Académique Documents

Professionnel Documents

Culture Documents

Fin Ratios-What They Mean PDF

Transféré par

IshaTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Fin Ratios-What They Mean PDF

Transféré par

IshaDroits d'auteur :

Formats disponibles

A Guide to Case Analysis

to support your diagnosis. Work through the case preparation exercises on Case-TUTOR conscientiously or,

if you are using study questions provided by the instructor, generate at least two pages of notes!

9. Develop an appropriate action plan and set of recommendations. Diagnosis divorced from corrective

action is sterile. The test of a manager is always to convert sound analysis into sound actionsactions

that will produce the desired results. Hence, the final and most telling step in preparing a case is to

develop an action agenda for management that lays out a set of specific recommendations on what to do.

Bear in mind that proposing realistic, workable solutions is far preferable to casually tossing out off-thetop-of-your-head suggestions. Be prepared to argue why your recommendations are more attractive than

other courses of action that are open. Youll find the case preparation exercises on Case-TUTOR helpful

in performing this step, too.

Table 1

Key Financial Ratios: How to Calculate Them and

What They Mean

Ratio

How Calculated

What It Shows

Sales Cost of goods sold

Sales

Shows the percentage of revenues available to cover

operating expenses and yield a profit. Higher is

better and the trend should be upward.

2. Operating profit margin

(or return on sales)

Sales Operating expenses

Sales

or

Operating income

Sales

Shows the profitability of current operations without

regard to interest charges and income taxes. Higher

is better and the trend should be upward.

3. Net profit margin (or net

return on sales)

Profits after taxes

Sales

Shows after tax profits per dollar of sales. Higher is

better and the trend should be upward.

4. Return on total assets

Profits after taxes + Interest

Total assets

5. Return on stockholders

equity

Profits after taxes

Total stockholders equity

A measure of the return on total investment in the

enterprise. Interest is added to after tax profits to

form the numerator since total assets are financed by

creditors as well as by stockholders. Higher is better

and the trend should be upward.

Shows the return stockholders are earning on their

investment in the enterprise. A return in the 12-15%

range is average, and the trend should be upward.

6. Earnings per share

Profits after taxes

Number of shares of common stock

outstanding

Shows the earnings for each share of common stock

outstanding. The trend should be upward, and the

bigger the annual percentage gains, the better.

Liquidity Ratios

1. Current ratio

Current assets Current liabilities

Shows a firms ability to pay current liabilities using

assets that can be converted to cash in the near term.

Ratio should definitely be higher than 1.0; ratios of 2

or higher are better still.

2. Quick ratio (or acid-test

ratio)

Current assets Inventory

Current liabilities

Shows a firms ability to pay current liabilities

without relying on the sale of its inventories.

Profitability ratios

1. Gross profit margin

A Guide to Case Analysis

Table 1 continued

3. Working capital

Current assets current liabilities

Bigger amounts are better because the company

has more internal funds available to (1) pay its

current liabilities on a timely basis and (2) finance

inventory expansion, additional accounts receivable,

and a larger base of operations without resorting to

borrowing or raising more equity capital.

Total debt

Total assets

Measures the extent to which borrowed funds have

been used to finance the firms operations. Low

fractions or ratios are betterhigh fractions indicate

overuse of debt and greater risk of bankruptcy.

2. Debt-to-equity ratio

Total debt

Total stockholders equity

Should usually be less than 1.0. High ratios

(especially above 1.0) signal excessive debt, lower

creditworthiness, and weaker balance sheet strength.

3. Long-term debt-toequity ratio

Long-term debt

Total stockholders equity

Shows the balance between debt and equity in

the firms long-term capital structure. Low ratios

indicate greater capacity to borrow additional funds

if needed.

4. Times-interest-earned (or

coverage) ratio

Operating income

Interest expenses

Measures the ability to pay annual interest charges.

Lenders usually insist on a minimum ratio of 2.0, but

ratios above 3.0 signal better creditworthiness.

Inventory

Cost of goods sold 365

Measures inventory management efficiency. Fewer

days of inventory are usually better.

2. Inventory turnover

Cost of goods sold

Inventory

Measures the number of inventory turns per year.

Higher is better.

3. Average collection

period

Accounts receivable

Total sales 365

or

Accounts receivable

Average daily sales

Indicates the average length of time the firm must

wait after making a sale to receive cash payment. A

shorter collection time is better.

Leverage Ratios

1. Debt-to-assets ratio

Activity Ratios

1. Days of inventory

Other Important Measures of Financial Performance

1. Dividend yield on

Annual dividends per share

common stock

Current market price per share

A measure of the return that shareholders receive in

the form of dividends. A typical dividend yield is

2-3%. The dividend yield for fast-growth companies

is often below 1% (maybe even 0); the dividend

yield for slow-growth companies can run 4-5%.

2. Price-earnings ratio

Current market price per share

Earnings per share

P-e ratios above 20 indicate strong investor

confidence in a firms outlook and earnings growth;

firms whose future earnings are at risk or likely to

grow slowly typically have ratios below 12.

3. Dividend payout ratio

Annual dividends per share

Earnings per share

Indicates the percentage of after-tax profits paid out

as dividends.

4. Internal cash flow

After tax profits + Depreciation

A quick and rough estimate of the cash a companys

business is generating after payment of operating

expenses, interest, and taxes. Such amounts can

be used for dividend payments or funding capital

expenditures.

