Académique Documents

Professionnel Documents

Culture Documents

Sample Exam

Transféré par

richardTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Sample Exam

Transféré par

richardDroits d'auteur :

Formats disponibles

Office Use Only

Sample Examination

Faculty of Business & Economics

EXAM CODES:

ETF2700 / ETF5970

TITLE OF PAPER:

Mathematics for Business

EXAM DURATION:

2 hours writing time

READING TIME:

10 minutes

THIS PAPER IS FOR STUDENTS STUDYING AT: (tick where applicable)

Berwick

Clayton

Malaysia

Off Campus Learning

Learning

Caulfield

Gippsland

Peninsula

Enhancement Studies

Parkville

Other (specify)

Open

Sth Africa

During an exam, you must not have in your possession, a book, notes, paper, electronic device/s,

calculator, pencil case, mobile phone, smart watch/device or other material/item which has not been

authorised for the exam or specifically permitted as noted below. Any material or item on your desk, chair

or person will be deemed to be in your possession. You are reminded that possession of unauthorised

materials, or attempting to cheat or cheating in an exam is a discipline offence under Part 7 of the Monash

University (Council) Regulations.

No exam paper or other exam materials are to be removed from the room.

AUTHORISED MATERIALS

YES

OPEN BOOK

CALCULATORS

YES

If yes, only a HP 10bII+ calculator is permitted.

SPECIFICALLY PERMITTED ITEMS

If yes, items permitted are:

YES

NO

NO

NO

Candidates must complete this section if required to write answers within this paper

STUDENT ID:

__ __ __ __ __ __ __ __

DESK NUMBER:

__ __ __ __ __

Page 1 of 8

ETF2700/ETF5970 Mathematics for Business

Page 2 of 9

There are 7 questions. Students should attempt all questions.

Marks total 85.

Formulae are provided at the end of this paper.

QUESTION 1

[(3+2) + 1 + (1+2+2) = 11 marks]

Energy company GreenVolt (GV) owns a property at the wind-swept, sunny location of Ocean Heads.

GV is evaluating two projects: a wind farm and a solar energy plant.

The wind farm requires an initial investment of $10m, and a $5m loss is expected for the first year. For

the following 3 years, GV expects annual returns of $8m from electricity sales.

The solar plant requires an initial investment of $15m. GV expects a loss of $2m for the first year and

annual returns of $9m for the following 3 years.

Assume a discount (interest) rate of 8% compounded annually.

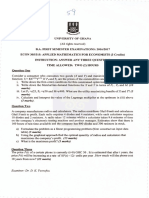

Exhibit 1.1 shows, for each project, a plot of NPV versus discount rate.

Show your working, unless you are instructed otherwise.

(a) (i)

Calculate, in $m to 3 decimal places, the NPV of the wind farm project.

(ii)

For the solar plant project, the NPV is $4.624m.

Ocean Heads City Council is prepared to offer GV an initial grant so that both projects

have the same NPV. If such a grant is necessary, which project should receive it? How

much should it be? Your answer should be in $m to 3 decimal places.

(b)

From your appraisal of the two projects that you have carried out in (a), explain which one you

think is preferable. (Assume that the council has not provided a grant.)

(c)

(i)

(ii)

(iii)

(iii)

Define the term internal rate of return (IRR).

On the basis of IRR, which project do you think is preferable?

Quote suitable figure(s) to justify your answer. You may calculate or estimate IRR.

(You dont have to show your working, but briefly explain how you obtained your value

for IRR. Its not sufficient to say, Used financial calculator.)

When you are choosing the better of two projects, your decision can differ depending

on whether it is based on NPV or IRR. Briefly explain why this is so.

Compare your answers for (b) and (c)(ii). You either chose the same project or different

projects. Briefly state the reason(s) for the similarity or the difference in these answers.

Exhibit 1.1

ETF2700/ETF5970 Mathematics for Business

Page 3 of 9

QUESTION 2

marks]

[5 + (4+1+2) = 12

BlockTech manufactures concrete blocks for the building industry.

Let Q denote the quantity (number of blocks) produced and P, the price ($) per block.

The supply function is

The demand function

P = 60e 0.0025Q

P = 180e 0.005Q

For the following questions, show your working.

(a) Calculate the equilibrium price and quantity. Round your answers to 3 decimal places.

(b)

(i) Show that the price elasticity of demand is given by d = 200/Q.

(ii)

Calculate, to 3 decimal places, the price elasticity of demand at the equilibrium

point.

