Académique Documents

Professionnel Documents

Culture Documents

MAS 1 (CPA Review Material)

Transféré par

MarkAlcazarCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

MAS 1 (CPA Review Material)

Transféré par

MarkAlcazarDroits d'auteur :

Formats disponibles

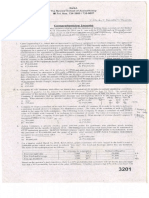

décld B) Conrada has EXCESS capacity? 760) 5. SHUTTING DOWN OPERATIONS “The most recent monthly income statement: for Gorgon Stores is given bel ‘China Branch | Japan Branch Total Sales P 1,200,000 P.800,000 2,000,000 Less: Variable expenses 40,000) (360,000) (1,200,000) sjpeContribution margin 360,000. 440,000 800,000 af (Legs: Traceable fixed expenses “> | (210,000) 42 (180,000) -_ (390,000) ‘Segment margin P150,000 | 260,000 ‘410,000 Tess: Common fixed expenses (180,000) (420,000) (300,000) Prof (loss) (30,000), 140,000 F-110,000 If China Branch were eliminated, then its traceable fixed expenses could be avoided. The total common fixed expenses are merely allocated and would be uhaffected. A) What will be the new company profit (loss) if China Branch is eliminated? a. P-260,000 “s (P-40,000) bP 140,000 @. (P 70,000) ) What will be the decrease In ‘company profit if Gorgon. doses its Chine Branch and 20%°oF its Weak ble ted expense would remain unchanged while Japan sales would decrease by 20%? Sogo a. 352,000 : cP 136,000 - 6. P 280,000 G. No decrease; profit will increase ) Page 3 of S pages: Gn) ‘ @ ose te z FE nar ea ws "SHY OF Sys] Sig of [aun sed Sino] a gid ded} wow Danpeig | gAonpoid |v enpard INS WOLINTOS: Ob| guoneuiquies jonposd asaq au Ui poreoosse qwosd ayy s) yonW MOH *Z 940 Suun OOT ‘A Jo suiun og !y Jo syun oot ‘p 940 sun OST ‘@ 40 31UN 9 !y Jo syuN 9g “> ‘940 SulUn OST {q Jo syun og !y Jo Sylun gg 940 sulun o¢t ‘a Jo sun og ty 40 swun ogre uopNGIAUOD ApeaM aun SeziLUPCeW BIA YOReUIqUICD Yonpald ysoq 24S! CUM. “T + _—:a3unae 05104 99 “POO 4st Pon ee 0H ata Bump mnoew a vo omereR soy do io, i 5-2 yun 40d ot sed 05). syun ost > os: 4 € Hun Jad g std suunoa = @ 9% Z_aun sad oF ord (Oy _suunoot ov oq ¥ SUNPEH US SinoH — CIDIENUORMGIUET TU TUN IHEW Jawoll se a1e (S4noy U1) auly>eU ain Uo auila pue ‘spueUap soles ‘suIbseW UonNguaudD ay, ‘s}onpoid axa gonpoid 0} pasn si BuI4>eUI 2UD “> pUe g “y :s\onpoId aas49 soanpold “oD sodey NOILYNIGWOD Londowd 1s3a “8 (00097 eaypid sw 2q iH yeym uous ‘uonse aiqeyord ysour oun so4ed AvedwoD ou jt -z 144 We the UO YO-ds 3e js usa aus pinous (S)Ronposd Yodan saxunoay 000°E 00s‘z. oO 7" W3C9 000'r1 000'0z 7 Anbi0), 00091 00'0¢ 1 De 000'87 ¢ 000'Or 4 We 3809 BuIssaD01d 1EUOHIPPY . sales S\NpOIE Esmollo} Se pios aue Aaua pu auiod 44o-14ds. 94 PUoAaG passaroid aie sianpoid au) “yuasosd ay ° ° bsu— Wye 4¢Loore 7 tas ¢ /0000r 7 ‘ ASbpb- 35-585" 0005 d | w 'SJUNOWE OuIMoyioy 249 44 UIOd yo-uids oun Ye {600°OT ji 40 1509 wwof w 10) stonpoud unoy Seampo!d AuedIuo> Ten Cay UBHLN SS3D0Ud YO TIaS *L sPnpoid ey (es pino> way aus { Coony (980)) youd 2 (0005) (00's) eet eee ‘Oah ae | iBieW UeRnqiAUos ‘ swum goore | su So0rz (a sur onde (G JaIn5 NOLLMTOS 91 10 epi 1a HK eswum o00'2 (a I) fo Ary 4% eswUR OOO" (Vv £94 01 pay2adxa a1e iauow 2x9u sojes J suoneledo ump anys vo drurguos kuedwos ain pImous °Z 000¢ .SiUN UraUlog UmopanUS ut si aeuNA “7 azvindau “s80] 949 Sziuutus 01 Moy asnf 5} AvedWO9 a4 Jo Wa|Qosd aun “suoRIpUED auosaid_Jepun ryosd 40 Aunaissod syeipouiuut