Académique Documents

Professionnel Documents

Culture Documents

Corrections 41 B - C 62 A - B: No Effect On Year 3 RE

Transféré par

Jade MarkTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Corrections 41 B - C 62 A - B: No Effect On Year 3 RE

Transféré par

Jade MarkDroits d'auteur :

Formats disponibles

SOLUTIONS TO SELECTED PROBLEMS (FAR 2ND PREBOARD SPSPS CPARC) Corrections 41 B-->C 62 A-->B

SITUATIONAL PROBLEM 1 SITUATIONAL PROBLEM 2

22) Cost of aircraft 10,400 23) In theory, the most applicable method approximates 24) AR (1600+100) 1,700 25) AP (4000+100+500) 4,600

Inspection cost - 400 the degree of consumption of the asset. In this FA@FVTPL 500 Acc Exp 1,500

Cost of aircraft less insp. costs 10,000 problem, the units of production method proved to Cash 1,100 Est Premium Liab 600

Jet engine x 60% 6,000 be the most appropriate. We only use straight line Invty 3,000 Total Current Liab 6,700

Body and equipment (20%+10%) x 30% 3,000 method for practical reasons (e.g. less cost in Prep Exp 100

Furniture and fittings x 10% 1,000 computation). Total Current Assets 6,400

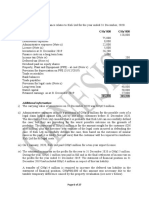

Inspection costs 400 26) Sales 5,000 28) Year 1 error is counterbalancing

CGS 2,800 no effect on year 3 RE

Note: Inspection cost is capitalizable because it is necessary for it is a GP 2,200 Year 2 error is counterbalancing

regulatory requisite before usage of such asset. No inspection cost, Other Income 400 but the effect of the error

asset cannot be used. No asset at all. Total Income 2,600 has not yet counterbalanced

Since it has different life (3 years), in this case, it was separated in 27) Expenses: Selling 700 End RE of Year 2 is Beg RE

the computation in terms of percentages. G&A 600 1,300 of Year 3

Inc before taxes 1,300 End Invty COS NI RE

SITUTATIONAL PROBLEM 3 Inc tax exp - 150 75,000 overstated

29) Cost of razing old building 300 30) Proceeds 290 Inc after taxes 1,150

Architect fee 950 Cost of Inv Prop 220

Construction cost 8,000 AccDep(22040x3yrs) (16.5) (203.5) SITUATIONAL PROBLEM 4

9,250 Gain on Sale 86.5 36) Securities Hist Cost Market 37) NY-Assoc 7,000

PIC of 2012 ruled that the cost of demolition (on a land bought with F 1,500 1,600 Own Interest

a dilapidated building) for the purpose of cleaning up the area so the A 1,200 1,400 (10% + 20%) x30%

entity can build a new building should be capitalized to the NEW BUILDING R 2,300 2,400 Inv Income 2,100

Total 5,000 5,400 400

31) Replacement cost (shingle roof) 750 32) Items counted in the bodega 4,000 1-Tax rate (140 200) x70%

Major improvement (elec wiring) 350 Items segregated per contract 100 A-OCI 12/31/20x4 280

Capitalizable improvements 1,100 Returned goods 50

Ordered items 400 38) Answer (d) is correct because IFRS requires that if 39) Inv in Rea

33) FV @ auction 800 Items shipped, FOB Destination 150 an asset is classified as fair value through profi t or loss, it is 400 15

Transportation costs - 8 Items, window display 200 remea sured to fair value and any profi t or loss is recorded in 50

Auctioneer's fee (800x2%) - 16 Items, on counter 800 the period. Therefore, Acadia should recognize a P3,000 gain 435

Bio Asset, initial recognition 776 Damage goods, counted - 50 in current earnings of the period.

