Académique Documents

Professionnel Documents

Culture Documents

Cash & Cash Equivalents

Transféré par

ralphalonzoCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Cash & Cash Equivalents

Transféré par

ralphalonzoDroits d'auteur :

Formats disponibles

Page 1 of 4

REVIEW OF FINANCIAL ACCOUNTING THEORY AND PRACTICE

CASH AND CASH EQUIVALENTS

1. The following data pertain to Angat Corporation on December 31, 2005:

Current account at Metrobank

Current account at BPI

Payroll account

Foreign bank account restricted (in equivalent pesos)

Postage stamps

Employees post dated check

IOU from controllers sister

Credit memo from a vendor for a purchase return

Travelers check

Not-sufficient-funds check

Money order

Petty cash fund (P4,000 in currency and expense receipts for

P6,000)

Treasury bills, due 3/31/06 (purchased 12/31/05)

Treasury bills, due 1/31/06 (purchased 1/1/05)

P2,000,000

(100,000)

500,000

1,000,000

1,000

4,000

10,000

20,000

50,000

15,000

30,000

10,000

200,000

300,000

Based on the above information, compute for the cash and cash equivalent that would

be reported on the December 31, 2005 balance sheet.

a. P2,784,000

c. P2,790,000

b. P3,084,000

d. P2,704,000

2. The following data pertain to Balagtas Corporation on December 31, 2005:

Checkbook balance

Bank statement balance

Check drawn on Balagtas account, payable to supplier, dated and

recorded on Dec. 31, 2005, but not mailed until Jan. 15, 2006

Cash in sinking fund

Money market, three months due January 31, 2006

P10,000,000

15,000,000

3,000,000

4,000,000

5,000,000

On December 31, 2005, how much should be reported as cash and cash equivalents?

a. P13,000,000

c. P18,000,000

b. P12,000,000

d. P17,000,000

3. On December 31, 2005, Baliuag Company had the following cash balances:

Cash in bank

Petty cash fund (all funds were reimbursed on December 31, 2005)

Time deposit

Saving deposit

P15,000,000

50,000

5,000,000

2,000,000

Cash in bank includes P500,000 of compensating balance against short term borrowing

arrangement at December 31, 2005. The compensating balance is legally restricted as

to withdrawal by Baliuag. A check of P300,000 dated January 15, 2006 in payment of

accounts payable was recorded and mailed on December 31, 2005. In the current

assets section of the December 31, 2005 balance sheet, what amount should be

reported as cash and cash equivalents?

a. P21,850,000

c. P21,800,000

b. P16,850,000

d. P14,850,000

Page 2 of 4

4. Bocaue Company had the following account balances on December 31, 2005.

Petty cash fund

Cash in bank current account

Cash in bank payroll account

Cash on hand

Cash in bank restricted account for plant additions, expected to

be disbursed in 2006

Treasury bills, due February 15, 2006

P50,000

10,000,000

2,000,000

500,000

4,000,000

3,000,000

The petty cash fund includes unreplenished December 2005 petty cash expense

vouchers of P20,000 and employee IOUs of P10,000. The cash on hand includes a

P100,000 check payable to Bocaue dated January 15, 2006. What should be reported

as cash and cash equivalents on December 31, 2005?

a. P12,420,000

c. P15,420,000

b. P19,420,000

d. P15,450,000

5. Bulacan Corporation's checkbook balance on December 31, 2005, was P800,000. In

addition, Bulacan held the following items in its safe on December 31:

Check payable to Bulacan Corporation, dated January 2, 2006, not

included in December 31 checkbook balance

Check payable to Bulacan Corporation, deposited December 20, and

included in December 31 checkbook balance, but returned by bank

on December 30, stamped "NSF." The check was redeposited

January 2, 2006, and cleared January 7

Post-dated checks

Check drawn on Bulacan Corporation's account, payable to a vendor,

dated and recorded December 31, but not mailed until January 15,

2006

P200,000

40,000

15,000

100,000

The proper amount to be shown as cash on Bulacan's balance sheet at December 31,

2005, is

a. P760,000

c. P860,000

b. P800,000

d. P975,000

6. You noted the following composition of Hagonoy Companys cash account as of

December 31, 2005:

Demand deposit account

Time deposit 30 days

NSF check of customer

Money market placement (due June 30, 2006)

Savings deposit in a closed bank

IOU from employee

Pension fund

Petty cash fund

Customer check dated January 1, 2006

Customer check outstanding for 18 months

Total

P2,000,000

1,000,000

40,000

1,500,000

100,000

20,000

3,000,000

10,000

50,000

40,000

P7,760,000

Additional information follows:

a) Check of P200,000 in payment of accounts payable was recorded on December 31,

2005 but mailed to suppliers on January 5, 2006.

b) Check of P100,000 dated January 15, 2006 in payment of accounts payable was

recorded and mailed on December 31, 2005.

