Académique Documents

Professionnel Documents

Culture Documents

8919 29741 1 SM

Transféré par

MihaiIliescuTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

8919 29741 1 SM

Transféré par

MihaiIliescuDroits d'auteur :

Formats disponibles

http://ijfr.sciedupress.

com

International Journal of Financial Research

Vol. 7, No. 2; 2016

The Monthly Effect and the Day of the Week Effect in the American

Stock Market

Bing Xiao1

1

Management Science, Universit dAuvergne, CRCGM EA 38 49 Universit dAuvergne, Auvergne, France

Correspondence: Bing Xiao, PhD in Management Science, Universit dAuvergne, CRCGM EA 38 49 Universit

dAuvergne, Auvergne, France.

Received: January 2, 2016

Accepted: January 17, 2016

doi:10.5430/ijfr.v7n2p11

Online Published: February 17, 2016

URL: http://dx.doi.org/10.5430/ijfr.v7n2p11

Abstract

This paper examine the recent evolution of seasonal anomalies in the American stock market. This study was based on

daily data from the Russell 3000 index over the 2000-2015 period. We examine the recent evolution of the week effect

and the monthly effect, and we investigate seasonal patterns in economically favourable times and unfavourable times.

We use a UCM model and ARCH model. We find evidence for fixed seasonality with a positive and significant

monthly effect. Our study confirms January and December effects to the values of the Russell 3000 index, but we dont

find evidence of the day of the week effect.

Keywords: stock markets, seasonal anomalies, efficiency, economic cycles, monthly effect, day of week effect,

ARCH

1. Introduction

In developed stock markets, anomalies are a well-documented stylized fact. One of the anomalies in the American

stock markets is the seasonal effect. Seasonalities in stock returns are among the most robust findings. There are two

sorts of seasonalities: high frequency seasonality: for example the day of the week effect and the turn of the month

effect. And the low frequency seasonality: such as January or February effect. In this paper, we focused on the day of

the week and the monthly regularities.

The seasonal effect generates a large amount of interest in academic circles. The major reason is theoretical: if it were

possible to show that investment strategy based on seasonality is capable of systematically beating the market, the

efficient market theory would be faulty. The seasonal effect also poses a problem with regards to the validity of the

Capital Asset Pricing Model (CAPM), validity according to which the expected yield of securities depends on the

systematic risk level (the Beta). According to behavioural finance researchers, seasonal anomaly is proof of the

irrationality of individuals. On the other hand, researchers who support the concept of rationality suggest that seasonal

effect can be attributed to risk factors other than the market.

Some anomalies seem to disappear after they are documented in the finance literature: Does their disappearance

reflect sample selection bias, so that there was never an anomaly in the first place? Or does it reflect the actions of

practitioners who learn about the anomaly and trade so that they make profitable transactions (Schwert 2003)? In this

paper, we analyse the recent evolution of the seasonal anomalies in the American stock markets. Thus, our paper

contributes to the existing finance literature by investigating the seasonal anomalies during the recent period. Our

second contribution is to re-examine the weak form of the efficient markets hypothesis (EMH) using daily American

stock market data.

The rest of the paper is organized as follows. Section II reviews the literature. Section III introduces Data and

methodology. Our empirical findings are discussed in Section IV. Section V concludes the paper.

2. Literature Review

A considerable body of literature has been produced that documents seasonal patterns in stock returns. Empirical

findings have established that mean stock returns vary over the days of the week A day of the week effect was

detected in the U.S. market by Cross (1973), French (1980), Gibbons and Hess (1981), Rogalski (1984). These

studies document a negative mean return for Monday and a positive mean return for Friday. Mookerjee and Yu

(1999) found that the higher returns on a particular weekday are due to the higher risk assumed on that day: a higher

Published by Sciedu Press

11

ISSN 1923-4023

E-ISSN 1923-4031

http://ijfr.sciedupress.com

International Journal of Financial Research

Vol. 7, No. 2; 2016

standard deviation is associated with higher daily mean returns except Monday. French (1980) hypothesized that the

standard deviation for Monday returns should be the highest because a greater number of shocks can manifest

themselves over the weekend break. The model to estimate the day of the week effect given by Mookerjee and Yu

(1999) is as follow:

,

is the return on day t and

Where

and is zero otherwise.