Items in the shipping dept 250

34) Gross Selling Price 160 5,900 SITUATIONAL PROBLEM 6 44) Int. Pay. Int. Exp. Amort. CV

Auctioneer's fee (3.2) 35) Cost 3,000 43) Bonds @ 103 (1,000k x 1.03) 1,030 1/1 833,760

Transportation costs (1.2) Life 6 years Accrued Interest (1000x9%x9/12) 15 6/30 45,000 50,025.60 5,025.60 838785.6

Net Proceeds 155.6 Depreciation 500 Transactions costs - 5 12/31 45,000 50,327.14 5327.14 844,112.74

Net Cash Receipt 1,040 ###

SITUATIONAL PROBLEM 5 PV factor

40) We will use the FV Model because there is a published 41) FV 12/31/14 (64x40,000) 2,560 45) Proceeds 7,700,000 Liab 7,393,472 Principal 8,000,000 0.620921 4,967,368

price quotation Acq Cost -3,000 (residual method) Equity 306,528.32 Interest 640000 3.790787 2,426,104

in FV-Loss (440) PV of Liab 1/1 7,393,472

FV 12/31/14 (81.25x40,000) 3,250 Div Inc (1,000x20%) 200 12/31/12 640,000 739,347 99,347 7,492,819

Acq Cost (3,000 - 50) - 2,950 Total inc related to the Investm 240 12/31/13 640,000 749,282 109,282 7,602,101

in FV-Gain 300 12/31/14 640,000 760,210 120,210 7,722,311

Dividend Income (1,000x20%) 200 **approx values, difference in rounding off

Transaction Cost - 50

Total Inc related to the Investm 450 SITUATIONAL PROBLEM 7

46) Govt T-bills 2,000 47) ADA AR, gross 590

42) Goodwill is amortized in SMEs (gen. 10 years) Cash 3,400 40 90 ADA -50

Cash and cash equi 5,400 AR, net 540

AC 800 Goodwill (20%) 200 50

BINA (3,000x20%) - 600 10 years 48) Trade AR 93

Excess-->Goodwill 200 Amortization-full year 20 Claims (shipper) 3

x6/12 ADA - 2

NY-Abet 320 Amortization 10 Trade AR, net 94

Own. Interest x20%

Inv Inc 64 Inv in Abet

800 40

Dividend declared-Abet 200 64 10

Own. Interest x20% 814

40

SITUATIONAL PROBLEM 8 SITUATIONAL PROBLEM 9

49) In this problem, the writedown is closed to CGS 56) Sales 6,600 59) Brough forward 14

CGS 5,600 Annual days of leave (6x8) 48

Book Value, End Invty 7,000 Beg Invty 5,000 Dealer's profit 1,000 Total number days of leave 62

Invty A, NRV - 500 Purchases (20,000+500) 20,500 Used leave (50-12) -38

Book Value, End Invty needs to be NRV - 2,000 End Invty -6,500 58) Operating lease-portion of land 800 Balance 24

4,500 CGS 19,000 1.5M/7.5M x20% Rate per day 150

LCNRV, Inv A 800 Operating lease exp 160 3,600

NRV, End Invty 2,000 x75%

End Invty 6,500 2,400

60) HAPPY Deferred 61) CV 210,000

51) Site prep 50,000 52) Re-dev't of detecting eqt 4,000 LONELY Outright FV 184,337 25,663 LOSS

Machinery and eqt 300,000 Final adj to destecting eqt 2,500 SP 150,000

Initial delivery 10,000 Capitalizable Intangible asset 6,500 CV 210,000

Installation and assembly 40,000 FV 184,337 60,000 LOSS

Testing 5,000 SP 150,000

Directly attrib prof fees 15,000

PV of decommissioning cost 23,160

(50,000x.4362)

Capitalizable 443,160

SITUATIONAL PROBLEM

63) Income tax expense for half year ended 6/30/2014 (5,000,000 x 35%) 1,750,000

Profit from January 1 to June 30, 2014 5,000,000

Profit from July 1 to December 31, 2014 9,000,000

Expected profit for the year 14,000,000

Since the expected profit for the year exceeds P 1 1,000,000, the applicable income tax rate is 35%

Vous aimerez peut-être aussi

- Mechanical Properties and Performance of Engineering Ceramics and Composites X: A Collection of Papers Presented at the 39th International Conference on Advanced Ceramics and CompositesD'EverandMechanical Properties and Performance of Engineering Ceramics and Composites X: A Collection of Papers Presented at the 39th International Conference on Advanced Ceramics and CompositesDileep SinghPas encore d'évaluation