Page 3 of 4

c) The company uses the calendar year. The cash receipts journal was held open

until January 15, 2006, during which time P400,000 was collected and recorded on

December 31, 2005.

The cash and cash equivalents to be shown on the December 31, 2005 balance sheet

is

a. P3,310,000

c. P1,910,000

b. P2,910,000

d. P4,410,000

7. The following information pertains to Bustos Company as of December 31, 2005:

Cash balance per general ledger

Cash balance per bank statement

Checks outstanding (including certified check of P100,000)

Bank service charge shown in December bank statement

Error made by Bustos in recording a check that cleared the bank in

December (check was drawn in December for P500,000

but recorded at P700,000)

Deposit in transit

P15,000,000

14,550,000

1,000,000

50,000

200,000

1,500,000

At the December 31, 2005 balance sheet cash in bank should be

a. P15,150,000

c. P14,250,000

b. P14,650,000

d. P14,550,000

8. The bookkeeper of Calumpit Company recently prepared the following bank

reconciliation on December 31, 2005:

Balance per bank statement

Add: Deposit in transit

Checkbook and other bank charge

Error made by Calumpit in recording check No.

1005 (issued in December)

Customer check marked DAIF

Total

Deduct: Outstanding checks

Note collected by bank (includes P200,000 interest)

Balance per book

20,000,000

1,500,000

50,000

150,000

500,000

1,900,000

2,300,000

2,200,000

22,200,000

4,200,000

18,000,000

Calumpit has P1,000,000 cash on hand on December 31, 2005. The amount to be

reported as cash on the balance sheet as of December 31, 2005 should be

a. P19,600,000

c. P20,600,000

b. P18,600,000

d. P19,750,000

9. The petty cash fund of Guiguinto Company on December 31, 2005 is composed of the

following:

Coins and currencies

Petty cash vouchers:

Gasoline payments

Supplies

Cash advances to employees

Employees check returned by bank marked NSF

Check drawn by the company payable to the order of Kristine

Anson, petty cash custodian, representing her salary

A sheet of paper with names of employees together with contribution

for a birthday gift of a co-employee in the amount of

Total

P14,000

3,000

1,000

2,000

5,000

20,000

8,000

P53,000

Page 4 of 4

The petty cash ledger account has an imprest balance of P50,000. What is the correct

amount of petty cash on December 31, 2005?

a. P34,000

b. P39,000

c. P14,000

d. P42,000

10. The Plaridel Corporation was organized on January 3, 2005 with an authorized capital

stock of P5,000,000. At December 31, 2005 of the same year, the general ledger of

said Company showed the following accounts and balances:

Accounts receivable

Merchandise inventory

Land

Building

Furniture and fixtures

Accounts payable

Notes payable bank

Common stock

Additional paid capital

Sales

Expenses paid (excluding purchases)

P 200,000

250,000

1,200,000

1,600,000

400,000

420,000

500,000

1,500,000

100,000

5,800,000

725,000

Your review of the bank statement for December disclosed the following information:

Bank balance, December 31, 2005

Bank service charge

Deposits in transit

Total checks not returned by the bank

P 524,500

6,000

62,500

128,000

Your review also revealed that the cash received of P62,500 on December 31, 2005

was deposited on January 2, 2006. The companys mark up on sales is 40%.

How much is the adjusted cash balance as of December 31, 2005?

a. P459,000

c. P39,000

b. P536,000

d. P1,619,000

11. Reconciliation of Malolos Corporations bank account at November 30, 2005 follows:

Balance per bank statement

Deposits in transit

Checks outstanding

Correct cash balance

P3,150,000

450,000

(45,000)

P3,555,000

Balance per books

Bank service charge

Correct cash balance

P3,558,000

(3,000)

P3,555,000

December data are as follows:

Checks recorded

Deposits recorded

Collection by bank (P600,000 plus interest)

