Académique Documents

Professionnel Documents

Culture Documents

Active Strategies: Strategic Investment

Transféré par

Amna NawazTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Active Strategies: Strategic Investment

Transféré par

Amna NawazDroits d'auteur :

Formats disponibles

Active strategies usually involve bond swaps, liquidating one group of bonds to purchase

another group, to take advantage of expected changes in the bond market, either to seek higher

returns or to maintain the value of a portfolio. Active strategies are used to take advantage of

expected changes in interest rates, yield curve shifts, and changes in the credit ratings of

individual issuers.

Passive strategies are used, not so much to maximize returns, but to earn a good return while

matching cash flows to expected liabilities or, as in indexing, to minimize transaction and

management costs. Pension funds, banks, and insurance companies use passive strategies

extensively to match their income with their expected payouts, especially bond immunization

strategies and cash flow matching. Generally, the bonds are purchased to achieve a specific

investment objective; thereafter, the bond portfolio is monitored and adjusted as needed.

Strategic Investment

A strategic investment is a transaction that is closely related to joint ventures. In strategic

investments, one company makes an investment in another. These two companies enter into

agreements that are designed to serve shared business goals.

How is Strategic Investment Done?

Strategic investment begins with identifying and evaluating various projects and making a

selection that is likely to boost the companys competitive advantage.

In a strategic investment, the investor generally acquires common or preferred stocks in the

target company. A loan may also be taken for acquiring the debt securities of the target company.

Moreover, the two companies may enter into supply and sourcing contracts, technology sharing

agreements or research and development agreements. They may also form separate joint venture

entities for engaging in specified businesses.

Vous aimerez peut-être aussi

- What Is Portfolio ManagementDocument14 pagesWhat Is Portfolio Managementnisha.shahi076Pas encore d'évaluation

- Nature and Scope of Strategic Financial ManagementDocument26 pagesNature and Scope of Strategic Financial ManagementRahat JaanPas encore d'évaluation

- Team 3 Funding and Income Sources Invesment StrategiesDocument12 pagesTeam 3 Funding and Income Sources Invesment Strategiesocampojohnoliver1901182Pas encore d'évaluation

- AFM Important TheoryDocument25 pagesAFM Important TheorygirishpawarudgirkarPas encore d'évaluation

- Portfolio ManagementDocument15 pagesPortfolio Managementnisha.shahi076Pas encore d'évaluation

- 1 - Nature and Scope of Strategic Financial ManagementDocument26 pages1 - Nature and Scope of Strategic Financial ManagementAiko GuintoPas encore d'évaluation

- DIVIDEND POLICY KKDocument14 pagesDIVIDEND POLICY KKAbdulkarim Hamisi KufakunogaPas encore d'évaluation

- Equity Financing Vs Debt FinancingDocument2 pagesEquity Financing Vs Debt FinancingAnna AbacanPas encore d'évaluation

- Vanguard InvestingDocument40 pagesVanguard InvestingrasmussenmachinePas encore d'évaluation

- Corporate Finance - MID TERM NOTESDocument7 pagesCorporate Finance - MID TERM NOTESsatyam skPas encore d'évaluation

- Intro To Portfolio MGTDocument39 pagesIntro To Portfolio MGTLea AndreleiPas encore d'évaluation

- Dividend Policy AfmDocument10 pagesDividend Policy AfmPooja NagPas encore d'évaluation

- Introduction To Investment Decision in Financial Management (Open Compatibility)Document5 pagesIntroduction To Investment Decision in Financial Management (Open Compatibility)karl markxPas encore d'évaluation

- To Investment Decision in Financial ManagementDocument15 pagesTo Investment Decision in Financial Managementpalakurthi_palakurthPas encore d'évaluation

- Private Equity Basics by - Shahid AnwarDocument8 pagesPrivate Equity Basics by - Shahid Anwarvinaymaladi24Pas encore d'évaluation

- IM 01 IntroductionDocument84 pagesIM 01 IntroductionAfif Abdur RahmanPas encore d'évaluation

- Benefits of Investing in Mutual FundsDocument4 pagesBenefits of Investing in Mutual Fundskumarpoonam2010Pas encore d'évaluation

- FRS Unit 3Document6 pagesFRS Unit 3Sushma KamblePas encore d'évaluation

- FM1.1 IntroductionDocument4 pagesFM1.1 IntroductionnehaasinghhPas encore d'évaluation

- Unit - 2 (Investment Decisions)Document22 pagesUnit - 2 (Investment Decisions)Shaik BabjanPas encore d'évaluation

