Académique Documents

Professionnel Documents

Culture Documents

EE2015 With An Eye On Safe Tech Solutions

Transféré par

melvinlimtr89Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

EE2015 With An Eye On Safe Tech Solutions

Transféré par

melvinlimtr89Droits d'auteur :

Formats disponibles

6 | COMPANIES & MARKETS The Business Times | Monday, September 7, 2015

With an eye on safe tech solutions

Specialising in video and data analytics, Zweec Analytics has deployed its technology in various settings across the island. BY SHEENA TAN

Z

WEEC Analytics may have pro-

gressed from tracking fish in a

tank to tracking swimmers in a Zweec has not limited its

pool, but its fundamental purpose growth to just the four

of ensuring safety has not

changed. Specialising in video and data analyt-

sides of a monitor screen.

ics, the company has deployed its technology After its success in testing

in various settings across the island.

It started with a need, says chief execu-

water quality, it partnered a

tive officer and co-founder Liaw Kok Eng. The water treatment firm and is

Public Utilities Board (PUB) had to manually venturing into providing

observe fish mortality to monitor water quali-

ty. Manual observations are trying, and en- safe drinking water, or

able action only after mortality. To many utili- IONI Water, which

ty owners, that is too little too late, Mr Liaw

said. When threat increases, they need to

operates on a bring your

know whats going on. The conventional own bottle concept.

measuring method is not going to do any-

thing.

Wanting to automate the system, PUB ap-

proached the Agency for Science, Technology

and Research (A*Star) in 2004. faced challenges at the start in quickly com-

Mr Liaw, a seasoned entrepreneur, was mercialising the licensed technology for end

brought in to work with A*Stars researchers users.

and industry managers. One of them was Ce- Originating from A*Star, the technology

cilia Chow, Zweecs director and co-founder. was very raw, said Mr Liaw. The biggest chal-

We came up with more than just an auto- lenge was turning it into something that has

mated system; we came up with an early warn- good commercial sense and application

ing management system, said Ms Chow. sense . . . and worthwhile for users, he said.

Known as AquaTEC, it enables remote moni- Although it took some time to overcome that,

toring and detects abnormal fish behaviour the team did not rest. We started to create de-

before mortality for faster response times.

mand and need for our system instead of just

AquaTEC has been picked up by the Taiwan

waiting for utility.

Water Corporation and the Yangtze River Wa-

ter Resources Commission.

Beyond water safety

As image analysis is its underlying technolo-

gy, application beyond water safety is viable.

Zweec, which spun off from A*Star in 2011,

implemented its smart surveillance system in

pools to detect distress and prevent drown-

ing fatalities.

There are people getting drowned, kids

getting drowned, and its very sad; its always

one too many. With this solution, were (From left) Mr Chng, Mr Liaw and Ms Chow. Though Zweec now provides surveillance functions, Mr Chng said it aims to complement,

pre-emptive, said Chng Hock Huat, Zweecs not replace, existing manpower. It intends to start smart community projects with town councils and campuses. PHOTO: SHAWN TEO

chief commercial officer.

Besides pools, the system is also present ensure safe water, providing a complete secu- next tier may be less affluent but have some ers and differentiate itself from bottled water

in public spaces to detect suspicious behav- rity solution. level of education they are aware of the im- companies.

iour and objects. The interesting thing about But Zweec has not limited its growth to portance of safe drinking water and can af- Further, its adoption of a decentralised sys-

Zweec . . . is really the ease of the core tech- This company is one of the

just the four sides of a monitor screen. After ford it, he added. tem allows easy scalability. IONI Water draws 14 finalists of the Emerging Enterprise

nology branching to other industries, said Mr

its success in testing water quality, it part- The water industry might seem flat, but pipe or surface water before treating it, remov- Award 2015. Jointly presented by

Chng.

nered a water treatment firm and is venturing growth is dynamic. Because safe drinking wa- ing the need for a central plant to deliver or The Business Times and OCBC Bank,

Though the company now provides sur- the Emerging Enterprise Award 2015

into providing safe drinking water, or IONI Wa- ter is something you cannot take for granted, distribute water. Were able to bring the facto-

veillance functions, Mr Chng said its aim is to recognises promising enterprises and

complement, not replace, existing manpow- ter. he said, and countries like Indonesia with ry to the people, said Mr Liaw.

startups which are up to 10 years old

er. It strengthens them, changes the work- IONI Water operates on a bring your own large populations and many rural and subur- Zweec is introducing IONI Water through and have an annual turnover of

flow, which for a labour-strapped nation like bottle concept, and consists of a water treat- ban areas need more help. franchising, working with convenience store S$15 million or less. It is supported

Singapore is a smart solution. ment system, dispensers and AquaTEC to en- People in these areas are buying water be- and supermarket chains, or property develop- by RSM Chio Lim, MasterCard,

