Académique Documents

Professionnel Documents

Culture Documents

Erl 19-12-2016 Derivative Report

Transféré par

Anjali SharmaCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Erl 19-12-2016 Derivative Report

Transféré par

Anjali SharmaDroits d'auteur :

Formats disponibles

qwertyuiopasdfghjklzxcvbnmqwerty

uiopasdfghjklzxcvbnmqwertyuiopasd

fghjklzxcvbnmqwertyuiopasdfghjklzx

cvbnmqwertyuiopasdfghjklzxcvbnmq

wertyuiopasdfghjklzxcvbnmqwertyui

opasdfghjklzxcvbnmqwertyuiopasdfg

hjklzxcvbnmqwertyuiopasdfghjklzxc

vbnmqwertyuiopasdfghjklzxcvbnmq

wertyuiopasdfghjklzxcvbnmqwertyui

opasdfghjklzxcvbnmqwertyuiopasdfg

hjklzxcvbnmqwertyuiopasdfghjklzxc

DERIVATIVE REPORT

vbnmqwertyuiopasdfghjklzxcvbnmq

19 December 2016

wertyuiopasdfghjklzxcvbnmqwertyui

Prepared by: Meenakshi Pal

opasdfghjklzxcvbnmqwertyuiopasdfg

Sr. Research Analyst

hjklzxcvbnmrtyuiopasdfghjklzxcvbn

mqwertyuiopasdfghjklzxcvbnmqwert

yuiopasdfghjklzxcvbnmqwertyuiopas

th

19th December 2016

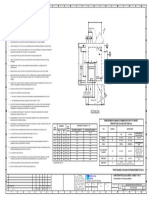

NIFTY FUTURE

NIFTY DAILY CHART

Nifty was down 14 points and closed at 8,139. It

NIFTYatOUTLOOK

opened

8,178.20 points, hitting a high of 8,178.70

and low of 8,127.45. It was a complete choppy

session, as market was seen grinding in a narrow 25

points trading range especially in the second half.

Nifty was unable to surpass the crucial 200-DMA

which is now placed at 8221. In addition, Nifty also

.

breached below the 8150 support zone for the first

time this week after managing to hold on throughout

the week. A close below the support zone indicates

that further weakness is likely on the cards. Any kind

of recovery will once again find stiff resistance at the

200-DMA of 8221 and its immediate previous peak

of 8250. The India VIX (Volatility) index was down

2.57% at 15.25. The BSE Midcap closed at 12236.5

and Smallcap indices closed at 12113.5, both closing

marginally down. The Indian Rupee was trading at

67.79 per dollar.

NIFTY FUTURE :

R1:8178

Nifty open Flat on Friday and shown Range

Bound trend over the full trading hours. Nifty

closed below the 8200 today. 8130 -8100 is the

support of nifty if its break that level down side

pressure will be seen. Nifty may be taste the level

of 7900-7950. Above 8250 new level of nifty

would be 8300-8350.

R2:8210

R3:8232

19th December 2016

PIVOT :8156

S1:8124

S2:8102

S3:8070

19th December 2016

NIFTY BANK FUTURE

NIFTY BANK DAILY CHART

NIFTY BANK OUTLOOK

NIFTY

Bank

niftyOUTLOOK

open flat

today and showing

consolidation movement, over the full trading

hours. Bank nifty closed below 18400. below

18200-18000 next level would be 17800-17900.

SBank nifty have major support of 17900-18000 on

daily time frame. ICICI BANK (-1.81%) and

AXIS BANK (-1.11%) is the top losers of the

day.

BANK NIFTY FUTURE :

PIVOT :18359

R1:18432

S1:18264

Bank nifty Open flat at 18455.00, to its previous

closing 18430.65 on Friday and touched high of

18455.00. Todays bank nifty made a low of

18286.30. Below 18000 next level for bank nifty

would be 17700-17900. Bank nifty can be trade

between the range of 18300-18800 .

R2:18528

S2:18190

R3:18601

S3:18095

19th December 2016

USDINR

The Indian rupee has opened higher at 67.82 to the dollar on Friday compared with 67.83 in previous

session. Yesterday, it ended at lowest closing level against dollar since December 6, especially after the

US Federal Reserve on Wednesday hiked interest rate by 25 basis points to 0.5 percent from 0.75 percent

and announced hawkish outlook of three rate hikes in 2017 against two hikes expected in Fed's

September policy. US Federal Reserve delivered as per market expectations. Hawkish undertone has

pushed Dollar index to 14-year high. This will impact USD-INR pair as well. He expects a range of

67.90-68.30 against the US dollar.