NSF check returned with December bank statement

Balances

Bank

P3,450,000

2,430,000

630,000

15,000

2,745,000

The checks outstanding on December 31, 2005 amount to

a. P45,000

b. P135,000

c. P90,000

- end -

Books

P3,540,000

2,700,000

2,715,000

d. P0

Vous aimerez peut-être aussi

- Receivables (Part 1) With AnswersDocument7 pagesReceivables (Part 1) With AnswersUzziehllah Ratuita80% (5)

- Cash and Cash Equivalent LatestDocument54 pagesCash and Cash Equivalent LatestMARJORIE BAMBALAN87% (15)

- Cash and Cash EquivalentsDocument9 pagesCash and Cash EquivalentsPau Santos76% (29)

- Cash and Cash EquivalentsDocument10 pagesCash and Cash EquivalentsZerjo Cantalejo67% (3)

- The Future of Online Banking Amidst CrisesDocument7 pagesThe Future of Online Banking Amidst CrisesJep TangPas encore d'évaluation

- Bank ReconciliationDocument3 pagesBank Reconciliationalford sery Cammayo86% (7)

- Exercises 1Document9 pagesExercises 1Anonymous QWaWnuMPas encore d'évaluation

- FAR ProblemsDocument7 pagesFAR ProblemsJemaimah Buhayan100% (1)

- Cash and Cash Equivalents AssignmentDocument15 pagesCash and Cash Equivalents AssignmentJonathan Peter Del Rosario100% (1)

- PA1 M 1404 InventoriesDocument30 pagesPA1 M 1404 InventoriesShaina Santiago Alejo100% (1)

- A. Variable Costs, P18 Million. B. Fixed Costs. P12 Million. C. Operating Income, P4 Million. D. Break-Even Sales Volume, P20 MillionDocument11 pagesA. Variable Costs, P18 Million. B. Fixed Costs. P12 Million. C. Operating Income, P4 Million. D. Break-Even Sales Volume, P20 Millionralphalonzo100% (1)

- MT103 Zheshang 100BDocument3 pagesMT103 Zheshang 100Brasool mehrjooPas encore d'évaluation

- P1 Reviewer ISAPDocument13 pagesP1 Reviewer ISAPVenus B. MacatuggalPas encore d'évaluation

- Proof of CashDocument7 pagesProof of CashPeachy80% (5)

- RECEIVABLESDocument28 pagesRECEIVABLESClarice Ilustre Guintibano100% (1)

- Chapter 11 Answers RepportDocument12 pagesChapter 11 Answers RepportJudy56% (16)

- RecvbleDocument24 pagesRecvbleJoseph Salido100% (1)

- 100% Key Answers For The 2 First Quizzes - ACT1104Document34 pages100% Key Answers For The 2 First Quizzes - ACT1104moncarla lagonPas encore d'évaluation

- Problems: Set B: InstructionsDocument4 pagesProblems: Set B: InstructionsflrnciairnPas encore d'évaluation

- Cash and CequizDocument5 pagesCash and CequizMaria Emarla Grace CanozaPas encore d'évaluation

- Cash and Cash Equivalents Basic ProblemsDocument6 pagesCash and Cash Equivalents Basic ProblemshellokittysaranghaePas encore d'évaluation

- Accounting - 1st Quiz Cash and Cash Equivalent 2011Document2 pagesAccounting - 1st Quiz Cash and Cash Equivalent 2011Louie De La Torre40% (5)

- Cash and Cash EquivalentsDocument16 pagesCash and Cash EquivalentsÇåsäō Ärts67% (3)

- Proof of Cash ProblemDocument4 pagesProof of Cash ProblemHtiduj Oretubag50% (4)

- SolutionDocument5 pagesSolutionClariz Angelika EscocioPas encore d'évaluation

- Loans and Receivables Sample Problems 2Document2 pagesLoans and Receivables Sample Problems 2Bryce Bihag60% (5)

- Accounts Receivable QuizzerDocument4 pagesAccounts Receivable Quizzerknorrpampapakang67% (3)

- Ia 2Document2 pagesIa 2Nadine SofiaPas encore d'évaluation

- FINANCIAL ACCOUNTING - Cash To Receivables Problems and SolutionsDocument8 pagesFINANCIAL ACCOUNTING - Cash To Receivables Problems and Solutionsstan iKONPas encore d'évaluation

- Account ReceivableDocument10 pagesAccount ReceivableHarold B. Lacaba0% (1)

- Polytechnic University of The Philippines College of Accountancy Junior Philippine Institute of AccountantsDocument15 pagesPolytechnic University of The Philippines College of Accountancy Junior Philippine Institute of AccountantsYassi CurtisPas encore d'évaluation

