Académique Documents

Professionnel Documents

Culture Documents

HSL PCG "Currency Daily": 02 February, 2017

Transféré par

Dinesh ChoudharyDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

HSL PCG "Currency Daily": 02 February, 2017

Transféré par

Dinesh ChoudharyDroits d'auteur :

Formats disponibles

HSL PCG CURRENCY DAILY

02 February, 2017

PRIVATE CLIENT GROUP [PCG]

VIEW POINT

STRATEGY FOR THE DAY Rupee to Strengthen on Fiscal Prudence in Budget

The Indian rupee closed 0.57% stronger, the maximum in eight

GBPINR FEB FUT. month, against the US dollar on budget day as Mr. Jaitley targeted a

budget deficit of 3.2% of GDP for fiscal 2018, down from 3.5% this

BUY ARND 85.25 SL 84.95 TGT 85.65 fiscal year. The home currency closed at 67.48--a level last seen on

14 December 2016, up 0.58%, biggest gains since 25 May 2016,

MAJOR CURRENCY from its previous close of 67.87.

India's 10-year bond yield closed at 6.431% compared to its

Prev. Tuesday's close of 6.407%. The bond yield will rise to 6.7% by year-

Close Chg. % Chg. end in line with rising U.S. yields and oil prices.

Close

In absolute terms, the gross fiscal deficit is pegged at 5,465 billion

USDINR 67.475 67.865 -0.390 -0.57%

rupees ($80.9 billion) for fiscal 2018. Of this, just 3,482 billion

DXY INDX 99.590 99.641 -0.051 -0.05% rupees will be financed via net market borrowing (net of buybacks

EURUSD 1.078 1.077 0.001 0.11% and redemptions), which is 770 billion rupees lower relative to 4,252

GBPUSD 1.267 1.266 0.001 0.06% billion rupees budgeted for the current fiscal year. The reduction will

USDJPY 113.020 113.250 -0.230 -0.20% help lower yields on government securities and leave more room for

DG USDINR 67.549 67.664 -0.115 -0.17% the private sector to tap the financial market.

The one month forward USDINR NDF last quoted at 67.61 versus

GLOBAL INDICES yesterdays 67.67 indicating flat to negative start at domestic

bourses. However, the bias for the pair remains bearish with spot

dragging lower to a level of 67.32 while continue to get resistance at

Prev. 68.06, the short term moving average of 20 days.

Close Chg. % Chg.

Close

SGX NIFTY 8705.5 8739.0 -34 -0.38% Dollar Edges Lower As Fed Holds Rates Steady

NIFTY 8716.4 8561.3 155 1.81% The dollar slipped early today, edging back toward recent lows after

SENSEX 28141.6 27656.0 486 1.76% the Federal Reserve after maintain status quo.

HANG-SENG 23239.0 23318.4 -79 -0.34% U.S. central bankers left their benchmark lending rate unchanged on

Wednesday and used their statement to acknowledge that

NIKKEI 19099.9 19148.1 -48 -0.25%

sentiment has gained, and that inflation will rise to their 2% target

SHANGHAI 3159.2 3149.6 10 0.31% even with gradual adjustments in interest rates. They werent

S&P INDEX 2279.6 2278.9 1 0.03% impressed by the fourth-quarter bounce-back in business

DOW JONES 19890.9 19864.1 27 0.14% investment and continued to term it soft.

NASDAQ 5642.7 5614.8 28 0.50% The economic data yesterday reinforced views of economic

FTSE improvement. U.S. factory activity accelerated to more than a two-

7107.7 7099.2 9 0.12%

year high last month.

CAC 4794.6 4748.9 46 0.96%

The dollar index edged slightly lower to 99.59, back toward a more

DAX 11659.5 11535.3 124 1.08% than seven-week low of 99.430 plumbed on Tuesday.

PRIVATE CLIENT GROUP [PCG]

TECHNICAL OUTLOOK

SPOT USDINR DAILY CHART

Technical Observations

USDINR close below short term moving averages indicating near term weaker trend.

Momentum oscillators RSI given negative divergence suggesting weakness in the pair.

