Académique Documents

Professionnel Documents

Culture Documents

Ch15 CASH FLOW STATEMENTS

Transféré par

ralphalonzoTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Ch15 CASH FLOW STATEMENTS

Transféré par

ralphalonzoDroits d'auteur :

Formats disponibles

Testbank

to accompany

Applying International

Accounting Standards

by

Alfredson, Leo, Picker, Pacter & Radford

Prepared by

Victoria Wise

John Wiley & Sons Australia, Ltd 2005

-2-

CHAPTER 15 Cash flow statements

Question 1

Warner Limited had the following cash flows during a reporting period:

Acquisition of subsidiary, net of cash flows $250 000

Dividends paid $65 000

Repayment of borrowings $90 000

Interest paid on borrowings $57 000

Proceeds from sale of plant $215 000

What is the amount of the cash flows in relation to financing activities of Warner Limited for the

reporting period?

A net cash inflow $155 000;

B net cash outflow $155 000;

C net cash inflow $212 000;

D net cash inflow $212 000.

Question 2

The following cash flow activities are regarded as investing cash flows:

A income taxes paid;

B interest paid;

C acquisition of subsidiary net of cash acquired;

D proceeds from issue of debentures.

Question 3

Brett Limited had a net profit after tax of $850 000 for the financial year. Included in this profit

was:

Depreciation expense of $120 000

Gain on sale of Investments of $28 000

Also, Accounts Receivable increased by $39 000 and Inventories decreased by $12 000. The

cash flow from operating activities during the year was:

A $785 000;

B $731 000;

C $915 000;

Applying International Accounting Standards Chapter 15

-3-

D $969 000.

Question 4

During the financial year Marina Limited had sales of $720 000. The beginning balance of

Accounts receivable was $103 000, and the ending balance was $139 000. Bad debts amounting

to $34 000 were written off during the period. The cash receipts from customers during the year

amounted to:

A $718 000;

B $650 000;

C $790 000;

D $722 000.

Question 5

During the financial year, Cresswell Limited had a Cost of Sales amounting to $260 000.

Beginning and ending balances were:

Beginning balance Ending balance

Inventory $46 000 $55 000

Accounts Payable $18 000 $26 000

A discount of $2 000 for prompt payment was received. The amount of cash paid for goods

purchased during the year was:

A $259 000;

B $263 000;

C $275 000;

D $279 000.

Question 6

Katsis Limited had the following cash flows during the reporting period:

Purchase of intangibles $30 000

Proceeds from sale of plant $28 000

Receipts from customers $832 000

Payments to suppliers $593 000

Interest received $17 600

Income taxes paid $45 500

The net cash connected to operating activities was:

Applying International Accounting Standards Chapter 15

-4-

A $239 100;

B $269 100;

C $256 600;

D $211 100.

Question 7

At balance sheet date, Dim Limited had the following net balance from cash flows:

Operating activities, $53 440;

Investing activities, $45 230;

Financing activities, $(47 860).

If the company had an ending balance of cash amounting to $107 310, what was the comparative

ending balance of cash for the previous year?

A $(39 220);

B $163 380;

C $56 500;

D $158 120.

Question 8

When presenting the proceeds from the acquisition and disposal of subsidiaries, IAS 7 Cash

Flow Statements, requires that the aggregate cash flows:

A should be presented as operating activities;

B should be presented separately;

C should be included amongst financing activities;

D may be set off for presentation purposes.

Question 9

In respect to both acquisitions and disposals of investments in subsidiaries, IAS 7 Cash Flow

Statements, requires that an entity should disclose, in aggregate, the following:

I. The total purchase or disposal consideration.

II. The portion of the consideration discharged by cash or cash equivalents.

III. The amount of cash and cash equivalents in the subsidiary acquired or disposed

of.

IV. The amount of the non-cash assets and liabilities acquired or disposed of.

Applying International Accounting Standards Chapter 15

-5-

A I, II, III and IV;

B I, II, and III only;

C I, II and IV only;

D II and III only.