(1)

is a dummy variable that takes the value of one for a given day of the week

The month-of-the-year effect was found by Roll (1983) and Ritter (1988). They found a positive January effect and a

negative December effect. Keim (1983) and Reingnum (1983) showed that much of the abnormal return to small

firms (measured relative to the CAPM) occurs during the first two weeks in January. Roll (1983) hypothesized that

the investors might want to realize for income tax purposes before the end of the year, the selling pressure might

reduce prices of small capitalization stocks in December, leading to a rebound in early January as investors

repurchase these stocks to reestablish their investment position. Cooper et al. (2006) report US evidence that returns

in January have predictive power for returns over the subsequent 11 months. Chen and Chien (2011) explained the

January effect with the theoretical arguments drawn from behavioral finance, they documented that there will be a

January effect when the whole market had positive performance growth in the preceding year.

To test the difference between the monthly effect, Mookerjee and Yu (1999) give the following regression:

(2)

is the holding period return for day t and

is a dummy variable that takes the value one for the first

Where

and last days of the month and takes the value of zero otherwise.

The seasonal effect is one of the anomalies of the financial market. For example, if there is a negative

day-of-the-week effect, the rational arbitrageurs could sell stocks short in the morning of that day and buy them back

the next day. Such trading activity would eventually result in the disappearance of the effect. Fama and French (1989)

find that expected returns contain risk premiums that move inversely with business condition. Kim and Burnie (2002)

advanced the hypothesis according to which size effect might be driven by the economic cycle. L'Her, Masmoudi and

Suret (2002) also pointed out that risk premiums vary according to economic conditions. DeStefano (2004) find that

stock returns decrease throughout economic expansions and become negative during the first half of recession.

The evidence regarding seasonal effects is rather mixed as conclusions from various studies seem to depend heavily

on the particular choice of sample period. For this reason, we associated the seasonal anomalies with the economic

cycles to research a new explanation to this issue. In this paper, we focus exclusively on the day of the week effect

and the monthly effect.

3. Data and Methodology

3.1 Data and Cycles

The Russell 3000 Index measures the performance of the largest 3,000 U.S. companies representing approximately 98% of

the investable U.S. equity market. Our sample contains 3904 daily observations from the Russell 3000 (February 2000

to September 2015) taken from Factset. Factset is a financial database and designates a software editor. The company

provides financial information and analytical software for investment professionals. Factset also offers access to data

for analysts, portfolio managers and investment banks.

The objective of this paper is to study the recent evolution of seasonal anomalies in the American stock market. To this

end, we will define the economic cycles between 2000 and 2015 in the U.S. The OECD system of Composite Leading

Indicators (CLIs) is designed to provide early signals of turning points in business cycles fluctuation of the economic

activity around its long term potential level. This approach, focusing on turning points (peaks and troughs), results in

CLIs that provide qualitative rather than quantitative information on short-term economic movements. The phases and

patterns in CLIs are likely to be followed by the business cycle, with the turning points of the CLI consistently

preceding 6 9 months of those of the business cycle.

Our study covers the period from 2000 to 2015. To be able to highlight the relationship between the seasonal effects

and the economic cycle, we have to give an objective description of the economic environment. We chose to break

down the economic cycle into two distinct phases: one phase that is favourable to companies and one that is

unfavourable. The problem that arises is to precisely determine the start and end date of each of these phases.

