Académique Documents

Professionnel Documents

Culture Documents

Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)

Transféré par

Shyam SunderTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)

Transféré par

Shyam SunderDroits d'auteur :

Formats disponibles

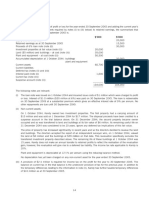

ACCURATE TRANSFORMERS LTD.

8,L.S.C., VARDHMAN SIDHANT PALAZA

SAVITA VIHAR,DELHI-110092

UNAUDITED FINANCIAL RESULTS FOR THE THREE MONTHS ENDED JUNE 2014

(In lac)

PART -I

SR.

NO.

3 Months

ended

Particulars

30.06.2014

(Unaudited)

a) Net Sales I Income from Operations (Excluding

Branch Transfer) (Net of Excise Duty)

b) Other Operating Income

Total Income from operations (net)

4

5

6

7

Expenses

a. Cost of Material Consumed

b. Purchase of Traded Goods

c. Changes in inventories of finished goods, work

in-oroqress and stock -in-trade

d. Emolovee benefits expense

e. Depreciation and Amortisation expense

f. Other Expenses

Total Expenses

Profit I (Loss) from Operations before other

income, finanace costs and exceptional items

(1 - 2)

Other Income

Profit I (Loss) from ordinary activities before

finance costs and exceptional Items (3 4)

Finance Costs

Profit I (Loss) from ordinary activities after

finance costs but before exceptional Items (5

6)

Year to date

Preceding 3 Corressponding 3

figures for

months months ended in

the previous

ended previous year

year ended

31.03.2014

31.12.2013

(Unaudited) (Unaudited)

30.06.2013

Previous

year ended

31.03.2014

(Unaudited)

(Unaudited)

7235.96

0.00

8109.23

0.00

4103.15

0.00

1565.15

0.00

22140.13

0.00

7235.96

8109.23

4103.15

1565.15

22140.13

6297.77

0.00

6524.63

0.00

3245.00

0.00

1200.00

0.00

18430.21

0.00

-304.12

94.56

18.29

263.56

132.56

113.36

35.98

296.94

-243.17

85.00

25.98

257.97

-2.64

25.00

21.02

37.55

-977.17

386.36

113.96

1091.91

6370.06

7103.47

3370.78

1280.93

19045.27

865.9

4.65

1005.76

41.25

732.37

85.20

284.22

5.61

3094.86

207.45

870.55

840.36

1047.01

994.89

817.57

803.57

289.83

276.00

3302.31

3176.46

30.19

52.12

14

13.83

125.85

87.037

c:;:t

'~7

509.19

--

0.00

0.00

0.00

0.00

0.00

30.19

52.12

14.00

13.83

125.85

10 Tax Expense

9.99

17.72

3.00

40.72

Net Profit 1 (Loss) from Ordinary Activities after

11

tax (9 10)

20.20

34.40

14.00

10.83

85.13

8

9

Exceotionalltems - Exoenditure 1 (Income)

Profit 1 (Loss) from Ordinary Activities before

12 Extraordinary items (Net of Tax expense Rs. Nil)

13 Net Profit 1 (Loss) for the period (11 12)

Paid-up Equity Share Capital (Face Value Rs. 101

14

each)

Reserves Excluding Revaluation Reserves as per

Balance Sheet of previous accounting year

Earning Per Share (before extraordinary items - not

16

annualised)

Ila) Basic

lib) Diluted

Earning Per Share (after extraordinary items - not

17

annualised)

I(a) Basic

lib) Diluted

0.00

0.00

0.00

0.00

20.20

34.40

14.00

10.83

85.13

299.72

299.72

299.72

299.72

299.72

15

0.07

0.07

0.11

8.72

3.79

3.79

0.04

0.04

0.28

0.28

6.11

6.11

0.11

8.72

3.79

3.79

0.04

0.04

0.28

0.28

PART -II

SR.

NO.

3 Months

ended

Particulars

PARTICULARS OF SHAREHOLDING

Public Share Holding

- Number of Shares

- Percentaae of Shareholdina

Promoter and Promoter Group Shareholding

a) Pledaed 1 Encumbered

Year to date

Preceding 3 Corressponding 3

figures for

months months ended in

the previous

ended previous year

Previous

year ended

year ended

30-09-2012

30-06-2012 30-09-2011

30-09-2011

(Unaudited)

(Unaudited) (Unaudited)

(Unaudited)

1616346

54.39

1616346

54.39

1616346

54.39

1616346

54.39

31.03.2013

(Unaudited)

1616346

54.39

'/~~

"\' ~ ~ )~\,

'-

./)r-J

oft'--' .""'/

/.

"

- Number of Shares

- Percentage of Shareholding (as a % of the

total shareholding of promoter and promoter

group)

- Percentage of Shares (as a % of total share

capital of the Company)

,I

0.001

0.001

0.001

0.001

0.00

0.001

0.001

0.001

0.001

0.00

0.001

0.001

0.001

0.001

0.00

13553541

13553541

13553541

13553541

1355354

100.00%1

100.00%1

100.00%1

100.00%1

100.00%

45.61%1

45.61%1

45.61%1

45.61%1

45.61%

b) Non - Pledged I Encumbered

- Number of Shares

- Percentage of Shares (as a % of total

shareholding of promoter and promoters

group)

- Percentage of Shares (as a % of total share

capital of the Company)

Notes:

-riie above results have been taken on record in the meeting of the Board of Directors of the Company held on 14th

1. Aug.2014

2. The results have been recommended by Audit Committee in the their meeting held on 07th Aug2014.

3 Limited Review of the above results have been carried out by the Statutory Auditor of the Company.

4 Previous periods figures have been regrouped ,wherever necessary

5 The Company is working in only Manufacture of transformers ,therefore segment reporting is not applicable.

6 No investors complaints were pending at the beginning of the quarter. Recd- none, Pending -none

.