The pair could head lower towards 67.325, the previous bottom, and face resistance at 68.07.

The short term bias turn neutral to bearish with downside support at 67.3250 and 67.23 until it surpass 68.10.

PRIVATE CLIENT GROUP [PCG]

TECHNICAL LEVELS

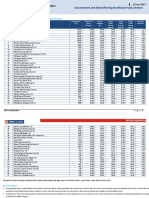

Contracts Last Pivot S3 S2 S1 R1 R2 R3 View For The Day

USDINR FEB17 67.68 67.74 67.40 67.54 67.61 67.81 67.95 68.02 Short Buildup

EURINR FEB17 73.12 73.16 72.82 72.95 73.03 73.25 73.38 73.46 Long Buildup

GBPINR FEB17 85.51 85.38 84.63 84.84 85.18 85.72 85.93 86.27 Unwinding

JPYINR FEB17 59.78 59.86 59.33 59.53 59.65 59.98 60.18 60.31 Short Buildup

Wkly Wkly 1-Mth. 1-Mth. 52 Wk 52 Wk

Spot 5 DMA 20 DMA 50 DMA 100 DMA 200 DMA

High Low High Low High Low

USDINR 68.23 68.02 68.39 67.48 68.86 66.07 67.88 68.06 68.06 67.46 67.23

EURINR 73.35 72.67 73.35 70.72 77.49 70.42 72.81 72.42 72.07 73.02 74.11

GBPINR 86.27 84.49 86.27 81.78 100.49 80.89 85.19 84.04 84.45 84.17 88.10

JPYINR 60.49 59.10 60.49 57.67 68.11 56.73 59.43 59.38 59.03 61.64 62.86

CURRENCY MOVEMENT

Abs Open Chg. in Chg. in

Currency Open High Low Close Volume

Chg. Interest OI Volume

SPOT USDINR 67.61 67.68 67.48 67.48 -0.39 -- -- -- --

USDINR FEB. FUT. 67.80 67.88 67.67 67.68 -0.39 1272365 148083 1291562 378241

SPOT EURINR 72.94 73.06 72.81 72.86 0.20 -- -- -- --

EURINR FEB. FUT. 73.19 73.29 73.08 73.12 0.20 58196 4358 38115 2986

SPOT GBPINR 85.08 85.33 84.74 85.26 0.88 -- -- -- --

GBPINR FEB. FUT. 85.13 85.59 85.05 85.51 0.81 38261 -3582 73085 -12053

SPOT JPYINR 59.86 59.87 59.52 59.55 -0.04 -- -- -- --

JPYINR FEB. FUT. 60.01 60.06 59.73 59.78 -0.03 22013 1244 25887 -20484

PRIVATE CLIENT GROUP [PCG]

ECONOMIC EVENTS RELEASED

Date Time Country Event Period Survey Actual Prior

02/01/2017 10:30 IN Nikkei India PMI Mfg. Jan -- 50.4 49.6

02/01/2017 14:30 EC Markit Eurozone Manufacturing PMI Jan F 55.1 55.2 55.1

02/01/2017 15:00 UK Markit UK PMI Manufacturing SA Jan 55.9 55.9 56.1

02/01/2017 17:30 US MBA Mortgage Applications 27-Jan -- -3.20% 4.00%

02/01/2017 18:45 US ADP Employment Change Jan 167k 246k 153k

02/01/2017 20:15 US Markit US Manufacturing PMI Jan F 55.1 55.0 55.1

02/01/2017 20:30 US ISM Manufacturing Jan 55 56.0 54.7

02/02/2017 00:30 US Fed Rate Feb 1 0.75% 0.75% 0.75%

ECONOMIC EVENTS TODAY

Date Time Country Event Period Survey Prior

02/02/2017 15:00 UK Markit/CIPS UK Construction PMI Jan 53.8 54.2

02/02/2017 17:30 UK Bank of England Bank Rate 2-Feb 0.25% 0.25%

02/02/2017 17:30 UK BOE Asset Purchase Target Feb 435b 435b

02/02/2017 17:30 UK BOE Corporate Bond Target Feb 10b 10b

02/02/2017 19:00 US Nonfarm Productivity 4Q P 0.90% 3.10%

02/02/2017 19:00 US Initial Jobless Claims 28-Jan 250k 259k

02/02/2017 19:00 US Continuing Claims 21-Jan -- 2100k

PRIVATE CLIENT GROUP [PCG]

