Académique Documents

Professionnel Documents

Culture Documents

ICICI Bank Demat Account Closure Form

Transféré par

Rahul SakareyDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

ICICI Bank Demat Account Closure Form

Transféré par

Rahul SakareyDroits d'auteur :

Formats disponibles

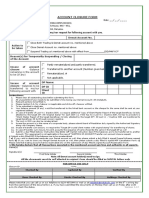

ICICI Bank Limited, C/o 3i Infotech Limited, Akruti Trade Centre, 3rd Floor, P.10, Road No.

7, MIDC Marol, Bhimnagar, Andheri (East), Mumbai - 400 093. Maharashtra.

(Important Note : Please do not send requests directly to this address. Kindly route all your requests through the nearest ICICI Bank Demat Servicing Branches)

Application for Closure of Demat Account (NSDL/CDSL)

Date D D M M Y Y Y Y DP ID Client ID (of account to be closed)

I / We hereby request you to close my / our Demat account with you as per following details:

Sole/First Holder

Second Holder

Third Holder

* Please tick the applicable option(s): (*Marked is a Mandatory field )

Option A (There are no balances / holdings in this account)

Option B Target Account Details

(Transfer the Transfer to my / our own account

balances / (Provide target account details and NSDL DP ID

holdings in enclose Client Master Report of Target

this account as Account)

per details given) CDSL

Transfer to any other account (Submit

duly filled Delivery Instruction Slip Client

signed by all holders) ID

Option C [Rematerialise / Reconvert (Submit duly filled Remat / Reconversion Request Form - For Mutual Fund units)]

* Please tick the reason for closing the Demat Account: (*Marked is a Mandatory field )

Moving to new area/abroad where ICICI Bank does not have a branch Unsatisfactory services

High demat charges Stopped trading forever

Consolidation of accounts Others (Please specify)

Recovery of dues

Direct Debit

Please debit my ICICI Bank Account(A/c No. for recovery of any pending dues against

my account

Cheque Payment

Cheque Number............................................................... drawn on Bank...........................................................................................................

Cash Payment

DECLARATION: In case of Account Closure due to Shifting of Account:

I/We declare and confirm that all the transactions in my/our Demat Account are true/authentic.

V - Dec 2016

SIGNATURE OF SOLE/FIRST HOLDER SIGNATURE OF SECOND HOLDER SIGNATURE OF THIRD HOLDER

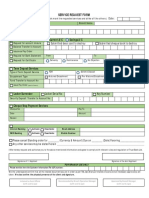

Notes

Transfer charges will be waived if account/s of transferee DP and transferor DP are the same, i.e. identical in all respects .To avail of the

waiver, a Client Master List (CML) for the target account/s needs to be submitted along with the Closure Form.

Ifthea CML is not submitted, the bank account in the Bank's records will be used to recover dues that arise out of transfer of securities to

specified account.

Whether you are NRI and holding RBI approval with ICICI Bank on your Saving Bank Account, NRE/NRO for trading into Indian Stock

market under Portfolio Investment Scheme (PIS), Yes No

If Yes, 1. In case your Residential Status has changed to Resident Indian from NRI, please submit:

a) PIS approval cancellation request

b) NRI Bank account (account on which PIS approval is granted) closure request along with this form

2. In case you wish to transfer your PIS Designation to other Authorized Dealer, please submit:

a) PIS approval cancellation request along with the form

For ICICI Bank use Only

Details of Recovery at Branch

Direct Debit

Bank Account Number debited ............................................for recovery of dues.

Transaction Id ........................................................................Transaction Date D D M M Y Y Y Y

Cheque Payment

Cheque No. ...........................................................................Drawn on Bank.............................................................................................

Transaction Id ........................................................................Transaction Date D D M M Y Y Y Y

Cash Payment

Bank Account Number credited : 003605000732

SR. No. ........................................... Name of the Bank Employee ................................................................................................................

Transaction Id ........................................................................Transaction Date D D M M Y Y Y Y

Signature of Bank Official .......................................................................................................................................

