Académique Documents

Professionnel Documents

Culture Documents

Inventory Estimation

Transféré par

ralphalonzoDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Inventory Estimation

Transféré par

ralphalonzoDroits d'auteur :

Formats disponibles

Page 1 of 2

REVIEW OF FINANCIAL ACCOUNTING THEORY AND PRACTICE

INVENTORY ESTIMATION

1. Benguet Companys accounting records indicated the following for 2005:

Inventory, January 1

Purchases

Sales

P6,000,000

20,000,000

30,000,000

A physical inventory taken on December 31, 2005 resulted in an ending inventory of

P4,500,000. The gross profit on sales remained constant at 30% in recent years.

Benguet suspects some inventory may have been taken by a new employee. At

December 31, 2005 what is the estimated cost of missing inventory?

a. P5,000,000

c. P500,000

b. P4,500,000

d. P

0

2. The Atok Corporation was organized on January 1, 2004. On December 31, 2005, the

corporation lost most of its inventory in a warehouse fire just before the year-end count

of inventory was to take place. Data from the records disclosed the following:

Beginning inventory, January 1

Purchases

Purchases returns and allowances

Sales

Sales returns and allowances

2004

P

0

4,300,000

230,600

3,940,000

80,000

2005

P1,020,000

3,460,000

323,000

4,180,000

100,000

On January 1, 2005, the Corporations pricing policy was changed so that the gross

profit rate would be three percentage points higher than the one earned in 2004.

Salvaged undamaged merchandise was marked to sell at P120,000 while damaged

merchandise was marked to sell at P80,000 had an estimated realizable value of

P18,000.

How much is the inventory loss due to fire?

a. P918,200

b. P947,000

c. P856,200

d. P824,600

3. The work-in-process inventory of Bakun Company were completely destroyed by fire

on June 1, 2005. You were able to establish physical inventory figures as follows:

Raw materials

Work-in-process

Finished goods

January 1, 2005

P 60,000

200,000

280,000

June 1, 2005

P120,000

240,000

Sales from January 1 to May 31, were P546,750. Purchases of raw materials were

P200,000 and freight on purchases, P30,000. Direct labor during the period was

P160,000. It was agreed with insurance adjusters than an average gross profit rate of

35% based on cost be used and that direct labor cost was 160% of factory overhead.

The work in process inventory destroyed as computed by the adjuster

a. P314,612

c. P185,000

b. P366,000

d. P265,000

Page 2 of 2

4. Tublay uses the retail inventory method to approximate the lower of average cost or

market. The following information is available for the current year:

Cost

P 1,300,000

18,000,000

400,000

600,000

300,000

400,000

Beginning inventory

Purchases

Freight in

Purchase returns

Purchase allowances

Departmental transfer in

Net markups

Net markdowns

Sales

Sales discounts

Employee discounts

Retail

P 2,600,000

29,200,000

1,000,000

600,000

600,000

2,000,000

24,400,000

200,000

600,000

What should be reported as the estimated cost of inventory at the end of the current

year?

a. P3,120,000

c. P3,000,000

b. P3,200,000

d. P3,840,000

5. Trinidad Company uses the average cost retail method to estimate its inventory. Data

relating to the inventory at December 31, 2005 are:

Inventory, January 1

Purchases

Net markups

Net markdowns

Sales

Estimated normal shoplifting losses

Estimated normal shrinkage is 5% of sales

Cost

P 2,000,000

10,600,000

Retail

P3,000,000

14,000,000

1,600,000

600,000

12,000,000

400,000

Trinidads cost of goods sold for the year ended December 31, 2004 is

a. P9,100,000

c. P8,400,000

b. P8,680,000

d. P7,700,000

6. Mankayan Company uses the first-in, first-out retail method of inventory valuation. The

following information is available:

Cost

P 2,500,000

13,500,000

Beginning inventory

Purchases

Net markups

Net markdowns

Sales

What would be the estimated cost of the ending inventory?

a. P7,000,000

c. P5,110,000

b. P5,250,000

d. P4,750,000

- end -

Retail

4,000,000

16,000,000

3,000,000

1,000,000

15,000,000

Vous aimerez peut-être aussi

- XDocument2 pagesXjaymark canayaPas encore d'évaluation

- Audit of Invest. in Equity and Debt SecuritiesDocument23 pagesAudit of Invest. in Equity and Debt SecuritiesJoseph SalidoPas encore d'évaluation