Published by Sciedu Press

12

ISSN 1923-4023

E-ISSN 1923-4031

http://ijfr.sciedupress.com

International Journal of Financial Research

Vol. 7, No. 2; 2016

In order to limit economic cycles, we have chosen to distinguish two states of the economic cycle expansion and

recession thus giving a macroeconomic approach to the cycle. The OCDE composite leading indicator was conceived

to indicate turning points in the economy. Figure 1 plots the evolution of the index Russell 3000 from 2000 to 2015.

We use the algorithm of Bry and Boschan (1971) (VBA programming) for the datation of the cycles, this allows us to

highlight three identified "peak to peak" cycles during the period from February 2000 to September 2015: February

2000 January 2003; January 2003 July 2007, July 2007 March 2009 and March 2009 September 2015.

CompositeLeadingIndicatorsUS

104

102

100

98

96

94

92

Fvr1999

Sept1999

Avr2000

Nov2000

Juin2001

Janv2002

Aot2002

Mars2003

Oct2003

Mai2004

Dc2004

Juil2005

Fvr2006

Sept2006

Avr2007

Nov2007

Juin2008

Janv2009

Aot2009

Mars2010

Oct2010

Mai2011

Dc2011

Juil2012

Fvr2013

Sept2013

Avr2014

Nov2014

Juin2015

90

Figure 1. Composite leading indicators US 2000 to 2015

3.2 Econometric Models

3.2.1 Unobserved Components Model

We approach our series of Russell 3000 by using an unobserved components time series model (UCM) (see Harvey

1989 and Girardin and Liu 2005). The model allows us to decompose the index It between three components given

by:

0,

),

(3)

Where ,

and

represent trend, seasonal and irregular components respectively. The trend and seasonal

components are modeled by linear dynamic stochastic processes which depend on disturbances. They are formulated

in a flexible way and can change over time rather than being deterministic.

corresponds to a set of explanatory

and dummy variables.

The trend component is simply modeled as a random walk process according to the structure of our data:

Where NID (0,

0, ),

(4)

) refers to a normally independently distributed series with mean zero and variance

For the seasonal component, we want to study if for a given month, deviations from trend tend to be of the same sign

from one year to the next. Let there be s seasons during the year, in our case s =12. We use a stochastic dummy

variable seasonal model for the effect

at time t:

,

~

0, )

(5)

In this model, the sum of the seasonal effect has a zero mean although their stochastic nature allows them to evolve

either slowly over time (when is small) or quickly over time (when is large). All disturbances are supposed

to be mutually uncorrelated. If the variance is equal to zero, the seasonal effects are fixed and do not vary over time

in contrast to the precedent specification (3). All models are estimated using maximum likelihood.

Published by Sciedu Press

13

ISSN 1923-4023

E-ISSN 1923-4031

http://ijfr.sciedupress.com

International Journal of Financial Research

Vol. 7, No. 2; 2016

3.2.2 ARCH Model

It is a non-linear model which does not assume that the variance is constant, and it describes how the variance of the

errors evolves t. Many series of financial asset returns that provide a motivation for the ARCH class of models, is

known as volatility clustering. Volatility clustering describes the tendency of large changes in asset prices (of either

sign) to follow large changes and small changes (of either sign).

Under the ARCH model, the autocorrelation in volatility is modeled by the conditional variance of the error term

t2, to depend on the immediately previous value of the squared error, and ARCH(1) model takes the following form

(See Angle 1982):

(6)

0,

1

. . .,

The form of ARCH (q) model is as follows where error variance depends on q lags of squared errors:

(7)

4. Empirical Results

4.1 The Day of the Week Effect

Table 1 reports the mean and standard deviation of daily stock returns for the Russell 3000. For the whole period,

returns have been negative. The lowest daily returns were found on Monday. Returns gradually build up to a peak on

Thursday and then dip slightly on Friday. Table 2 reports the mean return by day of week during the expansion

period and the recession period. The overall pattern is similar to that observed for the whole period; the Monday

returns have been negative in the recession period. However, we dont find a Friday effect. Overall, the results are

consistent with findings for other markets, except for the Friday effect. Table 1 and table 2 also report the standard

deviation in daily returns, because it would be a source of insight into whether higher returns on a particular weekday

are due to the higher risk assumed by an investor on that day. But we dont find that a higher standard deviation is

associated with higher daily returns in our patterns.