USDINR :

PIVOT : 67.84

R1:67.91

S1:67.73

R2:68.02

S2:67.66

R3:68.09

S3:67.55

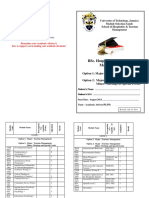

GLOBAL MARKETS

EUROPEAN MARKET

NAME

CHANGE

% CHANGE

FTSE 100

CAC 40

DAX

12.63

14.04

37.61

0.18

0.29

0.33

European markets finished higher on Friday with shares in Germany leading the region. The DAX is up

0.33% while France's CAC 40 is up 0.29% and London's FTSE 100 is up 0.18%.

ASIAN MARKET

NAME

CHANGE

% CHANGE

NIKKEI 225

STRAITS TIMES

HANG SENG

TAIWAN WEIGHTED

127.36

0.66

7.09

-38.65

-33.57

0.24

-0.18

-0.36

Asian markets finished mixed as of the most recent closing prices. The Nikkei 225 gained 0.66% and

the Shanghai Composite rose 0.17%. The Hang Seng lost 0.18%.

ADVANCES / DECLINES RATIO

ADVANCE

DECLINE

UNCHANGED

TOTALS

593

988

19th December 2016

1675

94

INDIAN MARKETS

Name

Change

% Change

-14.15

-88.35

-43.30

-9.00

-0.15

Nifty 50

Nifty Bank

Nifty Metal

Nifty Pharma

Nifty Realty

Name

Change

-0.17

-0.48

-1.58

-0.08

-0.09

% Change

Open

High

Low

8178.20

18417.90

2801.60

10657.70

168.35

8178.70

18428.45

2804.40

10680.00

168.95

8127.45

18268.30

2739.15

10538.85

166.60

Open

High

Low

Sensex

-29.51

-0.11

26548.67

26594.55

26455.21

S&P BSE

Small Cap

-14.15

-0.17

12159.49

12192.64

12103.74

S&P BSE

Midcap

-4.32

-0.04

12257.69

12275.18

12182.80

FII/DII ACTIVITY

BUY

No. Of

Contracts

INDEX

FUTURES

INDEX

OPTIONS

STOCK

FUTURES

STOCK

OPTIONS

SELL

Amt.

(In. Crores)

No. Of

Contracts

Amt.

(In. Crores)

OPEN INTEREST AT THE

END OF THE DAY

No. Of

Amt.

Contracts

(In. Crores)

18108

1160.24

26588

1664.72

174401

10997.31

407639

26283.82

406411

26241.11

1111615

68977.74

93165

5929.64

94449

6079.09

897058

54400.89

43176

2955.30

44124

3017.23

86633

5561.03

19th December 2016

TOP GAINERS VS. TOP LOSERS

TOP GAINERS

Company

TATA MOTORS

BHARTI INFRA.

INFOSYS

EICHER MOTORS

TATA CONSULT.

Prev. Close(Rs.)

463.20

351.10

992.35

21515.30

2259.30

Current Price(Rs.)

473.15

355.65

1005.15

21759.10

2282.65

% Change

+2.15

+1.30

+1.29

+1.13

+1.03

Prev. Close(Rs.)

176.10

3264.50

318.45

206.45

125.35

Current Price(Rs.)

170.20

3177.65

310.25

201.70

122.80

% Change

-3.35

-2.66

-2.57

-2.30

-2.03

TOP LOSERS

Company

HINDALCO

ULTRATECH

BHARTI AIRTEL

ONGC

BHEL

19th December 2016

ERL RESEARCH TEAM

Member Name

Designation

Mr. Tuhinanshu Jain

Mr. Yogesh Subnani

Miss. Meenakshi Pal

Research Head

Sr. Research Analyst

Sr. Research Analyst

E-mail ID

Tuhinanshu.jain@equityresearchlab.co.in

Yogesh.subnani@equityresearchlab.co.in

Meenakshi.pal@equityresearchlab.co.in

DISCLAIMER

The information and views in this report, our website & all the service we provide are believed to be

reliable, but we do not accept any responsibility (or liability) for errors of fact or opinion. Users have

the right to choose the product/s that suits them the most. Investment in Stocks has its own risks.

