Académique Documents

Professionnel Documents

Culture Documents

SF1012 77a PDF

Transféré par

ShamanicWisdomTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

SF1012 77a PDF

Transféré par

ShamanicWisdomDroits d'auteur :

Formats disponibles

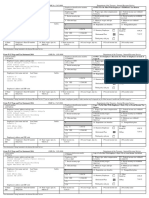

TRAVEL VOUCHER 1. DEPARTMENT OR ESTABLISHMENT, 2. TYPE OF TRAVEL 3. VOUCHER NO.

(Read the Privacy Act BUREAU, DIVISION, OR OFFICE

TEMPORARY DUTY

Statement on the 4. SCHEDULE NO.

back) PERMANENT CHANGE

OF STATION

a. NAME (Last, first, middle initial) b. SOCIAL SECURITY NUMBER 6. PERIOD OF TRAVEL

a. FROM b. TO

5. TRAVELER (PAYEE)

c. MAILING ADDRESS (Include ZIP Code) d. OFFICE TELEPHONE NO. 7. TRAVEL AUTHORIZATION

a. NUMBER(S) b. DATE(S)

e. PRESENT DUTY STATION f. RESIDENCE (city and State)

10. CHECK NO.

8. TRAVEL ADVANCE 9. CASH PAYMENT RECEIPT 11. PAID BY

a. Outstanding a. DATE RECEIVED b. AMOUNT RECEIVED

b. Amount to be applied $

c. Amount due Government c. PAYEE'S SIGNATURE

(Attached: Check Cash)

d. Balance outstanding

12. GOVERNMENT

I hereby assign to the United States any right I may have against any parties in connection with reimbursable Traveler's Initials

TRANSPORTATION

REQUEST, OR transportation charges described below, purchased under cash payment procedures (FPMR 101-7).

TRANSPORTATION

TICKETS, IF PUR- MODE,

CHASED WITH CASH AGENT'S ISSUING DATE POINTS OF TRAVEL

CLASS OF

(List by number below VALUATION CARRIER SERVICE ISSUED

and attached passenger (Initials)

coupon; if cash is used

OF TICKET AND ACCOM-

show claim on reverse MODATIONS FROM TO

side.) (a) (b) (c) (d) (e) (f)

13. I certify that this voucher is true and correct to the best of my knowledge and belief, and that payment or credit has not

been received by me. When applicable, per diem claimed is based and the average cost of lodging incurred during the period

covered by this voucher. DATE

AMOUNT

TRAVELER

SIGN HERE CLAIMED $

NOTE; Falsification of an item in an expense account works a forfeiture of claim (27 U.S.C. 2514) and may result in a fine

of not more than $10,000 or imprisonment for not more than 5 years or both (18 U.S.C. 287; i.d. 1001).

14. This voucher is approved. Long distance telephone calls, if any, are certified as necessary 17. FOR FINANCE OFFICE USE ONLY

in the interest of the Government. (NOTE: If long distance telephone calls are included, COMPUTATION

the approving official must have been authorized in writing by the head of the

department or agency to so certify. (31 U.S.C. 680a). a. DIFFER- $

ENCES,

IF ANY

APPROVING DATE (Explain

OFFICIAL and show

SIGN HERE amount)

15. LAST PRECEDING VOUCHER PAID UNDER SAME TRAVEL AUTHORIZATION

a. VOUCHER NO. b. D.O. SYMBOL c. MONTH & b. TOTAL VERIFIED CORRECT FOR

YEAR CHARGE TO APPROPRIATION

Certifier's Initials: $

16. THIS VOUCHER IS CERTIFIED CORRECT AND PROPER FOR PAYMENT c. APPLIED TO TRAVEL ADVANCE

(Appropriation symbol):

AUTHORIZED

CERTIFYING $

DATE

OFFICIAL

SIGN HERE

d. NET TO TRAVELER $

18. ACCOUNT CLASIFICATION

NSN 7540-00-634-4180 STANDARD FORM 1012 (REV. 10-77)

Prescribed by GSA, FPMR (41 CFR) 101-7

Complete this

INSTRUCTIONS TO TRAVELER (Unlisted items are self-explanation)

information PAGE

SCHEDULE Col. (c) If the voucher includes Com-

}

Col. (d) Show amount incurred for each meal, including tax and tips, and if this is a of

per diem allowances for plete (g) daily total meal cost. continuation

OF members of employee's (h) Show expenses, such as: laundry, cleaning and pressing clothes, tips

only sheet

EXPENSES immediate family, show

for (i)

to bellboys, porters, etc. (other than for meals).