Zweec intends to embark on smart com- sure water quality. It will be rolled out this cause they have, to an extent, lost confidence ers. Singtel, ACORN Marketing &

munity projects with town councils and cam- year in second-tier cities in Indonesia, Myan- in the water transported to them. There is a In the next three years, it expects IONI Wa- Research Consultants, INSEAD and

mar and China. real need in these cities, said Mr Liaw. ter to generate more than half of total reve- SPRING Singapore. The winners

puses. Its analytics systems can be integrated

will be unveiled at a gala dinner

into existing cameras in a community to pre- People in first-tier cities tend to buy Zweec expects to capitalise on the Singa- nue. While Zweec has now progressed to sup-

on September 23.

vent crimes from littering to molest, as well as in-house filters, said Mr Chng. Those in the pore brand to provide assurance to consum- plying safe drinking water to consumers, it

INSIDE MARKETS Higher

Buying falls for first time in four weeks, turnover

with figures down sharply on SGX in

August in

By Robert Halili

THE buying fell for the first time in the past four

The trades, which accounted for 57 per cent

of the stocks trading volume, were made on the

back of the 29 per cent drop in the share price

He previously acquired 1.44 million shares

from November 2006 to August 2014 at 52

Aug 28 to Sept 3 at an average of 36.4 cents

each. all activities

weeks while the selling among directors re- cents to 14 cents each or an average of 30 cents The trades, which accounted for 87 per cent

mained low based on filings on the Singapore since May from 59.5 cents. The counter is also each. Prior to those acquisitions, he sold 15.15 of the stocks trading volume, increased his di-

sharply down since April 2014 from 76.5 cents. Singapore

Exchange from Aug 31 to Sept 4. A total of 29 million shares from January to May 2006 at an rect holdings by 8 per cent to 14.522 million

Despite the fall in the share price, the stock average of 53 cents each. The counter closed at shares or 3.77 per cent of the issued capital. SECURITIES, derivatives and

companies recorded 68 purchases worth commodities activities posted

is still up since January 2012 from 16.2 cents. 30.5 cents on Friday. He also has deemed interest of 59.839 mil-

S$2.76 million versus one firm with four dispos- continued growth in August, the

The counter closed at 42.5 cents on Friday. lion shares or 15.55 per cent. The acquisitions

als worth S$0.37 million. Auric Pacific Group Singapore Exchange (SGX) says.

The buy figures were sharply down from the were made on the back of the 12 per cent drop

Tat Hong Holdings Executive director Andy Adhiwana recorded his in the share price since July from 41.5 cents. At S$28.1 billion, total turnover

previous weeks 50 companies, 122 purchases for securities was up 34 per cent

Heavy equipment services provider and suppli- first on-market trades in food and consumer He previously acquired 602,000 shares from

and US$19.4 million. The sales, on the other year-on-year and 16 per cent

er Tat Hong Holdings recorded its first buy- goods manufacturer and distributor and securi- June 8-17 and 239,000 shares from April 8 to

hand, were consistent with the previous weeks backs since October 2014 with 1.24 million month-on-month in August, despite

ties and properties investor Auric Pacific Group June 4 at an average of 38 cents each. Prior to

one firm, two disposals and S$0.83 million. shares purchased from Aug 24-31 at an average fewer trading days in the month

since his appointment in November 2014 with his purchases this year, he sold three million

Aside from directors, the buyback activity of 46.9 cents each. vis-a-vis August last year as well as

108,000 shares purchased from Sept 1-3 at an shares in May 1999 at an average of 73 cents

fell last week with 30 companies that posted The trades, which accounted for 48 per cent July this year.

average of 72.4 cents each. each.

110 repurchases worth US$91.3 million. The fig- of the stocks trading volume, were made on the The daily average traded value

The trades, which accounted for 92 per cent Also positive this year is managing director

ures were down from the previous weeks 37 back of the 21 per cent drop in the share price was S$1.5 billion, 35 per cent higher

of the stocks trading volume, increased his David Lum Kok Seng with 1.44 million shares month-on-month and 49 per cent

firms, 137 trades and US$126.9 million. since July from 59 cents. The counter is also deemed holdings to 27.601 million shares or purchased from March 12-27 at an average of higher year-on-year. Trading of

With buyers that dominated the trading, the sharply down since November 2014 from 81 21.96 per cent of the issued capital. The pur- 36 cents each, which boosted his deemed stake Straits Times Index (STI) stocks

bulk of the significant trades last week were ac- cents. chases were made on the back of the 16 per cent to 63.334 million shares or 16.51 per cent. He al-

quisitions with buybacks in BRC Asia Limited, The group previously acquired 464,000 represented nearly three-quarters of

drop in the share price since April from 86.5 so has direct interest of 10.938 million shares total trading value, versus 66 per

Centurion Corporation, Tat Hong Holdings and shares in October 2014 at an average of S$0.74 cents. or 2.85 per cent. cent in July this year and 57 per

Trek 2000 and insider buys in Auric Pacific each and 1.96 million shares from September to

The counter is also sharply down since Sep- He previously acquired 850,000 shares on cent in August last year.