(iii)

Interpret the value you obtained in (b)(ii).

QUESTION 3

[3 + (4+3+1) + 1 = 12 marks]

A monopolist faces a demand function P = 140 2Q and has costs given as

TFC = 200,

TVC = (1/3)Q3 10Q2 + 188Q.

For the following questions, show your working.

(a)

Obtain an expression for the profit function.

(b)

(i) Obtain the value(s) of Q at the turning point(s) of the profit function.

(ii)

What type(s) of turning point(s) have you found in (b)(i)?

Explain how you decided on the type(s).

(iii)

Calculate the maximum profit.

(c)

Briefly comment on the financial viability of this enterprise. Quote any relevant figure(s).

QUESTION 4

marks]

[4 + (1+9+1) = 15

The Cobb-Douglas function for production output Q is Q = ALK, where

L is labour input, K is capital input, A > 0, 0 < <1 and 0 < < 1.

For the following questions, show your working.

(a)

Use

QL

= Q/L

= AL-1K

and

QLL

= 2Q/L2

= ( 1){Q}/L2

to illustrate the Law of Diminishing Returns to Labour.

(b)

StreetSole makes shoes. The production function for their latest release is

Q = 50L0.4K0.6.

StreetSole wishes to maximise production, but is constrained by a budget of $1,000, with labour

costing $20 per unit and capital costing $50 per unit.

(i)

Write down the Lagrangian function for this optimisation.

(ii)

Find the values of L and K for which the production is maximised.

(iii)

Calculate, to 3 decimal places, the maximum level of production.

ETF2700/ETF5970 Mathematics for Business

QUESTION 5

Page 4 of 9

[(2+1+5) + 3 + 3 = 14 marks]

(a)

The demand and supply functions for two goods X and Y are given below.

Demand:

QX = 120 2PX + 3PY

QY = 150 + 6PX 4PY

Supply:

QX = -240 + 6PX

QY = -150 + 6PY

(i)

Obtain the equations which determine market equilibrium for goods X and Y.

(ii)

Write your answer from (i) as a single matrix equation of the form: AX = B.

(iii)

Using A-1, obtain the prices of the two goods at market equilibrium.

Show your working and provide answers correct to 2 decimal places.

(b)

The coefficients b of a regression model may be estimated via the matrix equation Y = Xb + e,

where the dimensions are Y: n1, X: n(k+1), b: (k+1)1 and e: n1.

Solve Y = Xb + e for b, in terms of X and Y only. Show your working

You may assume that XTe = 0, and that relevant inverse(s) exist.

(c)

Does the system of equations, depicted in matrix form AX = B below, have a unique solution?

Explain your answer.

QUESTION 6

marks]

(a)

[7 + 5 = 12

For the following differential equation, find the general solution for Q and the particular solution

for Q, given P 0, Q 0 and P = 120 when Q = 0.

Show all steps of your working.

(b)

Showing all steps of your working, evaluate the following integral.

1

dx

x ln x

QUESTION 7 (Show all calculations)

marks]

(a)

dQ P 1

=

dP Q Q

(i)

(ii)

[3.5 + 2.5 + (1+2) = 9

The 1995 Australian Bureau of Statistics Yearbook showed a table of Retail price index

numbers, long-term linked series (Base Year 1945=100). In this table, index values for

1970, 1979, 1980 and 1989 were, respectively, 313, 766, 844 and 1714. Use suitable

calculations to explain which decade had a higher rate of inflation: the 1970s or 1980s.

Use the information in (a)(i) to calculate the purchasing power in 1980 of a 1945 dollar.

(b)

Consumer Price Index (2011 = 100) values for the years 2013 and 2014 were 105.8 and 107.6,

respectively. Assume that money could be invested then at 7.2% per annum.

After allowing for the effect of inflation, calculate the real money growth from 2013 to 2014.

Express your answer as a percentage, correct to 2 decimal places.

(c)

(i)

The Consumer Price Index uses, essentially, the Laspeyres method of weighting.

A disadvantage of Laspeyres method is that base period weights become outdated.

Briefly explain how the Australian Bureau of Statistics deals with this disadvantage.

ETF2700/ETF5970 Mathematics for Business

(ii)

Page 5 of 9

Why do weighted composite indexes (eg, Laspeyres & Paasche) have the same weights

in their numerator as they have in their denominator?

