Académique Documents

Professionnel Documents

Culture Documents

Income Tax Return: 1 Taxpayer Details

Transféré par

Artha SarokarTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Income Tax Return: 1 Taxpayer Details

Transféré par

Artha SarokarDroits d'auteur :

Formats disponibles

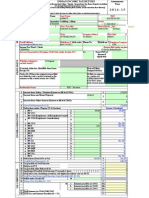

Form Income Tax-D-04-02-0860

INCOME TAX RETURN

For Individuals without Permanent Account Number (PAN) having Gain from Non-Business chargeable Assets only

ATTACH:

Annex 10 / Tax Credits Claim (Form Income Tax-C-01-02-0860) if you want to claim Tax Credits

Annex 11 / Medical Tax Credits (Form Income Tax-C-02-02-0860) if you want to claim Medical Tax Credits

Fiscal Year ________________________________

IRO Name __________________________________________________

TAXPAYER DETAILS

Name

House/

Block No

Address

Ward No.

Phone

Village, Area, Street

Metropolitan

Municipality

Sub-Metropolitan

VDC

District

Fax

CLUBBING DETAILS

Single

Couple

The person who has submitted this return is my wife/husband and shall be responsible for all my tax liabilities.

Name of wife/husband to be included

_______________________________

Remote Area Allowance (NPR)

_______________________________

Signature ____________________________________

CALCULATION OF GAIN OR LOSS FROM THE DISPOSAL OF SHARES OR SECURITIES

Name of Entity

Disposal Procedure

No of disposed Shares

Market Value of Shares

Incomings from the Disposal

Outgoings for the Disposal

Gain or Loss (rows 5-6)

Name of the new Owner

Address of the new Owner

10

PAN of the new Owner

11

Name of Entity

12

Disposal Procedure

13

No of disposed Shares

14

Market Value of Shares

15

Incomings from the Disposal

16

Outgoings for the Disposal

17

Gain or Loss (rows 16-17)

18

Name of the new Owner

19

Address of the new Owner

20

PAN of the new Owner

21

Name of Entity

22

Disposal Procedure

23

No of disposed Shares

24

Market Value of Shares

25

Incomings from the Disposal

26

Outgoings for the Disposal

27

Gain or Loss (rows 26-27)

28

Name of the new Owner

29

Address of the new Owner

30

PAN of the new Owner

31

GAIN OR LOSS FROM DISPOSAL OF SHARES OR SECURITIES (rows 7+17+27)

***For Instructions, read Brochure Income Tax Forms Instructions***

Page 1 of 2

Form Income Tax-D-04-02-0860

CALCULATION OF GAIN OR LOSS FROM THE DISPOSAL OF BUILDING OR LAND

32

Address of Building or Land

33

Disposal Procedure

34

Market Value of Building or Land

35

Incomings from the Disposal

36

Outgoings for the Disposal

37

Gain or Loss (rows 36-37)

38

Name of the new Owner

39

Address of the new Owner

40

PAN of the new Owner

41

Address of Building or Land

42

Disposal Procedure

43

Market Value of Building or Land

44

Incomings from the Disposal

45

Outgoings for the Disposal

46

Gain or Loss (row 46-47)

47

Name of the new Owner

48

Address of the new Owner

49

PAN of the new Owner

50

SUBTOTAL GAIN OR LOSS FROM DISPOSAL OF BUILDING OR LAND (rows 37+46)

51

GAINS OR LOSS (rows 31+50)

52

UNRELIEVED LOSS FROM PREVIOUS YEAR

53

NET GAIN OR LOSS (rows 51-52)

54 TAX LIABILITY (see Instruction below)

If you are Single: (Row 53 65,000 Remote Area Allowance) * 10%. If you are Couple: (Row 53 85,000 Remote Area Allowance) * 10%.

55

Advance Tax Credits

56

Medical Tax Credits

57

Total Tax Crecits (rows 55+56)

58

TAX PAYABLE (rows 54-57)

59

Charges as per Income Tax Act 2058, Section 117

60

Interests as per Income Tax Act 2058, Section 119

61

NET TAX PAYABLE (rows 58+59+60)

PAYMENT INFORMATION

Amount paid

Payment Date

Cash

Cheque

Receipt No.

Draft

Bank Name

Bank Voucher

Bank Name

Bank Code

Bank Code

Ch./Draft No.

Voucher No.

TAXPAYER CERTIFICATION

I/we declare that this income tax return is correct, true, and to the best of my knowledge.