ous] suey) S2UIS “peuimul Se. UieUss im eeoous 49d 000° ¢ 40 (sexe pue soueuauIeW yUeId '2")) 3509 umopinys e “papuadsns aie suoneiado aUeld st nN qWwold ‘00st 0007S 9809 paxld oo0'0t d — (2d © 00's) s1509 aiqeuen 13897 wea 2 o00’st a (€ 4 @ 000°s) sares sBurmonoy 24a mo\s swWUN 909's Jo S2/Bs AjAUOLL 243 40) Pa1edaid quaUloxers 9UIOIU1 Uy “WUOW! Jed su1UN 999s Jo Fane] qUaxiND ayy mojeg doup |INm Sajes eI sI29dX9 AUedWOD ASHIUD i ANIOd NOLLWNIWI1a 19nGeud ‘9 SNLLS@D LNWAR1Fa OYIS MITATY FLL - WSO vO-SVIN ADURIUNEDIY Jo |! ReSA - The Review School of Accountancy MAS-04 RELEVANT COSTING WRAP-UP EXERCISES (MULTIPLE 1. Which of the following costs is generally considered irrelevant in decision making process? a. Direct labor b. Direct materials é Fixed factory overhead d. Variable factory overhead 2. The salary you would otherwise earn by working rather than attending the CPA review is a good example of ‘a, Asunk Cost 26 An opportunity cost An incremental cost t d, An out-of-pocket cost 3. An opportunity cost is usually: "a Relevant, but is not part of traditional accounting records. | b.. Not relevant, but is part of traditional accounting records. Relevant, and is part of traditional accounting records. d. Not relevant, and is not part of traditional accounting records, E | there is no alternative vse? 2 The total manufacturing cost ofthe component B. The vanable cost ofthe component The fixed cost ofthe component | zee 4. What is the opportunity cost of making a component part in a factory with excess capacity for which | 5, IF there is excess capacity, the minimum acceptable price for a special order must cover | ‘a, Usual fixed manufacturing costs (22 Variable and usual fixed manufacturing costs . Variable manufacturing costs associated with the special order : | 4d. Variable manufacturing costs plus contribution margin foregone on lost regular units. JKC The product line shall be continued 7. If there are shutdown costs, then a company’s shutdown point is _ i 2. Nilor zero | Below its break-even point i > Above its break-even point d. Equal to its break-even point -> flere fe Mo ChUfeun cea | 6. Which is yeuely considered irrelevant in ‘sll or process further decision making? "a Dont costs 4 Purther processing costs e Salen Vue some cence gine di Salon volue er further proessing 9. Accompany that has a limited number of machine hours and abundant labor hours should produce first the product that has the highest a, Demand in units b. Contribution margin per unit c. £ontribution margin’per labor hour Contribution margin per machine hour : | 10. The role of sunk costs in decision making can be summed up in which of the following sayings? a. No pain, no gain BL Bygones are bygones © Apenny saved is a penny earned d. The love of money is the root of all evil | Page 5 of 5 pages ‘ ® cA untancy Management Advisory Services & Gs) ReSA - The Review School of Acco! MAS-05: BUDGETING BUDGET - i¢ a detailed plan, expressed in quantita budget Is a ADVANTAGES & LIMITATIONS OF BUDGETING ‘Uses/Advantages of Budgeting ‘+ Tt forces managers to It provides a mean: cating fnanagement’s plans throughout the entity. + Tedirects the activities. als. ache + “Te coordinates the activities of the entire entity by integrating plans of various parts. + Teprovides a means. tos «Tt defines goals that serve as benchmarks for evaluating subsequent