Académique Documents

Professionnel Documents

Culture Documents

EMP: Alliance Global Guaranteed Notes

Transféré par

BusinessWorldTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

EMP: Alliance Global Guaranteed Notes

Transféré par

BusinessWorldDroits d'auteur :

Formats disponibles

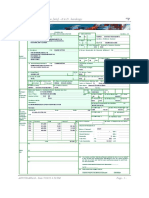

SECURITIES AND EXCHANGE COMMISSION

SEC FORM 17-C

CURRENT REPORT UNDER SECTION 17

OF THE SECURITIES REGULATION CODE

AND SRC RULE 17.2(c) THEREUNDER

1. 20 December 2016

Date of Report (Date of earliest event reported)

2. SEC Identification Number A200117595

3. BIR Tax Identification No. 214-815-715-000

4. EMPERADOR INC.

Exact name of issuer as specified in its charter

5. PHILIPPINES

Province, country or other jurisdiction of

incorporation

6.

(SEC Use Only)

Industry Classification Code:

7. 7th Floor, 1880 Eastwood Avenue, Eastwood City CyberPark

188 E. Rodriguez Jr. Avenue, Bagumbayan, Quezon City

Address of principal office

1110

Postal Code

8. (632)-709-2038 to 41

Issuer's telephone number, including area code

9. N/A

Former name or former address, if changed since last report

10. Securities registered pursuant to Sections 8 and 12 of the SRC or Sections 4 and 8 of the RSA

Title of Each Class

Number of Shares of Common Stock

Outstanding and Amount of Debt Outstanding

Common Shares

16,120,000,000

11. Indicate the item numbers reported herein: ITEM 9 OTHER EVENTS

Alliance Global Group, Inc. and its wholly owned subsidiary, Alliance Global Group Cayman Islands,

Inc., has filed the attached Notice in connection with the latters USD$500M 6.50% Guaranteed Notes

due 2017 (the Notes) currently listed on the Singapore Exchange Securities Trading Limited, on the

provision of an additional guarantee from each of Emperador Inc. and Emperador Distillers, Inc. upon

accession as an additional guarantor under the Notes.

SIGNATURES

Pursuant to the requirements of the Securities Regulation Code, the issuer has duly caused

this report to be signed on its behalf by the undersigned hereunto duly authorized.

EMPERADOR INC.

By:

DINA D. INTING

Compliance Officer and

Corporate Information Officer

20 December 2016

ALLIANCE GLOBAL GROUP CAYMAN ISLANDS, INC.

c/o Portcullis TrustNet (Cayman) Ltd.

The Grand Pavilion Commercial Centre

Oleander Way

802 West Bay Road, PO Box 32052

Grand Cayman KY1-1298, Cayman Islands

(the Issuer)

OFFICIAL NOTICE TO HOLDERS: The provision of an additional guarantee from each of Emperador Inc.

and Emperador Distillers Inc. upon accession as an additional guarantor under the Notes (as defined below)

DATED 20 December 2016

NOTICE TO HOLDERS OF THE NOTES

ISIN: XS0533657440

Common Code: 053365744

Capitalised terms not defined in this notice shall have the same meaning as in the Terms and Conditions of

the Notes (the Conditions).

Alliance Global Group Cayman Islands, Inc., as issuer of U.S.$500,000,000 6.50% Guaranteed Notes due

2017 (the Notes) guaranteed by Alliance Global Group, Inc. (AGG), hereby gives notice to the holders of

the Notes, in accordance with Condition 15 of the Conditions, of the provision of an additional guarantee by

each of Emperador Inc. and Emperador Distillers Inc. upon accession as an additional guarantor under the

Notes (together, the Additional Guarantors). Such additional guarantees are effective as of 20 December

2016 (the Additional Guarantees). The Additional Guarantees are given in connection with the guarantees

provided by each of Emperador Inc. and Emperador Distillers Inc. under a second Euro 370,000,000 facility

agreement dated 14 December 2016 between, amongst others, Emperador International Limited as

borrower, the Additional Guarantors and The Hongkong and Shanghai Banking Corporation Limited and J.P

Morgan Chase Bank N.A., Singapore Branch as Lenders (the Facility) and in accordance with Condition

4.5 of the Notes.

Each Additional Guarantor has undertaken, upon becoming an additional guarantor, to perform all the

obligations expressed to be undertaken by the Guarantor under the Trust Deed, on a joint and several basis

with the other Additional Guarantor. The obligations of each of AGG as the original guarantor and the

Additional Guarantors are joint and several for the term of the Facility.

The Additional Guarantees and the obligations of the Additional Guarantors thereunder shall terminate upon

the final repayment date of the Facility or until they are earlier terminated by the Issuer in accordance with

the Trust Deed and, if applicable, the Facility.