Question 10

Which of the following items would be presented in a cash flow statement?

A payment of dividends through a share investment scheme;

B acquisition of an investment in a subsidiary for consideration consisting of an

exchange of non-current assets and liabilities;

C proceeds from the issue of debentures;

D refinancing of long-term debt.

Question 11

The following item would not appear in a cash flow statement:

A receipts of cash from customers;

B conversion of preference shares to ordinary shares;

C payment of creditors;

D proceeds on disposal of non-current assets.

Question 12

IAS 7 Cash Flow Statements, requires that investing and financing transactions that do not

require the use of cash or cash equivalents should be:

A excluded from a cash flow statement;

B included in a cash flow statement before operating, investing and financing activities;

C presented in the cash flow statement after operating activities and before investing

and financing activities;

D presented in a cash flow statement after the operating, investing and financing

activities have been presented.

Applying International Accounting Standards Chapter 15

-6-

ANSWERS

1 B

2 C

3 C

4 B

5 A

6 D

7 C

8 B

9 A

10 C

11 B

12 A

Applying International Accounting Standards Chapter 15

Vous aimerez peut-être aussi

- Accrual Basis, Cash Basis, Single Entry & Error CorrectionDocument3 pagesAccrual Basis, Cash Basis, Single Entry & Error CorrectionYour MaterialsPas encore d'évaluation

- Toa.m-1402. Review of The Accounting ProcessDocument5 pagesToa.m-1402. Review of The Accounting ProcessLINDIE MARIE RABEPas encore d'évaluation

- Accounting Errors Impact on Income and Retained EarningsDocument5 pagesAccounting Errors Impact on Income and Retained EarningsGlizette SamaniegoPas encore d'évaluation

- Cash and Acrrual Basis QUIZDocument2 pagesCash and Acrrual Basis QUIZMarii M.100% (1)

- Calculating Consolidated Net IncomeDocument18 pagesCalculating Consolidated Net IncomeFleo GardivoPas encore d'évaluation

- Testbank for Applying International Accounting StandardsDocument6 pagesTestbank for Applying International Accounting Standardsralphalonzo100% (1)

- Father Saturnino Urios University Accountancy Program AIR-Cluster 1 (Drill #4)Document10 pagesFather Saturnino Urios University Accountancy Program AIR-Cluster 1 (Drill #4)marygraceomacPas encore d'évaluation

- Module 2 MISSTATEMENTS IN THE FINANCIAL STATEMENTSDocument7 pagesModule 2 MISSTATEMENTS IN THE FINANCIAL STATEMENTSNiño Mendoza MabatoPas encore d'évaluation

- Audit of SheDocument3 pagesAudit of ShegbenjielizonPas encore d'évaluation

- 13213213operating SegmentDocument2 pages13213213operating SegmentGlen JavellanaPas encore d'évaluation

- Criteria for discontinued operations under 40 charactersDocument3 pagesCriteria for discontinued operations under 40 charactersJohn Philip L Concepcion100% (1)

- FAR LONG QUIZ 2 Form AnalysisDocument17 pagesFAR LONG QUIZ 2 Form AnalysisshaniaPas encore d'évaluation

- 47 - Financial Reporting and Changing PricesDocument3 pages47 - Financial Reporting and Changing PricesYvonne Joy Mondano TehPas encore d'évaluation

- Interim Financial ReportingDocument119 pagesInterim Financial ReportingXander Clock100% (1)

- Advacc DecDocument8 pagesAdvacc DecJerico CastilloPas encore d'évaluation

- Practical Accounting 1 2011Document17 pagesPractical Accounting 1 2011abbey89100% (2)

- Segment and Interim Reporting QuestionsDocument2 pagesSegment and Interim Reporting QuestionsralphalonzoPas encore d'évaluation

- NU - Correction of Errors Single Entry Cash To AccrualDocument8 pagesNU - Correction of Errors Single Entry Cash To AccrualJem ValmontePas encore d'évaluation

