Académique Documents

Professionnel Documents

Culture Documents

Analysis FFC

Transféré par

Saqib Rehan0 évaluation0% ont trouvé ce document utile (0 vote)

24 vues2 pagesanalysis

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentanalysis

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

24 vues2 pagesAnalysis FFC

Transféré par

Saqib Rehananalysis

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 2

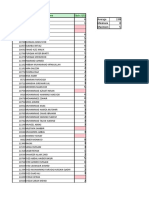

Fauji Fertilizers Company has been a leading fertilizer producer in Pakistan.

Being one of the

oldest fertilizer producers in the country it has been relatively financially stable. Below we will

present you some of the key financial measures that highlight the riskiness and return of the

company. These tools aid the management in immediate and long term future and general

contingency planning.

Considering the performance horizon of FFC of the past five years, FFCs average daily returns

are very less compared to that of the market during the five-year period. Fauji Fertilizers had a

return of only 0.015% as compared to markets 0.09% approx. From an investors point of view,

especially one inclined towards quick yielding stocks, the Fauji Fertilizer stocks were not a good

option since the average daily returns throughout the concerned period were negligible.

Comparison of standard deviations of FFCs stock and KSE 100 index should shed light on the

relative volatility of FFCs stock. The standard deviation of FFCs stock is nearly twice that of

the market making it more volatile .Keeping in mind the theoretical assumption of risk aversion

it could be said that to an average investor FFCs stock is less attractive. However, there are

numerous players in the stock market that seek high returns and are both willing and able to

compromise on relatively higher level of risk to in order to maximize short term return. As we

have seen earlier however that average returns of FFC are fairly lower which would dilute the

interest of investors willing to opt for this relatively risky investment.

While computing the risk for Fauji Fertilizers in relation to the market, it seems that FFC is not

very reactive to market changes. This is further reinforced by the beta figures for Fauji Fertilizer

stock of only 0.293 so we can analyze that FFCs stocks are not much affected by changing

market prices on average because beta shows that for every Rs.1 change in the market, Fauji

Fertilizer will only be affected by Rs. 0.3. This low beta can be due to a lot of reasons. The

decrease in dividend payout ratio, resulted in decreasing returns and also the slight decrease in

the stock prices of Fauji Fertilizers. The low beta figure signifies low sensitivity of the stock

compared to the market, i.e. FFcs stock position has been defensive for over some time period.

The beta of 0.293 means that as returns on market increases, FFC returns are forecasted to

increase less than the market. Thus, FFC stocks are less sensitive to the changing marketing

trends. This in part can be attributed to the fact that fertilizer is a sector of necessity since it

boosts agricultural productivity and supports the production of agricultural products necessary

for survival, therefore, even if economic conditions change, affecting market as a whole,

fertilizers stocks would be affected by a much lesser degree, since demand for fertilizers is not

determined by economic conditions by large. Therefore, if market prices increase or decrease by

10% only about 2.93% change in FFC stock indices was expected, signifying although a positive

relationship with the market, but a weak one. This is fairly obvious after computation of

correlation coefficient of 0.15 of FFC and KSE100 daily return.

It is recommended for investors to keep FFCs stock as a component of their portfolio with an

objective of diluting the effect of other more risky stocks with higher beta.

Concluding, the above analysis explains the riskiness and volatility of FFCs stocks in relative to

the market average returns and risk, signifying, that FFC stocks result in less daily returns on

average as compared to the stock market and are less relative volatile as portrayed by a beta

value of less than 1. With the trend of the market of producing low returns on average it could be

speculated that despite the higher deviation of FFCs stock investors might still be keen to keep a

low beta stock such as this as part of their portfolios.

Vous aimerez peut-être aussi

- Wedding IDocument1 pageWedding ISaqib RehanPas encore d'évaluation

- IBA ELP Review Status Form: Yes NoDocument1 pageIBA ELP Review Status Form: Yes NoSaqib RehanPas encore d'évaluation

- CC Lab Panel ListDocument13 pagesCC Lab Panel ListSaqib RehanPas encore d'évaluation

- Na Mohammad TM Mein Se Kisi Mard Ke Baap The Na Hain Lekin Allah K Rasool Hain Aur Khatam Un Nabbiyyin Hain Aur Allah Har Cheez Se Khub Agah HaiDocument1 pageNa Mohammad TM Mein Se Kisi Mard Ke Baap The Na Hain Lekin Allah K Rasool Hain Aur Khatam Un Nabbiyyin Hain Aur Allah Har Cheez Se Khub Agah HaiSaqib RehanPas encore d'évaluation

- Quiz 2 MarksDocument4 pagesQuiz 2 MarksSaqib RehanPas encore d'évaluation

- SBM Group DetailsDocument5 pagesSBM Group DetailsSaqib RehanPas encore d'évaluation

- Home Assignment (Oct 5 - 17)Document1 pageHome Assignment (Oct 5 - 17)Saqib RehanPas encore d'évaluation

- LGC Case Challenge - Guidelines: Tell Us in No More Than 6 SlidesDocument1 pageLGC Case Challenge - Guidelines: Tell Us in No More Than 6 SlidesSaqib RehanPas encore d'évaluation