Technical Analyst: Vinay Rajani (vinay.rajani@hdfcsec.com)

Currency Analyst: Dilip Parmar(dilip.parmar@hdfcsec.com)

HDFC securities Limited, I Think Techno Campus, Building - B, "Alpha", Office Floor 8, Near Kanjurmarg Station, Opp. Crompton Greaves, Kanjurmarg (East), Mumbai 400 042

HDFC securities Limited, 4th Floor, Astral Tower, Above HDFC Bank Ltd, Nr.Mithakhali Six Roads, Navrangpura, Ahmedabad 380009.

Phone: (079)66070168, Website: www.hdfcsec.com Email: pcg.advisory@hdfcsec.com

Disclosure:

I/We, Dilip Parmar and Vinay Rajani, MBA, hereby certify that all of the views expressed in this research report accurately reflect my views about the subject issuer (s) or securities. I also certify that no part of our

compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in his report.

Research Analyst or his/her relative does not have any financial interest in the subject company. Also HDFC Securities Ltd. or its Associate may have beneficial ownership of 1% or more in the subject instrument at the end of

the month immediately preceding the date of publication of the Research Report.

Further Research Analyst or his relative or HDFC Securities Ltd. or its associate does not have any material conflict of interest.

Any position in Instruments NO

Disclaimer:

This report has been prepared by HDFC Securities Ltd and is meant for sole use by the recipient and not for circulation. The information and opinions contained herein have been compiled or arrived at, based upon information

obtained in good faith from sources believed to be reliable. Such information has not been independently verified and no guaranty, representation of warranty, express or implied, is made as to its accuracy, completeness or

correctness. All such information and opinions are subject to change without notice. This document is for information purposes only. Descriptions of any company or companies or their securities mentioned herein are not

intended to be complete and this document is not, and should not be construed as an offer or solicitation of an offer, to buy or sell any securities or other financial instruments.

This report is not directed to, or intended for display, downloading, printing, reproducing or for distribution to or use by, any person or entity who is a citizen or resident or located in any locality, state, country or other

jurisdiction where such distribution, publication, reproduction, availability or use would be contrary to law or regulation or what would subject HDFC Securities Ltd or its affiliates to any registration or licensing requirement

within such jurisdiction.

If this report is inadvertently send or has reached any individual in such country, especially, USA, the same may be ignored and brought to the attention of the sender. This document may not be reproduced, distributed or

published for any purposes without prior written approval of HDFC Securities Ltd.

Foreign currencies denominated securities, wherever mentioned, are subject to exchange rate fluctuations, which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in

securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

It should not be considered to be taken as an offer to sell or a solicitation to buy any security. HDFC Securities Ltd may from time to time solicit from, or perform broking, or other services for, any company mentioned in this

mail and/or its attachments.

HDFC Securities and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the company(ies) mentioned herein or (b) be

engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or

lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions.

HDFC Securities Ltd, its directors, analysts or employees do not take any responsibility, financial or otherwise, of the losses or the damages sustained due to the investments made or any action taken on basis of this report,

including but not restricted to, fluctuation in the prices of shares and bonds, changes in the currency rates, diminution in the NAVs, reduction in the dividend or income, etc.

HDFC Securities Ltd and other group companies, its directors, associates, employees may have various positions in any of the stocks, securities and financial instruments dealt in the report, or may make sell or purchase or

other deals in these securities from time to time or may deal in other securities of the companies / organizations described in this report.

HDFC Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other assignment in the past twelve

months.

HDFC Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in respect of managing

or co-managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal course of business.

HDFC Securities or its analysts did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither HDFC

Securities nor Research Analysts have any material conflict of interest at the time of publication of this report. Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or

brokerage service transactions. HDFC Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report.

