Académique Documents

Professionnel Documents

Culture Documents

Canadian Economic Outlook

Transféré par

Zain Khwaja0 évaluation0% ont trouvé ce document utile (0 vote)

25 vues1 pageGDP (chain-weighted) Final Sales Final Domestic Demand Consumer Spending durables nondurables services Government Spending Business Investment non-residential construction machinery and equipment exports imports inventory change contribution to GDP Growth net exports. Inflation GDP Price Index CPI All Items Excl. Food and Energy Food Prices Energy Prices Services cpi all items boc core.

Description originale:

Copyright

© Attribution Non-Commercial (BY-NC)

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentGDP (chain-weighted) Final Sales Final Domestic Demand Consumer Spending durables nondurables services Government Spending Business Investment non-residential construction machinery and equipment exports imports inventory change contribution to GDP Growth net exports. Inflation GDP Price Index CPI All Items Excl. Food and Energy Food Prices Energy Prices Services cpi all items boc core.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

25 vues1 pageCanadian Economic Outlook

Transféré par

Zain KhwajaGDP (chain-weighted) Final Sales Final Domestic Demand Consumer Spending durables nondurables services Government Spending Business Investment non-residential construction machinery and equipment exports imports inventory change contribution to GDP Growth net exports. Inflation GDP Price Index CPI All Items Excl. Food and Energy Food Prices Energy Prices Services cpi all items boc core.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

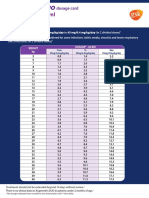

Canadian Economic Outlook

BMO Capital Markets Economics

March 5, 2010

2009 2010 2011 2008 2009 2010 2011

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

PRODUCTION (quarter/quarter % change : a.r.)

Real GDP (chain-weighted) -7.0 -3.5 0.9 5.0 3.7 3.4 3.2 2.9 2.9 3.5 3.8 3.6 0.4 -2.6 3.0 3.2

Final Sales -2.2 -4.0 -0.6 6.5 2.4 2.9 2.3 2.5 3.0 3.1 3.4 3.2 0.7 -1.5 2.4 2.9

Final Domestic Demand -7.4 0.3 5.6 4.6 3.3 3.1 2.9 2.8 3.1 2.9 3.2 3.3 2.6 -1.7 3.5 3.0

Consumer Spending -1.3 1.6 3.7 3.6 3.2 3.1 3.1 2.9 3.5 4.2 4.1 3.9 3.0 0.2 3.2 3.5

durables -11.7 3.6 12.8 10.7 4.0 3.0 3.0 2.5 4.0 6.0 6.0 5.0 5.6 -2.8 5.8 4.2

nondurables 2.6 0.0 1.6 -0.4 2.2 3.0 3.0 3.0 3.0 3.5 3.5 3.0 1.5 0.6 1.8 3.2

services 0.3 2.4 3.1 4.1 3.6 3.2 3.3 2.9 3.5 4.0 3.8 4.0 2.9 1.1 3.4 3.5

Government Spending 2.9 5.5 9.0 7.4 4.2 4.4 3.3 3.2 2.0 -0.8 -0.4 0.4 4.8 4.5 5.3 1.6

Business Investment -38.6 -19.0 6.4 -8.8 -2.5 1.0 1.8 2.5 4.5 4.5 6.5 7.0 0.2 -17.4 -2.3 4.0

non-residential construction -36.7 -22.0 -8.4 -8.5 -4.0 1.0 1.5 2.0 4.0 4.0 5.0 6.0 -0.1 -15.6 -4.8 3.4

machinery and equipment -40.4 -15.9 22.8 -9.2 -1.0 1.0 2.0 3.0 5.0 5.0 8.0 8.0 0.5 -19.2 0.0 4.6

Residential Construction -21.9 7.0 9.5 29.7 9.0 2.0 1.0 1.0 2.0 4.0 4.0 3.0 -2.7 -7.4 9.5 2.4

Exports -30.2 -19.1 12.2 15.4 2.5 4.1 4.6 5.6 5.7 6.7 6.7 5.7 -4.7 -14.0 5.2 5.8

Imports -39.2 -5.7 36.0 8.9 5.5 5.0 6.4 6.4 5.8 5.8 5.8 5.8 0.8 -13.4 8.8 5.9

(billions of chained 2002 dollars : a.r.)