- Sol. Man. - Chapter 15 - Ppe Part 1 - Ia Part 1BDocument5 pagesSol. Man. - Chapter 15 - Ppe Part 1 - Ia Part 1BMahasia MANDIGANPas encore d'évaluation

- Problem 9 Requirement 1: Adjusting EntriesDocument7 pagesProblem 9 Requirement 1: Adjusting EntriesJobby JaranillaPas encore d'évaluation

- Process CostingDocument8 pagesProcess CostingBTS 007Pas encore d'évaluation

- Management Accounting AnswerDocument3 pagesManagement Accounting AnswerRama fauziPas encore d'évaluation

- Construction 2020-AnskeyDocument23 pagesConstruction 2020-AnskeyElvira AriolaPas encore d'évaluation

- Property, Plant and Equipment Chapter 15Document9 pagesProperty, Plant and Equipment Chapter 15Kiminosunoo Lel100% (3)

- Property, Plant and Equipment Chapter 15Document9 pagesProperty, Plant and Equipment Chapter 15Kiminosunoo LelPas encore d'évaluation

- 04 Overheads DistributionDocument15 pages04 Overheads DistributionDevesh BahetyPas encore d'évaluation

- Financial Accounting 2022 NeHu Question PaperDocument7 pagesFinancial Accounting 2022 NeHu Question PaperSuraj BosePas encore d'évaluation

- Make Up Exercises ACCTG1 Sept20Document10 pagesMake Up Exercises ACCTG1 Sept20keith niduelan100% (1)

- Eva ProblemsDocument10 pagesEva ProblemsROSHNY DAVIS100% (1)

- Week9 - SeminarAssign Ch04Prob4 - 3ADocument12 pagesWeek9 - SeminarAssign Ch04Prob4 - 3Abhattfenil29Pas encore d'évaluation

- Bede Cost PlanDocument2 pagesBede Cost PlanDaphne Tan 丽文Pas encore d'évaluation

- Akuntansi Biaya IiDocument9 pagesAkuntansi Biaya IiMa'rifatusSolikhahPas encore d'évaluation

- This Study Resource Was: Cash Out Lear Flows FlowsDocument7 pagesThis Study Resource Was: Cash Out Lear Flows FlowsLayPas encore d'évaluation

- How To Approach A Case Study?: Sombrero: Proposed Juice OutletDocument15 pagesHow To Approach A Case Study?: Sombrero: Proposed Juice OutletPulkit0% (1)

- BQS659 Final Account Work ExampleDocument10 pagesBQS659 Final Account Work ExampleIrsyad EmirPas encore d'évaluation

- This Study Resource Was: Cost of Removing The Old Machine 12,000 Loss On Disposal of The Old Machine 150,000Document9 pagesThis Study Resource Was: Cost of Removing The Old Machine 12,000 Loss On Disposal of The Old Machine 150,000RPas encore d'évaluation

- Property Plant Equipment May SagotDocument9 pagesProperty Plant Equipment May SagotRPas encore d'évaluation

- 3 HW On PPE Answer KeyDocument5 pages3 HW On PPE Answer KeyHannah Jane ToribioPas encore d'évaluation

- VHINSON - Intermediate Accounting 3 (2023 - 2024 Edition) - 103Document1 pageVHINSON - Intermediate Accounting 3 (2023 - 2024 Edition) - 103Alyssa Marie NacionPas encore d'évaluation

- 71694bos57679 Inter P3aDocument12 pages71694bos57679 Inter P3aTECH TeluguPas encore d'évaluation

- Chapter 10 Homework and Solutions 1.: Account Titles and Explanation Debit CreditDocument24 pagesChapter 10 Homework and Solutions 1.: Account Titles and Explanation Debit Creditlana del reyPas encore d'évaluation

- Intermediate Accounting 1 Solution Manual: Chapter 15 - Property, Plant and Equipment To Chapter 17 - Depletion of Mineral ResourcesDocument20 pagesIntermediate Accounting 1 Solution Manual: Chapter 15 - Property, Plant and Equipment To Chapter 17 - Depletion of Mineral ResourcesMckenziePas encore d'évaluation