Research entity has not been engaged in market making activity for the subject company. Research analyst has not served as an officer, director or employee of the subject company. We have not received any

compensation/benefits from the Subject Company or third party in connection with the Research Report.

This report has been prepared by the PCG team of HDFC Securities Ltd. The views, opinions, estimates, ratings, target price, entry prices and/or other parameters mentioned in this document may or may not match or may

be contrary with those of the other Research teams (Institutional, Retail) of HDFC Securities Ltd.

"HDFC Securities Ltd. is a SEBI Registered Research Analyst having registration no. INH000002475.

PRIVATE CLIENT GROUP [PCG]

Vous aimerez peut-être aussi

- AD&D 2nd Edition - Dark Sun - Monstrous Compendium - Appendix II - Terrors Beyond Tyr PDFDocument130 pagesAD&D 2nd Edition - Dark Sun - Monstrous Compendium - Appendix II - Terrors Beyond Tyr PDFWannes Ikkuhyu100% (8)

- HSL PCG "Currency Daily": 03 February, 2017Document6 pagesHSL PCG "Currency Daily": 03 February, 2017Dinesh ChoudharyPas encore d'évaluation

- HSL PCG "Currency Daily": 08 December, 2016Document6 pagesHSL PCG "Currency Daily": 08 December, 2016shobhaPas encore d'évaluation

- HSL PCG "Currency Daily": 09 February, 2017Document6 pagesHSL PCG "Currency Daily": 09 February, 2017Dinesh ChoudharyPas encore d'évaluation

- HSL PCG "Currency Daily": 23 February, 2017Document6 pagesHSL PCG "Currency Daily": 23 February, 2017Dinesh ChoudharyPas encore d'évaluation

- HSL PCG "Currency Daily": 23 December, 2016Document6 pagesHSL PCG "Currency Daily": 23 December, 2016shobhaPas encore d'évaluation

- HSL PCG "Currency Daily": 27 December, 2016Document6 pagesHSL PCG "Currency Daily": 27 December, 2016shobhaPas encore d'évaluation

- HSL PCG "Currency Daily": 16 February, 2017Document6 pagesHSL PCG "Currency Daily": 16 February, 2017Dinesh ChoudharyPas encore d'évaluation

- HSL PCG "Currency Daily": 14 February, 2017Document6 pagesHSL PCG "Currency Daily": 14 February, 2017Dinesh ChoudharyPas encore d'évaluation

- HSL PCG "Currency Daily": 02 March, 2017Document6 pagesHSL PCG "Currency Daily": 02 March, 2017Dinesh ChoudharyPas encore d'évaluation

- HSL PCG "Currency Daily": 01 March, 2017Document6 pagesHSL PCG "Currency Daily": 01 March, 2017Dinesh ChoudharyPas encore d'évaluation

- HSL PCG "Currency Daily": 19 October, 2016Document6 pagesHSL PCG "Currency Daily": 19 October, 2016khaniyalalPas encore d'évaluation

- HSL PCG "Currency Daily": 23 November, 2016Document6 pagesHSL PCG "Currency Daily": 23 November, 2016khaniyalalPas encore d'évaluation

- HSL PCG "Currency Daily": 06 January, 2017Document6 pagesHSL PCG "Currency Daily": 06 January, 2017arun_algoPas encore d'évaluation

- HSL PCG "Currency Daily": 20 December, 2016Document6 pagesHSL PCG "Currency Daily": 20 December, 2016shobhaPas encore d'évaluation

- HSL PCG "Currency Daily": 17 February, 2017Document6 pagesHSL PCG "Currency Daily": 17 February, 2017Dinesh ChoudharyPas encore d'évaluation

- HSL PCG "Currency Daily": 19 January, 2017Document6 pagesHSL PCG "Currency Daily": 19 January, 2017arun_algoPas encore d'évaluation

- HSL PCG "Currency Daily": 17 November, 2016Document6 pagesHSL PCG "Currency Daily": 17 November, 2016khaniyalalPas encore d'évaluation

