Académique Documents

Professionnel Documents

Culture Documents

MR SB High Dividend Fund April

Transféré par

Anonymous xcFcOgMiCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

MR SB High Dividend Fund April

Transféré par

Anonymous xcFcOgMiDroits d'auteur :

Formats disponibles

SECURITY BANK CORPORATION

SB High Dividend Peso Equity Fund

Key Information and Investment Disclosure Statement

Month Ended of 29 April 2016

FUND FACTS

Classification: Peso Equity Fund Net Asset Value Per Unit: 1.036430

Launch Date: 10 March 2014 Total Fund NAV: Php 2,519.63 million

Minimum Investment: Php 10,000 Dealing Period 9:00 am 1:30 pm any banking day

Minimum Additional Investment: Php 5,000 Trust Fee: 1.50% p.a.

Bloomberg Ticker: SBPSHDF PM Equity Redemption Settlement: Four (4) banking days after the

redemption date

FEES*

Trustee Fee Custodianship External Auditor Fee

0.1232% 0.0026% 0.0001%

Security Bank Corporation HSBC SGV &Co.

*As a percentage of average daily NAV for the quarter valued at Php 2,542.28 million.

INVESTMENT OBJECTIVE AND STRATEGY

SB High Dividend Peso Equity Fund aims to achieve total returns through income growth and long-term capital

appreciation by investing in listed equity securities of Philippine companies that offer high dividend payouts (Equities).

At least 70% of the Funds investment should be in Equities. The Fund aims to surpass its benchmark (gross of fees)

which is 90% Philippine Stock Exchange Index (price only return) + 10% O/N Special Savings Account (net of

withholding tax).

CLIENT SUITABILITY

A client profiling process should be performed prior to participating in the Fund to guide the prospective investor if the

Fund is suited to his/her investment objectives and risk tolerance. Clients are advised to read the Declaration of

Trust/Plan Rules of the Fund, which may be obtained from the Trustee, before deciding to invest.

SB High Dividend Peso Equity Fund is suitable only for investors who:

Have an aggressive risk tolerance.

Seek potentially higher yields from dividends as well as from stock price appreciation.

Have the possibility to be exposed to capital losses given the volatility nature of the local equities markets.

Have an investment horizon of one (1) to three (3) years.

KEY RISKS AND RISK MANAGEMENT

You should not invest in this fund if you do not understand or are not comfortable with the accompanying risks.

Market | Price Risk The possibility for an investor to experience losses due to changes in market prices of equities or

bonds.

Liquidity Risk The possibility for an investor to experience losses due to inability to sell or convert assets into cash

immediately or in instances where conversion to cash is possible but at a loss.

THE UIT FUND IS NOT A DEPOSIT AND IS NOT INSURED BY THE PHILIPPINE DEPOSIT INSURANCE

CORPORATION (PDIC).

RETURNS CANNOT BE GUARANTEED AND HISTORICAL NAVPU IS FOR ILLUSTRATION OF NAVPU

MOVEMENTS/FLUCTUATIONS ONLY.

WHEN REDEEMING, THE PROCEEDS MAY BE WORTH LESS THAN THE ORIGINAL INVESTMENT AND ANY

LOSSES WILL BE SOLELY FOR THE ACCOUNT OF THE CLIENT.

THE TRUSTEE IS NOT LIABLE FOR ANY LOSS UNLESS UPON WILLFUL DEFAULT, BAD FAITH OR GROSS

NEGLIGENCE.

For more information, visit our website at www.securitybank.com or call (02) 888 7378 email us at trustmarketing@securitybank.com

SB FUNDS | SB HIGH DIVIDEND PESO EQUITY FUND

FUND PERFORMANCE AND STATISTICS AS OF 29 APRIL 2016

For reference purposes only and not a guarantee of future returns.

NAVPU Graph NAVPU over the past 12 months

1.3800 Highest 1.302733

SB High Dividend Equity

Fund Lowest 0.900832

Benchmark

1.2600 Statistics

*Volatility, Past Year 19.28 %

1.1400 **Sharpe Ratio (1.05)

***Information Ratio (1.33)

1.0200

*Volatility measures the degree to which the fund fluctuates vis--vis its

average return over a period of time.