Sincere efforts have been made to present the right investment perspective. The information contained

herein is based on analysis and up on sources that we consider reliable. We, however, do not vouch

for the accuracy or the completeness thereof. This material is for personal information and we are not

responsible for any loss incurred based upon it & takes no responsibility whatsoever for any financial

profit s or loss which may arise from the recommendations above. The stock price projections shown

are not necessarily indicative of future price performance. The information herein, together with all

estimates and forecasts, can change without notice.

Equity Research Lab does not purport to be an invitation or an offer to buy or sell any financial

instrument. Analyst or any person related to Equity Research Lab might be holding positions in the

stocks recommended. It is understood that anyone who is browsing through the site has done so at his

free will and does not read any views expressed as a recommendation for which either the site or its

owners or anyone can be held responsible for. Any surfing and reading of the information is the

acceptance of this disclaimer.

Our Clients (Paid or Unpaid), any third party or anyone else have no rights to forward or share our

calls or SMS or Report or Any Information Provided by us to/with anyone which is received directly

or indirectly by them. If found so then Serious Legal Actions can be taken. Any surfing and reading of

the information is the acceptance of this disclaimer.

ALL RIGHTS RESERVED.

Vous aimerez peut-être aussi

- Miniature Daisy: Crochet Pattern & InstructionsDocument8 pagesMiniature Daisy: Crochet Pattern & Instructionscaitlyn g100% (1)

- The New Trading for a Living: Psychology, Discipline, Trading Tools and Systems, Risk Control, Trade ManagementD'EverandThe New Trading for a Living: Psychology, Discipline, Trading Tools and Systems, Risk Control, Trade ManagementÉvaluation : 4 sur 5 étoiles4/5 (45)

- Candlestick and Pivot Point Trading Triggers: Setups for Stock, Forex, and Futures MarketsD'EverandCandlestick and Pivot Point Trading Triggers: Setups for Stock, Forex, and Futures MarketsPas encore d'évaluation

- Hans Belting - The End of The History of Art (1982)Document126 pagesHans Belting - The End of The History of Art (1982)Ross Wolfe100% (7)

- UltimateBeginnerHandbookPigeonRacing PDFDocument21 pagesUltimateBeginnerHandbookPigeonRacing PDFMartinPalmPas encore d'évaluation

- Enochian Dragon Ritual PDFDocument4 pagesEnochian Dragon Ritual PDFDenis NantelPas encore d'évaluation

- 2022 Mable Parker Mclean Scholarship ApplicationDocument2 pages2022 Mable Parker Mclean Scholarship Applicationapi-444959661Pas encore d'évaluation

- Activity On Noli Me TangereDocument5 pagesActivity On Noli Me TangereKKKPas encore d'évaluation

- Erl 20-12-2016 Derivative ReportDocument8 pagesErl 20-12-2016 Derivative ReportAnjali SharmaPas encore d'évaluation

- Derivative Report Erl 28-11-2016Document7 pagesDerivative Report Erl 28-11-2016Anjali SharmaPas encore d'évaluation

- Derivative Report Erl 29-11-2016Document8 pagesDerivative Report Erl 29-11-2016Anjali SharmaPas encore d'évaluation

- Derivative Report Erl 30-11-2016Document8 pagesDerivative Report Erl 30-11-2016Anjali SharmaPas encore d'évaluation

- Derivative Report Erl 05-12-2016Document8 pagesDerivative Report Erl 05-12-2016Anjali SharmaPas encore d'évaluation

- Erl 21-12-2016 Derivative ReportDocument8 pagesErl 21-12-2016 Derivative ReportAnjali SharmaPas encore d'évaluation

- Erl 27-12-2016 Derivative ReportDocument7 pagesErl 27-12-2016 Derivative ReportAnjali SharmaPas encore d'évaluation

- Erl 26-12-2016 Derivative ReportDocument8 pagesErl 26-12-2016 Derivative ReportAnjali SharmaPas encore d'évaluation

- Erl 12-12-2016 Derivative ReportDocument7 pagesErl 12-12-2016 Derivative ReportAnjali SharmaPas encore d'évaluation

- Erl 12-13-2016 Derivative ReportDocument7 pagesErl 12-13-2016 Derivative ReportAnjali SharmaPas encore d'évaluation

