Académique Documents

Professionnel Documents

Culture Documents

Annual Pivots Rule On The 10-Year, Crude Oil, and The Dow

Transféré par

ValuEngine.comTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Annual Pivots Rule On The 10-Year, Crude Oil, and The Dow

Transféré par

ValuEngine.comDroits d'auteur :

Formats disponibles

Richard Suttmeier is the Chief Market Strategist at www.ValuEngine.com.

ValuEngine is a fundamentally-based quant research firm in Princeton, NJ. ValuEngine

covers over 5,000 stocks every day.

A variety of newsletters and portfolios containing Suttmeier's detailed research, stock picks,

and commentary can be found HERE.

July 15, 2010 – Annual Pivots Rule on the 10-Year, Crude Oil, and the Dow

The US Treasury auctions were successful, but the 10-Year yield is still above 3%. Gold is

trading between my weekly and semiannual pivots at $1210.3 and $1218.7. Crude oil continues

to trade back and forth around my annual pivot at $77.05. Today’s risky level for the euro is

1.2796. My annual pivot at 10,379 for the Dow has been a strong magnet this week. Home

Foreclosures are on the Rise

10-Year Note – (3.050) Today’s neutral zone is between my daily pivot at 3.110 and my semiannual

pivot at 2.999. Semiannual and quarterly value levels are 3.479 and 3.486 with weekly, annual,

quarterly and semiannual risky levels at 2.858, 2.813, 2.495 and 2.249. The low yield for the move

was 2.879 set on July 1st, and was a failed test of my 2.999 and 2.813 annual risky levels. The 30-

Year Bond was auctioned on Wednesday at 4.080 and was a success with a bid to cover ratio of 2.89

times the auction size and Indirect Bids at 37% of the auction size. Indirect Bids includes demand from

foreign investors, and in my opinion 30% to 40% of this type of demand is the neutral range.

Courtesy of Thomson / Reuters

Comex Gold – ($1208.7) My quarterly and annual value levels are $1140.9 and $1115.2 with weekly

and semiannual pivots at $1210.3 and $1218.7, and semiannual and monthly risky levels at $1260.8

and $1279.3. The all time high of $1266.5 set on June 21st was a test of June’s monthly

resistance, as a significant top for gold. Gold is trading between the pivots this morning.

Courtesy of Thomson / Reuters

Nymex Crude Oil – ($76.77) My quarterly value level is $56.63 with weekly, annual and daily pivots at

$76.93, $77.05 and $77.55, and monthly and semiannual risky levels at $79.36 and $83.94. Crude oil

appears stuck in a trading range between $67 and $87.

Courtesy of Thomson / Reuters

The Euro – (1.2742) My weekly value level is 1.2422 with a monthly pivot at 1.2670, and a daily risky

level at 1.2796. Monthly and quarterly value levels are 1.2035 and 1.1424. Daily MOJO (12x3x3 slow

stochastic) is overbought as the euro tests today’s risky level at 1.2796 this morning.

Courtesy of Thomson / Reuters

Daily Dow: (10,367) Weekly value level is 9,635 with my annual pivot at 10,379, and daily, semiannual

and monthly risky levels at 10,511, 10,558 and 10,891. My annual risky level at 11,235 was tested at

the April 26th high at 11,258, which marked the end of the bear market rally that began in March 2009.

We are in the second leg of the multi-year bear market that began in October 2007 targeting 8,500

before 11,500. My annual pivot at 10,379 remains a magnet.

Courtesy of Thomson / Reuters

Home Foreclosures are on the Rise - According to RealtyTrac more than a million Americans will

lose their homes to foreclosure this year, which would be ten times the historical norm, and would

exceed the 900,000 of 2009.

The pace would be higher as banks are allowing delinquent borrowers to stay in their homes longer

rather than to add to the glut of foreclosed properties on the market. This will likely change in the

second half of the year as lenders are stepping up repossessions to clear out the backlog of depressed

home inventories on their books.

In the first half of 2010 approximately 1.7 million homeowners received a foreclosure warning, which is

one in 78 US homes. According to Lender Processing Services it typically takes 15 months to finally

sell a foreclosed property following the first missed payment.

If the US economy stabilizes it will take lenders through 2013 to clear out the backlog. If the economy

slows as the Fed fears in its Minutes released on Wednesday foreclosure problems will intensify. High

unemployment, failed mortgage-assistance programs and another wave of lower home prices will keep

the housing market in the doldrums and more homeowners will walk away.

With more than 7.3 million home loans in delinquency it’s easy to see how the housing dilemma can

worsen in the quarters ahead. Even after trying to modify mortgages, many borrowers simply can not

qualify for help, as they struggle to make other payments such as car loans and credit card debts, while

being worried about the job market.