Inventory Change -7.5 -6.3 -1.5 -4.3 -0.9 0.7 3.6 5.2 5.0 6.1 7.6 9.0 12.2 -4.9 2.2 6.9

Contribution to GDP Growth -4.7 0.6 1.5 -1.4 1.3 0.5 0.9 0.5 -0.1 0.3 0.4 0.4 -0.2 -1.1 0.5 0.3

Net Exports -58.3 -73.2 -99.5 -95.5 -99.9 -102.0 -105.5 -108.1 -109.7 -110.3 -110.9 -112.6 -90.7 -81.6 -103.9 -110.9

Contribution to GDP Growth 4.9 -4.3 -5.9 1.8 -0.9 -0.3 -0.6 -0.3 -0.1 0.2 0.2 -0.1 -2.0 0.1 -1.1 -0.1

(billions of dollars : a.r.)

Nominal GDP 1,519 1,508 1,524 1,560 1,585 1,605 1,628 1,648 1,668 1,688 1,710 1,731 1,600 1,528 1,616 1,699

(% chng : a.r.) -12.6 -2.8 4.3 9.8 6.6 5.1 5.8 5.2 4.8 5.0 5.3 5.1 4.4 -4.5 5.8 5.1

INFLATION (quarter/quarter % change : a.r.)

GDP Price Index -5.9 0.7 3.4 4.4 2.7 1.7 2.6 2.2 1.8 1.4 1.4 1.4 3.9 -1.9 2.8 1.8

CPI All Items -1.0 0.1 0.6 3.7 2.8 1.0 2.6 1.6 1.8 1.8 1.9 1.7 2.4 0.3 2.1 1.8

Excl. Food & Energy 0.8 1.2 0.6 1.1 1.7 0.9 2.7 1.3 1.7 1.8 1.8 1.5 1.2 1.1 1.4 1.7

Food Prices 4.8 2.2 0.1 0.5 1.5 1.5 2.2 2.2 1.6 1.5 1.9 1.5 3.5 4.9 1.3 1.8

Energy Prices -24.7 -12.9 1.5 37.3 15.3 1.6 2.8 2.4 3.1 3.2 3.2 3.7 9.8 -13.5 10.2 2.9

Services 0.2 3.6 1.8 0.7 0.5 2.3 3.4 1.3 2.2 2.1 2.0 4.2 3.4 2.1 1.6 2.3

(year/year % change)

CPI All Items 1.2 0.1 -0.9 0.8 1.8 2.1 2.6 2.0 1.8 2.0 1.8 1.8

BoC Core 1.9 1.9 1.6 1.6 1.8 1.6 1.6 1.5 1.6 1.6 1.7 1.8 1.7 1.8 1.6 1.7

FINANCIAL (average for the quarter : %)

Overnight Rate 0.83 0.25 0.25 0.25 0.25 0.25 0.58 1.08 1.58 2.08 2.58 3.08 2.96 0.40 0.54 2.33

3-Month T-Bill 0.64 0.25 0.22 0.21 0.17 0.25 0.77 1.24 1.72 2.21 2.69 3.17 2.33 0.33 0.61 2.45

90-Day BAs 0.82 0.35 0.31 0.32 0.32 0.38 0.90 1.37 1.85 2.34 2.82 3.30 3.18 0.45 0.74 2.58

10 Year Bond Yield 2.89 3.20 3.42 3.41 3.43 3.44 3.52 3.65 3.83 4.03 4.23 4.43 3.61 3.23 3.51 4.13

Canada/US spread: (bps)

90 day 43 8 6 15 7 12 51 49 39 37 43 41 94 18 30 40

10 year 15 -11 -10 -5 -24 -23 -25 -28 -33 -38 -43 -48 -6 -3 -25 -41

FOREIGN TRADE (billions of dollars : a.r.)