0.9000 **Sharpe Ratio is used to characterize how well the return of a Fund

compensates the investor for the level of risk taken. The higher the

number, the better.

***Information Ratio measures reward-to-risk efficiency of the portfolio

relative to the benchmark. The higher the number, the higher the reward

per unit of risk.

Top 10 Holdings

Cumulative Performance Cebu Pacific Air, Inc. 6.30%

Period 1Mo 3Mo 6Mo 1Y 3Y Ayala Land, Inc. 6,25%

Fund -1.49% 8.10% -5.22% -19.38% N/A Ayala Corporation 4.56%

Benchmark -1.27% 6.36% 0.42% -6.32% N/A DNL Industries 4.40%

Aboitiz Power Corporation 4.29%

Portfolio Composition SM Investments 4.10%

SM Prime Holdings 4.07%

Industrial 26.0% Semirara Mining 3.74%

Cash & Globe Telecom 3.72%

Cash Services 20.1%

Equities Equivale Trans Asia Oil & Energy 3.62%

84.5% nts

15.5%

Holdings Firms 17.0%

Property 15.6%

Mining and Oil 3.7%

Financials 2.0%

OUTLOOK AND STRATEGY

The Index consolidated in April after seeing a rally of 8.9% in March. Market players decided to stay on the sidelines ahead of the May

national elections and on lack of domestic catalysts. The PSEi dropped -1.42% for the month to end at 7,159.29, bringing total year-to-

date returns at 2.98%. In terms of flows, foreign funds were net sellers for the month with Php 1.54 bn leaving the market. Index heavy

weights AEV (+2.15%) and JGS (+2.71%) both rose primarily driven by passive flows. Trading lacked conviction as volumes were thin,

the total average value turnover was registered at Php 6.04 bn. Top index performers for the month of April include: MER (+6.19%),

EMP (+4.75%), BPI (+4.02%), PCOR (+3.50%) and SMPH (+3.19%). On the other hand, worst index performers were: BLOOM

(-17.28%), TEL (-13.28%), SMC (-12.99%), AGI (-12.12%) and MEG (-9.16%).

Entering May, we remain cautiously optimistic due to the uncertainty regarding the Philippine presidential elections. While Philippine

macro fundamentals remain healthy, markets will probably remain volatile as politics has become extremely divisive with the race to

the top positions being hotly contested. Approaching Election Day, we look to raise ample cash in order to take advantage of possible

dips in the market. In the event of clean and peaceful elections, we look to redeploy into fundamentally sound names. We continue to

gravitate towards large cap index names due to their relatively higher liquidity. The consumer sector remains highly favoured given its

healthy earnings growth and its defensive nature. Historically, the market has always rallied post-election and this year should be no

different as long as the political transition remains orderly and the new government implements much needed reforms.

INVESTMENT POLICY / PROSPECTIVE INVESTMENTS

The Fund may be invested allowed under regulations issued by the BSP relating to investment quality and their being subject to

marked-to-market valuation, where deemed applicable thereof and shall be in the form of any of the following:

(1) Common shares, Preferred shares, Convertible preferred shares listed in the Philippine Stock Exchange;(2) Shares offered in an

initial public offering (IPO) provided that the company will be listed on the Philippine Stock Exchange within the normal listed period

(approximately 30 days from the start of the offer period); (3) Exchange listed fixed income securities ; (4) Marketable instruments that

are traded in an organized exchange ; (5) Savings/Checking accounts and/or time deposits in any bank or financial institution,

including Security Bank Corporation ; (6) Various collective investment schemes available to the local investing public and in the

Philippine market, provided that such pooled funds shall be of similar portfolio structure as the Fund; (7) The Fund may avail of

financial derivatives solely for the purpose of hedging risk exposure of the existing investments of the Fund, in accordance with

existing BSP hedging guidelines and the Trustees risk management and hedging policy approved by the Trust Committee and

disclosed to fund participants. (8) Such other tradable investment outlets/categories as the BSP may allow.

RELATED TRANSACTIONS

The Fund has investments with Security Bank Corporation, in the amount of: Php 212 million in deposits. Investments in

the said outlets were approved by the Trust Committee. Likewise, all related party transactions are conducted on an

arms length and best execution basis and within established limits.