- D8Document11 pagesD8neo14100% (1)

- FAR q1q2Document7 pagesFAR q1q2Leane MarcoletaPas encore d'évaluation

- Problem 10-1 Problem 10-2Document13 pagesProblem 10-1 Problem 10-2Yen YenPas encore d'évaluation

- Conceptual Framework and Accounting Standards: Janesene N. Sol MWF 1:00-2:00 PMDocument4 pagesConceptual Framework and Accounting Standards: Janesene N. Sol MWF 1:00-2:00 PMJanesene SolPas encore d'évaluation

- Job OrderDocument9 pagesJob OrderMaybellePas encore d'évaluation

- 1Document2 pages1Your MaterialsPas encore d'évaluation

- Inventories Wit Ans Key (Pria)Document22 pagesInventories Wit Ans Key (Pria)Samantha Marie Arevalo100% (2)

- Investment in Equity Securities 2Document2 pagesInvestment in Equity Securities 2miss independentPas encore d'évaluation

- 5 6188442313212035099Document19 pages5 6188442313212035099JamiePas encore d'évaluation

- Auditibg Problems Purchase CommitmentDocument1 pageAuditibg Problems Purchase Commitmentnivea gumayagay0% (1)

- Wasting AssetsDocument4 pagesWasting AssetsjomelPas encore d'évaluation

- Conceptual FrameworkDocument9 pagesConceptual FrameworkAveryl Lei Sta.Ana0% (1)

- InventoriesDocument64 pagesInventoriesMarjorie PalmaPas encore d'évaluation

- FAR - Biological Assets and Agricultural ProduceDocument2 pagesFAR - Biological Assets and Agricultural ProduceMariella Catacutan67% (3)

- CasDocument29 pagesCasJunneth Pearl Homoc0% (1)

- Review 105 - Day 15 P1Document12 pagesReview 105 - Day 15 P1John De Guzman100% (1)

- INVENTORYDocument4 pagesINVENTORYNhemia ElevencionadoPas encore d'évaluation

- Exercise 1: Assignment: Accounitng For Materials (Adapted)Document2 pagesExercise 1: Assignment: Accounitng For Materials (Adapted)Charles TuazonPas encore d'évaluation

- ReceivablesDocument9 pagesReceivablesDiane Pascual0% (5)

- Audit of InventoryDocument7 pagesAudit of InventoryDianne Antoinette Basallo0% (1)

- ReviewerDocument5 pagesReviewermaricielaPas encore d'évaluation

- Bsa 1201-Financial Accounting and Reporting Preliminary Departmental Exam Reviewer Topic CoverageDocument15 pagesBsa 1201-Financial Accounting and Reporting Preliminary Departmental Exam Reviewer Topic CoverageChjxksjsgskPas encore d'évaluation

- Winding UpDocument9 pagesWinding UpJedaiah CruzPas encore d'évaluation

- Cash and CequizDocument5 pagesCash and CequizMaria Emarla Grace CanozaPas encore d'évaluation

- P1.004 - PPE Depreciation and Derecognition (Illustrative Problems)Document2 pagesP1.004 - PPE Depreciation and Derecognition (Illustrative Problems)Patrick Kyle AgraviadorPas encore d'évaluation

- Inventory LatojaDocument2 pagesInventory Latojalisa juganPas encore d'évaluation

- Pract 1Document12 pagesPract 1Kylie TarnatePas encore d'évaluation

- This Study Resource Was: C. P6,050,000 D. P53,900Document2 pagesThis Study Resource Was: C. P6,050,000 D. P53,900Nah HamzaPas encore d'évaluation

- Cash and Cash EquivalentsDocument6 pagesCash and Cash EquivalentsPamela Mae PlatonPas encore d'évaluation

- Finals Q3 - PPE Problems PDFDocument8 pagesFinals Q3 - PPE Problems PDFCzerielle Queens0% (1)

- This Study Resource Was: Available For Use 10,080,000Document8 pagesThis Study Resource Was: Available For Use 10,080,000Kez MaxPas encore d'évaluation