- Cash and Cash Equivalents - SCDocument33 pagesCash and Cash Equivalents - SCKaren Estrañero LuzonPas encore d'évaluation

- Lesson 1 - Cash and Cash EquivalentsDocument2 pagesLesson 1 - Cash and Cash EquivalentsPol Moises Gregory Clamor88% (16)

- SPDocument28 pagesSPkrizzmaaaayPas encore d'évaluation

- Bak ReconDocument1 pageBak ReconFlorimar Lagda100% (1)

- Cash and Cash EquivalentsDocument8 pagesCash and Cash EquivalentsRonel CaagbayPas encore d'évaluation

- Reviewer - Cash & Cash EquivalentsDocument5 pagesReviewer - Cash & Cash EquivalentsMaria Kathreena Andrea Adeva100% (1)

- Proof of Cash-1Document7 pagesProof of Cash-1Ella MalitPas encore d'évaluation

- Impairment of Loans and Receivable FinancingDocument17 pagesImpairment of Loans and Receivable FinancingGelyn CruzPas encore d'évaluation

- Cash and Cash EquivalentsDocument6 pagesCash and Cash EquivalentsPamela Mae PlatonPas encore d'évaluation

- Q4 - Audit of Receivables (Prob - KEY)Document5 pagesQ4 - Audit of Receivables (Prob - KEY)Kenneth Christian Wilbur100% (1)

- Trade and Other Receivables 1. On December 31, 2013, The Accounts Receivable of Harem Company Had A Balance ofDocument11 pagesTrade and Other Receivables 1. On December 31, 2013, The Accounts Receivable of Harem Company Had A Balance ofJude SantosPas encore d'évaluation

- Act 1 Solutions - Cash and Cash EquivalentsDocument3 pagesAct 1 Solutions - Cash and Cash Equivalents이시연100% (1)

- Proof of Cash ProblemsDocument2 pagesProof of Cash ProblemsSamantha Marie Arevalo100% (1)

- Cash and Cash EquivalentsDocument3 pagesCash and Cash EquivalentsLui100% (1)

- QUIZDocument21 pagesQUIZSol Andallo100% (1)

- 04c Receivables (Part 3) With AnswersDocument3 pages04c Receivables (Part 3) With Answershelaihjs100% (1)

- Docshare - Tips - Cash and Cash Equivalents PDFDocument10 pagesDocshare - Tips - Cash and Cash Equivalents PDFAMANDA0% (1)

- SolutionsDocument25 pagesSolutionsDante Jr. Dela Cruz100% (1)

- Problems 3 - Cash and Cash Equivalents PDFDocument17 pagesProblems 3 - Cash and Cash Equivalents PDFEliyah JhonsonPas encore d'évaluation

- Audit of InventoriesDocument4 pagesAudit of InventoriesMc Gavriel VillenaPas encore d'évaluation

- Cash and Cash EquivalentDocument2 pagesCash and Cash EquivalentJovani Laña100% (1)

- Compilation FARDocument7 pagesCompilation FARAlexandria SomethingPas encore d'évaluation

- AP - Cash & Cash EquivalentsDocument11 pagesAP - Cash & Cash EquivalentsRose AnnPas encore d'évaluation

- AP-5907 CashDocument12 pagesAP-5907 CashxxxxxxxxxPas encore d'évaluation

- The Following Data Pertain To Lincoln Corporation On December 31Document8 pagesThe Following Data Pertain To Lincoln Corporation On December 31Eiuol Nhoj Arraeugse100% (3)

- AP-5907 CashDocument12 pagesAP-5907 CashAiko E. LaraPas encore d'évaluation

- Far Drill 1 (Cce-Ppe) .Document20 pagesFar Drill 1 (Cce-Ppe) .ROMAR A. PIGAPas encore d'évaluation

- Cash and Cash Equivalents Quizzer #2Document3 pagesCash and Cash Equivalents Quizzer #2Al-Habbyel Baliola YusophPas encore d'évaluation

- AP - Cash and Cash EquivalentsDocument11 pagesAP - Cash and Cash EquivalentsErnest Andales88% (8)

- Post Test Cash and Cash Equivalents Name: Date: Professor: Section: ScoreDocument5 pagesPost Test Cash and Cash Equivalents Name: Date: Professor: Section: ScoreRisa Castillo MiguelPas encore d'évaluation

- AP - Audit of CashDocument4 pagesAP - Audit of CashRose CastilloPas encore d'évaluation