- Accounting Test Bank 2Document73 pagesAccounting Test Bank 2likesPas encore d'évaluation

- Benjo Lopez CoDocument2 pagesBenjo Lopez Conovy0% (1)

- Business combination equipment valuationDocument3 pagesBusiness combination equipment valuationJohn Philip L ConcepcionPas encore d'évaluation

- Intermediate Acctg A 1 10Document10 pagesIntermediate Acctg A 1 10Leonila RiveraPas encore d'évaluation

- FS to RECEIVABLE - Petty Cash, Accounts Receivable, Shareholders' EquityDocument31 pagesFS to RECEIVABLE - Petty Cash, Accounts Receivable, Shareholders' EquityWillen Christia M. MadulidPas encore d'évaluation

- CMAPart1A (Mircoeconomics)Document77 pagesCMAPart1A (Mircoeconomics)Nancy EvangelistaPas encore d'évaluation

- Acctg4a 02042017 Exam Quiz1aDocument5 pagesAcctg4a 02042017 Exam Quiz1aPatOcampoPas encore d'évaluation

- Standard CostingDocument45 pagesStandard CostingJosua PagcaliwaganPas encore d'évaluation

- Coursehero 12Document2 pagesCoursehero 12nhbPas encore d'évaluation

- Practical Accounting 2Document4 pagesPractical Accounting 2RajkumariPas encore d'évaluation

- Chapter 1Document13 pagesChapter 1Ella Marie WicoPas encore d'évaluation

- Exercise Answers - Consolidated Financial Position and Comprehensive IncomeDocument8 pagesExercise Answers - Consolidated Financial Position and Comprehensive IncomeJohn Philip L ConcepcionPas encore d'évaluation

- Quiz on Statement of Cash FlowsDocument6 pagesQuiz on Statement of Cash FlowsLynssej Barbon100% (1)

- ACTIVITY 3 - Operating Segments PDFDocument3 pagesACTIVITY 3 - Operating Segments PDFEstilo0% (2)

- 162 003Document5 pages162 003Alvin John San Juan33% (3)

- Comprehensive Examinations 2 (Part II)Document4 pagesComprehensive Examinations 2 (Part II)Yander Marl BautistaPas encore d'évaluation

- Exchange Rates for Foreign Subsidiary InventoryDocument1 pageExchange Rates for Foreign Subsidiary InventoryJohn Philip L Concepcion0% (1)

- Accrual and Cash BasisDocument4 pagesAccrual and Cash BasisShe Enna Ortaleza Ulap100% (1)

- Ginebra Corporation liability audit for 2005Document2 pagesGinebra Corporation liability audit for 2005jhobs100% (1)

- Adv AFARDocument145 pagesAdv AFARDvcLouisPas encore d'évaluation

- Final Accounting Exam ReviewDocument10 pagesFinal Accounting Exam ReviewKevin James Sedurifa OledanPas encore d'évaluation

- I Am Sharing 'SIM-ANSWERS - 6th-Exam-Topics - Hyperinflation - PABRES' With YouDocument9 pagesI Am Sharing 'SIM-ANSWERS - 6th-Exam-Topics - Hyperinflation - PABRES' With YouJeric TorionPas encore d'évaluation

- Morales, Jonalyn M.Document7 pagesMorales, Jonalyn M.Jonalyn MoralesPas encore d'évaluation

- Audit Quizzer ProblemDocument5 pagesAudit Quizzer ProblemJazzy100% (1)

- Midterm Exam No. 2Document1 pageMidterm Exam No. 2Anie MartinezPas encore d'évaluation

- Single Entry and Cash and AccrualDocument7 pagesSingle Entry and Cash and AccrualRinna LegaspiPas encore d'évaluation

- Pamantasan ng Cabuyao Auditing ExamDocument13 pagesPamantasan ng Cabuyao Auditing Examfer maPas encore d'évaluation

- 162.005.exercises and AssignDocument2 pages162.005.exercises and AssignAngelli Lamique50% (2)