For the avoidance of doubt, upon any discharge, release or arrangement by the Issuer, in whole or in part, of

the Additional Guarantees and the obligations of the Additional Guarantors thereunder, the obligations of

AGG as the Guarantor under the Notes, the Principal Trust Deed and the Principal Agency Agreement shall

not be affected whatsoever by any such discharge, release or arrangement.

Vous aimerez peut-être aussi

- Nation at A Glance - (12/06/18)Document1 pageNation at A Glance - (12/06/18)BusinessWorldPas encore d'évaluation

- Nation at A Glance - (12/21/18)Document1 pageNation at A Glance - (12/21/18)BusinessWorldPas encore d'évaluation

- Nation at A Glance - (12/11/18)Document1 pageNation at A Glance - (12/11/18)BusinessWorldPas encore d'évaluation

- Nation at A Glance - (12/18/18)Document1 pageNation at A Glance - (12/18/18)BusinessWorldPas encore d'évaluation

- Nation at A Glance - (12/07/18)Document1 pageNation at A Glance - (12/07/18)BusinessWorldPas encore d'évaluation

- Nation at A Glance - (12/20/18)Document1 pageNation at A Glance - (12/20/18)BusinessWorldPas encore d'évaluation

- Nation at A Glance - (11/21/18)Document1 pageNation at A Glance - (11/21/18)BusinessWorldPas encore d'évaluation

- Nation at A Glance - (11/29/18)Document1 pageNation at A Glance - (11/29/18)BusinessWorldPas encore d'évaluation

- Nation at A Glance - (12/04/18)Document1 pageNation at A Glance - (12/04/18)BusinessWorldPas encore d'évaluation

- Nation at A Glance - (11/23/18)Document1 pageNation at A Glance - (11/23/18)BusinessWorldPas encore d'évaluation

- Nation at A Glance - (11/27/18)Document1 pageNation at A Glance - (11/27/18)BusinessWorldPas encore d'évaluation

- Nation at A Glance - (10/24/18)Document1 pageNation at A Glance - (10/24/18)BusinessWorldPas encore d'évaluation

- Nation at A Glance - (11/30/18)Document1 pageNation at A Glance - (11/30/18)BusinessWorldPas encore d'évaluation

- Nation at A Glance - (11/22/18)Document1 pageNation at A Glance - (11/22/18)BusinessWorldPas encore d'évaluation

- Nation at A Glance - (11/06/18)Document1 pageNation at A Glance - (11/06/18)BusinessWorldPas encore d'évaluation

- Nation at A Glance - (11/16/18)Document1 pageNation at A Glance - (11/16/18)BusinessWorldPas encore d'évaluation

- Nation at A Glance - (11/20/18)Document1 pageNation at A Glance - (11/20/18)BusinessWorldPas encore d'évaluation

- Nation at A Glance - (11/08/18)Document1 pageNation at A Glance - (11/08/18)BusinessWorldPas encore d'évaluation

- Nation at A Glance - (11/09/18)Document1 pageNation at A Glance - (11/09/18)BusinessWorldPas encore d'évaluation

- Nation at A Glance - (11/13/18)Document1 pageNation at A Glance - (11/13/18)BusinessWorldPas encore d'évaluation

- Nation at A Glance - (10/30/18)Document1 pageNation at A Glance - (10/30/18)BusinessWorldPas encore d'évaluation

- Nation at A Glance - (10/26/18)Document1 pageNation at A Glance - (10/26/18)BusinessWorldPas encore d'évaluation

- Nation at A Glance - (10/25/18)Document1 pageNation at A Glance - (10/25/18)BusinessWorldPas encore d'évaluation

- Nation at A Glance - (11/14/18)Document1 pageNation at A Glance - (11/14/18)BusinessWorldPas encore d'évaluation

- Nation at A Glance - (11/07/18)Document1 pageNation at A Glance - (11/07/18)BusinessWorldPas encore d'évaluation

- Nation at A Glance - (10/22/18)Document1 pageNation at A Glance - (10/22/18)BusinessWorldPas encore d'évaluation

- Nation at A Glance - (10/23/18)Document1 pageNation at A Glance - (10/23/18)BusinessWorldPas encore d'évaluation

- Nation at A Glance - (10/16/18)Document1 pageNation at A Glance - (10/16/18)BusinessWorldPas encore d'évaluation

- Nation at A Glance - (10/18/18)Document1 pageNation at A Glance - (10/18/18)BusinessWorldPas encore d'évaluation

