Académique Documents

Professionnel Documents

Culture Documents

Tax Planning For FY 2016-17

Transféré par

Jay JayavarapuDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Tax Planning For FY 2016-17

Transféré par

Jay JayavarapuDroits d'auteur :

Formats disponibles

12/2/2016

TaxPlanningforFY201617

TaxPlanningGuideforFY201617

FiledunderBUDGET

Filedunder

BUDGET,,BUDGET2016

BUDGET2016,,INCOMETAX

INCOMETAX,,INVESTMENTPLAN

INVESTMENTPLAN,,TAXSAVING

TAXSAVING,,TAXES

20

We are releasing the

the eBook on Tax Planning for FY 2016

17. This is a short 45 slide power point presentation which

17.

gives the details of tax saving sections and investments

availabletoindividualtaxpayers.

ButfirstletslookatthechangesintheIncomeTaxrulesin

Budget2016.

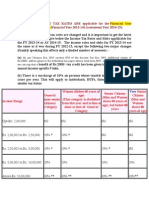

ChangesinIncomeTax

Rules:

TaxPlanningGuideforFY201617

1.Therehasbeen

1.

Therehasbeennochangeintheincometaxslabs

nochangeintheincometaxslabs..

2.For

2.

ForpeoplewithnettaxableincomebelowRs5lakh,the

peoplewithnettaxableincomebelowRs5lakh,thetaxrebatehasbeenincreasedfromRs2,000to

Rs5,000u/s87A..ThiswouldbenefitpeoplewhohavenettaxableincomebetweenRs2.7LakhstoRs5Lakhs.

Rs5,000u/s87A

3.AdditionalexemptionforfirsttimehomebuyeruptoRs.50,000oninterestpaidonhousingloans.This

3.AdditionalexemptionforfirsttimehomebuyeruptoRs.50,000oninterestpaidonhousingloans.This

wouldbeapplicablewherethepropertycostisbelowRs50LakhsandthehomeloanisbelowRs35lakhs.The

loanshouldbesanctionedonorafterApril1,2016.

4.TaxExemptionu/s80GG(forrentexpenseswhodohaveHRAcomponentinsalary)hasbeen

increasedfromRs24,000toRs60,000perannum.Thisisagoodmovetoaligntheexemptionamountwith

increasedfromRs24,000toRs60,000perannum.

todaysrentandkeepthesectionrelevant.

5.For

5.

ForpeoplewithnettaxableincomeaboveRs1crore,thesurchargehasbeenincreasedfrom12%to

15%

6.DividendIncomeinexcessofRs.10lakhperannumtobetaxedat10%

7.40%oflumpsumwithdrawalon NPS

7.40%oflumpsumwithdrawalon

NPSatmaturitywouldbeexemptedfromTax

atmaturitywouldbeexemptedfromTax.Thisrulenowalsoapplies

.Thisrulenowalsoapplies

toEPF.SonowincaseofEPF

toEPF.Sonowincaseof

EPFincometaxwouldbeapplicableon60%ofthecorpusonmaturity

incometaxwouldbeapplicableon60%ofthecorpusonmaturity..

8.PresumptivetaxationschemeintroducedforprofessionalswithreceiptsuptoRs.50lakhs.The

8.Presumptivetaxationschemeintroducedforprofessionals

http://apnaplan.com/taxplanningfy2017/

1/4

12/2/2016

TaxPlanningforFY201617

8.PresumptivetaxationschemeintroducedforprofessionalswithreceiptsuptoRs.50lakhs.The

8.Presumptivetaxationschemeintroducedforprofessionals

presumptiveincomewouldbe50%oftherevenues.

TheeBookcoversthefollowingincometaxsectionsavailableforindividualtaxpayers:

DownloadTaxPlanningeBookforFY201617(AY201718)

DownloadTaxPlanningeBookforFY201617(AY201718)

Download

2.46MB

1.Section80C/80CCC/80CCD

These 3 are the most popular sections for tax saving and have lot of options to save tax.

tax. The maximum

exemption combining all the above sections is Rs 1.5 lakhs.

lakhs. 80CCC deals with the pension products while

80CCDincludesCentralGovernmentEmployeePensionScheme.