Current Account Balance -27.1 -43.8 -55.2 -39.1 -42.7 -41.7 -38.3 -37.4 -39.4 -42.3 -42.8 -43.6 8.1 -41.3 -40.0 -42.0

Merchandise Balance 3.5 -6.7 -16.5 2.3 0.4 0.2 -0.2 0.0 0.7 1.4 1.9 2.0 46.9 -4.3 0.1 1.5

Non-Merchandise Balance -30.7 -37.1 -38.7 -41.4 -43.1 -41.9 -38.0 -37.4 -40.2 -43.7 -44.7 -45.6 -38.8 -37.0 -40.1 -43.5

(average for the quarter)

Exchange Rate (US¢/C$) 80.3 85.6 91.1 94.7 95.3 97.2 100.0 100.3 100.4 101.1 101.7 102.3 94.3 88.0 98.2 101.4

Exchange Rate (C$/US$) 1.245 1.168 1.097 1.056 1.050 1.028 1.000 0.997 0.996 0.990 0.983 0.977 1.067 1.141 1.019 0.986

Exchange Rate (¥/C$) 75.2 83.5 85.3 85.1 86.2 89.7 95.6 99.2 102.1 105.3 108.5 111.7 97.8 82.3 92.7 106.9

Exchange Rate (C$/Euro) 1.62 1.59 1.57 1.56 1.45 1.43 1.41 1.43 1.44 1.41 1.39 1.37 1.56 1.58 1.43 1.40

INCOMES (billions of dollars : a.r.)

Corporate Profits Before Tax 147.3 130.8 142.9 155.8 160.7 163.3 165.0 168.9 176.4 180.0 181.0 186.4 215.8 144.2 164.5 181.0

Corporate Profits After Tax 97.9 88.7 102.0 103.1 113.4 115.4 116.8 120.2 127.7 131.3 132.3 137.7 155.3 97.9 116.4 132.3

(year/year % change)

Corporate Profits Before Tax -30.9 -43.0 -39.9 -14.8 9.1 24.8 15.4 8.4 9.8 10.2 9.7 10.4 5.7 -33.2 14.0 10.0

Personal Income 0.8 0.3 0.1 0.7 2.7 3.8 4.8 4.8 4.6 4.5 4.2 4.2 4.8 0.5 4.0 4.4

Real Disposable Income 0.8 1.5 1.8 1.3 2.6 2.5 2.9 3.1 2.6 2.3 2.3 2.3 4.2 1.4 2.8 2.4

(average for the quarter : %)

Savings Rate 5.1 5.5 4.9 4.6 4.7 4.7 4.6 4.6 4.2 3.7 3.3 3.1 3.7 5.0 4.6 3.6

OTHER INDICATORS (quarter average or period end : a.r.)

Unemployment Rate (%) 7.8 8.4 8.5 8.4 8.3 8.3 8.2 8.1 8.1 8.0 7.9 7.8 6.1 8.3 8.2 7.9

Housing Starts (thousands) 132 128 156 180 178 181 170 176 174 179 182 185 212 149 176 180

Motor Vehicle Sales (millions) 1.42 1.45 1.53 1.55 1.59 1.61 1.62 1.64 1.65 1.67 1.69 1.71 1.67 1.49 1.62 1.68

(quarter/quarter % change : a.r.)