- HSL PCG "Currency Daily": 31 January, 2017Document6 pagesHSL PCG "Currency Daily": 31 January, 2017arun_algoPas encore d'évaluation

- HSL PCG "Currency Daily": 08 February, 2017Document6 pagesHSL PCG "Currency Daily": 08 February, 2017Dinesh ChoudharyPas encore d'évaluation

- HSL PCG "Currency Daily": 28 February, 2017Document6 pagesHSL PCG "Currency Daily": 28 February, 2017Dinesh ChoudharyPas encore d'évaluation

- HSL PCG "Currency Daily": 29 December, 2016Document6 pagesHSL PCG "Currency Daily": 29 December, 2016shobhaPas encore d'évaluation

- HSL PCG "Currency Daily": 29 November, 2016Document6 pagesHSL PCG "Currency Daily": 29 November, 2016khaniyalalPas encore d'évaluation

- HSL PCG "Currency Daily": 24 January, 2017Document6 pagesHSL PCG "Currency Daily": 24 January, 2017arun_algoPas encore d'évaluation

- HSL PCG "Currency Daily": 03 March, 2017Document6 pagesHSL PCG "Currency Daily": 03 March, 2017Dinesh ChoudharyPas encore d'évaluation

- HSL PCG "Currency Daily": 16 December, 2016Document6 pagesHSL PCG "Currency Daily": 16 December, 2016shobhaPas encore d'évaluation

- HSL PCG "Currency Daily": 18 November, 2016Document6 pagesHSL PCG "Currency Daily": 18 November, 2016khaniyalalPas encore d'évaluation

- HSL PCG "Currency Daily": 05 January, 2017Document6 pagesHSL PCG "Currency Daily": 05 January, 2017arun_algoPas encore d'évaluation

- HSL PCG "Currency Daily": 30 November, 2016Document6 pagesHSL PCG "Currency Daily": 30 November, 2016khaniyalalPas encore d'évaluation

- HSL PCG "Currency Daily": 01 December, 2016Document6 pagesHSL PCG "Currency Daily": 01 December, 2016khaniyalalPas encore d'évaluation

- HSL PCG "Currency Daily": 20 January, 2017Document6 pagesHSL PCG "Currency Daily": 20 January, 2017arun_algoPas encore d'évaluation

- HSL PCG "Currency Daily": 25 November, 2016Document6 pagesHSL PCG "Currency Daily": 25 November, 2016khaniyalalPas encore d'évaluation

- HSL PCG "Currency Daily": 28 December, 2016Document6 pagesHSL PCG "Currency Daily": 28 December, 2016shobhaPas encore d'évaluation

- HSL PCG "Currency Daily": 06 December, 2016Document6 pagesHSL PCG "Currency Daily": 06 December, 2016shobhaPas encore d'évaluation

- HSL PCG "Currency Daily": 11 January, 2017Document6 pagesHSL PCG "Currency Daily": 11 January, 2017arun_algoPas encore d'évaluation

- HSL PCG "Currency Daily": 15 December, 2016Document6 pagesHSL PCG "Currency Daily": 15 December, 2016shobhaPas encore d'évaluation

- HSL PCG "Currency Daily": 10 January, 2017Document6 pagesHSL PCG "Currency Daily": 10 January, 2017arun_algoPas encore d'évaluation

- HSL PCG "Currency Daily": 18 October, 2016Document6 pagesHSL PCG "Currency Daily": 18 October, 2016khaniyalalPas encore d'évaluation

- HSL PCG "Currency Daily": 26 October, 2016Document6 pagesHSL PCG "Currency Daily": 26 October, 2016khaniyalalPas encore d'évaluation

- HSL PCG "Currency Daily": 03 November, 2016Document6 pagesHSL PCG "Currency Daily": 03 November, 2016khaniyalalPas encore d'évaluation

- HSL PCG "Currency Daily": 21 October, 2016Document6 pagesHSL PCG "Currency Daily": 21 October, 2016khaniyalalPas encore d'évaluation