- Afm TheoryDocument4 pagesAfm TheoryMd YusufPas encore d'évaluation

- Investment Policy Statement and Its Major ComponentsDocument34 pagesInvestment Policy Statement and Its Major ComponentsanoopboptePas encore d'évaluation

- Strategic Financial ManagementDocument19 pagesStrategic Financial Managementsai krishnaPas encore d'évaluation

- Financial Management: Topic-Dividend PolicyDocument10 pagesFinancial Management: Topic-Dividend PolicyVibhuti SharmaPas encore d'évaluation

- IntroductionDocument7 pagesIntroductionAahana GuptaPas encore d'évaluation

- Capitasl Expenditure (Final Project)Document42 pagesCapitasl Expenditure (Final Project)nikhil_jbp100% (1)

- Finance Theory: (Suitable For CFM / FAM & CF Candidates) Corporate FinanceDocument7 pagesFinance Theory: (Suitable For CFM / FAM & CF Candidates) Corporate FinanceLal LalPas encore d'évaluation

- Role of A Financial ManagerDocument15 pagesRole of A Financial ManagerAadi Jain -Pas encore d'évaluation

- Investment Appraisal MethodsDocument15 pagesInvestment Appraisal MethodsFaruk Hossain100% (1)

- Id 49 BMDocument13 pagesId 49 BMMd Majedul HaquePas encore d'évaluation

- Portfolio Mangemnt Services Draft 28-7-14Document14 pagesPortfolio Mangemnt Services Draft 28-7-14Yash GaonkarPas encore d'évaluation

- 34682compilerfinal SFM n03n13 Cp1Document3 pages34682compilerfinal SFM n03n13 Cp1casarokarPas encore d'évaluation

- Financial Management 1Document6 pagesFinancial Management 1stocksshankarPas encore d'évaluation

- Capital StructureDocument37 pagesCapital StructureIdd Mic-dadyPas encore d'évaluation

- Financial Management and ControlDocument31 pagesFinancial Management and Controljeof basalof100% (1)

- Financial Management DPSDocument19 pagesFinancial Management DPSYashasviPas encore d'évaluation

- Corporate FinanceDocument56 pagesCorporate Financeskspankaj08Pas encore d'évaluation

- CCRA Session 13Document19 pagesCCRA Session 13VISHAL PATILPas encore d'évaluation

- HTBFM143 Yash Vanigotta Alternative InvestmentsDocument14 pagesHTBFM143 Yash Vanigotta Alternative InvestmentsYashPas encore d'évaluation

- Finals Fnm103Document40 pagesFinals Fnm103Novelyn DuyoganPas encore d'évaluation

- FM8 Module 4Document5 pagesFM8 Module 4Kim HeidelynPas encore d'évaluation

- Presentation 14Document16 pagesPresentation 14Rakesh ShuklaPas encore d'évaluation

- DocumentDocument2 pagesDocumentMaynardMiranoPas encore d'évaluation

- Business Finance 1Document17 pagesBusiness Finance 1moyopatron4Pas encore d'évaluation

- Project On Impact of Dividends PolicyDocument45 pagesProject On Impact of Dividends Policyarjunmba119624100% (1)

- Hedge Funds ProjectDocument8 pagesHedge Funds ProjectAyesha PattnaikPas encore d'évaluation

- m-1 Intro To InvestmentDocument19 pagesm-1 Intro To InvestmentMvasvaniPas encore d'évaluation

- Nasture of Capital Budgeting Problem&methods 4 Evaluating Investment Proposals.Document18 pagesNasture of Capital Budgeting Problem&methods 4 Evaluating Investment Proposals.Ashams MathewPas encore d'évaluation

- Corporate FinanceDocument11 pagesCorporate FinanceJoshua VernazzaPas encore d'évaluation

- Functional Strategy. Organizational Plan For HumanDocument11 pagesFunctional Strategy. Organizational Plan For HumanAli HashmiPas encore d'évaluation

- Hedge Fund StrategiesDocument3 pagesHedge Fund StrategiesKen BiiPas encore d'évaluation

- Investment IntroductionDocument25 pagesInvestment IntroductionKumarPas encore d'évaluation

- MAKE UpDocument5 pagesMAKE UpPiyush RohitPas encore d'évaluation

- FNE Security Analysis PRELIMDocument6 pagesFNE Security Analysis PRELIMAldrin John TungolPas encore d'évaluation

- Week 1 Module - Definition of Investment Portfolio ManagementDocument8 pagesWeek 1 Module - Definition of Investment Portfolio ManagementKrystal AquinoPas encore d'évaluation

- Dividend DecisionsDocument7 pagesDividend DecisionsAahana GuptaPas encore d'évaluation