Youcanchoosefromthefollowingfortaxsavinginvestments:

1.Employee/VoluntaryProvidentFund(EPF/VPF)

Employee/VoluntaryProvidentFund(EPF/VPF)

2.PPF(PublicProvidentfund)

PPF(PublicProvidentfund)

3.SukanyaSamriddhiAccount

SukanyaSamriddhiAccount

4.NationalSavingCertificate(NSC)

NationalSavingCertificate(NSC)

5.SeniorCitizensSavingScheme(SCSS)

SeniorCitizensSavingScheme(SCSS)

6.5years

5yearsTaxSavingFixedDeposit

TaxSavingFixedDepositinbanks/postoffices

7.LifeInsurance

LifeInsurancePremium

8.PensionPlansfromLifeInsuranceorMutualFunds

PensionPlansfromLifeInsuranceorMutualFunds

9.NPS(NewPensionScheme)

NPS(NewPensionScheme)

10.EquityLinkedSavingScheme

EquityLinkedSavingScheme(ELSSpopularlyknownasTaxSavingMutualFunds)

11.CentralGovernmentEmployeePensionScheme

CentralGovernmentEmployeePensionScheme

12.PrincipalPaymenton

PrincipalPaymentonHomeLoan

13.StampDutyandregistrationoftheHouse

StampDutyandregistrationoftheHouse

14.TuitionFeefor2children

TuitionFeefor2children

2.Section80CCD(1B)InvestmentinNPS

Budget 2015 has allowed additional exemption of Rs 50,000 for investment in NPS. We have done a

a complete

analysis andconcludedthatitwouldbebeneficialforyoutodiscardthisbenefitandinvestaftertaxmoneyina

analysis

goodequitymutualfund.

DownloadTaxPlanningeBookforFY201617(AY201718)

DownloadTaxPlanningeBookforFY201617(AY201718)

Download

http://apnaplan.com/taxplanningfy2017/

2.46MB

2/4

12/2/2016

TaxPlanningforFY201617

3. Payment of interest on Home Loan (Section

24/80EE)

TheinterestpaiduptoRs2lakhsonhomeloanforselfoccupiedhomeisexemptedu/s24.Thereisnolimitfor

homegivenonrent.

Budget2016hasprovidedadditionalexemptionuptoRs50,000forpaymentofhomeloaninterestforfirsttime

homebuyers.ToavailthisbenefitthevalueofhomeshouldnotexceedRs50lakhsandloanshouldnotbemore

thanRs35lakhs.

4. Payment of Interest on

on Education Loan

Loan (Section

80E)

Thetotalinterestpaidoneducationloancanbeclaimedastaxexemption.Thereisnoupperlimitforthesame.

5.InvestmentinRGESS

5.Investmentin

RGESS(Section80CCG)

Deduction Up to Rs 25,000 (50% of amount invested) is allowed if you make investment in preapproved stocks

andmutualfundsinRajivGandhiEquitySavingsScheme(RGESS).Thisisavailabletofirsttimeequityinvestors

subjecttocertainconditions.

6. Medical insurance for Self and Parents (Section

80D)

Youcanget taxdeductionuptoRs60,000bypayingmedicalinsurance

Youcanget

taxdeductionuptoRs60,000bypayingmedicalinsurance premiumforself,yourdependentsand

yourparents.ThereisalsosublimitofRs5,000forpreventivemedicalcheckup.

http://apnaplan.com/taxplanningfy2017/

3/4

12/2/2016

TaxPlanningforFY201617

7.TreatmentofSeriousdisease(Section80DDB)

YoucanclaimdeductionuptoRs80,000fortreatmentofcertaindiseaseslikeAIDS,renalfailure,etcforselfor

dependents

8.PhysicallyDisabledTaxpayer(Section80U)

PhysicallyDisabledTaxpayercangettaxexemptionuptoRs1.25lakhsu/s80U

9.PhysicallyDisabledDependent(Section80DD)

You can claim deduction up to Rs 1.25 lakhs for maintenance and medical treatment of Physically Disabled

dependent

10.DonationstoCharitableInstitutions(Section80G)

DeductionuptoRs40,000isallowedforDonationtocertaincharitablefunds,charitableinstitutions,etc.