- Chapter 9 SamplingDocument8 pagesChapter 9 SamplingNitinPas encore d'évaluation

- PFRS UPDATES ON ACCOUNTING CHANGES AND ERRORSDocument11 pagesPFRS UPDATES ON ACCOUNTING CHANGES AND ERRORSMark GerwinPas encore d'évaluation

- Question 3 and 4 Are Based On The FollowingDocument5 pagesQuestion 3 and 4 Are Based On The Following03LJPas encore d'évaluation

- Accounts payable and accrued liabilities for multiple companiesDocument2 pagesAccounts payable and accrued liabilities for multiple companiesNah HamzaPas encore d'évaluation

- Case Study - Bordeos, Kristine - Sec 5Document6 pagesCase Study - Bordeos, Kristine - Sec 5Kristine Lirose BordeosPas encore d'évaluation

- FINALS QUIZ Fin3Document11 pagesFINALS QUIZ Fin3Erika Larinay100% (1)

- Gialogo, Jessie Lyn San Sebastian College - Recoletos Quiz: Required: Answer The FollowingDocument12 pagesGialogo, Jessie Lyn San Sebastian College - Recoletos Quiz: Required: Answer The FollowingMeidrick Rheeyonie Gialogo AlbaPas encore d'évaluation

- Cash To AccrualDocument1 pageCash To AccrualJolina ManceraPas encore d'évaluation

- Set ADocument5 pagesSet ASomersPas encore d'évaluation

- Cordillera Career Development College problems and solutionsDocument10 pagesCordillera Career Development College problems and solutionsapatosPas encore d'évaluation

- Cash FlowDocument6 pagesCash FlowLara Lewis AchillesPas encore d'évaluation

- Ch15 CASH FLOW STATEMENTSDocument6 pagesCh15 CASH FLOW STATEMENTSralphalonzoPas encore d'évaluation

- 2015 AICPA FAR - DifficultDocument51 pages2015 AICPA FAR - DifficultTai D GiangPas encore d'évaluation

- 2022 Sem 1 ACC10007 Practice MCQs - Topic 3Document7 pages2022 Sem 1 ACC10007 Practice MCQs - Topic 3JordanPas encore d'évaluation

- FAR - Revaluation Increase and DecreaseDocument1 pageFAR - Revaluation Increase and DecreaseralphalonzoPas encore d'évaluation

- Sunday Monday Tuesday Wednesday Thursday Friday SaturdayDocument1 pageSunday Monday Tuesday Wednesday Thursday Friday SaturdayralphalonzoPas encore d'évaluation

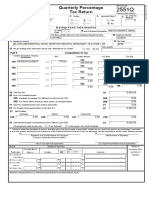

- Quarterly Percentage Tax Return: 12 - DecemberDocument1 pageQuarterly Percentage Tax Return: 12 - DecemberralphalonzoPas encore d'évaluation

- Chapter 4 and Chapter 5Document9 pagesChapter 4 and Chapter 5ralphalonzoPas encore d'évaluation

- 08 Investmentquestfinal PDFDocument13 pages08 Investmentquestfinal PDFralphalonzo0% (1)

- Real Estate Mortgage Requisites and RemediesDocument11 pagesReal Estate Mortgage Requisites and RemediesralphalonzoPas encore d'évaluation

- FAR - Conceptual FrameworkDocument8 pagesFAR - Conceptual FrameworkralphalonzoPas encore d'évaluation

- T02 - Capital BudgetingDocument121 pagesT02 - Capital Budgetingralphalonzo75% (4)

- Donor - S Tax - Oct 2017 - GCC - Self Test - Quiz 2Document3 pagesDonor - S Tax - Oct 2017 - GCC - Self Test - Quiz 2ralphalonzoPas encore d'évaluation

- MAS - DOL Vs DFLDocument3 pagesMAS - DOL Vs DFLralphalonzoPas encore d'évaluation