- DJMD SjdnajkDocument14 pagesDJMD Sjdnajksuhaib shaikhPas encore d'évaluation

- Chapter II Financial ManagementDocument4 pagesChapter II Financial ManagementHannah DiazPas encore d'évaluation

- Results On Banking Efficiency in Turkey 4. FindingsDocument5 pagesResults On Banking Efficiency in Turkey 4. FindingsAmna NawazPas encore d'évaluation

- Investment in Equity in India 1.2.2 How This Research Differs From Previous StudiesDocument9 pagesInvestment in Equity in India 1.2.2 How This Research Differs From Previous StudiesAmna NawazPas encore d'évaluation

- ISLAMIC EQUITY INVESTMENTS 4 FileDocument5 pagesISLAMIC EQUITY INVESTMENTS 4 FileAmna NawazPas encore d'évaluation

- Factors Affecting The Efficiency of Islamic and Conventional Banks in TurkeyDocument3 pagesFactors Affecting The Efficiency of Islamic and Conventional Banks in TurkeyAmna NawazPas encore d'évaluation

- And Compute The Index:: - The Inflation Rate Is Calculated As FollowsDocument4 pagesAnd Compute The Index:: - The Inflation Rate Is Calculated As FollowsAmna NawazPas encore d'évaluation

- Efficiency of Islamic and Conventional 2. LiteratureDocument5 pagesEfficiency of Islamic and Conventional 2. LiteratureAmna NawazPas encore d'évaluation

- Measuring The Cost of LivingDocument4 pagesMeasuring The Cost of LivingAmna NawazPas encore d'évaluation

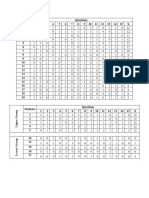

- Students Questions 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 X 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19Document3 pagesStudents Questions 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 X 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19Amna NawazPas encore d'évaluation

- Capital Structure TheoriesDocument3 pagesCapital Structure TheoriesAmna NawazPas encore d'évaluation

- Measuring The Cost of LivingDocument4 pagesMeasuring The Cost of LivingAmna NawazPas encore d'évaluation

- Micro Eco Ass1Document1 pageMicro Eco Ass1Amna NawazPas encore d'évaluation

- Difficulty IndexDocument2 pagesDifficulty IndexAmna NawazPas encore d'évaluation

- Demand and Supply: Elasticities and Government-Set PricesDocument3 pagesDemand and Supply: Elasticities and Government-Set PricesAmna NawazPas encore d'évaluation

- Example (Assignment)Document3 pagesExample (Assignment)Amna NawazPas encore d'évaluation

- Example (Assignment)Document3 pagesExample (Assignment)Amna NawazPas encore d'évaluation

- Sukuk Markets: Sukuk Issuer, Entered This Market in Mid-2001. The First Sukuk Issued by ADocument4 pagesSukuk Markets: Sukuk Issuer, Entered This Market in Mid-2001. The First Sukuk Issued by AAmna NawazPas encore d'évaluation

- What Is EducationDocument9 pagesWhat Is EducationAmna NawazPas encore d'évaluation

- Regulatory Framework of The Capital MarketsDocument1 pageRegulatory Framework of The Capital MarketsAmna NawazPas encore d'évaluation

- The Framework of Islamic FinanceDocument7 pagesThe Framework of Islamic FinanceAmna NawazPas encore d'évaluation

- The Determinants of Capital StructureDocument8 pagesThe Determinants of Capital StructureAmna Nawaz100% (1)

- What Is RiskDocument10 pagesWhat Is RiskAmna NawazPas encore d'évaluation

- Capital Markets BoardDocument3 pagesCapital Markets BoardAmna NawazPas encore d'évaluation

- Definition of Capital StructureDocument3 pagesDefinition of Capital StructureAmna NawazPas encore d'évaluation

- Cost of Capital (Sermayesi Maliyet)Document2 pagesCost of Capital (Sermayesi Maliyet)Amna NawazPas encore d'évaluation

- MultinationalDocument9 pagesMultinationalAmna NawazPas encore d'évaluation

- Meezan ExampleDocument5 pagesMeezan ExampleAmna NawazPas encore d'évaluation

- Cost of Capital (Sermayesi Maliyet)Document2 pagesCost of Capital (Sermayesi Maliyet)Amna NawazPas encore d'évaluation

- Cost of Capital (Sermayesi Maliyet)Document2 pagesCost of Capital (Sermayesi Maliyet)Amna NawazPas encore d'évaluation

- SukukDocument39 pagesSukukAmna NawazPas encore d'évaluation