11. Donations to Charitable Institutions (Section

80GGA)

DeductionuptoRs1lakhisallowedfordonationsforscientificresearchorruraldevelopment

12. Donations to Charitable Institutions (Section

80GGC)

DeductionuptoRs60,000isallowedfordonationstopoliticalparties

http://apnaplan.com/taxplanningfy2017/

4/4

Vous aimerez peut-être aussi

- SampleDocument11 pagesSampleYanyan RivalPas encore d'évaluation

- Professor Taranne (English Draft Script)Document38 pagesProfessor Taranne (English Draft Script)steryx880% (1)

- John Hart Ely - Democracy and Distrust - A Theory of Judicial Review (1980)Document283 pagesJohn Hart Ely - Democracy and Distrust - A Theory of Judicial Review (1980)Nicole Hart0% (1)

- CIS-Client Information Sheet - TEMPLATEDocument15 pagesCIS-Client Information Sheet - TEMPLATEPolat Muhasebe100% (1)

- Budget 2016 UpdatesDocument2 pagesBudget 2016 UpdatesRachel KowalskiPas encore d'évaluation

- TDS Calculation Sheet in Excel and Slabs For FY 2017-18 and AY 2018-19Document5 pagesTDS Calculation Sheet in Excel and Slabs For FY 2017-18 and AY 2018-19Nishit MarvaniaPas encore d'évaluation

- Moneysprite Spring Budget 2017 - ReportDocument26 pagesMoneysprite Spring Budget 2017 - ReportMoneyspritePas encore d'évaluation

- Technical Note: DisclaimerDocument13 pagesTechnical Note: DisclaimerNicquainCTPas encore d'évaluation

- Seneca Reid Budget Bulletin 2016Document26 pagesSeneca Reid Budget Bulletin 2016SenecaReidPas encore d'évaluation

- Army Institute of Law, Mohali: Provisions Relating To Rebates Under The Income Tax Act, 1961 A Project Submitted ToDocument7 pagesArmy Institute of Law, Mohali: Provisions Relating To Rebates Under The Income Tax Act, 1961 A Project Submitted ToAyushi JaryalPas encore d'évaluation

- How To Calculate Income TaxDocument4 pagesHow To Calculate Income TaxreemaPas encore d'évaluation

- Income Tax KnowledgeDocument5 pagesIncome Tax KnowledgeAbhishekPas encore d'évaluation

- Sec 87A PDFDocument1 pageSec 87A PDFCma Saurabh AroraPas encore d'évaluation

- Penalty For Underpayment of TaxDocument5 pagesPenalty For Underpayment of Taxjwasundara1654Pas encore d'évaluation

- Direct Tax CodeDocument13 pagesDirect Tax CodeabunaventanaPas encore d'évaluation

- Direct Tax CodeDocument13 pagesDirect Tax CodeabunaventanaPas encore d'évaluation

- Union Budget 2017-18: Janani P FinanceDocument17 pagesUnion Budget 2017-18: Janani P FinanceJanani ParameswaranPas encore d'évaluation

- Union Budget (2016-17) : FM Finally Gets It Right!Document12 pagesUnion Budget (2016-17) : FM Finally Gets It Right!Muralidharan KrishnamoorthyPas encore d'évaluation

- How To Calculate Ur Income TaxDocument3 pagesHow To Calculate Ur Income TaxrazeemshipPas encore d'évaluation

- KEY Tax Points From Today'S BudgetDocument6 pagesKEY Tax Points From Today'S Budgetapi-281744226Pas encore d'évaluation

- KEY Tax Points From Today'S BudgetDocument6 pagesKEY Tax Points From Today'S Budgetapi-281744226Pas encore d'évaluation

- A Critical Analysis of The Union Budget 2021Document4 pagesA Critical Analysis of The Union Budget 2021Jamila MustafaPas encore d'évaluation

- Notes On DTC BillDocument5 pagesNotes On DTC Billshikah sidarPas encore d'évaluation