- HSL PCG "Currency Daily": 22 February, 2017Document6 pagesHSL PCG "Currency Daily": 22 February, 2017Dinesh ChoudharyPas encore d'évaluation

- HSL PCG "Currency Daily": 14 December, 2016Document6 pagesHSL PCG "Currency Daily": 14 December, 2016shobhaPas encore d'évaluation

- HSL PCG "Currency Daily": 17 January, 2017Document6 pagesHSL PCG "Currency Daily": 17 January, 2017arun_algoPas encore d'évaluation

- HSL PCG "Currency Daily": 02 December, 2016Document6 pagesHSL PCG "Currency Daily": 02 December, 2016khaniyalalPas encore d'évaluation

- HSL PCG "Currency Daily": 12 January, 2017Document6 pagesHSL PCG "Currency Daily": 12 January, 2017shobhaPas encore d'évaluation

- HSL PCG "Currency Daily": 25 January, 2017Document6 pagesHSL PCG "Currency Daily": 25 January, 2017arun_algoPas encore d'évaluation

- HSL PCG "Currency Daily": 18 January, 2017Document6 pagesHSL PCG "Currency Daily": 18 January, 2017arun_algoPas encore d'évaluation

- HSL PCG "Currency Insight"-Weekly: 07 January, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 07 January, 2017arun_algoPas encore d'évaluation

- HSL PCG "Currency Insight"-Weekly: 26 December, 2016Document16 pagesHSL PCG "Currency Insight"-Weekly: 26 December, 2016arun_algoPas encore d'évaluation

- HSL PCG "Currency Insight"-Weekly: 24 October, 2016Document16 pagesHSL PCG "Currency Insight"-Weekly: 24 October, 2016khaniyalalPas encore d'évaluation

- HSL PCG "Currency Insight"-Weekly: 13 February, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 13 February, 2017Dinesh ChoudharyPas encore d'évaluation

- HSL PCG "Currency Insight"-Weekly: 18 February, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 18 February, 2017Dinesh ChoudharyPas encore d'évaluation

- HSL PCG "Currency Insight"-Weekly: 04 February, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 04 February, 2017Dinesh ChoudharyPas encore d'évaluation

- HSL PCG "Currency Daily": 08 November, 2016Document6 pagesHSL PCG "Currency Daily": 08 November, 2016khaniyalalPas encore d'évaluation

- HSL PCG "Currency Insight"-Weekly: 03 December, 2016Document16 pagesHSL PCG "Currency Insight"-Weekly: 03 December, 2016shobhaPas encore d'évaluation

- Weekly Capital Market Report - Week Ending 30.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 30.09.2022Fuaad DodooPas encore d'évaluation

- Weekly Capital Market Report - Week Ending 08.07.2022Document2 pagesWeekly Capital Market Report - Week Ending 08.07.2022Fuaad DodooPas encore d'évaluation

- Weekly Capital Market Report - Week Ending 11.02.2022Document2 pagesWeekly Capital Market Report - Week Ending 11.02.2022Fuaad DodooPas encore d'évaluation

- Market Outlook For 09 Dec - Cautiously OptimisticDocument5 pagesMarket Outlook For 09 Dec - Cautiously OptimisticMansukh Investment & Trading SolutionsPas encore d'évaluation

- David Windover-The Triangle Trading Method-EnDocument156 pagesDavid Windover-The Triangle Trading Method-EnDinesh Choudhary0% (1)

- FAQ - Related To Forensic Audit Resolution Plans and Additional InformationDocument2 pagesFAQ - Related To Forensic Audit Resolution Plans and Additional InformationDinesh ChoudharyPas encore d'évaluation

- All About Forensic AuditDocument8 pagesAll About Forensic AuditDinesh ChoudharyPas encore d'évaluation

- Equity Linked Savings Schemes (ELSS) : Retail ResearchDocument4 pagesEquity Linked Savings Schemes (ELSS) : Retail ResearchDinesh ChoudharyPas encore d'évaluation

- Retail Research: Franklin India Prima Plus FundDocument3 pagesRetail Research: Franklin India Prima Plus FundDinesh ChoudharyPas encore d'évaluation