Signature of Taxpayer or Representative

Name of Taxpayer or Representative

Date

Filing Extension Date (if extended)

OFFICIAL USE ONLY

Return Registration No

Return Filing Date

Receiving Official Name

Receiving Official Signature

***For Instructions, read Brochure Income Tax Forms Instructions***

Page 2 of 2

Vous aimerez peut-être aussi

- Income Tax Return: 1 Taxpayer DetailsDocument2 pagesIncome Tax Return: 1 Taxpayer DetailsArtha SarokarPas encore d'évaluation

- 1040 Exam Prep: Module II - Basic Tax ConceptsD'Everand1040 Exam Prep: Module II - Basic Tax ConceptsÉvaluation : 1.5 sur 5 étoiles1.5/5 (2)

- Sachin4kumar@yahoo - Co.in: Gross Total Income (1+2c) 4Document3 pagesSachin4kumar@yahoo - Co.in: Gross Total Income (1+2c) 4Sachin KumarPas encore d'évaluation

- Scan 0001Document11 pagesScan 0001Kimmie3050% (2)

- Gross Total Income (1+2+3) 4: System CalculatedDocument8 pagesGross Total Income (1+2+3) 4: System CalculatedShunmuga ThangamPas encore d'évaluation

- Form ITR-1Document3 pagesForm ITR-1Rajeev PuthuparambilPas encore d'évaluation

- ITR Form 1Document7 pagesITR Form 1gj29herePas encore d'évaluation

- Gross Total Income (1+2c) 4: System CalculatedDocument3 pagesGross Total Income (1+2c) 4: System CalculatedDHARAMSONIPas encore d'évaluation

- Marylynn Huggins - Clifden Ut State Tax Return 2013Document4 pagesMarylynn Huggins - Clifden Ut State Tax Return 2013api-2573405260% (1)

- 2012 Itr1 Pr21Document5 pages2012 Itr1 Pr21MRLogan123Pas encore d'évaluation

- New Income Tax Return BIR Form 1700 - November 2011 RevisedDocument4 pagesNew Income Tax Return BIR Form 1700 - November 2011 RevisedBusinessTips.Ph100% (2)

- Bir Form 1901 BlankDocument4 pagesBir Form 1901 BlankLecel Llamedo100% (1)

- Assessment Year Indian Income Tax Return SahajDocument7 pagesAssessment Year Indian Income Tax Return SahajallipraPas encore d'évaluation

- 1701 Bir FormDocument12 pages1701 Bir Formbertlaxina0% (1)

- Indian Income Tax Return Assessment Year SahajDocument7 pagesIndian Income Tax Return Assessment Year SahajSubrata BiswasPas encore d'évaluation

- Income TaxDocument6 pagesIncome TaxKuldeep HoodaPas encore d'évaluation

- IT Return 2011 2012Document3 pagesIT Return 2011 2012swapnil6121986Pas encore d'évaluation

- BIR FormDocument4 pagesBIR FormfyeahPas encore d'évaluation

- 1701qjuly2008 (ENCS)Document5 pages1701qjuly2008 (ENCS)Mary Rose AnilloPas encore d'évaluation

- 2011 Irs Tax Form 1040 A Individual Income Tax ReturnDocument3 pages2011 Irs Tax Form 1040 A Individual Income Tax ReturnscribddownloadedPas encore d'évaluation

- Sahaj Individual Income Tax Return Assessment Year 2 0 16 - 1 7Document22 pagesSahaj Individual Income Tax Return Assessment Year 2 0 16 - 1 7rahul srivastavaPas encore d'évaluation

- Form ITR-VDocument1 pageForm ITR-VSanjeev BansalPas encore d'évaluation

- BIR Form 1901Document2 pagesBIR Form 1901Jap Algabre40% (5)

- 2011 ITR1 r2Document3 pages2011 ITR1 r2Zafar IqbalPas encore d'évaluation

- U.S. Individual Income Tax Return: John Public 0 0 0 0 0 0 0 0 0 Jane Public 0 0 0 0 0 0 0 0 1Document2 pagesU.S. Individual Income Tax Return: John Public 0 0 0 0 0 0 0 0 0 Jane Public 0 0 0 0 0 0 0 0 1Renee Leon100% (1)

- ITR-4S: Assessment Year (Presumptive Business Income Tax Return) Indian Income Tax Return SugamDocument11 pagesITR-4S: Assessment Year (Presumptive Business Income Tax Return) Indian Income Tax Return SugamcachandhiranPas encore d'évaluation