Employment Growth -5.9 -1.1 -0.1 1.3 1.6 1.2 1.6 2.3 1.3 1.2 1.2 1.5 1.5 -1.6 1.1 1.5

Industrial Production -18.1 -14.5 -4.9 8.8 6.1 2.4 3.2 3.4 5.0 5.5 3.4 2.2 -4.2 -10.0 2.5 4.0

Note: Outlined areas represent forecast periods

The information, opinions, estimates, projections and other materials contained herein are provided as of the date hereof and are subject to change without notice. Some of the information, opinions, estimates, projections and other materials contained herein have been obtained from numerous sources and Bank of Montreal (“BMO”) and its affiliates make

every effort to ensure that the contents thereof have been compiled or derived from sources believed to be reliable and to contain information and opinions which are accurate and complete. However, neither BMO nor its affiliates have independently verified or make any representation or warranty, express or implied, in respect thereof, take no responsibility

for any errors and omissions which may be contained herein or accept any liability whatsoever for any loss arising from any use of or reliance on the information, opinions, estimates, projections and other materials contained herein whether relied upon by the recipient or user or any other third party (including, without limitation, any customer of the recipient or

user). Information may be available to BMO and/or its affiliates that is not reflected herein. The information, opinions, estimates, projections and other materials contained herein are not to be construed as an offer to sell, a solicitation for or an offer to buy, any products or services referenced herein (including, without limitation, any commodities, securities or

other financial instruments), nor shall such information, opinions, estimates, projections and other materials be considered as investment advice or as a recommendation to enter into any transaction. Additional information is available by contacting BMO or its relevant affiliate directly. BMO and/or its affiliates may make a market or deal as principal in the

products (including, without limitation, any commodities, securities or other financial instruments) referenced herein. BMO, its affiliates, and/or their respective shareholders, directors, officers and/or employees may from time to time have long or short positions in any such products (including, without limitation, commodities, securities or other financial

instruments). BMO Nesbitt Burns Inc. and/or BMO Capital Markets Corp., subsidiaries of BMO, may act as financial advisor and/or underwriter for certain of the corporations mentioned herein and may receive remuneration for same. “BMO Capital Markets” is a trade name used by the Bank of Montreal Investment Banking Group, which includes the

wholesale/institutional arms of Bank of Montreal, BMO Nesbitt Burns Inc., BMO Nesbitt Burns Ltée/Ltd., BMO Capital Markets Corp. and Harris N.A., and BMO Capital Markets Limited. TO U.S. RESIDENTS: BMO Capital Markets Corp. and/or BMO Nesbitt Burns Securities Ltd., affiliates of BMO NB, furnish this report to U.S. residents and accept responsibility

for the contents herein, except to the extent that it refers to securities of Bank of Montreal. Any U.S. person wishing to effect transactions in any security discussed herein should do so through BMO Capital Markets Corp. and/or BMO Nesbitt Burns Securities Ltd. TO U.K. RESIDENTS: The contents hereof are not directed at investors located in the U.K.,

other than persons described in Part VI of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2001.

Vous aimerez peut-être aussi

- Us ModelDocument1 pageUs ModellgfinancePas encore d'évaluation

- gdp4q20 3rdDocument21 pagesgdp4q20 3rd王建国Pas encore d'évaluation

- Quarterly Economic DataDocument1 pageQuarterly Economic Dataapi-25887578Pas encore d'évaluation

- GlanceDocument1 pageGlanceNigar MammadovaPas encore d'évaluation

- PVC Pipe Size ChartDocument1 pagePVC Pipe Size ChartPurvi PatelPas encore d'évaluation

- Client: Location:: Mosaic Fertilizantes Cajati-SPDocument17 pagesClient: Location:: Mosaic Fertilizantes Cajati-SPFlavio /lvesPas encore d'évaluation

- CRISIL Industry OverviewDocument100 pagesCRISIL Industry OverviewChaitanya MamadapurPas encore d'évaluation

- Παρουσίαση καθηγητή Γκ. Χαρδούβελη για την ελληνική οικονομίαDocument17 pagesΠαρουσίαση καθηγητή Γκ. Χαρδούβελη για την ελληνική οικονομίαfotiskPas encore d'évaluation