Complete for per diem and actual expense travel.

member's names, ages TRAVEL AUTHORIZATION

AND and relationship to em- actual (j) Show total subsistence expense incurred for actual expense travel.

NO.

(m) Show per diem amount, limited to maximum rate, or if travel on actual

AMOUNTS ployee and marital expense expense, show the lesser of the amount from col. (j) or maximum rate.

status of children travel (n) Show expenses, such as: taxi/limousine fares, air fare (if purchased

CLAIMED (unless information is with cash), local or long distance telephone calls for Government

TRAVELER'S LAST NAME

shown on the travel business, car rental, relocation other than subsistence, etc.

authorization.)

DATE TIME DESCRIPTION ITEMIZED SUBSISTENCE EXPENSES MILEAGE AMOUNT CLAIMED

RATE:

(Departure/arrival city, per diem MEALS MISCEL- TOTAL

(Hour

and computation, or other LANEOUS LODGING SUBSISTENCE

am/pm) explanations BREAK- SUBSIS- EXPENSE NO. OF MILEAGE SUBSISTENCE OTHER

of expense ) FAST LUNCH DINNER TOTAL TENCE MILES

(a) (b) (c) (d) (e) (f) (g) (h) (i) (j) ( k) (l) (m) (n)

SUBTOTALS

If additional space is required, continue on another SF 1012-A BACK, leaving the front blank.

TOTALS

In compliance with the Privacy Act of 1974, the following information is provided: Solicitation of the information on this investigations or prosecutions, or when pursuant to a requirement by this agency in connection with the hiring or firing of Enter grand total of columns (l), (m) and

form is authorized by 5 U.S.C. Chap. 57 as implemented by the Federal Travel Regulations (FPMR 101-7), E.O. an employee, the issuance of a security clearance, or investigations of the per- formance of official duty while in (n), below and in item 13 on the front of

11609 of July 22, 1971, E.O. 110012 of March 27, 1962, E.O. 9397 of November 22, 1943, and 26 U.S.C. 6011(b) Government service. Your Social Security Account Number (SSN) is solicited under the authority of the Internal

this form.

and 6109. The primary purpose of the requested information is to determine payment or reimbursement to eligible Revenue Code (26 U.S.C. 6011 (b) and 6109) and E.O. 9397, November 22, 1943, for use as a taxpayer and/or

individuals for allowable travel and/or relocation expenses incurred under appropriate administrative authorization and employee identification number; disclosure is MANDATORY on vouchers claiming travel and/or relocation allowance TOTAL

to record and maintain costs of such reimbursements to the Government. The information will be used by officers expense reimbursement which is, or may be, taxable income. Disclosure of your SSN and other requested information is

and employees who have a need for information in the performance of their official duties. The information may be voluntary in all other instances; however, failure to provide the information (other than SSN) required to support the claim

AMOUNT

disclosed to appropriate Federal, State, local, or foreign agencies when relevant to civil, criminal or regulatory may result in delay or loss of reimbursement. CLAIMED

STANDARD FORM 1012 BACK (10-77)

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hamlet Act 1 Study GuideDocument3 pagesHamlet Act 1 Study GuideShamanicWisdomPas encore d'évaluation

- Hassell v. StateDocument2 pagesHassell v. StateShamanicWisdomPas encore d'évaluation

- Charitable Property Tax ExemptionDocument8 pagesCharitable Property Tax ExemptionShamanicWisdomPas encore d'évaluation