Date D D M M Y Y Y Y (SEAL OF BANK BRANCH)

CHECKLIST

Items to be checked Action to be initiated by the Branch Tick for verification by the Bank

Name of the Beneficiary Owner(s) with If the customer's name & signature do not Checked

signature(s) match with the DP system, request is

rejected

Status of Account Number If Account was closed, the customer was Checked

Active/Suspended/Closed informed about it

Obtain PAN proof if Account was suspended

because of not complying with PAN rules

Obtain proof of identity and address if Account

was suspended because of not complying

with KYC rules

Holding in source Account Number If holding exists, then: Checked

Target Account no. should be mentioned on

the request

Customer can request for rematerialisation

Pending dues If dues were pending, the customer was Checked

informed about it and the dues recovered

Acknowledgement

We hereby acknowledge the receipt of the your request for closing the below mentioned Demat Account subject to verification:

DP ID Client ID

Demat Account Holders Name

Received by

Bank Official Signature Branch SR No

Date D D M M Y Y Y Y

Vous aimerez peut-être aussi

- Learn to Repair Credit | Get Approved for Business Loans: Loans, Tradelines and CreditD'EverandLearn to Repair Credit | Get Approved for Business Loans: Loans, Tradelines and CreditÉvaluation : 4.5 sur 5 étoiles4.5/5 (3)

- MUTUAL FUND EnglishDocument2 pagesMUTUAL FUND EnglishPukazhendhi BoominathanPas encore d'évaluation

- Steps of Loan ProcessDocument16 pagesSteps of Loan ProcessShraddha TiwariPas encore d'évaluation

- CIAC jurisdiction over construction disputesDocument4 pagesCIAC jurisdiction over construction disputesxyrakrezelPas encore d'évaluation

- Arabic Letters Practice WorksheetsDocument3 pagesArabic Letters Practice Worksheetsvinsensius soneyPas encore d'évaluation

- HertzDocument2 pagesHertzChhavi AnandPas encore d'évaluation

- Ngulchu Thogme Zangpo - The Thirty-Seven Bodhisattva PracticesDocument184 pagesNgulchu Thogme Zangpo - The Thirty-Seven Bodhisattva PracticesMario Galle MPas encore d'évaluation

- Account Closure and Term Deposit Premature Withdrawal FormDocument2 pagesAccount Closure and Term Deposit Premature Withdrawal FormSonali SarkarPas encore d'évaluation

- Advanced Customer Service: Presented by Amgad Salah Senior Customer ServicesDocument45 pagesAdvanced Customer Service: Presented by Amgad Salah Senior Customer ServiceslovemagicPas encore d'évaluation

- Four stroke engine working cycle revolutions crankshaftDocument17 pagesFour stroke engine working cycle revolutions crankshaftshekhadaaPas encore d'évaluation

- Inside JobDocument3 pagesInside JobJT LoganPas encore d'évaluation

- Ombudsman Complaint - TolentinoDocument5 pagesOmbudsman Complaint - TolentinoReginaldo BucuPas encore d'évaluation

- DematclosuresDocument1 pageDematclosuresKartheek PatnanaPas encore d'évaluation

- Dem at ClosureDocument1 pageDem at ClosureSravan KumarPas encore d'évaluation

- Dematclosure PDFDocument1 pageDematclosure PDFmohanPas encore d'évaluation

- Dem at ClosureDocument1 pageDem at ClosureShadow GamingPas encore d'évaluation

- Dem at ClosureDocument1 pageDem at ClosureSiddharth JainPas encore d'évaluation

- ICICI Bank Limited CPC-Demat Account Closure FormDocument1 pageICICI Bank Limited CPC-Demat Account Closure FormAkash MishraPas encore d'évaluation

- Ddmmyyyy: Signature of Sole/First Holder Signature of Second Holder Signature of Third HolderDocument1 pageDdmmyyyy: Signature of Sole/First Holder Signature of Second Holder Signature of Third Holderqq453911Pas encore d'évaluation

- Dematclosure PDFDocument1 pageDematclosure PDFGaurav KumarPas encore d'évaluation

- Dematclosure PDFDocument1 pageDematclosure PDFPrateek GargPas encore d'évaluation

- Waterfall in DetailDocument1 pageWaterfall in DetailAkash MishraPas encore d'évaluation

- Dem at ClosureDocument1 pageDem at ClosureVishal YadavPas encore d'évaluation

- Dematclosure PDFDocument1 pageDematclosure PDFGaurav KumarPas encore d'évaluation

- ICICI Bank Limited CPC-Demat Account Closure FormDocument1 pageICICI Bank Limited CPC-Demat Account Closure FormAkash MishraPas encore d'évaluation

- Dematclosure PDFDocument1 pageDematclosure PDFBibhash Chandra MistryPas encore d'évaluation

