Académique Documents

Professionnel Documents

Culture Documents

CTA Jurisdiction Summary PDF

Transféré par

MJ Decolongon0 évaluation0% ont trouvé ce document utile (0 vote)

14 vues3 pagesTitre original

CTA jurisdiction summary.pdf

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

14 vues3 pagesCTA Jurisdiction Summary PDF

Transféré par

MJ DecolongonDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 3

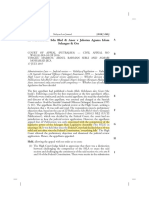

\\COURT OF TAX APPEALS JURISDICTION

EXCLUSIVE ORIGINAL JURISDICTION EXCLUSIVE APPELLATE JURISDICTION

OVER ALL CRIMINAL AND CIVIL OFFENSES IN CRIMINAL AND CIVIL OFFENSES:

EXCLUSIVE APPELLATE JURISDICTION

TO REVIEW BY APPEAL

(Civil action for the recovery of civil liability for taxes and penalties

deemed simultaneously instituted with the criminal action)

via a Petition for Review under Rule 42: arising from violations of the National Internal Revenue Same violations decided by the regular court where

Code or Tariff and Customs Code and other laws the amount involved is less than P1million or no

Decisions of the Commissioner of Internal Revenue in administered by the Bureau of Internal Revenue or the specified amount

cases involving disputed assessments, refunds of internal Bureau of Customs where the principal amount of taxes

revenue taxes, fees or other charges, penalties in relation and fees, exclusive of charges and penalties, claimed is

thereto, or other matters arising under the National P1 million or more

Internal Revenue or other laws administered by the tax collection case involving final and executory tax collection cases where the principal amount of

Bureau of Internal Revenue. assessments for taxes, fees, charges and penalties, the taxes and fees, exclusive of charges and penalties,

principal amount of taxes and fees, exclusive of charges claimed is less than P1 million

Inaction by the Commissioner of Internal Revenue in and penalties, claimed is P1 million or more

cases involving disputed assessments, refunds of internal via an appeal

revenue taxes, fees or other charges, penalties in

relations thereto, or other matters arising under the from the judgments, resolutions or orders of the RTC

National Internal Revenue Code or other laws in tax collection cases originally decided by them

administered by the Bureau of Internal Revenue, where

the National Internal Revenue Code provides a specific via a petition for review

period of action, in which case the inaction shall be

deemed a denial. of the judgments, resolutions or orders of the RTC in

the exercise of their appellate jurisdiction tax

Decisions of the Commissioner of Customs in cases collection cases originally decided by the MeTC,

involving liability for customs duties, fees or other money MTC, MCTC

charges, seizure, detention or release of property affected,

fines, forfeitures or other penalties in relation thereto, or

other matters arising under the Customs Law or other

laws administered by the Bureau of Customs.

Decisions of the Secretary of Finance on customs

cases elevated to him automatically for review from

decisions of the Commissioner of Customs which are

adverse to the Government under Section 2315 of the

Tariff and Customs Code.

Decisions of the Secretary of Trade and Industry, in

the case of nonagricultural product, commodity or article,

and the Secretary of Agriculture in the case of

agricultural product, commodity or article, involving

dumping and countervailing duties under Section 301 and

302, respectively, of the Tariff and Customs Code, and

safeguard measures under Republic Act No. 8800, where

either party may appeal the decision to impose or not to

impose said duties.

via a Petition for Review under Rule 42:

Decisions, orders or resolutions of the Regional Trial

Courts in local tax cases originally decided or resolved by

them in the exercise of their original or appellate

jurisdiction.

Decisions of the Central Board of Assessment

Appeals in the exercise of its appellate jurisdiction over

cases involving the assessment and taxation of real

property originally decided by the provincial or city board

of assessment appeals.

RTC MeTC, MTC, MCTC in criminal cases

EXCLUSIVE ORIGINAL JURISDICTION EXCLUSIVE ORIGINAL JURISDICTION

over all offenses punishable with imprisonment not exceeding 6 years

in all criminal and civil cases not within the exclusive jurisdiction of any court, tribunal or body, irrespective of the amount of fine, and regardless of other imposable accessory

(criminal: offenses punishable with imprisonment exceeding 6 years and regardless of other or other penalties, including the civil liability arising from such offenses or

imposable accessory or other penalties, including the civil liability arising from such offenses or predicated thereon, irrespective of kind, nature, value, or amount thereof:

predicated thereon, irrespective of kind, nature, value, or amount thereof)

over all violations of city or municipal ordinances committed within their

tax collection cases where the principal amount of taxes and fees, exclusive of charges and respective territorial jurisdiction

penalties, claimed is less than One million pesos and does not involve violations of city or

municipal ordinances Sec. 266 & Art. 357 IRR of LGC: collection of delinquent basic real property tax

where the amount due is less than P10,000.00

In all other cases in which the demand, exclusive of interest, damages of whatever kind,

attorney's fees, litigation expenses, and costs xxx exceed P100,000.00 or where items 1-7 of