- Bir Form 1701Document12 pagesBir Form 1701miles1280Pas encore d'évaluation

- Form ITR-VDocument2 pagesForm ITR-VSumit ManglaniPas encore d'évaluation

- Application For Registration: Kawanihan NG Rentas InternasDocument2 pagesApplication For Registration: Kawanihan NG Rentas InternasJay-r Eniel ArguellesPas encore d'évaluation

- Gross Total Income (1+2c) 4: Import Previous VersionDocument4 pagesGross Total Income (1+2c) 4: Import Previous Versionbalajiv_mailPas encore d'évaluation

- Bir Form 1701 Primer: Page 1 of 22Document22 pagesBir Form 1701 Primer: Page 1 of 22Alexander Cooley0% (1)

- 82255BIR Form 1701Document12 pages82255BIR Form 1701Leowell John G. RapaconPas encore d'évaluation

- Income Tax Return For Single and Joint Filers With No DependentsDocument3 pagesIncome Tax Return For Single and Joint Filers With No Dependentsラジャゴバラン サンカラナラヤナンPas encore d'évaluation

- 1901 (Encs) 2000Document4 pages1901 (Encs) 2000Alvin John Benavidez Salvador50% (2)

- 1901 (Encs) 2000Document4 pages1901 (Encs) 2000Alvin John Benavidez SalvadorPas encore d'évaluation

- Annual Income Tax Return: Encs)Document3 pagesAnnual Income Tax Return: Encs)Darlyn GuinaPas encore d'évaluation

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification Formbha_goPas encore d'évaluation

- Assessment Year Indian Income Tax Return Year Sahaj: Seal and Signature of Receiving Official Receipt No/ DateDocument3 pagesAssessment Year Indian Income Tax Return Year Sahaj: Seal and Signature of Receiving Official Receipt No/ DatethakurrobinPas encore d'évaluation

- Annual Income Tax Return: (To Be Filled Up by The BIR)Document10 pagesAnnual Income Tax Return: (To Be Filled Up by The BIR)Louie De La TorrePas encore d'évaluation

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification Formbha_goPas encore d'évaluation

- Bir Forms PDFDocument4 pagesBir Forms PDFgaryPas encore d'évaluation

- Assessment Year Indian Income Tax Return: I - IndividualDocument6 pagesAssessment Year Indian Income Tax Return: I - IndividualManjunath YvPas encore d'évaluation

- Application For Permanent Account Number (Pan)Document4 pagesApplication For Permanent Account Number (Pan)Artha SarokarPas encore d'évaluation

- PartnerIdentification (English) 1172014102329AMDocument1 pagePartnerIdentification (English) 1172014102329AMArtha SarokarPas encore d'évaluation

- Income Tax Return: 1 Taxpayer DetailsDocument2 pagesIncome Tax Return: 1 Taxpayer DetailsArtha SarokarPas encore d'évaluation

- Income Tax Return: 1 Taxpayer DetailsDocument2 pagesIncome Tax Return: 1 Taxpayer DetailsArtha SarokarPas encore d'évaluation

- BranchDetails (English) 1172014102329AMDocument1 pageBranchDetails (English) 1172014102329AMArtha SarokarPas encore d'évaluation

- Sfa' JFLX/SF) Kl/L:Yltdf B:T'/ LDGXF Dagwl LGJ) BG: CG' "RL - 13Document1 pageSfa' JFLX/SF) Kl/L:Yltdf B:T'/ LDGXF Dagwl LGJ) BG: CG' "RL - 13Artha SarokarPas encore d'évaluation

- In Come Tax D 0401738302016123223 PMDocument2 pagesIn Come Tax D 0401738302016123223 PMArtha SarokarPas encore d'évaluation

- Annex11 MedicalTaxCreditClaim (IncomeTax C 02-03-0162) English1172014100110AMDocument1 pageAnnex11 MedicalTaxCreditClaim (IncomeTax C 02-03-0162) English1172014100110AMArtha SarokarPas encore d'évaluation

- Annual Remuneration Return 1172014100110 AmDocument1 pageAnnual Remuneration Return 1172014100110 AmknmodiPas encore d'évaluation

- Annex7 IncomefromInvestment (IncomeTax D 17-02-0860) English1172014100110AMDocument1 pageAnnex7 IncomefromInvestment (IncomeTax D 17-02-0860) English1172014100110AMArtha SarokarPas encore d'évaluation

- Annual Remuneration Return Instruction 1172014100110 AmDocument1 pageAnnual Remuneration Return Instruction 1172014100110 AmArtha SarokarPas encore d'évaluation

- Annex9 RepatriatedIncome (IncomeTax D 19-01-0262) 1172014100110AMDocument1 pageAnnex9 RepatriatedIncome (IncomeTax D 19-01-0262) 1172014100110AMArtha SarokarPas encore d'évaluation