- Deductions From Gross IncomeDocument1 pageDeductions From Gross IncomeralphalonzoPas encore d'évaluation

- Business Law and TaxationDocument15 pagesBusiness Law and TaxationKhim Dagangon100% (1)

- TAX - Gross Estate RemindersDocument2 pagesTAX - Gross Estate RemindersralphalonzoPas encore d'évaluation

- FAR - DerivativesDocument1 pageFAR - DerivativesralphalonzoPas encore d'évaluation

- Estate Taxation Self-TestDocument4 pagesEstate Taxation Self-TestralphalonzoPas encore d'évaluation

- RFBT - Directors and Stockholders' MeetingDocument1 pageRFBT - Directors and Stockholders' MeetingralphalonzoPas encore d'évaluation

- 7 Remedial PDFDocument66 pages7 Remedial PDFMinahPas encore d'évaluation

- HyperinflationDocument2 pagesHyperinflationralphalonzoPas encore d'évaluation

- Afar AUD FAR MAS RFBT TAX TheoryDocument1 pageAfar AUD FAR MAS RFBT TAX TheoryralphalonzoPas encore d'évaluation

- PRTC at 1st PreboardDocument11 pagesPRTC at 1st PreboardralphalonzoPas encore d'évaluation

- A. Variable Costs, P18 Million. B. Fixed Costs. P12 Million. C. Operating Income, P4 Million. D. Break-Even Sales Volume, P20 MillionDocument11 pagesA. Variable Costs, P18 Million. B. Fixed Costs. P12 Million. C. Operating Income, P4 Million. D. Break-Even Sales Volume, P20 Millionralphalonzo100% (1)

- PRTC Mas First PBDocument11 pagesPRTC Mas First PBralphalonzo100% (2)

- PRTC TOA First PreboardDocument9 pagesPRTC TOA First PreboardralphalonzoPas encore d'évaluation

- RFBT - Forms of Partnership ContractsDocument1 pageRFBT - Forms of Partnership ContractsralphalonzoPas encore d'évaluation

- PRTC P2 1st PreboardDocument10 pagesPRTC P2 1st PreboardRommel Royce0% (1)

- PRTC AP First PBDocument9 pagesPRTC AP First PBralphalonzoPas encore d'évaluation

- MAS.M-1405 Cost of Capital Straight ProblemsDocument12 pagesMAS.M-1405 Cost of Capital Straight ProblemsralphalonzoPas encore d'évaluation

- Cost-Volume-Profit Relationslt R,) 56. The Company's Overall Contribution Margin Ratio Fur The Sales Mix Expected Is H. 45%. D. 60%Document10 pagesCost-Volume-Profit Relationslt R,) 56. The Company's Overall Contribution Margin Ratio Fur The Sales Mix Expected Is H. 45%. D. 60%ralphalonzoPas encore d'évaluation

- PRTC Mas First PBDocument11 pagesPRTC Mas First PBralphalonzo100% (2)

- Chapter 1 With Reference To ICAP 2015 Study TextDocument10 pagesChapter 1 With Reference To ICAP 2015 Study TextralphalonzoPas encore d'évaluation

- ACCCOB3 CVP Analysis Case Problems Instructions:: Ryan - Roque@dlsu - Edu.phDocument2 pagesACCCOB3 CVP Analysis Case Problems Instructions:: Ryan - Roque@dlsu - Edu.phdanii yaahPas encore d'évaluation

- Indian Gaap V/s Us GaapDocument32 pagesIndian Gaap V/s Us GaapArun PandeyPas encore d'évaluation

- F SDocument600 pagesF SAnugrah Prihantoro Amd TPas encore d'évaluation

- Distinguish Between Variable and Fixed CostsDocument7 pagesDistinguish Between Variable and Fixed CostsBianca PuglissiPas encore d'évaluation

- CA - Zam Dec-2017Document102 pagesCA - Zam Dec-2017Dixie CheeloPas encore d'évaluation