- Touchpoints Budget2020Document38 pagesTouchpoints Budget2020Elaine YeapPas encore d'évaluation

- Select Economic IndicatorsDocument1 pageSelect Economic Indicatorspls2019Pas encore d'évaluation

- 2015 Annual Results: Umut Zenar, CEO and Dr. Carsten Sauerland, CFODocument55 pages2015 Annual Results: Umut Zenar, CEO and Dr. Carsten Sauerland, CFOFrédéric GuillemetPas encore d'évaluation

- PT Depth Burden Depth Burden Target ActualDocument1 pagePT Depth Burden Depth Burden Target ActualDinesh KumarPas encore d'évaluation

- (2019-03-11) Gustavo Lopetegui - IAPG Houston - Energy in Argentina Investment Opportunities For The International Community - Pub PDFDocument14 pages(2019-03-11) Gustavo Lopetegui - IAPG Houston - Energy in Argentina Investment Opportunities For The International Community - Pub PDFIgnacio LabaquiPas encore d'évaluation

- Colombian Fiscal PolicyDocument24 pagesColombian Fiscal PolicyAndres OlayaPas encore d'évaluation

- Malaysia:: Macro Economic Key DataDocument58 pagesMalaysia:: Macro Economic Key DataWong Kai WenPas encore d'évaluation

- U.S. Economy at A Glance Table: ProductionDocument1 pageU.S. Economy at A Glance Table: ProductionMaia ZambranoPas encore d'évaluation

- Advanced EcoDocument2 pagesAdvanced EcoMaria SyPas encore d'évaluation

- Growth Rate and Composition of Real GDPDocument27 pagesGrowth Rate and Composition of Real GDPpallavi jhanjiPas encore d'évaluation

- 世界经济形势与展望- 执行摘要 2020Document21 pages世界经济形势与展望- 执行摘要 2020ZhuoqunPas encore d'évaluation

- 25 EcoDocument32 pages25 Ecoviral.jainPas encore d'évaluation

- Cara Pendaftaran Online Calon PaskibrakaDocument7 pagesCara Pendaftaran Online Calon PaskibrakaJeremiah RoriePas encore d'évaluation

- Activity Template Project PlanDocument47 pagesActivity Template Project PlanVaisakhPas encore d'évaluation

- Friction Loss ChartDocument1 pageFriction Loss ChartNoriel LunaPas encore d'évaluation

- Motor - Choising 2Document15 pagesMotor - Choising 2Cao Thắng NguyễnPas encore d'évaluation

- Construction Congestion Cost (CO) User Delay SoftwareDocument2 pagesConstruction Congestion Cost (CO) User Delay SoftwarezaherPas encore d'évaluation

- Emergency LightingDocument8 pagesEmergency LightingKhay SaadPas encore d'évaluation

- Financial RequirementsDocument1 pageFinancial Requirementstil telPas encore d'évaluation

- Yardeni - Stategist Handbook - 2019Document24 pagesYardeni - Stategist Handbook - 2019scribbugPas encore d'évaluation

- 2020 Poverty LADocument269 pages2020 Poverty LAgonza sotoPas encore d'évaluation

- Apr FileDocument1 pageApr FileAshwin GophanPas encore d'évaluation

- Berth Capacity2022Document1 pageBerth Capacity2022Shareit ShareitPas encore d'évaluation

- Taller Analisis PP: Codigo Fallas Quiz 1 Quiz 2 Total QuizDocument2 pagesTaller Analisis PP: Codigo Fallas Quiz 1 Quiz 2 Total QuizAndrés RamosPas encore d'évaluation

- NLM Kinematics Rotational Dynamics Centre of Mass Work, Power, Energy Circular MotionDocument4 pagesNLM Kinematics Rotational Dynamics Centre of Mass Work, Power, Energy Circular MotionghcPas encore d'évaluation