- Annex1 CalculationofTaxforIndividuals (IncomeTax D 10-04-0762) Nepali1172014100109AMDocument1 pageAnnex1 CalculationofTaxforIndividuals (IncomeTax D 10-04-0762) Nepali1172014100109AMArtha SarokarPas encore d'évaluation

- KF"RF) + /fli6 O S/ LBJ Ejotfsf Fy DKGG: /FH:J +SNG $ K - LTZTN) J (L4Document20 pagesKF"RF) + /fli6 O S/ LBJ Ejotfsf Fy DKGG: /FH:J +SNG $ K - LTZTN) J (L4Artha SarokarPas encore d'évaluation

- Income Tax Return: Annex 2 Calculation of Tax For EntitiesDocument1 pageIncome Tax Return: Annex 2 Calculation of Tax For EntitiesArtha SarokarPas encore d'évaluation

- Annex5 IncomefromBusiness (IncomeTax D 15-02-0860) English1172014100110AMDocument1 pageAnnex5 IncomefromBusiness (IncomeTax D 15-02-0860) English1172014100110AMArtha SarokarPas encore d'évaluation

- Annex2 CalculationofTaxforEntities (IncomeTax D 01-04-0762) Nepali1172014100109AMDocument1 pageAnnex2 CalculationofTaxforEntities (IncomeTax D 01-04-0762) Nepali1172014100109AMArtha SarokarPas encore d'évaluation

- Dfgglo PKK - WFGDGQL Tyf Cy (DGQL S (I0Faxfb'/ Dx/F4F/F: CFGTL/S /FH:J Ljefusf) Lg/Lif0FDocument12 pagesDfgglo PKK - WFGDGQL Tyf Cy (DGQL S (I0Faxfb'/ Dx/F4F/F: CFGTL/S /FH:J Ljefusf) Lg/Lif0FArtha SarokarPas encore d'évaluation

- Income Tax Return: Annex 1 Calculation of Tax For IndividualsDocument1 pageIncome Tax Return: Annex 1 Calculation of Tax For IndividualsknmodiPas encore d'évaluation

- Annex6 IncomefromEmployment (IncomeTax D 16-02-0860) English1172014100110AMDocument1 pageAnnex6 IncomefromEmployment (IncomeTax D 16-02-0860) English1172014100110AMArtha SarokarPas encore d'évaluation

- "RGF CFBFG K - BFG Ug) ( Demf) TF: /FH:J +SNG $% K - LTZTN) J (l4Document12 pages"RGF CFBFG K - BFG Ug) ( Demf) TF: /FH:J +SNG $% K - LTZTN) J (l4Artha SarokarPas encore d'évaluation

- Rent Tax Form7152015 105329 AMDocument1 pageRent Tax Form7152015 105329 AMArtha SarokarPas encore d'évaluation

- @! A'"B) 3F) If0Ffkq HF/L Ub) (Joj:Yfkg Uf) I7L DKGG: /FH:J +SNG @! K - LTZTN) J (L4Document12 pages@! A'"B) 3F) If0Ffkq HF/L Ub) (Joj:Yfkg Uf) I7L DKGG: /FH:J +SNG @! K - LTZTN) J (L4Artha SarokarPas encore d'évaluation

- Fs (:T/Lo S/ Dagwl ) LDGF/ DKGG: /FH:J +SNG @ K - LTZTN) J (L4Document12 pagesFs (:T/Lo S/ Dagwl ) LDGF/ DKGG: /FH:J +SNG @ K - LTZTN) J (L4Artha SarokarPas encore d'évaluation

- Sfo ( DKFBG Demf) TF DKGG: Ljefu Cgtu (TSF J) Sfof (Nox?AlrDocument16 pagesSfo ( DKFBG Demf) TF DKGG: Ljefu Cgtu (TSF J) Sfof (Nox?AlrArtha SarokarPas encore d'évaluation

- Sfo ( DKFBG Demf) TF DKGG: /FH:J +SNG # K - LTZTN) J (L4Document12 pagesSfo ( DKFBG Demf) TF DKGG: /FH:J +SNG # K - LTZTN) J (L4Artha SarokarPas encore d'évaluation

- CFGTL/S /FH:J Sfof (Nox?Sf) Lg/Lif0FDocument12 pagesCFGTL/S /FH:J Sfof (Nox?Sf) Lg/Lif0FArtha SarokarPas encore d'évaluation