ETF2700/ETF5970 Mathematics for Business

Page 6 of 9

ETF2700/ETF5970 Formulae

The Straight Line and Applications

m

Gradient

y 2 y1

x2 x1

Budget Constraint

Elasticity

xPx yPy M

Cost Constraint

y x

.

x y

Q P

.

P Q

wL rK C

Non-linear Functions

logb x = loga x/ loga b

Quadratic Formula

Elasticity

b b 2 4ac

x

2a

d = (dQ/dP)(P/Q)

Index Numbers

It

Simple Price Index

It

p 100

p

p q 100

p q

p q 100

p q

t

Simple Aggregate Price Index

LI t

Laspeyres Price Index

PI t

Paasche Price Index

Deflated Value

pt

100

p0

Current Value

100

Current CPI

Changing base period

Old index value

Old index value in new base year 100

New index value =

Matrices

Determinant

AX = C

consistent

if rank(A) = rank(augmented matrix).

inconsistent if rank(A) < rank(augmented matrix).

rank(A) = n, the solution is unique.

rank(A) < n, there are infinite solutions.

ETF2700/ETF5970 Mathematics for Business

Page 7 of 9

Financial Mathematics

Tn a n 1 d

Arithmetic Sequences and Series

Sn

Tn = arn 1

Geometric Sequences and Series

Simple Interest

Compound Interest

Sn

n

2a ( n 1)d

2

a 1 rn

1 r

a

1 r

Pt = P0(1 + it)

Pt P0 1 i

Compounded annually

i

Pt P0 1

m

Pt P0 e it

Compounded more frequently

Compounded continuously

mt

APR (effective rate) APR = (1 + i/m)m 1

Real growth

APR = ei 1

rr = (1 + r)/(1 + ri) - 1

Depreciation

At = A0(1 it)

At = A0(1 i)t

Straight line

Reducing balance

P0 = Pt(1+i)-t

Discounting & NPV calculation

Vn = P0(1+i/m)n + A0[(1+i/m)n 1)]/(i/m)

Annuities, Loans

V0 A 0

1 (1 i / m) n

i/m

A0 = L(i/m)/[1 (1 +

i/m)-n]

Comparison rate

Flat rate loan

A0 = L(1 + Rt)/n

Differentiation and Applications

dy

dy 1

dy

y ax n

nax n 1

y=lnx , = ; y =e ax , =a eax

dx

dx x

dx

MR

Marginal Revenue:

MC

Marginal Cost:

Price Elasticity of Demand:

dTR

dQ

TR

Q

AC

TC

Q

Average Revenue:

dTC

MVC

dQ

dQ P

.

dP Q

AR

Q P

.

P Q

Average Cost:

d

Cross-Price:

QA PB

.

PB QA

ETF2700/ETF5970 Mathematics for Business

z (f/x)x + (f/y)y

Total differential

z

z z

Page 8 of 9

ETF2700/ETF5970 Mathematics for Business

Page 9 of 9

Differentiation Rules

Power rule

Exponential

Exponential, base e

power ax, a is a constant

log

Product Rule

Quotient Rule

Chain Rule

xn

ex

nx n1

ex

e ax

ae ax

ln x

y u ( x )v ( x )

u ( x)

y

v( x)

1/x

dy/dx = v(du/dx) + u(dv/dx)

du

dv

v

u

dy

dx 2 dx

dx

v

dy/dx = (dy/du)(du/dx)

y f ( u ( x ))

Integration Rules

Power rule

One exception to power

rule

Integral of a constant

Integration of the Natural

Exponential Function

Integration by algebraic

substitution

x dx

xn+1/(n + 1)

x dx

K dx

e dx

ln( x) c

ex c

f [g(x )]dx

Step 1: Let u g (x) ;

Step 2: Deduce an expression for dx in terms of du

Step 3: Substitute u g (x) and dx (in terms of du)

Kx c

f [g ( x )]dx

into

Step 4: Use other rules to obtain final result.