On behalf of the Board of Di~ectors

Date: 8/13/2014

Place Delhi

For A..cc.!!!ate~ansforme

~\

C"S~a\ ~

Chai

., .~'.;

~-~'

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Take Back Your Strawman - YOUR BIRTH CERTIFICATE BOND IS WORTH BILLIONS - United Truth SeekersDocument6 pagesTake Back Your Strawman - YOUR BIRTH CERTIFICATE BOND IS WORTH BILLIONS - United Truth Seekerspepper100% (12)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Power Elite and The Secret Nazi PlanDocument80 pagesThe Power Elite and The Secret Nazi Planpfoxworth67% (3)

- Midterm Examination With SolutionDocument2 pagesMidterm Examination With SolutionSeulgi Bear100% (1)

- To Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961Document1 pageTo Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961Potu RavinderreddyPas encore d'évaluation

- Principles and Practice of Taxation Lecture Notes PDFDocument20 pagesPrinciples and Practice of Taxation Lecture Notes PDFAbhishek K. Singh100% (1)

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderPas encore d'évaluation

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderPas encore d'évaluation

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderPas encore d'évaluation

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderPas encore d'évaluation

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderPas encore d'évaluation

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderPas encore d'évaluation

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderPas encore d'évaluation

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderPas encore d'évaluation

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderPas encore d'évaluation

- Farm Laws: Confl Ating Deregulation With ModernisationDocument6 pagesFarm Laws: Confl Ating Deregulation With ModernisationRASHMI RASHMIPas encore d'évaluation

- Servet Mutlu-Late Ottoman PopulationDocument39 pagesServet Mutlu-Late Ottoman Populationaokan@hotmail.com100% (1)

- 17 5402ezbkDocument64 pages17 5402ezbkPhylicia MorrisPas encore d'évaluation

- Worksheet - Government Microeconomic IntervenDocument20 pagesWorksheet - Government Microeconomic IntervenNguyễn AnnaPas encore d'évaluation

- This Research Guide Summarizes The Sources of Philippine Tax LawDocument6 pagesThis Research Guide Summarizes The Sources of Philippine Tax LawMeanne Estaño CaraganPas encore d'évaluation

- Perquisites in Indian Tax SystemDocument5 pagesPerquisites in Indian Tax SystemShreyas DalviPas encore d'évaluation

- Cost of Gooods Manufactured 5,060,000Document5 pagesCost of Gooods Manufactured 5,060,000yayayaPas encore d'évaluation

- 2023 ADocument6 pages2023 ATahir DestaPas encore d'évaluation

- The World On The Edge: How To Prevent Environmental and Economic CollapseDocument21 pagesThe World On The Edge: How To Prevent Environmental and Economic Collapsevarunmalik123Pas encore d'évaluation

- Sison v. Ancheta, 130 SCRA 654, G.R. L-59431Document7 pagesSison v. Ancheta, 130 SCRA 654, G.R. L-59431Arkhaye SalvatorePas encore d'évaluation

- Request For Proposal (RFP) For Procurement of Fms BatteryDocument22 pagesRequest For Proposal (RFP) For Procurement of Fms BatteryAshish AgarwalPas encore d'évaluation

- STS Module-3-Government Plans and Projects in S and TDocument56 pagesSTS Module-3-Government Plans and Projects in S and TTERRIUS AcePas encore d'évaluation

- Taxability of AOP BOI Local Govt. Trust by CA. Anil Sathe 1 PDFDocument47 pagesTaxability of AOP BOI Local Govt. Trust by CA. Anil Sathe 1 PDFBhanuPas encore d'évaluation

- Linberg V MakatiDocument2 pagesLinberg V MakatiChimney sweepPas encore d'évaluation

- DCU - Academic Writing PDFDocument41 pagesDCU - Academic Writing PDFjunior_jiménez_7Pas encore d'évaluation

- Sponsor DocsDocument2 pagesSponsor DocsMaisa SantosPas encore d'évaluation

- Kandy Co Draft FSMT and MobyDocument4 pagesKandy Co Draft FSMT and MobyAliPas encore d'évaluation

- Final Draft Agreement Flat Duplex Plot RERADocument20 pagesFinal Draft Agreement Flat Duplex Plot RERAPratima KamblePas encore d'évaluation

- Tata Aia Life InsuranceDocument2 pagesTata Aia Life InsurancekotijbPas encore d'évaluation

- Taxation Material 1Document11 pagesTaxation Material 1Shaira Bugayong100% (1)

- By Graham HoltDocument5 pagesBy Graham Holtwhosnext886Pas encore d'évaluation

- Aviva Life Insurance Company India Limited Premium QuotationDocument2 pagesAviva Life Insurance Company India Limited Premium QuotationMohan BNPas encore d'évaluation

- PEFA ReportDocument238 pagesPEFA ReportDaisy Anita SusiloPas encore d'évaluation

- Emirates Fare ConditionsDocument12 pagesEmirates Fare ConditionsRaghuPas encore d'évaluation

- Macro Tut 4 - With AnsDocument11 pagesMacro Tut 4 - With AnsNguyen Tra MyPas encore d'évaluation