For more information, visit our website at www.securitybank.com or call (02) 888 7378 email us at trustmarketing@securitybank.com

Vous aimerez peut-être aussi

- In Search of Returns 2e: Making Sense of Financial MarketsD'EverandIn Search of Returns 2e: Making Sense of Financial MarketsPas encore d'évaluation

- Classification: Long Term Bond Net Asset Value Per Unit: 1.884264 FundDocument2 pagesClassification: Long Term Bond Net Asset Value Per Unit: 1.884264 FundJobert DiliPas encore d'évaluation

- Bdo Peso Money Market Fund: As A Percentage of Average Daily NAV For The Month Valued at PHP 85.457 BillionDocument7 pagesBdo Peso Money Market Fund: As A Percentage of Average Daily NAV For The Month Valued at PHP 85.457 Billionk100% (1)

- PNB Peso Fixed Income Fund PDFDocument3 pagesPNB Peso Fixed Income Fund PDFJj PahudpodPas encore d'évaluation

- Eq - Uitf - Bpi Invest Phdef Jan 2021Document3 pagesEq - Uitf - Bpi Invest Phdef Jan 2021janeneveraPas encore d'évaluation

- BPI Philippine High Dividend Equity Fund - November 2023 v2Document3 pagesBPI Philippine High Dividend Equity Fund - November 2023 v2Gabrielle De VeraPas encore d'évaluation

- FI - UITF - BPI Money Market Fund - May 2017Document3 pagesFI - UITF - BPI Money Market Fund - May 2017Yanyan RivalPas encore d'évaluation

- 6 - Kiid - Uitf - Eq - Bpi Eq - Jun2015Document3 pages6 - Kiid - Uitf - Eq - Bpi Eq - Jun2015Nonami AbicoPas encore d'évaluation

- BDO Equity FundDocument4 pagesBDO Equity FundKurt YuPas encore d'évaluation

- BPI Equity Value Fund - November 2023 v2Document3 pagesBPI Equity Value Fund - November 2023 v2Lexter Renzo RamosPas encore d'évaluation

- Key Information and Investment Disclosure Statement: Metro World Equity Feeder FundDocument3 pagesKey Information and Investment Disclosure Statement: Metro World Equity Feeder FundMartin MartelPas encore d'évaluation

- EQIF LatestDocument4 pagesEQIF LatestDxtr V DrnPas encore d'évaluation

- Bdo Esg Equity Fund: As A Percentage of Average Daily NAV For The Month Valued at PHP 117.841 MillionDocument4 pagesBdo Esg Equity Fund: As A Percentage of Average Daily NAV For The Month Valued at PHP 117.841 Millionfrancis280Pas encore d'évaluation

- BPI Global Equity Fund of Funds - September 2023 v2Document4 pagesBPI Global Equity Fund of Funds - September 2023 v2Ramon VinzonPas encore d'évaluation

- Metrobank Money Market FundDocument3 pagesMetrobank Money Market FundExequielCamisaCrusperoPas encore d'évaluation

- Bdo Focused Equity Fund: As A Percentage of Average Daily NAV For The Month Valued at PHP 0.999 BillionDocument4 pagesBdo Focused Equity Fund: As A Percentage of Average Daily NAV For The Month Valued at PHP 0.999 BillionDxtr V DrnPas encore d'évaluation

- Atram Global Dividend Feeder Fund Kiids - Dec 2021Document4 pagesAtram Global Dividend Feeder Fund Kiids - Dec 2021jvPas encore d'évaluation

- Eq Uitf Bpi Gefof Nov 2017Document4 pagesEq Uitf Bpi Gefof Nov 2017Jelor GallegoPas encore d'évaluation

- First Metro Save and Learn Fixed Income FundDocument1 pageFirst Metro Save and Learn Fixed Income FundkimencinaPas encore d'évaluation

- EQIF LatestDocument4 pagesEQIF LatestBryan SalamatPas encore d'évaluation

- Bpi Us Equity Index Feeder Fund Key Information and Investment Disclosure Statement As of July 31, 2018 Fund FactsDocument3 pagesBpi Us Equity Index Feeder Fund Key Information and Investment Disclosure Statement As of July 31, 2018 Fund FactsMartin MartelPas encore d'évaluation