- Safe Software FME Desktop v2018Document1 pageSafe Software FME Desktop v2018Dinesh ChoudharyPas encore d'évaluation

- MotiveWave Volume AnalysisDocument49 pagesMotiveWave Volume AnalysisDinesh ChoudharyPas encore d'évaluation

- Retail Research: Identifying Turnaround Equity Mutual Fund SchemesDocument4 pagesRetail Research: Identifying Turnaround Equity Mutual Fund SchemesDinesh ChoudharyPas encore d'évaluation

- ApplicationForm (GH FLATS)Document15 pagesApplicationForm (GH FLATS)Dinesh ChoudharyPas encore d'évaluation

- Retail Research: MF Ready ReckonerDocument3 pagesRetail Research: MF Ready ReckonerDinesh ChoudharyPas encore d'évaluation

- Shift in Sectors by Mutual Funds Over Quarters: Retail ResearchDocument1 pageShift in Sectors by Mutual Funds Over Quarters: Retail ResearchDinesh ChoudharyPas encore d'évaluation

- Monthly Report - Nov 2016: Retail ResearchDocument10 pagesMonthly Report - Nov 2016: Retail ResearchDinesh ChoudharyPas encore d'évaluation

- Equity MF SIP Baskets For 2017: Retail ResearchDocument2 pagesEquity MF SIP Baskets For 2017: Retail ResearchDinesh ChoudharyPas encore d'évaluation

- Retail Research: Changes in Shareholding in Listed Companies by MF Industry During June '16 QuarterDocument8 pagesRetail Research: Changes in Shareholding in Listed Companies by MF Industry During June '16 QuarterDinesh ChoudharyPas encore d'évaluation

- Retail Research: Concentrated and Diversified Equity Mutual Fund SchemesDocument4 pagesRetail Research: Concentrated and Diversified Equity Mutual Fund SchemesDinesh ChoudharyPas encore d'évaluation

- Retail Research: SIP in Equity Schemes - A Ready ReckonerDocument6 pagesRetail Research: SIP in Equity Schemes - A Ready ReckonerDinesh ChoudharyPas encore d'évaluation

- Post Budget Impact Analysis - MF & Debt: Retail ResearchDocument2 pagesPost Budget Impact Analysis - MF & Debt: Retail ResearchDinesh ChoudharyPas encore d'évaluation

- Report PDFDocument10 pagesReport PDFDinesh ChoudharyPas encore d'évaluation

- HSL PCG "Currency Insight"-Weekly: 04 February, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 04 February, 2017Dinesh ChoudharyPas encore d'évaluation

- Report PDFDocument3 pagesReport PDFDinesh ChoudharyPas encore d'évaluation

- HSL PCG "Currency Daily": 01 March, 2017Document6 pagesHSL PCG "Currency Daily": 01 March, 2017Dinesh ChoudharyPas encore d'évaluation

- HSL PCG "Currency Daily": 28 February, 2017Document6 pagesHSL PCG "Currency Daily": 28 February, 2017Dinesh ChoudharyPas encore d'évaluation

- Indian Currency Market: Retail ResearchDocument6 pagesIndian Currency Market: Retail ResearchDinesh ChoudharyPas encore d'évaluation

- HSL PCG "Currency Daily": 08 February, 2017Document6 pagesHSL PCG "Currency Daily": 08 February, 2017Dinesh ChoudharyPas encore d'évaluation

- HSL PCG "Currency Daily": 02 March, 2017Document6 pagesHSL PCG "Currency Daily": 02 March, 2017Dinesh ChoudharyPas encore d'évaluation

- Functions of Ecgc and Exim BankDocument12 pagesFunctions of Ecgc and Exim BankbhumishahPas encore d'évaluation

- 08 Night 09 Days Ujjain & Omkareshwar Tour Package - Travel HuntDocument5 pages08 Night 09 Days Ujjain & Omkareshwar Tour Package - Travel HuntsalesPas encore d'évaluation

