encore d'évaluation

- SwotDocument3 pagesSwotShahebazPas encore d'évaluation

- CIA P1 Plan A4 PDFDocument15 pagesCIA P1 Plan A4 PDFMohammed DonzoPas encore d'évaluation

- Management Accounting ThesisDocument8 pagesManagement Accounting Thesisafkogsfea100% (2)

- AUDITING Final Exam PaperDocument3 pagesAUDITING Final Exam PaperSajid IqbalPas encore d'évaluation

- Management Level Exam Blueprints 2023 2024 Final For WebDocument29 pagesManagement Level Exam Blueprints 2023 2024 Final For WebSANG HOANG THANHPas encore d'évaluation

- ARMANI F1 (1100 MCQS) ExDocument326 pagesARMANI F1 (1100 MCQS) ExSeeta Gilbert100% (1)

- Cost Accounting Vol II PDFDocument464 pagesCost Accounting Vol II PDFAnonymous qAegy6G100% (2)

- Audit and Assurance Syllabus 2015Document12 pagesAudit and Assurance Syllabus 2015Maddie GreenPas encore d'évaluation

- Top 25 Tricks/tips To Crack GATE 2013-14 Entrance Exam: New Link UpdatedDocument5 pagesTop 25 Tricks/tips To Crack GATE 2013-14 Entrance Exam: New Link UpdatedAnkur YashPas encore d'évaluation

- Accounting For Managers PurdueDocument6 pagesAccounting For Managers PurdueEy ZalimPas encore d'évaluation

- Fidelity 529 Unique PlanDocument75 pagesFidelity 529 Unique PlanJohn MichalakisPas encore d'évaluation

- CMA Prospectus Syl 2016Document68 pagesCMA Prospectus Syl 2016Niraj AgarwalPas encore d'évaluation

- Research TopicsDocument10 pagesResearch Topicspgk242003Pas encore d'évaluation

- Part1 SU1 2015 Rev2Document86 pagesPart1 SU1 2015 Rev2Mustafa Tevfik ÖzkanPas encore d'évaluation

- f6 Zaf PresentationDocument26 pagesf6 Zaf PresentationlmuzivaPas encore d'évaluation

- ACCA F5: Chapter 13 - Divisional Performance Measurement and Transfer PricingDocument8 pagesACCA F5: Chapter 13 - Divisional Performance Measurement and Transfer PricingRajeshwar NagaisarPas encore d'évaluation

- 02 Fundamentals of Business AnalysisDocument21 pages02 Fundamentals of Business AnalysisFree-Your-MindPas encore d'évaluation

- Bus 101Document7 pagesBus 101Bernard Vincent Guitan MineroPas encore d'évaluation

- The Finance Career Cluster ExamDocument35 pagesThe Finance Career Cluster ExamShantamPas encore d'évaluation

- Auditing Theory Question BankDocument38 pagesAuditing Theory Question BankBapu FinuPas encore d'évaluation

- f8 RQB 15 Sample PDFDocument98 pagesf8 RQB 15 Sample PDFChandni VariaPas encore d'évaluation

- Best Practices For Successful Statement of Purpose Writing: by Madhavi Mohit PatelDocument15 pagesBest Practices For Successful Statement of Purpose Writing: by Madhavi Mohit PatelDeepika Jain AspirePas encore d'évaluation

- University of HertfordshireDocument92 pagesUniversity of Hertfordshireshafaq khan100% (3)

- Master Thesis in Accounting and Finance PDFDocument5 pagesMaster Thesis in Accounting and Finance PDFrachellelewiskansascity100% (2)

- Fin701 Module3Document22 pagesFin701 Module3Krista CataldoPas encore d'évaluation

- Become A CPADocument10 pagesBecome A CPAheba_abdelkader_1Pas encore d'évaluation

- Business PerformanceDocument42 pagesBusiness Performancenerurkar_tusharPas encore d'évaluation

- Testprep Gmat Math Test PDFDocument4 pagesTestprep Gmat Math Test PDFedfarmerPas encore d'évaluation