performance. ‘THE MASTER BUDGET MASTER BUDGET - is comprehensive budget that. | for planning and controll form Budgeting is used to denote the process | wsolidates the overall pl terms, about business operations, cific period @ ry company expenses, cash fiows and earnings: The ‘coming up with budgets: Limitations of Budaeting Considerable time and cost are required. Budgets are mere judgment and might be modified or revised if sary eC SSaY yudgetary system requires A eecceion otal members ofthe organization: Budgets sdmetimes restrict the flexibility of the decison: aba process, ‘The budget program is merely a.quide, not a substitute for good management ability. speci the master budget Is mainly composed of: (1) and ‘inanci i Tice master budget, in some organizations, is elso referred to as ‘proforma budge, planning budoe, forecast budget,.master raft plan. [MASTER BUDGET oO OPERATING BUDGET sales budget Production budget Direct materials budget Direct labor budget Factory overhead budget. Budgeted cost of goods sold Budgeted operating expenses ~ Budgeted net income Budgeted income statement TERMINOLOGIES USED IN BUDGETING FIXED BUDGET term: static budget) FLEXIBLE BUDGET ‘A budget prepared for different levels of activi Sia lina ee FINANCIAL BUDGET ‘Cash budget ‘ ‘Budgeted balance sheet Budgeted cash flow statement - Capital expenditure budget Working capital budget ‘one level of activity.within a certain period (other ‘A budget prepared for a one le in period., (other termes variable budget, siding scle budget) CONTINUOUS ‘A 12-month budget that rolls month Is BUDGET ‘compieted (other term: perpetual budget) ZERO-BASED ‘A method of budgeting in which managers are.requirs asit BUDGETING the a bein ie first time IMPOSED fh process wherein budgets are-prepared_by-top_management with itie-or-np BUDGETING ‘inputs from operating. personnel PARTICIPATORY ‘A process wherein budgets are developed through joint decisions by top BUDGETING fanagement.and operating personnel puncet COMMITTEE A grou of key management persn_respanane ot evie-Al_oaley ett relating to the budget program and for coordi ting the budget preparation het ‘This deseribes how a budaet is prepared and includes a planning calendar and BUDGET MANUAL, distribution instructions for all budget schedules Page 1 of 4 pages © seGed » jo Z abeg (uatiem Aq uaunos>y jevre6eueyy :pordepy) OFP%¢\ “s9qWEAON 30 YUOWW 943 40) SeseyD:Nd asIpUeYZioW payaford -7~ 29 00| 494000 40 \AUOUS Bu} 40} sase\find Ssipuey>iow paYrafoud =Gumojos tp ouluareG saauTnORE “pjos spod6 Jo 3809 parsefold s.ynvous deynoried Jews Jo %OF 38 parebpng ave yRUOW y>ee Jo SalioqUaAUI BulUUIbsa = dn-ynewi GOP'SMI 9 eoionul yw jas oy axe S9sIpUEYDIOW y= sale Soyewinse parsbpng saIno, x 7 Ap) >19%¢- o00'80z sdequiazeq > Aak >192- O00'9ST Jaquianon 4 29 - AREAL -OOs'eeT A 49q0o1299—_ 19TOZ 40 Je32nb wb 218 JF SeTes'GuIMolio} atp pera6pnq sey SulsipueYDIOH opnddl Jo J9OeuEW Sores aly, “¢ i =e i : % —1 saunosoy « Ys{eroz Aen 2€ — Cenpiforoz usiew. 