- FM II Chapter 1Document23 pagesFM II Chapter 1Amanuel AbebawPas encore d'évaluation

- Resume ch04 AkmDocument9 pagesResume ch04 AkmRising PKN STANPas encore d'évaluation

- December 2018: Nur Amira Nadia Binti Azizi 2018404898 BA1185FDocument4 pagesDecember 2018: Nur Amira Nadia Binti Azizi 2018404898 BA1185FNur Amira NadiaPas encore d'évaluation

- Shankarlal Agrawal College of Management Studies, Gondia: Project Report OnDocument52 pagesShankarlal Agrawal College of Management Studies, Gondia: Project Report OnUjwal JaiswalPas encore d'évaluation

- Asset Valuation Methods and FactorsDocument4 pagesAsset Valuation Methods and FactorsSteffany RoquePas encore d'évaluation

- 4 Audit of Investments Docx Accounting Examination PDF Copy DownloadedDocument12 pages4 Audit of Investments Docx Accounting Examination PDF Copy DownloadedJANISCHAJEAN RECTOPas encore d'évaluation

- Netscape IPO ExcelDocument7 pagesNetscape IPO Exceldchristensen5100% (1)

- Questions PrelimsDocument14 pagesQuestions PrelimsNicole Allyson AguantaPas encore d'évaluation

- Calculating financial metrics and terminal value from corporate dataDocument5 pagesCalculating financial metrics and terminal value from corporate datapachpind jayeshPas encore d'évaluation

- Ceat Balance SheetDocument2 pagesCeat Balance Sheetkcr kc100% (2)

- Quiz and Major Exam Accounting For Special Transactions 1Document38 pagesQuiz and Major Exam Accounting For Special Transactions 1CmPas encore d'évaluation

- A221 BWFF2043 Group Assignment 2Document2 pagesA221 BWFF2043 Group Assignment 2Hs HamdanPas encore d'évaluation

- Summary of Pas 2 Inventories PDFDocument4 pagesSummary of Pas 2 Inventories PDFJimbo Manalastas50% (2)

- Scoman1 Final Outputs PDFDocument6 pagesScoman1 Final Outputs PDFJohn Bern PeñedaPas encore d'évaluation

- FS PT Acset 31 Maret 2023Document79 pagesFS PT Acset 31 Maret 2023Nanda WulanPas encore d'évaluation

- HARD ROCK COMPANY Statement of Financial PositionDocument3 pagesHARD ROCK COMPANY Statement of Financial PositionJade Lykarose Ochavillo GalendoPas encore d'évaluation

- The Accounting Cycle Step 6 - 10Document13 pagesThe Accounting Cycle Step 6 - 10Jessa Mae Banse LimosneroPas encore d'évaluation

- Nature, source and purpose of management informationDocument63 pagesNature, source and purpose of management informationBeatrice ColemanPas encore d'évaluation

- Tangy Candy Company premium plan journal entries and financial statement analysisDocument4 pagesTangy Candy Company premium plan journal entries and financial statement analysisAlexis KingPas encore d'évaluation

- The Role of Financial Information in Valuation and Credit Risk AssessmentDocument8 pagesThe Role of Financial Information in Valuation and Credit Risk AssessmentHassan AliPas encore d'évaluation

- Examples of Questions On Ratio Analysis: A: Multiple Choice QuestionsDocument3 pagesExamples of Questions On Ratio Analysis: A: Multiple Choice QuestionsLauraPas encore d'évaluation

- TCS-Registration Process - User Flow DocumentDocument8 pagesTCS-Registration Process - User Flow DocumentMadhan kumarPas encore d'évaluation

- Proj CostDocument64 pagesProj CostCarlisle ChuaPas encore d'évaluation

- Financial Analysis of Rolls Royce Holdings PLCDocument26 pagesFinancial Analysis of Rolls Royce Holdings PLCPrtk Srstha100% (1)

- FINM 7044 Group Assignment 终Document4 pagesFINM 7044 Group Assignment 终jimmmmPas encore d'évaluation