- Case StudyDocument5 pagesCase StudyAshwin KumarPas encore d'évaluation

- Mba Proposal1839Document100 pagesMba Proposal1839w5waPas encore d'évaluation

- Private Equity Investment Thesis PDFDocument4 pagesPrivate Equity Investment Thesis PDFafcmrdbef100% (2)

- Top 20 Accounting and Finance CertificationsDocument28 pagesTop 20 Accounting and Finance Certificationstimmy montgomery100% (1)

- T4 Mocks - Hafiz Muhammad Adnan (Sialkot)Document67 pagesT4 Mocks - Hafiz Muhammad Adnan (Sialkot)adnan79100% (1)

- Munawar Hameed CVDocument5 pagesMunawar Hameed CVMunawar Hameed MangalwalaPas encore d'évaluation

- 2019 인도네시아 - 진출전략 PDFDocument79 pages2019 인도네시아 - 진출전략 PDFKelly LaPas encore d'évaluation

- Notes For Letter of ExplanationDocument4 pagesNotes For Letter of ExplanationHHPas encore d'évaluation

- PHI Learning Business Management May 2022 PDFDocument212 pagesPHI Learning Business Management May 2022 PDFShiva Johri100% (1)

- ACCA Challenge Exam Candidate Guide-1Document11 pagesACCA Challenge Exam Candidate Guide-1Aslam SiddiqPas encore d'évaluation

- Business Leadership Dissertation TopicsDocument6 pagesBusiness Leadership Dissertation TopicsWhereToBuyPapersSingapore100% (1)

- Capital Bud Getting PDFDocument27 pagesCapital Bud Getting PDFBea CruzPas encore d'évaluation

- Assu - Chapter 10 (Documentation)Document10 pagesAssu - Chapter 10 (Documentation)Tanvir PrantoPas encore d'évaluation

- 2 - 5 Define Team Dynamics and PerformanceDocument28 pages2 - 5 Define Team Dynamics and Performanceapi-101303155Pas encore d'évaluation

- Uniform CPA Exam Guide Rev 082913Document4 pagesUniform CPA Exam Guide Rev 082913fluffynutz123Pas encore d'évaluation

- CMA Notes and ReviewerDocument10 pagesCMA Notes and ReviewerMarwin Ace KaiklianPas encore d'évaluation

- BrochureDocument14 pagesBrochureMuhammad Ziaur RahmanPas encore d'évaluation

- CMA Exam Guide: What Are The CMA Exams, and How To Pass ThemDocument15 pagesCMA Exam Guide: What Are The CMA Exams, and How To Pass ThemFire FactPas encore d'évaluation

- CMA The Essential CredentialDocument16 pagesCMA The Essential CredentialmUnTaDaPas encore d'évaluation

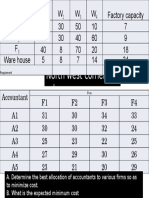

- Exam - Final - 11Document7 pagesExam - Final - 11Yusuf HusseinPas encore d'évaluation

- Except The: Income Sharing RatioDocument1 pageExcept The: Income Sharing RatioYusuf HusseinPas encore d'évaluation

- Lesson ThreeDocument14 pagesLesson ThreeYusuf HusseinPas encore d'évaluation

- Resource Usage: Issues Covered in This ChapterDocument21 pagesResource Usage: Issues Covered in This ChapterYusuf HusseinPas encore d'évaluation

- Lec 1 - Introduction To Wireless CommunicationDocument60 pagesLec 1 - Introduction To Wireless CommunicationYusuf HusseinPas encore d'évaluation

- QuizzDocument1 pageQuizzYusuf HusseinPas encore d'évaluation

- RSH - Qam11 - Excel and Excel QM Explsm2010Document153 pagesRSH - Qam11 - Excel and Excel QM Explsm2010Yusuf HusseinPas encore d'évaluation

- Chapter Four: Entering Beginning BalancesDocument4 pagesChapter Four: Entering Beginning BalancesYusuf HusseinPas encore d'évaluation