- 123Document11 pages123Jandave ApinoPas encore d'évaluation

- 3rd On-Line Quiz - Substantive Test For CashDocument3 pages3rd On-Line Quiz - Substantive Test For CashMJ YaconPas encore d'évaluation

- Sunday Monday Tuesday Wednesday Thursday Friday SaturdayDocument1 pageSunday Monday Tuesday Wednesday Thursday Friday SaturdayralphalonzoPas encore d'évaluation

- FAR - Conceptual FrameworkDocument8 pagesFAR - Conceptual FrameworkralphalonzoPas encore d'évaluation

- T02 - Capital BudgetingDocument121 pagesT02 - Capital Budgetingralphalonzo75% (4)

- PledgeDocument11 pagesPledgeralphalonzoPas encore d'évaluation

- 08 Investmentquestfinal PDFDocument13 pages08 Investmentquestfinal PDFralphalonzo0% (1)

- FAR - Revaluation Increase and DecreaseDocument1 pageFAR - Revaluation Increase and DecreaseralphalonzoPas encore d'évaluation

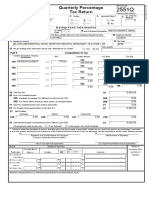

- Quarterly Percentage Tax Return: 12 - DecemberDocument1 pageQuarterly Percentage Tax Return: 12 - DecemberralphalonzoPas encore d'évaluation

- FAR - DerivativesDocument1 pageFAR - DerivativesralphalonzoPas encore d'évaluation

- TAX - Gross Estate RemindersDocument2 pagesTAX - Gross Estate RemindersralphalonzoPas encore d'évaluation

- Business Law and TaxationDocument15 pagesBusiness Law and TaxationKhim Dagangon100% (1)

- Chapter 4 and Chapter 5Document9 pagesChapter 4 and Chapter 5ralphalonzoPas encore d'évaluation

- MAS - DOL Vs DFLDocument3 pagesMAS - DOL Vs DFLralphalonzoPas encore d'évaluation

- Deductions From Gross IncomeDocument1 pageDeductions From Gross IncomeralphalonzoPas encore d'évaluation

- Estate Taxation - Oct 2017 - GCC - Self Test - Quiz 1Document4 pagesEstate Taxation - Oct 2017 - GCC - Self Test - Quiz 1ralphalonzoPas encore d'évaluation

- PRTC Mas First PBDocument11 pagesPRTC Mas First PBralphalonzo100% (2)

- Donor - S Tax - Oct 2017 - GCC - Self Test - Quiz 2Document3 pagesDonor - S Tax - Oct 2017 - GCC - Self Test - Quiz 2ralphalonzoPas encore d'évaluation

- RFBT - Forms of Partnership ContractsDocument1 pageRFBT - Forms of Partnership ContractsralphalonzoPas encore d'évaluation

- Afar AUD FAR MAS RFBT TAX TheoryDocument1 pageAfar AUD FAR MAS RFBT TAX TheoryralphalonzoPas encore d'évaluation

- PRTC AP First PBDocument9 pagesPRTC AP First PBralphalonzoPas encore d'évaluation

- RFBT - Directors and Stockholders' MeetingDocument1 pageRFBT - Directors and Stockholders' MeetingralphalonzoPas encore d'évaluation

- PRTC at 1st PreboardDocument11 pagesPRTC at 1st PreboardralphalonzoPas encore d'évaluation

- PRTC TOA First PreboardDocument9 pagesPRTC TOA First PreboardralphalonzoPas encore d'évaluation

- PRTC P2 1st PreboardDocument10 pagesPRTC P2 1st PreboardRommel Royce0% (1)

- PRTC Mas First PBDocument11 pagesPRTC Mas First PBralphalonzo100% (2)

- HyperinflationDocument2 pagesHyperinflationralphalonzoPas encore d'évaluation

- Cost-Volume-Profit Relationslt R,) 56. The Company's Overall Contribution Margin Ratio Fur The Sales Mix Expected Is H. 45%. D. 60%Document10 pagesCost-Volume-Profit Relationslt R,) 56. The Company's Overall Contribution Margin Ratio Fur The Sales Mix Expected Is H. 45%. D. 60%ralphalonzoPas encore d'évaluation

- Chapter 1 With Reference To ICAP 2015 Study TextDocument10 pagesChapter 1 With Reference To ICAP 2015 Study TextralphalonzoPas encore d'évaluation