- EconomyDocument86 pagesEconomySridhar HaritasaPas encore d'évaluation

- Tax Legal Weekly Alert 12 16 Oct 2015Document4 pagesTax Legal Weekly Alert 12 16 Oct 2015Anonymous w9EXUnPas encore d'évaluation

- BudgetDocument13 pagesBudgetSayan Dutta RoyPas encore d'évaluation

- Tax Saving GuideDocument36 pagesTax Saving GuideSamantha JPas encore d'évaluation

- Balanced Budget 2016 HighlightsDocument8 pagesBalanced Budget 2016 HighlightsMortgage ResourcesPas encore d'évaluation

- Tinjauan Yuridis Pemungutan Pajak Restoran Dalam MDocument8 pagesTinjauan Yuridis Pemungutan Pajak Restoran Dalam MGustia UlfaPas encore d'évaluation

- Analisis Perhitungan, Pencatatan, Penyetoran Dan Pelaporan Pajak Penghasilan 21 Pada Rs Vania BOGOR TAHUN 2015-2016Document12 pagesAnalisis Perhitungan, Pencatatan, Penyetoran Dan Pelaporan Pajak Penghasilan 21 Pada Rs Vania BOGOR TAHUN 2015-2016Agustina HalawaPas encore d'évaluation

- Pakistan Taxation SystemDocument4 pagesPakistan Taxation SystemAdil BalochPas encore d'évaluation

- New Income Tax Slabs Under New Tax Regime, No LTCG Tax Bene T On Debt Mutual Funds: 15 Income Tax Changes From April 1Document5 pagesNew Income Tax Slabs Under New Tax Regime, No LTCG Tax Bene T On Debt Mutual Funds: 15 Income Tax Changes From April 1Sudhir BhargavaPas encore d'évaluation

- Major Schemes: New Scheme-Namely "Pradhan Mantri Kisan Samman Nidhi (Pm-Kisan) " To Extend ToDocument42 pagesMajor Schemes: New Scheme-Namely "Pradhan Mantri Kisan Samman Nidhi (Pm-Kisan) " To Extend ToPrakharesh AwasthiPas encore d'évaluation

- Moneysprite Budget Bulletin 2015Document24 pagesMoneysprite Budget Bulletin 2015MoneyspritePas encore d'évaluation

- Tax Saving Guide - 2022-23Document28 pagesTax Saving Guide - 2022-23Padmapriya SrinivasanPas encore d'évaluation

- Jamia Millia Islamia: Tax LawDocument17 pagesJamia Millia Islamia: Tax LawpriyanshuPas encore d'évaluation

- INDIA BUDGET 2010-11: What Is A Budget ?Document25 pagesINDIA BUDGET 2010-11: What Is A Budget ?adipjksPas encore d'évaluation

- Union Budget Group 6Document18 pagesUnion Budget Group 6GayatriPas encore d'évaluation

- Supertax Revenue Impact Estimated at Rs 80 BillionDocument1 pageSupertax Revenue Impact Estimated at Rs 80 BillionMuhammad Anas DaraPas encore d'évaluation

- Budget Review 2015-2016Document6 pagesBudget Review 2015-2016S.M.HILALPas encore d'évaluation

- Key Highlights of The Finance Budget - 2017Document1 pageKey Highlights of The Finance Budget - 2017Paymaster ServicesPas encore d'évaluation

- FAQ S On Income Tax 2022-23Document4 pagesFAQ S On Income Tax 2022-23Ranjan SatapathyPas encore d'évaluation

- Income-Tax-Slab 13-14Document2 pagesIncome-Tax-Slab 13-14rani26octPas encore d'évaluation

- KEY Tax Points From George'S Summer Budget: Owner Managed BusinessesDocument8 pagesKEY Tax Points From George'S Summer Budget: Owner Managed Businessesapi-281744226Pas encore d'évaluation

- Beatles Tax Breaks Pranab MukherjeeDocument2 pagesBeatles Tax Breaks Pranab MukherjeeTasneema MakandarPas encore d'évaluation