- Example DVDDocument17 pagesExample DVDYusuf HusseinPas encore d'évaluation

- Yaaqshiid: 1 Xaafadaha, Laamaha Iyo Waax-AhaDocument4 pagesYaaqshiid: 1 Xaafadaha, Laamaha Iyo Waax-AhaYusuf HusseinPas encore d'évaluation

- Sample Solution: Midterm Exam - 300 PointsDocument4 pagesSample Solution: Midterm Exam - 300 PointsYusuf HusseinPas encore d'évaluation

- Exam 2 Sample SolutionDocument6 pagesExam 2 Sample SolutionYusuf HusseinPas encore d'évaluation

- Data and Process Modeling: Husein OsmanDocument17 pagesData and Process Modeling: Husein OsmanYusuf HusseinPas encore d'évaluation

- Chapter 1Document29 pagesChapter 1Yusuf Hussein100% (2)

- Chapter EightDocument11 pagesChapter EightYusuf HusseinPas encore d'évaluation

- Solution of Assignment Eco-04 Case: Mike (The Plumber) - A True StoryDocument5 pagesSolution of Assignment Eco-04 Case: Mike (The Plumber) - A True StoryYusuf HusseinPas encore d'évaluation

- Key Concepts: Week 5 Lesson 3: Economic Order Quantity (EOQ) ExtensionsDocument5 pagesKey Concepts: Week 5 Lesson 3: Economic Order Quantity (EOQ) ExtensionsYusuf HusseinPas encore d'évaluation

- CH 3 Accounting For Mudharabah Financing 1Document32 pagesCH 3 Accounting For Mudharabah Financing 1Yusuf Hussein40% (5)

- Capital BudgetDocument124 pagesCapital BudgetYusuf HusseinPas encore d'évaluation

- COB291, Section - or Time of Class - Home Work Decision AnalysisDocument8 pagesCOB291, Section - or Time of Class - Home Work Decision AnalysisYusuf HusseinPas encore d'évaluation

- Binomial Distribution WorksheetDocument2 pagesBinomial Distribution WorksheetYusuf Hussein100% (1)

- MSci331 - Simplex and Big MDocument34 pagesMSci331 - Simplex and Big MYusuf HusseinPas encore d'évaluation

- Research Methods - STA630 Spring 2007 Assignment 05Document2 pagesResearch Methods - STA630 Spring 2007 Assignment 05Yusuf HusseinPas encore d'évaluation

- CH I Introudction AISDocument11 pagesCH I Introudction AISYusuf HusseinPas encore d'évaluation

- X P (X) XP (X) (X - E (X) ) P (X) : To See The Formulas, Hold Down The CTRL Key and Press The ' (Grave Accent) KeyDocument7 pagesX P (X) XP (X) (X - E (X) ) P (X) : To See The Formulas, Hold Down The CTRL Key and Press The ' (Grave Accent) KeyYusuf HusseinPas encore d'évaluation

- Chapter 6 AnswersDocument8 pagesChapter 6 AnswersYusuf HusseinPas encore d'évaluation

- Chapter 6 Cost AccountingDocument12 pagesChapter 6 Cost AccountingYusuf HusseinPas encore d'évaluation

- Explicit TeachingDocument8 pagesExplicit TeachingCrisanta Dicman UedaPas encore d'évaluation

- SubwayDocument5 pagesSubwaykashfi350% (1)

- Wesleyan University - Philippines: Surgical Scrub Cases (Major)Document5 pagesWesleyan University - Philippines: Surgical Scrub Cases (Major)Kristine CastilloPas encore d'évaluation

- GMath2Q3Week7Day1 4Document15 pagesGMath2Q3Week7Day1 4Jerick JohnPas encore d'évaluation

- Archmodels Vol 171 PDFDocument16 pagesArchmodels Vol 171 PDFMrDingo007Pas encore d'évaluation

- School Form 5 (SF 5) Report On Promotion and Progress & AchievementDocument1 pageSchool Form 5 (SF 5) Report On Promotion and Progress & AchievementMK TengcoPas encore d'évaluation