- Problems Audit of InvestmentsDocument15 pagesProblems Audit of InvestmentsKm de Leon75% (4)

- Quiz - Inventories CostingDocument1 pageQuiz - Inventories CostingAna Mae Hernandez67% (3)

- MB2 2013 Ap Set BDocument6 pagesMB2 2013 Ap Set BMary Queen Ramos-UmoquitPas encore d'évaluation

- ACt1104 Final Quiz No. 1wit AnsDocument7 pagesACt1104 Final Quiz No. 1wit AnsDyenPas encore d'évaluation

- Audit of Investments - Set ADocument4 pagesAudit of Investments - Set AZyrah Mae SaezPas encore d'évaluation

- Learning Guide No. 3 - AnswersDocument10 pagesLearning Guide No. 3 - AnswersXaivri Ylaina VriesePas encore d'évaluation

- Midterm Exam No. 2Document1 pageMidterm Exam No. 2Anie MartinezPas encore d'évaluation

- 05 - Receivable Financing and Notes ReceivableDocument2 pages05 - Receivable Financing and Notes Receivableralphalonzo100% (3)

- P1 Day1 RMDocument4 pagesP1 Day1 RMabcdefg100% (2)

- Review 105 - Day 17 P1: How Much of The Proceeds From The Issuance of Convertible Bonds Should Be Allocated To Equity?Document10 pagesReview 105 - Day 17 P1: How Much of The Proceeds From The Issuance of Convertible Bonds Should Be Allocated To Equity?Maryjel17Pas encore d'évaluation

- Cost Accounting Quizzer No. 1: Basic ConceptsDocument11 pagesCost Accounting Quizzer No. 1: Basic ConceptsLuming100% (1)

- Father Saturnino Urios University Accountancy Program AIR-Cluster 1 (Drill #2)Document11 pagesFather Saturnino Urios University Accountancy Program AIR-Cluster 1 (Drill #2)marygraceomacPas encore d'évaluation

- Estimating InventoriesDocument4 pagesEstimating InventoriesNah Hamza0% (1)

- Financial Accounting - ReceivablesDocument7 pagesFinancial Accounting - ReceivablesKim Cristian MaañoPas encore d'évaluation

- Prelim Review Docx 427399963 Prelim ReviewDocument42 pagesPrelim Review Docx 427399963 Prelim ReviewMarjorie PalmaPas encore d'évaluation

- Retake: Financial Accounting and ReportingDocument21 pagesRetake: Financial Accounting and ReportingJan ryanPas encore d'évaluation

- Applied Auditing Audit of InvestmentsDocument2 pagesApplied Auditing Audit of InvestmentsCar Mae LaPas encore d'évaluation

- Accounting For Foreign Currency TransactionDocument3 pagesAccounting For Foreign Currency TransactionWilmar AbriolPas encore d'évaluation

- CLINCHERDocument1 pageCLINCHERJerauld BucolPas encore d'évaluation

- Total Cost: C o Ototl CastDocument10 pagesTotal Cost: C o Ototl CastCeline FloranzaPas encore d'évaluation

- Final Term Quiz 3 On Cost of Production Report - FIFO CostingDocument4 pagesFinal Term Quiz 3 On Cost of Production Report - FIFO CostingYhenuel Josh LucasPas encore d'évaluation

- Equity Retained Earnings 2Document2 pagesEquity Retained Earnings 2Marked ReversePas encore d'évaluation

- AP 5905Q InventoriesDocument4 pagesAP 5905Q Inventoriesxxxxxxxxx100% (1)

- Review of Financial Accounting Theory and PracticeDocument2 pagesReview of Financial Accounting Theory and PracticeMary Jullianne Caile SalcedoPas encore d'évaluation

- Review of Financial Accounting Theory and PracticeDocument2 pagesReview of Financial Accounting Theory and PracticeMary Jullianne Caile SalcedoPas encore d'évaluation

- 08 - Inventory EstimationDocument2 pages08 - Inventory EstimationROMAR A. PIGAPas encore d'évaluation

- 08 - Inventory EstimationDocument2 pages08 - Inventory EstimationROMAR A. PIGAPas encore d'évaluation