7% WILh groz Aenuet, 7 :BuLinp ajgehie2—4 swuno22e uo suoNDe|IO9 YseD :Buymolios tp euaReG “azumnOIH (000'62z 4 pamoys aouejeg aiqentaas squnoaoe ayp ‘9TOz “t Arenuer uo “000"002 d_[_sune coorozy dT Arenidas_ [55> ‘oooTo09 {Few | .,,, [00's d | Azenuer 000%0ss ¢_| judy e000 d | Jequsz=eq | (000005 d_| wiew 000%0S% | JequIerON. —____iSMOIIOJ SP 51 S\UOUI snoInaid Jo Sa}es 1aU ANUOUA Jo p10de Y -yUOU BUIMOII0} puod—s 21291109 348 OT Pur ‘nLrOU SuMMO}IOF UA UT PE19]]09 31 EOE ‘SELES Jo YIU ai BuLINP pa3901/0> S48 tAWOU-e UT PAI Safes IU oY 46 %09 yey oYe2}pu! AuedwOD IBeN Aq pa2uaLIOdxo suoNDa}IOD ised “Z (aot :peadepy) v ‘ (002 soserpind seusey“p 19 3809 6uumpenuew jero1. “ a ip) peapTono rowed ° 449 PlOS spoo8 Jo 3809 “T ase i Buymolioy 47 SUIWOG FO3UINDIY 000‘01 000's ‘Spoo6 paysiul4 ba 00s‘z o0s‘2 $$a00sd-UI-10 M34 -49 000d ot O00'e d sjeusen 4 pe Te Teques3q Tener M031). 40 “oa :Smoljo} se aq 0} a1e sauoiUSAut {31502 40921 1euIp Jo-%EZ re pondde 2q 01 s1 peoyione Aloive4 ‘sIs09-BuMPeMMUEUT TO cee 0b 0a 03 perradxe 51 10487 “sofesso-BAET = onensiiwpe ‘soIeE IO TOT ~ Buljos seoioye) Le oem Se sasuady “Seles 241 30 MOT JO WoId e sisadxo pue GOV'OUT d 1 912s parOpng sey AUedWwe> Uouiey “T SNIISDONG “S3SIOWIS onLa9GNe GO-SVIN. AaueqNoddy Jo JooysS MaTAZy UL YSOY ReSA - The Review School of Accountancy MAS-05 BUDGETING ‘4. The following information is taken from. Glery Corporation's. accounting records for the year ended Sar ieese data would be used as the basis for the next year's cash budget. December 31, (a). Customer sales receipts for P 870,000 | (5B) Purchased machinery and equipment for P 125,000 cash epee cae {0C), Settled income taxes of, P 110,000 =o 1D) Sold investment securities for P 500,000 e7ok Chsk (HE) Paid dividends of P 600,000, CY “cok £1). Received rentals of P 105,000 ie Hr) £ G) Issued 500 shares of common stock for P 250,000. 23 250k EG), ue S00 eer 50,000 due to supplies and payroll to employees (Wik) (SK) gc0k so) Paretased real estate for P-550,000 cash that was borrowed from o Panke Clow’) f:53) Pata P 450,000 for treasury shares REQUIRED: Determine the following: 4 1. Net cash provided by opesating activities: 765- 2. Net cash vsedin investing actites 295 (175 ) 3. Net cash used In financing activities: 4-59, 9) 4] Net cash increase or decrease. -34y 4; i ig (Adapted; AICPA) WRAP-UP EXERCISES (Multiple-Cholce Questions) 1. The master budget usualy begins withthe a production budget B._Operating budget c. Financial budget Sales budget 2. AMlof the following are considered operating budgets, EXCEPT a, Sales budget be Capital budget ‘c. Materials budget 4. Production budget ‘3:~-The'production budget process usually begins with the “a: Sales budget b. Direct labor budget ¢. Direct materials budget 6. Manufacturing overhead budget 4, Which of these budgets is usually prepared first? Production budget . Materials purchases budget © Cash disbursements budget AL Gash budget * 5. Which of the following budgets is based on many-other master budget components? 'a. Direct labor budget b. Overhead budget c. Sales budget -d- Cash budget 6. ina cash budget prepared based on operating, investing and financing activities, dividend payments to shareholders shall be classified as part of ‘a. Investing activities Jb Financing activities ‘c._ Operating activities d. Any cash flow activity 7. Hawaii inc, has projected sales to be P 260,000 In June, P 270,000 in July and F. 200,000 jn Hugi Tama collects 30% of a month's sales in the month of sale, 50% in the month following the sale; and 20% in the second month following the sale. What Is the accounts receivable balance on August 31? a. P90,000 4 b, 210,000 -c. P.264,000 d. Some other number Page 3 of 4 pages