- ATRAM GLOBAL ALLOCATION FEEDER FUND KIIDS (USD) - Oct 2021Document5 pagesATRAM GLOBAL ALLOCATION FEEDER FUND KIIDS (USD) - Oct 2021Glenda ReyesPas encore d'évaluation

- Atc MM Combined Kiids Rda PtaDocument12 pagesAtc MM Combined Kiids Rda PtaronPas encore d'évaluation

- Fact Sheet - HSBC Islamic Global 2021equity Index Fund Legal General Pension PMC HSBC Islamic Global Equity Index Fund 3Document3 pagesFact Sheet - HSBC Islamic Global 2021equity Index Fund Legal General Pension PMC HSBC Islamic Global Equity Index Fund 3umairPas encore d'évaluation

- Inbound 1447676777343781147Document2 pagesInbound 1447676777343781147ML ChingPas encore d'évaluation

- Atram Global Technology Feeder Fund KiidsDocument4 pagesAtram Global Technology Feeder Fund KiidsChina AldayPas encore d'évaluation

- ATRAM Total Return Peso Bond Fund - KIIDS Dec 2022Document4 pagesATRAM Total Return Peso Bond Fund - KIIDS Dec 2022ParazolaPas encore d'évaluation

- ATRAM ASIA EQUITY OPPORTUNITY FEEDER FUND KIIDS - Sept 2021Document4 pagesATRAM ASIA EQUITY OPPORTUNITY FEEDER FUND KIIDS - Sept 2021Ma. Goretti Jica GulaPas encore d'évaluation

- ATRAM ASIA EQUITY OPPORTUNITY FEEDER FUND KIIDS - July 2022Document4 pagesATRAM ASIA EQUITY OPPORTUNITY FEEDER FUND KIIDS - July 2022Rohit BadavePas encore d'évaluation

- Eq - Uitf - Bpi Peif - Oct 2018Document3 pagesEq - Uitf - Bpi Peif - Oct 2018Darren ValientePas encore d'évaluation

- BPI US Equity Feeder Fund Latest DisclosureDocument3 pagesBPI US Equity Feeder Fund Latest DisclosureJelor GallegoPas encore d'évaluation

- ALFM Peso Bond FundDocument2 pagesALFM Peso Bond FundkimencinaPas encore d'évaluation

- FactsheetDocument2 pagesFactsheetMighfari ArlianzaPas encore d'évaluation

- Schroder Dana Likuid: Fund FactsheetDocument1 pageSchroder Dana Likuid: Fund FactsheetTuPandePas encore d'évaluation

- Financial and Capital Market Services: Individual AssignmentDocument9 pagesFinancial and Capital Market Services: Individual Assignmentvaishakh kkPas encore d'évaluation

- Investment Process: Portfolio ConstructionDocument22 pagesInvestment Process: Portfolio ConstructionÃarthï ArülrãjPas encore d'évaluation

- Hpam Ultima Ekuitas 1Document2 pagesHpam Ultima Ekuitas 1Serly MarcelinaPas encore d'évaluation

- Portfolio ManagementDocument35 pagesPortfolio ManagementmohikumarPas encore d'évaluation

- For The Period Ending March 31, 2019Document2 pagesFor The Period Ending March 31, 2019Ibarra Miguel AboboPas encore d'évaluation

- Ffs-Jambaf Jan2021Document2 pagesFfs-Jambaf Jan2021Johan CahyantoPas encore d'évaluation

- TCR Active Alpha Fact Sheet 16022017Document4 pagesTCR Active Alpha Fact Sheet 16022017api-319756580Pas encore d'évaluation

- 2020 12 December PublicDocument2 pages2020 12 December Publicsumit.bitsPas encore d'évaluation

- SmartElite19072022 8468161Document3 pagesSmartElite19072022 8468161manishPas encore d'évaluation

- Fund Fact Sheet As at 31 July 2021: Investment ObjectiveDocument1 pageFund Fact Sheet As at 31 July 2021: Investment ObjectiveMohd Hafizi Abdul RahmanPas encore d'évaluation