Table 1. Mean and standard deviation (S.D.) of daily percentage return: day of the week during the whole period

Whole period ( Feb 2000 Sep 2015)

Observations

Mean

S.D.

Monday

780

-0.02779

0.0135

Tuesday

781

0.06029

0.0131

Wednesday

781

0.01801

0.0126

Thursday

780

0.04225

0.0129

Friday

780

-0.00115

0.0182

Table 2. Mean and standard deviation (S.D.) of daily percentage return: day of the week during the expansion and

the recession period

Monday

Tuesday

Wednesday

Thursday

Friday

Recession

Expansion

Recession

Expansion

Feb 00 Jan 03

Jan 03 Jul 07

Jul 07 Mar 09

Mar 09 Sep 15

-0.08873

0.05246

-0.3824

0.02826

(120) [0.0145]

(233) [0.00805]

(86) [0.02522]

(341) [0.0119]

-0.1692

0.06642

0.19396

0.10381

(121) [0.01526]

(233) [0.00789]

(86) [0.02437]

(341) [0.01098]

-0,01335

0.08995

-0.29324

0.05994

(120) [0.0159632]

(232) [0.0076]

(86) [0.02215]

(341) [0.01057]

-0,04557

0.032

-0.301

0.13594

(120) [0.01433]

(233) [0.0076]

(87) [0.02194]

(340) [0.01191]

-0.1165

0.0258

-0.02751

0.02737

(120) [0.01407]

(233) [0.00712]

(86) [0.0174428]

(340) [0.0093]

In each case, the first row is the mean, in parenthesis is the number of observations and in brackets is the standard

deviation.

Published by Sciedu Press

14

ISSN 1923-4023

E-ISSN 1923-4031

http://ijfr.sciedupress.com

International Journal of Financial Research

Vol. 7, No. 2; 2016

In Table 3 below, we report results of the estimated variances of the different components of our unobserved

components model. Column Stochastic Trend presents estimations for the basic stochastic component model. In

column Determinist, we introduce the determinist component. We dont find the day of the week effect by using

the UCM model and the ARCH model. The coefficients are not significant and we dont observe the influence of

economic condition in the day of week effect.

Table 3. Estimated variances for the unobserved components model

Stochastic Trend

Coef.

Std. Err.

Determinist Trend

Prob.

Determinist Trend

Coef.

Std. Err.

Prob.

0.000131

0.000

0.045**

Stochastic Trend

0.0006139

0.000

0.000***

6.027

0.0177

0.000***

7.0096

0.11378

0.708

Ar(1)

0.9540

0.0038

0.000***

0.99779

0.00087

0.000***

Monday

-0.00061

0.0005

0.224

-0.00047

0.000388

0.222

Thursday

-0.00021

0.0005

0.669

-0.00006

0.00049

0.904

Wednesday

-0.00022

0.0004

0.579

-0.00006

0.00051

0.93

0.00017

0.00046

0.708

Thursday

Friday

-0.00016

0.0004

0.720

Log likelihood

11623.083

11518.13

Iterations

11

13

*, **, and *** indicate statistical significance at the 10, 5 and 1 percent levels, respectively.

4.2 The Monthly Effect

Table 4 reports the mean daily return by month during the expansion period and the recession period. For the whole

period, we find the inversion of the December and January effect. In fact, there is a negative January effect and a

positive December effect. The results obtained by analyzing the economic cycles confirm our findings, the December

returns do better than the January returns. We find positive mean returns for March, April and May. Girardin and Liu

(2005) explain that the speculators accumulate their holdings of stocks in the first 2 months of the year, during

March and April, speculators would try to corner the market and bid up the price. From the end of April, speculators

would try to reduce their holdings when the price is still high. After the middle of June, they would get money back

from the sale of their stocks plus speculative profit, in order to pay back what they borrowed, over a half-year period,

at the beginning of the year. This practice may also explain the bad performance in June returns.