- ArtikelDocument12 pagesArtikelptcleosakaryasentosaPas encore d'évaluation

- CHAPTER 4 Regular Income Taxation Individuals ModuleDocument10 pagesCHAPTER 4 Regular Income Taxation Individuals ModuleShane Mark Cabiasa100% (1)

- Advance I Ch-IDocument63 pagesAdvance I Ch-IUtban Ashab100% (1)

- Taxation Workbook 2022Document204 pagesTaxation Workbook 2022Navya GulatiPas encore d'évaluation

- Tax Lift Goes Down, You're Up One Floor: Take A Home Loan, Take Home MoreDocument1 pageTax Lift Goes Down, You're Up One Floor: Take A Home Loan, Take Home MoreIna PawarPas encore d'évaluation

- Budget 2019-2020Document16 pagesBudget 2019-2020Sidhi SoodPas encore d'évaluation

- Budget 2015-16 New Tax On Rich People's Electricity Bills Likely - 29-05-2015Document3 pagesBudget 2015-16 New Tax On Rich People's Electricity Bills Likely - 29-05-2015Abdul Haadi ButtPas encore d'évaluation

- Income Tax EXPLAINATIONDocument11 pagesIncome Tax EXPLAINATIONVishwas AgarwalPas encore d'évaluation

- Edristi February 2019 English PDFDocument148 pagesEdristi February 2019 English PDFmadhukar tiwariPas encore d'évaluation

- The Tax Season of 2020 Is Going To Be Different Than What You Know - PostDocument2 pagesThe Tax Season of 2020 Is Going To Be Different Than What You Know - PostShahu PawarPas encore d'évaluation

- Income TaxDocument59 pagesIncome TaxRicha Bansal100% (4)

- SS Tax PlanDocument12 pagesSS Tax PlanChristianPas encore d'évaluation

- Advance I Ch-IDocument61 pagesAdvance I Ch-IBamlak WenduPas encore d'évaluation

- Have A TIN? Get Ready To File Tax Return: Sohel ParvezDocument3 pagesHave A TIN? Get Ready To File Tax Return: Sohel ParvezSmith DavidPas encore d'évaluation

- FY 2022-23 (AY 2023-24) - Taxguru - inDocument3 pagesFY 2022-23 (AY 2023-24) - Taxguru - inHarshilPas encore d'évaluation

- Everything You Need To Know About The Tax Year-End - Vanguard UK InvestorDocument6 pagesEverything You Need To Know About The Tax Year-End - Vanguard UK InvestorRocketPas encore d'évaluation

- Direct and Indirect Taxes: Assignment OnDocument9 pagesDirect and Indirect Taxes: Assignment Onpurn kaurPas encore d'évaluation

- How To Pay Zero Tax For Income Up To Rs 12 Lakhs From Salary For Financial Year 2016-17 Budget 2016 by CA Chirag ChauhanDocument18 pagesHow To Pay Zero Tax For Income Up To Rs 12 Lakhs From Salary For Financial Year 2016-17 Budget 2016 by CA Chirag Chauhanaghosh704Pas encore d'évaluation

- Make Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformD'EverandMake Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformPas encore d'évaluation

- 007 Pinni 01 03 PDFDocument30 pages007 Pinni 01 03 PDFJay Jayavarapu50% (12)

- Double Ka Meetha PDFDocument2 pagesDouble Ka Meetha PDFJay JayavarapuPas encore d'évaluation

- Best Investment - Money Back Plan - Yahoo! Answers IndiaDocument2 pagesBest Investment - Money Back Plan - Yahoo! Answers IndiaJay JayavarapuPas encore d'évaluation

- AnnavaramDocument3 pagesAnnavaramJay Jayavarapu0% (1)

- UPSC - PART-I RegistrationDocument2 pagesUPSC - PART-I RegistrationJay Jayavarapu0% (1)

- Branch and Offices DetailsDocument78 pagesBranch and Offices DetailsJay JayavarapuPas encore d'évaluation

- Daniel Scot C V - MF Aug07Document3 pagesDaniel Scot C V - MF Aug07agapeable4uPas encore d'évaluation