- Ucits Kiid Blackrock Ics Euro Government Liquidity Fund Premier Acc t0 Eur GB Ie00b41n0724 enDocument2 pagesUcits Kiid Blackrock Ics Euro Government Liquidity Fund Premier Acc t0 Eur GB Ie00b41n0724 enja1220087Pas encore d'évaluation

- Fundsmith Equity Fund I Class KIID (For Institutional Investors)Document2 pagesFundsmith Equity Fund I Class KIID (For Institutional Investors)John SmithPas encore d'évaluation

- T Class Shares in Fundsmith Equity Fund: Key Investor InformationDocument2 pagesT Class Shares in Fundsmith Equity Fund: Key Investor InformationJohn SmithPas encore d'évaluation

- TMB EASTSPRING Global Core Equity Fund (Tmb-Es-Gcore) : YTD 3 Month 6 Month 1 YearDocument3 pagesTMB EASTSPRING Global Core Equity Fund (Tmb-Es-Gcore) : YTD 3 Month 6 Month 1 Yearaekkasit.sePas encore d'évaluation

- CohenSteers Senior Variable 2019-3 FCDocument2 pagesCohenSteers Senior Variable 2019-3 FCA RPas encore d'évaluation

- PGPSFDocument2 pagesPGPSFFabian NgPas encore d'évaluation

- FFS SSSF-EngDocument1 pageFFS SSSF-EngBagus kuningPas encore d'évaluation

- FFS Jambaf Aug2021Document2 pagesFFS Jambaf Aug2021royescspchiitymmuaPas encore d'évaluation

- Product Highlights Sheets-Dynamic Income FundDocument7 pagesProduct Highlights Sheets-Dynamic Income FundCheeseong LimPas encore d'évaluation

- SIM Inflation Plus Fund Class B4 Latest13 PDFDocument4 pagesSIM Inflation Plus Fund Class B4 Latest13 PDFSizwePas encore d'évaluation

- Jarvis Balance Fund - FFS-JUN21Document2 pagesJarvis Balance Fund - FFS-JUN21Triwibowo B NugrohoPas encore d'évaluation

- FFS SEF-EngDocument1 pageFFS SEF-EngSaham ChristianPas encore d'évaluation

- Peso Powerhouse Fund - Fund Fact Sheet - December - 2020Document2 pagesPeso Powerhouse Fund - Fund Fact Sheet - December - 2020Jayr LegaspiPas encore d'évaluation

- CohenSteers Senior Variable Rate 2020-1 FCDocument2 pagesCohenSteers Senior Variable Rate 2020-1 FCA RPas encore d'évaluation

- Mrs - Fidelity Global Inflation-Linked Bond Fund Usd - Class 5Document2 pagesMrs - Fidelity Global Inflation-Linked Bond Fund Usd - Class 5emirav2Pas encore d'évaluation

- Daily Notes: Wilcon Depot, Inc. (pse:WLCON)Document2 pagesDaily Notes: Wilcon Depot, Inc. (pse:WLCON)Anonymous xcFcOgMiPas encore d'évaluation

- Daily Notes: SM Investments Corporation (pse:SM)Document2 pagesDaily Notes: SM Investments Corporation (pse:SM)Anonymous xcFcOgMiPas encore d'évaluation

- C BuildingBlocks BaxterDocument4 pagesC BuildingBlocks BaxterAnonymous xcFcOgMiPas encore d'évaluation

- Daily Notes: Eagle Cement Corporation (pse:EAGLE)Document2 pagesDaily Notes: Eagle Cement Corporation (pse:EAGLE)Anonymous xcFcOgMiPas encore d'évaluation

- Daily Notes: Holcim Philippines, Inc. (pse:HLCM)Document2 pagesDaily Notes: Holcim Philippines, Inc. (pse:HLCM)Anonymous xcFcOgMiPas encore d'évaluation

- Updates: High Strength Reinforcement For Seismic Applications in ACI 318-19Document4 pagesUpdates: High Strength Reinforcement For Seismic Applications in ACI 318-19neve08Pas encore d'évaluation

- Daily Notes: Ginebra San Miguel, Inc. (pse:GSMI)Document2 pagesDaily Notes: Ginebra San Miguel, Inc. (pse:GSMI)Anonymous xcFcOgMiPas encore d'évaluation