Table 4. Daily percentage average return of monthly effect

Whole period

Recession

Expansion

Recession

Expansion

Feb 00 Jan 03

Jan 03 Jul 07

Jul 07 Mar 09

Mar 09 Sep

15

January

-0.02268

0.05361

0.02068

-0.31965

0.01922

February

-0.01428

-0.29148

-0.00271

-0.3442

0.17958

March

0.06005

-0.05066

0.00687

-0.31568

0.19454

April

0.10104

0.06168

0.07888

0.22367

0.10988

May

0.0215

-0.0001

0.09706

0.08661

-0.03405

June

-0.06303

-0.22638

0.01823

-0.41037

-0.02827

July

0.01963

-0.20661

0.02921

-0.14317

0.11321

Published by Sciedu Press

15

ISSN 1923-4023

E-ISSN 1923-4031

http://ijfr.sciedupress.com

International Journal of Financial Research

Vol. 7, No. 2; 2016

August

0.02612

-0.11951

0.03967

0.06785

-0.06394

September

-0.03766

-0.48507

0.03681

-0.12721

0.07316

October

0.06357

0.14514

0.10286

-0.32679

0.13179

November

0.04675

0.05735

0.13085

-0.26664

0.08769

December

0.06559

-0.04057

0.09873

0.04729

0.1003

In Table 5 on the following page, we report results of the estimated variances of the different components of our

unobserved components model. Column month presents estimations for the seasonality in the recession cycle. In

column month*dummy, we introduce the effect of expansion. We find a significant and positive May effect and

December effect while the impact for January is not significant.

Table 5. Estimated variances for the unobserved components and ARCH (1) model

Month

Month*Dummy

Coef.

Std. Err.

Prob.

0.00324

0.001207

0.007

January

0.000681

0.0008473

0.422

February

Coef.

Std. Err.

Prob.

0.0008296

0.0015308

0.588

0.0021522

0.0015961

0.178

March

0.003723

0.0010347

0.000***

-0.0013995

0.0015577

0.369

April

0.005841

0.0011044

0.000***

-0.0041574

0.0015889

0.009

May

0.004447

0.0011509

0.000***

-0.0025409

0.0016446

0.122

June

0.000673

0.0012742

0.597

July

0.001310

0.0010831

0.226

0.0002728

0.0016043

0.865

August

0.003309

0.001107

0.003***

-0.0014146

0.0016191

0.382

September

-0.003134

0.0007942

0.000***

0.0053807

0.0014353

0.000***

October

0.004207

0.0007596

0.000***

-0.0019903

0.0014168

0.160

November

-0.00001

0.0007852

0.903

0.00224478

0.0014312

0.116

December

0.003425

0.0008798

0.000***

-0.0015925

0.0015643

0.309

AR(1)

-0.23285

0.0074205

0.000***

0.000094

2.15 e-06

0.000***

ARCH (1)

0.4942827

0.026

0.000***

*, **, and *** indicate statistical significance at the 10, 5 and 1 percent levels, respectively.

5. Conclusions and Discussions

We have used UCM and ARCH model to detect the presence of seasonality over the 2000 to 2015 period for the

American stock market. It would seem that the monthly effect persists. Our results point to the fact that the economic

cycles do not have an effect on the observed pattern in daily stock returns. However, it is acknowledged in existing

literature that, on a general level, seasonality is often very sensitive to the presence of outliers. And the inversion of

the day of the week effect and the monthly effect is highly dependent on the estimation method and sample period in

particular. Such an anomaly vanishes after correcting for non-normality (Girardin and Liu 2005). This being said, a

reversed monthly effect during certain periods does not necessarily imply a disappearance of the seasonality. For

further analysis of seasonality in the American stock market, we think we have to analyse if investment strategy

based on seasonality is capable of systematically beating the market.