- ICICI Bank Limited CPC-Demat Account Closure FormDocument1 pageICICI Bank Limited CPC-Demat Account Closure Formsujit patraPas encore d'évaluation

- ICICI Bank Limited CPC-Demat Account Closure FormDocument1 pageICICI Bank Limited CPC-Demat Account Closure FormVirat KohliPas encore d'évaluation

- Dematclosure PDFDocument1 pageDematclosure PDFGaurav KumarPas encore d'évaluation

- DematclosureDocument1 pageDematclosureVishal YadavPas encore d'évaluation

- ICICI Bank Limited CPC-Demat Account Closure FormDocument1 pageICICI Bank Limited CPC-Demat Account Closure FormPrateek GargPas encore d'évaluation

- Close ICICI Bank Demat AccountDocument1 pageClose ICICI Bank Demat AccountP Venu Gopala RaoPas encore d'évaluation

- Dematclosure 230818 131447Document2 pagesDematclosure 230818 131447amit kumarPas encore d'évaluation

- Term Deposit Related Requests FormDocument2 pagesTerm Deposit Related Requests Formmabu5Pas encore d'évaluation

- Dem at ClosureDocument3 pagesDem at ClosureArun SankarPas encore d'évaluation

- Term Deposit Related RequestsDocument2 pagesTerm Deposit Related Requestskumar281472Pas encore d'évaluation

- Account Closer Form TradeBullsDocument1 pageAccount Closer Form TradeBullsDeepa MistryPas encore d'évaluation

- Account Closure and Term Deposit Premature Withdrawal FormDocument2 pagesAccount Closure and Term Deposit Premature Withdrawal Formmod688104Pas encore d'évaluation

- Account Closure Form For Savings Current and Investment AccountDocument2 pagesAccount Closure Form For Savings Current and Investment AccountParikshit SachdevPas encore d'évaluation

- Account Closure FormDocument1 pageAccount Closure FormChetan ChaudhariPas encore d'évaluation

- Account Closure Request Form WellworthDocument1 pageAccount Closure Request Form WellworthHimanshuPas encore d'évaluation

- Account Closure FormDocument1 pageAccount Closure FormDineshya GPas encore d'évaluation

- Account Closure RequestDocument1 pageAccount Closure Requestpradeep kumarPas encore d'évaluation

- Account Closure FormDocument1 pageAccount Closure FormvarunPas encore d'évaluation

- Axis DP Closure Form CDSL FinalDocument1 pageAxis DP Closure Form CDSL FinalShridhar BhokrePas encore d'évaluation

- Bonanza COMBINE CLOSER FORM PDFDocument1 pageBonanza COMBINE CLOSER FORM PDFhimanshuextraPas encore d'évaluation

- Account Closure Request FormDocument2 pagesAccount Closure Request FormRahul NagaonkarPas encore d'évaluation

- Account Related Common Request FormDocument2 pagesAccount Related Common Request FormJephiasPas encore d'évaluation

- Account Closure FormDocument1 pageAccount Closure FormDeepak DevaprasadPas encore d'évaluation

- Casa Closure FormDocument1 pageCasa Closure FormAli SagarPas encore d'évaluation

- Demat ClosureDocument1 pageDemat ClosureSuleiman HaqPas encore d'évaluation

- Account Closing FormDocument1 pageAccount Closing Formrealsky77777Pas encore d'évaluation

- Ddmmyyyy: Application For Closing An Trading/ Demat Account (Resident Individual) To, Kotak Securities LTDDocument1 pageDdmmyyyy: Application For Closing An Trading/ Demat Account (Resident Individual) To, Kotak Securities LTDMohit SingalPas encore d'évaluation

- Account Closure Form PDFDocument1 pageAccount Closure Form PDFDeepal DhamejaPas encore d'évaluation

- Re_Activation_Dormant_Ac_form_Combine_2september_2021_v2Document1 pageRe_Activation_Dormant_Ac_form_Combine_2september_2021_v2syedumarahmed52Pas encore d'évaluation

- Es Direct Debit MandateDocument4 pagesEs Direct Debit Mandatecatherinecastillo914Pas encore d'évaluation

- Tattva Fincorp LTD - ProcessDocument28 pagesTattva Fincorp LTD - ProcessMADANMOHANREDDYPas encore d'évaluation

- DP & Trading Combine Closure Request Form - 0 PDFDocument2 pagesDP & Trading Combine Closure Request Form - 0 PDFJitendra Nath ChauhanPas encore d'évaluation