Group, ASL Marine Holdings, Lum Chang Hold- October 2008 at S$1.25 to S$0.53 each or an av-

tember 2013 from S$1.49. Despite the fall in the Feb 24 via open and off-market trades at an aver- Exchange-traded fund (ETF)

ings and Sinostar PEC Holdings. The purchases, erage of S$0.91 each. The counter closed at 50

share price, the stock is still up since September age of 36 cents each and 2.1 million shares trading was S$307 million, up 20

with the exception of Sinostar PEC Holdings, cents on Friday.

2011 from 49 cents. The counter closed at 73 from March to April 2009 at an average of 14.7 per cent month-on-month and 40

were made following the fall in share prices. Trek 2000 International cents on Friday. cents each. The counter closed at 37.5 cents on per cent year-on-year.

Friday. S$7.4 billion was raised in

BRC Asia Computer hardware and software research, de- ASL Marine Holdings)

sign and development firm Trek 2000 Interna- August as 23 new bonds were listed,

Prefabricated steel reinforcement firm BRC Asia Chairman and managing director Ang Kok Tian Sinostar PEC Holdings with foreign issuers accounting for

Limited recorded its first buybacks since Janu- tional bought back for the first time since Janu-

recorded his first on-market trade in marine ser- Non-executive chairman Li Xiang Ping recorded nearly three-quarters of the bond

ary 2013 with 209,000 shares purchased from ary 2008 with 308,000 shares purchased from

vices provider ASL Marine Holdings since Octo- his first on-market trades in mainland oil and listings. Meanwhile, there were two

Aug 31 to Sept 4 at an average of 29.8 cents

Sept 3-4 at an average of 66.6 cents each. The ber 2008 with 8,000 shares purchased on petrochemical products producer and supplier new listings on Catalist, raising S$40

each.

trades were made on the back of the 26 per cent Aug 31 at 33.6 cents each. Sinostar PEC Holdings since the stock was listed million.

The trades, which accounted for 73 per cent

drop in the share price since May from 90 cents. The trade increased his direct holdings to in September 2007 with 300,000 shares pur- The total market capitalisation of

of the stocks trading volume, were made on the

The counter is also sharply down since March 58.775 million shares or 14.01 per cent of the is- chased from Aug 26 to Sept 1 at an average of the 771 listed companies totalled

back of the 41 per cent drop in the share price

2014 from S$1.125. sued capital. The acquisition was made on the 13.3 cents each. S$899 billion for the month.

since May from 50.5 cents. Despite the fall in

The group previously acquired S$158,000 back of the 31 per cent drop in the share price The trades, which accounted for 43 per cent Meanwhile, the derivatives

the share price, the counter is still up since May

worth of shares in January 2013 at an estimated since January from 48.5 cents. of the stocks trading volume, increased his volume of 17 million contracts was

2014 from 18.8 cents.

price of 78 cents each. The counter closed at 70 The counter is also sharply down since Janu- deemed holdings to 330.296 million shares or up 82 per cent year-on-year,

The group previously acquired 7.08 million

cents last Friday. ary 2014 from 73.5 cents. Mr Ang previously ac- 51.61 per cent of the issued capital (registered although it was 21 per cent lower

shares from November 2007 to January 2008 at

holder is Intelligent People Holdings Limited). from the previous month. Equity

31-36 cents each or an average of 34.1 cents quired 100,000 shares in October 2008 at 67

Centurion Corporation cents each. The counter closed at 36 cents on The purchases were made on the back of the index futures volume hit 15.3

each.

Storage disc manufacturer and distributor and million contracts, up 76 per cent

Investors should note that chairman and Friday. 114 per cent rebound in the share price since

dormitory services provider Centurion Corpora- year-on-year and down 23 per cent

CEO Henn Tan sold 100,000 shares on April 8 at March from 6.2 cents. Despite the rebound in

tion bought back for the first time since listing Lum Chang Holdings from the prior month.

38.5 cents each, which reduced his deemed the share price, the counter is still down since

Similarly, SGX commodities

in January 1995 on SGX Sesdaq and in October holdings by 12 per cent to 720,000 shares or Chairman Raymond Lum Kwan Sung picked up April 2012 from 21.5 cents. The counter closed

derivatives volume surged 285 per

1998 on SGX main board with two million 0.24 per cent of the issued capital. He also has where he left off in construction and property at 13.1 cents on Friday.

cent year-on-year to 535,438

shares purchased from Sept 2-4 at an average of direct interest of 100.035 million shares or developer and investor Lum Chang Holdings in The writer is managing director, contracts but fell 22 per cent

42.3 cents each. 33.67 per cent. June with 1.12 million shares purchased from Asia Insider Limited month-on-month.