Published by Sciedu Press

16

ISSN 1923-4023

E-ISSN 1923-4031

http://ijfr.sciedupress.com

International Journal of Financial Research

Vol. 7, No. 2; 2016

References

Boschan, Bry G. (1971). Cyclical analysis of the time series: Selected procedures and computer program. Columbia

University Press, Technical Paper 20, NBER.

Chen, Tsung-Cheng, & Chien, Chin-Chen. (2011). Size effect in January and cultural influences in an emerging

stock market: The perspective of behavioral finance. Pacific-Basin Finance Journal, 19, 208-229.

http://dx.doi.org/10.1016/j.pacfin.2010.10.002

Cooper, M. J., McConnell, J. J., & Ovtchinnikov, A. V. (2006). The Other January Effect. Journal of Financial

Economics, 82, 315-41.

DeStefano Micheal. (2004). Stock returns and the business cycle. The Financial Review, 39, 527-547.

http://dx.doi.org/10.1111/j.0732-8516.2004.00087.x

Fama, E., & French, K. (1989). Business conditions and expected returns on stocks and bonds. Journal of Financial

Economics, 25, 23-49. http://dx.doi.org/10.1016/0304-405X(89)90095-0

Girardin, E., & Liu, Z. (2005). Bank credit and seasonal anomalies in China's stock markets. China Economic

Review, 16, 465-483. http://dx.doi.org/10.1016/j.chieco.2005.03.001

Harvey, A. C. (1989). Forecasting, Structural Time Series Models and the Kalman Filter. Cambridge: Cambridge

University Press.

Kim, Moon K., & Burnie D. A. (2002). The Firm Size Effect and the Economic Cycle. The Journal of Financial

Research, XXV(1), 111-124.

L'Her, Masmoudi, & Suret. (2002). Effet taille et Book-to-Market au Canada. Revue canadienne d'investissement.

t.

Mookerjee Rajen, & Yu Qiao. (1999). Seasonality in returns on the Chinese stock markets: the case of Shanghai and

Shenzhen. Global Finance Journal, 10(1), 93-105. http://dx.doi.org/10.1016/S1044-0283(99)00008-3

Schwert, William G. (2003). Anomalies and Market Efficiency. In G.M. Constantinides (Ed.), Handbook of the

Economics of Finance (Chapter 15, pp. 941-962).

Published by Sciedu Press

17

ISSN 1923-4023

E-ISSN 1923-4031

Vous aimerez peut-être aussi

- 1 Minute Video Ad TemplateDocument1 page1 Minute Video Ad TemplatefadhlulPas encore d'évaluation

- Onboarding Business Questionaire - DejanDocument8 pagesOnboarding Business Questionaire - DejanMihaiIliescuPas encore d'évaluation

- Spellbrand Offer Suggestion: Brand StrategyDocument1 pageSpellbrand Offer Suggestion: Brand StrategyMihaiIliescuPas encore d'évaluation

- Customer Avatar - DejanDocument6 pagesCustomer Avatar - DejanMihaiIliescuPas encore d'évaluation

- Spellbrand Brand Strategy Service - ConfidentialDocument3 pagesSpellbrand Brand Strategy Service - ConfidentialMihaiIliescuPas encore d'évaluation

- Sales Products QuantityDocument20 pagesSales Products QuantityMihaiIliescuPas encore d'évaluation

- Thrive - Advertising TimeDocument37 pagesThrive - Advertising TimeMihaiIliescuPas encore d'évaluation

- Spellbrand Service List: Logo Design: $550 - $1,250Document2 pagesSpellbrand Service List: Logo Design: $550 - $1,250MihaiIliescuPas encore d'évaluation

- Creating Manifesting Your Goals 12 Month PlanDocument32 pagesCreating Manifesting Your Goals 12 Month PlanMihaiIliescuPas encore d'évaluation