Vous aimerez peut-être aussi

- Math - T (5) QDocument24 pagesMath - T (5) Q水墨墨Pas encore d'évaluation

- Wa0034.Document5 pagesWa0034.Anil KumarPas encore d'évaluation

- Assignment 1Document5 pagesAssignment 1Mr. PsychoPas encore d'évaluation

- Revised 202101 Tutorial STUDENTS VERSION UBEQ1013 Quantitative Techniques IDocument53 pagesRevised 202101 Tutorial STUDENTS VERSION UBEQ1013 Quantitative Techniques IPavitra RavyPas encore d'évaluation

- Thapar Institute of Engineering and Technology (Deemed To Be University)Document2 pagesThapar Institute of Engineering and Technology (Deemed To Be University)AdityaPas encore d'évaluation

- Kepong Baru KL 2013 M3 (A)Document10 pagesKepong Baru KL 2013 M3 (A)STPMmathsPas encore d'évaluation

- QM - Exam Statistics & Data Management 2019Document8 pagesQM - Exam Statistics & Data Management 2019Juho ViljanenPas encore d'évaluation

- Problem Set 1 SolutionsDocument6 pagesProblem Set 1 SolutionsTanzy SPas encore d'évaluation

- AEC 603 - Mathematics For Economists - Revision Exercises - December 2021Document5 pagesAEC 603 - Mathematics For Economists - Revision Exercises - December 2021Purity MutheuPas encore d'évaluation

- Final TCCDocument11 pagesFinal TCCLinh VũPas encore d'évaluation

- ENGM90011 2020 Final Exam PDFDocument3 pagesENGM90011 2020 Final Exam PDFMuhammed MinhajPas encore d'évaluation

- ME - PGP Exam Last YearDocument3 pagesME - PGP Exam Last Yearvijay2293Pas encore d'évaluation

- ETC1010 Paper 1Document9 pagesETC1010 Paper 1wjia26Pas encore d'évaluation

- 3 PROBLEM SET Eco MicroDocument4 pages3 PROBLEM SET Eco MicroPranil ChaudhariPas encore d'évaluation

- Elasticity and Demand ExerciseDocument10 pagesElasticity and Demand ExerciseOmar Faruk 2235292660Pas encore d'évaluation

- AnswerDocument6 pagesAnswerAinin Sofea FoziPas encore d'évaluation

- Practice Paper 3: (Unsolved)Document3 pagesPractice Paper 3: (Unsolved)NDA AspirantPas encore d'évaluation

- Tme 601Document14 pagesTme 601dearsaswatPas encore d'évaluation

- Dec 2012 A-QMDocument15 pagesDec 2012 A-QMShel LeePas encore d'évaluation

- Economics NumericalsDocument9 pagesEconomics NumericalsIshaan KumarPas encore d'évaluation

- 281 Winter 2015 Final Exam With Key PDFDocument15 pages281 Winter 2015 Final Exam With Key PDFAlex HoPas encore d'évaluation

- Pre Board - 2 11 EcoDocument3 pagesPre Board - 2 11 EcoNDA AspirantPas encore d'évaluation

- AssignmentDocument2 pagesAssignmentnavneet26101988Pas encore d'évaluation

- Ebe2043 Managerial Economics - In-ClassDocument7 pagesEbe2043 Managerial Economics - In-ClassS'haidahk Pindutt0% (1)

- Lcci BS 1Document17 pagesLcci BS 1Kyaw Htin WinPas encore d'évaluation

- Bmme 5103Document12 pagesBmme 5103liawkimjuan5961Pas encore d'évaluation

- Exam AnswersDocument9 pagesExam AnswersGiorgi ChemiaPas encore d'évaluation

- bài tập vận dụng chap 1 2 m4bDocument12 pagesbài tập vận dụng chap 1 2 m4bconkienlua2005Pas encore d'évaluation

- Elasticity and Demand ExerciseDocument7 pagesElasticity and Demand ExerciseKhairul Bashar Bhuiyan 1635167090Pas encore d'évaluation

- AppzDocument11 pagesAppzramganesh907887Pas encore d'évaluation

- Content Hull 8763Document10 pagesContent Hull 8763DWPas encore d'évaluation

- 2012 Math Studies Exam PaperDocument41 pages2012 Math Studies Exam PaperTifeny Seng100% (1)

- Elasticity and Demand ExerciseDocument7 pagesElasticity and Demand ExerciseAurik IshPas encore d'évaluation

- Topic 3 Solution of Short Answer QuestionsDocument7 pagesTopic 3 Solution of Short Answer QuestionsTy VoPas encore d'évaluation

- Business Mathematics Reappear - Bba 105 - 2004 Dec - End TermDocument2 pagesBusiness Mathematics Reappear - Bba 105 - 2004 Dec - End Termggsipu_info100% (1)

- MGMT 540: Managerial Economics Midterm Exam: Minutes To Complete The Exam (Including Formatting, Uploading, Etc.) - YouDocument9 pagesMGMT 540: Managerial Economics Midterm Exam: Minutes To Complete The Exam (Including Formatting, Uploading, Etc.) - Youliu anPas encore d'évaluation