- Population Viability Analysis Part ADocument3 pagesPopulation Viability Analysis Part ANguyễn Phương NgọcPas encore d'évaluation

- 160 LW Bending Tester v2.0Document4 pages160 LW Bending Tester v2.0Sá StrapassonPas encore d'évaluation

- An Improved Version of The Skin Chapter of Kent RepertoryDocument6 pagesAn Improved Version of The Skin Chapter of Kent RepertoryHomoeopathic PulsePas encore d'évaluation

- Gallery IsKCON Desire Tree PDF MudrasDocument2 pagesGallery IsKCON Desire Tree PDF MudrassanatanPas encore d'évaluation

- Occupant Response To Vehicular VibrationDocument16 pagesOccupant Response To Vehicular VibrationAishhwarya Priya100% (1)

- National ScientistDocument2 pagesNational ScientistHu T. BunuanPas encore d'évaluation

- Chapter 2-EER and Relational Database SchemaDocument146 pagesChapter 2-EER and Relational Database Schemagirmay tadesePas encore d'évaluation

- ICT LegalEthical Issue PowerPoint PresentationDocument4 pagesICT LegalEthical Issue PowerPoint PresentationReydan MaravePas encore d'évaluation

- Project Dayan PrathaDocument29 pagesProject Dayan PrathaSHREYA KUMARIPas encore d'évaluation

- Calcutta Bill - Abhimanyug@Document2 pagesCalcutta Bill - Abhimanyug@abhimanyugirotraPas encore d'évaluation

- Breast Cancer ChemotherapyDocument7 pagesBreast Cancer Chemotherapydini kusmaharaniPas encore d'évaluation

- Types of CostsDocument9 pagesTypes of CostsPrathna AminPas encore d'évaluation

- Rainfall Runoff ModellingDocument23 pagesRainfall Runoff ModellingmansikakaniPas encore d'évaluation

- Consumer Trend Canvas (CTC) Template 2022Document1 pageConsumer Trend Canvas (CTC) Template 2022Patricia DominguezPas encore d'évaluation

- Chapter 5, 6Document4 pagesChapter 5, 6anmar ahmedPas encore d'évaluation

- PDF Certificacion 3dsmaxDocument2 pagesPDF Certificacion 3dsmaxAriel Carrasco AlmanzaPas encore d'évaluation

- Secant Method - Derivation: A. Bracketing MethodsDocument5 pagesSecant Method - Derivation: A. Bracketing MethodsStephen Dela CruzPas encore d'évaluation

- Development Communication Theories MeansDocument13 pagesDevelopment Communication Theories MeansKendra NodaloPas encore d'évaluation

- Yahoo Tab NotrumpDocument139 pagesYahoo Tab NotrumpJack Forbes100% (1)

- ECON 4035 - Excel GuideDocument13 pagesECON 4035 - Excel GuideRosario Rivera NegrónPas encore d'évaluation

- 9 Prospect EvaluationDocument40 pages9 Prospect EvaluationgeorgiadisgPas encore d'évaluation

- Power System Planning Lec5aDocument15 pagesPower System Planning Lec5aJoyzaJaneJulaoSemillaPas encore d'évaluation

- The Distracted Mind - ExcerptDocument15 pagesThe Distracted Mind - Excerptwamu885Pas encore d'évaluation

- Paper 2Document8 pagesPaper 2Antony BrownPas encore d'évaluation

- Deeg Palace Write-UpDocument7 pagesDeeg Palace Write-UpMuhammed Sayyaf AcPas encore d'évaluation

- Victor Nee (Editor) - Richard Swedberg (Editor) - The Economic Sociology of Capitalism-Princeton University Press (2020)Document500 pagesVictor Nee (Editor) - Richard Swedberg (Editor) - The Economic Sociology of Capitalism-Princeton University Press (2020)Tornike ChivadzePas encore d'évaluation

- The Impact of Video Gaming To The Academic Performance of The Psychology Students in San Beda UniversityDocument5 pagesThe Impact of Video Gaming To The Academic Performance of The Psychology Students in San Beda UniversityMarky Laury GameplaysPas encore d'évaluation