- Problems On Total IncomeDocument12 pagesProblems On Total IncomedipakPas encore d'évaluation

- Overhead ApportionmentDocument3 pagesOverhead ApportionmentHassanAbsarQaimkhaniPas encore d'évaluation

- Assignment For Accounting Policies, Estimate and Errors: Problem 3Document3 pagesAssignment For Accounting Policies, Estimate and Errors: Problem 3Fria Mae Aycardo AbellanoPas encore d'évaluation

- Valuations - Awethu - SolutionDocument2 pagesValuations - Awethu - SolutionTNPas encore d'évaluation

- Answer KEY PPEDocument6 pagesAnswer KEY PPExjammerPas encore d'évaluation

- Cma-I Semester-Ii Contract Costing (C.U Sums For Revision) : Compute The Amount Profit ThatDocument13 pagesCma-I Semester-Ii Contract Costing (C.U Sums For Revision) : Compute The Amount Profit Thatvivek kumarPas encore d'évaluation

- Semester Paper CostDocument4 pagesSemester Paper CostMd HussainPas encore d'évaluation

- AmountDocument3 pagesAmountJudy TotoPas encore d'évaluation

- 2nd Summative Examination Submissions: Standalone AssignmentDocument17 pages2nd Summative Examination Submissions: Standalone AssignmentJohn Lexter Macalber100% (1)

- Cost Accounting: 1/4/2010 10:55:09 AM Page 1 of 7Document7 pagesCost Accounting: 1/4/2010 10:55:09 AM Page 1 of 7meelas123Pas encore d'évaluation

- Cma 1 GeneralDocument10 pagesCma 1 GeneralMax MarckPas encore d'évaluation

- INTACC2 - Chapter 30Document2 pagesINTACC2 - Chapter 30Shane TabunggaoPas encore d'évaluation

- Accounting For Property, Plant and Equipment - ACCA Global - 1621239130982Document13 pagesAccounting For Property, Plant and Equipment - ACCA Global - 1621239130982Farhan Osman ahmedPas encore d'évaluation

- Dream World CompanyDocument9 pagesDream World CompanyJC NicaveraPas encore d'évaluation

- Cases PpeDocument19 pagesCases PpeDavid Harrison PascualPas encore d'évaluation

- Cost Accounting BBS - 2200 Test 2Document5 pagesCost Accounting BBS - 2200 Test 2PAULPas encore d'évaluation

- Quiz - Single Entry (Answer Key)Document2 pagesQuiz - Single Entry (Answer Key)Gloria BeltranPas encore d'évaluation

- Cost Accounting Group Assignment: BY Madhu Varshini Maheswari Mithun Monika Navin NeelaveniDocument15 pagesCost Accounting Group Assignment: BY Madhu Varshini Maheswari Mithun Monika Navin NeelaveniNaveen RecizPas encore d'évaluation

- Module 2 Answer Key On Property Plant and EquipmentDocument7 pagesModule 2 Answer Key On Property Plant and EquipmentLoven BoadoPas encore d'évaluation

- 63edbface4b06000ece81962 OriginalDocument49 pages63edbface4b06000ece81962 OriginalTM GamingPas encore d'évaluation

- 1) Answer Any Two From The Following: 10X2 20Document2 pages1) Answer Any Two From The Following: 10X2 20Alvarez StarPas encore d'évaluation

- Cash Flow EstimationDocument6 pagesCash Flow EstimationFazul RehmanPas encore d'évaluation

- Sample Development AppraisalDocument5 pagesSample Development AppraisalchrispittmanPas encore d'évaluation

- Solutions - Chapter 7 Non-Current Operating Assets Solutions - Chapter 7 Non-Current Operating AssetsDocument9 pagesSolutions - Chapter 7 Non-Current Operating Assets Solutions - Chapter 7 Non-Current Operating AssetsJohanna VidadPas encore d'évaluation

- QuizDocument4 pagesQuizRinconada Benori ReynalynPas encore d'évaluation

- Resource Company Required Debit Credit 2020 Rock and Gravel PropertyDocument10 pagesResource Company Required Debit Credit 2020 Rock and Gravel PropertyAnonnPas encore d'évaluation