- CFGTL/S /FH:J Ljefu / /SF/L Jlsnalr CGTLQM (OfDocument12 pagesCFGTL/S /FH:J Ljefu / /SF/L Jlsnalr CGTLQM (OfArtha SarokarPas encore d'évaluation

- Digest. Compilation. Tax2Document148 pagesDigest. Compilation. Tax2Ma. Consorcia GoleaPas encore d'évaluation

- 1701 Jan 2018 Final With RatesDocument4 pages1701 Jan 2018 Final With RatesexquisitePas encore d'évaluation

- Statcon DigestsDocument6 pagesStatcon DigestsKatrina Santander LealPas encore d'évaluation

- CIR Vs Central LuzonDocument3 pagesCIR Vs Central LuzonMarianne Shen PetillaPas encore d'évaluation

- Pamonag - Accenture Inc. vs. Commissioner of The Internal RevenueDocument4 pagesPamonag - Accenture Inc. vs. Commissioner of The Internal RevenueNoel Christopher G. BellezaPas encore d'évaluation

- Greenfield v. MeerDocument14 pagesGreenfield v. MeerJian CerreroPas encore d'évaluation

- Income From Property SummaryDocument39 pagesIncome From Property SummaryINFANTE, RANDOLPH BHUR S.Pas encore d'évaluation

- ULI Hudson Park Case Study Report Final 9.10.18Document17 pagesULI Hudson Park Case Study Report Final 9.10.18Gabriel RojasPas encore d'évaluation

- 2021 GeneralDocument8 pages2021 GeneralWajiha HaroonPas encore d'évaluation

- Sidvin Pharma - Form Vat 105 - July-11Document4 pagesSidvin Pharma - Form Vat 105 - July-11Lakshmi NarayanaPas encore d'évaluation

- Republic of The Philippines Court of Tax Appea Quezon CityDocument10 pagesRepublic of The Philippines Court of Tax Appea Quezon CitySonnyPas encore d'évaluation

- Form 4A - GCT Returns PDFDocument2 pagesForm 4A - GCT Returns PDFNicquainCTPas encore d'évaluation

- J. Bersamin TaxDocument14 pagesJ. Bersamin TaxJessica JungPas encore d'évaluation

- TAX1 Compilation of CasesDocument3 pagesTAX1 Compilation of CasesYvet KatPas encore d'évaluation

- Chart of AccountDocument6 pagesChart of AccountSophath Sky100% (1)

- I 8802Document13 pagesI 8802ccshanPas encore d'évaluation

- 2019 760 Instructions PDFDocument52 pages2019 760 Instructions PDFLelosPinelos123Pas encore d'évaluation

- Paseo Realty Vs CIR Case DigestDocument2 pagesPaseo Realty Vs CIR Case DigestRalph VelosoPas encore d'évaluation

- TCCP Vol.1Document27 pagesTCCP Vol.1Euxine Albis100% (1)

- Administrative Law Case Digest PDFDocument39 pagesAdministrative Law Case Digest PDFLyle BucolPas encore d'évaluation

- Goya EDA MemoDocument6 pagesGoya EDA MemoNew Jersey Policy PerspectivePas encore d'évaluation

- INPUT & OUTPUT TAX - FORT BONIFACIO DEVELOPMENT CORPORATION vs. CIR DIGESTDocument3 pagesINPUT & OUTPUT TAX - FORT BONIFACIO DEVELOPMENT CORPORATION vs. CIR DIGESTthinkbeforeyoutalkPas encore d'évaluation

- 2022 Edition of The Guide To Doing Business in OmanDocument25 pages2022 Edition of The Guide To Doing Business in OmanafrahPas encore d'évaluation

- Bonifacio Water Corp V CIR (Digest)Document3 pagesBonifacio Water Corp V CIR (Digest)Angelo CastilloPas encore d'évaluation

- Commercial Taxes Department - Tamil NaduDocument11 pagesCommercial Taxes Department - Tamil NaduVEDAM BUS SERVICEPas encore d'évaluation

- Tax 3rd Assignmnet DigestDocument45 pagesTax 3rd Assignmnet DigestSallen DaisonPas encore d'évaluation

- The Impact of Financial Structure On The Cost of Solar EnergyDocument40 pagesThe Impact of Financial Structure On The Cost of Solar EnergyAlexander VovaPas encore d'évaluation

- TMC Vs CIRDocument3 pagesTMC Vs CIREllaine BernardinoPas encore d'évaluation

- WOTCDocument2 pagesWOTCSa MiPas encore d'évaluation

- Input:Output Tax ReviewerDocument2 pagesInput:Output Tax ReviewerHiedi SugamotoPas encore d'évaluation