Académique Documents

Professionnel Documents

Culture Documents

Financial Results For Sept 30, 2015 (Standalone) (Result)

Transféré par

Shyam SunderDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Financial Results For Sept 30, 2015 (Standalone) (Result)

Transféré par

Shyam SunderDroits d'auteur :

Formats disponibles

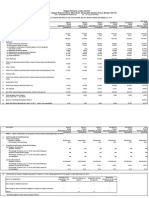

SHRI LAKSHMI COTSYN LIMITED

An ISO 9001:2008 Certified Company

CIN:L17122UP1988PLC009985

Regd. Office : 19/X-1, KRISHNAPURAM, G.T. ROAD, KANPURTel. No. : 0512-2401492,2402893,2402733, Fax, 0512-2402339, E mail : shri@shrilakshmi.in

Corp. Office: C-40, Sector-57, Gautam Budh Nagar, Noida Tel. No. 0120-4722700, Fax 0120- 4722722

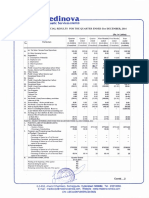

STANDALONEUNAUDITEDFINANCIALRESULTSFORTHEQUARTER/HALFYEARENDEDON30THSEPTEMBER2015

(Rs. in Crores except for shares & EPS)

Quarter Ended

Half Year Ended

Year Ended

PART I

Sr. No Particulars

1 Income from operations

(a) Net Sales/Income from operations

Total Income from operations(net)

2

Total Expenditure

Cost of materials consumed

Employee benefits expenses

Depreciation and amortisation expenses

Other Expenses

30.09.2015 30.06.2015 30.09.2014

30.09.2015 30.09.2014

(Unaudited) (Unaudited) (Unaudited) (Unaudited) (Unaudited)

90.66

90.66

121.48

87.53

87.53

113.98

149.71

149.71

238.33

178.19

178.19

235.46

328.05

328.05

497.49

31.03.2015

(Audited)

577.50

577.50

934.11

59.12

13.74

22.68

25.94

60.48

10.64

27.50

15.36

169.69

13.58

26.50

28.56

119.60

24.38

50.18

41.3

365.45

26.23

52.75

53.06

648.66

51.61

110.78

123.06

Profit from operations before other income,

finance costs & exceptional items (1-2)

(30.82)

(26.45)

(88.62)

(57.27)

(169.44)

(356.61)

4

5

Other Income

Profit from operations before finance cost (3+4)

9.87

(20.95)

3.27

(23.18)

9.07

(79.55)

13.14

(44.13)

15.98

(153.46)

23.54

(333.07)

6

7

Finance Cost

Profit from ordinary activities before Tax(5-6)

44.17

(65.12)

30.28

(53.46)

44.99

(124.54)

74.45

(118.58)

120.76

(274.22)

171.01

(504.08)

8

9

Tax expense (Including Deferred Tax)

Net Profit/ Loss after Tax (7-8)

(65.12)

(53.46)

(124.54)

(118.58)

(274.22)

(504.08)

10

11

Exceptional items

Net Loss after Exceptional items (9-10)

(6.27)

(71.39)

(53.46)

(141.57)

(266.11)

(6.27)

(124.85)

(226.20)

(500.42)

(430.22)

(934.30)

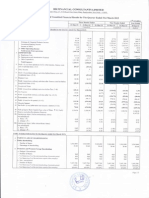

A

12

PARTICULARS OF SHAREHOLDING

Paid up Equity Share Capital (Face value Rs.10)

28.47

28.47

28.47

28.47

28.47

28.47

13

Reserves excluding revaluation reserves

14

Earnings Per Share (EPS) (in Rs.)