- Sepi Group List FinalDocument11 pagesSepi Group List FinalSaqib RehanPas encore d'évaluation

- FIN 201 - Introduction To Business Finance: Session 1 - 2Document8 pagesFIN 201 - Introduction To Business Finance: Session 1 - 2Saqib RehanPas encore d'évaluation

- Q1 Exports: Bed Wear Cotton ClothDocument10 pagesQ1 Exports: Bed Wear Cotton ClothSaqib RehanPas encore d'évaluation

- Assignment: Saqib Rehan 11310Document11 pagesAssignment: Saqib Rehan 11310Saqib RehanPas encore d'évaluation

- Course Outline BC 2017Document9 pagesCourse Outline BC 2017Saqib RehanPas encore d'évaluation

- Asleveleconrevisionstudyguide PKDocument5 pagesAsleveleconrevisionstudyguide PKSaqib RehanPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- 2016 Closing The Gap ReportDocument64 pages2016 Closing The Gap ReportAllan ClarkePas encore d'évaluation

- An Annotated Bibliography of Timothy LearyDocument312 pagesAn Annotated Bibliography of Timothy LearyGeetika CnPas encore d'évaluation

- Business Plan in BDDocument48 pagesBusiness Plan in BDNasir Hossen100% (1)

- Leadership Styles-Mckinsey EdDocument14 pagesLeadership Styles-Mckinsey EdcrimsengreenPas encore d'évaluation

- Design of Combinational Circuit For Code ConversionDocument5 pagesDesign of Combinational Circuit For Code ConversionMani BharathiPas encore d'évaluation

- Nadee 3Document1 pageNadee 3api-595436597Pas encore d'évaluation

- Cisco BGP ASPATH FilterDocument115 pagesCisco BGP ASPATH FilterHalison SantosPas encore d'évaluation

- EqualLogic Release and Support Policy v25Document7 pagesEqualLogic Release and Support Policy v25du2efsPas encore d'évaluation

- Tesco True Results Casing Running in China Results in Total Depth PDFDocument2 pagesTesco True Results Casing Running in China Results in Total Depth PDF123456ccPas encore d'évaluation

- Acer N300 ManualDocument50 pagesAcer N300 Manualc_formatPas encore d'évaluation

- Injections Quiz 2Document6 pagesInjections Quiz 2Allysa MacalinoPas encore d'évaluation

- Determination Rules SAP SDDocument2 pagesDetermination Rules SAP SDkssumanthPas encore d'évaluation

- Heimbach - Keeping Formingfabrics CleanDocument4 pagesHeimbach - Keeping Formingfabrics CleanTunç TürkPas encore d'évaluation

- 2022 WR Extended VersionDocument71 pages2022 WR Extended Versionpavankawade63Pas encore d'évaluation

- CV & Surat Lamaran KerjaDocument2 pagesCV & Surat Lamaran KerjaAci Hiko RickoPas encore d'évaluation

- Bullshit System v0.5Document40 pagesBullshit System v0.5ZolaniusPas encore d'évaluation

- Cable To Metal Surface, Cathodic - CAHAAW3Document2 pagesCable To Metal Surface, Cathodic - CAHAAW3lhanx2Pas encore d'évaluation

- Activity On Noli Me TangereDocument5 pagesActivity On Noli Me TangereKKKPas encore d'évaluation

- Music CG 2016Document95 pagesMusic CG 2016chesterkevinPas encore d'évaluation

- Assessment of The Genitourinary System: GeneralDocument2 pagesAssessment of The Genitourinary System: GeneralMaharani UtamiPas encore d'évaluation

- Quarter 1-Week 2 - Day 2.revisedDocument4 pagesQuarter 1-Week 2 - Day 2.revisedJigz FamulaganPas encore d'évaluation

- Student Exploration: Inclined Plane - Simple MachineDocument9 pagesStudent Exploration: Inclined Plane - Simple MachineLuka MkrtichyanPas encore d'évaluation

- Sample Monologues PDFDocument5 pagesSample Monologues PDFChristina Cannilla100% (1)

- ISO 27001 Introduction Course (05 IT01)Document56 pagesISO 27001 Introduction Course (05 IT01)Sheik MohaideenPas encore d'évaluation

- Illustrating An Experiment, Outcome, Sample Space and EventDocument9 pagesIllustrating An Experiment, Outcome, Sample Space and EventMarielle MunarPas encore d'évaluation

- Pidsdps 2106Document174 pagesPidsdps 2106Steven Claude TanangunanPas encore d'évaluation

- Measurement Assignment EssayDocument31 pagesMeasurement Assignment EssayBihanChathuranga100% (2)

- Cyber Briefing Series - Paper 2 - FinalDocument24 pagesCyber Briefing Series - Paper 2 - FinalMapacheYorkPas encore d'évaluation

- Cloud Comp PPT 1Document12 pagesCloud Comp PPT 1Kanishk MehtaPas encore d'évaluation

- Man As God Created Him, ThemDocument3 pagesMan As God Created Him, ThemBOEN YATORPas encore d'évaluation