- 30 TCA DirectionsDocument2 pages30 TCA DirectionsAnonymous xcFcOgMiPas encore d'évaluation

- 20 TCA DirectionsDocument2 pages20 TCA DirectionsAnonymous xcFcOgMiPas encore d'évaluation

- Daily Notes: Wilcon Depot, Inc. (pse:WLCON)Document2 pagesDaily Notes: Wilcon Depot, Inc. (pse:WLCON)Anonymous xcFcOgMiPas encore d'évaluation

- On Balance - Weekly Notes For February 3 2019Document3 pagesOn Balance - Weekly Notes For February 3 2019Anonymous xcFcOgMiPas encore d'évaluation

- 2020-01-17-Ph-S-Mpi, DMCDocument7 pages2020-01-17-Ph-S-Mpi, DMCAnonymous xcFcOgMiPas encore d'évaluation

- 2020 01 29 PH S UrcDocument8 pages2020 01 29 PH S UrcAnonymous xcFcOgMiPas encore d'évaluation

- 2020 01 29 PH DDocument8 pages2020 01 29 PH DAnonymous xcFcOgMiPas encore d'évaluation

- Weekly Notes Jan 20 24Document3 pagesWeekly Notes Jan 20 24Anonymous xcFcOgMiPas encore d'évaluation

- On Balance - Daily Notes For January 24 2020Document2 pagesOn Balance - Daily Notes For January 24 2020Anonymous xcFcOgMiPas encore d'évaluation

- On Balance - Daily Notes For January 28 2020Document2 pagesOn Balance - Daily Notes For January 28 2020Anonymous xcFcOgMiPas encore d'évaluation

- 2020 01 17 PH S BankingDocument6 pages2020 01 17 PH S BankingAnonymous xcFcOgMiPas encore d'évaluation

- 2020 01 30 PH DDocument5 pages2020 01 30 PH DAnonymous xcFcOgMiPas encore d'évaluation

- Why Concrete Cracks - The Concrete NetworkDocument5 pagesWhy Concrete Cracks - The Concrete NetworkAnonymous xcFcOgMiPas encore d'évaluation

- Additional Works: Item Description Qty Unit Unit CostDocument4 pagesAdditional Works: Item Description Qty Unit Unit CostAnonymous xcFcOgMiPas encore d'évaluation

- 2020 01 17 PH S ConsumerDocument10 pages2020 01 17 PH S ConsumerAnonymous xcFcOgMiPas encore d'évaluation

- Amplification of Accidental Torsion When Using Dynamic Analysis As Per ASCE-7-05 - Computers and Structures - ETABS - Eng-TipsDocument2 pagesAmplification of Accidental Torsion When Using Dynamic Analysis As Per ASCE-7-05 - Computers and Structures - ETABS - Eng-TipsAnonymous xcFcOgMiPas encore d'évaluation

- Section Cut F1 F2 Srss KN KN KN Load Case/Co MboDocument9 pagesSection Cut F1 F2 Srss KN KN KN Load Case/Co MboAnonymous xcFcOgMiPas encore d'évaluation

- A Presentation On Strut and Tie Models (S T M) - CivilDigitalDocument6 pagesA Presentation On Strut and Tie Models (S T M) - CivilDigitalAnonymous xcFcOgMiPas encore d'évaluation

- Adding Eccentricity Using - Coefficient Lateral Force - Computers and Structures - ETABS - Eng-TipsDocument2 pagesAdding Eccentricity Using - Coefficient Lateral Force - Computers and Structures - ETABS - Eng-TipsAnonymous xcFcOgMiPas encore d'évaluation

- Pipe Chart PDFDocument2 pagesPipe Chart PDFCarlos Rivera0% (1)

- STRUCTURE Magazine - Correlation Between Soil Bearing Capacity and Modulus of Subgrade ReactionDocument7 pagesSTRUCTURE Magazine - Correlation Between Soil Bearing Capacity and Modulus of Subgrade ReactionAnonymous xcFcOgMiPas encore d'évaluation

- FHWA - Deep Beam DesignDocument25 pagesFHWA - Deep Beam DesignVarun Singh ChandelPas encore d'évaluation

- USC MBA Employment Report 2018Document4 pagesUSC MBA Employment Report 2018Robert Sunho LeePas encore d'évaluation