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Chapter 1 Partnership Formation Test BanksDocument46 pagesChapter 1 Partnership Formation Test BanksRaisa Gelera91% (23)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Partnership RequirementDocument6 pagesPartnership RequirementAlyssa Marie Miguel100% (1)

- 3 - SALESssDocument13 pages3 - SALESssVinz HipolitoPas encore d'évaluation

- AccountingDocument82 pagesAccountingMarkAlcazarPas encore d'évaluation

- GROUP 1 - IT Application in Business (BSA 2-2)Document3 pagesGROUP 1 - IT Application in Business (BSA 2-2)MarkAlcazarPas encore d'évaluation

- Principles of TaxationDocument13 pagesPrinciples of TaxationHazel OrtegaPas encore d'évaluation

- Online Enrollment System For Cavite Maritime Institute DasmariÑas, Cavite ADocument105 pagesOnline Enrollment System For Cavite Maritime Institute DasmariÑas, Cavite Ajaz_0777802477% (30)

- Utilization of ICT As A Predictor of Educational StressDocument6 pagesUtilization of ICT As A Predictor of Educational StressMarkAlcazarPas encore d'évaluation

- College Activities in ArtDocument3 pagesCollege Activities in ArtMarkAlcazarPas encore d'évaluation

- A Comprehensive Course Timetabling and Student Scheduling SystemDocument2 pagesA Comprehensive Course Timetabling and Student Scheduling SystemMarkAlcazarPas encore d'évaluation

- Effectiveness and Utilization of Computer TechnologyDocument12 pagesEffectiveness and Utilization of Computer TechnologyMarkAlcazarPas encore d'évaluation

- Argumentative Essay 16-17Document21 pagesArgumentative Essay 16-17MarkAlcazarPas encore d'évaluation

- Online Scheduling SystemDocument15 pagesOnline Scheduling SystemMarkAlcazarPas encore d'évaluation

- MITDocument263 pagesMITMarkAlcazarPas encore d'évaluation

- Philippine Literature 101Document8 pagesPhilippine Literature 101MarkAlcazar100% (1)

- Term Paper WritingDocument8 pagesTerm Paper WritingMarkAlcazarPas encore d'évaluation

- Position PaperDocument23 pagesPosition PaperMarkAlcazarPas encore d'évaluation

- cph101l Module 03 Microprocessor and Memory2 PDFDocument47 pagescph101l Module 03 Microprocessor and Memory2 PDFMarkAlcazarPas encore d'évaluation

- PR2 Module 1 ResearchDocument38 pagesPR2 Module 1 ResearchMarkAlcazar100% (6)

- Evolution of Atomic ModelDocument2 pagesEvolution of Atomic ModelMarkAlcazarPas encore d'évaluation

- Fundamental Principles of Catholic Social Teaching July 2012Document8 pagesFundamental Principles of Catholic Social Teaching July 2012api-288255580Pas encore d'évaluation

- FAR 1 (CPA Review Material)Document42 pagesFAR 1 (CPA Review Material)MarkAlcazarPas encore d'évaluation

- A Comprehensive Course Timetabling and Student Scheduling SystemDocument2 pagesA Comprehensive Course Timetabling and Student Scheduling SystemMarkAlcazarPas encore d'évaluation

- Aerobic ExerciseDocument22 pagesAerobic ExerciseMarkAlcazarPas encore d'évaluation

- Liturgical Mass Songs - Chords OnlyDocument17 pagesLiturgical Mass Songs - Chords OnlyMarkAlcazarPas encore d'évaluation

- Kuya PedroDocument6 pagesKuya PedroMarkAlcazarPas encore d'évaluation

- Espiritung BanalDocument2 pagesEspiritung BanalMarkAlcazarPas encore d'évaluation