- Sunday Monday Tuesday Wednesday Thursday Friday SaturdayDocument1 pageSunday Monday Tuesday Wednesday Thursday Friday SaturdayralphalonzoPas encore d'évaluation

- PledgeDocument11 pagesPledgeralphalonzoPas encore d'évaluation

- T02 - Capital BudgetingDocument121 pagesT02 - Capital Budgetingralphalonzo75% (4)

- FAR - Conceptual FrameworkDocument8 pagesFAR - Conceptual FrameworkralphalonzoPas encore d'évaluation

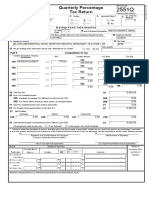

- Quarterly Percentage Tax Return: 12 - DecemberDocument1 pageQuarterly Percentage Tax Return: 12 - DecemberralphalonzoPas encore d'évaluation

- 08 Investmentquestfinal PDFDocument13 pages08 Investmentquestfinal PDFralphalonzo0% (1)

- Deductions From Gross IncomeDocument1 pageDeductions From Gross IncomeralphalonzoPas encore d'évaluation

- RFBT - Directors and Stockholders' MeetingDocument1 pageRFBT - Directors and Stockholders' MeetingralphalonzoPas encore d'évaluation

- Estate Taxation - Oct 2017 - GCC - Self Test - Quiz 1Document4 pagesEstate Taxation - Oct 2017 - GCC - Self Test - Quiz 1ralphalonzoPas encore d'évaluation

- MAS - DOL Vs DFLDocument3 pagesMAS - DOL Vs DFLralphalonzoPas encore d'évaluation

- Cost-Volume-Profit Relationslt R,) 56. The Company's Overall Contribution Margin Ratio Fur The Sales Mix Expected Is H. 45%. D. 60%Document10 pagesCost-Volume-Profit Relationslt R,) 56. The Company's Overall Contribution Margin Ratio Fur The Sales Mix Expected Is H. 45%. D. 60%ralphalonzoPas encore d'évaluation

- FAR - DerivativesDocument1 pageFAR - DerivativesralphalonzoPas encore d'évaluation

- TAX - Gross Estate RemindersDocument2 pagesTAX - Gross Estate RemindersralphalonzoPas encore d'évaluation

- PRTC at 1st PreboardDocument11 pagesPRTC at 1st PreboardralphalonzoPas encore d'évaluation

- Donor - S Tax - Oct 2017 - GCC - Self Test - Quiz 2Document3 pagesDonor - S Tax - Oct 2017 - GCC - Self Test - Quiz 2ralphalonzoPas encore d'évaluation

- PRTC AP First PBDocument9 pagesPRTC AP First PBralphalonzoPas encore d'évaluation

- PRTC TOA First PreboardDocument9 pagesPRTC TOA First PreboardralphalonzoPas encore d'évaluation

- Afar AUD FAR MAS RFBT TAX TheoryDocument1 pageAfar AUD FAR MAS RFBT TAX TheoryralphalonzoPas encore d'évaluation

- PRTC P2 1st PreboardDocument10 pagesPRTC P2 1st PreboardRommel Royce0% (1)

- HyperinflationDocument2 pagesHyperinflationralphalonzoPas encore d'évaluation

- PRTC Mas First PBDocument11 pagesPRTC Mas First PBralphalonzo100% (2)

- PRTC Mas First PBDocument11 pagesPRTC Mas First PBralphalonzo100% (2)

- Quiz 5 Activity Based Costing SolutionsDocument4 pagesQuiz 5 Activity Based Costing SolutionsralphalonzoPas encore d'évaluation

- A. Variable Costs, P18 Million. B. Fixed Costs. P12 Million. C. Operating Income, P4 Million. D. Break-Even Sales Volume, P20 MillionDocument11 pagesA. Variable Costs, P18 Million. B. Fixed Costs. P12 Million. C. Operating Income, P4 Million. D. Break-Even Sales Volume, P20 Millionralphalonzo100% (1)

- MAS.M-1405 Cost of Capital Straight ProblemsDocument12 pagesMAS.M-1405 Cost of Capital Straight ProblemsralphalonzoPas encore d'évaluation

- ? (Ultipft Choice Questions: Supporting Analysis/ComputationDocument11 pages? (Ultipft Choice Questions: Supporting Analysis/Computationralphalonzo100% (1)