- Erl 02-01-2017 Derivative ReportDocument7 pagesErl 02-01-2017 Derivative ReportAnjali SharmaPas encore d'évaluation

- Erl 14-12-2016 Derivative ReportDocument8 pagesErl 14-12-2016 Derivative ReportAnjali SharmaPas encore d'évaluation

- Derivative Report 11 November 2016Document8 pagesDerivative Report 11 November 2016Anjali SharmaPas encore d'évaluation

- Erl 08-12-2016 Derivative ReportDocument8 pagesErl 08-12-2016 Derivative ReportAnjali SharmaPas encore d'évaluation

- NIFTY - REPORT 21 December Equity Research LabDocument4 pagesNIFTY - REPORT 21 December Equity Research Labram sahuPas encore d'évaluation

- NIFTY - REPORT 30 November Equity Research LabDocument4 pagesNIFTY - REPORT 30 November Equity Research Labram sahuPas encore d'évaluation

- NIFTY - REPORT 18 November Equity Research LabDocument4 pagesNIFTY - REPORT 18 November Equity Research Labram sahuPas encore d'évaluation

- NIFTY - REPORT 22 December Equity Research LabDocument4 pagesNIFTY - REPORT 22 December Equity Research Labram sahuPas encore d'évaluation

- NIFTY - REPORT - 17 November Equity Research LabDocument4 pagesNIFTY - REPORT - 17 November Equity Research Labram sahuPas encore d'évaluation

- NIFTY - REPORT 01 December Equity Research LabDocument4 pagesNIFTY - REPORT 01 December Equity Research Labram sahuPas encore d'évaluation

- Nifty Outlook: 19 December 2016 Prepared By: Meenakshi PalDocument4 pagesNifty Outlook: 19 December 2016 Prepared By: Meenakshi PalAnjali SharmaPas encore d'évaluation

- NIFTY - REPORT - 10 November Equity Research LabDocument4 pagesNIFTY - REPORT - 10 November Equity Research Labram sahuPas encore d'évaluation

- NIFTY - REPORT - 16 November Equity Research LabDocument4 pagesNIFTY - REPORT - 16 November Equity Research Labram sahuPas encore d'évaluation

- NIFTY - REPORT 29 November Equity Research LabDocument4 pagesNIFTY - REPORT 29 November Equity Research Labram sahuPas encore d'évaluation

- NIFTY - REPORT 15 December Equity Research LabDocument4 pagesNIFTY - REPORT 15 December Equity Research Labram sahuPas encore d'évaluation

- Nifty Outlook: 23 August 2016 Prepared By: Meenakshi PalDocument4 pagesNifty Outlook: 23 August 2016 Prepared By: Meenakshi Palram sahuPas encore d'évaluation

- NIFTY - REPORT 05 December Equity Research LabDocument4 pagesNIFTY - REPORT 05 December Equity Research Labram sahuPas encore d'évaluation

- NIFTY - REPORT - 21 November Equity Research LabDocument4 pagesNIFTY - REPORT - 21 November Equity Research Labram sahuPas encore d'évaluation

- NIFTY - REPORT 23 December Equity Research LabDocument4 pagesNIFTY - REPORT 23 December Equity Research Labram sahuPas encore d'évaluation

- NIFTY - REPORT 28 December Equity Research LabDocument4 pagesNIFTY - REPORT 28 December Equity Research Labram sahuPas encore d'évaluation

- NIFTY - REPORT - 08 November Equity Research LabDocument4 pagesNIFTY - REPORT - 08 November Equity Research Labram sahuPas encore d'évaluation

- NIFTY - REPORT 07 December Equity Research LabDocument4 pagesNIFTY - REPORT 07 December Equity Research Labram sahuPas encore d'évaluation

- NIFTY - REPORT 08 December Equity Research LabDocument4 pagesNIFTY - REPORT 08 December Equity Research Labram sahuPas encore d'évaluation

- NIFTY - REPORT 06 December Equity Research LabDocument4 pagesNIFTY - REPORT 06 December Equity Research Labram sahuPas encore d'évaluation

- NIFTY - REPORT 09 December Equity Research LabDocument4 pagesNIFTY - REPORT 09 December Equity Research Labram sahuPas encore d'évaluation

- NIFTY - REPORT - 09 November Equity Research LabDocument4 pagesNIFTY - REPORT - 09 November Equity Research Labram sahuPas encore d'évaluation