Sec. 19 of BP 129, as amended exceeds P200,000.00

Sec. 266 & Art. 357 IRR of LGC: collection of delinquent basic real property tax where the

amount due is more than P10,000.00

EXERCISE APPELLATE JURISDICTION

over all cases decided by Metropolitan Trial Courts, Municipal Trial Courts, and Municipal Circuit

Trial Courts

under the Local Govt. Code:

Sec. 119 over decisions of the sanggunian concerned in boundary disputes of LGUs

Sec. 266 & Art. 357 IRR of LGC: collection of delinquent RPT

Vous aimerez peut-être aussi

- German Management & Services, Inc. V Court of Appeals FactsDocument3 pagesGerman Management & Services, Inc. V Court of Appeals FactsMJ DecolongonPas encore d'évaluation

- By Nature - Cannot Be Moved From Place To PlaceDocument15 pagesBy Nature - Cannot Be Moved From Place To PlaceMJ DecolongonPas encore d'évaluation

- Agency DigestsDocument10 pagesAgency DigestsJulian Paul CachoPas encore d'évaluation

- PossessionDocument5 pagesPossessionMJ DecolongonPas encore d'évaluation

- By Nature - Cannot Be Moved From Place To PlaceDocument15 pagesBy Nature - Cannot Be Moved From Place To PlaceMJ DecolongonPas encore d'évaluation

- Digests FullDocument6 pagesDigests FullMJ DecolongonPas encore d'évaluation

- IBC V AmarillaDocument3 pagesIBC V AmarillaMJ DecolongonPas encore d'évaluation

- Defective ContractsDocument1 pageDefective ContractsMJ DecolongonPas encore d'évaluation

- Gibbs Vs Govt Digest and FulltextDocument5 pagesGibbs Vs Govt Digest and FulltextMJ DecolongonPas encore d'évaluation

- Transpo Fulltext 6Document3 pagesTranspo Fulltext 6MJ DecolongonPas encore d'évaluation

- Cruz V de Leon Elane V CA and ChuaDocument3 pagesCruz V de Leon Elane V CA and ChuaMJ DecolongonPas encore d'évaluation

- Digests FullDocument6 pagesDigests FullMJ DecolongonPas encore d'évaluation

- ZalameaDocument6 pagesZalameaR.A. GregorioPas encore d'évaluation

- Casedigest February24Document12 pagesCasedigest February24Maria Reylan GarciaPas encore d'évaluation

- Velazco Vs Blas July 1982Document3 pagesVelazco Vs Blas July 1982MJ DecolongonPas encore d'évaluation

- Pascual Vs CirDocument5 pagesPascual Vs CirGlo Allen CruzPas encore d'évaluation

- Property Relations CasesDocument8 pagesProperty Relations CasesMJ DecolongonPas encore d'évaluation

- Gibbs Vs Govt Digest and FulltextDocument5 pagesGibbs Vs Govt Digest and FulltextMJ DecolongonPas encore d'évaluation

- Casedigest February24Document12 pagesCasedigest February24Maria Reylan GarciaPas encore d'évaluation

- PRELIMS PubCorp ReviewerDocument13 pagesPRELIMS PubCorp ReviewerMJ DecolongonPas encore d'évaluation

- Tan v. ComelecDocument14 pagesTan v. ComelecElise Rozel DimaunahanPas encore d'évaluation

- Liga NG Mga Brgy Vs Judge Paredes Sept 2004Document8 pagesLiga NG Mga Brgy Vs Judge Paredes Sept 2004MJ DecolongonPas encore d'évaluation

- Reyes Vs Comelec G.R. No. 120905 March 7, 1996Document8 pagesReyes Vs Comelec G.R. No. 120905 March 7, 1996Paolo Antonio EscalonaPas encore d'évaluation

- Garcia Vs Pajaro GR 141149Document8 pagesGarcia Vs Pajaro GR 141149MJ DecolongonPas encore d'évaluation

- Tan v. ComelecDocument14 pagesTan v. ComelecElise Rozel DimaunahanPas encore d'évaluation

- Mercado Vs ManzanoDocument6 pagesMercado Vs ManzanoMJ DecolongonPas encore d'évaluation

- Riosvs Sandiganbayan 279 SCRA581Document3 pagesRiosvs Sandiganbayan 279 SCRA581MJ DecolongonPas encore d'évaluation

- Moday Vs CaDocument2 pagesModay Vs CaChedeng KumaPas encore d'évaluation

- Farinas Vs BarbaDocument4 pagesFarinas Vs BarbaMJ DecolongonPas encore d'évaluation

- Velazco Vs Blas July 1982Document3 pagesVelazco Vs Blas July 1982MJ DecolongonPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Cauton v. ComelecDocument2 pagesCauton v. ComelecAudris Bulatao50% (2)