- DP & Trading Combine Closure Request Form - 0Document2 pagesDP & Trading Combine Closure Request Form - 0Harshal JadhavPas encore d'évaluation

- Standing Instructions Request FormDocument1 pageStanding Instructions Request FormMogli SinghPas encore d'évaluation

- Auto Debit Arrangement - 20190804 - 020707 PDFDocument4 pagesAuto Debit Arrangement - 20190804 - 020707 PDFKim Josashiwa BergulaPas encore d'évaluation

- Ada Form DownloadDocument1 pageAda Form DownloadDona DolorzoPas encore d'évaluation

- Service Request FormDocument1 pageService Request FormMamun RashedPas encore d'évaluation

- Combined Closure Tradinganddemat RSL 005124Document1 pageCombined Closure Tradinganddemat RSL 005124rakshit_2000Pas encore d'évaluation

- Indusind Bank Customer-Request-FormDocument2 pagesIndusind Bank Customer-Request-FormShravani JayanthyPas encore d'évaluation

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaD'EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaPas encore d'évaluation

- Think Successfully: The Ultimate Credit Repair GuideD'EverandThink Successfully: The Ultimate Credit Repair GuidePas encore d'évaluation

- Book 1Document3 pagesBook 1Rahul SakareyPas encore d'évaluation

- Siloda KhurdDocument93 pagesSiloda KhurdRahul SakareyPas encore d'évaluation

- VLSI Design TechniquesDocument2 pagesVLSI Design TechniquesRahul SakareyPas encore d'évaluation

- RRB Section Engineer Previous PapersDocument8 pagesRRB Section Engineer Previous PapersbaneshPas encore d'évaluation

- Gmail - FW - Email Offer For AsstDocument3 pagesGmail - FW - Email Offer For AsstRahul SakareyPas encore d'évaluation

- RRB SE Solved Question PaperDocument8 pagesRRB SE Solved Question PaperRahul SakareyPas encore d'évaluation

- Enrollment Formkjg HolkarDocument2 pagesEnrollment Formkjg HolkarRahul SakareyPas encore d'évaluation

- Ibps Cwe - Po - MT - VDocument2 pagesIbps Cwe - Po - MT - VRahul SakareyPas encore d'évaluation

- Principal Holkar Science College receipt for exam fee paymentDocument1 pagePrincipal Holkar Science College receipt for exam fee paymentRahul SakareyPas encore d'évaluation

- Slide 5B - Generate StatementsDocument14 pagesSlide 5B - Generate StatementsRahul SakareyPas encore d'évaluation

- RRB Junior Engineers Practice Questions PDFDocument8 pagesRRB Junior Engineers Practice Questions PDFjenidaniPas encore d'évaluation

- Slide 1 - VHDL IntroductionDocument11 pagesSlide 1 - VHDL IntroductionRahul SakareyPas encore d'évaluation

- RRB Mechanical Engineer Solved Model Paper 1Document40 pagesRRB Mechanical Engineer Solved Model Paper 1Arun Prakash NatesanPas encore d'évaluation

- Ad DKYDDocument1 pageAd DKYDRahul SakareyPas encore d'évaluation

- 1Document1 page1Rahul SakareyPas encore d'évaluation

- Property Tax 15-16Document1 pageProperty Tax 15-16Rahul SakareyPas encore d'évaluation

- RRB Mechanical Engineer Solved Model Paper 1Document40 pagesRRB Mechanical Engineer Solved Model Paper 1Arun Prakash NatesanPas encore d'évaluation

- PassportApplicationForm Main English V2.0Document1 pagePassportApplicationForm Main English V2.0Rahul SakareyPas encore d'évaluation

- Appointment RecieptDocument3 pagesAppointment RecieptRahul SakareyPas encore d'évaluation

- 12B253 BE IV Examination APR - MAY 2012 E&I Engg: 4EI-302, Sample Data and Non Linear Control System Time: 3Hrs. MM-100Document23 pages12B253 BE IV Examination APR - MAY 2012 E&I Engg: 4EI-302, Sample Data and Non Linear Control System Time: 3Hrs. MM-100Rahul SakareyPas encore d'évaluation

- Resume Shubham NeemaDocument2 pagesResume Shubham NeemaRahul SakareyPas encore d'évaluation

- Meaning of National AnthemDocument1 pageMeaning of National Anthemmanishchaudhry73Pas encore d'évaluation