- Venture Capital in INDIADocument83 pagesVenture Capital in INDIAnawaz100% (2)

- Cap Table TemplateDocument5 pagesCap Table TemplatetransitxyzPas encore d'évaluation

- Business Finance Quiz 3Document4 pagesBusiness Finance Quiz 3deeplabuPas encore d'évaluation

- Contango Oil & Gas Co. PresentationDocument18 pagesContango Oil & Gas Co. PresentationCale SmithPas encore d'évaluation

- Initial Syngenta Response - 4!30!2015Document2 pagesInitial Syngenta Response - 4!30!2015Marla BarbotPas encore d'évaluation

- Advanced Accounting Part 2 Take Home Activity: - Total Present Value)Document3 pagesAdvanced Accounting Part 2 Take Home Activity: - Total Present Value)Airille CarlosPas encore d'évaluation

- Report of Investigation: Burns Philp and Co LTDDocument41 pagesReport of Investigation: Burns Philp and Co LTDa_bleem_userPas encore d'évaluation

- Partnership REPORTDocument4 pagesPartnership REPORTAiza A. CayananPas encore d'évaluation

- 10 Principles of FinanceDocument15 pages10 Principles of Financelouise carinoPas encore d'évaluation

- AssetDocument12 pagesAssetpoonamPas encore d'évaluation

- BooksDocument4 pagesBooksMadhvi GuptaPas encore d'évaluation

- Valuation of Marine VesselsDocument41 pagesValuation of Marine VesselsReza Babakhani100% (1)

- Banking System 1Document52 pagesBanking System 1Banshul KumarPas encore d'évaluation

- Deloitte Op Risk WorkshopDocument78 pagesDeloitte Op Risk WorkshopindraPas encore d'évaluation

- chemicals:-: Submitted To Dr. Pankaj K.Aggarwal Group-3 Section - D Submitted byDocument6 pageschemicals:-: Submitted To Dr. Pankaj K.Aggarwal Group-3 Section - D Submitted byAnonymous cXj9QhssPas encore d'évaluation

- Assignment: Financial Management: Dividend - MeaningDocument4 pagesAssignment: Financial Management: Dividend - MeaningSiddhant gudwaniPas encore d'évaluation

- 2Q22 Alcoa Financial ResultsDocument16 pages2Q22 Alcoa Financial ResultsRafa BorgesPas encore d'évaluation

- Risk ManagementDocument22 pagesRisk Managementkirang gandhiPas encore d'évaluation

- Elliot Investor LetterDocument1 pageElliot Investor LetterArjun KharpalPas encore d'évaluation

- Karvy Company ProfileDocument17 pagesKarvy Company ProfileSubhadeep Basu64% (14)

- Preference SharesDocument7 pagesPreference Sharesmayuresh bariPas encore d'évaluation

- Lux Gaap - Ifrs-Us GaapDocument32 pagesLux Gaap - Ifrs-Us GaapPavel MochalinPas encore d'évaluation

- MODEC, Inc. 2019 Half-Year Financial Results Analysts PresentationDocument16 pagesMODEC, Inc. 2019 Half-Year Financial Results Analysts Presentationfle92Pas encore d'évaluation

- Has Finance Made The World RiskierDocument36 pagesHas Finance Made The World RiskierbbarooahPas encore d'évaluation

- Ripples XRP and The Never Ending SEC Battle Continues TCRxyxysrtsnqDocument2 pagesRipples XRP and The Never Ending SEC Battle Continues TCRxyxysrtsnqaircow4Pas encore d'évaluation

- 7 Steps To Understanding The Stock Market Ebook v6Document32 pages7 Steps To Understanding The Stock Market Ebook v6Harsh ThakkarPas encore d'évaluation

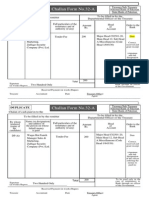

- Challan Form No.32-ADocument2 pagesChallan Form No.32-AWaqas Bin Faateh100% (7)

- Forex U Turn - Manual PDFDocument59 pagesForex U Turn - Manual PDFDaniel NespriasPas encore d'évaluation

- Liken Vs ShafferDocument1 pageLiken Vs ShafferMikhail JavierPas encore d'évaluation