- Economics EC 7418 Mathematical Methods For Economists October 2019 ADocument3 pagesEconomics EC 7418 Mathematical Methods For Economists October 2019 Apremium info2222Pas encore d'évaluation

- Engineering Economics Exercises - SolutionsDocument4 pagesEngineering Economics Exercises - SolutionsMehmet ZirekPas encore d'évaluation

- BS 140 Classwork Four 2020 - 2021Document3 pagesBS 140 Classwork Four 2020 - 2021YvonnePas encore d'évaluation

- PS 7Document9 pagesPS 7Gülten Ece BelginPas encore d'évaluation

- Week 5 Take Home Assignment Questions-Semester 1 2024-3 Jaime DurkinDocument13 pagesWeek 5 Take Home Assignment Questions-Semester 1 2024-3 Jaime DurkinMr Christ101Pas encore d'évaluation

- Time Value of Money AssignmentDocument2 pagesTime Value of Money AssignmentErika Rez LapatisPas encore d'évaluation

- MecDocument138 pagesMecvcoolj0% (1)

- Blank 3e ISM Ch02Document40 pagesBlank 3e ISM Ch02Sarmad KayaniPas encore d'évaluation

- Answer CH 7 Costs of ProductionDocument11 pagesAnswer CH 7 Costs of ProductionAurik IshPas encore d'évaluation

- Pxand: P Marks) X and (5 Marks) (3 Marks)Document2 pagesPxand: P Marks) X and (5 Marks) (3 Marks)Bright KorantengPas encore d'évaluation

- Econ300 Problem SetsDocument12 pagesEcon300 Problem SetsMark VazquezPas encore d'évaluation

- 12TH Maths Paper (April To October)Document19 pages12TH Maths Paper (April To October)Yash SakpalPas encore d'évaluation

- Final W11Document10 pagesFinal W11NaPas encore d'évaluation

- The Cost of Production: VC AVC VC Q QDocument5 pagesThe Cost of Production: VC AVC VC Q QSuprabhat TiwariPas encore d'évaluation

- ĐÁP ÁN PHIẾU ÔN TẬP TOÁN CAO CẤPDocument62 pagesĐÁP ÁN PHIẾU ÔN TẬP TOÁN CAO CẤPTrường XuânPas encore d'évaluation

- Production With Two Variable Inputs-FDocument39 pagesProduction With Two Variable Inputs-Fcancerdona50% (2)

- Midterm Fall2013Document2 pagesMidterm Fall2013api-238876342Pas encore d'évaluation

- Mba ZC417 Ec-3m First Sem 2018-2019Document6 pagesMba ZC417 Ec-3m First Sem 2018-2019shiintuPas encore d'évaluation

- BBK BUMN052S6 2015 Financial ManagementDocument10 pagesBBK BUMN052S6 2015 Financial ManagementVan Der Heijden CPas encore d'évaluation

- Oligopoly 2Document6 pagesOligopoly 2cybergearPas encore d'évaluation

- Mbaex - 8103 Managerial EconomicsDocument2 pagesMbaex - 8103 Managerial Economicsgaurav jainPas encore d'évaluation

- Data Interpretation Guide For All Competitive and Admission ExamsD'EverandData Interpretation Guide For All Competitive and Admission ExamsÉvaluation : 2.5 sur 5 étoiles2.5/5 (6)

- Sample Exam SolutionsDocument7 pagesSample Exam SolutionsrichardPas encore d'évaluation

- MFB Assgt 2-2016 - 2-SolnDocument16 pagesMFB Assgt 2-2016 - 2-SolnrichardPas encore d'évaluation

- MFB Assgt 3 2016 - 2 SolnDocument12 pagesMFB Assgt 3 2016 - 2 SolnrichardPas encore d'évaluation

- MFB Assgt 3 2016 - 2Document6 pagesMFB Assgt 3 2016 - 2richardPas encore d'évaluation

- Formula Sheet 16 - 2Document5 pagesFormula Sheet 16 - 2richardPas encore d'évaluation

- MFB Assgt 2 2016 - 2Document6 pagesMFB Assgt 2 2016 - 2richardPas encore d'évaluation

- MFB Assgt 1-2016 - 2-SolnDocument15 pagesMFB Assgt 1-2016 - 2-SolnrichardPas encore d'évaluation

- MFB Assgt 1 2016 - 2Document7 pagesMFB Assgt 1 2016 - 2richardPas encore d'évaluation