- Exhibit 017 - Affid of Void ComplaintDocument3 pagesExhibit 017 - Affid of Void ComplaintShamanicWisdom100% (1)

- Writ of Praecipe PDFDocument3 pagesWrit of Praecipe PDFShamanicWisdom100% (1)

- Torah Pictografico PDFDocument358 pagesTorah Pictografico PDFLaécioPas encore d'évaluation

- SF1038 77Document1 pageSF1038 77ShamanicWisdomPas encore d'évaluation

- Web Judicial Notice and Proclamation 3Document7 pagesWeb Judicial Notice and Proclamation 3rahsheed100% (9)

- Why We Are Under TheDocument7 pagesWhy We Are Under ThealanbwilliamsPas encore d'évaluation

- Checklist Renew-Registration MarylandDocument12 pagesChecklist Renew-Registration MarylandShamanicWisdomPas encore d'évaluation

- Neil MerrettDocument2 pagesNeil MerrettShamanicWisdomPas encore d'évaluation

- Cease and Desist Letter 2Document1 pageCease and Desist Letter 2ShamanicWisdomPas encore d'évaluation

- Mommy Survival Kit: Open, Enjoy, and BreatheDocument1 pageMommy Survival Kit: Open, Enjoy, and BreatheShamanicWisdomPas encore d'évaluation

- Health DisordersDocument1 pageHealth DisordersShamanicWisdomPas encore d'évaluation

- Cease and Desist Letter 4Document2 pagesCease and Desist Letter 4ShamanicWisdomPas encore d'évaluation

- Cease and Desist Letter 1Document1 pageCease and Desist Letter 1haroldebealePas encore d'évaluation

- Removing InquiriesDocument1 pageRemoving InquiriesShamanicWisdom100% (1)

- EYYYDocument17 pagesEYYYShamanicWisdomPas encore d'évaluation

- Why We Are Under TheDocument7 pagesWhy We Are Under ThealanbwilliamsPas encore d'évaluation

- Workshop Transcription Martineau 122504Document21 pagesWorkshop Transcription Martineau 122504ShamanicWisdom100% (3)

- Why We Are Under TheDocument7 pagesWhy We Are Under ThealanbwilliamsPas encore d'évaluation

- General Services Administration U.S. Air Force: New Round of Protests in MayDocument2 pagesGeneral Services Administration U.S. Air Force: New Round of Protests in MayShamanicWisdomPas encore d'évaluation

- General Services Administration U.S. Air Force: New Round of Protests in MayDocument2 pagesGeneral Services Administration U.S. Air Force: New Round of Protests in MayShamanicWisdomPas encore d'évaluation

- Hcso - Request For Public InformationDocument2 pagesHcso - Request For Public InformationShamanicWisdomPas encore d'évaluation

- Petition For Relief From A Conviction or Sentence by A Person in State CustodyDocument16 pagesPetition For Relief From A Conviction or Sentence by A Person in State CustodyShamanicWisdomPas encore d'évaluation

- Court DocketDocument1 pageCourt DocketShamanicWisdomPas encore d'évaluation

- Clerks PDocument259 pagesClerks PShamanicWisdomPas encore d'évaluation

- 1 3 11Keating&ChrisSummersDocument12 pages1 3 11Keating&ChrisSummersShamanicWisdom100% (6)

- GFFFHDocument1 pageGFFFHShamanicWisdomPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- PerfAlign PerfObj PerfStandDocument7 pagesPerfAlign PerfObj PerfStandcastrojacPas encore d'évaluation

- SSA - POMS - RM 10210.420 - Priority List of Acceptable Evidence of Identity Documents - 08 - 30 - 2017Document10 pagesSSA - POMS - RM 10210.420 - Priority List of Acceptable Evidence of Identity Documents - 08 - 30 - 2017PatriZia Sanchez HerreraPas encore d'évaluation

- CURT-ALLEN: of The Family Byron V LOVICK, Et Al. - 1 - Complaint - Gov - Uscourts.wawd.166908.1.0Document7 pagesCURT-ALLEN: of The Family Byron V LOVICK, Et Al. - 1 - Complaint - Gov - Uscourts.wawd.166908.1.0Jack RyanPas encore d'évaluation