- 14 Ways To Get Breakthrough Ideas EbookDocument17 pages14 Ways To Get Breakthrough Ideas EbookRoger RamjetPas encore d'évaluation

- Onboarding Questionaire Mash BonigalaDocument8 pagesOnboarding Questionaire Mash BonigalaMihaiIliescuPas encore d'évaluation

- Rolling AMS Report (AMS Course)Document3 pagesRolling AMS Report (AMS Course)MihaiIliescuPas encore d'évaluation

- Demographics: Onboarding Customer Avatar For Mash BonigalaDocument6 pagesDemographics: Onboarding Customer Avatar For Mash BonigalaMihaiIliescuPas encore d'évaluation

- Ageron 2017Document3 pagesAgeron 2017MihaiIliescuPas encore d'évaluation

- Kimberly K. Sullivan: ObjectiveDocument5 pagesKimberly K. Sullivan: ObjectiveMihaiIliescuPas encore d'évaluation

- The 7 Principles of Conversion-Centered Design PDFDocument56 pagesThe 7 Principles of Conversion-Centered Design PDFSebastian FloresPas encore d'évaluation

- HR Manager - ST LouisDocument6 pagesHR Manager - ST LouisMihaiIliescuPas encore d'évaluation

- Week and PaysDocument1 pageWeek and PaysMihaiIliescuPas encore d'évaluation

- Customer Avatar Myexpresscolor PDFDocument1 pageCustomer Avatar Myexpresscolor PDFMihaiIliescuPas encore d'évaluation

- Date Who From Untill: Is Using ZOOM?Document2 pagesDate Who From Untill: Is Using ZOOM?MihaiIliescuPas encore d'évaluation

- 1 e 8203 CDDocument2 pages1 e 8203 CDMihaiIliescuPas encore d'évaluation

- Charles H. Chaffin, Jr. (Chuck), SPHRDocument2 pagesCharles H. Chaffin, Jr. (Chuck), SPHRMihaiIliescuPas encore d'évaluation

- Bill Resume 2017Document4 pagesBill Resume 2017MihaiIliescuPas encore d'évaluation

- Alexander Patano: Professional Experience ContinuedDocument4 pagesAlexander Patano: Professional Experience ContinuedMihaiIliescuPas encore d'évaluation

- Brooks Felicia S 2017Document3 pagesBrooks Felicia S 2017MihaiIliescuPas encore d'évaluation

- Andrew Twillman Resume 10.6.2016Document3 pagesAndrew Twillman Resume 10.6.2016MihaiIliescuPas encore d'évaluation

- Manda Arela: Talent Acquis It On S Trat Egy LeaderDocument3 pagesManda Arela: Talent Acquis It On S Trat Egy LeaderMihaiIliescuPas encore d'évaluation

- John Dulemba 08292011Document6 pagesJohn Dulemba 08292011MihaiIliescuPas encore d'évaluation

- Candace Banks Resume 2017Document3 pagesCandace Banks Resume 2017MihaiIliescuPas encore d'évaluation

- BriggsDonA ResumeDocument3 pagesBriggsDonA ResumeMihaiIliescuPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- ACCT 10001: Accounting Reports & Analysis Lecture 2 Illustration: ARA Galleries Pty LTDDocument5 pagesACCT 10001: Accounting Reports & Analysis Lecture 2 Illustration: ARA Galleries Pty LTDBáchHợpPas encore d'évaluation

- The Land System in Malabar in TheDocument31 pagesThe Land System in Malabar in TheBalakrishna GopinathPas encore d'évaluation

- Partners Healthcare (Tables and Exhibits)Document9 pagesPartners Healthcare (Tables and Exhibits)sahilkuPas encore d'évaluation

- 6th NLIU Trilegal Summit 2021 BrochureDocument11 pages6th NLIU Trilegal Summit 2021 Brochuremihir khannaPas encore d'évaluation