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Burton SensorsDocument7 pagesBurton SensorsMOHIT SINGHPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Text Book 2023Document142 pagesText Book 2023Henna NguboPas encore d'évaluation

- 121 Diamond Hill Funds Annual Report - 2009Document72 pages121 Diamond Hill Funds Annual Report - 2009DougPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

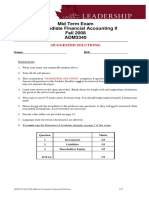

- Mid Term Exam Intermediate Financial Accounting II Fall 2008 ADM3340Document12 pagesMid Term Exam Intermediate Financial Accounting II Fall 2008 ADM3340yoonPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Indian Alcohol Brewaries Industry VCKDocument29 pagesIndian Alcohol Brewaries Industry VCKSubrata Sarkar100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Ashish Chugh Unearths Hidden Gems For Your Portfolio - 22jul2010Document2 pagesAshish Chugh Unearths Hidden Gems For Your Portfolio - 22jul2010Sreeselva VeenePas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Financial Management, Principles and ApplicationsDocument15 pagesFinancial Management, Principles and ApplicationsOsama SaleemPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Introduction of Philip CapitalDocument4 pagesIntroduction of Philip CapitalAbhishek SinhaPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- 2010 General Mills Kellogg's Current Assets Current Liabilities Current Ratio 0.92 0.92Document3 pages2010 General Mills Kellogg's Current Assets Current Liabilities Current Ratio 0.92 0.92SHIVANI SHARMAPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- What Is Corporate GovernanceDocument9 pagesWhat Is Corporate GovernanceLareb ShaikhPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- BUAD 847 Individual AssignmentDocument8 pagesBUAD 847 Individual AssignmentUnachukwu Sopulu SopsyPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Project Report On Working Capital Management in HCLDocument95 pagesProject Report On Working Capital Management in HCLRockyLagishetty100% (2)

- Look at The Benjamin Graham ApproachDocument4 pagesLook at The Benjamin Graham Approachjitendrasutar1975Pas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Enron Scandal The Fall of A Wall Street DarlingDocument3 pagesEnron Scandal The Fall of A Wall Street DarlingAnonymous 2LqTzfUHY50% (2)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Philamlife vs. SOFDocument1 pagePhilamlife vs. SOFMichellePas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Student Guide Lesson TwelveDocument7 pagesStudent Guide Lesson Twelveapi-344266741Pas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- R60 Introduction To Alternative Investments Q BankDocument26 pagesR60 Introduction To Alternative Investments Q BankAhmedPas encore d'évaluation

- Risk Management in Bse and NseDocument52 pagesRisk Management in Bse and NseAvtaar SinghPas encore d'évaluation

- Aviva Hy2021 Analyst PackDocument119 pagesAviva Hy2021 Analyst PackIan McConnochiePas encore d'évaluation

- Unit 6 Mutual FundDocument46 pagesUnit 6 Mutual Fundpadmakar_rajPas encore d'évaluation

- FIN3212 - Individual Assignment - April 2019Document24 pagesFIN3212 - Individual Assignment - April 2019Amanda LimPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- UGBS 202 Study GuideDocument17 pagesUGBS 202 Study Guidejeff bansPas encore d'évaluation

- Vault Career Guide To The Real Estate IndustryDocument118 pagesVault Career Guide To The Real Estate IndustryShubham BhatiaPas encore d'évaluation

- Short Notes ABADDocument135 pagesShort Notes ABADsing jotPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Kevin Byun's Q1 2010 Denali Investors LetterDocument9 pagesKevin Byun's Q1 2010 Denali Investors LetterThe Manual of IdeasPas encore d'évaluation

- Etfl Industry Review Jul10 UsDocument90 pagesEtfl Industry Review Jul10 UseconomicburnPas encore d'évaluation

- RCC SRC Bar MCQDocument8 pagesRCC SRC Bar MCQPao AbuyogPas encore d'évaluation

- Chapter 5 Financial Forwards and FuturesDocument16 pagesChapter 5 Financial Forwards and FutureshardrockerseanPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (120)

- SWOT Analysis of Bank AlfalahDocument14 pagesSWOT Analysis of Bank Alfalahamina8720% (1)

- Stock Prediction Using Neural Networks and Evolution AlgorithmDocument13 pagesStock Prediction Using Neural Networks and Evolution AlgorithmIJRASETPublications100% (1)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)