- Caribbean Studies Paper 1 - Specimen PaperDocument6 pagesCaribbean Studies Paper 1 - Specimen PaperWarren88% (8)

- DLSMC Policy On Grants: International Research Presentation and Continuing Medical Education TrainingDocument4 pagesDLSMC Policy On Grants: International Research Presentation and Continuing Medical Education TrainingqwertyuiopkmrrPas encore d'évaluation

- Aerofood ACSDocument4 pagesAerofood ACSELya Poernama DewyPas encore d'évaluation

- K-8 Lunch Menu December 2014Document1 pageK-8 Lunch Menu December 2014Medford Public Schools and City of Medford, MAPas encore d'évaluation

- SolicitationDocument6 pagesSolicitationAlaine BaletaPas encore d'évaluation

- Pre Confirmation Appraisal Form - Mr. K RavikumarDocument7 pagesPre Confirmation Appraisal Form - Mr. K RavikumarRn KisPas encore d'évaluation

- Questionnaire Échelle Subjective Lysholm GilquistDocument5 pagesQuestionnaire Échelle Subjective Lysholm GilquistHoudhaifa KlaiPas encore d'évaluation

- JBI Nationwide 2023 Group of SubrabasDocument6 pagesJBI Nationwide 2023 Group of SubrabasDonnabel BicadaPas encore d'évaluation

- Deepankar BishtDocument3 pagesDeepankar BishtRahul YadavPas encore d'évaluation

- Arch 112Document2 pagesArch 112munimPas encore d'évaluation

- Final Evaluation Ingles 4Document8 pagesFinal Evaluation Ingles 4Orlando CastilloPas encore d'évaluation

- Chapter 15 Vocab AP PsychDocument2 pagesChapter 15 Vocab AP PsychTylerPas encore d'évaluation

- Elevator PitchDocument2 pagesElevator PitchBianca SandovalPas encore d'évaluation

- EDT 323 Ass # 1-LeeDocument7 pagesEDT 323 Ass # 1-LeeLeedon HepoePas encore d'évaluation

- Course Outline Media Uses ARTS2093Document12 pagesCourse Outline Media Uses ARTS2093Stephanie LeePas encore d'évaluation

- Mc101 Nur Micropara OrientationDocument22 pagesMc101 Nur Micropara OrientationAskYahGirl ChannelPas encore d'évaluation

- Striving For Accuracy LPDocument2 pagesStriving For Accuracy LPapi-382709966Pas encore d'évaluation

- Early Childhood DevelopmentDocument100 pagesEarly Childhood DevelopmentJoviner Yabres LactamPas encore d'évaluation

- Pap 2019 PDFDocument630 pagesPap 2019 PDFAnoopPas encore d'évaluation

- Effects of Child Marriage On Girls Education and EmpowermentDocument8 pagesEffects of Child Marriage On Girls Education and EmpowermentAbdulPas encore d'évaluation

- The Fourteen Domains of Literacy in The Philippines MTB-MLE CurriculumDocument32 pagesThe Fourteen Domains of Literacy in The Philippines MTB-MLE CurriculumKaren Bisaya100% (1)

- Exploring Factors Influencing The Non-Completion of Theses Among Teachers Pursuing A Master's Degree: A Case Study AnalysisDocument10 pagesExploring Factors Influencing The Non-Completion of Theses Among Teachers Pursuing A Master's Degree: A Case Study AnalysisPsychology and Education: A Multidisciplinary JournalPas encore d'évaluation

- 7564 L3 Qualification Handbook v2Document143 pages7564 L3 Qualification Handbook v2Achmad Deddy FatoniPas encore d'évaluation

- CLASS PROGRAM S.Y. 2020-2021 2 Semester: Lyceum-Northwestern University Urdaneta CampusDocument2 pagesCLASS PROGRAM S.Y. 2020-2021 2 Semester: Lyceum-Northwestern University Urdaneta CampusJohnson FernandezPas encore d'évaluation