- How To Get Employer Identification NumberDocument3 pagesHow To Get Employer Identification NumberChristian Jerrel SantosPas encore d'évaluation

- IRS 6209 ManualDocument18 pagesIRS 6209 ManualDiego RamirezPas encore d'évaluation

- The PCN Secret To Wealth: David T. Parker'sDocument68 pagesThe PCN Secret To Wealth: David T. Parker'sCasey Robert Boyd100% (13)

- DS11 CompleteDocument6 pagesDS11 CompleteDrew100% (1)

- SF 181Document18 pagesSF 181K'yandra Graham100% (1)

- PPDocument2 pagesPPSNG RYKPas encore d'évaluation

- Certification of Nevada Residency: Customer InformationDocument1 pageCertification of Nevada Residency: Customer InformationnoPas encore d'évaluation

- SS4 Application-2Document11 pagesSS4 Application-2madnoaPas encore d'évaluation

- Notice: Privacy Act Systems of RecordsDocument83 pagesNotice: Privacy Act Systems of RecordsJustia.comPas encore d'évaluation

- DL 32 PDFDocument3 pagesDL 32 PDFYour MommaPas encore d'évaluation

- Cybertek Electric 3Document18 pagesCybertek Electric 3Marcy ToalPas encore d'évaluation

- U.S. Individual Income Tax Return: (See Instructions.)Document2 pagesU.S. Individual Income Tax Return: (See Instructions.)Daniel RamirezPas encore d'évaluation

- 23 IEN ManualDocument32 pages23 IEN ManualenfermerorepartidorPas encore d'évaluation

- Quality Control Self-Assessment: Measuring The Effectiveness of Your Quality Control ProgramDocument8 pagesQuality Control Self-Assessment: Measuring The Effectiveness of Your Quality Control ProgrampinoyarkiPas encore d'évaluation

- Oregon Income Tax Instructions and SchedulesDocument36 pagesOregon Income Tax Instructions and SchedulesStatesman JournalPas encore d'évaluation

- UCC IRS Form For Discharge of Estate Tax Liens f4422Document3 pagesUCC IRS Form For Discharge of Estate Tax Liens f4422Anonymous 23VuLx100% (23)

- US Internal Revenue Service: I1040 - 2004Document128 pagesUS Internal Revenue Service: I1040 - 2004IRS100% (1)

- DS 11 From 2004Document6 pagesDS 11 From 2004John Hall0% (1)

- Information and Application Instructions: When Should I Go To The SSA Office?Document2 pagesInformation and Application Instructions: When Should I Go To The SSA Office?Tuhin KunduPas encore d'évaluation

- W21225760934 0 PDFDocument2 pagesW21225760934 0 PDFAnonymous czHLQeLPB4Pas encore d'évaluation

- DS82 Complete PDFDocument6 pagesDS82 Complete PDFAnonymous FQPDtx6Pas encore d'évaluation

- Identity PDF The Modern Identity Changer How To Create and Use A New Identity For Privacy and Personal Freedom Sheldon CharrettDocument216 pagesIdentity PDF The Modern Identity Changer How To Create and Use A New Identity For Privacy and Personal Freedom Sheldon CharrettJUAN RAMON95% (19)

- Sav 1522Document4 pagesSav 1522Tanasha FlandersPas encore d'évaluation

- WarariDocument4 pagesWarariapi-532208198Pas encore d'évaluation

- 1098T17Document2 pages1098T17RegrubdiupsPas encore d'évaluation

- Peace Corps Report of Dental Examination - PC-OMS-1790 Dental 08/2009Document4 pagesPeace Corps Report of Dental Examination - PC-OMS-1790 Dental 08/2009Accessible Journal Media: Peace Corps DocumentsPas encore d'évaluation

- Uber Massachusetts RegulationsDocument29 pagesUber Massachusetts RegulationsNate Boroyan100% (2)