15

Public Shareholding

- Number of Shares

- Percentage of Shareholding

16958744

59.57

16958744

59.57

14943481

52.49

16958744

59.57

14943481

52.49

16958744

59.57

7521302

7521302

9536565

7521302

9536565

7521302

65.34

26.42

65.34

26.42

70.50

33.50

65.34

26.42

70.50

33.50

65.34

26.42

(a)

(b)

(c)

(d)

3

16

Promoters & Promoter group Shareholding

a) Pledged/Encumbered

- No. of Shares

- Percentage of Shares of Promoters & promoters

Group

- Percentage of Shares of total share capital

b) Non -encumbered

- No. of Shares

3990599

3990599

3990599

3990599

3990599

3990599

- Percentage of Shares of Promoters/ Promoters

Group

34.66

34.66

29.50

34.66

29.50

34.66

- Percentage of Shares of total share capital

14.01

14.01

14.01

14.01

14.01

14.01

B INVESTOR COMPLAINTS

- Pending at the beginning of the quarter (Nos)

1

- Received during the quarter (Nos)

1

-Disposed off during the quarter (Nos)

2

-Lying unresolved at the end of the quarter (Nos)

0

NOTES:

1. The above results were duly reviewed by Audit Committee and were taken on record by the Board at its meeting held on 14.11.2015.

2. The Company is functioning in only one segment i.e.Textiles, hence Segment Reporting required under AS-17 is not applicable.

3. Claims for discounts / rebates pertaining to sales have been assessed , quantified and adjusted in these results.

4.The Company is registered with the BIFR in terms of the provisions of Sick Industrial Companies (Special Provisions) Act. The Bench in the last

hearing held on 01.10.2015 directed the Banks to file written objections within 4 weeks time and the next date is fixed on 17.02.2016.

5. The figures of previous periods have been regrouped/recasted wherever necessary.

Dated : 14.11.2015

Place: Kanpur

Chairman & Managing Director

DIN:00311806

Vous aimerez peut-être aussi

- Financial Results For Sept 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Updates On Financial Results For Sept 30, 2015 (Result)Document4 pagesUpdates On Financial Results For Sept 30, 2015 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Revised Financial Results & Limited Review For Sept 30, 2015 (Standalone) (Result)Document7 pagesRevised Financial Results & Limited Review For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- PTC India Limited: Registered Office:2nd Floor, NBCC Tower, 15 Bhikaji Cama Place New Delhi - 110 066 (CINDocument3 pagesPTC India Limited: Registered Office:2nd Floor, NBCC Tower, 15 Bhikaji Cama Place New Delhi - 110 066 (CINDeepak GuptaPas encore d'évaluation

- Colgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Document4 pagesColgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Aditya MishraPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Document6 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- PDF Processed With Cutepdf Evaluation EditionDocument6 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderPas encore d'évaluation

- June 2015Document2 pagesJune 2015Aarush VermaPas encore d'évaluation

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Result)Document16 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For March 31, 2015 (Result)Document5 pagesFinancial Results & Limited Review For March 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

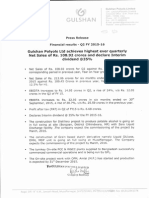

- Announces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Document5 pagesAnnounces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- q1 DEVIS LABORATORYDocument3 pagesq1 DEVIS LABORATORYNaman KaushikPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Updates Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document7 pagesUpdates Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document8 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results With Results Press Release & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document5 pagesFinancial Results With Results Press Release & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Dec 31, 2012 (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2012 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results For Dec 31, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For June 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- An Iso 9001:2008 and Iso 22000 Accredited Company Registered Office: D-19-20, Panki Industrial Area, Kanpur - 208 022Document1 pageAn Iso 9001:2008 and Iso 22000 Accredited Company Registered Office: D-19-20, Panki Industrial Area, Kanpur - 208 022Muralis MuralisPas encore d'évaluation

- Standalone Financial Results For September 30, 2016 (Result)Document4 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document5 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisD'EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisPas encore d'évaluation

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderPas encore d'évaluation

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderPas encore d'évaluation

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- What Is Emergency ManagementDocument8 pagesWhat Is Emergency ManagementHilina hailuPas encore d'évaluation

- Cooling Tower (Genius)Document7 pagesCooling Tower (Genius)JeghiPas encore d'évaluation

- NSTP1 MODULE 3 Disaster Awareness Preparedness and ManagementDocument16 pagesNSTP1 MODULE 3 Disaster Awareness Preparedness and Managementrenz dave100% (2)

- Grounds of Divorce Under Hindu Religion or Hindu Law Unit-A: Chapter-IiDocument42 pagesGrounds of Divorce Under Hindu Religion or Hindu Law Unit-A: Chapter-IiSatyam PathakPas encore d'évaluation