- Soalan2 Quiz Chapter 3Document8 pagesSoalan2 Quiz Chapter 3biarrahsiaPas encore d'évaluation

- Business Accounting and Finance: QUESTION 1 (P17-2A)Document9 pagesBusiness Accounting and Finance: QUESTION 1 (P17-2A)sang_ratu_1Pas encore d'évaluation

- Flexible BudgetsDocument23 pagesFlexible BudgetsscienceplexPas encore d'évaluation

- Item Description Unit Quantity Rate Cost AmountDocument5 pagesItem Description Unit Quantity Rate Cost AmountAZEEMULAZAMPas encore d'évaluation

- July 22 Far620Document8 pagesJuly 22 Far620FARAH ZAFIRAH ISHAMPas encore d'évaluation

- Gumpp Priority Investment Project in Two Secondary Cities in Ghana Additional Two (2) Cells Landfill Cells at The Oti Landfill Site in KumasiDocument19 pagesGumpp Priority Investment Project in Two Secondary Cities in Ghana Additional Two (2) Cells Landfill Cells at The Oti Landfill Site in KumasiIsaac Ekow MensahPas encore d'évaluation

- Group 2-Fin 6000BDocument7 pagesGroup 2-Fin 6000BBellindah wPas encore d'évaluation

- MTP 12 16 Answers 1696782053Document14 pagesMTP 12 16 Answers 1696782053harshallahotPas encore d'évaluation

- Ateneo Law SchoolDocument13 pagesAteneo Law SchoolJade MarkPas encore d'évaluation

- RMC No. 62-2018 Estate TaxDocument2 pagesRMC No. 62-2018 Estate TaxJade MarkPas encore d'évaluation

- AFAR Joint ArrangementDocument62 pagesAFAR Joint ArrangementJade Mark100% (1)

- Execution Phase Documents: Integrated Results and Risk Based Audit (Irrba)Document1 pageExecution Phase Documents: Integrated Results and Risk Based Audit (Irrba)Jade MarkPas encore d'évaluation

- Commission On Audit Circular No. 84-223 March 2, 1984Document5 pagesCommission On Audit Circular No. 84-223 March 2, 1984Jade MarkPas encore d'évaluation

- Total NCA 1110: 75,000 OverstatedDocument2 pagesTotal NCA 1110: 75,000 OverstatedJade MarkPas encore d'évaluation

- List of Rural and Cooperative Banks (BSP)Document75 pagesList of Rural and Cooperative Banks (BSP)Jade Mark0% (1)

- Jim Cover ProjDocument1 pageJim Cover ProjJade MarkPas encore d'évaluation

- Far Final Pre-Board Key Answers Spsps CparcDocument1 pageFar Final Pre-Board Key Answers Spsps CparcJade MarkPas encore d'évaluation

- Certificate Less Than 300 PesosDocument1 pageCertificate Less Than 300 PesosJade MarkPas encore d'évaluation

- 1234449Document19 pages1234449Jade MarkPas encore d'évaluation

- 3456782345Document17 pages3456782345Jade MarkPas encore d'évaluation

- Handout Business 3Document1 pageHandout Business 3Jade MarkPas encore d'évaluation

- CIVILDocument11 pagesCIVILjohnmiggyPas encore d'évaluation

- Sales Agency AccountingDocument11 pagesSales Agency AccountingJade MarkPas encore d'évaluation

- About EthicsDocument21 pagesAbout EthicsJade MarkPas encore d'évaluation

- Infini Travel & Tours Infini: Name of AgencyDocument3 pagesInfini Travel & Tours Infini: Name of AgencyJade MarkPas encore d'évaluation

- Parliamentary Debate Rules IASAS DraftDocument11 pagesParliamentary Debate Rules IASAS DraftJade MarkPas encore d'évaluation

- PQE 2009 AM QuestionnaireDocument7 pagesPQE 2009 AM QuestionnaireJade MarkPas encore d'évaluation

- Analysis of Financial StatementsDocument33 pagesAnalysis of Financial StatementsKushal Lapasia100% (1)

- Suggested Quey4uujjrstions For Advance Assignment To StudentsDocument3 pagesSuggested Quey4uujjrstions For Advance Assignment To StudentsDendy FebrianPas encore d'évaluation