- Swot Analysis - DHA 1Document15 pagesSwot Analysis - DHA 1Laxmi PriyaPas encore d'évaluation

- Kuliah 3 Stoikiometri IntDocument49 pagesKuliah 3 Stoikiometri IntMambaulkPas encore d'évaluation

- The Economic Times: Name Designation CompanyDocument49 pagesThe Economic Times: Name Designation CompanyArvind Kumar SPas encore d'évaluation

- Finman - Q2 Cost Os CaptDocument2 pagesFinman - Q2 Cost Os CaptJennifer RasonabePas encore d'évaluation

- Standard Costing Practice QuestionsDocument3 pagesStandard Costing Practice Questionsmohammad AliPas encore d'évaluation

- Week 4-1 Types of MAJOR AccountsDocument2 pagesWeek 4-1 Types of MAJOR AccountsSelenaPas encore d'évaluation

- Project Budgeting and Accounting: What Is A Budget?Document8 pagesProject Budgeting and Accounting: What Is A Budget?Syed YaserPas encore d'évaluation

- McDonalds' Trademark RegistrationsDocument10 pagesMcDonalds' Trademark RegistrationsDaniel BallardPas encore d'évaluation

- Global Marketing Strategy of Coca-ColaDocument2 pagesGlobal Marketing Strategy of Coca-ColaRimsha shakirPas encore d'évaluation

- Chapter 7 - Accepting The Engagement and Planning The AuditDocument9 pagesChapter 7 - Accepting The Engagement and Planning The Auditsimona_xoPas encore d'évaluation

- 2 SJ 117Document3 pages2 SJ 117Nacho ConsolaniPas encore d'évaluation

- Business Proposal FormatDocument4 pagesBusiness Proposal FormatAgnes Bianca MendozaPas encore d'évaluation

- Zendiggi Kebab House MenuDocument2 pagesZendiggi Kebab House MenukatayebPas encore d'évaluation

- Kopie Van The Lazy Goldmaker's Jewelcrafting SpreadsheetDocument14 pagesKopie Van The Lazy Goldmaker's Jewelcrafting SpreadsheetAnonymous 7jb17EQPPas encore d'évaluation

- Olympics, A Zim AppraisalDocument3 pagesOlympics, A Zim Appraisalbheki213Pas encore d'évaluation

- African Development BankDocument7 pagesAfrican Development BankAasma HaseebPas encore d'évaluation

- Sol14 4eDocument103 pagesSol14 4eKiều Thảo Anh100% (1)

- Investments, Chapter 4: Answers To Selected ProblemsDocument5 pagesInvestments, Chapter 4: Answers To Selected ProblemsRadwan MagicienPas encore d'évaluation

- Visit WWW Pearsonhighered Com Horngren To View A Link To Starbucks Corporation 2011Document1 pageVisit WWW Pearsonhighered Com Horngren To View A Link To Starbucks Corporation 2011Amit PandeyPas encore d'évaluation

- Emgoldex by Selvaam Rev1Document28 pagesEmgoldex by Selvaam Rev1Veenesha MuralidharanPas encore d'évaluation

- Company Profile TPSLDocument2 pagesCompany Profile TPSLbhagawathiPas encore d'évaluation

- Pmo Framework and Pmo Models For Project Business ManagementDocument22 pagesPmo Framework and Pmo Models For Project Business Managementupendras100% (1)

- 2014-15 Mayor Proposed BudgetDocument478 pages2014-15 Mayor Proposed BudgetEricFruitsPas encore d'évaluation

- Action1 Test U7 1Document4 pagesAction1 Test U7 1Ñlkj Ñlkj100% (1)

- F18, H24 Parts CatalogDocument299 pagesF18, H24 Parts CatalogKLE100% (6)

- UNITED - Flight World MapDocument1 pageUNITED - Flight World MaparquitrolPas encore d'évaluation

- WORLD BANK PresentationDocument30 pagesWORLD BANK PresentationAmna FarooquiPas encore d'évaluation

- Algo - Lec3 - Verifying Correctness of Algorithm PDFDocument126 pagesAlgo - Lec3 - Verifying Correctness of Algorithm PDFHamza BhattiPas encore d'évaluation

- World Machine Tool Survey: ResearchDocument12 pagesWorld Machine Tool Survey: Researchפּואַ פּוגאַPas encore d'évaluation

- Chapter 6Document10 pagesChapter 6narasimha100% (1)