- Willie Yu v. Defensor SantiagoDocument4 pagesWillie Yu v. Defensor SantiagoBianca TocaloPas encore d'évaluation

- Digest - Bautista vs. SalongaDocument2 pagesDigest - Bautista vs. SalongaKeij Ejercito100% (1)

- 018united States Vs Sweet, 1 Phil 18, G.R. No. 448, September 20, 1901Document4 pages018united States Vs Sweet, 1 Phil 18, G.R. No. 448, September 20, 1901Estrella DolawPas encore d'évaluation

- Constitutional Law Assignment 3Document12 pagesConstitutional Law Assignment 3Moses GawesebPas encore d'évaluation

- Quasi-Judicial Method/ Process: Presented byDocument32 pagesQuasi-Judicial Method/ Process: Presented byAli ArslanPas encore d'évaluation

- Habeas CorpusDocument2 pagesHabeas CorpusJulia UnarcePas encore d'évaluation

- (DIGEST) (178) Nunal v. Commision On Appointments G.R. No. 78648Document2 pages(DIGEST) (178) Nunal v. Commision On Appointments G.R. No. 78648Mark Cruz100% (1)

- Catiis Vs CADocument3 pagesCatiis Vs CACheska Christiana Villarin Saguin100% (2)

- Presented By: Monika Joshi Mitesh Bechara Kumar RaoDocument11 pagesPresented By: Monika Joshi Mitesh Bechara Kumar Raomoni314Pas encore d'évaluation

- TP 1 - Curso Americas Unwriitten Constitution - CourseraDocument2 pagesTP 1 - Curso Americas Unwriitten Constitution - CourseraMaría Lucía ChesiniPas encore d'évaluation

- Introduction To Statutory ConstructionDocument20 pagesIntroduction To Statutory ConstructionNeil Bryan N. MoninioPas encore d'évaluation

- Affidavit in Support of MotionDocument4 pagesAffidavit in Support of MotionRuss Wishtart100% (1)

- Bumiputra Commerce Bank BHD v. Amanah Raya BHD Sivaloganathan Kanagasabai (Intervener)Document7 pagesBumiputra Commerce Bank BHD v. Amanah Raya BHD Sivaloganathan Kanagasabai (Intervener)Alae KieferPas encore d'évaluation

- Concerned Trial Lawyers Vs Judge VeneracionDocument3 pagesConcerned Trial Lawyers Vs Judge VeneracionJohn Daryl B. YuPas encore d'évaluation

- RPH Module-2Document5 pagesRPH Module-2Duclayan, Rexanne Fia Mayee A.Pas encore d'évaluation

- Hri Prasenjit Acharjee v. Ongc, Tripura Power CompanyDocument9 pagesHri Prasenjit Acharjee v. Ongc, Tripura Power CompanyRaaghav SapraPas encore d'évaluation

- Jack Leverett v. The City of Pinellas Park, 775 F.2d 1536, 11th Cir. (1985)Document8 pagesJack Leverett v. The City of Pinellas Park, 775 F.2d 1536, 11th Cir. (1985)Scribd Government DocsPas encore d'évaluation

- Cognizance of Complaints - S. 190, CRPC: Cognizance: Meaning and ConceptDocument2 pagesCognizance of Complaints - S. 190, CRPC: Cognizance: Meaning and ConceptJoy BosePas encore d'évaluation

- Holgaland Court of Appeal DecisionDocument3 pagesHolgaland Court of Appeal DecisionManan DuggalPas encore d'évaluation

- Salientes vs. AbanillaDocument6 pagesSalientes vs. Abanillahmn_scribdPas encore d'évaluation

- RP V Bantigue Point Devt CorpDocument9 pagesRP V Bantigue Point Devt Corpyasuren2Pas encore d'évaluation

- Indian State Bhikhu Parekh ArticleDocument15 pagesIndian State Bhikhu Parekh Articleparas kumarPas encore d'évaluation

- Legal System of PakistanDocument5 pagesLegal System of Pakistankhizar hayatPas encore d'évaluation

- January 3Document2 pagesJanuary 3Pj TignimanPas encore d'évaluation

- Appendix 8 Petitioners Motion To Correct Fraud Upon The CourtDocument14 pagesAppendix 8 Petitioners Motion To Correct Fraud Upon The CourtNeil GillespiePas encore d'évaluation

- Civil Courts in The UkDocument3 pagesCivil Courts in The UkThao TranPas encore d'évaluation

- ZI Publications SDN BHD & Anor V Jabatan Agama Islam Selangor & OrsDocument17 pagesZI Publications SDN BHD & Anor V Jabatan Agama Islam Selangor & OrsShasmeethaa NairPas encore d'évaluation

- Nuñez Vs IbayDocument1 pageNuñez Vs Ibayjcfish07100% (1)

- Preventive Detention and Violation of Human Rights: Bangladesh PerspectiveDocument22 pagesPreventive Detention and Violation of Human Rights: Bangladesh PerspectiveX YPas encore d'évaluation