That’s today’s Four in Four. Have a great day.

Richard Suttmeier

Chief Market Strategist

www.ValuEngine.com

(800) 381-5576

As Chief Market Strategist at ValuEngine Inc, my research is published regularly on the website www.ValuEngine.com. I

have daily, weekly, monthly, and quarterly newsletters available that track a variety of equity and other data parameters as

well as my most up-to-date analysis of world markets. My newest products include a weekly ETF newsletter as well as the

ValuTrader Model Portfolio newsletter. I hope that you will go to www.ValuEngine.com and review some of the sample

issues of my research.

“I Hold No Positions in the Stocks I Cover.”

Vous aimerez peut-être aussi

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Combining FactorsDocument13 pagesCombining FactorsIsachar BernaldezPas encore d'évaluation

- Financial Analysis Using Financial Performance Metrics-Fitri-IsmiyantiDocument26 pagesFinancial Analysis Using Financial Performance Metrics-Fitri-Ismiyantiputri shanahPas encore d'évaluation

- EMI Prepayment CalculatorDocument17 pagesEMI Prepayment CalculatorKhaja ShaikPas encore d'évaluation

- Essentials of Accounting For Governmental and Not For Profit Organizations 13th Edition Copley Solutions ManualDocument49 pagesEssentials of Accounting For Governmental and Not For Profit Organizations 13th Edition Copley Solutions Manuala538448756100% (1)

- Tsai Vs Court of Appeals DigestDocument2 pagesTsai Vs Court of Appeals Digestgnrslash01Pas encore d'évaluation

- C04 PDFDocument35 pagesC04 PDFYiha FentePas encore d'évaluation

- Case Study - Club MedDocument118 pagesCase Study - Club MedUtsab BagchiPas encore d'évaluation

- Financial System of BangladeshDocument24 pagesFinancial System of Bangladeshmoin06100% (2)

- RSM430 Final Cheat SheetDocument1 pageRSM430 Final Cheat SheethappyPas encore d'évaluation

- Unit 5 Questions DoneDocument4 pagesUnit 5 Questions Donespirit26nightPas encore d'évaluation

- Unsecured X Secured LoansDocument2 pagesUnsecured X Secured LoansEllaPas encore d'évaluation

- Test Bank 1 - Ia 2Document18 pagesTest Bank 1 - Ia 2Xiena100% (2)

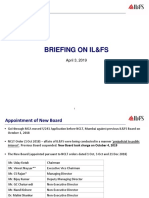

- ILFS Briefing (April 2019)Document15 pagesILFS Briefing (April 2019)Richard DierdrePas encore d'évaluation

- Chapter 8 - Part ADocument22 pagesChapter 8 - Part AKwan Kwok AsPas encore d'évaluation

- FM I - 3 P1Document11 pagesFM I - 3 P1Henok FikaduPas encore d'évaluation

- Problem Set No.1Document3 pagesProblem Set No.1paolo sulitPas encore d'évaluation

- Case StudyDocument10 pagesCase Studyamit sharmaPas encore d'évaluation

- Spouses Panlilio vs. CitibankDocument15 pagesSpouses Panlilio vs. CitibankJed MendozaPas encore d'évaluation

- Chapter 20 - AnswerDocument11 pagesChapter 20 - AnswerLove FreddyPas encore d'évaluation

- MBA MCI Case StudyDocument16 pagesMBA MCI Case StudyThomas Innocenti50% (2)

- Femip Study Private Sector Syria enDocument219 pagesFemip Study Private Sector Syria enNishi KumariPas encore d'évaluation

- Accounting Warren 23rd Edition Solutions ManualDocument47 pagesAccounting Warren 23rd Edition Solutions ManualKellyMorenootdnj100% (79)

- History of Bank of PunjabDocument32 pagesHistory of Bank of PunjabMahrukh AlTafPas encore d'évaluation

- Financial Analysis of Hul and GodrejDocument53 pagesFinancial Analysis of Hul and GodrejJiwan Jot SinghPas encore d'évaluation

- Sap Fico Balance SheetDocument28 pagesSap Fico Balance Sheetvenkat pulluriPas encore d'évaluation

- Separation AgreementDocument3 pagesSeparation AgreementEdward BattlePas encore d'évaluation

- LFC Sector Update 13Document16 pagesLFC Sector Update 13Randora LkPas encore d'évaluation

- Bajaj CapitalDocument15 pagesBajaj Capitalharshita khadaytePas encore d'évaluation

- Chapter 16 Managing Costs and UncertaintyDocument22 pagesChapter 16 Managing Costs and UncertaintyCelestaire LeePas encore d'évaluation

- Bond PricingDocument70 pagesBond PricingSharika EpPas encore d'évaluation