- L (Z) TableDocument4 pagesL (Z) TableLamiaPas encore d'évaluation

- L (Z) TableDocument4 pagesL (Z) Tablegaurav sahuPas encore d'évaluation

- LOM Exam PrepDocument8 pagesLOM Exam PrepPaul EshanPas encore d'évaluation

- Westpac Forecasts JulyDocument1 pageWestpac Forecasts Julypeter_martin9335100% (2)

- Augmentin DuoDocument2 pagesAugmentin Duojunaid hashmiPas encore d'évaluation

- KBSL - IIP October UpdateDocument4 pagesKBSL - IIP October UpdateRahulPas encore d'évaluation

- Buckling Lab ResultsDocument3 pagesBuckling Lab ResultsDanelPas encore d'évaluation

- Extra Data For Comparative AnalysisDocument2 pagesExtra Data For Comparative Analysis박상현Pas encore d'évaluation

- HDPE Pipe Dimensions and Pressure Ratings1 - P.E.S CoDocument2 pagesHDPE Pipe Dimensions and Pressure Ratings1 - P.E.S CoJGon100% (1)

- Shurjoint Grooved FittingsDocument1 pageShurjoint Grooved FittingsMohammed Abir MahdiPas encore d'évaluation

- Commercial Vehicle Lease Agreement IndiaDocument22 pagesCommercial Vehicle Lease Agreement Indiavivek foj2Pas encore d'évaluation

- 3 069 432 enDocument426 pages3 069 432 enRodolfo MouraPas encore d'évaluation

- Comparison of Deck Sheet Profiles-2Document1 pageComparison of Deck Sheet Profiles-2KPas encore d'évaluation

- Table 60, BSPDocument10 pagesTable 60, BSPShielaMarie MalanoPas encore d'évaluation

- U.S. Economic Statistics - Quarterly DataDocument1 pageU.S. Economic Statistics - Quarterly Dataapi-25887578Pas encore d'évaluation

- Iecmd - February 2023Document104 pagesIecmd - February 2023zak sutomoPas encore d'évaluation

- JIS Pipe CatalogueDocument3 pagesJIS Pipe CatalogueAries BatamPas encore d'évaluation

- 341+265 Design Report - 40 PDFDocument1 page341+265 Design Report - 40 PDFVivekPas encore d'évaluation

- Data - Extract - FromInternational Debt StatisticsDocument3 pagesData - Extract - FromInternational Debt StatisticsArmin StiflerPas encore d'évaluation

- 102L Spring 2021 16.2 Raw Data Unk TrialDocument32 pages102L Spring 2021 16.2 Raw Data Unk TrialDiya PatelPas encore d'évaluation

- Create One For ThisDocument74 pagesCreate One For ThisYogi WijayaPas encore d'évaluation

- Pile Driving Log: BRIDGE (Bagacay - Batinguel)Document3 pagesPile Driving Log: BRIDGE (Bagacay - Batinguel)Allia TuboroPas encore d'évaluation

- Industrial - Statistics Key Indi Jan 2021Document5 pagesIndustrial - Statistics Key Indi Jan 2021CuriousMan87Pas encore d'évaluation

- Consumer Price Index by BNM On 2013 Until 2016Document1 pageConsumer Price Index by BNM On 2013 Until 2016Qurratu AinPas encore d'évaluation

- Bus700 T323Document10 pagesBus700 T323Đinh HạnhPas encore d'évaluation

- Gross National ProductDocument1 pageGross National ProductJoy CaliaoPas encore d'évaluation

- Across The Spectrum: The Wide Range of Jobs Immigrants Do: A Fiscal Policy Institute Report April, 2010Document21 pagesAcross The Spectrum: The Wide Range of Jobs Immigrants Do: A Fiscal Policy Institute Report April, 2010Zain KhwajaPas encore d'évaluation

- PIIGS Win. Bankers Win. Voters Lose. by Gary NorthDocument9 pagesPIIGS Win. Bankers Win. Voters Lose. by Gary NorthZain KhwajaPas encore d'évaluation