- Nation at A Glance - (10/17/18)Document1 pageNation at A Glance - (10/17/18)BusinessWorldPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- BP2313 Audit With Answers)Document44 pagesBP2313 Audit With Answers)hodgl1976100% (4)

- International Business: Gaurav DawarDocument22 pagesInternational Business: Gaurav Dawarsarathnair26Pas encore d'évaluation

- ZEROPAY WhitepaperDocument15 pagesZEROPAY WhitepaperIlham NurrohimPas encore d'évaluation

- Arthakranti 12 MinutesDocument26 pagesArthakranti 12 Minutesmadhusri002Pas encore d'évaluation

- Cpa Questions Part XDocument10 pagesCpa Questions Part XAngelo MendezPas encore d'évaluation

- Practice Set 1Document6 pagesPractice Set 1morePas encore d'évaluation

- UNI DRFT - Duty - Apsara - 31.07.2023Document1 pageUNI DRFT - Duty - Apsara - 31.07.2023praneeth jayeshaPas encore d'évaluation

- CBI Holding Company, Inc. / Case 2.6Document3 pagesCBI Holding Company, Inc. / Case 2.6octaevia50% (4)

- TRAVELERS INDEMNITY COMPANY OF ILLINOIS Et Al v. CLARENDON AMERICAN INSURANCE COMPANY Et Al ComplaintDocument41 pagesTRAVELERS INDEMNITY COMPANY OF ILLINOIS Et Al v. CLARENDON AMERICAN INSURANCE COMPANY Et Al ComplaintACELitigationWatchPas encore d'évaluation

- Chapter 6 Power Point - ASSIGNDocument10 pagesChapter 6 Power Point - ASSIGNmuluPas encore d'évaluation

- Summative Test in Math (Part Ii) Quarter 1Document1 pageSummative Test in Math (Part Ii) Quarter 1JAY MIRANDAPas encore d'évaluation

- Arbitage TheoryDocument9 pagesArbitage Theorymahesh19689Pas encore d'évaluation

- How To Know Fraud in AdvanceDocument6 pagesHow To Know Fraud in AdvanceMd AzimPas encore d'évaluation

- Account Titles and Its ElementsDocument3 pagesAccount Titles and Its ElementsJeb PampliegaPas encore d'évaluation

- Agrarian Crisis and Farmer SuicidesDocument38 pagesAgrarian Crisis and Farmer SuicidesbtnaveenkumarPas encore d'évaluation

- Investment Theory Body Kane MarcusDocument5 pagesInvestment Theory Body Kane MarcusPrince ShovonPas encore d'évaluation

- Bipard Prashichhan (Gaya) - 87-2023Document8 pagesBipard Prashichhan (Gaya) - 87-2023tinkulal91Pas encore d'évaluation

- Sheraton Yilan Investment Memorandum 2010Document3 pagesSheraton Yilan Investment Memorandum 2010Sky Yim100% (1)

- CR Sample L6 Module 2 PDFDocument4 pagesCR Sample L6 Module 2 PDFDavid JonathanPas encore d'évaluation

- Cash Flow statement-AFMDocument27 pagesCash Flow statement-AFMRishad kPas encore d'évaluation

- Ledger - Problems and SolutionsDocument1 pageLedger - Problems and SolutionsDjamal SalimPas encore d'évaluation

- Research Report Pidilite Industries LTDDocument7 pagesResearch Report Pidilite Industries LTDAnirudh PatilPas encore d'évaluation

- L5 Financial PlansDocument55 pagesL5 Financial Plansfairylucas708Pas encore d'évaluation

- Government Grant and Borrowing CostDocument2 pagesGovernment Grant and Borrowing CostMaximusPas encore d'évaluation

- Internship Report On "Human Resource Managemet Practices of NCC Bank Ltd.Document57 pagesInternship Report On "Human Resource Managemet Practices of NCC Bank Ltd.Arefin RidwanPas encore d'évaluation

- Tax Invoice: ALWAR GAS SERVICE (000010176)Document1 pageTax Invoice: ALWAR GAS SERVICE (000010176)VijendraPas encore d'évaluation

- GCG MC No. 2012-07 - Code of Corp Governance PDFDocument31 pagesGCG MC No. 2012-07 - Code of Corp Governance PDFakalamoPas encore d'évaluation

- 5.5 Manufacturing AccountsDocument6 pages5.5 Manufacturing AccountsZaynab ChowdhuryPas encore d'évaluation

- Group Assignment Cover Sheet: Student DetailsDocument9 pagesGroup Assignment Cover Sheet: Student DetailsMinh DucPas encore d'évaluation

- The White Paper-Equity And: Excellence - Implications For GpsDocument24 pagesThe White Paper-Equity And: Excellence - Implications For GpsTim SandlePas encore d'évaluation