- ICICIDocument61 pagesICICISukanya DeviPas encore d'évaluation

- Quarter 3 Module Entrepreneurship 10Document7 pagesQuarter 3 Module Entrepreneurship 10Jowel BernabePas encore d'évaluation

- Business 9 Week 1 2nd Term Chapter 1 Part 3Document17 pagesBusiness 9 Week 1 2nd Term Chapter 1 Part 3cecilia capiliPas encore d'évaluation

- Compilation Notes On Journal Ledger and Trial BalanceDocument14 pagesCompilation Notes On Journal Ledger and Trial BalanceAB12P1 Sanchez Krisly AngelPas encore d'évaluation

- Itr - 1Q13Document75 pagesItr - 1Q13Usiminas_RIPas encore d'évaluation

- Partnership Accounting Practical Accounting 2Document13 pagesPartnership Accounting Practical Accounting 2random17341Pas encore d'évaluation

- Thompson IndictmentDocument10 pagesThompson IndictmentCrainsChicagoBusinessPas encore d'évaluation

- Investment Analyst Retirement Plan Manager in Dallas TX Resume Jeff RockDocument2 pagesInvestment Analyst Retirement Plan Manager in Dallas TX Resume Jeff RockJeffRock1Pas encore d'évaluation

- Pre-Feasibility Study Prime Minister's Small Business Loan SchemeDocument20 pagesPre-Feasibility Study Prime Minister's Small Business Loan SchemeMian Adi ChaudhryPas encore d'évaluation

- Corporate Governance: Accountants and AuditorsDocument22 pagesCorporate Governance: Accountants and AuditorsVam EnzioPas encore d'évaluation

- Chpater 3 - Sole Trader, Partnership, Franchisee and Social EnterprisesDocument10 pagesChpater 3 - Sole Trader, Partnership, Franchisee and Social EnterprisesHashan SiriwardanePas encore d'évaluation

- Pak Turk Fund ReceiptDocument1 pagePak Turk Fund ReceiptAbdullah Khan ShahiPas encore d'évaluation

- Family Must KnowDocument16 pagesFamily Must KnowKhalilahmad Khatri83% (6)

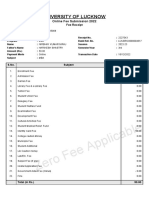

- Fee Receipt - Lucknow UniversityDocument3 pagesFee Receipt - Lucknow UniversityNirbhay NirajPas encore d'évaluation

- Insurance ThesisDocument2 pagesInsurance ThesisMinh LêPas encore d'évaluation

- Pradhan Mantri Fasal Bima Yojna (Pmfby) : Bajaj Allianz General Insurance Company LimitedDocument2 pagesPradhan Mantri Fasal Bima Yojna (Pmfby) : Bajaj Allianz General Insurance Company LimitedRahulSinghPas encore d'évaluation

- Quizzer #8 PPEDocument13 pagesQuizzer #8 PPEAseya CaloPas encore d'évaluation

- About GVKDocument14 pagesAbout GVKmiddha_ankurmbaPas encore d'évaluation

- Project Manager Inc. Real Estate DevelopmentDocument13 pagesProject Manager Inc. Real Estate DevelopmentinventionjournalsPas encore d'évaluation

- Project Pankaj MehraDocument67 pagesProject Pankaj MehraMITALIPas encore d'évaluation

- AFAR 3 (Test Questions)Document4 pagesAFAR 3 (Test Questions)Lalaine BeatrizPas encore d'évaluation

- Interview With A Stock BrokerDocument8 pagesInterview With A Stock Brokertarachandmara100% (3)

- Basic Accounting Concepts and Case StudiesDocument114 pagesBasic Accounting Concepts and Case Studiesgajiniece429Pas encore d'évaluation

- Proposal Stock MarketDocument62 pagesProposal Stock MarketMugea Mga100% (1)

- Project On HondaDocument68 pagesProject On HondaPraveen Kumar Hc50% (2)

- Maybank List ReportDocument3 pagesMaybank List ReportpalmkodokPas encore d'évaluation