- Torture at Times Hks StudentsDocument22 pagesTorture at Times Hks Studentspaola pisiPas encore d'évaluation

- High Frequency Trading Is A Scam - The Market Ticker ®Document6 pagesHigh Frequency Trading Is A Scam - The Market Ticker ®Zain KhwajaPas encore d'évaluation

- America's Ten Most Corrupt CapitalistsDocument5 pagesAmerica's Ten Most Corrupt CapitalistsZain KhwajaPas encore d'évaluation

- Potash One Investment ReportDocument9 pagesPotash One Investment ReportZain KhwajaPas encore d'évaluation

- An Open Letter: Kenneth RogoffDocument5 pagesAn Open Letter: Kenneth RogoffZain KhwajaPas encore d'évaluation

- What Is The Average Return Rate of The Stock MarketDocument3 pagesWhat Is The Average Return Rate of The Stock MarketZain KhwajaPas encore d'évaluation

- Dollar Cost Averaging Test PaperDocument3 pagesDollar Cost Averaging Test PaperZain KhwajaPas encore d'évaluation

- 'Zero Intelligence' Trading Closely Mimics Stock Market - Physics-Math - 01 February 2005 - New ScientistDocument9 pages'Zero Intelligence' Trading Closely Mimics Stock Market - Physics-Math - 01 February 2005 - New ScientistZain KhwajaPas encore d'évaluation

- Fiscal Policy & Price InflationDocument3 pagesFiscal Policy & Price InflationZain KhwajaPas encore d'évaluation

- Goldman America AnalysisDocument55 pagesGoldman America AnalysisZain KhwajaPas encore d'évaluation

- International Monetary Fund: How Did Emerging Markets Cope in The Crisis?Document47 pagesInternational Monetary Fund: How Did Emerging Markets Cope in The Crisis?qtipxPas encore d'évaluation

- Copper Review 2008Document13 pagesCopper Review 2008Zain KhwajaPas encore d'évaluation

- What Is The Average Return Rate of The Stock MarketDocument3 pagesWhat Is The Average Return Rate of The Stock MarketZain KhwajaPas encore d'évaluation

- Financial Rankings - Hedge Fund 100Document6 pagesFinancial Rankings - Hedge Fund 100Zain KhwajaPas encore d'évaluation

- Gold Thesis CBsDocument10 pagesGold Thesis CBsZain KhwajaPas encore d'évaluation

- Top 20 Consolidated Short PostionsDocument1 pageTop 20 Consolidated Short PostionsZain KhwajaPas encore d'évaluation

- 2009 BBA Employment SurveyDocument8 pages2009 BBA Employment SurveyZain KhwajaPas encore d'évaluation

- Recommended Top TradesDocument1 pageRecommended Top TradesZerohedgePas encore d'évaluation

- Why I Am Not An Austrian EconomistDocument24 pagesWhy I Am Not An Austrian EconomistZain KhwajaPas encore d'évaluation

- Strategic Trends Programme: Global Strategic Trends - Out To 2040Document169 pagesStrategic Trends Programme: Global Strategic Trends - Out To 2040OccupyMediaPas encore d'évaluation

- 'Zero Intelligence' Trading Closely Mimics Stock Market - Physics-Math - 01 February 2005 - New ScientistDocument9 pages'Zero Intelligence' Trading Closely Mimics Stock Market - Physics-Math - 01 February 2005 - New ScientistZain KhwajaPas encore d'évaluation

- Datasheet BUK7508-55Document9 pagesDatasheet BUK7508-55Luis PerezPas encore d'évaluation

- Return, Risk, and The Security Market LineDocument45 pagesReturn, Risk, and The Security Market Lineotaku himePas encore d'évaluation

- Demand LetterDocument45 pagesDemand LetterBilly JoePas encore d'évaluation

- Consumer SurplusDocument7 pagesConsumer SurplusKarpagam MahadevanPas encore d'évaluation