- Partnership Exercises Answers and ExplanationsDocument25 pagesPartnership Exercises Answers and Explanationsralphalonzo100% (1)

- Quiz 12 Budgeting and Profit Planning SolutionsDocument6 pagesQuiz 12 Budgeting and Profit Planning Solutionsralphalonzo100% (1)

- 21 - Intangible AssetsDocument6 pages21 - Intangible AssetsralphalonzoPas encore d'évaluation

- Theory of AccountsDocument7 pagesTheory of AccountsralphalonzoPas encore d'évaluation

- Master Budget 1Document17 pagesMaster Budget 1Noel Diamos AllanaraizPas encore d'évaluation

- MS ASE20104 September 2018 - FINAL REVISEDDocument17 pagesMS ASE20104 September 2018 - FINAL REVISEDAung Zaw HtwePas encore d'évaluation

- Discuss The Impact of Depreciation Expense On The Cash Flow AnalysisDocument2 pagesDiscuss The Impact of Depreciation Expense On The Cash Flow AnalysisDjahan RanaPas encore d'évaluation

- Equirus Securities Initiating Coverage GAEX 08.01.2018-Gujarat Ambuja ExportsDocument41 pagesEquirus Securities Initiating Coverage GAEX 08.01.2018-Gujarat Ambuja Exportsrchawdhry123100% (2)

- CFA Level I Revision Day IIDocument138 pagesCFA Level I Revision Day IIAspanwz SpanwzPas encore d'évaluation

- Accounting Principles and Standards: For Financial AnalystsDocument91 pagesAccounting Principles and Standards: For Financial AnalystsRamona VoinescuPas encore d'évaluation

- Makivik Structural Review Committee Report - AGM2017Document22 pagesMakivik Structural Review Committee Report - AGM2017NunatsiaqNewsPas encore d'évaluation

- Soal-Soal Capital Budgeting # 1Document2 pagesSoal-Soal Capital Budgeting # 1Danang0% (2)

- IFRS 14 Regulatory Deferral AccountsDocument24 pagesIFRS 14 Regulatory Deferral AccountsMarc Eric RedondoPas encore d'évaluation

- G.R. No. 121413Document5 pagesG.R. No. 121413Aleana Cecilia BantoloPas encore d'évaluation

- MRKT 434 Case 2 - Durr EnvironmentalDocument4 pagesMRKT 434 Case 2 - Durr EnvironmentalRohita50% (2)

- No Arbitrage PrincipleDocument4 pagesNo Arbitrage PrincipleMaurya BandaPas encore d'évaluation

- Billionaire Bonanza - The Forbes 400 and The Rest of Us - IPSDocument28 pagesBillionaire Bonanza - The Forbes 400 and The Rest of Us - IPSPrince Tafari MartinPas encore d'évaluation

- Case Laws - SUPREME COURT JUDGEMENT IN SAHARA INDIA REAL ESTATE CORP LTD & Ors VS PDFDocument6 pagesCase Laws - SUPREME COURT JUDGEMENT IN SAHARA INDIA REAL ESTATE CORP LTD & Ors VS PDFkimmiahujaPas encore d'évaluation

- 2020 KSA Audit ReportDocument38 pages2020 KSA Audit ReportMatt BrownPas encore d'évaluation

- Beximco PHARMACEUTICALS LTD ISDocument2 pagesBeximco PHARMACEUTICALS LTD ISSuny ChowdhuryPas encore d'évaluation

- Exercise 1 - Gross Domestic ProductDocument2 pagesExercise 1 - Gross Domestic ProductAl Marvin SantosPas encore d'évaluation

- Chap 2 Dess Strategic Management SlideDocument37 pagesChap 2 Dess Strategic Management SlideTMPas encore d'évaluation

- BCDA V CIRDocument2 pagesBCDA V CIRSelynn CoPas encore d'évaluation

- Financial Accounting 04Document56 pagesFinancial Accounting 04nmoiuonu87Pas encore d'évaluation

- CA Inter FMEF Suggested Answers For May 2019Document19 pagesCA Inter FMEF Suggested Answers For May 2019Sayyamee BedmuthaPas encore d'évaluation