- NIFTY - REPORT - 11 November Equity Research LabDocument4 pagesNIFTY - REPORT - 11 November Equity Research Labram sahuPas encore d'évaluation

- Daily Option News Letter: 07/july/2014Document7 pagesDaily Option News Letter: 07/july/2014api-256777091Pas encore d'évaluation

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-234732356Pas encore d'évaluation

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-234732356Pas encore d'évaluation

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-256777091Pas encore d'évaluation

- Daily Option News Letter: 10/june/2014Document7 pagesDaily Option News Letter: 10/june/2014api-254948565Pas encore d'évaluation

- NIFTY - REPORT 12 December Equity Research LabDocument4 pagesNIFTY - REPORT 12 December Equity Research Labram sahuPas encore d'évaluation

- Stock Option Latest News by Theequicom For Today 21 October 2014Document7 pagesStock Option Latest News by Theequicom For Today 21 October 2014Riya VermaPas encore d'évaluation

- NIFTY - REPORT 27 December Equity Research LabDocument4 pagesNIFTY - REPORT 27 December Equity Research Labram sahuPas encore d'évaluation

- Daily Option News Letter: 20/june/2014Document7 pagesDaily Option News Letter: 20/june/2014api-256777091Pas encore d'évaluation

- NIFTY - REPORT - 23 November Equity Research LabDocument4 pagesNIFTY - REPORT - 23 November Equity Research Labram sahuPas encore d'évaluation

- NIFTY - REPORT - 15 November Equity Research LabDocument4 pagesNIFTY - REPORT - 15 November Equity Research Labram sahuPas encore d'évaluation

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-234732356Pas encore d'évaluation

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-254948565Pas encore d'évaluation

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-256777091Pas encore d'évaluation

- Daily Option News Letter: 25/june/2014Document7 pagesDaily Option News Letter: 25/june/2014api-256777091Pas encore d'évaluation

- Daily Option News Letter: 31/july/2014Document7 pagesDaily Option News Letter: 31/july/2014api-256777091Pas encore d'évaluation

- Daily Option News Letter: 16/june/2014Document7 pagesDaily Option News Letter: 16/june/2014api-256777091Pas encore d'évaluation

- Derivatives Report 28aprilDocument6 pagesDerivatives Report 28aprilAru MehraPas encore d'évaluation

- Daily Option News Letter: 08/july/2014Document7 pagesDaily Option News Letter: 08/july/2014api-256777091Pas encore d'évaluation

- Nifty Outlook: 2 September 2016 Prepared By: Meenakshi PalDocument4 pagesNifty Outlook: 2 September 2016 Prepared By: Meenakshi PalAashika JainPas encore d'évaluation

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-256777091Pas encore d'évaluation

- Nifty Outlook: 02 January 2017 Prepared By: Meenakshi PalDocument4 pagesNifty Outlook: 02 January 2017 Prepared By: Meenakshi PalAnjali SharmaPas encore d'évaluation

- Erl 26-12-2016 Derivative ReportDocument8 pagesErl 26-12-2016 Derivative ReportAnjali SharmaPas encore d'évaluation

- Erl 02-01-2017 Derivative ReportDocument7 pagesErl 02-01-2017 Derivative ReportAnjali SharmaPas encore d'évaluation

- Equity Research Lab 06-02-2017 NIFTY REPORTDocument4 pagesEquity Research Lab 06-02-2017 NIFTY REPORTAnjali SharmaPas encore d'évaluation

- Erl 27-12-2016 Derivative ReportDocument7 pagesErl 27-12-2016 Derivative ReportAnjali SharmaPas encore d'évaluation

- Erl 21-12-2016 Derivative ReportDocument8 pagesErl 21-12-2016 Derivative ReportAnjali SharmaPas encore d'évaluation

- Nifty Outlook: 19 December 2016 Prepared By: Meenakshi PalDocument4 pagesNifty Outlook: 19 December 2016 Prepared By: Meenakshi PalAnjali SharmaPas encore d'évaluation

- Erl 12-13-2016 Derivative ReportDocument7 pagesErl 12-13-2016 Derivative ReportAnjali SharmaPas encore d'évaluation

- Erl 14-12-2016 Derivative ReportDocument8 pagesErl 14-12-2016 Derivative ReportAnjali SharmaPas encore d'évaluation

- Erl 08-12-2016 Derivative ReportDocument8 pagesErl 08-12-2016 Derivative ReportAnjali SharmaPas encore d'évaluation