- ComprehensiveexamDocument14 pagesComprehensiveexamLeah BakerPas encore d'évaluation

- On Company ValuationDocument43 pagesOn Company Valuationneelam mishraPas encore d'évaluation

- On January 1 2013 Porter Company Purchased An 80 InterestDocument1 pageOn January 1 2013 Porter Company Purchased An 80 InterestMuhammad ShahidPas encore d'évaluation

- Hhtfa8e ch03 SMDocument119 pagesHhtfa8e ch03 SMharryPas encore d'évaluation

- FinanzasDocument111 pagesFinanzasJuan GSPas encore d'évaluation

- Down Dog Corporation Statement of Affairs June 30, 2014 Book Value AssetsDocument11 pagesDown Dog Corporation Statement of Affairs June 30, 2014 Book Value AssetsEirolPas encore d'évaluation

- Fsa Chapter 7Document15 pagesFsa Chapter 7Nadia ZahraPas encore d'évaluation

- Ratio Analysis About S.R. Steel IndustriesDocument51 pagesRatio Analysis About S.R. Steel IndustriesshaileshPas encore d'évaluation

- ch10 Financial Accounting AnswerDocument74 pagesch10 Financial Accounting AnswerGalih Astiansha Putra100% (10)

- Working Capital - LupinDocument13 pagesWorking Capital - Lupinprashantrikame1234Pas encore d'évaluation

- FM Part2Document46 pagesFM Part2himewendyPas encore d'évaluation

- Project On Financial Analysis Between Tata Motors and Ashok LeylanDocument23 pagesProject On Financial Analysis Between Tata Motors and Ashok LeylannafisurPas encore d'évaluation

- Accounting Study GuideDocument4 pagesAccounting Study GuideCPALawyer012Pas encore d'évaluation

- CH 2Document19 pagesCH 2yebegashetPas encore d'évaluation

- CS Executive Company Accounts Notes FinalDocument41 pagesCS Executive Company Accounts Notes FinalShivam GuptaPas encore d'évaluation

- Bes 30 A EteaapDocument26 pagesBes 30 A EteaapEstelito Perez100% (1)

- Xavier University (Ateneo de Cagayan)Document3 pagesXavier University (Ateneo de Cagayan)Starilazation KDPas encore d'évaluation

- QUESTION 6 Financial Reporting May 2021 KOLIDocument6 pagesQUESTION 6 Financial Reporting May 2021 KOLILaud ListowellPas encore d'évaluation

- Practice To Chapter 10 Part 1-5Document17 pagesPractice To Chapter 10 Part 1-5Gulzhan AmanbaikyzyPas encore d'évaluation

- Naqdown - Final QuestionsDocument41 pagesNaqdown - Final QuestionssarahbeePas encore d'évaluation

- Current Assets 400,000 Equipment 600,000 Land 200,000 Building 1,200,000 Liabilities (320,000) 2,080,000Document2 pagesCurrent Assets 400,000 Equipment 600,000 Land 200,000 Building 1,200,000 Liabilities (320,000) 2,080,000Amamore PlazaPas encore d'évaluation

- Advanced Financial Management: Tuesday 3 June 2014Document13 pagesAdvanced Financial Management: Tuesday 3 June 2014SajidZiaPas encore d'évaluation

- Beams Adv Acc CH 14Document21 pagesBeams Adv Acc CH 14Josua PranataPas encore d'évaluation

- CH 11Document40 pagesCH 11Corliss Ko100% (1)

- Partnership (Advacc 1) - MKCDDocument20 pagesPartnership (Advacc 1) - MKCDToni Rose Hernandez LualhatiPas encore d'évaluation

- Audit of Stockholders' EquityDocument32 pagesAudit of Stockholders' EquityReverie Sevilla100% (3)

- To Study The Mergers and Acquisitions in Banking SectorDocument42 pagesTo Study The Mergers and Acquisitions in Banking SectorAayush UpadhyayPas encore d'évaluation

- Simer Project On Non Performing Assets..Document61 pagesSimer Project On Non Performing Assets..Simer KaurPas encore d'évaluation