- 7 Remedial PDFDocument66 pages7 Remedial PDFMinahPas encore d'évaluation

- MAS.M-1405 Cost of Capital Straight ProblemsDocument12 pagesMAS.M-1405 Cost of Capital Straight ProblemsralphalonzoPas encore d'évaluation

- Time Value of MoneyDocument40 pagesTime Value of MoneyAhmedmughalPas encore d'évaluation

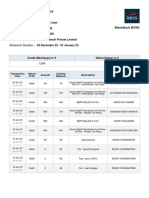

- Fastag Account Summary:: Blackbuck User: 8954736002: UP32NN4603Document1 pageFastag Account Summary:: Blackbuck User: 8954736002: UP32NN4603rpPas encore d'évaluation

- Institution Collects Funds Public Financial Assets Deposits Loans Bonds Tangible PropertyDocument4 pagesInstitution Collects Funds Public Financial Assets Deposits Loans Bonds Tangible PropertyDibakar DasPas encore d'évaluation

- XXXXXXXXXX0009 20240128150640302188 UnlockedDocument6 pagesXXXXXXXXXX0009 20240128150640302188 Unlockedr6540073Pas encore d'évaluation

- Islamic BankingDocument3 pagesIslamic BankingTegegne AlemayehuPas encore d'évaluation

- BankDocument4 pagesBankkimba worthPas encore d'évaluation

- Secretary'S Certificate Know All Men by These PresentsDocument2 pagesSecretary'S Certificate Know All Men by These Presentsiris galecioPas encore d'évaluation

- Npa Policy PDFDocument21 pagesNpa Policy PDFravi kumarPas encore d'évaluation

- Fee InvoiceDocument1 pageFee InvoiceMuhammad Usman YousafPas encore d'évaluation

- Chapter 26 - Cash Flow ForecastingDocument3 pagesChapter 26 - Cash Flow ForecastingKamalaPas encore d'évaluation

- Capital Adequacy Ratios AnalysisDocument4 pagesCapital Adequacy Ratios AnalysisAsma RajaPas encore d'évaluation

- Journal EntriesDocument2 pagesJournal EntriesAmaryPas encore d'évaluation

- 2020 Landbank Products ServicesDocument28 pages2020 Landbank Products ServicesNikki YturriagaPas encore d'évaluation

- Nigerian Maritime University: Payer InformationDocument1 pageNigerian Maritime University: Payer InformationFasasi NurudeenPas encore d'évaluation

- Problem Session-2 - 15.03.2012Document44 pagesProblem Session-2 - 15.03.2012markydee_20Pas encore d'évaluation

- Southeast Europe Hydropower Database March 2018 For PublicationDocument35 pagesSoutheast Europe Hydropower Database March 2018 For PublicationTeto SchedulePas encore d'évaluation

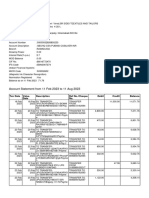

- Account Statement From 11 Feb 2023 To 11 Aug 2023Document8 pagesAccount Statement From 11 Feb 2023 To 11 Aug 2023vinodbommadeniPas encore d'évaluation

- Loan Functions of BanksDocument38 pagesLoan Functions of BanksEunice EsteraPas encore d'évaluation

- Timeline: The Failure of The Royal Bank of ScotlandDocument7 pagesTimeline: The Failure of The Royal Bank of ScotlandFailure of Royal Bank of Scotland (RBS) Risk Management100% (1)

- Credit and Debit CardsDocument23 pagesCredit and Debit CardsRaihana Karolly100% (1)

- All Products October 20 Payout StructureDocument18 pagesAll Products October 20 Payout StructurePDRK BABIUPas encore d'évaluation

- Continue Admission FormDocument1 pageContinue Admission FormS U ProductionPas encore d'évaluation

- MurabahaDocument32 pagesMurabahagoodfriend123499Pas encore d'évaluation

- Cibn 2020 TimetableDocument1 pageCibn 2020 TimetableAromasodun Omobolanle IswatPas encore d'évaluation

- Hey Bhanwar,: Here Is Your Credit Report For Jul '23Document31 pagesHey Bhanwar,: Here Is Your Credit Report For Jul '23Ruloans VaishaliPas encore d'évaluation

- Daftar RefundDocument4 pagesDaftar RefundTarry CesmoyPas encore d'évaluation

- Conference Call Transcript: 2021 Investor Engagement ForumDocument25 pagesConference Call Transcript: 2021 Investor Engagement ForumTvrtko TvrtkoPas encore d'évaluation