- Resume - Siddhant TiwariDocument1 pageResume - Siddhant TiwariRahul SakareyPas encore d'évaluation

- Amravati Indore - 09 May 2015Document3 pagesAmravati Indore - 09 May 2015Rahul SakareyPas encore d'évaluation

- Ad DKYDDocument1 pageAd DKYDRahul SakareyPas encore d'évaluation

- FromDocument2 pagesFromRahul SakareyPas encore d'évaluation

- 1418736962963Document3 pages1418736962963Rahul SakareyPas encore d'évaluation

- PassportApplicationForm Main English V2.0Document1 pagePassportApplicationForm Main English V2.0Rahul SakareyPas encore d'évaluation

- Homework 2.Document11 pagesHomework 2.Berson Pallani IhuePas encore d'évaluation

- The Slow Frog An Intraday Trading Strategy: A Rules Based Intra-Day Trading Strategy (Ver 1.0)Document17 pagesThe Slow Frog An Intraday Trading Strategy: A Rules Based Intra-Day Trading Strategy (Ver 1.0)ticman123Pas encore d'évaluation

- Ecocritical Approach To Literary Text Interpretation: Neema Bagula JimmyDocument10 pagesEcocritical Approach To Literary Text Interpretation: Neema Bagula JimmyhafizhPas encore d'évaluation

- Seife Progress TrackerDocument4 pagesSeife Progress TrackerngilaPas encore d'évaluation

- ICPC Members 24 July 2023Document6 pagesICPC Members 24 July 2023Crystal TsangPas encore d'évaluation

- Environmental PolicyLegislationRules & RegulationsDocument14 pagesEnvironmental PolicyLegislationRules & RegulationsNikin KannolliPas encore d'évaluation

- PMT Machines LTD Inspection and Test Plan For Bogie Frame FabricationDocument6 pagesPMT Machines LTD Inspection and Test Plan For Bogie Frame FabricationAMIT SHAHPas encore d'évaluation

- Who Am I Assignment InstructionsDocument2 pagesWho Am I Assignment Instructionslucassleights 1Pas encore d'évaluation

- Flowserve Corp Case StudyDocument3 pagesFlowserve Corp Case Studytexwan_Pas encore d'évaluation

- NSS 87Document2 pagesNSS 87Mahalakshmi Susila100% (1)

- Public-International-Law Reviewer Isagani Cruz - Scribd 2013 Public International Law (Finals) - Arellano ..Document1 pagePublic-International-Law Reviewer Isagani Cruz - Scribd 2013 Public International Law (Finals) - Arellano ..Lylanie Alexandria Yan GalaPas encore d'évaluation

- Chapter 3-Hedging Strategies Using Futures-29.01.2014Document26 pagesChapter 3-Hedging Strategies Using Futures-29.01.2014abaig2011Pas encore d'évaluation

- Interview - Duga, Rennabelle PDocument4 pagesInterview - Duga, Rennabelle PDuga Rennabelle84% (19)

- Network Marketing - Money and Reward BrochureDocument24 pagesNetwork Marketing - Money and Reward BrochureMunkhbold ShagdarPas encore d'évaluation

- Investment Decision RulesDocument113 pagesInvestment Decision RulesHuy PanhaPas encore d'évaluation

- City of Watertown Seasonal Collection of Brush and Green WasteDocument3 pagesCity of Watertown Seasonal Collection of Brush and Green WasteNewzjunkyPas encore d'évaluation

- Title:Football: Player:Cristiano Ronaldo Dos Santos AveroDocument60 pagesTitle:Football: Player:Cristiano Ronaldo Dos Santos AveroranvenderPas encore d'évaluation

- KSDL RameshDocument10 pagesKSDL RameshRamesh KumarPas encore d'évaluation

- Service Culture Module 2Document2 pagesService Culture Module 2Cedrick SedaPas encore d'évaluation

- LTD NotesDocument2 pagesLTD NotesDenis Andrew T. FloresPas encore d'évaluation

- PLAI 10 Point AgendaDocument24 pagesPLAI 10 Point Agendaapacedera689100% (2)

- Introduction to Social Media AnalyticsDocument26 pagesIntroduction to Social Media AnalyticsDiksha TanejaPas encore d'évaluation

- La Fuerza de La Fe, de La Esperanza y El AmorDocument2 pagesLa Fuerza de La Fe, de La Esperanza y El Amorandres diazPas encore d'évaluation