- Institute of Chartered Accountants of India - WikipediaDocument1 pageInstitute of Chartered Accountants of India - Wikipediaramthecharm_46098467Pas encore d'évaluation

- Assignment On Business PlanDocument28 pagesAssignment On Business PlanFauzia AfrozaPas encore d'évaluation

- LOD For Personal LoanDocument4 pagesLOD For Personal LoanAditya's TechPas encore d'évaluation

- Galt 500Document2 pagesGalt 500satishPas encore d'évaluation

- CGRF Greater NOIDA Finds Builders Overcharging For ElectricityDocument12 pagesCGRF Greater NOIDA Finds Builders Overcharging For ElectricitydeegaliaPas encore d'évaluation

- Teachers Service Commission: Tender Document For Procurement of ServicesDocument56 pagesTeachers Service Commission: Tender Document For Procurement of ServicesinyasiPas encore d'évaluation

- UMIDIGI Power 3 - Android 10 - Android Development and HackingDocument7 pagesUMIDIGI Power 3 - Android 10 - Android Development and HackingAahsan Iqbal احسن اقبالPas encore d'évaluation

- Lesson 08. Franchising - Sample ProblemsDocument7 pagesLesson 08. Franchising - Sample ProblemsHayes HarePas encore d'évaluation

- Petron Vs CaberteDocument2 pagesPetron Vs CabertejohneurickPas encore d'évaluation

- WePay Global Payments LLC V Apple Inc Patent InfringementDocument5 pagesWePay Global Payments LLC V Apple Inc Patent InfringementJack PurcherPas encore d'évaluation

- TERGITOLTM TMN-100X 90% Surfactant PDFDocument4 pagesTERGITOLTM TMN-100X 90% Surfactant PDFOnesany TecnologiasPas encore d'évaluation

- RC Transfer ProcessDocument2 pagesRC Transfer Processguiness_joe9154Pas encore d'évaluation

- Chua v. Absolute Management Corp.Document10 pagesChua v. Absolute Management Corp.Hv EstokPas encore d'évaluation

- Visa Travel Insurance Vti 606441Document7 pagesVisa Travel Insurance Vti 606441ASRA CG BZPas encore d'évaluation

- Common Size/Vertical Analysis: Lecture No. 9Document4 pagesCommon Size/Vertical Analysis: Lecture No. 9naziaPas encore d'évaluation

- The Bill of Rights in Real Life Teacher GuideDocument21 pagesThe Bill of Rights in Real Life Teacher GuideRomen Elijah HuertasPas encore d'évaluation

- In The United States District Court For The District of ColoradoDocument16 pagesIn The United States District Court For The District of ColoradoMichael_Lee_RobertsPas encore d'évaluation

- Correspondence - Ministry of Energy, Mines Letter Re Direct Award of A Petroleum and Natural Gas TenureDocument7 pagesCorrespondence - Ministry of Energy, Mines Letter Re Direct Award of A Petroleum and Natural Gas TenureTom SummerPas encore d'évaluation

- LANE-Concise Daily Routine For TromboneDocument12 pagesLANE-Concise Daily Routine For Trombonemaskedhombre100% (1)

- Ethics, Fraud and Internal Control - MCQDocument1 pageEthics, Fraud and Internal Control - MCQHads LunaPas encore d'évaluation

- Prakas On Accreditation of Professional Accounting Firm Providing... EnglishDocument12 pagesPrakas On Accreditation of Professional Accounting Firm Providing... EnglishChou ChantraPas encore d'évaluation

- ACC1ILV - Chapter 1 Solutions PDFDocument3 pagesACC1ILV - Chapter 1 Solutions PDFMegan Joye McFaddenPas encore d'évaluation

- Introducción A Suplementos Técnicos OMSDocument8 pagesIntroducción A Suplementos Técnicos OMSMiguel Ángel Sare CruzPas encore d'évaluation

- Electric Circuits 10th Edition Nilsson Solutions ManualDocument36 pagesElectric Circuits 10th Edition Nilsson Solutions Manualkelson.overbow8cv5100% (41)

- TpaDocument11 pagesTpaVijay SinghPas encore d'évaluation