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Royal Malaysian Customs Department: Jabatan Kastam Diraja MalaysiaDocument5 pagesRoyal Malaysian Customs Department: Jabatan Kastam Diraja MalaysiaSyed IsaPas encore d'évaluation

- Acc 423 Advanced TaxationDocument50 pagesAcc 423 Advanced Taxationkajojo joyPas encore d'évaluation

- Payroll Register SampleDocument2 pagesPayroll Register SampleMichelle OliPas encore d'évaluation

- Series: Safety, Operation, and Procedure Instructions For The PTS Series of DC Hipot/MegohmmetersDocument37 pagesSeries: Safety, Operation, and Procedure Instructions For The PTS Series of DC Hipot/MegohmmetersBarajiux100% (1)

- Auditing Arens Chapter 20Document30 pagesAuditing Arens Chapter 20MARLINPas encore d'évaluation

- Arias vs. SandiganbayanDocument17 pagesArias vs. SandiganbayanFlorz Gelarz0% (1)

- Income Taxation ModuleDocument52 pagesIncome Taxation ModulePercival CelestinoPas encore d'évaluation

- Machinery Breakdown InsuranceDocument20 pagesMachinery Breakdown InsuranceRumman Arshad DarPas encore d'évaluation

- Optional Standard Deduction OSDDocument28 pagesOptional Standard Deduction OSDLes EvangeListaPas encore d'évaluation

- POI Submission GuidelinesDocument4 pagesPOI Submission Guidelinesswapna vijayPas encore d'évaluation

- "Sri Lanka": Global / Country Study and ReportDocument218 pages"Sri Lanka": Global / Country Study and ReportPakayaPas encore d'évaluation

- B. Hilado vs. Collector of Internal Revenue, Et Al., G.R. No. L-9408, October 31, 1956Document2 pagesB. Hilado vs. Collector of Internal Revenue, Et Al., G.R. No. L-9408, October 31, 1956Rhenee Rose Reas SugboPas encore d'évaluation

- Commission: 979197/895-HS Talha Ahmed ButtDocument1 pageCommission: 979197/895-HS Talha Ahmed ButtGooglo FanPas encore d'évaluation

- Escaping The Fragility TrapDocument79 pagesEscaping The Fragility TrapJose Luis Bernal MantillaPas encore d'évaluation

- Pramerica Life Rakshak SmartDocument10 pagesPramerica Life Rakshak SmartTraditional SamayalPas encore d'évaluation

- Arevalo Cabel ReyesDocument124 pagesArevalo Cabel ReyesDiannarose MarinPas encore d'évaluation

- Marcia Brady Tucker and Estate of Carll Tucker, Deceased, Marcia Brady Tucker, Carll Tucker, JR., and Luther Tucker, Executors v. Commissioner of Internal Revenue, 322 F.2d 86, 2d Cir. (1963)Document5 pagesMarcia Brady Tucker and Estate of Carll Tucker, Deceased, Marcia Brady Tucker, Carll Tucker, JR., and Luther Tucker, Executors v. Commissioner of Internal Revenue, 322 F.2d 86, 2d Cir. (1963)Scribd Government DocsPas encore d'évaluation

- Cambridge International AS & A Level: Economics 9708/32Document12 pagesCambridge International AS & A Level: Economics 9708/32PRIYANK RAWATPas encore d'évaluation

- Coolturita IIDocument174 pagesCoolturita IINehuén D'AdamPas encore d'évaluation

- The Taxpayer Burden of Family FragmentationDocument4 pagesThe Taxpayer Burden of Family FragmentationMichigan Family ForumPas encore d'évaluation

- AlienationsDocument25 pagesAlienationsAnam KhanPas encore d'évaluation

- Temporal Goods NotesDocument21 pagesTemporal Goods NotesAdriano Tinashe Tsikano80% (5)

- Model Question Paper - IGST Act.: (2 Marks Each) Multiple Choice QuestionsDocument25 pagesModel Question Paper - IGST Act.: (2 Marks Each) Multiple Choice QuestionsShyam Prasad100% (1)

- BIR Ruling 244-12 PDFDocument3 pagesBIR Ruling 244-12 PDFJudy RoblesPas encore d'évaluation

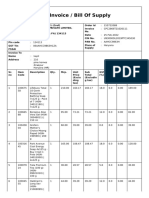

- Tax Invoice / Bill of SupplyDocument2 pagesTax Invoice / Bill of SupplyKapil SinglaPas encore d'évaluation

- Consolidated 2018 Forms 1099 and Details: Robinhood (650) 940-2700Document8 pagesConsolidated 2018 Forms 1099 and Details: Robinhood (650) 940-2700Renjie XuPas encore d'évaluation

- A Project Report On MultiplexDocument36 pagesA Project Report On MultiplexSantosh Chhabria100% (2)

- Factors That Influence The Performance of Micro and Small Business Enterprises (A Case Study in Arbegona Town)Document53 pagesFactors That Influence The Performance of Micro and Small Business Enterprises (A Case Study in Arbegona Town)Gadisa Gudina100% (1)

- Annual Report 2022 23Document150 pagesAnnual Report 2022 23rrocktemtubePas encore d'évaluation

- Puyat and Sons Vs City of ManilaDocument4 pagesPuyat and Sons Vs City of ManilaJohn Jeffrey L. Ramirez100% (1)