- Erl 12-12-2016 Derivative ReportDocument7 pagesErl 12-12-2016 Derivative ReportAnjali SharmaPas encore d'évaluation

- Derivative Report 11 November 2016Document8 pagesDerivative Report 11 November 2016Anjali SharmaPas encore d'évaluation

- Siemens Make Motor Manual PDFDocument10 pagesSiemens Make Motor Manual PDFArindam SamantaPas encore d'évaluation

- Advanced Chemical Engineering Thermodynamics (Cheg6121) : Review of Basic ThermodynamicsDocument74 pagesAdvanced Chemical Engineering Thermodynamics (Cheg6121) : Review of Basic ThermodynamicsetayhailuPas encore d'évaluation

- Notes:: Reinforcement in Manhole Chamber With Depth To Obvert Greater Than 3.5M and Less Than 6.0MDocument1 pageNotes:: Reinforcement in Manhole Chamber With Depth To Obvert Greater Than 3.5M and Less Than 6.0Mسجى وليدPas encore d'évaluation

- Promotion-Mix (: Tools For IMC)Document11 pagesPromotion-Mix (: Tools For IMC)Mehul RasadiyaPas encore d'évaluation

- Perancangan Crushing Plant Batu Andesit Di PT Nurmuda Cahaya Desa Batujajar Timur Kecamatan Batujajar Kabupaten Bandung Barat Provinsi Jawa BaratDocument8 pagesPerancangan Crushing Plant Batu Andesit Di PT Nurmuda Cahaya Desa Batujajar Timur Kecamatan Batujajar Kabupaten Bandung Barat Provinsi Jawa BaratSutan AdityaPas encore d'évaluation

- Implementation of E-Governance To Improve The Civil Administration Service Quality in Public SectorDocument11 pagesImplementation of E-Governance To Improve The Civil Administration Service Quality in Public SectorChristie YohanaPas encore d'évaluation

- Sandstorm Absorbent SkyscraperDocument4 pagesSandstorm Absorbent SkyscraperPardisPas encore d'évaluation

- Chapter 2Document13 pagesChapter 2Kumkumo Kussia KossaPas encore d'évaluation

- Iguana Joe's Lawsuit - September 11, 2014Document14 pagesIguana Joe's Lawsuit - September 11, 2014cindy_georgePas encore d'évaluation

- Mosfet Irfz44Document8 pagesMosfet Irfz44huynhsang1979Pas encore d'évaluation

- Pg2022 ResultDocument86 pagesPg2022 ResultkapilPas encore d'évaluation

- Micro Lab Midterm Study GuideDocument15 pagesMicro Lab Midterm Study GuideYvette Salomé NievesPas encore d'évaluation

- Sveba Dahlen - SRP240Document16 pagesSveba Dahlen - SRP240Paola MendozaPas encore d'évaluation

- Anemia in PregnancyDocument5 pagesAnemia in PregnancycfgrtwifhPas encore d'évaluation

- SachinDocument3 pagesSachinMahendraPas encore d'évaluation

- Cisco BGP ASPATH FilterDocument115 pagesCisco BGP ASPATH FilterHalison SantosPas encore d'évaluation

- W25509 PDF EngDocument11 pagesW25509 PDF EngNidhi SinghPas encore d'évaluation

- Resume: Mr. Shubham Mohan Deokar E-MailDocument2 pagesResume: Mr. Shubham Mohan Deokar E-MailAdv Ranjit Shedge PatilPas encore d'évaluation

- Obligatoire: Connectez-Vous Pour ContinuerDocument2 pagesObligatoire: Connectez-Vous Pour ContinuerRaja Shekhar ChinnaPas encore d'évaluation

- Wholesale Terminal Markets - Relocation and RedevelopmentDocument30 pagesWholesale Terminal Markets - Relocation and RedevelopmentNeha Bhusri100% (1)

- 16783Document51 pages16783uddinnadeemPas encore d'évaluation

- Fds-Ofite Edta 0,1MDocument7 pagesFds-Ofite Edta 0,1MVeinte Años Sin VosPas encore d'évaluation

- CHAPTER 1 SBL NotesDocument13 pagesCHAPTER 1 SBL NotesPrieiya WilliamPas encore d'évaluation

- BSC HTM - TourismDocument4 pagesBSC HTM - Tourismjaydaman08Pas encore d'évaluation