- Balnce Sheet Sam 3Document2 pagesBalnce Sheet Sam 3Samuel DebebePas encore d'évaluation

- Eagle Security v. NLRC DigestDocument2 pagesEagle Security v. NLRC Digestada9ablaoPas encore d'évaluation

- Mathematical Literacy P1 GR 12 Exemplar 2021 EngDocument15 pagesMathematical Literacy P1 GR 12 Exemplar 2021 EngJeketera Shadreck67% (21)

- 7 Income Tax Act 1Document161 pages7 Income Tax Act 1Noneya BidnessPas encore d'évaluation

- Eastman Kodak's Chapter 11 DeclarationDocument96 pagesEastman Kodak's Chapter 11 DeclarationDealBook100% (1)

- The Role of SEBI in Corporate GovernanceDocument8 pagesThe Role of SEBI in Corporate GovernanceHarshit Sultania100% (1)

- VouchingDocument2 pagesVouchingguptrakeshPas encore d'évaluation

- China HongxingDocument12 pagesChina Hongxing靳雪娇33% (3)

- Chapter 15 Investment, Time, and Capital Markets: Teaching NotesDocument65 pagesChapter 15 Investment, Time, and Capital Markets: Teaching NotesMohit ChetwaniPas encore d'évaluation

- Getting to Yes: How to Negotiate Agreement Without Giving InD'EverandGetting to Yes: How to Negotiate Agreement Without Giving InÉvaluation : 4 sur 5 étoiles4/5 (652)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!D'EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Évaluation : 4.5 sur 5 étoiles4.5/5 (14)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindD'EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindÉvaluation : 5 sur 5 étoiles5/5 (231)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)D'EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Évaluation : 4.5 sur 5 étoiles4.5/5 (15)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineD'EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlinePas encore d'évaluation

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesD'EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesPas encore d'évaluation

- The Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingD'EverandThe Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingÉvaluation : 4.5 sur 5 étoiles4.5/5 (760)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsD'EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsPas encore d'évaluation

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)D'EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Évaluation : 4.5 sur 5 étoiles4.5/5 (5)

- Start, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookD'EverandStart, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookÉvaluation : 5 sur 5 étoiles5/5 (4)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeD'EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeÉvaluation : 4 sur 5 étoiles4/5 (21)

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCD'EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCÉvaluation : 5 sur 5 étoiles5/5 (1)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsD'EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsÉvaluation : 5 sur 5 étoiles5/5 (1)

- Ratio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetD'EverandRatio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetÉvaluation : 4.5 sur 5 étoiles4.5/5 (14)

- How to Measure Anything: Finding the Value of "Intangibles" in BusinessD'EverandHow to Measure Anything: Finding the Value of "Intangibles" in BusinessÉvaluation : 4.5 sur 5 étoiles4.5/5 (28)

- The Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceD'EverandThe Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceÉvaluation : 4 sur 5 étoiles4/5 (1)

- Beyond the E-Myth: The Evolution of an Enterprise: From a Company of One to a Company of 1,000!D'EverandBeyond the E-Myth: The Evolution of an Enterprise: From a Company of One to a Company of 1,000!Évaluation : 4.5 sur 5 étoiles4.5/5 (8)

- Project Control Methods and Best Practices: Achieving Project SuccessD'EverandProject Control Methods and Best Practices: Achieving Project SuccessPas encore d'évaluation

- The Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyD'EverandThe Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyPas encore d'évaluation

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)D'EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Évaluation : 4 sur 5 étoiles4/5 (33)

- Small Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessD'EverandSmall Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessPas encore d'évaluation

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsD'EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsÉvaluation : 4 sur 5 étoiles4/5 (7)

- Contract Negotiation Handbook: Getting the Most Out of Commercial DealsD'EverandContract Negotiation Handbook: Getting the Most Out of Commercial DealsÉvaluation : 4.5 sur 5 étoiles4.5/5 (2)

- Financial Accounting For Dummies: 2nd EditionD'EverandFinancial Accounting For Dummies: 2nd EditionÉvaluation : 5 sur 5 étoiles5/5 (10)

- Your Amazing Itty Bitty(R) Personal Bookkeeping BookD'EverandYour Amazing Itty Bitty(R) Personal Bookkeeping BookPas encore d'évaluation