- Astm A712 PDFDocument3 pagesAstm A712 PDFCristian OtivoPas encore d'évaluation

- CL Analyzer: Coagulometric, Chromogenic and Immunological AssaysDocument2 pagesCL Analyzer: Coagulometric, Chromogenic and Immunological AssaysEdwinPas encore d'évaluation

- 感應馬達安裝、保養使用說明書31057H402E (英)Document17 pages感應馬達安裝、保養使用說明書31057H402E (英)Rosyad Broe CaporegimePas encore d'évaluation

- Course Syllabus Manufacturing Processes (1) Metal CuttingDocument4 pagesCourse Syllabus Manufacturing Processes (1) Metal CuttingG. Dancer GhPas encore d'évaluation

- Water TreatmentDocument27 pagesWater TreatmentArya Singh Rathod100% (1)

- Wa0016Document3 pagesWa0016Vinay DahiyaPas encore d'évaluation

- Palf PDFDocument16 pagesPalf PDFKamal Nadh TammaPas encore d'évaluation

- Mobil Delvac 1 ESP 5W-40Document3 pagesMobil Delvac 1 ESP 5W-40RachitPas encore d'évaluation

- FRM Valuation & Risk Models Dowd, Chapter 2: - Hosted by David Harper Cfa, FRM, Cipm - Published April 22, 2012Document19 pagesFRM Valuation & Risk Models Dowd, Chapter 2: - Hosted by David Harper Cfa, FRM, Cipm - Published April 22, 2012BeastPas encore d'évaluation

- Complete Renold CatalogueDocument92 pagesComplete Renold CatalogueblpPas encore d'évaluation

- Qualification of Analytical Instruments For Use in Pharmaceutical Industry-A Scientific ApproachDocument23 pagesQualification of Analytical Instruments For Use in Pharmaceutical Industry-A Scientific Approachmicrobioasturias100% (4)

- 1 Nitanshi Singh Full WorkDocument9 pages1 Nitanshi Singh Full WorkNitanshi SinghPas encore d'évaluation

- KhanIzh - FGI Life - Offer Letter - V1 - Signed - 20220113154558Document6 pagesKhanIzh - FGI Life - Offer Letter - V1 - Signed - 20220113154558Izharul HaquePas encore d'évaluation

- Exercise 8 BeveragewareDocument9 pagesExercise 8 BeveragewareMae Cleofe G. SelisanaPas encore d'évaluation

- 10.0 Ms For Scaffolding WorksDocument7 pages10.0 Ms For Scaffolding WorksilliasuddinPas encore d'évaluation

- Brain Slides SEMINAR 1 - 220606 - 142811 - 220606 - 223805Document32 pagesBrain Slides SEMINAR 1 - 220606 - 142811 - 220606 - 223805pang pangPas encore d'évaluation

- Cheap TBE Inverter TeardownsDocument33 pagesCheap TBE Inverter TeardownsWar Linux92% (12)

- A I R P O R T S Construction Program Management 56Document56 pagesA I R P O R T S Construction Program Management 56Carl WilliamsPas encore d'évaluation

- Sindh Rescue 1122 Test Sample PapersDocument12 pagesSindh Rescue 1122 Test Sample PapersMAANJONY100% (1)

- Extraordinary GazetteDocument10 pagesExtraordinary GazetteAdaderana OnlinePas encore d'évaluation

- 2008 NOHC - JPHDSupplementDocument62 pages2008 NOHC - JPHDSupplementEliza DNPas encore d'évaluation

- Soal 2-3ADocument5 pagesSoal 2-3Atrinanda ajiPas encore d'évaluation

- Science 9-Quarter 2-Module-3Document28 pagesScience 9-Quarter 2-Module-3Mon DyPas encore d'évaluation

- Understanding Senior Citizens Outlook of Death Sample FormatDocument14 pagesUnderstanding Senior Citizens Outlook of Death Sample FormatThea QuibuyenPas encore d'évaluation

- Cash and Cash Equivalents ReviewerDocument4 pagesCash and Cash Equivalents ReviewerEileithyia KijimaPas encore d'évaluation

- Richard Teerlink and Paul Trane - Part 1Document14 pagesRichard Teerlink and Paul Trane - Part 1Scratch HunterPas encore d'évaluation