- Faasos 140326132649 Phpapp01Document15 pagesFaasos 140326132649 Phpapp01Arun100% (1)

- CA PracticeDocument2 pagesCA PracticeNatalia CalaPas encore d'évaluation

- FGH60N60SFD: 600V, 60A Field Stop IGBTDocument9 pagesFGH60N60SFD: 600V, 60A Field Stop IGBTManuel Sierra100% (1)

- Presented by DR Jey at BIRD LucknowDocument16 pagesPresented by DR Jey at BIRD LucknowvijayjeyaseelanPas encore d'évaluation

- Status Report of The Pan European Corridor XDocument52 pagesStatus Report of The Pan European Corridor XWeb BirdyPas encore d'évaluation

- CH 03Document33 pagesCH 03Akshay GoelPas encore d'évaluation

- Irfz 48 VDocument8 pagesIrfz 48 VZoltán HalászPas encore d'évaluation

- Market & Competitor Analysis Template inDocument25 pagesMarket & Competitor Analysis Template inSlidebooks Consulting87% (31)

- MyDocument33 pagesMyAnubhav GuptaPas encore d'évaluation

- Bar GraphDocument16 pagesBar Graph8wtwm72tnfPas encore d'évaluation

- Examples of The Art of Book-BindingDocument219 pagesExamples of The Art of Book-BindingSawyer_Books100% (3)

- Retirement of A PartnerDocument6 pagesRetirement of A Partnershrey narulaPas encore d'évaluation

- Fairtrade Quiz For Children 2012Document3 pagesFairtrade Quiz For Children 2012pauricbanPas encore d'évaluation

- Ch7 HW AnswersDocument31 pagesCh7 HW Answerscourtdubs78% (9)

- Atlantic Computer: A Bundle of Pricing Options Group 4Document16 pagesAtlantic Computer: A Bundle of Pricing Options Group 4Rohan Aggarwal100% (1)

- FICO Configuration Transaction CodesDocument3 pagesFICO Configuration Transaction CodesSoumitra MondalPas encore d'évaluation

- SR05 - Amruth Pavan Davuluri - How Competitive Forces Shape StrategyDocument14 pagesSR05 - Amruth Pavan Davuluri - How Competitive Forces Shape Strategyamruthpavan09Pas encore d'évaluation

- Fixed Asset Accounting Audit Work ProgramDocument4 pagesFixed Asset Accounting Audit Work Programbob2nkongPas encore d'évaluation

- Money Growth and InflationDocument52 pagesMoney Growth and InflationMica Ella GutierrezPas encore d'évaluation

- For: Jyg Travel and Tours 2D1N Bohol Tour Itinerary MAY 23 - 25, 2018 Good For 3 Pax PHP 2,900/PAXDocument2 pagesFor: Jyg Travel and Tours 2D1N Bohol Tour Itinerary MAY 23 - 25, 2018 Good For 3 Pax PHP 2,900/PAXLiza L. PadriquezPas encore d'évaluation

- 1 .Operating Ratio: Year HUL Nestle Britannia MaricoDocument17 pages1 .Operating Ratio: Year HUL Nestle Britannia MaricoSumith ThomasPas encore d'évaluation

- BenihanaDocument6 pagesBenihanaaBloomingTreePas encore d'évaluation

- James Montier WhatGoesUpDocument8 pagesJames Montier WhatGoesUpdtpalfiniPas encore d'évaluation

- Republic of The Philippines: Department of Transportation Land Transportation Office Regional Office No. VIIDocument1 pageRepublic of The Philippines: Department of Transportation Land Transportation Office Regional Office No. VIIJay SuarezPas encore d'évaluation

- Wells Fargo Preferred CheckingDocument3 pagesWells Fargo Preferred CheckingAarón CantúPas encore d'évaluation

- ch01 Introduction Acounting & BusinessDocument37 pagesch01 Introduction Acounting & Businesskuncoroooo100% (1)